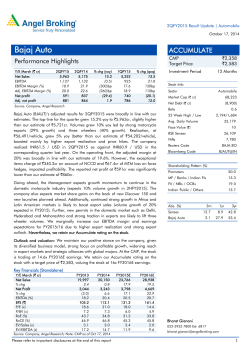

Performance Highlights

1QSY2015 Result Update | Tyre February 13, 2015 MRF BUY Performance Highlights CMP Target Price Y/E Sept. (` cr) Net sales EBITDA EBITDA margin (%) Reported PAT 1QSY2015 1QSY2014 % chg (yoy) 4QSY2014 % chg (qoq) 3,353 626 18.7 324 3,201 419 13.1 180 4.8 49.5 559bp 79.8 3,361 608 18.1 317 (0.2) 3.1 61bp 2.1 Source: Company, Angel Research `40,703 `47,548 Investment Period 12 Months Stock Info Tyre Sector Market Cap (Rs cr) 17,263 Net Debt For 1QSY2015, MRF reported an excellent set of numbers. Its top-line grew by 4.8% yoy to `3,353cr. During the quarter, the company’s raw material cost as a percentage of sales surprised positively, declining by 729bp yoy to 57.9%. Employee expense as a percentage of sales increased by 55bp yoy to 6.0% and other expenses as a percentage of sales increased by 115bp yoy to 17.4%. Aided by a lower raw material cost, the EBITDA margin witnessed a 559bp yoy increase to 18.7%, which is 261bp higher than our estimate. During the quarter, the other income increased by 157.7% yoy to `26cr. On the back of strong operational performance, the net profit increased by 79.8% yoy to `324cr, bettering our estimate of `287cr. Improving OEM demand coupled with stable replacement demand to drive revenue: MRF’s diversified portfolio, with a leading position in a majority of its segments, will help it in reaping benefits from a revival in auto demand. This would be on the back of improved consumer sentiments after formation of a stable government at the center. Further, robust growth in the auto industry during FY2009-12 provides huge opportunity in the replacement market, which will aid revenue growth for the company, going forward. Low rubber prices to aid margins: During 1QSY2014, the price of rubber in the domestic market declined by 23.9% yoy; rubber currently trades at `~134/kg in the domestic market. Considering the high global inventory levels, cheaper synthetic rubber and lower demand from China, we expect rubber prices to remain at lower levels. This will help the company in maintaining its EBITDA margin. 107 Beta 0.8 52 Week High / Low 41672 / 18701 Avg. Daily Volume 2,186 Face Value (Rs) 10 BSE Sensex 28,805 Nifty 8,712 Reuters Code MRF.BO Bloomberg Code MRF IN Shareholding Pattern (%) Promoters 27.2 MF / Banks / Indian Fls 35.0 FII / NRIs / OCBs 8.8 Indian Public / Others Abs. (%) Sensex MRF 29.0 3m 1yr 3yr 2.8 40.9 62.1 26.2 112.1 338.7 Outlook and valuation: We expect MRF to post a CAGR of 6.5% in net sales over SY2014-16E to `14,970cr, while the EBITDA margin is expected to be at 18.8% in SY2016E. Consequently, the net profit is expected to grow at a CAGR of 26.6% over SY2014-16E to `1,440cr. At the current market price, MRF is trading at a PE of 12x its SY2016E earnings and at a P/BV of 2.4x for SY2016E. We have revised our recommendation on the stock to Buy with a target price of `47,548 based on a target P/E of 14.0x for SY2016E. Key Financials (Standalone) Y/E March (` cr) Net Sales % chg Net Profit % chg EBITDA (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x) SY2013 12,131 2.2 802 40.2 14.6 1,892 