TOWARDS A THEORY OF SOCIOCULTURAL MUNIFICENCE

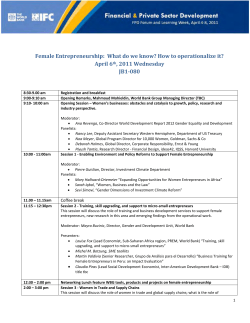

TOWARDS A THEORY OF SOCIOCULTURAL MUNIFICENCE: FIRM SURVIVAL IN THE GREEN BUILDING SUPPLY INDUSTRY Siddharth Vedula* PhD Candidate, Department of Management & Entrepreneurship University of Colorado - Boulder Leeds School of Business 303-263-9388 [email protected] Jeffrey G. York Assistant Professor, Department of Management & Entrepreneurship University of Colorado - Boulder Leeds School of Business 303-807-6027 [email protected] Michael Conger PhD Candidate, Department of Management & Entrepreneurship University of Colorado - Boulder Leeds School of Business 303-476-3657 [email protected] *Corresponding author Last revised on 06/30/2014 Working paper: Please do not cite or circulate without permission Firm Survival in the Green Building Supply Industry TOWARDS A THEORY OF SOCIOCULTURAL MUNIFICENCE: FIRM SURVIVAL IN THE GREEN BUILDING SUPPLY INDUSTRY ABSTRACT We extend the social entrepreneurship literature by introducing three types of sociocultural munificence for hybrid social ventures in an emerging industry sector: 1) social movement alignment, 2) social norms alignment and 3) political norms of needs versus meritbased resource allocation. Moreover we argue that the influence of sociocultural munificence on social entrepreneurs’ survival depends on overall economic munificence. Across a large multiyear panel of hybrid social entrepreneurship ventures we find the survival rate of social entrepreneurs is positively impacted by alignment with regional social movements and regional social norms. In addition, we find that political norms of need-based resource allocation insulate social entrepreneurs from negative economic conditions, whereas political norms of merit-based resource allocation amplify the impacts of economic munificence. Our theory and findings contribute to the entrepreneurship, social entrepreneurship, and organizational ecology literatures. 1 Firm Survival in the Green Building Supply Industry “When I was a boy and I would see scary things in the news, my mother would say to me, ‘Look for the helpers. You will always find people who are helping.’ To this day, especially in times of disaster, I remember my mother’s words, and I am always comforted by realizing that there are still so many helpers – so many caring people in this world.” –Fred Rogers (Mr. Rogers) “If we take the route of the permanent handout, the American character will itself be impoverished.” –President Richard Nixon INTRODUCTION Social entrepreneurship has emerged as an important mechanism for hybrid organizations create economically sustainable solutions to major social and environmental problems (Battilana & Dorado, 2010; Mair & Marti, 2006; Miller, Grimes, McMullen, & Vogus, 2012; Moss, Short, Payne, & Lumpkin, 2010; Tracey, Phillips, & Jarvis, 2011). For example, researchers have examined hybrid ventures that produce products that profit from providing small loans to microentrepreneurs (Battilana & Dorado, 2010), provide health care for workers in the developing world (Mair & Marti, 2006), alleviate poverty (Mair & Marti, 2009), recycle valuable resources (Lounsbury, Ventresca, & Hirsch, 2003), remove pesticides from food (Weber, Heinze, & DeSoucey, 2008), and harvest environmentally sustainable energy from the wind (Sine & Lee, 2009) and sun (Meek, Pacheco, & York, 2010). This nascent literature illustrates the powerful potential for new hybrid firms (i.e. social entrepreneurs) to have a positive impact on markets and society. However, because social entrepreneurship is such a recent phenomenon, the factors that impact the success or failure of such ventures have been little examined. Scholars have suggested that social entrepreneurs are more determined and motivated than their traditional entrepreneur counterparts (Austin, Stevenson, & Wei-Skillern, 2006; Dacin, Dacin, & Matear, 2010), which may increase their chances of survival. A broader perspective suggests that social entrepreneurs 2 Firm Survival in the Green Building Supply Industry are more likely than traditional entrepreneurs to fail (Aldrich & Fiol, 1994; Stinchcombe, 1965) because their businesses are not only focused on maximizing firm value, but seek to generate positive externalities for society (Santos, 2012). This dual-set of priorities exposes social entrepreneurs to criticism on one side from traditional social movements for “profiting from others’ problems” and from economic stakeholders on the other side for not being singlemindedly focused on the bottom-line (Lumpkin, Moss, Gras, Kato, & Amezcua, 2013). Hybrid ventures occupy the messy middle ground between being purely non-profit charities and for- profit companies and thus, are likely more fragile than either of these purer organizational forms (Austin et al., 2006; Lumpkin et al., 2013). However, social entrepreneurship is a novel and creative vehicle for addressing social and environmental problems; therefore it is critical to understand the drivers of why these firms survive or perish. We begin with the economic munificence in an industry sector, which, according to prior theory, should be one of the most important predictors of new venture survival. For social entrepreneurs high economic munificence should also be important. However, this seemingly obvious relationship between broad economic conditions and organizational performance has been surprisingly difficult to detect empirically. For example, some studies find that economic munificence is positively related to performance (Everett & Watson, 1998; Swaminathan, 1996), some find no relationship (Audretsch & Mahmood, 1995; Boeri & Bellmann, 1995), and some even find a negative association (Beck, Levine, & Loayza, 2000; Demirgüç-Kunt & Maksimovic, 1995). Overall, broader economic conditions have been shown to only explain two percent of the variance in organizational performance (McGahan & Porter, 1997; Rumelt, 1991). So, why is the association between economic munificence and organizational performance so variable? To help solve this puzzle, we suggest that sociocultural norms, defined 3 Firm Survival in the Green Building Supply Industry as normative beliefs regarding the legitimacy of a practice, technology, or business, determine how economic munificence is distributed in a region; economic munificence determines the quantity of money that is available in a region, and sociocultural norms determine how that money is allocated (Ingram & Silverman, 2002; North, 1990; Olson, 1982; Scott, 1995). Simply put, the sociocultural norms in a region may determine whether distributing resources to social ventures is deemed legitimate, and whether resources tend to be distributed to ventures based on equality, merit, or need-based norms. We theorize that regional economic munificence is allocated to social ventures based on the regional resource allocation norms, which can be a source of sociocultural munificence (or not). Specifically, we argue that economic resources will tend to be distributed to social entrepreneurs in regions with supportive social movements as well as supportive social norms. We test our theory utilizing a unique panel of 861 new entrants into the green building supply industry, over the period 1999-2007. Following Santos (2009) and Zahra et al. (2009), in this study we define social entrepreneurs as individuals who create organizations that seek to create “total wealth” (Zahra et al, 2009: 519), generating economic income while provisioning neglected positive externalities under conditions of market failure (Santos, 2009 20). Because the environmental and health benefits of green building are inherent to this industry (Eichholtz, Kok, & Quigley, 2010; Hoffman & Henn, 2008; York & Lenox, Forthcoming), green building provides a robust setting to better understand how the macro environment influences the survival of social entrepreneurs who seek to address to create both economically and ecologically sustainable products and services. Our findings suggest that in favorable economic conditions, social entrepreneurs will be able to claim more resources in regions allocating resources based on merit, and during difficult economic times social entrepreneurs will be able to claim more 4 Firm Survival in the Green Building Supply Industry resources in regions allocating resources based on need. Thus, the relationship between economic conditions and social entrepreneurship is largely dependent upon regional social norms, and social movements. Our theoretical rationale and empirical findings answer the call to identify predictors of social entrepreneurial survival (Dacin, Dacin, & Tracey, 2011; Short, Moss, & Lumpkin, 2009) while helping solve the puzzle of why economic munificence is so weekly related to firm performance. We also contribute to the broader literature examining institutions and entrepreneurship (Tolbert, David, & Sine, 2010) by showing that informal, decentralized institutions may be important considerations for new firms’ survival above and beyond formalized institutional and economic munificence. Finally, we contribute to the business and the natural environment literature (Bansal & Hoffman, 2012) and the social entrepreneurship literature (Dacin et al, 2011; Short et al., 2009) by theorizing how sociocultural munificence may impact the emergence of firms pursuing environmentally superior products offerings (Lenox & York, 2011) and firms seeking to address