Account Booklet Information

Traders Bank & Citizens Bank of Lafayette “Serving Thousands of Customers, ONE at a Time!” Account Information This booklet is a reference for Traders Bank customers for their Deposit Accounts after the merger of Trader’s Bank and Citizens Bank of Lafayette. Effective April 18, 2015 Member FDIC TABLE OF CONTENTS Purpose and Benefits of this Booklet ..................................................................... 1 Reminder Checklist ................................................................................................... 2-3 Non-Interest Checking Accounts Previous Regular Checking, BanClub Checking ................................. 6 New Regular Checking, BanClub Checking ......................................... 7 Previous Business Checking ...................................................................... 8 New Business Advantage .......................................................................... 9 Interest Checking Accounts Previous Trader’s Best, DDA Plus, Investment .................................. 10 New Best Account, Plus Checking, Investment ............................... 11 New Additional Checking Accounts Available .......................................... 12-13 Money Market, Gold Club Checking Savings Accounts Previous Regular Savings, Christmas Club, IRA’s .............................. 16 New Regular Savings, Christmas Club, IRA’s ...................................... 17 New Additional Savings Accounts Available .............................................. 18-19 Vacation Club, Kids Club, Roth IRA, Educational IRA Miscellaneous Certificate of Deposit (CD) ....................................................................... 22 Fee Schedule ................................................................................................................ 23 Branch Location and Hours .............................................................................. 24-25 PURPOSE AND BENEFITS OF THIS BOOKLET The purpose of this booklet is to inform and help Traders Bank customers through the merging process with Citizens Bank of Lafayette. Your current deposit account will have some new features, and some may even have a new name. This booklet will define details on each account type, current and new. Please reference our Branch Location and Hours page in the back of this booklet as a guide for our 20 branch locations. We look forward to serving you and appreciate your business. Traders Bank Citizens Bank 1 REMINDER CHECKLIST The list of items is designed to help ensure you are prepared for our conversion Review the Account Information Booklet Review features of your new Traders Bank accounts. If you are not satisfied with your new account choice, please speak with your branch to review alternative account options. You may also call us at (931) 455-3426. Activate Your New Traders Bank Debit MasterCard You will receive your new Traders Bank Debit MasterCard in the mail prior to April 19, 2015. You may activate your card on the afternoon of April 19, 2015. Your old Visa debit card will no longer work after 2:00 am on April 20, 2015. Your 4-digit PIN will not change. Log Onto eBanking With Your Current Online Banking User ID You will be able to log into our new website (www.citizens-bank.org) starting April 20, 2015. In the top right corner of every page you can enter your eBanking Login and click “submit”. The first time you will need to use your temporary User PIN (last 4 digits of ss# or tax id), then you will be prompted to update your User PIN along with adding security questions and answers. You will also be able to access the new website using www.tradersbank.com. Update the New Wire Transfer Information Beginning April 20, 2015, incoming