Summer, 2014 - Economic Development Corporation of Utah

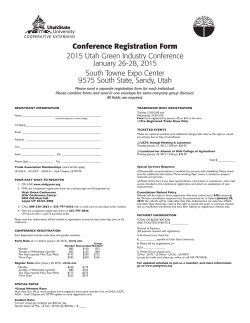

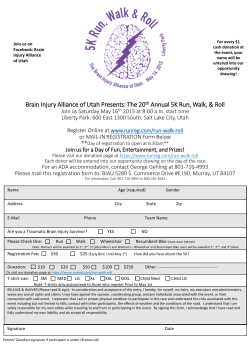

FOURTH QUARTER | SUMMER 2014 Utah Site Selection Quarterly A P U B L I C AT I O N O F T H E E C O N O M I C D E V E LO P M E N T C O R P O R AT I O N O F U TA H The Salt Palace has been a staple of conventions in Utah since its construction in 1969. It has undergone two major revisions, the latest being in 1995. Another Strong Year for Economic Development We just completed our 2013-2014 fiscal year, and the preliminary results indicate another exceptional year for economic development. We won’t report our final numbers until our annual meeting in October, but it looks like we have added 8,326 new jobs to Utah’s economy and retained another 733 jobs for the 12-month period. That’s more than 9,000 new jobs added to our economy that otherwise wouldn’t be here. 2013/14 Fiscal New Convention Hotel Will Help Keep Salt Lake Viable as Convention Destination In 2013 Salt Lake City cracked Cvent’s list of top 50 U.S. cities for meetings. Cvent is the largest online event management and registration company and its ranking is based on booking activity, such as RFPs received and room nights booked. “It’s exciting to be ranked among the top cities for meetings and events in the United States,” says Scott Beck, president and CEO of Visit Salt Lake, the county’s convention and visitors’ bureau. Two of the major shows held in Salt Lake City that likely helped it crack the list are the world’s largest outdoor gear shows: the Outdoor Retailer Summer and Winter Markets, which have been staged here since 1996. The 2014 Summer Market is set to take place Aug. 6-9 in the Salt Palace Convention Center and August 5 at the Open Air Demo at Pineview Reservoir in Weber County. This Follow us on year’s Summer Market is expected to be bigger than ever. Average attendance has grown 13 percent over the last four years and the number of exhibitors has also expanded significantly. In the 18 years since the markets moved to Salt Lake City, direct delegate spending by Outdoor Retailer attendees has totaled more than $468 million and generated approximately $43.6 million in city, county and state taxes, according to the University of Utah’s Bureau of Economic and Business Research. Research show the average Outdoor Retailer delegate spends $923 while attending the Summer or Winter Markets in Salt Lake City. Outdoor Retailer (OR), produced by the Nielsen Expo Outdoor Group, is booked in Salt Lake City through the end of 2016. As the state’s largest convention event, keeping OR in Salt Lake City has been a huge priority. For more information, and Site Selection, please visit edcutah.org. Year-End Numbers: The new jobs New Jobs 8,326 represent 36 new companies Jobs Retained 733 bringing Companies operations to locating in Utah 36 Utah, seven of Capital which were Investment$677M headquarters relocations. As for jobs retained, those are jobs that were headed out of the state through acquisitions or transfers, which we were able to keep in Utah by working with the companies and helping them see the benefits of remaining in Utah. We will also see more than $677 million in new capital investment in the state through business expansion and new construction. Meanwhile, Oracle recently announced plans to open a new technical support center in Salt Lake County. The company will make a $6 million investment and add another 350 jobs to its Utah workforce over the next 10 years. We are currently working more than 200 open projects and continue to add new projects every month. Our business development team brought on 16 new projects and hosted six site visits during June. Here’s a breakdown of our open projects by industry: (Continued on page 5) 1-800-574-UTAH (8824) U TA H S I T E S E L E C T O R Q U A R T E R LY F O U R T H Q U A R T E R / S U M M E R 2 0 1 4 But it hasn’t been easy. With more and more exhibitors and attendees, the shows out grew the available convention space, prompting the Salt Palace to expand twice. City, county and state leaders are now working on the development of a 1,000-room convention hotel, not just to make Salt Lake got behind the endeavor. HB 356 passed, creating a post-performance $75 million tax-rebate incentive for the hotel and set up a mitigation fund for existing downtown hotels to tap for financial assistance should their bottom lines be harmed by the hotel. The cost of the tax rebate will be shared by Salt Lake City, Salt Lake County and the State of Utah. PA G E 2 conventions, which were courted last year by four other cities. For that reason, Beck says Visit Salt Lake never stops talking to its customers about what is