Maximizing Pension Options

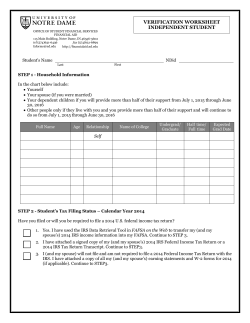

Maximizing Pension Options Anthony B. Soldano and Larry Zavadoff CFP® If you have a defined-benefit pension plan, it pays to learn more about options that can provide the maximum amount of pension income while you are alive and provide for the income needs of your spouse and family when you’re gone. Most defined-benefit pension plans offer multiple options upon retirement; single-life or joint-life payout options are the most common. Should you choose the single-life option, the monthly pension check amount will be much higher during your lifetime, however no income is left to the surviving spouse upon your death. The joint-life payout option provides a lower monthly income while you are alive, but it allows for some of the pension income (full, 75% or 50%) to continue going to your spouse until their death. However, once the spousal beneficiary passes away, the pension is forfeited and lost forever; it cannot be passed on to children or loved ones. Whether you think the joint-life option looks more attractive or not, it really comes down to the individual needs of the family and other components of their current financial plan. Here are some pension payout options for a retiree: Single-Life Payout: Retiree gets $100,000 a year while living, and pension ends upon their death with no benefit to their spouse Joint-Life Full: Retiree gets $75,000 a year while living; upon their death, their spouse continues to receive $75,000 a year until their death (retiree pays $25,000 a year for life) Joint-Life 75%: Retiree gets $85,000 a year while living; upon their death, their spouse would get 75% of the $85,000 ($63,750 a year) until their death (retiree pays $15,000 a year for life) Joint-Life 50%: Retiree gets $90,000 a year while living; upon their death, their spouse gets 50% of the $90,000 ($45,000 a year) until their death (retiree pays $10,000 a year for life) A Good Candidate for Pension Maximization: n Participates in a defined-benefit pension plan - government or state employees, teachers, police officers, firemen, union employees etc. n Ready to plan for retirement and retirement income n Married, with a desire to protect their spouse and family n Healthy enough to get life insurance coverage or convert existing coverage An Alternate Solution to the Single-Life Option: n When you choose the single-life option, rather than a reduced joint and survivor benefit, you can use all or some of the difference between the amount of the single option versus the joint and survivor benefit to purchase life insurance. The goal is to ensure the right amount of permanent insurance coverage is used to take the place of the lost pension benefit, should the retiree die first. As illustrated under the joint-life options, the amount of income forfeited annually is substantial. The funding of the life insurance for the single-life option would come from the difference being given up if the retiree were to choose a joint-life option; more often than not, the insurance costs less than what is being given up by electing a joint-life option. $120,000 Savings $100,000 $5,000 $20,000 $80,000 Insurance Premium $60,000 $100,000 $40,000 $75,000 n n n n Insurance benefits can also be set up as an annuity with income benefits that are guaranteed for the life of the beneficiary Life insurance benefits may be accelerated to help with long-term care expenses Should the spouse predecease the retiree, the life insurance can be surrendered, which would increase the retiree’s income If the retiree chooses to keep the life insurance, the beneficiary(ies) can be redesignated (at any time) to their children, loved ones or a favorite charity, which would create a tax deduction A pension can be structured to pass on to other generations, unless the joint-life option was chosen, in which case the pension ends with the passing of the retiree and spouse Next Steps: The pension option you choose has a tremendous impact not only on the income and quality of life you have while you’re alive, but also on the legacy you leave for your family. There are many planning factors that should be considered before choosing your pension option. $20,000 $0 Single Life Income n n n Joint Life Income Retiree receives the maximum pension benefits to which he or she is entitled; the spouse shares in the benefits of having more money while they are both alive Should the retiree pass away first, the pension will stop, but the spouse’s income continues via the insurance proceeds, similar to the joint-life option. The life insurance can be paid to a beneficiary in a lump sum, which will allow for more flexibility should the spouse need to liquidate a mortgage or other debt items Life insurance death benefits are received incometax-free You should consult with an insurance and financial services professional who has the expertise in this area to help you decide which option makes the most sense for you, and the goals and dreams you have for your family. The Evolution Group is a full service Insurance, Tax & Financial Planning firm. Our suite of products & services serve both individuals and businesses with a focus on protection, savings & growth strategies. We have vast understanding of the financial needs of government, state and civil service workers and develop comprehensive plans that focus on pension, tax and retirement planning strategies. Our goal is to help you protect, preserve and manage your wealth. We will keep you focused on where you want to go, advise you how to get there, and continually remind you of the importance of maintaining a disciplined approach to realizing your dreams. 300 South Oyster Bay Road | Syosset, NY 11791 Office: (516) 629-9054 | Fax: (888) 371-3135 | Mobile: (631) 525-2220 [email protected] | TheEvolutionGroup.US

© Copyright 2026