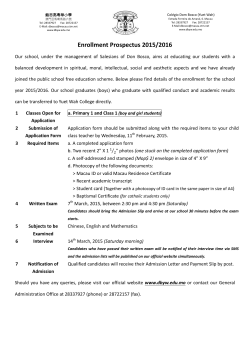

Waiting for Uncle Sam - Macau Business Daily