societal problems (Mair & Marti, 2006). ECONOMIC MUNIFICENCE, SOCIOCULTURAL MUNIFICENCE, AND SOCIAL ENTREPRENEURSHIP SURVIVAL Sector Economic Munificence and Social Entrepreneurship Survival Social entrepreneurship is a growing phenomenon that has captured the attention of organizational scholars (Austin et al., 2006; Dacin et al., 2011, 2010; Mair & Marti, 2006; Miller et al., 2012; Short et al., 2009). Social entrepreneurs differ from traditional entrepreneurs in that they address social and environmental problems while simultaneously pursuing economic profit 5 Firm Survival in the Green Building Supply Industry (Battilana & Dorado, 2010; Mair & Marti, 2006; Miller et al., 2012; Moss, et al., 2011; Tracey et al., 2011) and seek to create “total wealth” (Zahra, Gedajlovic, Neubaum, & Shulman, 2009: 519). Because of this dual social/profit focus, social entrepreneurs may be empirically distinguished from, and face different challenges than, their traditional philanthropic and commercial counterparts across several dimensions. Social entrepreneurs typically serve a different type of customer, often including the poor and disadvantaged (Peredo & Chrisman, 2006; Peredo & McLean, 2006; Seelos & Mair, 2005), bottom of the pyramid markets (Kistruck, Sutter, Lount, & Smith, 2012; Kistruck, Webb, Sutter, & Ireland, 2011), or even the natural environment (Lenox & York, 2011; York & Venkataraman, 2010). Moreover, a significant portion of the value created by social entrepreneurs often accrues to the commons as public goods, which means social firms do not capture the same level of created value that their purely commercial counterparts do (Dart, 2004; Ostrom, 1990). Therefore, social entrepreneurship often occurs within emerging sectors that offer socially or environmentally preferable alternatives. Examples included organic foods (alternative to pesticide based farming), microfinance (alternative to traditional banking and philanthropy), and renewable energy (alternative to polluting coal and gas-based energy production). The creation of such sectors requires social entrepreneurs to create both innovative business models, and to engage in broader institutional entrepreneurship within the macro-environment. However, most social entrepreneurship research has examined the motivations of social entrepreneurs (Dacin et al., 2010; Miller et al., 2012; Short et al., 2009), saying little about how macro conditions may influence the persistence, or demise of the social ventures they initiate. We suggest that, like all entrepreneurs, social entrepreneurs must secure resources in order to have their ventures succeed; the ability to grow and secure a resource base is clearly one 6 Firm Survival in the Green Building Supply Industry hallmark of successful, versus failed entrepreneurs (Castrogiovanni, 1996; Pfeffer & Salancik, 1978). The impact of resource munificence, or scarcity, should be particularly pronounced in the context of social entrepreneurship because social entrepreneurs seek to create positive externalities that are overlooked by current market offerings (Santos, 2012). Drawing the investment and talent needed to succeed may be significantly more difficult for social ventures because only the suppliers, customers, investors, and employees who are willing to forego appropriating some economic value in favor of creating social value will be available to them (Austin et al., 2006; Lumpkin et al., 2013). Thus, we are faced with a puzzle: What are the regional, macro-environmental factors that will help social entrepreneurs survive? The extent to which environmental characteristics give new firms increased access to resources or compensate for a lack of resource munificence affects firms’ chances of survival (Cabral & Mata, 2003; Castrogiovanni, 1996; Geroski, Mata, & Portugal, 2010; Hiatt & Sine, 2013) because new firms have less slack and are disproportionately affected by changes in the resources that are available to them (Hiatt & Sine, 2013). Social ventures are fragile because they often offer unproven products, are new organizations without a track record, and face competition from incumbent firms (Carroll & Hannan, 2000; Markman & Phan, 2011; Stinchcombe, 1965). In times of economic downturn, nascent social ventures may be even less likely to survive because resources are less available to them (Rao, 2004; Stinchcombe, 1965). When resources become scarce, such firms may tend to have smaller reserves on which to draw and fewer capabilities to overcome this deficit (Zimmerman & Zeitz, 2002). Survival is further complicated because social ventures lack cultural-cognitive legitimacy (Scott, 1995) owing to their unorthodox solutions to social problems, bearing an imperfect resemblance to both commercial entrepreneurs and non-profits. 7 Firm Survival in the Green Building Supply Industry Not only are social entrepreneurs subject to liability of newness (Stinchcombe, 1965), but the pool of resources available to them is limited to those provided by stakeholders who are willing and able to commit to the social mission of the venture without requiring the maximum financial return they would expect from a commercial venture. In other words, providing resources to social ventures exacts a premium from the provider. Similar to luxury goods, the demand for the social value created by social entrepreneurs may drop severely during times of economic hardship. Social ventures are akin to the “canaries in the coal mine” that will be among the first businesses to die during difficult economic conditions. We expect that the impacts of sector economic conditions will be readily seen among new social ventures, thus: Hypothesis 1: Economic munificence in an emerging sector will be positively related to the survival of social entrepreneurs in that sector. Sociocultural Munificence and Social Entrepreneurship Survival Although we expect that the economic munificence in an industry sector will increase social entrepreneurs’ survival chances, we do not posit that such economic conditions will act in isolation. In addition to economic conditions, firms are the product of the sociocultural environments in which they are embedded (DiMaggio & Powell, 1983; DiMaggio, 1988; Meyer & Rowan, 1977; Scott, 1995; Shane, 2004). In contrast to the rational, opportunity-based influence of economic munificence the sociocultural environment consists of decentralized institutions (Ingram & Silverman, 2002) that are enforced through normative legitimacy (Scott, 1995). Following recent work on institutions and entrepreneurship (see Sine & David, 2010 for a review) we define the sociocultural environment as the unwritten “rules of the game” as represented by the actions of social movements (Hiatt, Sine, & Tolbert, 2009; Sine & Lee, 2009) 8 Firm Survival in the Green Building Supply Industry and the prevalence of social norms (Meek et al., 2010; York & Lenox, Forthcoming). As noted above, the economic environment provides economic resources, and the sociocultural environment provides sociocultural resources in the form of legitimacy that a firm is doing the “right” thing and is engaged in a morally desirable endeavor (Aldrich & Fiol, 1994). As Begley and Tan (2001: 537) write, “the sociocultural environment for entrepreneurship” may also have significant impact on social entrepreneurship. Because social entrepreneurs focus on a simultaneous economic and social/environmental mission (Lenox & York, 2011; Miller, Grimes, McMullen, & Vogus, 2012), scholars have argued they may be highly aware of, and influenced by, the sociocultural context (Fauchart & Gruber, 2011; Meek et al., 2010; Sine & Lee, 2009). For this study, we define sociocultural munificence as the degree to which actors in a region hold beliefs enforcing the moral correctness of the specific activities of social entrepreneurs; thus sociocultural munificence represents a high level of normative legitimacy (Scott, 1995). Normative beliefs have been previously shown to influence individuals’ perceptions of the legitimacy, and attractiveness of engaging in entrepreneurship (McMullen & Shepherd, 2006). Numerous researchers have examined the importance of the sociocultural environment on entrepreneurship focusing on the role of social movement organizations (SMOs) (Hiatt et al., 2009; Lounsbury et al., 2003; Sine & Lee, 2009) and social norms (Meek et al., 2010) in moderating founding rates. For example, York and Lenox (Forthcoming) showed that both SMOs and environmental norms differentially influenced entry of entrepreneurs into the emergent green building sector, but not incumbent, diversifying firms. Building on this body of evidence, we theorize that the sociocultural environment may impact the survival rate of social entrepreneurs through the activities of social movement organizations and regional social norms. 