SH 5-1 (This is a Reset of the Acquisition Plan)

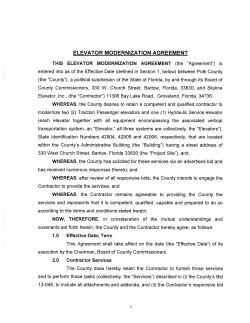

SH 5-1 (This is a Reset of the Acquisition Plan) ACQUISITION PLAN FOR OMNIBUS INFRASTRUCTURE OPERATIONS SUPPORT SERVICES (IOSS) CONTRACT FEBRUARY 20X1 JOINT BASE POWELL, CA AMCI CON 280 (FAR 7.105) ACQUISITION PLAN FOR INFRASTRUCTURE OPERATIONS SUPPORT SERVICES (IOSS) CONTRACT RECOMMENDED FOR APPROVAL: Chris Cooper Program Manager Marie Stallworth Contracting Officer Margot Johnson Small Business Specialist Jeffrey Hightower Legal Counsel Sam Smythe Competition Advocate John Brown, BGEN, USA Source Selection Authority APPROVED: Cheryl Levin Head of Contracting Agency (HCA) Source Selection Information – See FAR 2.101, 3.104 AMCI CON 280 Day 5 SH 5-1 RESET Acquisition Plan v2.0 SH 5-1 2 SECTION 1.0 ACQUISITION BACKGROUND AND OBJECTIVES 1.1 STATEMENT OF NEED. The purpose of this acquisition is to provide Infrastructure Operations Support Services (IOSS) to support mission requirements for Joint Base Powell. The contractor shall provide all management, administration, quality control, labor, transportation, equipment, materials, vehicles, heavy equipment, supplies and other items as necessary to perform the services contained in the Performance Work Statement (PWS). These services include engineering, grounds keeping/landscaping, personnel management, financial management, security protection, transportation/motor pool management, housing management, airfield management and port support to accomplish the mission of Joint Base Powell organizations safely and effectively, while maintaining environmental compliance. The contractor shall coordination with base civil engineering, logistics, security, services, personnel and finance functions to ensure effective and economical operation of activities. The contractor will provide support to numerous Joint Base Powell customers, commercial customers and other military and civil agencies as directed. This effort is similar to work performed in private industry and shall be based on industry standards and manufacturer’s recommendations. Acquisition alternatives have been considered and analyzed for suitability as a possible strategy as follows: 1.1.1 Bundling. Several of the services being acquired are currently on separate smaller individual contracts with different contractors, some of which are small businesses concerns. This acquisition will consolidate the existing requirements for services previously provided or performed under these contracts into a single contract that will be performance based in order to gain benefit and additional value of effectiveness and efficiencies in cost as well as performance, similar to large businesses and commercial practices in private industry. Market research and a bundling assessment in accordance with FAR 7.107 has been conducted by the IOSS program office and determined that the Government will receive substantial cost savings, quality, and efficiency benefits by consolidating specific Joint Base Powell IOSS requirements into a single Omnibus contract. The estimated value of the derived Government benefits over the five year expected contract period is projected to exceed $10.3M. This savings is expected to come from several sources: a) reduced contact labor prices due to increased competition and reduced contractor overhead costs; b) reduction in contractor man-hours attributable to implementation of commercial best practices; and c) shorter acquisition cycle times and contract management efficiencies. Specific measures will be taken during the acquisition process to encourage large business prime contractors to use small businesses as subcontractors to the maximum extent practical. Included measures are a subcontracting plan requirement, specified small business utilization goals for the prime contractor, and government-sponsored industry day activities and “match-making” forums designed to assist and facilitate partnerships between interested large and small businesses during the solicitation period of the acquisition. 1.1.2 Interagency Acquisitions. Some services may be available through the General Services Administration (GSA). This acquisition does not include information technology services where Government-wide acquisition contracts (GWACs) would apply. Services that are available on the Federal Supply Schedules (FSS) include facilities maintenance, grounds maintenance, engineering, financial, and security protection. These services are provided by a number of contractors, many of which are small businesses, including veteran-owned small business, service-disabled veteran-owned small business, HUBZone small business, women-owned small business, or small disadvantaged business. Use of FSS contractors is not feasible since the analysis has shown that each contractor would need to enter into a separate contract, and some services Source Selection Information – See FAR 2.101, 3.104 AMCI CON 280 Day 5 SH 5-1 RESET Acquisition Plan v2.0 SH 5-1 3 would require more than one contractor if the contractors are small businesses, increasing administrative burden and costs. 1.1.3 AbilityOne. AbilityOne offers custodial, housing management, security, pest control, and grounds maintenance services. They do not provide the other required services or act as an integrating contractor. A comparative analysis of the services provided by AbilityOne and the Joint Base Powell requirements showed that AbilityOne would not be able to handle the full range or volume of the Joint Base Powell IOSS services. The original Joint Base Powell IOSS requirement did include custodial/janitorial services which have historically been sourced from AbilityOne. During the acquisition planning phase it was determined that there was no substantial benefit to be derived by including the custodial/janitorial requirements in the omnibus IOSS contract. As a result, those custodial/janitorial requirements have now been removed and will be procured as a set-aside contract to AbilityOne. 