Visa Europe: UK Expenditure Index

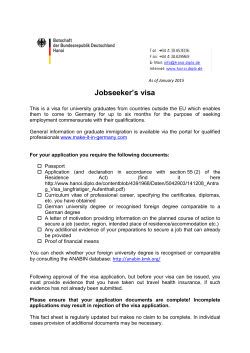

9 March 2015 Visa Europe: UK Expenditure Index Compiled by Markit on behalf of Visa Europe Further growth in consumer spending in February, as rising real incomes and low inflation take effect Headline findings: Consumer spending rises 1.2% on an annual basis in February Strongest spending increases in Hotels, Restaurants & Bars; Food, Beverages & Tobacco; and Household Goods High street spending remains a key driver of overall growth The Visa Europe: UK Expenditure Index indicated a further solid increase in consumer spending in February, with expenditure increasing through all three monitored channels. Sector data indicated that expenditure growth was sustained in key sectors such as Food, Beverages & Tobacco, Hotels, Restaurants & Bars and Household Goods in February. Household spending rose +1.2% year-on-year in February, thereby extending the current sequence of annual expenditure growth to five months. However, spending fell marginally on the monthly measure (-0.5%), following a strong January (+2.1%). As has been the case throughout much of the past two years, Hotels, Restaurants & Bars saw the strongest increase in expenditure in February (+9.0% on the year). Household Goods (+3.6%) and Food, Beverages & Tobacco (+2.7%) also saw solid spending growth. Meanwhile, both Recreation & Culture (+1.1%) and Transport & Communication (+0.8%) saw increases in expenditure for the first time in six and four months respectively. At -4.6%, household spending continued to decline in Misc. Goods & Services (which includes hairdressing and jewellery), while Clothing & Footwear retailers noted reduced spending for the third successive month (-3.4% on the year). High Street spending rose solidly for the second month running (+1.5% year-on-year), and continued to outpace Online expenditure growth (+0.8% on an annual basis). Kevin Jenkins, UK & Ireland Managing Director Visa Europe said: “Household spending may not have been quite as strong as January, but February was still another good month for the consumer economy. With household incomes returning to pre-recession levels and low prices on food and fuel, consumer confidence looks in decent shape. “British consumers look to be spending more on the things they enjoy. Dining out was clearly popular again in February as hotels, restaurants and bars saw a bumper month, while spend on recreation and culture bounced back for the first time since August 2014. “On the flip side, spending on clothing fell for a third month in a row in February.” Paul Smith, Senior Economist at Markit said: “Despite a slight monthly drop following a strong January, February’s Visa Europe: UK Expenditure Index signalled that underlying year-on-year growth of consumer spending remains solid. With the exception of Clothing & Footwear, retailfacing sectors seemed to perform particularly well, especially household goods which enjoyed its best performance for seven months. “Overall, we expect consumer spending to make ongoing positive contributions to total UK economic activity, with the data indicative of a 0.6% q/q rise in GDP over the first quarter as a whole.” Visa Europe: UK Expenditure Index Dec-14 Jan-15 Feb-15 Overall Spending Annual % Change (SA) +1.2% +1.4% +1.2% Overall Spending Monthly % Change (SA) -2.6% +2.1% -0.5% Face-to-Face Spending Annual % Change (NSA) -0.2% +1.4% +1.5% Online Spending Annual % Change (NSA) -0.4% -0.2% +0.8% Mail/Telephone Order Spending Annual % Change (NSA) +4.6 +2.1 +3.1% Visa Europe: UK Expenditure Index Summary Household spending continued to increase on an annual basis in February, according to the latest Visa Europe: UK Expenditure Index data. Expenditure was up by +1.2% year-on-year, following a similar increase in January (+1.4% on the year). Your tex Visa Europe: UK Expenditure Index Annual % Change 3m/3m % Change 15 Total V E I E xpenditure, Y ear-on-Y ear, S A (LH S ) Total V E I E xpenditure, 3m /3m , S A (R H S ) 10 However, following a strong month-on-month rise in household expenditure in January (+2.1%), a slight decline in consumer spending on a monthly basis was registered in February (-0.5%). Expenditure also fell marginally on the quarterly measure in February (-0.2%), after a slight increase at the start of the year (+0.6%). 