9 Firm Survival in the Green Building Supply Industry Social Movements and Social Entrepreneurship. One way in which the broader sociocultural environment can impact the legitimization, and thus survival likelihood of, social entrepreneurs is through the activities of social movement organizations (SMOs). Social movements are “organized collective endeavors to solve social problems” (Rao, Morrill, & Zald, 2000: 244); they are the collective organization of individuals and organizations with shared identities or goals (Blumer, 1962) towards social change (McCarthy & Zald, 1977). Social movements are often enacted through social movement organizations (SMOs) which are “complex, or formal, organizations which identify their goals with the preferences of a social movement or a countermovement and attempt to implement those goals” (McCarthy & Zald, 1973: 1218) through formally organizing mobilizing resources for collective action (McCarthy & Zald, 1973; Zald & McCarthy, 1986). The broader impacts of SMOs on entrepreneurial survival have been often examined by scholars at the intersection of institutions and entrepreneurship. For example, Hiatt and his coauthors (2009) examined how the sociocultural environment created by the temperance movement harmed alcohol entrepreneurs while Sine and Lee (2009) examined how the sociocultural environment fostered by the Sierra Club influenced entry for wind energy entrepreneurs. When SMOs aligned with an emerging sector’s economic and normative value propositions are active in a region, they can strengthen the legitimacy of sectors, and the entrepreneurs entering into a new sector. In a study of the U.S. wind power industry Sine and Lee (2009) found evidence that local Sierra Club (an environmental SMO) membership had a greater influence than economic resources on founding of new wind power firms. Similarly, Weber et al. (2008) describe how SMOs motivated entrepreneurship in the nascent grass-fed beef sector. SMOs directly related to 10 Firm Survival in the Green Building Supply Industry environmental causes may have a differential impact on social entrepreneurs who seek to address environmental market failures through (1) providing normative legitimacy for their firms, (2) fostering market demand for their offerings, and (3) increasing the flow of information to entrepreneurs related to potential policy opportunities and opposition. In sum, we expect that based on prior research, that the prevalence of SMOs in a region aligned with social entrepreneurs in an emerging sector will not only impact entry, but also survival of such organizations. Thus we hypothesize: Hypothesis 2: Collective action supporting an emerging sector will be positively related to the survival of social entrepreneurs in that sector. Social Norms and Social Entrepreneurship. While the influence of SMOs on entrepreneurial entry has received recent attention in entrepreneurship research, the influence of social norms - defined as the unwritten rules of conduct of a group (Elster, 1989) - has been relatively unexamined. In addition, we could find no studies that examined how social norms might actually impact the survival of entrepreneurs, rather than their entry (e.g. Meek et al., 2010). For social entrepreneurs, this is a particularly acute question; we propose that social norms may influence the survival of social entrepreneurs through two mechanisms: (1) regional perception of social entrepreneurship as desirable and important and (2) regional perception that an emergent sector, and the social entrepreneurs within it, are pursuing an important and valuable opportunity. Prior studies on social norms and entrepreneurship have largely focused on regional variation in whether entrepreneurs are socially esteemed (Aldrich & Fiol, 1994; Aldrich, 1999). For example, if entrepreneurship is viewed as a “foolish” activity in a community, entrepreneurs will not be held up as examples of bold innovation, but rather, as an example of an undesirable 11 Firm Survival in the Green Building Supply Industry career choice (Manolova, Eunni, & Gyoshev, 2008). Conversely, there is evidence that when entrepreneurs are perceived as role models, individuals are more likely to see entrepreneurship as a viable career and socially desirable (Freytag & Thurik, 2010; Tominc & Rebernik, 2007). Thus, the effect of social norms regarding entrepreneurship on entrepreneurial entry is relatively clear and intuitive. However, our understanding of how social norms affect specific opportunities and practices is far less clear. We propose that this will be a critical consideration for social entrepreneurs; the degree to which regional norms endorse their activities as normatively correct and important could be an important determinant of resource allocation. For example, when social entrepreneurs enter into ecologically relevant industries (i.e. organic foods, green building, and renewable energy) environmental norms in a region could be a critical consideration. Social norms related to environmentalism vary across regions (Mazur & Welch, 1999; Mazur, 2010) and largely influence individuals’ perceptions of environmental degradation (Lubell, 2002)4/23/2015 3:21:00 PM. We argue social norms are likely to influence regional assessments of the value of entrepreneurship in environmentally beneficial sectors, and therefore survival of social entrepreneurs in such sectors. Prior studies examining the role of environmental social norms on entrepreneurial entry have found that these norms were highly correlated with entry in the solar energy (Meek et al., 2010) and green building (York & Lenox, Forthcoming) sectors. While this work suggests that environmental norms influenced new entrants, it gives no indication of whether such entrants are more likely to survive than those in less socioculturally munificent regions. We propose that social norms, much like SMOs, act as a resource that will improve the likelihood of survival for social entrepreneurs. For social entrepreneurs who focus their identity 12 Firm Survival in the Green Building Supply Industry on an emergent socially or environmentally relevant sector, social norms will likely influence survival by first encouraging actors within a region to support such entrepreneurs both economically through their patronage, but also psychologically by assessing what they are doing as normatively “right.” For example, for entrepreneurs in regions highly supportive of norms of political freedom and self-sufficiency, potential customers may be more interested in supporting “local” food (Weber et al., 2008) as well as alternative means of assisting impoverished individuals. Recent work has shown that social identity, that is, how individuals view their membership in groups such as environmentalists, drives the types of opportunities pursued, by entrepreneurs as well as the audiences they engage (Fauchart & Gruber, 2011). When entrepreneurs can align their identity, and the opportunity they pursue, with regional norms we would expect they would be more likely to persist, and thus survive. For example, Amezuca and colleagues (2013) found that regional differences in levels of organizational endorsement enhance resource munificence and affect new firm survival in a study of university business incubators. In sum, when social entrepreneurs align with the social norms in a region, they will benefit from adoption of their product, but beyond that, receive consistent confirmatory feedback from the audiences to which they present their business, products, and mission. Thus we argue: Hypothesis 3: Social norms supporting an emerging sector will be positively related to the survival of social entrepreneurs in that sector. Sociocultural Munificence, Economic Munificence, and Social Entrepreneurship Survival Beyond the clear linkage between social movements and social norms that are relevant to the opportunities pursued, and the products and services offered, by social entrepreneurs, we anticipate that broader, more diffuse, sociocultural munificence will also impact such ventures. Specifically, we propose that norms of resource distribution, which determine how a society 13 Firm Survival in the Green Building Supply Industry believes valuable capital should be allocated, may influence the ability for social entrepreneurs to survive. There are three main resource distribution norms – equality, merit and need (Deutsch, 1975). The default distribution norm is equality but groups tend to deviate from the equality norm – and distribute resources based either on group member needs or merits. For example, assume a group has $100 to distribute among the members. The default norm is to distribute it equally so that each group member gets an equal share of the $100 (Deutsch, 1975). However, some groups tend to give a greater share of the resources to their highest performing members (i.e. merit resource distribution norm), and other groups tend to give a greater share of the resources to their most needy members (i.e. need resource distribution norm; Deutsch, 1975). We argue that differing resource allocation norms that result from regional political norms will either mute or amplify the effects of economic munificence on social entrepreneurs’ survival rate (Deutsch, 1975). Politically liberal regions tend to distribute resources based on need, such that the most needy individuals tend to receive the greatest share of resources (Grote & Clark, 1998). Individuals abiding by a need-based resource allocation norm tend to feel responsibility for meeting others' needs (Clark & Finkel, 2005), have greater concern for those around them (Eagly & Steffen, 1984), and tend to be more willing to harm their own economic self-interest in order to help others (Thompson & DeHarpport, 1998). These allocation norms should be particularly important for social entrepreneurs attempting to allocate resources towards solving economic market failures. Not surprisingly, this need-based resource allocation norm is most commonly found in regions with high levels of "close kinship ties" (Fiske, 1992: 692; Khayesi & George, 