ESTIMATING INFORMAL ECONOMY SHARE IN RUSSIAN REGIONS

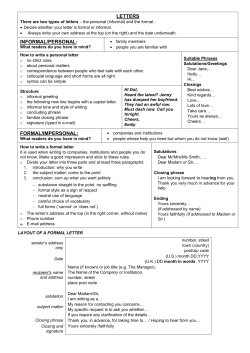

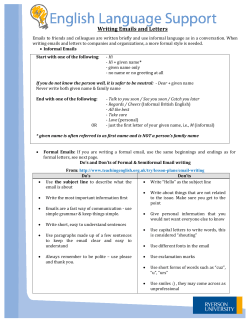

ISSN 1561-2422 ESTIMATING INFORMAL ECONOMY SHARE IN RUSSIAN REGIONS Pavel Vorobyev Working Paper No E15/02 This project (No 113-062) was supported by the Economics Education and Research Consortium and funded by GDN All opinions expressed here are those of the authors and not those of the EERC, GDN and Government of Sweden Research dissemination by the EERC may include views on policy, but the EERC itself takes no institutional policy positions Estimating informal economy share in Russian regions Pavel Vorobyev 1 March 27, 2015 Abstract Informal economy in Russian regions is measured using two approaches: 1) cross-section regression model for electricity consumption in Russian regions; 2) augmented electricity dynamics approach. 1) Regression model is applied for electricity consumption in production of goods and services (total electricity consumption less losses, less households’ consumption). Model was estimated on the basis of regional data in 2011. It allowed estimating informal economy share in 67 Russian regions in 2011. The average informal economy share is estimated at 40% with standard deviation 18 percentage points. These results show high positive correlation with usual proxies for informal economy such as corruption, unemployment, and especially dependency of regional budget from Federal transfers. 2) Augmented electricity dynamics approach is developed to estimate dynamics of informal economy share in regions over 2004-2011. Comparing to traditional method in the literature, it takes into account changes in regional industrial structure and electricity intensity of GRP. It leads to more accurate estimates. It has been shown that the share of informal economy in Russia diminished from 55% in 2004 to 40% in 2011 due to the growth of formal sector. Only 16 from 65 regions witnessed an increase in informal economy share over the period. Keywords: informal economy, electricity consumption, Russia, regions, gross regional product JEL classification: R110 Acknowledgements. I am grateful to EERC experts, especially to Prof. Gary Krueger and Prof. Tom Coupe for their valuable comments and advise. I also appreciate comments made by seminar participants, especially by Tigran Kostanyan and Dmitry Vorobyev. I am grateful to Nikita Suslov, Anna Mishura for their useful recommendations. I gratefully acknowledge financial support from the Economics Education and Research Consortium Grant No. 130621.The views expressed in this paper, and all remaining errors, are mine. 1 E-mail: [email protected] 1 Contents 1 Introduction ......................................................................................................................2 2 Overview of the literature .................................................................................................4 3 Regression model for regional electricity consumption ................................................... 11 4 3.1 Estimates of informal activity in Russian regions in 2011 ........................................ 15 3.2 Comparison with alternative indicators of informal economy .................................. 21 3.3 Informal economy and economic conditions in Russian regions .............................. 25 Dynamics of informal economy share ............................................................................. 26 4.1 Methodology ........................................................................................................... 27 4.1.1 Traditional electricity consumption method ...................................................... 27 4.1.2 Proposed augmented electricity consumption method ....................................... 28 4.2 Empirical results on dynamics of informal economy share in Russian regions over 2004-2011 ............................................................................................................................. 32 5 Conclusion ..................................................................................................................... 36 6 Bibliography .................................................................................................................. 