next. “We begin negotiations for the next contract the day after the last contract was signed,” Beck adds. “It is inherent in every relation- “It’s exciting to be ranked among the top cities for meetings and events in the United States.” Horse-drawn wagons beginning construction of the Hotel Utah at the top of Salt Lake City’s Main Street. Completed in 1911 at a cost of almost $2 million. more viable for OR shows, but for all convention and event customers. “If we are to continue growing Salt Lake City’s convention and meeting industry, we need a convention hotel,” says Beck. “We need to improve the mix of full-service, convention center hotel rooms to our center.” A convention hotel, Beck notes, would make Salt Lake City “infinitely” more desirable as a location for all conventions and would ensure the city remains relevant as a meeting and tradeshow destination. The idea for a privately-built convention hotel has been kicked around for decades, but it wasn’t until the 2014 legislative session that state leaders Approximately $8 million in mitigation funds, spread over four years, would be available for distribution, according to a short-term formula. The funds would come from proceeds from the new hotel. The convention hotel project is now in the RFP stage. A developer and location have yet to be defined. And whether construction will come soon enough to entice OR to stay in Salt Lake City beyond 2016 remains unknown. The competition with other host cities is fierce, not just for OR but for all of the major conventions Salt Lake City is hosting, such as the USANA and NuSkin ship. We talk to them about all of the things that keep them here, the infrastructure we have and the things we don’t have. We analyze how the event went. We look at performance of the hotels and performance of other industries like taxis, restaurants, airport and the convention center. And, each time, we try to make improvements or change directions to make sure we meet the needs of our customers. It never stops.” Selling Salt Lake City to the convention and meeting industry is easy because Beck’s team is so passionate about it. “Salt Lake City is a great product. It has authenticity and a particular alignment between the direction of our elected officials and the enormous amount of investment that has been made by the private sector,” he says. “And our citizens take in where they live. Together, all of those things make a pretty lethal combination. It’s a wonderful time to be in Salt Lake.” 2014 Fourth Quarter Rankings Triple play: Utah No. 1 for Business for Third Straight Year Pollina Corporate Utah Ranks Third in U.S. for Most SelfEmployed Women U.S. Chamber of Commerce Foundation’s Center for Women in Business Utah Transit Authority Named Transit System of the Year Mountain States Construction Utah has More Top 10 Economic Rankings Than Any Other State The Pyramid Utah No. 3 in “America’s Top States For Business” CNBC Utah No. 1 for Economic Dynamism in the “2014 State New Economy Index” ITIF Follow us on Utah Cities Rank High in “U.S. Metro Economies Report” United States Conference of Mayors Utah No. 3 for “10 Best States for Retirement” Bankrate Utah No. 1 for “Most Likely to Donate Money and Time” Gallup Utah No. 3 for “Best Places to Live” Gallup Utah No. 5 in “Best Places to Make a Living” MoneyRates Salt Lake City No. 1 in “10 Least Stressed Out Cities” CNN Money For more information, and Site Selection, please visit edcutah.org. 1-800-574-UTAH (8824) U TA H S I T E S E L E C T O R Q U A R T E R LY F O U R T H Q U A R T E R / S U M M E R 2 0 1 4 PA G E 3 USU is the Epicenter of Small Satellite Industry Unless you’re a techno geek or involved in the aerospace industry, you probably haven’t heard that the largest small satellite conference in the world takes place in Logan every August. Consider it the biggest small conference most Utahns have never heard about. Nonetheless, it’s a huge deal, says Dr. Pat Patterson, chairman of the annual AIAA/USU Conference on Small Satellites. “The average Utahn may not know that Utah State University has been home to world’s largest small satellite conference for 28 years, but there is an enormous percentage of people in the global small satellite industry that have either heard about or attended the conference,” he says. “People in the industry are keen on knowing what goes on here.” “This year’s conference will look at the exciting entrepreneurial endeavors that are enabled by small satellites, including the technical and business challenges of this worldwide phenomenon,” says Patterson. Opportunity, demand and emerging markets have sparked the imagination of entrepreneurs seeking to capitalize on the reality of small satellites to