Implementation of Remuneration Policy in 2015

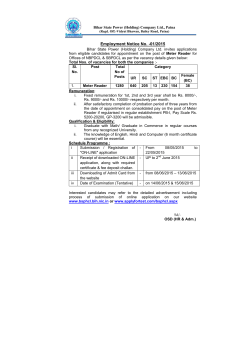

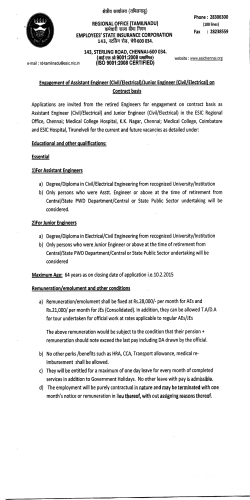

Overview and Highlights Strategy Performance Governance Directors’ Remuneration Report Financial Statements Implementation of Remuneration Policy in 2015 Implementation of policy in 2015 As set out in our policy, the salaries and pension payments for Christopher Satterthwaite and Mark Smith are frozen until January 2016. The value of benefits may change but only in respect of the cost of the insurance policies. There is no intention to widen the list of benefits provided. With regards to annual bonus for 2015, 50% will be paid on the achievement of a stretching headline profit target and 50% measured against a set of KPIs linked to our strategic aims. At this stage the disclosure of any further detail on the measures is deemed to be commercially sensitive. Additional detail, to the extent the Committee deems it possible, will be set out in our next report. It is our intention to make an award under the Performance Share Plan of 200% of salary to Christopher Satterthwaite and of 175% to Mark Smith. No awards will be made to Lord Coe. We shall retain EPS and total shareholder return as the performance measures. The targets will continue to be stretching over the four year performance period. For the 2015 Award, these will be weighted equally. At the time of this report being approved, the targets had not yet been finalised with the Board. Directors’ interests in shares of Chime Communications plc (audited) The interests of those Directors of the Company who held shares in the Company during 2014 are detailed below. All were Directors for the whole year. The remaining Directors of the Company did not have interests in the Company during 2014. Christopher Satterthwaite Mark Smith Lord Davies Rodger Hughes 35,685 27,053 Shareholding – beneficial holdings 1 January 2014 430,209(1) Acquired 362,137(1) - - 19,018 - 49,950 35,678 - - - - - - 530,848 439,763 49,849 27,053 1 January 2014 75,214 53,724 Awarded 49,950 35,678 Released - - Lapsed - - Deferred Share Award Placing 31 December 2014 Deferred Shares (beneficially owned) (3) 31 December 2014 125,164 (1) 89,402(1) Co-Investment Plan(2) 1 January 2014 499,268 324,523 - - 499,268 324,523 1 January 2014 410,958 256,849 Awarded 300,644 187,902 Awarded Released Lapsed 31 December 2014 Performance Share Plan (2) (4) Released 31 December 2014 - - 711,602 444,751 he total shareholding figure includes shares awarded under the Deferred Share Plan and beneficially owned by participants during the deferral period. The T deferred shares are subject to retention conditions but not further performance conditions. Co-Investment Plan and Performance Share Plan Awards are subject to performance conditions over a specified Performance Period. (3) Details relating to this award are on page 125. (4) Performance conditions related to this award are detailed on page 60. The awards made in 2014 were as nil-cost options. (1) (2) Annual Report and Accounts 2014 61 Implementation of Remuneration Policy in 2015 continued Shareholding guidelines for Executive Directors were introduced in 2013. By 31 December 2017, Christopher Satterthwaite is required to have acquired and thereafter to hold shares in Chime to the value of 300% of basic salary and Mark Smith to have acquired and thereafter to hold shares in Chime to the value of 250% of basic salary. Past Directors and loss of office payments(audited) During 2014 no payments were made to past Directors and no loss of office payments were made. TSR performance graph The following graph compares Chime’s TSR performance to that of the same investment in the FTSE250 (excluding Investment Trusts). This comparison has been chosen because the FTSE 250 (excluding Investment Trusts) is the comparator group for the current long term incentive plan (The Performance Share Plan). TSR is the measure of the returns that a company has provided for its shareholders, reflecting share price movements and assuming reinvestment of dividends. Data is averaged over 30 days at the end of each financial year. Value of a hypothetical £100 investment £700 £600 Source: DataStream Return Index £539 £500 £400 £325 Chime £300 FTSE 250 (excluding Investment Trusts) £200 £100 £0 2008 2009 2010 2011 2012 2013 2014 2009 2010 2011 2012 2013 2014 CEO pay table Total CEO Remuneration inc. Vesting LTIP Awards(3) £924,094(1) £1,529,134 £622,873 £1,020,036 £1,135,175(2) £777,352 Total CEO Remuneration exc. Vesting LTIP Awards(3) £924,094(1) £873,903 £622,873 £1,020,036 £826,928 £777,352 £250,000 £250,000 £250,000 £393,750 £525,000 £525,000 £250,000 £250,000 0 £393,750 £174,825 £131,250 100% 0% Annual Variable Pay £ Maximum Actual Bonus Actual as % of maximum Long-term Variable Pay No of Shares Maximum Actual Actual as % of maximum 100% No LTIP with performance period ending in year 449,400 336,016 74.77% No LTIP with performance period ending in year 100% 33.3% 25% 238,095 283,286 215,982 0 97,153 0 0% 34.3% 0% Includes taxable gain of £46,116 in respect of Deferred Share release. The 2013 Total CEO Remuneration figures including and excluding vesting LTIP awards have been amended to reflect the actual value of the LTIP shares on release on 11 September 2014 and have increased the relevant figures by £2,400. (3) Totals from 2009-2013 include certain non-taxable benefits such as Permanent Health Insurance and Life Assurance. Totals from 2014 include taxable benefits only. (1) (2) 62 Chime Communications plc Overview and Highlights Strategy Performance Governance Directors’ Remuneration Report Financial Statements Percentage increase in CEO remuneration Relative importance of spend on pay The following table sets out the percentage change (2014 over 2013) in Chief Executive Remuneration against staff in two comparator groups. Chime is a group of people businesses. Therefore our ability to attract and retain and motivate our staff is an important factor in our success. The following table sets out the change in profit, dividends and remuneration expenditure for 2014 over 2013. Executive Chief Management Executive Team Salary Benefits Annual Bonus Total Remuneration Chime Central Staff 0.0% +0.01% +0.15% -3.68% -0.25% -0.29% -24.92% -4.44% -1.55% -6.17% -0.82% -0.06% Staff comparator groups We have shown the percentage change against two comparator groups. Executive Management Team The Executive Management Team is responsible for the implementation of strategy, the allocation of resources and other commercial aspects of the Group. The membership is mainly drawn from the senior management teams within the divisions. Most of these individuals work directly with clients. Therefore those members are remunerated on the performance of the individual divisions they represent. Christopher Satterthwaite spends a significant proportion of his time with Group clients and therefore the comparison is relevant. Chime Central The Chime Central team are those staff who work directly for the Company in managing the Group. Their bonuses and incentives are paid on Company performance and therefore there is a direct correlation between the Chief Executive and this group of staff. Dividends and staff pay 2014 £000 2013 £000 Year on Year Change £000 % Dividends 7,570 6,289 1,281 20% Staff pay 132,980 113,900 19,080 17% Executive Directors’ external appointments The Executive Directors may take non-executive positions with other organisations with the prior approval of the Chairman of the Board. Where fees are payable by the organisation concerned the Board shall agree whether they may be retained by the Director concerned. Christopher Satterthwaite is Non-Executive Chair of the Roundhouse Trust; a Director of Business in the Community and Senior Independent Director of Centaur Media plc. Mark Smith is Non-Executive Chair of Holiday Extras Investments Ltd. Lord Coe is Chairman of the British Olympic Association; Vice President of the IAAF (International Association of Athletics Federations); a Trustee of the British University in Egypt; a Director of London 2017 Ltd.; a member of the Coordination Commission for the Tokyo 2020 Olympic and Paralympic Games; and a member of the European Olympic Committee Executive Committee. In addition Lord Coe holds a number of ambassadorial roles for businesses, charities and sports organisations. (Full details of his interests can be found in the Parliamentary Register of Interests.) Shareholder voting At the AGM on 15 May 2014 two resolutions regarding Executive Remuneration were put before shareholders with the following outcome. Annual Report and Accounts 2014 63 Implementation of Remuneration Policy in 2015 continued To approve the Directors’ Remuneration Policy for year ended 31 December 2013 For Against Withheld Did not vote 62,376,600 2,720,462 18,098,634 15,597,645 Of votes cast 95.82% 4.18% - - Of issued share capital 63.14% 2.75% 18.32% 15.79% To approve the Directors’ Remuneration Report for year ended 31 December 2013 For 64,816,776 Against Withheld Did not vote 714,730 17,664,190 15,597,645 Of votes cast 98.91% 1.09% - - Of issued share capital 65.61% 0.72% 17.88% 15.79% The issued share capital (ISC) of the Company on 15 May 2014 was 98,793,341. WPP vote Our largest shareholder WPP abstained (withheld) its vote on the two resolutions as part of a general WPP policy. At the time of the AGM vote WPP held 17,330,000 shares representing 17.54% of the voting rights of the Company. This Report was approved by the Board of Directors and signed on its behalf by: Rodger Hughes Chairman of the Remuneration Committee 25 March 2015 64 Chime Communications plc

© Copyright 2026