39 7 Appendix........................................................................................................................ 42 1 Introduction A lot of attention is drawn to the informal economy in Russia both in the mass-media and in the Russian government. Anton Siluanov (the Russian finance minister) said that hidden sector amounts to 15-20% of GDP which means that the budget system loses about 3 trn rubles of tax incomes each year. Andrey Belousov (economic expert at the Russian President) has argued that if small businesses go from the shade, its share in Russian economy will increase from 19% to 4050%. Now 18 mln people are employed in unofficial small business which accounts for a quarter of total labor force in Russia. Government policy dealing with informal economy sometimes looks inconsistent. For example, according to Oleg Savel’ev (Deputy Minister of Economic Development) increased insurance payments (2 times since the beginning of 2013) have forced 2 426 thousand individual entrepreneurs to work unofficially. Finally government had to abandon its previous decision. Significant amount of firms in Russia use different methods to avoid paying taxes. It leads to creation of fictive one-day-firms and increases demand for cashing in. Some commercial banks are involved in these operations. Russian central bank is fighting with such banks. In November 2013 it withdrawn the license from Master-bank which was a big player in Russian banking market and the biggest agent serving informal economy. Estimates of informal economy share in Russia differ significantly from 19% (Rosstat, Ministry of Finance) to 40% (Worldbank, Global financial integrity). It means that there is no consensus in the literature. Another important field of study is a regional dimension of informal economy. Existing literature lacks regional estimates of informal economy in Russia. We could mention two regional studies which were made in the form of master’s thesis: Komarova (2003) who used KaufmanKaliberda electricity consumption approach and Bilonizhko (2006) who applied MIMIC approach. We could suppose that Russian regions are quite different in the size of informal sector. Regional estimates would allow analyzing causes and consequences of informal sector on the basis of regional panel data. For example, there is a number of studies on the relationship between decentralization and informal economy (Teobaldelli D. (2010), Alexeev and Habodaszova (2012)). Electricity consumption method is usually used for estimation of informal economy; however it has a number of drawbacks, for example, it does not take into account changes in industrial structure and different factors of electricity intensity. The main goal of this research is to estimate the size of unofficial (informal) sector in the regions of Russian Federation using electricity consumption method. It implies two tasks: • To estimate the level of informal economy in Russian regions for a base year (2011) • To estimate dynamics of informal economy share in Russian regions 3 This report consists of three parts. Section 2 “Overview of the literature” is about different existing methods of informal economy measurement and their results for Russia. It is concluded that electricity consumption method has very good perspective to be applied on the regional level, however it should be improved. Section 3 “Regression model for regional electricity consumption” develops the model of electricity demand which takes into account a structure of economy, electricity prices, weather, and natural gas prices. It is estimated on a cross-section of Russian regions in 2011. Informal economy share is derived as a residual of this regression. Section 4 “Dynamics of informal economy share” is devoted to the augmented electricity dynamics model which allows taking into account changes in the structure of economy. This methodology provides estimates of informal economy share dynamics in Russian regions in 2004-2011. Thus we are able to calculate informal economy share not only in 2011, but also in 2004-2010. 