1.1.4 Federal Prison Industries (UNICOR). UNICOR does not offer the services being acquired. 1.1.5 Office of Management and Budget (OMB) Circular No. A-76. An A-76 study was conducted by the Joint Base Powell installation commander and it determined that there were significant benefits to be derived by outsourcing personnel, security, and financial management services that are not inherently governmental to commercial industry. A copy of the full Joint Base Powell A-76 analysis report and decision memorandum is on file and available by request. 1.2 APPLICABLE CONDITIONS. 1.2.1 Requirements for compatibility with existing or future systems or programs. There are currently no requirements for compatibility with existing or future systems or programs since these are commonly provided services with no unique or special requirements. 1.2.2 Cost constraints. The future-year O&M budget for infrastructure operations of Joint Base Powell is expected to decline by 25% over the next five years. As such, an effective acquisition approach to help drive out operating inefficiencies is needed. Furthermore, the likelihood of unexpected mission requirements and associated surges in support costs present contract management challenges that must be dealt with and accommodated in the acquisition strategy. These uncertainties can be somewhat mitigated by the selected acquisition strategy and by carefully prioritizing requirements. Such prioritization will be coordinated with the contractor during contract performance to ensure contractor effort is focusing expenditure on key mission objectives. 1.2.3 Schedule constraints. The IOSS contract must be in place prior to 01 OCT 20X1 when the current contracts expire to ensure continuity of services vital to mission success. This contract effort includes a phase-in period of up to 90 days. Negotiated bridge contracts with the appropriate contractors for services being consolidated into this Omnibus IOSS contract are being planned for execution should the Omnibus IOSS award schedule be compromised. The appropriate FAR 6.302-1, Only one or a limited number of responsible sources and no other supplies or services will satisfy agency requirements, justification and approval would be required for those bridge contracts. Source Selection Information – See FAR 2.101, 3.104 AMCI CON 280 Day 5 SH 5-1 RESET Acquisition Plan v2.0 SH 5-1 4 1.2.4 Performance constraints. The IOSS services contained within the PWS are not technically complex. However, the magnitude of the scope, schedule complexity, and the number of different government agencies and contractors with whom the IOSS contractor interfaces complicates the effort and increases associated performance risk. The contractor would also need to be responsive to increases in providing services such as increased air, port and transportation operations meet surge requirements, and housing and other services for incoming personnel as a result of Base Realignment and Closures (BRAC). 1.3 COST. The total estimated five year cost of the contract covered by this acquisition plan, including all options, is $169M. This total includes funds from both institutional and reimbursable customers. The phase-in period (of up to 90 days) is identified as a budget requirement, dependent on successful offeror’s proposed plan and associated price. A one-year basic period of performance and four 12-month pre-priced option periods are anticipated. If all options are exercised, total contract length will be five years. The option periods will be subject to the conditions required to exercise options in FAR 17.207 and will be funded annually. An Independent Government Cost Estimate (IGCE) was prepared. The cost estimate was based on historical data and a staffing model developed by the Joint Base Powell engineering organization and was used in the Joint Base Powell A-76 study conducted last year. Based on the acquisition strategy panel recommendation, and further functional office deliberations the independent cost estimate encompasses a 90-day ramp up period, a one-year basic period of performance and four 12-month option periods. FY 20X2 Phase-in Period – Up to 90 days (01 OCT 20X1 – 30 DEC 20X1) $4.0M FY 20X4 & FY 20X5 Option 2 – Year 3 (JAN 20X4 – DEC 20X4) $32.9M FY 20X2 & FY 20X3 Base – Year 1 (JAN 20X2 – DEC 20X2) $31.7M FY 20X3 & FY 20X4 Option 1 – Year 2 (JAN 20X3 – DEC 20X3) $32.3M FY 20X5 & FY 20X6 Option 3 – Year 4 (JAN 20X5 – DEC 20X5) $33.6M FY 20X6 & FY 20X7 Option 4 – Year 5 (JAN 20X6 – DEC 20X6) $34.3M A cost realism analysis will be performed to ensure contractor understanding of contract requirements and to uncover possible contractor “buy-ins”. “Information Other than Cost and Pricing Data” will be requested to support the cost realism analysis, IAW FAR 15.403-3. 1.3.1 Life-cycle cost. (FAR 7.101) Not applicable to this acquisition. The proposed contract is not for the development of a major system. 1.3.2 Design-to-cost. (FAR 7.101) Not applicable to this acquisition. The proposed contract is not for the development of a major system. 