The approach to achieve a sound remuneration policy

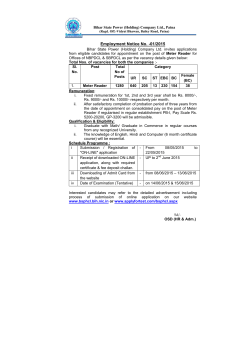

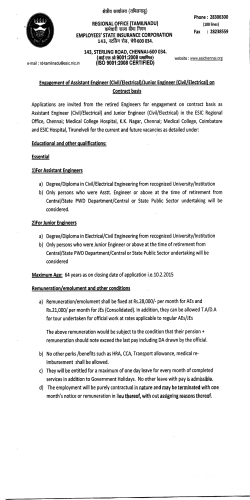

AIFMD - The approach to achieve a sound remuneration policy Employees under policy Employees under policy Establishing objectives and risks Establishing objectives and risks Granting variable remuneration Determining payment process Approval of the remuneration policy Publication of the policy Determining which employees fall under the policy The approach starts by establishing who the ‘identified staff’ is. They are the employees who, when performing their duties, can have an impact on the risk profile of the administrator and the administrated investment institutions. Who they are can differ per administrator, but this includes at least the management and so-called ‘risk takers’ are concerned, such as traders and commercial employees. Employees with a salary corresponding to the management’s also fall under the remuneration policy, as well as employees in ‘controlling’ functions, such as compliance, risk management and internal control functions. Establishing objectives and risks The administrator must establish the objectives of the administrator and the administrated investment institutions and make a connection with the objectives of the remuneration policy. The risks that possibly threaten these objectives also need to be identified. These may concern ‘soft’ risks, often difficult to measure, such as a reputation risk. Consequently what needs to be verified is whether adequate measures have been put in place to control the identified risks. An example of a controllable risk is the risk that employees meet their performance objectives in an undesirable way, making them qualify for a variable remuneration ‘automatically’. The objectives that individual employees need to meet in a certain period also need to be established. AIFMD - The approach to achieve a sound remuneration policy Employees under policy Granting variable remuneration Determining payment process Establishing objectives and risks Granting variable remuneration Determining payment process Approval of the remuneration policy Publication of the policy Granting variable remuneration The administrator must have established which requirements and indicators an employee (or group of employees) have to meet to qualify for variable remunerations. These must be quantitative as well as qualitative, and the quantitative factors must be related to the possible risks an employee can or is permitted to take within his function. Determining payment process What needs to be established with regard to the payment of remunerations is how and when a variable remuneration is paid out, which part of it in the form of money and which part in financial instruments. Which percentages are to be paid out when and according to what criteria. An important part of this is the periodic check, at regular intervals, to see if the criteria related to the remuneration are still being fulfilled. This serves to establish that the initial activities with which the variable remunerations were ‘earned’ will also have positive effects in the long run. AIFMD - The approach to achieve a sound remuneration policy Employees under policy Approval of the remuneration policy Publication of the policy Establishing objectives and risks Granting variable remuneration Determining payment process Approval of the remuneration policy Publication of the policy Approval of the remuneration policy The policy must be drawn up under the responsibility and direction of senior management. It may be supported by internal control, risk management and compliance function in order to come to a well worked-out policy and an underlying analysis. The eventual approval of the policy happens through the internal regulation function (the Supervisory Board). Publication of the policy The remuneration policy will have to be published internally as well as externally. There are requirements for the contents of both publications. However, this does not mean that the received variable remuneration of each employee individually needs to be made visible.

© Copyright 2026