2 Overview of the literature Unofficial economy can be defined following Kaufman and Kaliberda (1996): “From a meaningful economic standpoint, we define an unofficial activity as the unrecorded value added by any deliberate misreporting or evasion by a firm or individual.” More precise definition was given in Schneider et al. (2010): “The shadow economy includes all market-based legal production of goods and services that are deliberately concealed from public authorities for any of the following reasons: (1) to avoid payment of income, value added or other taxes, (2) to avoid payment of social security contributions, (3) to avoid having to meet certain legal labor market standards, such as minimum wages, maximum working hours, safety standards, etc., and (4) to avoid complying with certain administrative procedures, such as completing statistical questionnaires or other administrative forms.” Thus, for the needs of quantitative estimation, informal economy represents all existing economic activities which are not properly registered by the government due to different reasons 4 from simple mistakes to tax evasion or other prohibited activities. Among factors which force economic activities to informal sector are taxes, government regulation, corruption, etc. Another problem is to find indicator which measures the absolute and relative size of informal economy. It could be employment, output, value added. In our study we focused on value added (or gross domestic product). There are 3 main classes of approaches for measurement of unofficial economy: 1) direct methods (micro surveys or tax audits); 2) indicator approach; 3) multiple indicators – multiple causes model or MIMIC model. • Direct methods represent micro surveys or tax audits. This is the most relevant approach; however it is very costly for implementation. Rosstat surveys Russian workers (about 69 thousand people) and publish number of informally employed people. Informal employment treats as working for not registered enterprises. Another source of survey data is BEEPS provided by EBRD. However survey data has a bias as people usually do not want to reveal their informal activity. • Indicator approach. The method is based on the use of observable indicators which correlate with total economic activity including informal. There are a number of such indicators: consumption of electricity (Kaufman, Kaliberda (1996)), currency demand (Tanzi (1983)), consumption of other resources. • Multiple indicators – multiple causes model or MIMIC model (Breusch (2005)). This method is based on econometric estimation of regression where the share of unofficial economy is a latent variable. This approach does not give us the absolute level of unofficial economy, it produces only dynamics. Another problem is that we use assumptions on the causes of unofficial economy which themselves should be tested. Electricity consumption method is considered as the most prospective for the measurement of informal activity. Electricity is the most important energy source in the Russian economy. In 2012 electricity consumption for final use in Russia was 47% of the total use of energy sources. All 5 economic activities require energy for equipment, lightening, heating. Electricity consumption data is available from Rosstat with high level of details (regional, industrial dimensions). The simplest modification of electricity approach is called “Electricity consumption model” (ECM). It implies that total electricity consumption has a constant elasticity (usually unitary) to the total economic activity. Thus, percentage point change of informal economy share is calculated as a difference between growth rate in electricity consumption and growth rate of officiallyrecorded GDP (Kaufman, Kaliberda (1996)). Such simple approach have certain biases which are discussed in Kaufman and Kaliberda (1996): 1) electricity consumption could grow slower (in terms of growth rates) than GDP due to fixed electricity costs; 2) growth rates of electricity consumption could deviate from growth rates of GDP due to changes in industrial structure in respect to more and less electricity intensive industries; 3) electricity consumption could grow slower that GDP due to the impact of the growth of electricity prices. For sensitivity analysis Kaufman and Kaliberda suggested different scenarios of informal economy depending on assumption of electricity elasticity to output. Eilat and Zinnes (2002) introduced approach based on regression with factors of electricity consumption: changes in electricity prices, share of industrial production in GDP and efficiency