2011; Meek et al., 2010). Accordingly, densely populated areas are more politically liberal perhaps because individuals in such urban centers are physically closer to their 14 Firm Survival in the Green Building Supply Industry neighbors and thus cannot ignore the less fortunate in their midst (“What Republicans Are Really Up Against,” n.d.). Applied to social entrepreneurship, we expect regions with a high percentage of politically liberal citizens to have a heightened tendency to have a strong need-based norm of resource allocation (Khayesi & George, 2011). When these regions face difficult economic conditions, social entrepreneurs would be able to claim a greater share of regional resources because they have relatively greater economic needs (i.e. they need to keep their business from going bankrupt), which would decrease their chances of failure during such difficult economic conditions. A regional norm of political liberalism is then a type of sociocultural munificence in difficult economic conditions because it enables entrepreneurs to claim a greater share of the region's resources. However, regional need-based resource allocation norms resulting from political liberalism may act as a drag on social entrepreneurial ventures during favorable economic conditions. Under such conditions, entrepreneurs would likely be viewed as doing quite well for themselves financially. Certainly, they would encounter many others in their region who have greater needs than they themselves do and may thus feel compelled to "share the wealth" with these less fortunate individuals. Because social entrepreneurs are expected to have broader goals than pure profitmaximization, they may feel especially obligated to provide resources (e.g. employment, contracts) to individuals in their region based on need rather than merit (Khayesi & George, 2011). Thus, the need-based resource allocation norms resulting from political liberalism may act as a double-edged sword, buffering social entrepreneurs from the economy in bad economic times, and draining their resources in good economic times. In other words, regions with high levels of political liberalism are financially "sticky," such that it is hard for entrepreneurs to get 15 Firm Survival in the Green Building Supply Industry too far behind in bad times, and hard for them to get too far ahead in good times. In sum, we expect that regional norms of political liberalism will diminish social entrepreneurial chances of failure in difficult economic conditions, and enhance their chances of failure in munificent economic conditions. In contrast, politically conservative areas tend to have a merit-based resource allocation norm, so that members of the community who work harder and are more talented get more resources. This is evidenced by conservative activist Charles Koch who borrows from Marx to create his own maxim, “From each according to his ability, to each according to his contribution.” (“Koch’s Laws,” n.d.) This merit-based resource allocation norm produces a positive feedback loop between success and resources, such that successful individuals are able to claim more resources from those around them, which fuels further success and even more resources. In contrast, struggling individuals have less legitimacy and have a diminished capability to claim resources, which further increases their chances of failing, and further diminishes the resources they attain. We expect regions with strong conservative political norms to have a strong merit-based norm of resource allocation (Khayesi & George, 2011). Thus, when highly conservative regions face difficult economic times, social entrepreneurs will tend to suffer financially, which will decrease their ability to claim regional resources, thereby increasing their chances of failure during such difficult economic conditions. A regional norm of political conservatism is then a type of sociocultural burden in difficult economic conditions because it diminishes entrepreneurs' abilities to claim a greater share of the region's resources. However, regional merit-based resource allocation norms resulting from political conservatism may act as a form of sociocultural munificence to social entrepreneurial ventures during favorable economic 16 Firm Survival in the Green Building Supply Industry conditions. Under such conditions, entrepreneurs would tend to thrive and would thus likely be viewed by those around them as some of the most worthy candidates for more resources. Following this logic, the merit-based resource allocation norms resulting from political conservatism may act as a double-edged sword, enhancing the harmful effects of the economy in bad times, as well as enhancing the beneficial effects of the economy in good times. In other words, regions with high levels of political conservatism are financially "slippery," such that failure is more likely in bad times and survival is more likely in good times. In sum, we expect that regional norms of political conservatism will increase social entrepreneurs’ chances of failure in difficult economic conditions, and diminish their chances of failure in munificent economic conditions, leading us to hypothesize: Hypothesis 4: Economic munificence will be more positively related to social entrepreneurs’ survival when a region has high levels of political conservatism norms (i.e. merit-based resource allocation); that is political conservatism will increase social entrepreneurs’ survival chances when economic munificence is high, and decrease social entrepreneurial survival chances when economic munificence is low. DATA AND METHODS Context We test our theory utilizing a unique panel of 861 ventures in the green building supply industry, over the period 1999-2007. Following Santos (2009) and Zahra et al. (2009), in this study we define social entrepreneurs as individuals who create organizations that seek to create “total wealth” (Zahra et al, 2009: 519), generating economic income while provisioning neglected positive externalities under conditions of market failure (Santos, 2009 20). Because the environmental and health benefits of green building are inherent to this industry (Eichholtz, Kok, & Quigley, 2010; Hoffman & Henn, 2008; York & Lenox, Forthcoming), green building provides a robust setting to better understand how the macro environment influences the survival 17 Firm Survival in the Green Building Supply Industry of social entrepreneurs who seek to address to create both economically and ecologically sustainable products and services. We test our hypotheses by examining firm survival in the green building supply industry. We chose this industry for several reasons. First, as our research question is how the sociocultural environment impacts the survival of social entrepreneurs, we needed to identify an industry in which new entrants could be considered to be “neglected positive externalities” (Santos, 2009: 20). As green building is defined as a process of “design and construction practices that significantly reduce or eliminate the negative impact of buildings on the environment and occupants” (USGBC, 2004), new entrants that seek to operate in this industry meet these criteria. Second, in view of the amorphous nature of social and environmental entrepreneurship, researchers have struggled to construct any reliable records of entrepreneurial entry and exit. The green building supply industry does have reliable and reasonably detailed data along this line, as described in the next section. Third, because we were specifically interested in the impact of the sociocultural environment, it was necessary to identify an issue that is clearly defined, considered important by specific social movement organizations, and is representative of a larger social norm, (e.g. environmentalism). Because green buildings are designed to use less energy, water and reduce the overall life cycle of environmental impacts through improved sitting design, material selection and construction, they are deemed very desirable by environmentalists. Finally, because green building is an emergent, specialized sector within the construction industry, it provides ample opportunity for examining the births and deaths of new firms. 18 Sample Firm Survival in the Green Building Supply Industry Unlike previous research on social entrepreneurship that largely relies on small samples and qualitative analysis of a particular venture (Short et al., 2009; Dacin, 2011) our dataset is a representative snapshot of social entrepreneurs who entered and exited the green building industry, 1999-2007 (the last full year for which these data were available). To identify social entrepreneurs entering and exiting the green building supply sector, we utilized the GreenSpec Directory of green building products and suppliers created by Building Green, a non-profit organization focused on promoting green building practices (BuildingGreen, 2007). The GreenSpec directory has been published annually every year since 1999 (with the exception of 2004) and identifies products screened on a criteria including conserving natural resources, saving energy or water, or avoiding toxic emissions. For each product, the directory identifies the firm providing the product, as well as the address of the firm. Our use of a directory as a proxy for measuring new firm entry and exit follows prior studies in the organizational ecology and entrepreneurship literature (Baum & Singh, 1994; Carroll & Hannan, 2000; Chen, Williams, & Agarwal, 2012). Following prior work in entrepreneurship (Amezcua et al., 2013; Evans, 1987; Fritsch & Mueller, 2004; McDougall, Oviatt, & Shrader, 2003; Reynolds & Curtin, 2009, 2010) which has designated new firms to be those 5-8 years old, we then parsed the data based on a founding date of 1994 or later. We chose 1994 because 1994 for was 6 years prior to our first listing in the GreenSpec directory (2000). In addition, the US Green Building Council was founded in 1994, so for the purposes of examining green building, 1994 represents a shift when green building became more nationally known as an emerging sector. 