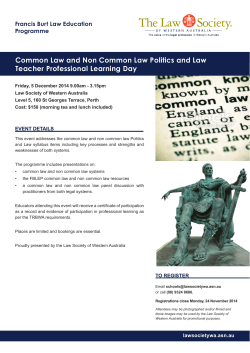

Load and Go China Card Supplementary Short Form

Supplementary Short-Form Product Disclosure Statement Prepared 23 March 2015 This Supplementary Short-Form Product Disclosure Statement supplements and must be read together with the Australia Post Load&Go China Card Short-Form Product Disclosure Statement. A copy of the full Product Disclosure Statement including all applicable Terms and Conditions (PDS) for the Australia Post Load&Go China Card (the Card) is available at www.auspost.com.au/ loadandgochina. 1. ROLE OF AUSTRALIAN POSTAL CORPORATION Australian Postal Corporation ABN 28 864 970 579 (Australia Post) has ceased to act as an Authorised Representative of Bank of China (Australia) Limited (ABN 28 110 077 622) (Bank of China) and is appointed as an Authorised Representative (Authorised Representative No. 338646) of Australia Post Services Pty Ltd (ABN 67 002 599 340 AFS Licence No. 457551) (Australia Post Services). As the Authorised Representative of Australia Post Services (not Bank of China), Australia Post will continue to act as a distributor and promoter of the Card and will continue to be responsible for providing various cardholder services. Like Australia Post, Australia Post Services: • does not make or give any express or implied warranty or representation in connection with the Card. • is not liable for any loss you suffer (including indirect or consequential loss) arising in connection with the Card. Further, neither Australia Post Services nor anyone else acting on its behalf has the authority on behalf of Bank of China to: • tell you anything about any Card that is inconsistent with the information contained in a PDS; • give you financial product advice (that is, a recommendation or statement of opinion intended or that could be reasonably regarded as being intended to influence you in making a decision) about any Card; or • do anything else on the Bank of China’s behalf, other than marketing, arranging for the issue of and providing customer services for a Card. 3. CARD BALANCE AND TRANSACTION HISTORY • The Card Balance can also be obtained via SMS, at ATMs displaying the UnionPay logo, or by calling Customer Assistance and following the IVR prompts*. • To request your Card Balance by SMS using your Registered mobile phone number (without blocked caller ID), you will need to text POST BAL then a space, followed by your Access Code and another space and then the last 4 digits of your Card Number to 0499 881 882 (or +61 409 881 882 from outside Australia). Include the spaces. Example: “POST BAL 123456 1234”. • To request your transaction history (last 3 transactions) by SMS, text POST TRN then a space, followed by your Access Code and another space and then the last 4 digits of your Card Number to 0499 881 882 Example: “POST TRN 123456 1234”. 4. BACK-UP CARDS Back-Up Cards may be made available for purchase online via the Website*. A Back-Up Card is intended for use in the event that your primary Card is lost, stolen or damaged, and can be linked to access the same Card Balance as your primary Card. As such, the Back-Up Card should only be activated when the primary Card has been reported lost, stolen or damaged, and has been locked to prevent its use. 2.PRIVACY It may be necessary for Bank of China or Australia Post to share your Personal Information with Australia Post Services to administer a complaint or the Product provided to you. Information collected by Australia Post Services will be subject to the same conditions as set out in the Privacy Policy applying to Australia Post available at www.auspost.com.au. *P lanned enhancement. The Website at www.auspost.com.au will indicate when each planned enhancement becomes available. Australia Post Load&Go China Card Supplementary PDF and FSG as at 23 March 2015. FICS_PDS_FA.indd 1 12/03/2015 3:40 pm Australia Post Load&Go China Card Australia Post Financial Services Guide Preparation date: 23rd March 2015 About this Financial Services Guide This Financial Services Guide (FSG) is issued by Australian Postal Corporation (ABN 28 864 970 579, Authorised Representative No. 338646) (Australia Post) and Australia Post Services Pty Ltd (ABN 67 002 599 340) (Australia Post Services) (AFS Licence No. 457551) (together us, our or we). The purpose of this FSG is to assist you in deciding whether to use any of the financial services relating to the Australia Post Load&Go China Card (Card) that are described in this FSG, and to inform you about how we provide financial services in respect of the Card. It contains information about: • How you can contact us; • What financial services we are authorised to provide; • How we and other relevant parties are paid in relation to the services offered; and • What to do if you have a complaint. What other documents should you receive? You should also receive a Short-Form Product Disclosure Statement (Short-Form PDS) when you purchase a Card in-store. The Short‑Form PDS contains a summary of the significant benefits, risks, costs, features and conditions of use of the Card to assist you in deciding whether to acquire the Card. More detailed information is set out in the full Product Disclosure Statement (PDS), which is available at auspost.com.au/loadandgochina or by contacting Customer Assistance between 8:00am to 8:00pm AEST on a business day and speaking to a customer service consultant. How