develop new businesses or government services. Supporting these exciting endeavors is increasingly available investment funding from many sources such Keynote speaker Steve Jurvetson, a partner in the venture capital firm Draper Fisher Jurvetson, is one of the commercial space industry’s most successful investors. He serves on the boards of Planet Labs, SpaceX, Synthetic Genomics and Tesla Motors and was the founding VC investor in Hotmail and the public companies Interwoven, Kana and NeoPhotonics. A self-described techno geek, Jurvetson is looking for financial returns from small satellite systems and as this year’s keynote speaker will highlight how he came to the conclusion that investing in the small satellite arena is a wise investment strategy. The small satellite market shows that good things do come in small packages. In the 1960s, during the genesis of the satellite industry, communication satellites were typically the size of a Volkswagen Beetle. In the 90s, and Evidence of the confereven up to today, large ence’s success? Just try satellites are often the to book a hotel room in size of a school bus. The Logan, Tremonton or size and weight of these Brigham City from Aug. massive spacecraft add to 2-7, when the conference the overall cost of takes place. Most of the building and launching 1,200 attendees from 33 them. Thanks to advancecountries and about 400 ments in science and different organizations engineering, many of the have likely booked their same capabilities that hotels a year in advance. were the sole domain of Space Dynamics Laboratory’s Thermal and Optical Research (THOR) chamber at Utah State University. Photo: Donna Barry, Utah State University During the conference large, complex satellites they’ll spread out in Utah can be provided in as high-tech venture capital firms, angel State University’s Taggart Student Center for smaller, less expensive packages. Depending investors and even crowd-sourcing, he a variety of technical sessions and a trade on the needs of the user, small satellites can explains. The new funding sources have show featuring more than 100 booths. be about the size of a loaf of bread–or smaller, Attendees include representatives from NASA allowed innovative companies, government up to the size of a dorm room refrigerator, administrators and researchers from within and the European Space Agency and many of says Patterson. Today’s smaller satellites the small satellite community to aggressively the global companies that support those offer a variety of benefits, and because of pursue diverse concepts such as providing organizations. They’ll be in Logan this year their size, weight and power requirements, low-cost remote sensing data products at to learn about “The Commerce of Small they are less expensive to build and easier unprecedented revisit rates, prospecting Satellites,” which is the 2014 theme. to launch. near-Earth asteroids for precious mineral The primary markets for small satellites are Small satellites can often piggyback on other deposits and manifesting novel sensors as within military, civil/commercial remote launches. For example, a small satellite may hosted payloads. sensing and civil/commercial communication piggyback on a hosted payload already set Proving there must be big money and big applications. According to a 2012 report by to launch, making the mission only slightly opportunities in small satellites, Google Futron Corporation, world satellite industry more expensive. “With small satellites, you purchased Skybox Imaging for $500 million. revenues totaled $177.3 billion in 2011, can launch multiple missions with a little while overall space industry revenues totaled “That’s a big deal,” Patterson notes. “Skybox extra cost rather than multiple missions $289.8 billion and global telecommunications Imagery is a commercial venture building with a bunch more costs,” Patterson explains. small satellites in the 150-200 pound range industry revenues totaled $4.23 trillion. The “Piggybacked missions are a byproduct of that will likely transform Google Maps. satellite industry is a subset of both the space the efforts being made by the small satellite Skybox will eventually image the entire Earth and telecommunications industries and is industry.” (continued page 5) three times a day at very high resolution.” growing at a faster rate. Follow us on For more information, and Site Selection, please visit edcutah.org. 1-800-574-UTAH (8824) U TA H S I T E S E L E C T O R Q U A R T E R LY F O U R T H Q U A R T E R / S U M M E R 2 0 1 4 PA G E 4 New Database Helping Manufacturers Find Local Supply Chain The missing link isn’t missing any more, at least in terms of supply chain management in Utah’s