19 Firm Survival in the Green Building Supply Industry The resulting dataset consists of 861 firms observed over 8 years. Given constraints in the availability of data for our measure of environmental social norms (discussed below), we test our hypotheses on a sample of 45 U.S. states when utilizing this data, thus leading to a total data set of 360 state-year observations. These analyses exclude the states of Nebraska, New Hampshire, Nevada, Rhode Island, and Utah (since these states are not included in the General Social Survey [GSS] data from which we measure state-level social norms). Further assessment of new firm entry in these states suggests that there are no statistical differences between the populationadjusted mean firm entry in green building supply in these states as compared to the rest of the sample (t=.102; p=.921). Dependent and Independent Variables Firm Exit. The dependent variable in our study is Firm Exit, which is coded annually when a firm is no longer listed in the GreenSpec directory. Our final sample consisted of 861 firms, 278 of which exited during our period of observation. Sector Economic Munificence. We measured economic munificence specifically in green building by the count of newly certified LEED buildings in a state during a given year (LEED Certified Buildings). As the LEED certification process can take from six months to two years after submission, this variable contains a natural lag. The US Green Building Council provided these data directly to the authors. Collective Action. We operationalize the presence of collective action supporting the green building supply industry through measuring the state-level presence of the USGBC. USGBC Membership is the number of USGBC members in a given state-year. These data were provided by the USGBC and coded as a count variable. To be clear, USGBC membership is not necessary for LEED certification. While some USGBC members have projects that receive 20 Firm Survival in the Green Building Supply Industry LEED certification, the majority of this sample was composed of other groups such as contractors and builders (34.2%), consultants (13.4%), architects (7.7%), engineers (9.6%), nonprofits (5.2%), local governments (3.1%), and a myriad of other organization types including accountants, attorneys, landscape architects, trade associations, and utilities interested in advancing green building and sustainable communities. Social Norms Supporting the Sector. We utilized a direct measure of the social norm of environmentalism (Environmental Social Norms) taken from the Sensitive Data Files of the General Social Survey (GSS) conducted by the National Opinion Research Council (NORC). 1 The GSS is a multistage, stratified sample of American society with a data-collection program designed to monitor social change within the United States (Davis, Smith, & Marsden, 2001). It is a widely used social science data source that has been utilized by researchers in sociology, economics and political science. Some of the social norms examined in prior research include family interdependence and satisfaction (Buchmann & DiPrete, 2006; Kiecolt, 2003), trust and cooperation (Gächter, Herrmann, & Thöni, 2004), cultural conformity (Gibson, 1992; Van der Slik & Driessen, 2005), and environmentalism (Lubell, 2002). For an overview of the GSS survey method and sample please see Davis et al. (2001). We utilized data from the GSS conducted in the years 2000, 2002, 2004 and 2006. The survey consists of a series of questions that measure individuals’ opinions on a variety of topics, including environmental issues. Following prior research in the geography of environmental social norms in the United States (Mazur & Welch, 1999; Meek et al., 2010), we used the following question from the GSS: We are faced with many problems in this country, none of which can be solved easily or inexpensively. I'm going to name some of these problems and for each 1 The Sensitive Data Files were obtained under special contractual arrangements designed to protect the anonymity of respondents. These data are not available from the authors. Persons interested in obtaining GSS Sensitive Data Files should contact the GSS at [email protected]. 21 Firm Survival in the Green Building Supply Industry one I'd like you to tell me whether you think we're spending too much money on it, too little money, or about the right amount. One of the “problems” described is “Improving and protecting the environment”; we coded responses of “spending too little” as environmentalism, and collapsed responses by the median response for the state for each year. We then linearly interpolated the score for missing years using the ipolate command in Stata. Resource Allocation Norms. We measured the resource-allocation norms in a region, from the the prevalence of liberal (need-based) versus conservative (merit-based) political orientation, using the following question from the GSS: We hear a lot of talk these days about liberals and conservatives. I'm going to show you a seven-point scale on which the political views that people might hold are arranged from extremely liberal--point 1--to extremely conservative-- point 7. Where would you place yourself on this scale? This item is the most established measure of political orientation (Graham, Haidt, & Nosek, 2009). Again, for this measure we collapsed responses by the median response for the state for each year. We then linearly interpolated the score for missing years using the ipolate command in Stata. Control Variables We control for a variety of factors that may have also impacted the survival of social entrepreneurs in the emerging green building sector. At the firm-level, we matched our sample of firms with data from the Dun & Bradstreet NETS database and controlled for the annual Firm Sales, as well as the Firm Number of Employees. Since higher quality entrepreneurs are more likely to survive, we used these two measures to account for heterogeneity in the quality of ventures in our sample. We also include a range of controls at the state-level as described below, 22 Firm Survival in the Green Building Supply Industry in addition to a full set of state dummy variables (state fixed effects) to account for stable unobserved differences between states. First, state electricity prices (Energy Price) can impact adoption of practices that reduce consumption of power, and thus entry (Sine, Haveman, & Tolbert, 2005), therefore we controlled for states’ average retail price with data obtained from U.S. Energy Information Agency. Second, we controlled for the organizational density of the green building sector (Field Density), measured as the log of the total number of green building companies known to exist in a state for the previous year. Third, we measure supportive regulatory institutions as the implementation of policies that supported the adoption of green building at both the state and local level. We gathered data on State Policies for Green Building by U.S. state from an online database of incentives provided by the USGBC and from the Database of State Incentives for Renewables and Efficiency (DSIRE). Policies enacted at a city or county level were included in our count for the state in which the city or county resides. All policy measures were coded as cumulative continuous counts. Fourth, we included we included a measure of the overall rate of construction in a state by including the number of new commercial building permits issued (Commercial Construction) in that region. These data were provided by Reed Construction Data and are available from their website at www.reedconstructiondata.com. Fifth, we controlled we controlled for the population in each state (State Population). Finally, we also controlled for the level of Sierra Club membership in a state (Sierra Club Membership) consistent with prior studies that have found Sierra Club membership to influence environmentally relevant entrepreneurship (Sine & Lee, 2009). 