wires will need to be sent to the following correspondence: Wire Funds To: The Independent Bankers Bank (T.I.B), ABA#111010170 For Credit To: Citizens Bank of Lafayette, Account Number: 1021997 Update Your New Debit Card Number for Automatic Payments You will need to contact any merchant that you have setup automatic payments with and update your debit card information. Examples may include Utilities, Insurance, Mobile Phone Carrier, etc. Update the New Routing Number for Direct Deposits/Withdrawals Beginning April 20, 2015, you will need to update any automatic deposits/ withdrawals with the Routing Number 064102740 / Citizens Bank of Lafayette. 2 REMINDER CHECKLIST CONTINUED... Note Any Bill Payments and Automatic Transfers This feature will be accessible through your new eBanking. Once you login, access the Account and Bill Payment tab to schedule transfers and/or payments. Print Statements Prior to May, 2014 Only 12 months of statements will be available in eBanking after conversion. Please print any statements you may need prior to this date. Print Copies of Checks You Want to Keep Images of checks that have cleared prior to May, 2014 will not be available in eBanking. Download Our Free Mobile Banking App If you currently have an iPhone, iPad, or an Android device, you may download our free mobile app. After you download the app, you will need to login to your eBanking account online and grant access to your app. You can do this by going to the “options” tab, then go to “mobile settings”. Enter your carrier information, your cell number, and then check which accounts you would like to have mobile access to. Ask for Mobile Deposit Access Mobile Deposit gives you the capability of depositing checks from anywhere in the world, and at any time of day. It is as simple as taking a picture. Once you have downloaded and signed into your new mobile app, call us at (866666-2195) for approval. $0.50 charge per check applies. Review the New Fee Schedule Please review the new Fee Schedule on page 23 of this booklet. Call Your Local Branch if You Have Not Received Your Debit Card by April 16, 2015. Your Traders Bank Visa Debit Card will only work through 2:00 am on April 20, 2015. In order to prevent any interruption in access to your funds through your card, we encourage you to ensure you have both your old Visa and new MasterCard with you until this time. If you have not received your new Debit MasterCard, please call us prior to April 20, 2015. 3 4 Checking Accounts 5 YOUR PREVIOUS NON-INTEREST CHECKING ACCOUNT Regular Checking Minimum Deposit to Open Minimum Balance to Avoid Service Charge Service Charge $100 $400 $4 < $100 balance $3 < $200 balance $2 < $300 balance $1 < $400 balance Comments: • Unlimited check writing. • Unlimited debits. • Free Debit/ATM cards. • Monthly image statements mailed. BanClub Checking Minimum Deposit to Open Insurance Coverage Monthly Service Charge $100 Individual-$10,000 Joint$10,000 Each (Owner and co-owner) Family- $30,000 account holder & spouse, $1,500 dependent child(ren) $4-Individual $5-Joint $6-Family Comments: • BanClub check orders are included in monthly fee. 6 YOUR NEW NON-INTEREST CHECKING ACCOUNT Regular Checking Minimum Deposit to Open Minimum Balance to Avoid Service Charge Service Charge $10 $300 $4 Comments: • Unlimited check writing. • Unlimited debits. • Free Debit/ATM cards. • Account may qualify for ODP. • Monthly image statements mailed. • First book of checks are free. BanClub Checking Minimum Deposit to Open Insurance Coverage Monthly Service Charge $10 Basic- $10,000 Plus- $20,000 Family- $20,000 account holder, $10,000 spouse $1,500 dependent child(ren) $6-Basic $7-Plus $8-Family Comments: • Unlimited check writing. • Unlimited debits. • Free Debit/ATM cards. • Account may qualify for ODP. • Monthly image statements mailed. • BanClub checks free ($4 discount off other checks). • 0.25% discount on installment loans. • No fee for cashier checks (Limit 10 per month). • Accidental death and dismemberment insurance (not a deposit, not FDIC insured). 