manufacturing sector. And the implications could be a game changer for the Beehive State. A little more than two years ago, the Utah Manufacturers Association convened a contingent of about 30 prominent manufacturing executives in the state to answer the question: “How do we improve Utah’s certifications, capacities and much more. The platform offers Utah manufacturers the ability to query the database using key words, industry segments or regions, NAICS codes, capacities, machinery, equipment and certifications to produce lists of possible Utah companies that might meet their needs. Bingham says Utah companies can search for in-state manufacturers of parts, components, processes, sub-assemblies–including Highly specialized dials awaiting placement within the ATK parts warehouse. manufacturing industry?” The meetings involved executives from companies like Autoliv, ATK, L-3, Rio Tinto, Mighty-Lite, Merit Medical and Boeing. One of the outcomes of that process was the development of the Utah Capabilities Assessment Network (UCAN), an online portal that connects Utah’s manufacturing companies to bring work back to the state. “Utah manufacturers are eager to determine whether they can reduce costs, shorten lead times and increase quality in their supply chains through more local partnerships,” says Todd Bingham, president of the Utah Manufacturers Association. “They want to keep more business in Utah, rather than outsourcing it to other states or foreign countries. Our big manufacturers are looking for companies in Utah that can do the type of work they are currently outsourcing.” The challenge, however, was that many Utah manufacturers didn’t have the time to search for local suppliers. It’s too laborious a process. Outside of word or mouth, networking events or Google searches, tracking down local suppliers was difficult. That, he says, is why UCAN was developed. Initially called the Virtual Industrial Park, UCAN is a secure, online portal launched in April to connect and align manufacturers. Through UCAN, individual manufacturers and suppliers can identify capabilities, Follow us on capacities, certifications, equipment and key contacts–through the online portal. “It’s all there at their fingertips,” he adds. As for populating the database, Bingham says a company can input its data in about an hour. The more data entered, the more searchable the company will be to the other companies in the database. Companies can update data as needed, so it is always current. UCAN also provides the ability to upload project bids, communicate with other manufacturers and manage and track the bid process. A metric page in development will allow companies to know who has visited their pages and requested information. The Utah Manufacturers Association worked with manufacturers of all sizes and industries, their customers and other industry constituents to methodically determine what company-specific information should be collected and inserted into the database, along with the criterion necessary to identify potential opportunities for Utah manufacturers. Even before the online portal went live it had paid off in terms of bringing work back to Utah. Bingham says during portal development meetings, leaders from a large Utah manufacturer discussed their need for a local supplier of defense-related antenna arrays. Leaders from a structural steel company, also in the meetings, said they could fill that need. For more information, and Site Selection, please visit edcutah.org. “A $70 million contract was the result,” Bingham notes. “During another meeting, leaders from a large defense contractor expressed difficulty in finding a local cable company. Another leader in the room knew a Utah company that provided the exact product and had the necessary certifications. Before we rolled the system out, by simply having 20 supply chain managers in one room, we generated more than $100 million in projects that are coming back to Utah.” UCAN, he says, connects Utah’s manufacturers, and that in turn will mean hiring more employees, paying more taxes and creating more economic development. From that perspective, the UCAN portal can show what the supply chain is like in Utah. For example, a company looking to locate here could use the database to find out if there are enough local suppliers for the products it needs. The company could generate a list of possible suppliers, see the certifications and equipment they have and determine if it will have the supply chain it needs to be successful. Bingham says economic developers would also find the UCAN portal useful for identifying gaps in the supply chain in order to do strategic business recruitment. “If there is a gap,” he says, “specific