1.3.3 Application of should-cost. (FAR 15.407-4) Not applicable to this acquisition. The proposed contract is not for the development of a major system. Source Selection Information – See FAR 2.101, 3.104 AMCI CON 280 Day 5 SH 5-1 RESET Acquisition Plan v2.0 SH 5-1 5 1.4 CAPABILITY OR PERFORMANCE. The overall performance objectives for the IOSS program are (listed in order of importance): 1) Maximize operational availability of mission essential base infrastructure and common services 2) Maintain acceptable quality levels for delivered contracted services 3) Control and continually reduce base operating costs The PWS contains performance standards/thresholds required to accomplish requirements as identified in the service summary. The requirements are stated in outcome based language in accordance Performance Based Service Acquisition practices. Performance thresholds for IOSS service areas are driven by mission requirements and must be achieved. The high performance thresholds of 100 % of availability of essential infrastructure services is vital for optimal operation and mission success of Joint Base Powell. Key Performance Thresholds: Availability of essential base infrastructure services 100% Achieved Acceptable Quality Levels (AQLs) 99% Base Operating Cost Reduction 10% (over 5 year period) 1.5 DELIVERY OR PERFORMANCE-PERIOD REQUIREMENTS. The complexity and magnitude associated with bundling of existing separate services requirements dictates a five-year period of performance to re-coup start up investments, capture steady state operating data, incorporate lessons learned, test contract strategy, evaluate and refine the requirements and workload data, in preparation of entering into the next long term contract. The technical complexity, cost and schedule risk of bundling requirements after 10 years of separate individual contracts is significant. A large portion of the current contract requirement is separated and performed by disparate contractors. With the consolidation of requirements, Joint Base Powel will be reliant on a single contractor to perform a number of services seamlessly, meeting commercial standards. Based on discussions during the acquisition strategy panel, the performance period will be written to allow up to a 90 day phase-in period with a basic one-year period of performance and four one-year options. A request for information to industry asked “What period of time for transition is necessary for this acquisition?” Responses received ranged from 45 to 90 days. Based on previous contracts and comments from industry, it was recommended that the offerors identify the phase in length (up to a maximum of 90 days) in their proposals. This period will allow the contractor to establish work plans and procedures, staff with fully trained, qualified, and certified personnel with appropriate security clearances, prior to full performance by JAN 20X2 (three months after OCT 20X1 contract award). 1.6 TRADE-OFFS. Among the cost, schedule and performance goals of this acquisition, contractor service level and schedule performance in support of mission needs is more important to the Government than cost. With that said, there are some service areas of the Omnibus IOSS contract that are more critical to the base’s mission than others. The following prioritized service areas are considered “priority services” and should take precedence if cost or schedule tradeoffs are necessary: Security Services, Port Support Services, Airfield Management Services, Transportation / Motor Pool Services and Housing Services. Performance failure by the IOSS contractor in these service areas could have a significant consequence to DoD and other civil users if a critical service was not provided. However, achievement of the Omnibus IOSS contract cost reduction goal is important. If the contractor is faced with the opportunity to increase a Source Selection Information – See FAR 2.101, 3.104 AMCI CON 280 Day 5 SH 5-1 RESET Acquisition Plan v2.0 SH 5-1 6 service performance level above its acceptable level or to reduce operating costs, the government’s preference would be to reduce operating costs. Active contractor management is expected to result in innovative solutions and an associated reduction in overall support costs without degradation of performance. 1.7 RISKS. A risk assessment workshop was conducted during acquisition planning to identify program risks using a probability/consequence methodology. The risks were posted to FedBizOpps for industry comment. Overall, industry agreed that the risks were properly identified. Responses to the IOSS risk assessment were reviewed and validated by the Government team. Industry’s inputs were considered in the development of the Request for Proposal, Sections L & M, the past performance questionnaire, and to identify areas where the Government Program Office should emphasize surveillance of contractor performance. Mitigation strategies have been developed for the highest ranked risks in each area. The primary risk mitigation methods are: working closely with the user and functional representatives to provide a clear description of the requirement in the PWS; conducting market research on commercial best practices and soliciting industry inputs on performance thresholds in the primary service areas; instituting cost and incentive CLINS for those service areas with unpredictable future requirement projections; instituting service phase-in periods into the contract; and assigning clear responsibility for contractor performance surveillance within service areas to base functional experts and organizations. Key risks in the areas of Performance, Cost and Schedule are summarized and analyzed as follows: 1.7.1 Performance risk. As this is a follow-on contract, the risk of providing services inferior to existing services is considered to be low. The current contracts are being successfully performed; however, the current contracts were awarded separately. By streamlining the current services contracts into one IOSS contract, the administrative burden on the Government will be lessened and will allow for a more efficient service from one contractor. Further, one omnibus contract will provide for a more efficient method of contract price reductions. Failure to mitigate performance risk will result in equipment failures, loss of operational availability of systems, decreased reliability of mission essential/critical infrastructure, customer dissatisfaction, mission degradation/delay and an increase in contract costs. The phase-in period is crucial to performance long into the contract. 