Terms & Conditions

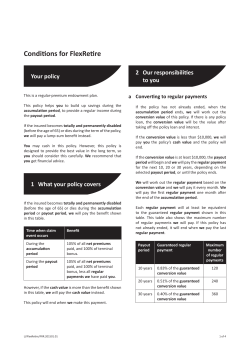

FUNERAL PROTECTION PLAN TERMS AND CONDITIONS This is an important document, so please make sure You keep it in a safe place and let Your family know where to find it. These terms and conditions, the Plan Schedule and any letters confirming changes to Your Plan make up Your contract with the Insurer. Inflation Fighter increases the Cover Amount and Please note, all of the words used in these terms and conditions that are in bold and italics are explained in the Glossary below. premiums are guaranteed and will not change Your Premium on each Plan Anniversary. Your Plan Schedule shows if You have Inflation Fighter. See Section 5.3. Insurer means iptiQ Life S.A. Level Premiums – If this premium type is selected, unless You change Your Cover Amount or You have chosen Inflation Fighter. Your Plan Schedule shows Your Premium type. For an illustration, see the table in Section 5.3. Glossary Life Insured means the person named on the Plan Accidental Death means a death directly caused Schedule who is covered by the Plan. from suffering accidental bodily injury from an Plan means Your Funeral Protection Plan. external, violent and visible event which occurs whilst covered by the Plan. The death must not be attributable to a medical condition of the Life Insured and must have occurred within 90 days of the accident. Accidental Death Period means either 12 or 24 months as shown in Your Plan Schedule following Plan Anniversary means the twelve month anniversary of the initial Cover Commencement Date as shown on Your Plan Schedule. Plan Owner means the person or persons shown on Your Plan Schedule who own, and are authorised to make changes to the Plan. the Cover Commencement Date during which Plan Schedule means the document that We cover is only provided for Accidental Death. provide to You showing the Plan Owner(s), the Business Days means Monday to Friday 9am to 6pm except UK public holidays. Cover Amount means the level of cover You have chosen, as shown on Your Plan Schedule (including Inflation Fighter increases where applicable) Claim Amount means the cash lump sum payable following a valid claim under Your Plan. Cover Commencement Date means the date We confirm Your cover started from. Increasing Premiums – If this premium type is selected, premiums increase on each Plan Anniversary by 3%. This is guaranteed not to change. Your Plan Schedule shows Your Premium type. For an illustration, see the table in Section 5.3. Life Insured, what options have been chosen, the Cover Amount, Cover Commencement Date and the Premium payable. Premium(s) means the amount You have to pay for this Plan. UK means England, Wales, Scotland and Northern Ireland and does not include the Channel Islands or the Isle of Man. We, Us and Our means the Insurer. You and Your means the Plan Owner(s). 3 About your Insurance 3. Who can be covered Your Plan is distributed by Promis Life, a trading A life insured must be aged between 30 and 79 name of Global Life Distribution (UK) Ltd registered years of age and a resident of the UK at the Cover in England and Wales, which is authorised and Commencement Date. regulated by the Financial Conduct Authority (the Financial Services Regulator), and entered on the Financial Services Register under reference number: 629767. Registered office: The St Botolph Building, 138 Houndsditch, London EC3A 7AR. You can check this by visiting the FCA website www.fca. org.uk/register or calling the FCA on 0800 111 6768. Your Plan is issued, underwritten and administered by iptiQ Life S.A. UK Branch registered in England and Wales. Registration No: BR017015. Registered If You do change Your residency status, it’s important that You let Us know. A change in residency may be subject to tax implications, and this is Your responsibility. 4. Cover Amount The minimum Cover Amount is £1,000. The maximum Cover Amount You can have at the Cover Commencement Date is £20,000. Office: 30 St Mary Axe, London EC3A 8EP. iptiQ Life Regardless of how many Plans You take out, the S.A. is a public limited company (societé anonyme) total Cover Amount for each Life Insured cannot incorporated and registered in Luxembourg. exceed £20,000 (not including Inflation Fighter Authorised by Le Commissariat aux Assurances. increases). Registered Office: 2a, rue Albert Borschette, L-1246 Luxembourg. R.C.S. Luxembourg B 184281. 1. What is covered If the Life Insured dies from any cause after the Accidental Death Period, We will pay the Cover You can always change Your level of cover at a later date, upwards or downwards, within the above limits. Any increase in cover other than Inflation Fighter will have a new Accidental Death Period applied to the additional amount. Amount. 5. Plan Options If the Life Insured dies due to an Accidental Death Below are the Plan options You can select. Your at any time whilst covered by the Plan, We will pay selections are shown on Your Plan Schedule. double the Cover Amount. 2. What is not covered If the Life Insured dies due to a non-Accidental Death during the Accidental Death Period, the full Cover Amount will not be payable. However, We will refund the Premiums paid to date. 5.1 Accidental Death Period You can choose a 12 or a 24 month Accidental Death Period. 