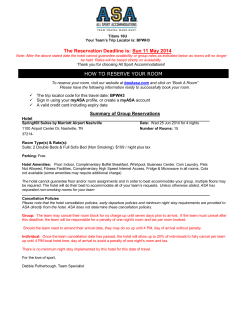

Notes - Dalata Hotel Group