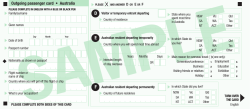

Card Product Disclosure Statement