7 YOUR PREVIOUS NON-INTEREST CHECKING ACCOUNT Business Checking Minimum Deposit to Open Service Charge $100 $6 Comments: • Charge for each item deposited - $0.05 • Charge for each check written - $0.10 • Credit is given against these charges for the average available balance on deposit with us. • Lock bags for night deposit are $9.00/year for the 1st bag and $5.00/year for each thereafter. • For wire transfers out of your bank, there is a $15.00 charge. • For incoming wire transfers, there is a charge of $5.00. • If you have a check you deposited to your account, which is returned to you as a non-payment for any reason, there is a $0.10 charge. • The cost for any ACH item is the same as a check, $0.10 8 YOUR NEW NON-INTEREST CHECKING ACCOUNT Business Advantage Minimum Deposit to Open Service Charge $100 $6 Comments: • Charge for each item deposited - $0.05 • Charge for each check written - $0.10 • Credit is given against these charges for the average available balance on deposit with us. • Lock bags for night deposit are $9.00/year for the 1st bag and $5.00/year for each thereafter. • For wire transfers out of your bank, there is a $15.00 charge. • For incoming wire transfers, there is a charge of $5.00. • If you have a check you deposited to your account, which is returned to you as a non-payment for any reason, there is a $0.10 charge. • The cost for any ACH item is the same as a check, $0.10 *No changes to account features, the only change is the account name* 9 YOUR PREVIOUS INTEREST CHECKING ACCOUNT Traders Best Account Minimum Deposit to Open Minimum Balance to Avoid Service Charge Service Charge $100 $101 $3 if account is < $101 Comments: • Monthly interest paid on balances > $1,000. • Monthly statements printed, cancelled checks are not returned. DDA Plus Minimum Deposit to Open Minimum Balance to Avoid Service Charge Service Charge $500 $3,000 $5 if account is < $3,000 Comments: • Interest paid monthly. May be used for individual, joint personal & sole proprietorship business, also county and municipal boards, and county and memorial hospitals. Investment Account Minimum Deposit to Open Minimum Balance to Avoid Service Charge Service Charge $1,000 $1,000 $15 if account is < $1,000 Comments: • Monthly interest tiered to your account balance. • Unlimited check writing. • No charge for issue of bank official checks. 10 YOUR NEW INTEREST CHECKING ACCOUNT Best Account Checking Minimum Deposit to Open Minimum Balance to Avoid Service Charge Service Charge $100 $101 $3 if account < $101 Comments: • Monthly interest paid on balances > $1,000. • Monthly statements printed, cancelled checks are not returned. *No changes to account features, the only change is the account name* Plus Checking Minimum Deposit to Open Minimum Balance to Avoid Service Charge Service Charge $1,000 $1,000 $5 Comments: • Free Debit/ATM cards. • Account may qualify for ODP. • Monthly image statements mailed. • First book of checks free. Investment Account Minimum Deposit to Open Minimum Balance to Avoid Service Charge Service Charge $1,000 $1,000 $15 if account < $1,000 Comments: • Monthly interest tiered to your account balance. • Unlimited check writing. • No charge for issue of bank official checks. *No changes to account features* 11 NEW ADDITIONAL CHECKING ACCOUNTS AVAILABLE Money Market Minimum Deposit to Open Minimum Balance to Avoid Service Charge Service Charge $2,500 $2,500 $5 Comments: • Account may qualify for ODP. • Monthly image statements