5.2 Level or Increasing Premiums You can choose Your premium type: Level or Increasing Premiums. With Level Premiums, the amount You pay is locked in for the life of the Plan and will not change unless You make changes to the Plan or choose Inflation Fighter. Insured’s 90th Birthday. Your Cover Amount will 6.How much does Your Plan cost? stay the same unless you choose Inflation Fighter The Premium payable is shown on Your Plan or ask us to change your Cover Amount. Schedule and is determined by: If the Increasing Premium option is chosen, You -the Life Insured’s age, With Increasing Premiums, the amount You pay increases on each Plan Anniversary until the Life can switch to Level Premiums at any time but this will impact the Premium or Cover Amount. If You switch from Increasing Premiums to Level Premiums, You cannot switch back. - Your Cover Amount, -whether You have chosen Level Premiums or Increasing Premiums, 5.3 Inflation Fighter -whether You have selected a 12 or 24 month Inflation Fighter is optional and helps protect Your Cover Amount against rising costs over time. If selected, at each Plan Anniversary before the Life Insured’s 90th Birthday, the Cover Amount is increased by 3%. If You have selected Level Premiums with Inflation Fighter, then, Your Premiums will increase by 4.5% to pay for this extra cover. If You have selected Increasing Premiums with Inflation Fighter, then Premiums increase by 7.5%. Accidental Death Period, -whether You have selected to include Inflation Fighter, - Your Premium frequency. As long as You pay Your Premiums when due, the Plan will continue until the Life Insured dies. The last Premium payable is the one before the Life Insured’s 90th birthday. After that, You won’t have to pay any further Premiums and the Plan Inflation Fighter can be selected or removed at any time, but once removed, it cannot be selected again. continues for free. Please note, depending on how long the Life Insured lives, the total Premiums paid may be How much Your Cover Amount and Premiums increase more than the Cover Amount. Annual Inflation Increase Fighter on in Cover or off Amount Annual Increase in Premium 7. Paying for Your Plan Level Off 0% 0% every four weeks by Direct Debit from a UK bank Level On 3% 4.5% Increasing Off 0% 3% paying 4 weekly, You can choose a day, Monday to Increasing On 3% 7.5% Friday on which payments will be debited every 4 Premium type You can pay Your Premium once a month or once account. If paying monthly You can choose a date between the 1st and the 28th of the month to pay. If weeks. 5 8.Missed Premiums 10. Making a claim If You do miss a Premium payment We will write To make a claim, please call Our Customer Service to inform You of the unpaid Premium(s). We will team as soon as possible: let You know that if You miss three Premium payments, Your Plan will be cancelled. You can pay the missed Premium(s) by calling and making a •phone Us on 0800 907 0800 • or write to Us at: Freepost PROMIS LIFE debit or credit card payment over the phone. CUSTOMER CARE If You do miss three Premiums, We will write a final notice letter and inform You that if Premiums Our Customer Service team will explain how the remain unpaid, We will cancel Your Plan. If Your claims process works and what is required to make missed Premiums are consecutive, (e.g. March, a claim. In most cases We will just need: April, May), You have five days from the receipt of the final notice letter to call Us and make a debit or credit card payment. If Your missed Premiums are not consecutive (e.g. March, July, December), You have thirty days from the receipt of the final notice letter to call Us and make a debit or credit card • an original death certificate, • a completed claim form, •a certified copy of an identification document of the claimant, and payment. • the original Plan Schedule, if available If Premiums remain unpaid, We will cancel Your In rare situations, We may need to request Plan and write to You to confirm that Your cover additional documents to assess the claim. has been cancelled. If the information provided when taking out this If a claim is payable and there are unpaid Plan was not honest or accurate, We might not be Premiums on Your Plan, the unpaid Premiums will able to pay the full Claim Amount. If the date of be deducted from the Claim Amount. birth on the Plan Schedule is incorrect, the Claim Plans that have been cancelled because of unpaid Premiums can be restarted within two months Amount will be adjusted to reflect the correct date of birth. of the cancellation date if You pay all the missed 10.1 Claims Promis Premiums and no claim has been made. You will Once all correctly completed documentation has not be covered until the missed Premiums are paid. been received, (fully completed claim form, required documents stated on the claim form and any other 9. Cover End Date documents requested) and the claim is agreed by Your Plan will end on the earliest of: hours (2 Business Days). If the claim payment is not - The death of the Life Insured, or made within this time frame, an additional £100 will - Cancellation of the Plan by a Plan Owner or -Cancellation of the Plan by the Insurer due to non-payment of Premiums Us to be valid, the payment will be made within 48 be added to Your Claim Amount. 