21.5 4.7 24.7 28.3 1.5 8.1 SY2014E 13,198 8.8 898 11.9 14.6 2,117 19.2 3.8 22.0 28.8 1.3 7.3 SY2015E 13,878 5.2 1,286 43.2 18.5 3,031 13.4 3.0 25.0 35.7 1.2 6.0 Source: Company, Angel Research; Note: CMP as of February 12, 2015 Please refer to important disclosures at the end of this report SY2016E 14,970 7.9 1,440 12.0 18.8 3,396 12.0 2.4 22.2 34.3 1.1 5.1 Milan Desai +91- 22- 3935 7800 Ext: 6846 [email protected] 1 MRF | 1QSY2015 Result Update Exhibit 1: 1QSY2015 performance Y/E Sept (` cr) 1QSY15 1QSY14 yoy chg (%) 4QSY14 qoq chg (%) SY2014 SY2013 % chg Net Sales 3,353 3,201 4.8 3,361 (0.2) 13,198 12,131 8.8 Net raw material (7.0) 1,999 (2.9) 8,379 7,899 6.1 63.5 65.1 12.1 733 603 5.6 5.0 1.7 2,158 1,862 1,941 2,086 (% of Sales) 57.9 65.2 Staff Costs 202 175 (% of Sales) Other Expenses (% of Sales) 6.0 5.5 584 520 59.5 15.4 180 12.1 574 5.4 15.9 17.4 16.3 16.3 15.3 2,727 2,782 (2.0) 2,754 (1.0) 11,270 10,365 8.7 Operating Profit 626 419 49.5 608 3.1 1,928 1,767 9.1 OPM 18.7 13.1 559bp 18.1 61bp 14.6 14.6 5bp 60 59 56 232 196 Depreciation 116 99 111 423 373 Other Income 26 10 25 66 29 PBT 476 271 1,339 1,227 (% of Sales) 14.2 8.5 10.1 10.1 - Tax 152 91 441 425 3.9 (% of PBT) 32.0 33.6 31.8 32.9 34.6 - - - - - - - 324 180 2.1 898 802 11.9 6.8 6.6 - 2.1 898 802 11.9 4 4 - 2.1 2,118 1,892 11.9 Total Expenditure Interest Extraordinary income Reported PAT PATM Adjusted PAT Equity capital (cr) EPS (`) 9.6 5.6 324 180 4 4 763 424 17.1 21.4 75.6 465 2.3 13.8 67.3 148 79.8 317 79.8 317 79.8 747 2.9 9.4 4 9.1 Source: Company, Angel Research Results impress, EBITDA margin steals the show For 1QSY2015, MRF reported an excellent set of numbers. Its top-line grew by 4.8% yoy to `3,353cr, below our estimate of `3,540cr. During the quarter, the company’s raw material cost as a percentage of sales surprised positively, declining by 729bp yoy to 57.9%. Employee expense as a percentage of sales increased by 55bp yoy to 6.0% and other expenses as a percentage of sales increased by 115bp yoy to 17.4%. Aided by lower raw material cost, the EBITDA margin witnessed a 559bp yoy increase to 18.7%, which is 261bp higher than our estimate. During the quarter, the other income has increased by 157.7% yoy to `26cr. On the back of a strong operational performance, the net profit increased by 79.8% yoy to `324cr, bettering our estimate of `287cr. Exhibit 2: Actual vs. Estimate (1QSY2015) Particulars (` cr) Actual Estimate Variation (%) Total Income 3,353 3,540 (5.3) EBIDTA EBIDTA margin (%) Adjusted PAT 626 569 10.1 18.7 16.1 16.2 324 287 12.6 Source: Company, Angel Research February 13, 2015 2 MRF | 1QSY2015 Result Update Investment rationale Improvement in demand from OEMs During SY2014, the auto industry has witnessed a dip in production across most segments resulting in bleak demand from OEMs. However, the replacement tyre demand was stable resulting in 8.8% yoy growth in net sales. We expect the auto sector to do well owing to improved consumer sentiment, declining fuel prices and availability of easy financing options. Green shoots of recovery are visible as MHCV sales have improved in 1QSY2015, positing a 41.1% yoy growth, while