1.7.2 Schedule risk. Delays may potentially be incurred as a result of protests, transition challenges, and other issues. Anytime services previously performed by small business are openly competed there is a high probability that there will be political inquiries and possibly pressure to slow down the acquisition until all potential issues and questions have been adequately addressed and decisions justified. Furthermore, the contractor’s transition management ability and flexibility to maintain and operate facilities in an environment of mission-scheduled events are keys to performance success from a scheduling perspective. Mission changes demand flexible scheduling of port and airfield service operations as well as close coordination with security services. The Joint Base Powell Support Office is the communication center and the conduit for information flow between all organizations on Joint Base Powell, both Government and commercial. Communication breakdown in this office has the greatest potential to cause mission obstruction. 1.7.3 Cost risk. As a result of the continuing reduction of funds available to support existing facility support contracts due to overall Government budget decreases, it is critical this acquisition achieve cost savings while maintaining a level of service customers have come to expect. Cost risk for this acquisition can occur either as a cost overrun by the contractor during the performance period or as a result of higher bids than expected during proposal competition (as a result of inadequate competition). Source Selection Information – See FAR 2.101, 3.104 AMCI CON 280 Day 5 SH 5-1 RESET Acquisition Plan v2.0 SH 5-1 7 1.7.4 Risk Mitigation Frequent and early publication of the IOSS acquisition on federal solicitation websites and through aggressive promotion of industry day events is aimed at reducing the potential for poor competition among interested facility support contractors. This can further be mitigated through planned “industry or corporate matchmaking” events at the industry day events. Attempts to head off or minimize potential political inquiries about SB bundling impacts will be undertaken by pre-briefing the results of the JB Powell IOSS SB bundling assessment to command and service leaders as well as to local congressional representatives in the base locale. SB subcontracting goals have also been added into the contract requirements and will be a focus during the proposal evaluation / source selection phase. Communication problems between organizations and the contractor are seen as a potential driver of schedule delays and transition performance problems. Communication risks are being mitigated by detailing the customer support functions and interface points in the PWS. Associate Contractor Agreements are also required between contractors providing other base support functions which will clarify lines of communication. The transition risk was mitigated by providing up to a 90 day phase-in period. Proposals will be evaluated on an acceptable/unacceptable basis for approach to employee recruitment, retention of incumbent personnel and security background checks. Software and data will be migrated from the incumbent contractor to the Joint Base Powell information technology (IT) infrastructure prior to contract award. The migration will ensure data and software are available to the contractor during the phase-in period. The incumbent contractor is developing a detailed phase out plan to ensure proper transition. Finally, the chosen contract type (FFP/CPIF) is itself a risk mitigation technique aimed at balancing cost and performance risks in light of budgetary pressures and unknown mission demand forecasts. The CPIF will include Quality Performance Indices (QPIs) to ensure that performance objectives are not sacrificed to achieve cost objectives by applying the QPI to adjust the profit earned. QPIs may be based on key performance areas such as customer satisfaction and small business goals. By utilizing cost sharing, cost incentives and performance incentives, the aim is to decrease out-year costs without dropping below acceptable performance levels which will lower future budget requirements. 1.8 ACQUISITION STREAMLINING . Acquisition streamlining efforts have been and will continue to be implemented by the source selection team. Exchanges with industry have been encouraged. Requests for Information (RFIs) have been used to obtain market research information. An Industry Day was held on 18 DEC 20X0, including one-on-one sessions. Industry Day participants were asked to provide feedback on the Government’s risk assessment, incremental draft request for proposal (DRFP) documents, contract length, and contract structure. A pre-proposal conference is planned. Finally, references to Joint Base Instructions (JBIs) incorporated in the performance work statement have been tailored to require compliance with only the applicable paragraphs. Industry day discussions revealed that potential offerors feel JBI references do not overly restrict contractor innovation. SECTION 2.0 PLAN OF ACTION 2.1 SOURCES. Efforts to identify all potential sources of supply have been conducted. On 1 NOV 20X0, a sources sought notice was published on FEDBIZOPPS. Capability packages were received from 27 potential offerors as follows: Company Aleut Facilities Support Services Applied Planning Internations Inc, Size Alaska Native WO, SDB Interest Prime or Subcontractor Partner or Subcontractor Source Selection Information – See FAR 2.101, 3.104 AMCI CON 280 Day 5 SH 5-1 RESET Acquisition Plan v2.0 SH 5-1 8 Company Arctic Slope World Services/DBA ASWS Bechtel National, Inc BSU, Inc. C. Martin Company, Inc CSC Applied Technologies LLC Del-Jen Inc Diversitech, Inc