23 Model and Analysis Firm Survival in the Green Building Supply Industry To investigate our hypotheses we used a Cox proportional hazard regression model (stcox command in Stata), modeling the likelihood of firm exit in a calendar year. Our observation window runs from the period 1999-2007 and consists of 1,349 unique firms. The dataset is structured so that we have a set of annual observations for each firm, hence allowing for model covariates to vary by time (Allison, 1995) reducing the number of firms in our baseline model to 861. Left-side truncation is not an issue in our sample given that our data collection window starts with the initial GreenSpec directory publication, a proxy for the birth of the green building industry upon introduction of the LEED certification standard in 2000. The model structure accounts for right-side truncation in the sample, given that we end our observation period at 2007. RESULTS Our descriptive results indicate 278 of the 861 firms that we were able to observe across 2,875 firm-year observations exited during the time period 1999-2007. Therefore, while an exit event is relatively infrequent for any given year (~9.6%), approximately 29% of the firms in the sample failed (i.e. exited) over the course of the study period. Table 1 below shows descriptive statistics and pairwise correlations between the variables in our model. ------------------------------Insert Table 1 about here ------------------------------The results of the multivariate analysis are shown in table 2. Note that we mean-centered and normalized all covariates to facilitate the interpretation of results. In model 1, we estimated the main effects of our model control variables. In terms of statistically significant control variables, we find that firms are less likely to fail in states with larger populations and more likely to fail in states with a higher level of commercial building activity. Surprisingly, we also 24 Firm Survival in the Green Building Supply Industry find that larger firms, as measured by those with more employees, are more likely to exit the industry in any given year, although the coefficient of this variable is not statistically significant. -----------------------Insert Table 2 Here -----------------------In model 2, we estimated the main effects of the economic munificence, collective action and environmental social norms variables. In lieu with previous research that has found mixed results for the impacts of economic munificence, we find weak statistical support of hypothesis 1, such that an increase in industry economic munificence by 1 standard unit decreases the probability of firm exit by ~9% (coefficient=-0.32, odds ratio=0.72, p=0.077). With respect to the socio-cultural munificence variables, we found that a 1 unit increase in USGBC membership in a state (collective action) decreased the probability of firm exit by ~37 % (coefficient=-1.88, odds ratio=0.15, p=0.002), while a 1 unit increase in environmental social norms decreased the probability of firm exit by 7% (coefficient=-0.27, odds ratio=0.76, p=0.018) in a given calendar year. Hence both hypotheses 2 and 3 are strongly supported by our data. Lastly, in model 3, we estimated the conditioning effects of political norms (i.e. the degree to which states are liberal or conservative), which we use as proxies of norms of resource allocation. We found that political norms in a state condition the negative relationship between industry economic munificence and firm exit (coefficient=-0.51, odds ratio=0.61, p=0.025). Hence, hypothesis 4 is strongly supported by our data. Figure 1 below illustrates this dynamic by plotting survival curves for each of the conditions (high economic munificence-conservative norms, high economic munificence-liberal norms, low economic munificence-conservative norms, low economic munificence-liberal norms), where high and low conditions refer to variable values 1 standard deviation above and below the mean value respectively. As can be 25 Firm Survival in the Green Building Supply Industry visually observed, the presence of conservative norms amplifies the negative relationship between industry and economic munificence and firm exit, while an increase in liberal norms dampens this relationship (a large gap between the solid and dashed line vs. the two dashed lines respectively). -----------------------Insert Figure 1 Here ------------------------ DISCUSSION & CONCLUSION In this study we found that both economic and sociocultural munificence were significant predictors of the survival of social entrepreneurs entering into an emerging sector. While prior work has shown the importance of the economic environment for an emerging sector, we expand these studies by relating economic munificence directly to the survival of entrepreneurs that seek non-economic goals. In addition, we found that alignment with active social movements as well as regional social norms can increase the survival likelihood of social entrepreneurs. Finally, we found that political norms of conservatism can enhance the impact of the economic environment on survival of social entrepreneurs; when an emerging sector is experiencing strong demand and growth, politically conservative norms of merit-based allocation will provide support for social entrepreneurship. However, when economic conditions sour, such norms will enhance the impact of economic scarcity, and be associated with higher failure rates. These findings make a contribution to the literature examining the relationship between institutions and entrepreneurship, the social entrepreneurship literature, and to our understanding of industry emergence. First, we expand on studies that examine the relationship between the institutional environment and entrepreneurship. While prior studies have shown that both social movement 26 Firm Survival in the Green Building Supply Industry and social norms can impact entrepreneurial entry above and beyond the regulatory and economic environment, ours is the first study, to our knowledge, which looks at how such forces impact survival. We thus expand on Hiatt et al.’s (2009) study that showed how social movement activism could impact the failure of targeted businesses, to illustrate how supportive movements can help firms to survive in nascent industries. In addition, while prior studies have examined how social norms impact entrepreneurial entry (Meek et. al., 2009; York & Lenox, Forthcoming) we build on this emerging literature to show how sociocultural munificence, in the form of aligned social norms may help buoy the efforts of social entrepreneurs. Beyond these contributions, we examined the broader sociocultural environment to better understand how broad-based, more highly diffused norms, such as political preferences may intact with economic conditions. We show that the effect of social norms may not simply be supportive or destructive for emergent sectors, but may be dependent on the economic environment. Second, for social entrepreneurship, we offer one of the first empirical studies to directly examine how the informal, normative institutional environment impacts the survival of social entrepreneurs. While many studies have articulated the motivations and actions of social entrepreneurs, we examine how such ventures can enhance their chances for success. Third, we expand the literature on industry emergence by detailing how sociocultural munificence may offer a substitute, or complement, to the economic munificence experienced by an emerging sector. As with any empirical study, ours has some weaknesses. First, while we were able to control for some firm-level factors (e.g. number of employees, firm sales), we do not have more detailed information on the rationale or specific reasons behind firms’ exit decisions. For instance, founders of firms might choose to voluntarily exit the industry (e.g., De Tienne, 27 Firm Survival in the Green Building Supply Industry Shepherd, & De Castro, 2008). Recognizing these caveats, we highlight that our research design is consistent with prior empirical studies that equate exit to failure. Furthermore, while additional firm level controls would also be preferable, the panel design of our study should account for some unobserved firm effects over time. Another potential concern is that we offer only interactions for our political views variable. While we attempted interactions between the economic munificence, collective action, and environmental norms variables, such interactions were not statistically significant. This actually supports our findings overall, as it implies that the impact of SMO activity and prevalent, aligned norms in a region are not dependent upon economic conditions. This study has important implications for both social entrepreneurs, and those who would support their efforts. For social entrepreneurs, our findings suggest that entering into regions in which aligned SMOs are more highly active can increase their odds of creating a sustainable organization. Further, social norms may complement such forces. Regarding our findings on political norms, the recommendation is more dependent on the preferences of the social entrepreneur. For those entering into a sector that is experiencing strong demand and increased adoption, entering into more politically conservative regions may increase even further their survival rate. However, if the economic munificence of the sector is low, social entrepreneurs would be far more benefited by entering politically liberal regions. Thus, our findings suggest a “risk and reward” model for social entrepreneurs. If they wish to lessen the impact of boom and bust economic conditions, overall, their best move is to locate in regions with more needs-based, liberal political views. The current study offers only a glimpse into the potential for understanding the impact of sociocultural munificence on entrepreneurs’ chances of survival. Our hope is that it begins to 28 Firm Survival in the Green Building Supply Industry strengthen our understanding not only the effects of social entrepreneurs on society, but also the effect of the sociocultural environment on social entrepreneurs. REFERENCES Aldrich, H. 1999. Organizations evolving. Sage. Aldrich, H. E., & Fiol, C. M. 1994. Fools Rush in? The Institutional Context of Industry Creation. Academy of Management Review, 19(4): 645–670. 