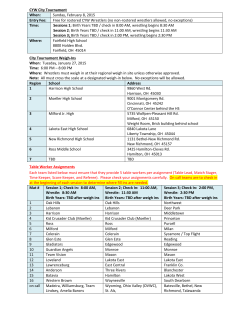

- Milford Asset