Dyncorp International EG&G Technical Services, Inc Execusys Inc H&S Resources Corp ITT Systems Division Jacobs Engineering Group, Inc Jantec, Inc Kellogg Brown &Root Services, Inc Lockheed Martin Mission Services ManTech Northrop Grumman Technical Services Parsons Raytheon Project Solutions Inc DBA Sandra Burns Science Applications International Corp Sierra Lobo, Inc TEDCO Yang Enterprises Inc Size Alaska Native Large Large 8(a) Large Large WO, SDB Large Large Small WO Large Large WOSB Large Large Large Large Large Large 8(a), SDB Large SDB Large WO Interest Prime or Subcontractor Prime or Subcontractor Prime or Subcontractor Prime or Subcontractor Prime or Subcontractor Prime Prime Prime Prime Subcontractor Subcontractor Prime Prime Subcontractor Prime Prime or Subcontractor Prime or Subcontractor Prime or Subcontractor Prime Prime or Subcontractor Prime or Subcontractor Subcontractor Subcontractor Subcontractor Subcontractor Industry Day was held on 18 DEC 20X0. The Government presented information to assist prospective offerors in understanding the PWS requirements and aid them in making a bid / no bid decision. The presentation included a power point overview followed by bus tour of Joint Base Powell with site visits to various facilities, a working lunch, followed by a question and answer comment session. 56 potential offerors participated in Industry Day. 42 firms that submitted capabilities packages were in attendance along with 14 additional firms. 17 firms requested one-on-one discussions with the source selection team. 2.1.1 Set-aside recommendation. The contracting officer has determined there is no reasonable expectation offers will be obtained from at least two responsible small business concerns offering the services of different small business concerns IAW FAR 19.502-2(b). There are small businesses that have experience in similar operation and maintenance activities; however, there are no small businesses that have experience in industrial O&M within the magnitude of this requirement. 2.1.2 Subcontracting Opportunity recommendation. Considering the individual services and skills required, there are many subcontracting opportunities available in the IOSS effort. Most of the specific services and skill sets can be performed by small business. However, the skill set is not the only factor in deciding appropriate subcontracting opportunities. Industry was polled on the realistic, fair and attainable small business subcontracting goals. The responses ranged from a low of 20% to a high of 50% with the majority of the input from 25% - 35%. Subcontracting goals above 45% put the acquisition at an unacceptable risk of retaining qualified interest and may be difficult to achieve during periods of uncertain or rapidly fluctuating service demands; therefore, a 35% small business subcontracting goal is recommended. Source Selection Information – See FAR 2.101, 3.104 AMCI CON 280 Day 5 SH 5-1 RESET Acquisition Plan v2.0 SH 5-1 9 2.1.3 Foreign contractors will not be permitted to participate at the prime contractor level or any other level due to national security issues. 2.1.4 FAR Part 8, Required Sources of Supplies and Services are not applicable to this requirement. 2.2 COMPETITION. The existing base operations support contracts were solicited and competed on an unrestricted basis. With that precedent and thorough market research, the contracting officer and the Joint Base Powell Small Business Office agree that a full and open competition is appropriate for this acquisition. A DD Form 2579 has been prepared and coordinated through the Small Business Office. The proposed competition will be competed among businesses operating under North American Industry Classification System (NAICS) code 561210 (Facilities Support Services). The size standard for this NAICS code is $35.5M. Every effort to identify a small business capable of being the prime contractor has been conducted. Opportunity for small businesses to compete for subcontracts will be sought, promoted and sustained through the requirement for large business offerors to submit a small business subcontracting plan that will be evaluated for acceptability. A small business subcontracting goal of 30% was recommended based on a review of semi-annual submittals of SF 294, “Subcontracting Report for Individual Contracts” for the current contracts. Major components or subsystems are not applicable to this acquisition. 2.3 CONTRACT TYPE SELECTION. The contract will be a hybrid FFP/CPIF contract. The risk associated with the work performed during the transition phases (i.e. training, certification, obtaining security clearances, establishing work plans, procedures, and developing a quality control plan) is considered low. This supports a decision to use FFP CLINS for all transition activities. The contract type for the individual service areas will vary. Firm Fixed Price (FFP) CLINS will be used for service areas with well defined requirements and stable service demands across the contract period of performance. Cost-Plus Incentive Fee (CPIF) CLINs will be used for services affected by dynamic and unpredictable mission surges or changes. Examples of changing mission requirements include surges of airfield, port and transportation management and operations to meet varying levels of deployment and increases in housing management to meet needs of incoming personnel as a result of BRAC . If offerors were required to propose on these services on a FFP basis, prices would include unacceptably large contingencies to offset associated contractor risk. Under such a scenario, and in light of current budget constraints, the high cost risk associated with a FFP contract would be unacceptable. Additionally, market research with private industry has shown that common commercial practice for many infrastructure support contracts are