Ave Maria Rising Dividend Fund

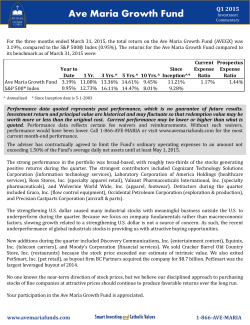

Ave Maria Rising Dividend Fund Q1 2015 Investment Commentary For the three months ended March 31, 2015, the total return on the Ave Maria Rising Dividend Fund (AVEDX) was 0.34%, compared to 0.95% for the S&P 500® Index. The returns for the Ave Maria Rising Dividend Fund compared to its benchmark as of March 31, 2015 were: Current Prospectus Year to Since Expense Expense Date Ratio Ratio 1 Yr. 3 Yrs.^ 5 Yrs.^ Inception^* Ave Maria Rising Dividend Fund 0.34% 8.16% 15.42% 13.90% 9.66% 0.92% 0.98% 0.95% 12.73% 16.11% 14.47% S&P 500® Index 8.24% ^ Annualized * Since Inception date is 5-2-2005 Performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value are historical and may fluctuate so that redemption value may be worth more or less than the original cost. Current performance may be lower or higher than what is quoted. Performance data reflects certain fee waivers and reimbursements. Without such waivers, performance would have been lower. Call 1-866-AVE-MARIA or visit www.avemariafunds.com for the most current month-end performance. The adviser has contractually agreed to limit the Fund’s ordinary operating expenses to an amount not exceeding 1.25% of the Fund’s average daily net assets until at least May 1, 2015. Contributors to positive performance were broad-based, with over 60% of the stocks generating positive returns during the quarter. The strongest contributors included Hasbro, Inc. (toys & games), Lowe’s Companies, Inc. (home products store), Microchip Technology, Inc. (semiconductor devices), Ross Stores, Inc. (specialty apparel retail), and Tupperware Brands Corporation (consumer products). The detractors during the quarter included Caterpillar, Inc. (construction & mining machinery), Franklin Resources, Inc. (investment management), Intel Corporation (semiconductor devices), Occidental Petroleum Corporation (exploration & production), QUALCOMM, Inc. (semiconductor devices), and United Parcel Service, Inc. (courier services). With the world’s central banks trying to outdo each other in stimulating their respective economies, foreign currency exchange rates have been volatile. In particular, the U.S. dollar has strengthened versus other major currencies. This has hurt earnings and stock prices of many companies with meaningful business outside the U.S. during the quarter. Because we focus on the long-term underlying fundamentals, we’re inclined to use these short-term price declines as opportunities to purchase exceptional companies at lower prices. New additions during the quarter included Donaldson Company, Inc. (pollution control equipment), W.W. Grainger, Inc. (industrial distribution & rental), and Fifth Third Bancorp (banks). We exited HCC Insurance Holdings, Inc. (p&c insurance) and PetSmart, Inc. (pet retail) during the quarter. A group of investors led by BC Partners acquired PetSmart for $8.7 billion, which was the largest leveraged buyout of 2014. Next month, the Fund will be 10 years old, having commenced operations in May 2005. Since inception through March 31, 2015, the return for the Fund was 9.66% compounded annually. (This compares with 8.24% for the S&P 500 Index). What is noteworthy is this period spanned the “great recession” and the super bear market of 2008 when the S&P 500 Index was down 37.0%. Through it all, most of our portfolio www.avemariafunds.com 1-866-AVE-MARIA Ave Maria Rising Dividend Fund Q1 2015 Investment Commentary companies continued to grow, prosper, and compound value for shareholders, returning some of that value in the form of a rising stream of dividends. The future, as always, remains uncertain, but we will continue to search out and invest in companies that have a demonstrated ability to thrive during the good times and challenging times. Your participation in the Ave Maria Rising Dividend Fund is appreciated. IMPORTANT INFORMATION FOR INVESTORS As of 3-31-15, the holding percentages of the stocks mentioned in this commentary are as follows; Hasbro, Inc. (2.4%), Lowe’s Companies, Inc. (3.0%), Microchip Technology. Inc. (3.3%), Ross Stores, Inc. (2.8%), Tupperware Brands Corporation (3.1%), Caterpillar, Inc. (2.6%), Franklin Resources, Inc. (2.4%), Intel Corporation (2.0%), Occidental Petroleum Corporation (2.2%), QUALCOMM, Inc. (2.8%), United Parcel Service, Inc. (2.2%), Donaldson Company, Inc. (2.1%), W.W. Grainger, Inc. (2.1%), and Fifth Third Bancorp (1.9%). Fund holdings are subject to change and should not be considered purchase recommendations. There is no assurance that the securities mentioned remain in the Fund’s portfolio or that securities sold have not been repurchased. The Fund’s top ten holdings as of 3-31-15: Johnson Controls, Inc. (3.6%), Microchip Technology, Inc. (3.3%), Bank of NY Mellon Corp. (3.3%), Cisco Systems, Inc. (3.2%), Abbott Laboratories (3.2%), Tupperware Brands Corp. (3.1%), Lowe’s Companies, Inc. (3.0%), Schlumberger Limited (2.9%), Diageo PLC ADR (2.8%) and Norfolk Southern Corp. (2.8%). The most current available data regarding portfolio holdings can be found on our website, www.avemariafunds.com. The investment performance assumes reinvestment of dividends and capital gains distributions. Performance data reflects certain fee waivers and reimbursements. Without such waivers, performance would have been lower. The S&P 500® Index is a capitalization weighted unmanaged index of 500 widely traded stocks, created by Standard & Poor’s. The index is considered to represent the performance of the stock market in general. Indexes do not incur fees and it is not possible to invest directly in an index. Request a prospectus, which includes investment objectives, risks, fees, expenses and other information that you should read and consider carefully before investing. The prospectus can be obtained by calling 1-866-283-6274 or online at www.avemariafunds.com. Distributed by Ultimus Fund Distributors, LLC. www.avemariafunds.com 04-05-071515 The Adviser invests only in securities that meet the Fund’s investment and religious requirements. The returns may be lower or higher than if decisions were based solely on investment considerations. The method of security selection may or may not be successful and the Fund may underperform or outperform the stock market as a whole. All mutual funds are subject to market risk, including possible loss of principal. The Fund’s investments in small- and mid-capitalization companies could experience greater volatility than investments in large-capitalization companies. AVEDX invests primarily in dividend paying companies and it is possible these companies may eliminate or reduce their dividend payments. 1-866-AVE-MARIA

© Copyright 2026