29 Firm Survival in the Green Building Supply Industry Allison, D. B. 1995. Methodological issues in obesity research: Examples from biometrical genetics. Obesity. New Directions in Assessment and Management, Charles Press, Philadelphia, 122–132. Audretsch, D. B., & Mahmood, T. 1995. New Firm Survival: New Results Using a Hazard Function. The Review of Economics and Statistics, 77(1): 97. Austin, J., Stevenson, H., & Wei-Skillern, J. 2006. Social and Commercial Entrepreneurship: Same, Different, or Both? Entrepreneurship Theory and Practice, 30(1): 1–22. Bansal, P., & Hoffman, A. J. 2012. The Oxford Handbook of Business and the Natural Environment. Oxford University Press. Battilana, J., & Dorado, S. 2010. Building Sustainable Hybrid Organizations: The Case of Commercial Microfinance Organizations. Academy of Management Journal, 53(6): 1419–1440. Baum, J. A., & Singh, J. V. 1994. Evolutionary dynamics of organizations. Oxford University Press, USA. Beck, T., Levine, R., & Loayza, N. 2000. Finance and the sources of growth. Journal of Financial Economics, 58(1–2): 261–300. Begley, T. M., & Tan, W.-L. 2001. The socio-cultural environment for entrepreneurship: A comparison between East Asian and Anglo-Saxon countries. Journal of international business studies, 537–553. Blumer, H. 1962. Symbolic Interactionism: Perspective and Method. Berkeley, CA: University of California Press. Boeri, T., & Bellmann, L. 1995. Post-entry behaviour and the cycle: Evidence from Germany. International Journal of Industrial Organization, 13(4): 483–500. Buchmann, C., & DiPrete, T. A. 2006. The Growing Female Advantage in College Completion: The Role of Family Background and Academic Achievement. American Sociological Review, 71(4): 515–541. Cabral, L. M. B., & Mata, J. 2003. On the Evolution of the Firm Size Distribution: Facts and Theory. The American Economic Review, 93(4): 1075–1090. Carroll, G. R., & Hannan, M. T. 2000. The Demography of Corporations and Industries. Princeton University Press. Castrogiovanni, G. J. 1996. Pre-Startup Planning and the Survival of New Small Businesses: Theoretical Linkages. Journal of Management, 22(6): 801–822. Chen, P.-L., Williams, C., & Agarwal, R. 2012. Growing pains: Pre-entry experience and the challenge of transition to incumbency. Strategic Management Journal, 33(3): 252–276. Clark, M. S., & Finkel, E. J. 2005. Willingness to express emotion: The impact of relationship type, communal orientation, and their interaction. Personal Relationships, 12(2): 169–180. Dacin, M. T., Dacin, P. A., & Tracey, P. 2011. Social Entrepreneurship: A Critique and Future Directions. Organization Science, 22(5): 1203–1213. Dacin, P. A., Dacin, M. T., & Matear, M. 2010. Social Entrepreneurship: Why We Don’t Need a New Theory and How We Move Forward From Here. Academy of Management Perspectives, 24(3): 37–57. Dart, R. 2004. The legitimacy of social enterprise. Nonprofit Management and Leadership, 14(4): 411–424. Davis, J. A., Smith, T. W., & Marsden, P. V. 2001. General Social Survey, 1972-2000: Cumulative codebook. Chicago, IL: NORC. Demirgüç-Kunt, A., & Maksimovic, V. 1995. Stock market development and firm financing choices. World Bank, Policy Research Department, Finance and Private Sector Development Division. DeTienne, D. R., Shepherd, D. A., & De Castro, J. O. 2008. The fallacy of “only the strong survive”: The effects of extrinsic motivation on the persistence decisions for under-performing firms. Journal of Business Venturing, 23(5): 528–546. Deutsch, M. 1975. Equity, Equality, and Need: What Determines Which Value Will Be Used as the Basis of Distributive Justice? Journal of Social Issues, 31(3): 137–149. DiMaggio, P. 1988. Interest and agency in institutional theory: 3–21. DiMaggio, P., & Powell, W. W. 1983. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48(2): 147–160. Eagly, A. H., & Steffen, V. J. 1984. Gender stereotypes stem from the distribution of women and men into social roles. Journal of Personality and Social Psychology, 46(4): 735–754. Eichholtz, P., Kok, N., & Quigley, J. M. 2010. Doing well by doing good? Green office buildings. The American Economic Review, 100(5): 2492–2509. Elster, J. 1989. Social norms and economic theory. The Journal of Economic Perspectives, 3(4): 99–117. Evans, D. S. 1987. Tests of alternative theories of firm growth. The journal of political economy, 95(4): 657–674. Everett, J., & Watson, J. 1998. Small Business Failure and External Risk Factors. Small Business Economics, 11(4): 371–390. 30 Firm Survival in the Green Building Supply Industry Fauchart, E., & Gruber, M. B. 2011. Darwinians, Communitarians and Missionaries: The Role of Founder Identity in Entrepreneurship. Academy of Management Journal, 54(5). Fiske, A. P. 1992. The four elementary forms of sociality: Framework for a unified theory of social relations. Psychological Review, 99(4): 689–723. Freytag, A., & Thurik, R. 2010. Introducing Entrepreneurship and Culture. In A. Freytag & R. Thurik (Eds.), Entrepreneurship and Culture: 1–8. http://link.springer.com/chapter/10.1007/978-3-540-87910-7_1, October 29, 2013, Springer Berlin Heidelberg. Fritsch, M., & Mueller, P. 2004. Effects of New Business Formation on Regional Development over Time. Regional Studies, 38(8): 961–975. Gächter, S., Herrmann, B., & Thöni, C. 2004. Trust, voluntary cooperation, and socio-economic background: survey and experimental evidence. Journal of Economic Behavior & Organization, 55(4): 505–531. Geroski, P. A., Mata, J., & Portugal, P. 2010. Founding conditions and the survival of new firms. Strategic Management Journal, 31(5): 510–529. Gibson, J. L. 1992. The Political Consequences of Intolerance: Cultural Conformity and Political Freedom. The American Political Science Review, 86(2): 338. Graham, J., Haidt, J., & Nosek, B. A. 2009. Liberals and conservatives rely on different sets of moral foundations. Journal of Personality and Social Psychology, 96(5): 1029–1046. Hiatt, S. R., & Sine, W. D. 2013. Clear and present danger: Planning and new venture survival amid political and civil violence. Strategic Management Journal, n/a–n/a. Hiatt, S. R., Sine, W. D., & Tolbert, P. S. 2009. From Pabst to Pepsi: The deinstitutionalization of social practices and the creation of entrepreneurial opportunities. Administrative Science Quarterly, 54(4): 635–667. Hoffman, A. J., & Henn, R. 2008. Overcoming the Social and Psychological Barriers to Green Building. Organization & Environment, 21(4): 390–419. Ingram, P. L., & Silverman, B. S. 2002. The new institutionalism in strategic management. JAI. Khayesi, J. N. O., & George, G. 2011. When does the socio-cultural context matter? Communal orientation and entrepreneurs’ resource accumulation efforts in Africa. Journal of Occupational and Organizational Psychology, 84(3): 471–492. Kiecolt, K. J. 2003. Satisfaction With Work and Family Life: No Evidence of a Cultural Reversal. Journal of Marriage and Family, 65(1): 23–35. Kistruck, G. M., Sutter, C. J., Lount, R. B., & Smith, B. R. 2012. Mitigating Principal-Agent Problems in Base-ofthe-Pyramid Markets: An Identity Spillover Perspective. Academy of Management Journal. Kistruck, G. M., Webb, J. W., Sutter, C. J., & Ireland, R. D. 2011. Microfranchising in Base-of-the-Pyramid Markets: Institutional Challenges and Adaptations to the Franchise Model. Entrepreneurship Theory and Practice, 35(3): 503–531. Koch’s Laws. n.d. Forbes. http://www.forbes.com/2007/02/26/science-success-management-lead-ceocz_df_0226kochbookreview.html, October 29, 2013. Lenox, M. J., & York, J. G. 2011. Environmental Entrepreneurship. In A. J. Hoffman & T. Bansal (Eds.), Oxford Handbook of Business and the Environment. Oxford: Oxford University Press. Lounsbury, M., Ventresca, M., & Hirsch, P. M. 2003. Social movements, field frames and industry emergence: a cultural–political perspective on US recycling. Socio-Economic Review, 1(1): 71–104. Lubell, M. 2002. Environmental Activism as Collective Action. Environment and Behavior, 34(4): 431–454. Lumpkin, G. T., Moss, T. W., Gras, D. M., Kato, S., & Amezcua, A. S. 2013. Entrepreneurial Processes in Social Contexts: How Are They Different, If At All? Small Business Economics, 40(3): 761–783. Mair, J., & Marti, I. 2006. Social Entrepreneurship Research: A Source of Explanation, Prediction, and Delight. Journal of World Business, 41(1): 36–44. Mair, J., & Marti, I. 2009. Entrepreneurship in and around institutional voids: A case study from Bangladesh. Journal of Business Venturing, 24(5): 419–435. Manolova, T. S., Eunni, R. V., & Gyoshev, B. S. 2008. Institutional Environments for Entrepreneurship: Evidence from Emerging Economies in Eastern Europe. Entrepreneurship Theory and Practice, 32(1): 203–218. Markman, G., & Phan, P. H. 2011. The Competitive Dynamics of Entrepreneurial Market Entry. Edward Elgar Publishing. Mazur, A., & Welch, E. W. 1999. The geography of American environmentalism. Environmental Science & Policy, 2(4–5): 389–396. McCarthy, J. D., & Zald, M. N. 1973. The trend of social movements in America: Professionalization and resource mobilization. General Learning Press. 