4 3 2 5 1 0 0 -1 -5 This is according to Visa Europe’s UK Expenditure Index, which takes card spending data and adjusts it for a variety of factors to create a like-for-like comparison of consumer spending. This distinguishes the Index from Visa’s corporate performance, and thereby provides a robust indicator of consumer spending habits. -2 -10 -3 -15 -4 2006 2007 2008 2009 2010 2011 2012 2013 2014 Online and Face-to-Face Spend UK consumer spending increased across all three monitored channels in February, with Mail/Telephone Order categories noting the strongest rate of growth. UK Expenditure Index: Online vs Face-to-Face* Annual % Change 15 Online expenditure increased in February (+0.8% yearon-year), following a marginal reduction at the start of the year (-0.2%). Furthermore, it was the first time that Online spending had increased on an annual basis since last September. 10 5 0 Meanwhile, Face-to-Face spending rose for the second successive month in February, with the rate of expansion little-changed from January (+1.5% on the year). -5 -10 Mail/Telephone Order categories also saw a solid increase in expenditure during February (+3.1%), thereby extending its current sequence of growth to three months. V E I E xpenditure by C hannel, O nline, Y ear-on-Y ear, N S A V E I E xpenditure by C hannel, Face-to-Face, Y ear-on-Y ear, N S A -15 2009 2010 2011 2012 2013 2014 Spending by Sector Visa Europe’s UK Expenditure Index monitors eight broad sectors. Summary data for annual growth rates in January and February 2015, which are not adjusted for seasonality and trading days, are provided in the table opposite. Annual Growth Rates By Sector* Latest data indicated that spending rose in five of the eight broad categories in February. The strongest rate of growth continued to be recorded by Hotels, Restaurants & Bars. Household Goods and Food, Beverages & Tobacco also saw solid expenditure growth in February, while spending volumes rose slightly in Recreation & Culture and Transport & Communication categories. Jan ‘15 Feb ‘15 Food, Beverages & Tobacco +4.9% +2.7% -3.8% -3.4% Household Goods +1.8% +3.6% Health & Education -0.7% -2.6% Transport & Communication -1.8% +0.8% Recreation & Culture -1.3% +1.1% Hotels, Restaurants & Bars +9.7% +9.0% Misc. Goods & Services -5.4% -4.6% Clothing & Footwear At the other end of the table, Misc. Goods & Services (which includes hairdressing and jewellery) reported the sharpest reduction in expenditure, while Clothing & Footwear and Health & Education also noted marked reductions in spending. Broad Sector *data not adjusted for seasonality and trading days Visa Europe: UK Expenditure Index Your tex Official Data Comparisons UK Expenditure Index & Household Expenditure Annual percentage changes in Visa Europe’s UK Expenditure Index have an excellent relationship with a number of official data series, in particular household expenditure from the Office for National Statistics (ONS). Annual % Change Annual % Change 15 Total V E I E xpenditure, Y ear-on-Y ear, S A (LH S ) O N S U K H ousehold E xpenditure, Y ear-on-Y ear, S A (R H S ) 10 8 7 6 5 Most recently, the Visa Europe: UK Expenditure Index successfully tracked a further expansion of GDP in the final quarter of 2014. 4 5 3 2 0 1 0 The Visa Europe: UK Expenditure Index data pointed to a further improvement in underlying household spending trends in February, with expenditure rising for the fifth successive month on an annual basis in February and at a solid rate. Meanwhile, following a strong January, a slight decline in expenditure on the monthly measure was seen in February, while spending on a quarterly basis also fell marginally. -1 -5 -2 -3 -10 -4 -5 -15 -6 2006 2007 2008 2009 2010 2011 2012 2013 2014 Your tex The stronger underlying year-on-year expenditure trends have been supported by a variety of factors across the UK economy. Unemployment has plummeted to its lowest level for more than six years, while the recent slump in global oil prices has helped to dampen inflation to a record low. Meanwhile, wage packets are starting to increase in real terms after a sustained period of decline. UK Expenditure Index & GDP Annual % Change Annual % Change 15 Total V E I E xpenditure, Y ear-on-Y ear, S A (LH S ) O N S U K G ross D om estic P roduct, Y ear-on-Y ear, S A (R H S ) 10 12 10 8 6 5 With improving economic conditions and strong consumer confidence, household spending should continue to increase in the near-term, and will contribute to a further expansion of GDP in the first quarter of 2015. 