IFN COUNTRY CORRESPONDENTS The UAE

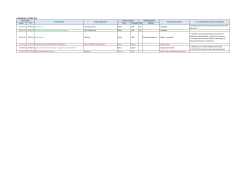

IFN COUNTRY CORRESPONDENTS The UAE — A key participant in the Islamic ϐinance economy UAE By Rima Mrad A number of delegations visited the UAE in the past period with the aim of focusing on the terms of cooperation between the UAE and various European governments with respect to the promotion of the Islamic finance sector. This definitely is helping in shaping the progressive role the UAE is playing in the development of this sector and in fostering Dubai’s identification as a capital for the global Islamic finance economy. Belgian economic mission in the UAE Belgium is one of the UAE’s top trading partners. During the past month, a Belgian economic mission was hosted in the UAE. The mission was presided by Princess Astrid. This economic mission occurred in the UAE between the 24th-26th March 2015, the aim of which was to further promote and strengthen economic ties between the UAE and Belgium. During the mission, a seminar, ‘Islamic Economy in Belgium: Scope and Concrete Opportunities’, was hosted on the 26th March 2015, at the Conrad Hotel in Dubai at which Nadim Bardawil and Ahmad Waheed of Bin Shabib & Associates gave a presentation on sovereign and private Sukuk. The seminar included a delegation of businessmen and various officials from Belgium. The UAE representatives/ delegation at this seminar included key officials from the Dubai Chamber of Commerce, Dubai Economic Development and the Dubai Islamic Economy Development Center. Islamic Economy ‘Fiqh’ Conference Together with the Dubai government, the Islamic Affairs and Charitable Activities Department in Dubai hosted an Islamic Economy Conference between the 22nd24th March 2015, at the Dubai World Trade Center. The aim was to explore the principles surrounding Islamic economy and to promote Dubai as the capital of Islamic banking. This conference offered a platform to discuss topical issues such as whether Islamic finance is preferable © to conventional financing in the current economic climate and whether Islamic financing will promote more global economic equality. Proposed Emirates Airline deal backed by Britain’s Export Credit Agency Emirates Airline has announced that it will be purchasing four new A380s, via a US$913 million Sukuk issuance, which will be guaranteed by Britain’s Export Credit Agency (BECA). The predicted average life of the bond will be 5.37 years (Emirates 24/7 Business). This has captured a lot of international interest, as this will be the first time that BECA has guaranteed a Sukuk issuance. Deϐinition of Sukuk in Islamic ϐinance In its simplest terms, Sukuk can be described as an Islamic bond or Shariah compliant Islamic investment certificates. Sukuk is becoming an increasingly popular financial instrument among those wishing to raise funds for projects, developments, etc. Conventional bonds and Sukuk Conventional bonds represent an issuer’s debt obligation to the bondholder, whereas Sukuk represents the investor’s undivided ownership in an underlying asset. The investors (Sukukholders) are issued with Sukuk certificates, in return for initial funds. The income generated by the underlying asset is then divided periodically, among the investors. Types of Sukuk structures The various types of Sukuk structures are as follows: • Ijarah: This is based on a structure involving leasing a tangible asset. The conventional equivalent of this is a lease. • Mudarabah: This structure is based on a partnership, whereby one party provides the capital (Rab Al Maal), and the other manages it (Mudarib). The conventional equivalent to this is a fund manager. • Murabahah: This structure entails the financier buying goods/investment 20 for the cost price and then selling it on to the customer for a profit (cost price plus a mark-up). The conventional equivalent to this is cost-plus financing. • Musharakah: This is a type of partnership, both parties contribute capital and labor and share the profits at an agreed ratio. The conventional equivalent to this is a joint venture. • Istisnah: In this type of structure, the asset does not exist at the time of contracting. This type of structure is commonly used in manufacturing projects, to finance such projects. The conventional equivalent to this is short-term project finance. • Hybrid: In this type of structure, the underlying pool of assets consists of different Islamic finance contracts, such as Istisnah, Mudarabah and Sukuk Ijarah. Types of bonds A conventional bond is described as a debt security/investment, whereby the issuer (borrower), repays the money to the bondholder (investor), with interest. The different types of bonds are as follows: • Fixed rate bonds: The interest is fixed at the date that the bond is issued and this rate remains the same throughout the existence of the bond. • Floating rate notes: The interest varies in these types of investments. It is based on benchmark rates, such as LIBOR or EURIBOR. • Variable rate notes: The interest in these types of investments will vary at different set times or at certain triggers, during the existence of the bond/notes. • Zero coupon bonds: These bonds do not have interest but are issued to the investor at a lower price. The investor will receive the full price back once the bond matures. • Partly-paid bonds: The price of the bonds is paid in installments and interest only accrues on the part that is paid. Rima Mrad is a partner at Bin Shabib & Associates. She can be contacted at rima. [email protected]. 15th April 2015

© Copyright 2026