established on a cost basis with an incentive for improving on cost targets while performing to standards or better. The focus is on lowering costs with sustained or potentially improved performance and encouraging the contractor to increase efficiency which can be accomplished with a CPIF whereas a FFP would only give the contractor the opportunity to lower its costs to increase its profit and not provide the Government with savings. Incentive. Each type of incentive (Fixed Fee, Escalating Fee, Award Term, Award Fee, and Incentive fee) was researched to determine the lowest risk to the Government while still incentivizing the contractor. Based on the research, incentive fee is recommended. This incentive arrangement motivates the contractor to earn more compensation by controlling costs. It further provides a comprehensive surveillance plan to ensure quality is not sacrificed for cost savings. Based on the results of the IGCE, an Under Target share ratio of 80/20 and Over Target share ratio of 55/45 are anticipated for the CPIF CLINs (subject to negotiation and validation during source selection and proposal evaluation). 2.4 SOURCE-SELECTION PROCEDURES. Source Selection Information – See FAR 2.101, 3.104 AMCI CON 280 Day 5 SH 5-1 RESET Acquisition Plan v2.0 SH 5-1 10 2.4.1 The source selection organization is: [THIS SECTION REMOVED FOR ACADEMIC PURPOSES. SOURCE SELECTION ORGANIZATION TO BE DETERMINED DURING UPCOMING SOURCE SELECTION PLANNING EXERCISE] 2.4.2 A number of acquisition procedures have been analyzed for suitability as a possible strategy: 2.4.2.1 Commercial Item / Service (FAR 12) – Firm Fixed Price (FFP) and Fixed-price with Economic Price Adjustment cannot be uniformly applied to all contract line items due to the complex mix of service requirements not customarily offered or found in the commercial market such as those for airfield and port support operations and maintenance. The dynamic nature of Joint Base Powell missions such as surge, deployment and influx of personnel on an irregular basis requires constant modification of practices, services, and varied level of maintenance. 2.4.2.2 Simplified Acquisition Procedures (FAR 13) are not applicable to this acquisition as the requirement is greater than $150,000. 2.4.2.3 Sealed Bidding (FAR 14) – Awarding on only price and price-related factors does not allow technical and past performance evaluation to mitigate performance risk. Additionally, it may be necessary to conduct discussions to determine best value. 2.4.2.4 Lowest Price Technically Acceptable (LPTA) (FAR 15.101-2) [THIS PARAGRAPH REMOVED FOR ACADEMIC PURPOSES. TO BE DETERMINED DURING UPCOMING SOURCE SELECTION PLANNING EXERCISE] 2.4.2.5 Performance Price Trade Off [THIS PARAGRAPH REMOVED FOR ACADEMIC PURPOSES. TO BE DETERMINED DURING UPCOMING SOURCE SELECTION PLANNING EXERCISE] 2.4.2.6 Full Trade-Off Source Selection Procedures [THIS PARAGRAPH REMOVED FOR ACADEMIC PURPOSES. TO BE DETERMINED DURING UPCOMING SOURCE SELECTION PLANNING EXERCISE] 2.4.3 Proposal Evaluation Factors & Subfactors [THIS PARAGRAPH REMOVED FOR ACADEMIC PURPOSES. EVALUATION FACTORS, IF NEEDED, TO BE DETERMINED DURING UPCOMING SOURCE SELECTION PLANNING EXERCISE] 2.4.4 Solicitation and Posting [THIS PARAGRAPH REMOVED FOR ACADEMIC PURPOSES. TO BE DETERMINED DURING UPCOMING SOURCE SELECTION PLANNING EXERCISE] 2.4.5 Evaluation Period. [THIS PARAGRAPH REMOVED FOR ACADEMIC PURPOSES. TO BE DETERMINED DURING UPCOMING SOURCE SELECTION PLANNING EXERCISE] 2.4.6 Discussions [THIS PARAGRAPH REMOVED FOR ACADEMIC PURPOSES. TO BE DETERMINED DURING UPCOMING SOURCE SELECTION PLANNING EXERCISE] Source Selection Information – See FAR 2.101, 3.104 AMCI CON 280 Day 5 SH 5-1 RESET Acquisition Plan v2.0 SH 5-1 11 2.4.7 Selection Decision & Documentation [THIS PARAGRAPH REMOVED FOR ACADEMIC PURPOSES. TO BE DETERMINED DURING UPCOMING SOURCE SELECTION PLANNING EXERCISE] 2.5 ACQUISITION CONSIDERATIONS. The proposed contract will be a hybrid consisting of Firm Fixed Price (FFP) and Cost Plus Incentive Fee (CPIF) pricing arrangements. Each contract performance period is expected to include the following contract line item numbers (CLINs) (Excluding Phase-In) Contract Line Item Number __ X001 Phase-in (Ramp up period) X002 Engineering Services X003 Grounds Keeping/Landscaping X004 Personnel Management X005 Financial Management X006 Security Protection X007 Housing Services X008 Transportation/Motor Pool Mgt X009 Airfield Management X010 Port Support Activity Contract Type FFP CPIF FFP FFP FFP CPIF CPIF CPIF CPIF CPIF 2.5.1 Section B of the Request for Proposals will likely include alternative CLINS to accommodate budget fluctuations/ constraints which will allow the Government greater flexibility in fulfilling requirements. 2.5.2 A multi-year contract was considered given that it offers certain advantages. However, FAR 17.106-3(d) limits the use of multi-year contracts to firm fixed-price (FFP), fixed price with economic price adjustment (FP w/EPA) or fixed price incentive fee (FPIF) contracts. A completely FFP contract is impractical for the acquisition, excluding phase-in, as it would result in higher contract prices in order for the contractor to offset risks associated with schedule and workload uncertainties. 2.5.3 Sealed Bidding or Negotiation. In accordance with FAR 6.401, use of competitive proposals rather than sealed bidding is appropriate because award will not be made solely on the basis of price and other price-related factors. 2.5.4 Special clauses or provisions: Administrative Contracting Officer (ACO), Environmental Compliance, Government Furnished Property (GFP) “As Is”, Contractor Responsibility for Government Records, Infrastructure Operations and Maintenance Services Associate Contractor Agreements (ACAs), Capitalization of Contractor Owned Equipment, and Potential Organizational Conflict of Interest are envisioned. No FAR deviations are contemplated. 