passenger car sales grew by 6.6% yoy for the same period. Accounting for this along with stable demand from the replacement tyre segment, we expect MRF to perform well in SY2015 and SY2016. Exhibit 3: Domestic vehicle sales trend 50 Passanger Car MHCV LCV Motor Cycle 40 41.1 30 (%) 20 10 6.6 (5.4) (9.3) 0 (10) (20) (30) 1QSY15 4QSY14 3QSY14 2QSY14 1QSY14 4QSY13 3QSY13 2QSY13 1QSY13 4QSY12 3QSY12 2QSY12 1QSY12 (40) Source: Company, Angel Research Lower rubber prices to help in sustaining EBITDA margin MRF’s EBITDA margin expansion in the past year and current quarter has been on the back of steady decline in raw material prices. Domestic natural rubber prices have followed the global trend, which have declined due to excess production by rubber producing countries - Thailand, Indonesia and Malaysia, and drop in demand from China. Additionally, with declining oil prices and a decline in the price of styrene butadiene rubber (SBR) which is also used for manufacturing tyres, raw material costs are expected to remain at lower levels. Rubber prices have slightly recovered, both globally and in India, due to Thai government aggressively purchasing rubber from local markets and owing to an agreement between the Kerala Government and 12 leading tyre companies requiring them to buy the commodity locally at a higher price in return for the government refunding half the purchase tax (5%) to the companies and the other half being refunded as a claim on the value added tax collected from the buyers. However, media reports indicate that this agreement is already facing issues as the various rubber growers associations have cited violation of the agreement by tyre companies. We believe that natural rubber prices will likely remain at current levels of `132-`135/kg in the near future and expect prices to remain stable, going forward. Thus, we expect MRF’s EBITDA margin to improve by 420bp over SY2014-16E to 18.8%. February 13, 2015 3 MRF | 1QSY2015 Result Update Exhibit 4: Domestic and International rubber price trends 230 International Price Domestic Price 210 (`/kg) 190 170 150 132 130 110 110 Feb-15 Nov-14 Aug-14 May-14 Feb-14 Nov-13 Aug-13 May-13 Feb-13 Nov-12 Aug-12 May-12 Feb-12 90 Source: Angel Research Financials Exhibit 5: Key assumptions Particulars (%) SY2015E SY2016E Change in tyre realization (1.5) - Change in tyre volume sales 7.0 8.0 Change in rubber price (6.5) - Source: Angel Research Pick-up in OEM demand to drive revenue growth The auto industry has witnessed sluggish growth over the past three years in India. However, we expect the OEM demand and replacement demand to improve significantly with an improvement in consumer sentiments and economic revival. MRF is expected to post a 6.5% CAGR in revenue over SY2014-16E from `13,198cr in SY2014 to `14,970cr in SY2016E. Exhibit 6: Pick-up in OEM demand to drive revenue growth 35 30.7 (` cr) 21.8 8,000 30 14,970 10,000 13,198 12,000 13,878 14,000 25 20 15 6,000 11,870 12,131 2,000 8.8 9,743 4,000 SY2011 SY2012 SY2013 0 Revenue (LHS) 7.9 10 5 5.2 2.2 (%) 16,000 0 SY2014E SY2015E SY2016E Revenue growth (RHS) Source: Company, Angel Research February 13, 