Choose your company type

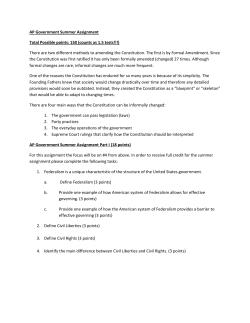

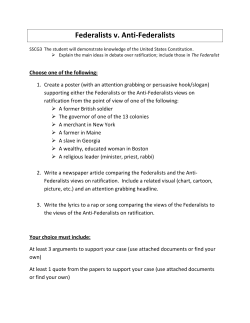

May, 2015 Entity Governance & Compliance Choose your company type Companies Act 2014 It’s finally here, welcome to our new governing legislation, Companies Act 2014 (‘the Act’). The long awaited new legislation is now upon us and now it’s time for each of us to review, discuss and decide on the actions required under the new legislation. This bulletin will look at the types of company under the new legislation, the characteristics of the more popular types and the choices available to you under the new legislation. LTD Types of Company: Company Limited by Shares DAC Designated Activity Company UC CLG Private Unlimited Company Company Limited by Guarantee PLC Public Limited Company Key Features of the new entities: Private Company Limited by Shares (LTD): Designated Activity Company (DAC): • A simple single document constitution • Ultra Vires no longer applies • A DAC will still have a Memorandum & Articles of Association referred to as a constitution • Will not have a main objects clause • It will have an objects clause • Can have a minimum of one director • Must have a minimum of two directors • Must have a Company Secretary who has the requisite skills or access to same • If the Company only has one director then he/she cannot act as secretary also • May dispense with AGMs • No name change, name will end in Limited or Irish equivalent • No need to have an authorised share capital • Written resolutions may be passed by the relevant majority • Cannot offer shares to the public or list debt securities. • Must have a Company Secretary, who can be one of the directors, if they have the requisite skills or access to same • Must state its authorised share capital • Written resolutions may be passed by the relevant majority • Name change required, the name must end with Designated Activity Company or DAC or Irish equivalent • May dispense with AGMs if it is a single member. Multi member companies will continue to hold AGMs • Cannot issue shares to the public but will be able to list debt securities. Unlimited Company (UC): Public Limited Company (Plc): Company Limited by Guarantee (CLG): • A UC will have a Memorandum & Articles of Association referred to as a constitution • A Plc will have a Memorandum & Articles of Association referred to as a constitution • A CLG will have a Memorandum & Articles of Association referred to as a constitution • It will have a main objects clause • It will have a main objects clause • It will have a main objects clause • It may opt to have just one member • It may opt to have just one member • It may opt to have just one member • It must have at least two directors • It must have at least two directors • It must have at least two directors • Must have a Company Secretary, who can be one of the directors, if they have the requisite skills or access to same • Must have a Company Secretary, who can be one of the directors, if they have the requisite skills or access to same • Must have a Company Secretary, who can be one of the directors, if they have the requisite skills or access to same • Name change required, the name must end with Unlimited Company or UC or Irish equivalent. • There is no name change • Name change required, the name must end with Company Limited by Guarantee or CLG or Irish equivalent • Minimum share capital requirement will continue • It is the only type of company that is permitted to have shares listed on the stock exchange. Choices available for the existing Private Limited Company Here we take a look at the options available to the Private Limited Company, being the most popular and most registered entity in Ireland accounting for over 85% of registered companies. Private Limited Company Option 1 Do Nothing Should you decide to do nothing then you will be treated as a DAC during the transition period (although you will not be required to change the company name). Following the transition period you will automatically become a LTD and you will have a deemed constitution (not matching public records). Doing nothing is not recommended and directors will be in breach of their obligations under the Act. It may also cause stakeholders confusion as the Company will be a DAC for a period and will have a deemed constitution. Not Recommended Option 2 Action Re-Register as a LTD Prepare new constitution We anticipate that most companies will take this route. This will be the simplest form of Irish Limited Company. Prepare Members/Directors Resolution File Form N1 together with new constitution at Companies Registration Office. Option 3 Re-Register as a DAC Action If you wish to RETAIN your main objects clause, if you have listed debt , if you are a credit institution or an insurance company then you will be required to re-register as a DAC. Shareholders may also request that a Company re-register as a DAC to which the directors should conform. Prepare new constitution Prepare Members/Directors Resolution File Form N2 together with new constitution at Companies Registration Office. 18 months - ending 30th November, 2016 Type of entity: DAC Is name change required: Is a new Constitution required: Yes Yes 15 months - ending 31st August, 2016 Timeline: Must register within 15 months to become a DAC. Last chance to voluntarily register and file updated Constitution at CRO. Mths to complete: LTD No Yes UC Yes Yes Afterwards, post 30th November, 2016: 15 mths Last period to voluntarily re-register as an Ltd and file an updated constitution at CRO. 18 Mths to complete: mths Aggrieved members or creditors may apply for Court Approval to compulsory register as a DAC An existing Limited Company will automatically become a new type of LTD company with a deemed constitution Agree to change of name, adopt & file new constitution 18 Mths to complete: mths Name change enforced if no action was taken Adopt & file new constitution PLC No Yes 18 Mths to complete: mths N/A Agree to change of name, as UC above CLG Yes Yes 18 Mths to complete: mths Name change enforced if no action taken Private Limited Companies will have a transition period of 18 months (15 months to convert to a DAC) from the commencement of the Act to take action. If a company takes no action in that time then they will be deemed an LTD and will have a deemed constitution as set out in the Act. Note: The Public Limited Company. The Unlimited Company and Company Limited by Guarantee must file the relevant forms to change their name and should also file their new constitution with the CRO. If you re-register as an LTD then the name will “NOT” change. • Items (non-exhaustive) to be addressed if the company name changes include company stationery, website, company seal and third party notifications. A few Highlights on Accounting Implications that Companies need to consider! • 18 months is the maximum period for a set of financial statements • Financial year end date can rotate +/- one week, typically in retail sector • Other than the above exception the financial year end can only be changed once every 5 years and this change must now be notified to the CRO on Form B78A • If your financial statements are not finalised by the commencement date, the Companies Act 2014 format and references will need to be used • Directors do not have to disclose any interests in shares less than 1% and no disclosure required in the financial statements • Audit exemption extended to dormant companies, small groups and CLGs • Increase in Medium Company threshold and audit exemption criteria changes. While the Act does introduce new types of company and a variety of new provisions, ensuring that you are prepared when the legislation is commenced need not be a huge chore. help you decide on the most suitable company type for you. We can also assist with the resolutions to convert and draft a new constitution for you. Let’s make it simple. Any of the team would be delighted to call out to you and discuss the impact of the legislation and Contacts Alan Bigley Partner +353 1 792 6403 [email protected] Ruairí Cosgrove Director +353 1 792 6070 [email protected] Fiona Barry Senior Manager +353 1 792 6720 [email protected] Trudy Kealy Senior Manager +353 1 792 6881 [email protected] Edel Dooley Manager +353 1 792 6466 [email protected] www.pwc.ie/egc © 2015 PricewaterhouseCoopers. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. 05368

© Copyright 2026