of energy use. This approach was called “Modified electricity consumption model” (MEC). The analysis was done for former Soviet Union (FSU) countries. Later Feige and Urban (2003) replicated these results. The basic idea of MEC is to filter out the influence of other factors of electricity consumption besides total economic activity. It was done with the help of regression of the following type. The percentage change in electricity consumption was in the left-hand side of equation. The right-hand side was constituted by 1) the percentage change of electricity prices, 2) the percentage point change of industry share in GDP, 3) and the percentage point change in the share of private sector in GDP (which is assumed to be a proxy for energy efficiency improvements). Feige and Urban (2003) got the following results on the basis of a panel of countries for 1994-1997 (47 observations): 6 ̇ 𝑡𝑡 ̇ 𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸 𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸 𝑡𝑡+0.005𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼 ̇ ̇ =0.035−0.026 𝑡𝑡 −0.0022𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃 𝑡𝑡 𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝑡𝑡 𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝑡𝑡 (3.63) (−2.97) Adj. R2 = 29% (2.44) (−1.94) Residual of this regression is considered to be a true measure of total economic activity change. Informal economy share dynamics was calculated as a difference between this residual and officially recorded GDP growth rate. ECM or MEC approaches are dealing with dynamics (or growth rate) of variables. This analysis generates dynamics of informal economy share, but it fails to provide us with estimates of the absolute volume of informal activities. The absolute volume of informal economy can be estimated using electricity consumption regression in levels rather than growth rates. An example of such analysis was done by Lackó (1998) who used the regression approach for household electricity consumption in order to define the size of household informal activities. Lackó’s model (1998) is described by the following equations: 𝑙𝑙𝑙𝑙𝐸𝐸𝑖𝑖 = 𝛼𝛼1 𝑙𝑙𝑙𝑙𝐶𝐶𝑖𝑖 + 𝛼𝛼2 𝑙𝑙𝑙𝑙𝑃𝑃𝑃𝑃𝑖𝑖 + 𝛼𝛼3 𝐺𝐺𝑖𝑖 + 𝛼𝛼4 𝑄𝑄𝑖𝑖 + 𝛼𝛼5 𝐻𝐻𝑖𝑖 + 𝑢𝑢𝑖𝑖 𝐻𝐻𝑖𝑖 = 𝛽𝛽1 𝑇𝑇𝑖𝑖 + 𝛽𝛽2 (𝑆𝑆𝑖𝑖 − 𝑇𝑇𝑖𝑖 ) + 𝛽𝛽3 𝐷𝐷𝑖𝑖 (1) (2) Where i - the country index, 𝐸𝐸𝑖𝑖 - per capita household electricity consumption in country i in Mtoe, 𝐶𝐶𝑖𝑖 - per capita real consumption of households without the consumption of electricity in country i in US dollars (at purchasing power parity), 𝑃𝑃𝑃𝑃𝑖𝑖 - the real price of consumption of 1 kWh of residential electricity in US dollars (at purchasing power parity), 𝐺𝐺𝑖𝑖 - the relative frequency of months with the need of heating in houses in country i, 𝑄𝑄𝑖𝑖 - the ratio of energy sources other than electricity energy to all energy sources in household energy consumption 𝐻𝐻𝑖𝑖 - the per capita output of the hidden economy, 7 𝑇𝑇𝑖𝑖 - the ratio of the sum of paid personal income, corporate profit and taxes on goods and services to GDP 𝑆𝑆𝑖𝑖 - the ratio of public social welfare expenditures to GDP, and 𝐷𝐷𝑖𝑖 - the sum on number of dependents over 14 years and of inactive earners, both per 100 active earners. Lacko’s method implies a cross-country estimation of regression (1) substituting the per capita output of the hidden economy by equation (2). Regression estimates allow to calculate the electricity consumption in the informal economy defined as follows: 𝛼𝛼5 (𝛽𝛽1 𝑇𝑇𝑖𝑖 + 𝛽𝛽2 (𝑆𝑆𝑖𝑖 − 𝑇𝑇𝑖𝑖 ) + 𝛽𝛽3 𝐷𝐷𝑖𝑖 ). In order to estimate the volume of activity in informal economy we should know electricity intensity of output in informal economy. If it is unknown, then this approach can give us only relative ranking of countries by the size of informal economy. In order to get absolute figures of informal economy, we need to define the basis level. Lacko supposed informal economy share in the USA on the level of 10.5% which was taken from external source. Then she managed to calculate informal economy share in other countries using simple proportion to US level implied by her regression estimates. The main advancement in Lacko’s method was using factors of cross-country variance in the level of informal economy (tax burden, social expenditures, number of dependents). It allows separating informal economy and other factors which influence