31 Firm Survival in the Green Building Supply Industry McCarthy, J. D., & Zald, M. N. 1977. Resource mobilization and social movements: A partial theory. American journal of sociology, 1212–1241. McDougall, P. P., Oviatt, B. M., & Shrader, R. C. 2003. A Comparison of International and Domestic New Ventures. Journal of International Entrepreneurship, 1(1): 59–82. McGahan, A. M., & Porter, M. E. 1997. How much does industry matter, really? Strategic Management Journal, 18(S1): 15–30. McMullen, J. S., & Shepherd, D. A. 2006. Entrepreneurial action and the role of uncertainty in the theory of the entrepreneur. Academy of Management Review, 31(1): 132. Meek, W. R., Pacheco, D. F., & York, J. G. 2010. The Impact of Social Norms on Entrepreneurial Action: Evidence From the Environmental Entrepreneurship Context. Journal of Business Venturing, 25(5): 493–509. Meyer, J. W., & Rowan, B. 1977. Institutionalized organizations: Formal structure as myth and ceremony. American journal of sociology, 340–363. Miller, T. L., Grimes, M., McMullen, J. S., & Vogus, T. J. 2012. Venturing for Others With Heart and Head: How Compassion Encourages Social Entrepreneurship. Academy of Management Review, 37(4). Moss, T. W., Short, J. C., Payne, G. T., & Lumpkin, G. T. 2010. Dual Identities in Social Ventures: An Exploratory Study. Entrepreneurship Theory and Practice. http://doi.wiley.com/10.1111/j.1540-6520.2010.00372.x. Moss, T. W., Short, J. C., Payne, G. T., & Lumpkin, G. T. 2011. Dual Identities in Social Ventures: An Exploratory Study. Entrepreneurship Theory and Practice, 35(4): 805–830. North, D. C. 1990. Institutions, institutional change, and economic performance. Cambridge University Press. Olson, M. 1982. The rise and decline of nations: Economic growth, stagflation, and economic rigidities. Yale University Press, New Haven and London. Ostrom, E. 1990. Governing the commons: The evolution of institutions for collective action. Cambridge University Press. Peredo, A. M., & Chrisman, J. J. 2006. Toward a Theory of Community-Based Enterprise. Academy of Management Review, 31(2): 309–328. Peredo, A. M., & McLean, M. 2006. Social entrepreneurship: A critical review of the concept. Journal of World Business, 41(1): 56–65. Pfeffer, J., & Salancik, G. R. 1978. The External Control of Organizations: A Resource Dependence Perspective. New York: Harper & Row. Rao, H. 2004. Institutional activism in the early American automobile industry. Journal of Business Venturing, 19(3): 359–384. Rao, H., Morrill, C., & Zald, M. N. 2000. Power plays: How social movements and collective action create new organizational forms. Research in Organizational Behavior, 22(0): 237–281. Reynolds, P. D., & Curtin, R. T. 2009. New firm creation in the United States: Initial explorations with the PSED II data set. Springer. Reynolds, P. D., & Curtin, R. T. 2010. New Firm Creation: An International Overview. New York: Springer. Rumelt, R. P. 1991. How Much Does Industry Matter? Strategic Management Journal, 12(3): 167–185. Santos, F. M. 2012. A Positive Theory of Social Entrepreneurship. Journal of Business Ethics, 111(3): 335–351. Scott, W. R. 1995. Institutions and organizations. Sage Publications, Inc. Seelos, C., & Mair, J. 2005. Social entrepreneurship: Creating new business models to serve the poor. Business Horizons, 48(3): 241–246. Shane, S. A. 2004. Academic Entrepreneurship: University Spinoffs and Wealth Creation. Edward Elgar Publishing. Short, J. C., Moss, T. W., & Lumpkin, G. T. 2009. Research in Social Entrepreneurship: Past Contributions and Future Opportunities. Strategic Entrepreneurship Journal, 3(2): 161–194. Sine, W. D., & David, R. J. 2010. Institutions and entrepreneurship. Research in the Sociology of Work, 21: 1–26. Sine, W. D., Haveman, H. A., & Tolbert, P. S. 2005. Risky business? Entrepreneurship in the new independentpower sector. Administrative Science Quarterly, 50(2): 200–232. Sine, W. D., & Lee, B. H. 2009. Tilting At Windmills? The Environmental Movement and the Emergence of the US Wind Energy Sector. Administrative Science Quarterly, 54(1): 123–155. Stinchcombe, A. 1965. Social structure and organizations. In J. G. March (Ed.), Handbook of Organizations: 142– 193. Chicago: Rand McNally. Swaminathan, A. 1996. Environmental Conditions at Founding and Organizational Mortality: A Trial-by-Fire Model. Academy of Management Journal, 39(5): 1350–1377. Thompson, L., & DeHarpport, T. 1998. Relationships, Goal Incompatibility, and Communal Orientation in Negotiations. Basic and Applied Social Psychology, 20(1): 33–44. 32 Firm Survival in the Green Building Supply Industry Tolbert, P. S., David, R. J., & Sine, W. D. 2010. Studying Choice and Change: The Intersection of Institutional Theory and Entrepreneurship Research. Organization Science, orsc.1100.0601. Tominc, P., & Rebernik, M. 2007. Growth Aspirations and Cultural Support for Entrepreneurship: A Comparison of Post-Socialist Countries. Small Business Economics, 28(2-3): 239–255. Tracey, P., Phillips, N., & Jarvis, O. 2011. Bridging Institutional Entrepreneurship and the Creation of New Organizational Forms: A Multilevel Model. Organization Science, 22(1): 60–80. Van der Slik, F. W. P., & Driessen, G. W. J. M. 2005. Mutual Influences Among American Parents for Their Values Placed on Children’s Conformity in the 1970s and 1980s. Marriage & Family Review, 37(4): 95–122. Weber, K., Heinze, K. L., & DeSoucey, M. 2008. Forage for thought: Mobilizing codes in the movement for grassfed meat and dairy products. Administrative Science Quarterly, 53(3): 529–567. What Republicans Are Really Up Against: Population Density. n.d. . http://www.theatlanticcities.com/politics/2012/11/what-republicans-are-really-against-populationdensity/3953/, October 29, 2013. York, J. G., & Lenox, M. J. Forthcoming. Exploring the socio-cultural determinants of de novo versus de alio entry in emerging industries. Strategic Management Journal, n/a–n/a. York, J. G., & Venkataraman, S. 2010. The Entrepreneur-Environment Nexus: Uncertainty, Innovation, and Allocation. Journal of Business Venturing, 25(5): 449–463. Zahra, S. A., Gedajlovic, E., Neubaum, D. O., & Shulman, J. M. 2009. A Typology of Social Entrepreneurs: Motives, Search Processes and Ethical Challenges. Journal of Business Venturing, 24(5): 519–532. Zald, M. N., & McCarthy, J. D. 1986. Social movements in an organized society. New Brunswick, NJ. Zimmerman, M. A., & Zeitz, G. J. 2002. Beyond Survival: Achieving New Venture Growth by Building Legitimacy. Academy of Management Review, 27(3): 414–431. 33 Firm Survival in the Green Building Supply Industry Table 1. Descriptive Statistics and Correlation Matrix Variable Mean Std 1 1. Firm Exit 0.85 0.36 2. Firm Sales (Millions) 7.85 30.90 0.01 3. Firm Number of Employees 49.93 143.46 0.01 4. Energy Price 8.51 2.69 0.01 5. Field Density 8.32 8.00 -0.02 6. Sierra Club Membership (1000's) 38.17 52.81 0.01 7. State Policies for Renewable Energy 0.27 0.83 0.00 8. Commercial Building Activity 656.68 556.64 0.01 9. State Population (Millions) 12.41 10.92 0.01 10. Sector Economic Munificence 2.83 4.00 0.05** 11. Collective Action 164.01 367.28 0.02 12. Social Norms Supporting the Sector 1.44 0.21 0.03 13. Resource Allocation Norms 4.10 0.31 0.01 *p<0.05, **p<0.01, ***p<0.001 2 3 4 5 6 7 8 9 10 11 12 0.86*** -0.03 -0.03 -0.03 0.01 -0.01 -0.02 -0.01 -0.01 0.02 0.02 -0.05** -0.05** -0.05** -0.01 -0.03 -0.04** -0.04* -0.04* 0.01 0.03 0.41*** 0.55*** 0.09*** 0.38*** 0.50*** 0.39*** 0.35*** 0.25*** -0.20*** 0.78*** 0.13*** 0.53*** 0.77*** 0.49*** 0.56*** -0.01 -0.30*** 0.08*** 0.64*** 0.91*** 0.46*** 0.40*** -0.01 -0.31*** -0.03 0.13*** 0.33*** 0.32*** 0.21*** -0.36*** 0.85*** 0.45*** 0.34*** 0.01 -0.02 0.52*** 0.46*** 0.74*** 0.04* 0.14*** 0.10*** -0.22*** -0.20*** -0.21*** -0.31*** 34 Firm Survival in the Green Building Supply Industry Table 2. Proportional Hazards Cox Model Estimating the Likelihood of Firm Failure VARIABLES Model 1 Model 2 Model 3 Firm Salesa -0.27 (0.22) -0.30 (0.22) -0.30 (0.22) Firm Number of Employeesa 0.19 (0.14) 0.22 (0.14) 0.23 (0.14) -0.20 (0.25) 0.03 (0.12) 0.84 (1.73) -0.24 (0.16) 0.52* (0.27) -7.42** (3.12) 0.23 (0.28) 0.07 (0.12) -5.04** (2.29) 0.11 (0.20) -0.00 (0.32) 1.04 (3.96) 0.21 (0.28) 0.04 (0.12) -2.76 (2.49) 0.02 (0.21) 0.24 (0.35) -0.09 (4.02) -0.32* (0.18) -1.88*** (0.62) -0.27** (0.12) -0.38** (0.18) -1.89*** (0.63) -0.29** (0.12) Firm-Level Controls State-Level Controls Energy Price Field Density Sierra Club Membership State Policies for Renewable Energy Commercial Building Activity State Population Economic & Sociocultural Munificence Sector Economic Munificence Collective Action Social Norms Supporting the Sector Resource Allocation Normsc -0.32 (0.21) -0.51** (0.23) Sector Economic Munificence*Resource Allocation Norms State-Fixed Effects Included Observations Firms Failures Model Chi-square Standard errors in parentheses. *p<0.1, ** p<0.05, *** p<0.01 a Yes 2,875 861 278 68.60 Yes 2,774 832 269 93.48 Yes 2,774 832 269 98.61 We replaced missing values for firm-level controls with the industry mean (by year). b All variables were mean-centered and standardized prior to analysis. Note that negative coefficients indicate decreased likelihood of firm exit (i.e. increase likelihood of firm survival) c Lower values of this variable correspond to more liberal (i.e. need-based) resource allocation norms. 35 Firm Survival in the Green Building Supply Industry Figure 1. Moderating Impacts of Resource Allocation Norms on Economic Munificence (Hypothesis 4 in Study) As illustrated below, the relationship between industry economic munificence and firm survival is amplified in conservative states (with merit-based resource allocation norms) while suppressed in liberal states (with need-based resource allocation norms) 36

© Copyright 2026