4 2 0 0 -2 -5 -4 The Visa UK Expenditure Index uses card transaction data to provide a robust indicator of total consumer expenditure across all payment methods and is used by a range of stakeholders to gain insights into consumer spending, including HM Treasury. It is based on spending on all Visa debit, credit and prepaid cards which are used to make an average of over 1.9 billion transactions every quarter and account for £1 in £3 of all UK spending. Working with Markit, these card spending data figures are adjusted for a variety of factors such as card issuance, changing consumer preferences to pay by card rather than cash and inflation. These adjustments mean that these data are distinct from Visa Europe’s business performance and the Index reflects overall consumer spending, not just that on cards. -6 -10 -8 -15 -10 2006 2007 2008 2009 2010 2011 2012 2013 2014 UK Expenditure Index & Consumer Confidence Net Balance Annual % Change 15 10 Total V E I E xpenditure, Y ear-on-Y ear, S A (LH S ) D G E C FIN C onsum er C onfidence, Y ear-on-Y ear, S A (R H S ) 10 0 5 -10 For further information, please contact: 0 Mark Hooper, Visa Europe Tel: 020 7297 1356 Email: [email protected] -20 -5 -30 -10 David Chambers, H+K Strategies Tel: 020 7413 3047 Email: [email protected] -15 -40 2006 2007 2008 2009 2010 2011 2012 2013 2014 Sources for Charts: Visa Europe, ONS, European Commission NSA: Non-Seasonally Adjusted, SA: Seasonally Adjusted Visa Europe: UK Expenditure Index Notes and Further Information The headline ‘Visa Europe: UK Expenditure Index’ is based on data for all Visa debit, credit and prepaid cards with a number of adjustments made to ensure an accurate indication of consumer spending trends is provided. Visa Europe works at the forefront of technology to create the services and infrastructure which enable millions of European consumers, businesses and governments to make electronic payments. Its members are responsible for issuing cards, signing up retailers and deciding cardholder and retailer fees. First, the data are cleaned to remove any spending on items that are not ordinarily be classified as consumer expenditure (such as spending on savings products or taxes). Moreover, refunds and cashback are also accounted for at this stage. Second, the data are deflated by changes in the number of active Visa cards in order to account for the expansion of Visa’s card operations, particularly on the debit side. Thirdly, an adjustment is made to offset changing consumer preferences for card usage. This is based on an assessment of the trends in cash withdrawals and point-of-sale (POS) transactions on Visa cards. Fourthly, to account for inflation, the data are deflated by changes in the consumer price index to provide an indicator of real changes in household spending. Finally, the headline data are seasonally and trading day adjusted. Visa Europe operates a high volume, low cost business model that provides services to its members. Its surplus is reinvested into the business and used to improve capital and reserves. More than £1 in every £3 spent in the UK is on a Visa card, with debit cards accounting for over 80% of this. In the year to September 2013, total expenditure on UK Visa cards increased 9.2% to £445 billion, while online spending increased 18% to £110 billion. The ‘Visa Europe: UK Expenditure Index’ spending by product categories consist of the following standard Classification of Individual Consumption According to Purpose (COICOP) groups: Product Category COICOP Group Food, Beverage & Tobacco Clothing & Footwear Housing & Household Goods Health & Education Transport & Communication Recreation & Culture Hotels & Restaurants Miscellaneous Goods & Services 1, 2 3 4,5 6,10 7,8 9 11 12 Visa Europe is a payments technology business owned and operated by member banks and other payment service providers from 37 countries across Europe. Since 2004, Visa Europe has been independent of Visa Inc. and incorporated in the UK, with an exclusive, irrevocable and perpetual licence in Europe. Both companies work in partnership to enable global Visa payments. As a dedicated European payment system Visa Europe is able to respond quickly to the specific market needs of European banks and their customers cardholders and retailers - and to meet the European Commission’s objective to create a true internal market for payments. For more information, please visit www.visaeurope.com Markit Economics is a specialist compiler of business surveys and economic indices, including TM TM the Purchasing Managers’ Index (PMI ) series, which is now available for 32 countries and key regions including the TM Eurozone. The PMI surveys have become the most closely watched business surveys in the world, favoured by central banks, financial markets and business decision makers for their ability to provide up-todate, accurate and often unique monthly indicators of economic trends. e-mail: [email protected]

© Copyright 2026