electricity consumption and present in the residual of regression 1. However the list of informal economy determinants might be incomplete. Thus, Lacko’s method estimates only a part of informal economy which is attributable directly to a chosen set of factors. Dynamic approaches (e.g. MEC approach) produce only dynamics of informal economy share: how much is it increasing or decreasing. We cannot estimate the share itself: is it 20% or 40%. That is why dynamic models require some external estimate of informal economy share in a basis year. Then, estimated dynamics of informal economy share can be applied to a basis year and 8 produce informal economy share estimates in other years. Regression in levels (e.g. Lacko’s approach) produces the level of informal economy itself. There are several limitations for using Lacko’s approach in our study. Lacko’s approach is designed for a cross-section of countries. When studying cross-section of regions, we may find variation in tax burden insignificant because tax regime is almost equal in all Russian regions. One might suggest using actual paid taxes in the region. Actually paid taxes are a function of tax rate and informal economy share. Thus, we might have endogeneity bias. Moreover, the difference in informal sector share can be determined by historical, geographic and other factors except government policy. However these factors could hardly be measured and put into regression. In our study we also implement regression analysis of cross-section electricity consumption data. However, there are 3 differences to Lacko: 1) we use cross-section of regions instead of countries; 2) we analyze electricity consumption in production of goods and services, while Lacko was focused on households; 3) we do not model factors which affect informal output, we treat informal economy as a residual of regression for electricity consumption. Thus, we do not restrict analysis by assumptions on what factors impact informal output. Cross-regional data does not provide us with sufficient variation of tax burden which is considered as the most important factor for informal economy share. Usual critics of electricity method (see for example Schneider, 2002) argues that not all informal economy activities require electricity. Estimates based on electricity consumption reflect informal activity only in electricity-dependent sectors. Nevertheless this analysis remains valuable for efficient allocation of resources between formal and informal sectors. If informal economy does not consume such material resource as electricity it would not lead to a shortage of resources available for the formal sector. 9 Empirical estimates of unofficial economy in Russia Unofficial economy in the Soviet Union was estimated at 12% of GDP (Alexeev et al. (2003)). During transition period of 1990-s its share substantially increased according to the majority of studies. In 1995 unofficial economy was estimated at 41.6% of GDP (Alexeev et al. (2003)). Exhibit 1. Comparison of the estimates of informal economy share in Russia, % of GDP 90% Schneider et al (2010) 80% Global Financial Integrity (2013) Kaufman and Kaliberda (1996) - Unity elasticity scenario Johnson, Kaufman and Shleifer (1997) Alexeev, Pyle (2001) 70% 60% 50% 40% 30% 20% Rosstat 10% 0% 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 Ministry of Finance Estimated share of unofficial sector in Russia in 2000-s is sizeable. Schneider (2006) reported 48.7% in 2002/2003 on the basis of DYMIMIC model and currency demand approach. Relatively recent study by Worldbank published the same result – 43.6% during 1999-2007 (Schneider et all, 2010). According to Rosstat about 19% of Russian workers were engaged in informal activities in 2012. Only 4% of workers were employed in informal sector in Moscow and 9% in Moscow region. Informal workers are concentrated in several sectors: trade (34%), agriculture (26%), construction (10%), manufacturing (9%) and transport & communications (8%). High variation in estimates of informal economy in Russia suggests that there is a room for our study. Literature lacks estimates of informal economy in Russian regions. At the same time, regional budgets face significant deficits needing permanent transfer from federal budget. Decreasing informal economy could lead to higher tax