mailed. • You may not make more than 6 withdrawals per month. • $5 fee per withdrawal after 6 per month. • First book checks are free. • Free Debit/ATM cards Gold Club Checking Minimum Deposit to Open Minimum Balance to Avoid Service Charge Service Charge $500 $500 $5 Comments: • Unlimited check writing. • Unlimited debits. • Free Debit/ATM cards. • Account may qualify for ODP • Monthly image statements mailed. • Free Gold Club checks. • 25% discount on Safe Deposit Box. • No fee for cashier checks (limit 10 per month). *Gold Club is for customers age 50 and better* 12 NEW ADDITIONAL CHECKING ACCOUNTS CONTINUED... Free Checking Minimum Deposit to Open Minimum Balance to Avoid Service Charge Service Charge $10 $0 $0 Comments: • Free Debit/ATM cards. • Account may qulify for ODP. • Monthly check images are NOT mailed. • First book of checks are free. Business Checking Minimum Deposit to Open Minimum Balance to Avoid Service Charge Service Charge $10 $300 $4 Comments: • Business Checking is a non-interest bearing account on which a service fee of $4 will be assessed if the balance falls below $300 during the statement cycle. • Unlimited check writing. • Unlimited debits. • Free Business Debit/ATM cards available. • Account may qualify for Overdraft Privilege (there is cost for any overdraft service when it is used). • Monthly image statements mailed. • First book of checks are free. 13 14 Savings Accounts 15 YOUR PREVIOUS SAVINGS ACCOUNT Regular Savings Minimum Deposit to Open Number of Withdrawals Service Charge $100 Maximum of 6 per quarter $3 quarterly service charge for balances < $101. First 6 withdrawals are free, $1 per withdrawal after that Comments: • Interest is credited quarterly. Christmas Club Minimum Deposit to Open Number of Withdrawals Service Charge $1 Checks mailed Thanksgiving No Fee Comments: • If account is closed before interest is credited, you do not receive the accrued interest. • Interest credited annually. IRA’s Minimum Deposit to Open Service Charge $1,000 unless transferred Early withdrawal penalty applies Comments: • Terms from 32 days to 60 months. • 18 month variable rate. • Distribution can begin at age 59.5. • Insured for $250k. • Tax deferred. 16 YOUR NEW SAVINGS ACCOUNT Regular Savings Minimum Deposit to Open Number of Withdrawals Service Charge $10 Maximum of 6 per month $2 fee per withdrawal over 18 per quarter Comments: • Interest is paid quarterly. • Statements are mailed quarterly. Christmas Club Minimum Deposit to Open Number of Withdrawals Service Charge $1 Checks mailed Thanksgiving No fee Comments: • If account is closed before interest is credited, you do not receive the accrued interest. • Interest credited annually. IRA’s Minimum Deposit to Open Service Charge $500 Early withdawal penalty applies Comments: • Available for long term investments. • Great tax deferral vehicle for saving for retirement. • Distribution can begin at age 59.5. • Insured for $250k. • Tax deferred. 17 NEW ADDITIONAL SAVINGS ACCOUNTS AVAILABLE Vacation Club Minimum Deposit to Open Number of Withdrawals Service Charge $10 Checks mailed in May $10 fee per early withdrawal Comments: • May deposit $250/week up to $1,000/month. • Account earns interest at a premium rate. • Interest is paid on balances at maturity • Checks are issued in May. Kids Club Minimum Deposit to Open Number of Withdrawals Service Charge $10 Maximum of 6 per month No Fee Comments: • Amount is for children newborn-13 years of age. • Account earns interest at premium rate. • Must be maintenanced when holder turns 13. 