2.6 BUDGETING AND FUNDING. Funding for the contract base year and subsequent option years is programmed and included in the approved President’s budget for FY 20X2. The solicitation will include FAR Clause 52.232-18, Availability of Funds. Source Selection Information – See FAR 2.101, 3.104 AMCI CON 280 Day 5 SH 5-1 RESET Acquisition Plan v2.0 SH 5-1 12 2.7 PRODUCT OR SERVICE DESCRIPTIONS. The PWS defines contractor efforts required for the IOSS. 2.8 PRIORITIES, ALLOCATIONS, AND ALLOTMENTS. 15 CFR Part 700 (Defense and Priority Allocations System) does not apply to this acquisition. This is not a rated contract. 2.9 CONTRACTOR VERSUS GOVERNMENT PERFORMANCE. Contractors have been performing IOSS support for all of the required services except security, personnel and financial management since 1999. An A-76 study was conducted by the Joint Base Powell installation commander and it determined that there were adequate commercial capabilities and significant benefits to be derived by outsourcing personnel, security, and financial management services. As defined in OMB Circular A-76, the IOSS scope of work is commercial and will be subjected to competitive forces IAW policy (FAR 7.302). The Joint Base Powell Program Office and Joint Base Contracting Office will manage and oversee the contractor’s performance with the assistance of assigned CORs and will use the Contractor Performance Assessment Reporting System (CPARS) for formal reporting and documentation of contractor performance. Potential organizational conflict of interests has been analyzed by the Contracting Officer. Legal advice was obtained, and it was determined that no actual or potential conflicts of interest exist at this time. 2.10 INHERENTLY GOVERNMENTAL FUNCTIONS. The inherently governmental functions addressed in FAR Part 7.5 have been reviewed and found not to be relevant to the IOSS effort. None of the tasks to be performed by the contractor are inherently governmental. 2.11 MANAGEMENT INFORMATION REQUIREMENTS. The contractor will have requirements for resource management, cost accounting, work control, data management, operations scheduling, systems staffing, etc. These performance requirements, combined with the need for Government insight in these areas, indicate a need for substantial automated hardware and software to meet these requirements. The contractor’s efforts will be monitored through Contract Data Requirement List deliverables, meetings, a windows based application reporting tool, and through Defense Contract Audit Agency (DCAA) audits and reports. 2.12 MAKE OR BUY. This is not a production contract, therefore the make or buy program does not apply. 2.13 TEST AND EVALUATION. Acquisition is not for a major system; therefore, test and evaluation considerations do not apply. 2.14 LOGISTICS CONSIDERATIONS. The contractor is expected to perform to industry standards which include documented procedures for control of documents and records, internal audits, monitoring and measurement of processes, control of nonconforming products, corrective and preventive actions. Contractor will be required to provide plant, material, and equipment and reduce warehouse footprint through “just in time” philosophy and analyze operational/administrative space requirements to comply with allocation goals. In addition, the contractor must be prepared to respond quickly to unexpected and immediate surge requirements. A sustaining Source Selection Information – See FAR 2.101, 3.104 AMCI CON 280 Day 5 SH 5-1 RESET Acquisition Plan v2.0 SH 5-1 13 quality control program focus shall be the attainment of continuous quality improvement. International Organization for Standardization (ISO) 9001 certification is not required. Contractor’s quality management system/program will be assessed with validation of contractor metrics data and collection processes. A Performance Plan shall define the Government’s performance monitoring process and team roles. The Program manager will be provided insight into contract performance through the periodic evaluation and validation of reported critical performance metrics and associated data. Using FAR 46.703 (Criteria for Use of Warranties), the Contracting Officer does not consider a warranty for any item or service necessary beyond standard commercial warranties for this acquisition, including warranties of technical data. Contract data requirements are included in the PWS. Technical data such as engineering data, repair manuals, inspection and test data generated in the performance of the IOMS contract shall become the property of the Government. Technical data generated and paid for as a contractor’s corporate expense will be considered proprietary data. Contractors will be instructed to appropriately mark proprietary data. This ensures that the government has adequate data to compete future contracts and transition to new contractors when necessary. The solicitation and contract will contain the appropriate contract clauses. Data from the current contract will be available to potential offerors through the technical library posted to FedBizOpps. 2.15 GOVERNMENT-FURNISHED PROPERTY. A Government Furnished Property (GFP) list will be included in the RFP. The GFP will be made available to the contractor on the contract start date. The PWS requires the IOSS contractor to provide an updated GFP list containing only those items required for performance of the contract, all remaining items will be disposed of as appropriate IAW FAR Part 45. Since the use of GFP is not identified as a risk to the program, it will not be a discriminator in proposal evaluation. Additional Government property to be acquired in performance of the contract will be funded and acquired through the Contractor Acquired Property CLIN. The contractor shall provide all plant, equipment, material, supplies, labor and/or other services not specifically identified as government furnished in the RFP. The contracting officer has determined that possession of the GFP by the incumbent does not create any competitive advantage since all GFP will transfer to the successful offeror and there are no expected cost savings attributable to the possession of the GFP. Property administration will be performed by Joint Base Powell Property Administrator/Plant Clearance Officers. The contractor will be required to follow all applicable procedures in FAR Part 45. The solicitation and contract will contain the appropriate Government Property clauses. 