2015 4 MRF | 1QSY2015 Result Update EBITDA and PAT margins to improve The effects of the lower rubber prices are being reflected in the company’s current quarter numbers and will carry over into SY2015. We expect EBITDA margins to improve to 18.5% in SY2015E and 18.8% in SY2016E. Consequently, we estimate the net profit to post a 26.6% CAGR over SY2014-16E to `1,440cr in SY2016E. 71.0 1400 1000 12.0 65.0 10.6 63.0 63.5 4.0 58.7 2.0 SY2012 SY2013 SY2014E EBITDA margin SY2015E 59.0 400 57.0 200 55.0 0 4.4 7.0 6.0 4.8 5.0 4.0 SY2011 SY2012 SY2013 SY2014E SY2015E SY2016E 3.0 2.0 SY2016E RM/Net sales (RHS) PAT (LHS) Source: Company, Angel Research 10.0 8.0 6.8 800 600 61.0 58.4 6.0 6.6 1,440 8.0 65.2 11.0 9.0 1,286 10.0 (` cr) 1200 67.0 (%) 69.0 9.6 9.3 (%) 1600 14.0 16.0 (%) 14.6 73.0 898 14.6 18.8 802 18.0 18.5 70.4 572 20.0 Exhibit 8: Steady growth in net profit 432 Exhibit 7: Lower rubber prices to aid EBITDA margin PAT margin (RHS) Source: Company, Angel Research Outlook and valuation We expect MRF to post a CAGR of 6.5% in net sales over SY2014-16E to `14,970cr while the EBITDA margin is expected to be at 18.8% in SY2016. Consequently, the net profit is expected to grow at a CAGR of 26.6% over SY2014-16E to `1,440cr. At the current market price, MRF is trading at a PE of 12.0x its SY2016E earnings and at a P/BV of 2.4x for SY2016E. We recommend a Buy rating on the stock with a revised target price of `47,548, based on a target P/E of 14.0x for SY2016E earnings. Exhibit 9: One-year forward P/E band 54,000 Price 48,000 4x 8x 12x 16x 42,000 (`) 36,000 30,000 24,000 18,000 12,000 6,000 Feb-15 Aug-14 Feb-14 Aug-13 Feb-13 Aug-12 Feb-12 Aug-11 Feb-11 Aug-10 Feb-10 0 Source: Company, Angel Research February 13, 2015 5 MRF | 1QSY2015 Result Update Exhibit 10: Relative valuation Year end Sales (` cr) OPM (%) PAT (` cr) Apollo Tyres FY2017E MRF SY2016E EPS (`) 14,810 15.2 1,100 21.6 14,970 18.8 1,440 3,396.3 ROE (%) P/E (x) P/BV (x) EV/EBITDA (x) EV/Sales (x) 16.5 8.7 1.4 5.6 0.7 22.2 12.0 2.4 5.8 1.1 Source: Company Risks Volatile rubber prices: Natural rubber is the major raw material used in the manufacture of tyres. Domestic rubber prices have declined from the level of `158/kg in 1QSY2014 to average levels of `120/kg in 1QSY2015. Increase in rubber prices would have a negative impact on the company’s EBITDA margin and consequently on its profit. Hike in import duty on rubber: In the wake of falling domestic rubber prices, the Central Government has increased the import duty on natural rubber to a lower of 20% or `30/kg, from the currently lower of 20% or `20/kg. Any further upward revision in import duty will have an adverse impact on MRF’s profitability. Slowdown in automobile sector: Automobile demand in India has been declining since SY2011. Of the total tyre consumption in terms of tonnage for the industry, original equipment manufacturers (OEMs) account for ~36%. If the demand from OEMs continues to be sluggish, it will impact the revenue growth of the company. February 13, 2015 6 MRF | 1QSY2015 Result Update Company Background MRF manufactures rubber products such as tyres, tubes, flaps, tread rubber and