18 NEW ADDITIONAL SAVINGS ACCOUNTS CONTINUED... Roth IRA Minimum Deposit to Open Service Charge $50 Early withdrawal penalty applies Comments: • Available for long term investments. • Great tax deferral vehicle for saving for retirement. Educational IRA Minimum Deposit to Open Minimum Balance to Avoid Service Charge $50 Early withdrawal penalty applies Comments: • Easy way to help with college expenses. • Transfers are flexible. • Earnings are non-taxable. • Funds can be passed on to another child. 19 20 Miscellaneous 21 MISCELLANEOUS Certificate of Deposit (CD) Comments: • IRA’s are availiable for long-term investments. • 7-31 Days • 3 Month • 6 Month • 12 Month • 18 Month • 24 Month • 36 Month • 48 Month • 60 Month 22 FEE SCHEDULE Cashiers Cashiers Check Fee Check Fee Check Fee - Non Customer Check Cashing Fee Cashing - Non Customer SERVICE Check Check Printing Fee Printing Fee Cashiers Check Fee Check Cashiers Fee Collections (international checks) Collections (international checks) Check Cashing Fee - NonCard Customer Check Cashing Fee - Non Customer Debit/ATM Replacement Fee Debit/ATM Card Replacement Fee Check Printing Fee Check Printing Fee Debit/ATM Card Withdrawal Limits Debit/ATM Card Withdrawal Limits Collections (international checks) Collections (international checks) Debit/ATM Foreign ATM Fee Fee Debit/ATM ATMCard Fee Replacement Debit/ATM Foreign Card Replacement Fee Debit/ATM (our customer, ATM) (our customer, foreign ATM)foreign Debit/ATM Card Withdrawal Limits Debit/ATM Card Withdrawal Limits Debit/ATM ATM Fee Debit/ATM Foreign ATMForeign Fee Debit/ATM Foreign ATM Feeour Debit/ATM Foreign ATM Feeour ATM) (foreign customer, (foreign customer, ATM) (our customer, ATM)foreign ATM) (ourforeign customer, Debit/ATM Foreign ATM Fee ATMLimits Debit/ATM Foreign Fee Debit Card Purchasing Debit Card Purchasing Limits (foreign customer, our ATM) our ATM) (foreign customer, Consumer Card Consumer Card Business Card Business Card Debit Card Purchasing Limits Debit Card Purchasing Deposit Item ReturnedLimits Deposit Item Returned Consumer Card Consumer Fee Card Dormant FeeDormant BusinessGarnishments, Card BusinessGarnishments, Card Executions, Levies Executions, Levies Deposit ItemDeposit Returned Item Returned IRA Closure IRA Closure Dormant FeeDormant Fee Executions, Garnishments, Levies Executions, Garnishments, Levies Mobile Fee Mobile Deposit Fee Deposit IRA Mobile ClosureDeposit IRA Closure Mobile LimitDeposit Limit Money Market Checking Excessive W/D Money Market Checking Excessive W/D MobileDeposit Deposit FeeDeposit Mobile DepositBags Fee (locking) Night Night Bags (locking) MobileFee Deposit Limit Mobile Deposit Overdraft Fee ODP Limit Overdraft ODP Money Market Checking W/D Money Market Checking Excessive W/D Overdraft FeeExcessive ODP Overdraft Fee ODP Night Deposit Bags (locking) Night Deposit Bags (locking) Overdraft Return Fee Overdraft Return Fee Overdraft Transfer Fee ODPFeeFee Overdraft ODPaccount) Transfer Fee (linked account) Overdraft (linked Overdraft Fee ODP Fee ODP Overdraft Photocopies Photocopies Overdraft Return FeeSaving Overdraft Return Fee Regular Excessive W/D Regular Saving Excessive W/D Overdraft Transfer FeeTransfer (linked account) Overdraft Fee (linked account) Photocopies Photocopies Records Request Records Request Regular Saving Excessive W/D Regular Saving Excessive W/D Research Research Statement Reproduction Statement Reproduction Records Records Fax Request Fax Request Research E-mail Research Document E-mail (encrypted) Document (encrypted) Statement Reproduction Statement Reproduction Deposit Box SafeFax DepositSafe BoxFax Document (encrypted) Document 2” x 4”E-mail (encrypted) 2” x 4” E-mail 3” x 5” 3” x 5” Safe Deposit Box Deposit Box 5” x 5” 5” xSafe 5” 2” xx 10” 4” 2” 3” xx 4” 10” 3” 3” xx 10” 5” 3” 5” xx 5” 10” 5” 5” xx5”10” 5” 10”x x5”10” 10” 3” x 10” x 10” Safe Deposit Safe Deposit3” Drilling Fee Drilling Fee 5” x 10” 5” x 10” 10” Stop x 10” Payment 10” x 10” Stop