PCORI Fee - Benefit Commerce Group

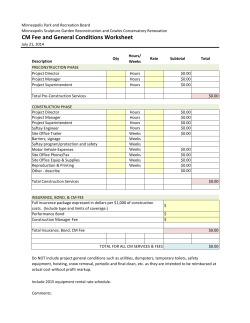

PCORI Fee (Patient-Centered Outcomes Research Institute) WHAT IS IT? Created by the Patient Protection and Affordable Care Act (PPACA), the PCORI fee is to promote research to evaluate and compare the health outcomes and clinical effectiveness, risks, and benefits of medical treatments, services, procedures, and drugs. PCORI is funded, in part, by fees assessed on health insurers and plan sponsors of self-insured group health plans. NOTE: The PCORI fee is also referred to by some as: CER or CERF (Comparative Effectiveness Research Fee) or the Comparative Research Assessment. WHEN IS IT DUE? HOW MUCH IS THE FEE? For policy years beginning on or after November 1, 2011, the first fee is due no later than July 31st of the calendar year immediately following the last day of the plan year; phasing out in 2019. For calendar year plans, the due date will be July 31 of the following year. Plan Year Start Date Fee Due Date From November 1, 2011 through January 1, 2012 From February 1, 2012 through October 1, 2012 From November 1, 2012 through January 1, 2013 From February 1, 2013 through October 1, 2013 From November 1, 2013 through January 1, 2014 From February 1, 2014 through October 1, 2014 On or after November 1, 2014 going forward $1/covered life* $1/covered life* $2/covered life* $2/covered life* $2.08/covered life* $2.08/covered life* TBD** 7/31/2013 7/31/2014 7/31/2014 7/31/2015 7/31/2015 7/31/2016 7/31 of cal yr following plan yr end *actual or average number of covered employees and dependents (for non-integrated HRAs: count number of employees enrolled in HRA; do not count dependents) **fee is expected to increase until phase-out in 2019 WHO PAYS? --Health insurers pay the fee on fully-insured plans. --Employers (plan sponsors) pay the fee on self-funded plans, including Health Reimbursement Accounts (HRAs). Retiree coverage and retiree-only plans are also subject to the fee. The fee is tax deductible as an ordinary business expense. ___________________________________________________________________________________ Special rules for Health Reimbursement Accounts (HRAs) and Health Flexible Spending Accounts (FSAs). •If you have a fully-insured health plan and an HRA, the HRA is considered a self-funded plan. The health plan insurer pays the fee on the fully-insured group health plan and you, the plan sponsor, pay the fee on the HRA, even if you use a third-party HRA administrator. •If you sponsor both a self-funded group health plan and a separate HRA, you pay the fee only on the group health plan. •If you sponsor only an HRA with no group health plan, you pay the fee on the HRA. •Most health FSAs will not be subject to the PCORI fee because they satisfy the requirements to be an excepted benefit, specifically the maximum benefit requirement and group health plan coverage. If you believe your FSA may require a fee, please contact your FSA vendor for details. The IRS specifically states that retiree coverage and retiree-only plans are subject to the PCORI fee. The final regulations also clarify that accident and health coverage provided to individuals who have continuation coverage under COBRA or similar state continuation laws may be subject to the fee. HOW IS NUMBER OF COVERED LIVES DETERMINED? Rules for counting covered lives vary slightly for fully insured plans (fee paid by insurance company) and self-funded plans. NOTES: --Former employees and their dependents covered under COBRA extension must be included in the average covered lives. --For non-integrated HRAs, the plan sponsor may count the number of employees enrolled in HRA; do not count dependents. Fully insured Plans-- Four methods to count covered lives: *Actual Count *Snapshot Method *NAIC Member Months Method *State Form Method Self-funded Plans-- Like fully insured plans, plan sponsors must use the same method consistently for the duration of any year and the same method for all policies subject to the fee. • Actual Count – Count total covered lives each day of plan year and divide by the number of days in the plan year. • Snapshot Method – Use data of covered lives on a single day in each quarter (or more than one day) and divide the total by the number of dates on which a count was made. (The date or dates must be consistent for each quarter.) o Snapshot Count: Count the total number of covered employee lives and covered dependent lives. o Snapshot Factor: Use the sum of: (1) the number of participants with self-only coverage, and (2) the number of participants with other than self-only coverage multiplied by 2.35. • Form 5500 Method – For self-only coverage, determine the average number of participants by combining the total number of participants at the beginning of the plan year with the total number of participants at the end of the plan year as reported on the Form 5500 and divide by 2. In the case of plans with self-only and other coverage, the average number of total lives is the sum of total participants covered at the beginning and the end of the plan year, as reported on the Form 5500. Sponsors that want to use the 5500 method for calculating covered lives need to ensure that the Form 5500 for those plans will be filed by their July 31 due date for PCORI, and that no extensions will be necessary. NOTE: If a self-funded plan sponsor has more than one self-funded plan (e.g., one for medical, another for pharmacy) it may treat them as a single self-funded plan for purposes of this fee to avoid double counting of the members. This special counting rule only applies to self-funded plans. WHAT FORM IS USED?/HOW IS THE FEE PAID? IRS Form 720 (Quarterly Federal Excise Tax Return Form) will be used for paying and reporting the PCORI fee. Third parties cannot report or remit the fees on behalf of plan sponsors. The current Form 720 (Rev. January 2015) is an online fillable form that can be found on the IRS website at www.irs.gov/pub/irspdf/f720.pdf. Instructions for Form 720 can be found at www.irs.gov/pub/irs-pdf/i720.pdf. The instructions for the PCORI fee section are on pages 8 and 9 of the Instructions document. In addition, BCG has completed a “Sample Form 720” showing reporting of only the PCORI fee (bracketed to show $2 fee or $2.08 fee). It is posted on our website’s Health Reform section. If you pay the fee by check rather than through EFTPS, make your check payable to "United States Treasury" and include the Form 720-V (payment voucher) form. Do not file the voucher part of the form with your Form 720 if you pay by EFTPS. Companies that have no other excise taxes to report on Form 720 only need to file the form for the 2nd quarter of applicable years (due date July 31). Companies that file Form 720 each quarter, to report other excise taxes, should report and pay the PCORI fee only on the form filed for the 2nd quarter of applicable years (due date July 31). [20150326]

© Copyright 2026