conveyor belts. The company is present across all categories of tyres. MRF is a market leader in the tyre industry with an ~24% market share as on FY2012. The company is also a leader in the passenger car tyre segment with a 24.8% market share and holds a third position in the MHCV segment with a 22.3% market share. MRF also exports tyres to over 65 countries in America, Europe, Middle East, Japan and the Pacific region. Exhibit 11: Overall Market Share (FY2012) Goodyear India, 4.9 Birla Tyres, 8.9 MRF Tyres, 24.4 Others, 17.6 Ceat Ltd., 9.3 Apollo Tyres, 20.6 JK Industries, 14.3 Source: Crisil Report, Angel Research February 13, 2015 7 MRF | 1QSY2015 Result Update Profit & Loss Statement (Standalone) Y/E Sept (` cr) Gross sales Less: Excise duty Net Sales % chg Net Raw Materials Personnel Other SY2012 SY2013 SY2014 SY2015E SY2016E 13,062 13,453 14,649 15,405 16,617 1,192 1,322 1,451 1,527 1,647 11,870 12,131 13,198 13,878 14,970 21.8 2.2 8.8 5.2 7.9 8,353 7,899 8,379 8,153 8,739 514 603 733 819 883 1,743 1,862 2,158 2,345 2,530 10,609 10,365 11,270 11,317 12,153 1,261 1,767 1,928 2,561 2,818 % chg 57.3 40.1 9.1 32.8 10.0 (% of Net Sales) 10.6 14.6 14.6 18.5 18.8 Depreciation & Amort. 301 373 423 465 534 EBIT 960 1,394 1,505 2,096 2,283 % chg 73.3 45.2 8.0 39.3 8.9 8.1 11.5 11.4 15.1 15.3 159 196 232 241 217 Total Expenditure EBITDA (% of Net Sales) Interest & other charges Other Income 32 29 66 59 79 (% of sales) 0.3 0.2 0.5 0.4 0.5 PBT 833 1,227 1,339 1,914 2,145 % chg 73.0 47.3 9.1 43.0 12.0 Tax 261 425 441 629 705 (% of PBT) 31.3 34.6 32.9 32.9 32.9 PAT (reported) 572 802 898 1,286 1,440 Minority interest - - - - - Extraordinary (Exp)/Inc. - - - - - Tax on extraordinary exp ADJ. PAT 572 802 898 1,286 1,440 % chg 32.6 40.2 11.9 43.2 12.0 4.8 6.6 6.8 9.3 9.6 Basic EPS (`) 1,350 1,892 2,117 3,031 3,396 Fully Diluted EPS (`) 1,350 1,892 2,117 3,031 3,396 32.6 40.2 11.9 43.2 12.0 (% of Net Sales) % chg February 13, 2015 8 MRF | 1QSY2015 Result Update Balance Sheet (Standalone) SY2012 SY2013 SY2014 Equity Share Capital 4 4 4 4 4 Preference Capital - - - - - Reserves& Surplus 2,854 3,641 4,513 5,774 7,189 Shareholders’ Funds 2,858 3,645 4,518 5,778 7,193 Total Loans Y/E Sept (` cr) SY2015E SY2016E SOURCES OF FUNDS Equity share warrants 1,659 1,562 1,903 2,074 1,970 Deferred Tax Liability 187 222 235 235 235 Other Long Term Liabilities 957 1,080 1,145 859 644 Long Term Provisions 87 75 92 97 104 5,748 6,585 7,892 9,042 10,147 Gross Block 5,063 5,475 6,328 7,150 8,223 Less: Acc. Depreciation 2,149 2,505 2,899 3,364 3,898 Net Block Total Liabilities APPLICATION OF FUNDS 2,914 2,970 3,429 3,787 4,325 Capital Work-in-Progress 415 359 627 658 200 Investments 425 906 1,088 1,088 1,088 Long Term Loans and adv. 57 138 224 224 224 Other noncurrent assets 30 35 42 42 42 3,371 3,850 4,387 4,949 6,099 61 331 708 1,016 1,827 211 167 137 208 225 Inventory 1,646 1,795 1,800 1,939 2,121 Debtors 1,454 1,556 1,708 1,749 1,887 Current Assets Cash Loans & Advances Other current assets - - 35 37 39 Current liabilities 1,464 1,672 1,905 1,705 1,831 Net Current Assets 1,907 2,177 2,483 3,244 4,268 Mis. Exp. not written off Total Assets February 13, 2015 - - - - - 5,748 6,585 7,892 9,042 10,147 9 MRF | 1QSY2015 Result Update Cash Flow Statement (Standalone) Y/E Sept (` cr) Profit before tax Depreciation Change in Working Capital Other income Direct taxes paid SY2013 SY2014 SY2015E SY2016E 833 1,227 1,339 1,914 2,145 301 373 423 465 534 (294) (0) 71 (452) (214) 443 248 280 (59) (79) (261) (425) (428) (629) (705) 1,023 1,422 1,685 1,239 1,683 (Inc.)