The Pharmaceutical & Healthcare Industry in Latin America Citi`s

Citi’s Online Academy Presents: The Pharmaceutical & Healthcare Industry in Latin America Jamie Davies Oscar Mazza Head of Pharmaceuticals & Healthcare Business Monitor International Consumer & Healthcare Industry Head Citi Transaction Services Latin America Agenda Introduction 1 Risk/Reward Ratings 2 Market drivers 0 min 3 Case Studies 4 Company Activity 5 7 Q&A 30 min 2 Introduction • Established in 1984. • Headquartered in London, with regional offices in Singapore, Johannesburg and New York City. • Clients include corporations, investment banks, consultancies, governments and academic institutions. • Over 100 research analysts. Image: the City of London 3 The Global Context Pharmaceutical Sales In 2011 Asia US$265bn Latin America US$70bn Europe US$329bn Middle East US$16bn Africa US$19bn North America US$358bn Source: BMI BMI View: moderate risk, moderate reward 4 The Global Outlook Pharmaceutical Sales (US$bn) Middle East +116% Africa +145% Latin America +119% 1,600 1,400 1,200 Asia +82% 1,000 800 Europe +18% 600 400 200 North America +22% 0 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Source: BMI BMI View: emerging markets to drive industry growth 5 Economic Expansion Real GDP Growth In 2012 China India Peru Chile Colombia Argentina Brazil Mexico Russia Venezuela United States Japan United Kingdom Germany France Eurozone -1 0 1 2 3 4 5 6 7 8 Source: BMI BMI View: Latin America has several favourable economies 6 Drivers Of Market Growth Healthcare Spending In 2011 Guatemala Paraguay Dominican Republic Puerto Rico Ecuador Venezuela Brazil Mexico Chile Argentina Nicaragua Honduras El Salvador Belize Peru Bolivia Panama Uruguay Costa Rica Colombia Government Private 0% 10% 20% 30% 40% BMI View: surprisingly divergent 50% 60% 70% 80% 90% 100% Source: WHO 7 Demographics Population Growth In 2011 Venezuela India Colombia Mexico Peru United States Chile Brazil Argentina United Kingdom France China Eurozone Japan Russia Germany -.4 -.2 .0 .2 .4 .6 .8 1.0 1.2 1.4 1.6 Source: BMI BMI View: appeals to vaccine manufacturers 8 Demographics Pensionable Population As % Of Total Working Population In 2011 Japan Germany France United Kingdom United States Russia Argentina Chile China Brazil Mexico Peru Venezuela Colombia India 0 5 10 15 20 25 30 35 40 45 Source: BMI BMI View: truly ageing populations decades away 9 Disease Burden Diabetes Prevalence In 2011 Mexico Russia Japan United States Chile Brazil Venezuela China Colombia India Germany France United Kingdom Argentina Peru 0 2 4 6 8 10 12 14 16 Source: IDF BMI View: a typical emerging markets profile 10 Healthcare Access Number Of Hospitals Beds Per 1,000 Population Argentina Brazil Canada United States Panama Chile Mexico Peru Ecuador Paraguay Uruguay El Salavador Costa Rica Belize Venezuela Bolivia Guatemala Nicaragua Honduras 0 0.5 1 1.5 2 2.5 3 BMI View: an under-appreciated growth driver 3.5 4 4.5 5 Source: PAHO 11 Company Activity Acquisitions Fixed capital investments Partnerships Other BMI View: a sharp uptick in activity 12 Foreign Company Performance BMI View: only surpassed by Asia Pacific 13 Anti-American? BMI View: outperformance by European firms 14 Risk/Reward Ratings Market expenditure Spending per capita Market Rewards Market growth Rewards Urban/rural split Pensionable population Country Rewards Population growth Risk/Reward Rating Patent respect Policy enforcement Market Risks Approvals expediency Risks Economic diligence Policy continuity Lack of bureaucracy Country Risks Legal diligence Business transparency BMI View: an objective assessment tool 15 Risk/Reward Ratings Brazil Pharmaceutical Risk/Reward Rating Market expenditure Spending per capita Market growth Urban/rural split Pensionable population Note: the higher the score, the more attractive the market feature Population growth IP Laws Policy/reimbursements Approvals process Economic structure Policy continuity Bureaucracy Legal framework Corruption 0 1 2 3 4 5 6 7 8 9 10 Source: BMI BMI View: a frequent initial