companies meeting the needs of manufacturers could be recruited to locate here.” Now that the UCAN portal is online, Bingham’s biggest objective is to get Utah companies to populate their data and begin using it. St. George-based Wilson Electronics, he says, is in the process of uploading a bid to the portal as the company searches for a Utah company that can make injection-molded or die cast aluminum cases for its cell phone boosters, which are currently manufactured in Shanghai. “Wilson Electronics would love to obtain those products in Utah,” he says. “From a reshoring standpoint, we hope to bring some of those jobs back to Utah. I think we can do it simply by identifying companies locally that might be interested and capable of performing that work.” Development for the UCAN portal was funded through a Utah Cluster Acceleration Partnership grant and from industry contributions. It was built in four months, he notes, but will continue to be tweaked until it completely meets the needs of Utah manufacturers. (continued page 5) 1-800-574-UTAH (8824) U TA H S I T E S E L E C T O R Q U A R T E R LY F O U R T H Q U A R T E R / S U M M E R 2 0 1 4 PA G E 5 (Local Supply Chain Database, from page 4) (President’s Message, from Page 1) – Manufacturing: 49% – Information | IT: 5% – Distribution | Warehouse: 5% – Finance | Insurance: 8% – Professional: 3% – Healthcare: 5% – Mining: 1% – Other: 24% Utah’s economy remains one of the strongest in the nation. Pollina Corporate just ranked Utah the most pro-business state in the nation for the third straight year. It’s a great time to be doing business here. Jeff Edwards President & CEO, EDCUtah To promote UCAN, Utah Manufacturers Association members are hosting numerous events. Campbell Scientific will host an event on June 30. Other events have been hosted by Utah Industrial Supply, ATK, Mighty-Lite, Wilson Electronics, Barnes Aerospace and L-3. For the events, manufacturing companies are asked to invite their supply chains and, where possible, data from the companies is entered into the portal on the spot. Bingham is proud to say there is nothing else like Utah’s UCAN portal. It is industry-driven and industry-hosted. Ultimately, it was designed to bring business back to Utah and he hopes Utah’s manufacturing businesses will get on board and take advantage of the opportunity to do just that. Interior of the famous Rio-Tinto Kennecott Copper Mine. (USU Epicenter, from page 3) Utah State University’s Space Dynamics Laboratory (SDL) is likely the biggest long-term benefactor of the conference. Patterson says that while SDL doesn’t have a direct role in hosting the conference, its credibility, reputation, experience and success add weight to the conference and provide long-term name recognition among conference attendees. SDL has driven USU to the forefront of space research. Utah companies like ATK and L-3 also add to the conference through their participation and support. While ATK focuses on launch systems, L-3 builds miniature communication systems that fly on the small satellites. The northern Utah economy also benefits from the conference, which brings in nearly $1 million in economic impact. The broader economic impact is shared across the state. Patterson says many conference attendees bring their families and like to visit Moab and other parts of the state while they are here. “It’s hard to put a number on the total economic impact,” he continues, “but we know it is good for the community and for the state.” E co n o m i c D e v e lo p m e n t R e s o u r c e s EDCUtah Web Site www.edcutah.org Utah Governor’s Office of Economic Development (GOED) www.business.utah.gov Utah Economic Developer Directory www.edcutah.org/solutionproviders EDCUtah Economic Review Weekly Newsletter www.edcutah.org/newsletter EDCUtah Custom Research www.edcutah.com/customResearch Important Contact Information Jeff Edwards, EDCUtah President & CEO 801-328-8824 Val Hale, GOED Executive Director 801-538-8700 Theresa Foxley, GOED Corporate Recruitment and Incentives 801-538-8850 Todd Brightwell, EDCUtah Chief Operating Officer 801-323-4240 Kim Frost, EDCUtah Director of Marketing & Communications 801-328-9742 Please note: This newsletter is produced to give site selectors and corporate decision-makers the best opportunity to stay up to date on ED news in Utah. This publication is simultaneously e-mailed to site selectors and corporate decision-makers within the edcUtah database. We are solely publishing this document via a e-mail. If you would still like to receive a print copy of this publication, please call 801.328.8824. Antelope Island antelope. Follow us on Facebook and Twitter the partnership for U tah ’ s g ro w th

© Copyright 2026