10.2 Who we will pay the Claim Amount to? Once a claim is approved by Us, We will pay the Claim Amount as a cash sum into the UK bank account of the person legally entitled to receive it. This will be the second Plan Owner named on the Plan Schedule or if there is no other Plan Owner, 13.If You have a complaint We hope You never need to, but if You would like to make a complaint about any aspect of the service You have received, please contact Our Customer Service team. the payment will be made to the Life Insured’s If we canot settle Your complaint immediately we estate. will send You a letter within 5 working days. 11.Cancelling Your Plan We will keep You informed about what we’re doing and will aim to put it right before 8 weeks. You can cancel Your Plan at any time for any If You are not satisfied with the response to Your reason by contacting Us on 0800 907 0800 or complaint, or after 8 weeks You can contact the writing to Us at the address in section 12. Financial Ombudsman Service: This Plan does not have a cash value at any time. By phone: 0800 023 4567 If You choose to cancel Your Plan within 30 days of receiving Your welcome pack, We will refund any Premiums paid, provided a claim has not been made. If You cancel it after 30 days from receiving Your In writing:The Financial Ombudsman Service, Exchange Tower, Harbour Exchange Square, London, E14 9SR. Email: [email protected] welcome pack, You will not get any money back. Website: www.financial-ombudsman.org.uk We will confirm the cancellation in writing. Making a complaint won’t affect Your legal rights. 12.Customer Service and Making Changes 14.Money Laundering Regulations 2007 If You have any questions about Your Plan, if You’d Under the above regulations We have a like to amend Your Cover Amount or make other requirement to confirm the identity of anyone who changes, please contact Us wishes to receive benefits from a life insurance By phone: 0800 907 0800 In writing: Freepost contract. In very rare situations We may need to ask You to send certain documents to help verify Your identity. We will write to You if this is the case. PROMIS LIFE CUSTOMER CARE Please note telephone calls may be recorded to enhance the quality of Our service to You. 15. Data protection 15.1How Your personal information is used The personal information collected from You will be held securely and used lawfully and in accordance with the Data Protection Act 1998. 7 Your personal information will only be used for the of the value of a claim. You can find out more about following purposes: the FSCS (including amounts and eligibility to claim) • issuing the products and services You request, by visiting its website www.fscs.org.uk or calling 0800 678 1100. • Plan administration and claim handling, • fraud and money laundering prevention, 17. Law and Language • research and analysis Your Plan will be governed in accordance with the • legal and regulatory reasons; and •marketing other products and services, unless You have asked not to receive such marketing. Your personal information will be shared, where necessary, with trusted third parties for the purposes listed above. Law of England and Wales. The courts of England and Wales shall have jurisdiction in any dispute, unless you live in Scotland or Northern Ireland in which case their courts will have jurisdiction in any dispute. All communication relating to Your Plan will be in English. may be insured You confirm that You have the 18.Customers with Disabilities consent of these individuals to supply their personal This document and information about the Funeral information. Protection Plan is also available in other formats. If Calls may be monitored and recorded for security You require an alternative format, please contact When providing information about others who and service quality. You have the right to ask for a copy of the information that is held about You. To make sure that the information held about You is accurate and up to date You can call the Customer Service team. See Section 12 for contact details. 15.2How to opt out from receiving marketing communications Our Customer Service team. 19.Taxes The Cover Amount paid on death is currently free from income and capital gains tax. The amount paid on death may form part of the deceased’s estate, so may be subject to inheritance tax, unless the Plan is put in an appropriate trust. Tax information is based on Our interpretation of current law and If You wish to opt out from receiving marketing HM Revenue & Customs practice. How taxation about Promis Life products and services, could affect You will depend on Your individual please contact the Customer Service team on circumstances. Both tax law and HM Revenue & 0800 907 0800. Customs practice may change in the future. We are not authorised to provide tax advice. 16.The Financial Services Compensation Scheme The Financial Services Compensation Scheme 20.Changes to the Terms and Conditions (FSCS) covers Your plan. If the Insurer is unable to We reserve the right to change these terms and pay a claim, the FSCS may assist by transferring conditions to reflect new laws and regulations. In Your Plan to another insurer or by paying the event of a change, We will notify You at least 30 compensation. Compensation can cover up to 90% days in advance. PL-FP-T&C-0215 Funeral Protection Plan is promoted by Global Life Distribution (UK) Limited trading as Promis Life, authorised and regulated by the Financial Conduct Authority number 629767. Registered office: The St Botolph Building, 138 Houndsditch, London EC3A 7AR The product is administered and underwritten by iptiQ Life S.A. UK Branch registered in England and Wales. Registration No: BR017015. Registered Office: 30 St Mary Axe, London EC3A 8EP. iptiQ Life S.A. is a public limited company (societé anonyme) incorporated and registered in Luxembourg. Authorised by Le Commissariat aux Assurances. Registered Office: 2a, rue Albert Borschette, L-1246 Luxembourg. R.C.S. Luxembourg B 184281

© Copyright 2026