/Dec. in Fixed Assets (603) (357) (1,120) (854) (615) (Inc.)/Dec. in Investments (352) (481) (182) - - (Decr)/Incr in Long term prov. 38 (12) 17 5 8 (Incr)/Decr In L.T loans & adv. 82 (85) (93) - - Other income 32 29 66 59 79 Cash Flow from Operations Others (126) 12 (455) - - Cash Flow from Investing (929) (895) (1,768) (790) (528) - - - - - Issue of Equity Inc./(Dec.) in loans 241 26 405 (115) (318) Dividend Paid (Incl. Tax) (12) (13) (25) (25) (25) (317) (315) (328) - - (89) (301) 52 (140) (344) 5 226 (31) 309 811 Others Cash Flow from Financing Inc./(Dec.) in Cash Fixed Deposit February 13, 2015 SY2012 - 44 408 - - Opening Cash balances 56 61 331 708 1,016 Closing Cash balances 61 331 300 1,016 1,827 10 MRF | 1QSY2015 Result Update Key Ratios SY2012 SY2013 SY2014 SY2015E SY2016E P/E (on FDEPS) 30.2 21.5 19.2 13.4 12.0 P/CEPS 19.8 14.7 13.1 9.9 8.7 P/BV 6.0 4.7 3.8 3.0 2.4 Dividend yield (%) 0.1 0.1 0.1 0.1 0.1 EV/Sales 1.6 1.5 1.3 1.2 1.1 14.6 10.0 9.0 6.7 5.8 3.2 2.7 2.2 1.9 1.6 EPS (Basic) 1,349.9 1,892.0 2,117.1 3,031.2 3,396.3 EPS (fully diluted) 1,349.9 1,892.0 2,117.1 3,031.2 3,396.3 Cash EPS 2,060.1 2,771.6 3,114.7 4,127.0 4,656.6 25.0 30.0 50.0 50.0 50.0 6,740 8,597 10,652 13,623 16,960 EBIT margin 8.1 11.5 11.4 15.1 15.3 Tax retention ratio 0.7 0.7 0.7 0.7 0.7 Asset turnover (x) 2.4 2.4 2.4 2.2 2.1 13.6 18.3 18.4 22.4 21.8 Cost of Debt (Post Tax) 6.8 8.0 9.0 8.1 7.2 Leverage (x) 0.4 0.1 0.0 (0.0) (0.1) 16.4 19.2 18.7 22.3 19.9 ROCE (Pre-tax) 18.1 22.6 20.8 24.8 23.8 Angel ROIC (Pre-tax) 22.5 28.3 28.8 35.7 34.3 ROE 22.2 24.7 22.0 25.0 22.2 Asset Turnover (Gross Block) 2.7 2.3 2.2 2.1 1.9 Inventory / Sales (days) 49 52 50 49 49 Receivables (days) 42 45 45 46 46 Payables (days) 51 55 58 55 55 WC cycle (ex-cash) (days) 52 56 50 53 57 Net debt to equity 0.4 0.1 0.0 (0.0) (0.1) Net debt to EBITDA 0.9 0.2 0.1 (0.0) (0.3) Interest Coverage (EBIT / Int.) 6.0 7.1 6.5 8.7 10.5 Y/E Sept (` cr) Valuation Ratio (x) EV/EBITDA EV / Total Assets Per Share Data (`) DPS Book Value Dupont Analysis ROIC (Post-tax) Operating ROE Returns (%) Turnover ratios (x) Solvency ratios (x) February 13, 2015 11 MRF | 1QSY2015 Result Update Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have investment positions in the stocks recommended in this report. Disclosure of Interest Statement MRF 1. Analyst ownership of the stock No 2. Angel and its Group companies ownership of the stock No 3. Angel and its Group companies' Directors ownership of the stock No 4. Broking relationship with company covered No Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors Ratings (Returns): February 13, 2015 Buy (> 15%) Reduce (-5% to -15%) Accumulate (5% to 15%) Sell (< -15%) Neutral (-5 to 5%) 12

© Copyright 2026