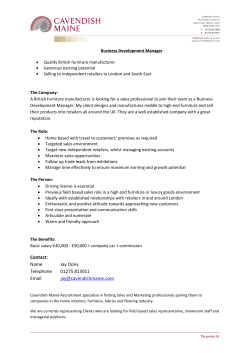

Maglaras Bourlakis Fotopoulos 2015