you can contact us? You can contact Australia Post and Australia Post Services by: Phone:13 13 18 from Australia, or +61 3 8847 9045 from overseas Mail: Australia Post Customer Sales and Service GPO Box 9911 Melbourne VIC 3001 Website:www.auspost.com.au What financial services are we authorised to provide? Australia Post Services and Australia Post (on behalf of Australia Post Services) are authorised to provide financial services in relation to the Card. We are authorised to arrange the issue, variation and disposal of the Card. We are also authorised to provide general advice in marketing materials about the Card but we are not authorised to give personal advice. This means any commentary, statements of opinion and recommendations by us in relation to the Card contain only general advice. That is, such statements of opinion and recommendations have been prepared without taking into account your personal objectives, financial situation or needs. Compensation arrangements Australia Post will be acting on behalf of Australia Post Services. Australia Post Services is therefore responsible for the financial services described in this FSG. Australia Post Services has professional indemnity insurance cover and other internal arrangements in place in respect of financial services provided to retail clients. These arrangements comply with the requirements of Section 912B of the Corporations Act 2001. How is Australia Post remunerated for providing the financial services? Australia Post receives remuneration and benefits in respect of, or attributable to, the financial services that Australia Post is authorised to provide. The remuneration and benefits will be payable if Australia Post arranges for Bank of China (Australia) Limited (ABN 28 110 077 622, AFSL / Australian Credit Licence 287322) (Bank of China) to issue or vary a Card to you. Payment for the services Australia Post provides Australia Post receives fees paid by you for using the product (as outlined in the PDS), as well as fees from Bank of China. Some fees are paid to Australia Post daily, others monthly. Bank of China pays Australia Post an amount calculated on the daily total Australian Dollar (AUD) balances available for transactions for Cards issued. The amount paid is based on the Cash Rate Target (CRT) published by the Reserve Bank of Australia (less a margin) and the actual rate applied is determined by which of the following tiers the daily total balance falls into. The CRT can vary and can be viewed at: www.rba.gov.au. Balance Rate AUD$1 or more, but less than AUD$5,000,000 CRT minus 0.75% AUD$5,000,000 or more, but less than AUD$30,000,000 CRT minus 0.50% AUD$30,000,000 or more CRT minus 0.25% Bank of China also pays Australia Post an amount calculated on the daily total Chinese Yuan (CNY) balances available for transactions for Cards issued. The amount paid is based on the Hong Kong Interbank Offered Rate for offshore-traded Chinese Yuan (CNH HIBOR) as published by Thomson Reuters (less a margin) and the actual rate applied is determined by which of the following tiers the daily total balance falls into. The CNH HIBOR can vary and can be viewed at: https://www.tma.org.hk/en_market_info.aspx. Balance Rate CNY1 or more, but less than CNY5,000,000 CNH HIBOR minus 0.75% CNY5,000,000 or more, but less than CNY30,000,000 CNH HIBOR minus 0.50% CNY30,000,000 or more CNH HIBOR minus 0.25% Bank of China will pay to Australia Post the fees and charges received from you, as listed in the PDS, debited to the available balances of the Cards (subject to any fees and charges Bank of China retains as specified in this FSG). Australia Post may also obtain a benefit by including its own margin, or being paid the UnionPay margin, included in the foreign exchange rate used in foreign exchange transactions. You can request details of these margins from us before, or at any time after, a Card is issued to you. How is Bank of China paid in respect to each Card issued? Bank of China receives the following amounts in respect of each Card issued (exclusive of any applicable goods and services tax) – $0.10 for each Card sold, $0.11 for each Card reload made by direct entry, $7.50 for each returned direct entry reload if manual work is required, and 0.55% of the exchange rate margin used in foreign exchange transactions. What should you do if you have a complaint? If you have a complaint about the services provided by us, you should contact Australia Post by: Phone: 13 13 18 from Australia, or +61 3 8847 9045 from overseas Mail:Australia Post Customer Sales and Service GPO Box 9911 Melbourne VIC 3001 Website:www.auspost.com.au Our internal dispute resolution process requires that we aim to resolve most complaints within 10 working days. If we are unable to resolve your complaint to your satisfaction within 45 days, you may be eligible to escalate the complaint to our external dispute resolution service. Australia Post Services uses the services of the Financial Ombudsman Service for external dispute resolution and their contact details are as follows: Mail: GPO Box 3, Melbourne VIC 3001 Phone: 1300 78 08 08 Fax: 03 9613 6399 Website:www.fos.org.au Please note that FOS will refer your complaint back to Australia Post Services if it has not been investigated. Australia Post Load&Go China Card Supplementary PDF and FSG as at 23 March 2015. FICS_PDS_FA.indd 2 12/03/2015 3:40 pm

© Copyright 2026