2.16 GOVERNMENT-FURNISHED INFORMATION. All government-owned site operation and maintenance manuals and drawings will be identified to all interested parties through FedBizOpps or FedTeDs. Any additional Government-owned documentation will be provided to the successful contractor when requested, necessary and available. The Government is in the process of identifying and securing work control and maintenance data for transition to Joint Base Powell-owned IT infrastructure. Data will be available for transition during the phase-in period. 2.17 ENVIRONMENTAL AND ENERGY CONSERVATION OBJECTIVES. All applicable Federal, State and local laws and regulations will apply to this acquisition. The requirement has been analyzed IAW FAR Part 23, Environment, Energy and Water Efficiency, Renewable Energy Technologies, Occupational Safety, and Drug-Free Workplace and all applicable supplements. The successful contractor will be required to meet all the applicable FAR requirements. Applicable policies are: Hazardous Material Identification and Material Safety Data, Right-to-Know Laws, Pollution Prevention Requirements, and Ozone Depleting Substances. The Environmental Protection Agency’s list of EPA-designated products has been reviewed and no products were found applicable. Source Selection Information – See FAR 2.101, 3.104 AMCI CON 280 Day 5 SH 5-1 RESET Acquisition Plan v2.0 SH 5-1 14 2.18 SECURITY CONSIDERATIONS. Security issues will be addressed in the DD Form 254, Department of Defense Contract Security Classification Specification. The contractor will be required to maintain a SECRET facility clearance. The successful offeror will undergo an agency security check prior to award. Technical support may be required at classified DoD locations. No classified documents or hardware will be generated in the performance of the contract. IAW DFARS PGI 207.105(b)(20)(C), Special Considerations for Acquisition Planning for Crisis Situations Outside the United States, it is not likely that the contractor will have to perform in a crisis situation at any overseas location. All documents have been cleared by Government security personnel to release on FedBizOpps except for the following documents which will be released on FedTeDS: Security badging requirements, technical summary of infrastructure, facilities and system listing. All documents will be reviewed by the security monitor to determine if the document will be posted on FedBizOpps or FedTeDS. 2.19 CONTRACT ADMINISTRATION. Contract administration, to include property administration, will be performed by the Joint Base Powell Contracting Squadron in accordance with FAR Part 42. CORs for each individual service area will be assigned from the following Joint Base Powell organizations: Engineering Personnel Management and Support Financial Management Security Protection Grounds Keeping/Landscaping Housing Transportation/Motor Pool Mgt Airfield Management Port Support JBP / Civil Engineering JBP / Personnel JBP / Finance & Accounting JBP / Security JBP / Services JBP / Services JBP / Logistics & Transportation JBP / Logistics & Transportation JBP / Logistics & Transportation The CORs will be responsible for monitoring the contractor’s day-to-day compliance with the provisions of the contract and reporting instances of non-compliance as appropriate. Financial audits will be performed by the Defense Contract Audit Agency (DCAA). The performance plan will define the Government’s performance monitoring process and team roles. The Government team will oversee contractor performance and CPARS will be used. 2.20 OTHER CONSIDERATIONS. The contractor will be responsible for adhering to all federal, state, and local statutes and ordinances. This acquisition will contain the required value-engineering clause. Associate Contractor Agreements (ACA) will be required within 90-days of assumption of full performance. The Contracting Officer will review before execution. The ACA will not relieve contract requirements. No conflicts of interest exist at this time. Source Selection Information – See FAR 2.101, 3.104 AMCI CON 280 Day 5 SH 5-1 RESET Acquisition Plan v2.0 SH 5-1 15 2.21 MILESTONES FOR THE ACQUISITION CYCLE. [THIS MILESTONE SECTION REMOVED FOR ACADEMIC PURPOSES. AN ACQUISITION MILESTONE AND SOURCE SELECTION SCHEDULE WILL BE DETERMINED DURING UPCOMING SOURCE SELECTION PLANNING EXERCISE] 2.22 IDENTIFICATION OF PARTICIPANTS IN ACQUISITION PLAN PREPARATION. Ms. Marie Stallworth, Contracting Officer, JBP/Contracting, DSN XX7-7005 Mr. Richard Wilson, Contracting Specialist, JBP/Contracting, DSN XX7-7006 Mr. Sam Smythe, Competition Advocate, JBP/Contracting, DSN XX7-7007 Mr. Chris Cooper, Project Manager, Joint Base Powell IOSS Project, DSN XX7-7010 Ms. Tracy Thorson, Project Assistant, Joint Base Powell IOSS Project, DSN XX7-7011 Mr. Patrick Steele, Chief, Civil Engineering, JBP/ Civil Engineering, DSN XX7-7002 Ms. Margot Johnson, Small Business Specialist, JBP/Small Business, DSN XX7-7350 Mr. Jackson Gold, Financial Analyst, JBP/Finance & Accounting, DSN XX7-7560 Source Selection Information – See FAR 2.101, 3.104 AMCI CON 280 Day 5 SH 5-1 RESET Acquisition Plan v2.0 SH 5-1 16

© Copyright 2026