market 16 Risk/Reward Ratings Latin America Pharmaceutical Risk/Reward Ratings Brazil Argentina Mexico Colombia Chile Peru Panama Costa Rica Belize El Salvador Venezuela Guatemala Nicaragua Honduras Regional Average Attractiveness i.e. priority for product launch 0 10 20 30 40 50 60 70 Source: BMI BMI View: an increasingly attractive region 17 Foreign Company Case Study: Sanofi Sanofi's Performance In Latin America 900 12 800 10 700 600 8 500 6 400 300 4 200 2 100 0 0 Q209 Q309 Q409 Q110 Q210 Q310 Q410 Q111 Q211 Q311 Q411 Latin America Sales (EURmn) (LHS) Latin America sales as % of global sales (RHS) Source: Sanofi BMI View: strength through organic and inorganic growth 18 Local Company Case Study: Genomma The Relative Performance Of Genomma Lab Internacional And The Mexico IPC Index 450 400 350 300 250 200 150 100 50 0 Genomma Mexico IPC Index Source: Bloomberg BMI View: should concentrate on its domestic market 19 Market Case Study: Brazil • Highlighted by multinationals. • Pricing pressures. • Unfair public-private partnerships? Brazil's Pharmaceutical Market 35 30 30 25 25 20 20 15 15 10 10 5 5 0 0 2009 2010 2011 2012f Sales (US$bn) 2013f 2014f 2015f Change % y-o-y BMI View: the recent outperformer Image: Oswaldo Cruz Foundation (Fiocruz) 2011 2012f 2013f 2014f 2015f CAGR Expenditure 42.9 (BRLbn) Current forecast y-o-y % 16.4 growth Expenditure 39.6 (BRLbn) Early 2011 forecast y-o-y % 7.5 growth 47.9 53.3 58.9 64.4 11.7 11.2 10.5 10.1 42.6 46.1 49.9 54.1 7.6 8.3 8.0 8.6 20 10.7 8.1 Market Case Study: Mexico • No energy liberalisation? • Dependent on US economy. • General security concerns. Mexico's Pharmaceutical Market 20 15 10 15 Image: Petróleos Mexicanos (Pemex) oil rig in the Gulf of Mexico 5 2011 2012f 2013f 2014f 2015f CAGR 0 10 -5 -10 5 -15 0 -20 2009 2010 2011 2012f Sales (US$bn) 2013f 2014f 2015f Change % y-o-y BMI View: a positive surprise Expenditure (MXNbn) Current forecast y-o-y % growth Expenditure Early 2011 (MXNbn) forecast y-o-y % growth 161 175 189 204 220 8.5 8.3 8.1 7.9 7.7 152 156 161 165 170 2.5 2.6 2.8 2.9 2.9 21 8.0 2.8 Market Case Study: Venezuela • High oil prices. • Repatriation of revenues. • Anti-American sentiment. Venezuela's Pharmaceutical Market 10 40 30 20 10 0 -10 -20 -30 -40 8 6 4 2 0 2009 2010 2011 2012f Sales (US$bn) 2013f 2014f Change % y-o-y 2015f Image: Hugo Chavez 2011 2012f 2013f 2014f 2015f CAGR Expenditure (VEFbn) Current forecast y-o-y % growth Expenditure (VEFbn) Early 2011 forecast y-o-y % growth BMI View: October 2012 election is key 33.3 41.2 49.8 59.3 69.5 24.6 23.8 21.1 19.0 17.1 29.4 36.1 42.8 49.9 57.6 10.0 23.0 18.4 16.7 15.4 22 20.2 18.3 Market Case Study: Argentina • Under-reporting of inflation. • Patent approval backlog. • Import restrictions. Argentina's Pharmaceutical Market 10 25 8 20 6 15 4 10 2 5 0 0 2009 2010 2011 2012f Sales (US$bn) 2013f 2014f 2015f Change % y-o-y BMI View: consistently defying risks Image: Instituto Nacional de Estadística y Censos, INDEC 2011 2012f 2013f 2014f 2015f CAGR Expenditure (ARSbn) Current forecast y-o-y % growth Expenditure (ARSbn) Early 2011 forecast y-o-y % growth 37.9 45.4 53.7 62.9 72.8 30.7 19.6 18.4 17.1 15.7 34.2 39.9 46.2 53.2 60.9 17.2 16.7 15.8 15.2 14.3 23 17.7 15.5 Conclusion The Pharmaceutical Markets Of Latin America 25 20 Brazil Venezuela 15 Local currency market growth (2011-2016 CAGR) Ecuador Paraguay 10 Argentina Nicaragua Bolivia Uruguay Peru 5 Colombia Guatemala Panama El Salvador Costa Rica Honduras Chile Mexico 0 0 50 100 150 200 250 x-axis = per-capita pharmaceutical spending in 2011 (US$); size of bubble = absolute market size (US$bn) BMI View: crucial to identify opportunities and risks 24 Questions For all questions and inquiries related to Business Monitor International, including interest in a free trial or to obtain more information about our subscription services, please contact: Claudio Salazar Account Manager - LATAM & Caribbean Office: +1.646.368.1775| Cell: +1.347.922.8902 | Fax: +1.212.202.5062 [email protected] 25

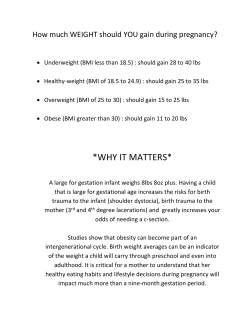

© Copyright 2026