Payment Deposit Drilling Fee Safe Deposit Drilling FeeFee Vacation Club Early Withdrawal Vacation Safe Club Early Withdrawal Fee Wire Fee(Domestic) - Incoming (Domestic) Wire Fee - Incoming Stop Fee Payment Stop Wire Payment Fee(Domestic) - Outgoing (Domestic) Wire - Outgoing Vacation Early Withdrawal Vacation Club Early Fee Withdrawal Fee Wire Fee - Incoming (International) Wire Fee -Club Incoming (International) Wire Fee Incoming (Domestic) Wire Fee Incoming (Domestic) Wire Fee Outgoing (International) Wire Fee - Outgoing (International) Wire Fee - Outgoing Wire Fee(Domestic) - Outgoing (Domestic) Wire Fee - Incoming Wire Fee(International) - Incoming (International) Wire Fee - Outgoing Wire Fee(International) - Outgoing (International) $2.00 each item each item $2.00 not for cash checks for non-custom n/anot cashwill will checks non-customers n/a FEE NOTES yes depending varieson depending on style yes varies style eachcheck item each $2.00 item $2.00 per check $15.00 per $15.00 will not cash checks for non-customers n/a will not cash checks for non-custom n/a $10.00 for lost card for lost card $10.00 yes varies on style yesdaydepending varies depending on style $500.00 per day $500.00 per per check per check $15.00 $15.00 for lost card for $10.00 lost card $10.00 bank customer, non money-pass AT $1.00 bank customer, non money-pass ATM $1.00 $500.00 per day $500.00 per day non bank customer, varies by non ATMbank customer, bank ATM bank ATM fee varies byfee ATM $1.00 bank customer, money-pass ATM banknon customer, non money-pass AT $1.00 non bank customer, ATM bank ATM fee varies byfee ATM non bankbank customer, varies by ATM per day $1,500.00 $1,500.00 per day per day $2,000.00 $2,000.00 per day no charge no charge $1,500.00 per day quarterly per day quarterly $5.00 charged $5.00 $1,500.00 charged $2,000.00 per day per day $25.00 $25.00 $2,000.00 no charge charge no no charge charge no $5.00 charged quarterly $5.00 charged quarterly $25.00 $25.00 $0.50 per check per check $0.50 no charge no charge perapproval day (initial approval required) $1,500.00 per day (initial required) $1,500.00 $5.00 $0.50 $9.00 $1,500.00 $26.00 $5.00 $26.00 $9.00 $26.00 $26.00 $3.00 $26.00 $0.25 $26.00 $2.00 $3.00 $0.25 $2.00 $25.00 $5.00 $5.00 $25.00 $1.00 $5.00 $5.00 $1.00 $17.00 $20.00 $25.00 $17.00 $35.00 $20.00 $40.00 $25.00 $55.00 $35.00 $300.00 $40.00 $55.00 $26.00 $300.00 $10.00 free $26.00 $15.00 $10.00 free free $40.00 $15.00 free $40.00 perover transaction over 6 per month $5.00 per transaction 6 per month perfor check per check $0.50 $9.00 $5 for each $5 each bag after firstbag after first per day (initial approval required) per day (initial approval required) $1,500.00 $26.00 each item each item per transaction over 6 per month transaction over 6 per month $5.00 $26.00 each item each item per $5 foritem each bag after first $9.00 $5 for each bag after first $26.00 each item each eachday item each $26.00 item $3.00 per day per each page item (black $26.00 each &item $0.25 page (black & white) each white) eachtransaction item each $26.00 item $2.00 perover transaction over 18 per quarter per 18 per quarter per day $3.00 per day each page (black white) $0.25 each & page (black & white) per hour transaction 18 $2.00 per transaction over 18 per quarter $25.00 perover hour (1 per hourquarter minimum) per (1 hour minimum) $5.00 each archived monthly statement each archived monthly statement $5.00 per fax per fax per hour (1 hour minimum) $25.00 per (1 hour minimum) $1.00 eachhour e-mail each e-mail each archived monthly statement $5.00 each archived monthly statement per fax $5.00 per fax each e-mail each $1.00 e-mail per year $17.00 per year per year $20.00 per year per year $25.00 per year per year year per $17.00 per year year $35.00 per per year year per $20.00 per year year $40.00 per per year year per $25.00 per year year $55.00 per perlost/not year returning per year keyreturning key $35.00 for lost/not $300.00 for per year per year $40.00 per year $55.00 eachyear item $26.00 each item per for lost/not returning keyreturning key for $300.00 $10.00 perlost/not withdrawal per withdrawal free customers only customers only each item only each item only $26.00 customers $15.00 customers per $10.00 per withdrawal customers only freewithdrawal customers only customers only free customers customers only only $40.00 customers only customers only customers only $15.00 customers only customers only free customers only customers only $40.00 23 BRANCH LOCATIONS & HOURS CITIZENS BANK LAFAYETTE MAIN OFFICE 400 Hwy 52 Bypass West Lafayette, TN 37083 (615) 666-2195 M-Th 8-4, F 8-5, S 8-12 BANK OF CELINA CELINA MAIN OFFICE 101 East Lake Avenue Celina, TN 38551 (931) 243-3161 M-Th 8-4, F 8-5, S 8-12 LAFAYETTE PUBLIC SQUARE BRANCH 201 West Locust Street Lafayette, TN 37083 (615) 666-2196 M-T 8-4, W closed, Th 8-4, F 8-5, S 8-12 SMITH COUNTY BANK CARTHAGE MAIN BRANCH 50 North Main Street Carthage, TN 37030 (615) 735-2800 M-T 8-4, W closed, Th 8-4, F 8-5, S 8-12 LAFAYETTE SCOTTSVILLE RD BRANCH 1108 Scottsville Road Lafayette, TN 37083 (615) 666-4677 M-W 8-4, Th closed, F 8-5, S 8-12 RED BOILING SPRINGS BRANCH 32 Carthage Road Red Boiling Springs, TN 37150 (615) 699-2205 M-T 8-4, W closed, Th 8-4, F 8-5, S 8-12 WESTMORELAND BRANCH 990 New Highway 52 Westmoreland, TN 37186 (615) 644-2119 M-Th 8-4, F 8-5, S 8-12 GAINESBORO BRANCH 116 S Grundy Quarles Hwy Gainesboro, TN 38562 (931) 268-2141 M-T 8:30-5, W 8:30-12, Th- F 8:30-5, S 8:30-12 HERMITAGE SPRINGS BRANCH 17345 Clay County Highway Red Boiling Springs, TN 37150 (615) 699-2820 M-T 8-4, W closed, Th 8-4, F 8-5, S 8-12 24 CARTHAGE HIGHWAY 25 BRANCH 55 Dixon Springs Highway Carthage, TN 37030 (615) 735-2618 M8-4, T closed, W-Th 8-4, F 8-5, S 8-12 CONTINUED... LIBERTY STATE BANK LIBERTY BRANCH 311 East Main St Liberty, TN 37095. (615) 536-5101 M-Th 8-4, F 8-6, S closed TRADERS BANK TULLAHOMA MAIN OFFICE 120 N. Jackson St. Tullahoma, TN 37388 931-455-3426 M-Th 8:30-4, F 8:30-5:30, S closed ALEXANDRIA BRANCH 100 North Public Square Alexandria, TN 37012 (615) 529-2375 M-T 8-4, W 8-12, Th 8-4, F 8-6, S 8-12 TULLAHOMA BRANCH 412 W. Lincoln St. Tullahoma, TN 37388 931-455-2391 M-Th 8:30-4, F 8:30-5:30, S closed SMITHVILLE BRANCH 735 South Congress Blvd. Smithville, TN 37166 (615) 597-2265 M-T 8-4, W 8-12, Th 8-4, F 8-5, S 8-12 MANCHESTER BRANCH 1207 Hillsboro Blvd. Manchester, TN 37355 931-728-1474 M-Th 8:30-4, F 8:30-5:30, S closed LEBANON N. CUMBERLAND BRANCH 214 North Cumberland St Lebanon, TN 37088 (615) 449-4441 M-Th 8-4, F 8-6, S closed SHELBYVILLE BRANCH 1602 North Main St. Shelbyville, TN 37160 (931) 680-3500 M-Th 8:30-4, F 8:30-5:30, S closed LEBANON W. MAIN BRANCH 1035 West Main St Lebanon, TN 37088 (615) 444-4166 M-Th 8-4, F 8-6, S 8-12 WINCHESTER BRANCH 2695 Decherd Blvd. Winchester, TN 37398 (931) 967-3755 M-Th 8:30-4, F 8:30-5:30, S closed WEBSITES & INTERNET BANKING www.citizens-bank.org www.smithcountybank.com www.bankofcelina.com www.libertystatebanktn.com www.tradersbank.com MOBILE BANKING iPhone and Android search... “Citizens Bank of Lafayette” to Download our Citizens Bank of Lafayette app. 24-HOUR TOLL-FREE BANKING (866) 666-2195 25 Tullahoma Shelbyville Alexandria Lebanon Westmoreland Lafayette LIBERTY STATE BANK Liberty Winchester Manchester Smithville Carthage Gainesboro Celina Hermitage Springs Red Boiling Springs SMITH COUNTY BANK TRADERS BANK Serving Middle Tennessee for Over 100 Years. BANK of CELINA CITIZENS BANK

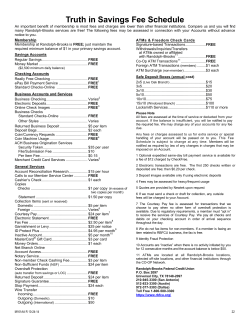

© Copyright 2026