collection and solution for balanced regional budgets. Informal economy measurement is the primary step for adequate policy design 10 aimed at moving business to official reporting and paying taxes. This study provides special methodology which is tailored for particular Russian publicly-available regional data. 3 Regression model for regional electricity consumption Electricity consumption was chosen as a proxy for total economic activity in a region. Electricity is consumed by firms among other production inputs. However, there are activities which do not consume electricity at all, for example, road transportation consuming gasoline as energy source instead of electricity. Electricity consumption cannot be used as a proxy for such activities what limits the applicability of the method based on electricity consumption. Let us consider activities which consume electricity. Electricity consumption by an individual firm consists of fixed and variable parts. Fixed part of electricity consumption is determined by the total stock of production capacities. Fixed electricity consumption is required to maintain capacities workable; it includes for example lightening rooms and heating. It does not change when output is changed. Variable component represents direct electricity consumption for producing output. Short-term electricity consumption depends on output (capacity utilization of existing capacities). Let us consider the model of electricity consumption in industry j in the region i consisting of variable and fixed parts. 𝐸𝐸𝑖𝑖,𝑗𝑗,𝑡𝑡 = 𝛾𝛾𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 + 𝜇𝜇𝑖𝑖,𝑗𝑗,𝑡𝑡 𝐶𝐶𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 (3) Where 𝐸𝐸𝑖𝑖,𝑗𝑗,𝑡𝑡 – electricity consumption in region i in sector j in year t; 𝛾𝛾𝑖𝑖,𝑗𝑗,𝑡𝑡 – electricity consumption in region i in sector j in year t per unit of output in this sector 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 ; 𝜇𝜇𝑖𝑖,𝑗𝑗,𝑡𝑡 – electricity consumption in region i in sector j in year t per unit of capacities in this sector 𝐶𝐶𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 . Total electricity consumption in a region is a sum of formal sector (with index f) and informal (index u): 𝑓𝑓 𝑓𝑓 𝑢𝑢 𝑢𝑢 𝐸𝐸𝑖𝑖,𝑗𝑗,𝑡𝑡 = 𝛾𝛾𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 + 𝜇𝜇𝑖𝑖,𝑗𝑗,𝑡𝑡 𝐶𝐶𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 + 𝛾𝛾𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 + 𝜇𝜇𝑖𝑖,𝑗𝑗,𝑡𝑡 𝐶𝐶𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 (4) 11 Total electricity consumption in the region is given by: 𝑓𝑓 𝑓𝑓 𝑢𝑢 𝑢𝑢 𝐸𝐸𝑖𝑖,𝑡𝑡 = ∑𝑗𝑗 𝛾𝛾𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 + ∑𝑗𝑗 𝜇𝜇𝑖𝑖,𝑗𝑗,𝑡𝑡 𝐶𝐶𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 + ∑𝑗𝑗 𝛾𝛾𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 + ∑𝑗𝑗 𝜇𝜇𝑖𝑖,𝑗𝑗,𝑡𝑡 𝐶𝐶𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 (5) In a cross-regional regression variable output reflects also variation in capacities. Regional output variation is very significant. On the level of particular industries inter-regional differences in output might be 10, 100, 1000 times and even more. This huge variation can be almost perfectly explained by variation in capacities, variation in capacity utilization will play minor role. 𝑓𝑓 𝑢𝑢 𝐸𝐸𝑖𝑖,𝑡𝑡 = ∑𝑗𝑗 (𝛾𝛾𝑖𝑖,𝑗𝑗,𝑡𝑡 + 𝜇𝜇𝑖𝑖,𝑗𝑗,𝑡𝑡 )𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 + ∑𝑗𝑗 (𝛾𝛾𝑖𝑖,𝑗𝑗,𝑡𝑡 + 𝜇𝜇𝑖𝑖,𝑗𝑗,𝑡𝑡 )𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 (6) Let us rename (𝛾𝛾𝑖𝑖,𝑗𝑗,𝑡𝑡 + 𝜇𝜇𝑖𝑖,𝑗𝑗,𝑡𝑡 ) as 𝛾𝛾𝑖𝑖,𝑗𝑗,𝑡𝑡 . There is a strong cross-section correlation between output of different industries as all industries are correlated with the size of the region. It causes multicollinearity problems. Also there could be heteroscedasticity in residuals due to different size of regions. It is possible to solve these problems 𝑓𝑓 by dividing equation by formal gross regional output 𝑄𝑄𝑖𝑖,𝑡𝑡 . 𝐸𝐸𝑖𝑖,𝑡𝑡 𝑓𝑓 𝑄𝑄𝑖𝑖,𝑡𝑡 = 𝑓𝑓 ∑𝑗𝑗 𝛾𝛾𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑓𝑓 𝑄𝑄𝑖𝑖,𝑡𝑡 + 𝑢𝑢 ∑𝑗𝑗 𝛾𝛾𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑓𝑓 𝑄𝑄𝑖𝑖,𝑡𝑡 (7) Thus our dependent variable will be electricity consumption per unit of formal gross regional product or electricity intensity of the regional economy. Informal economy is considered as omitted variable in our regression for electricity consumption. Thus, informal economy can be reflected in regression in two ways: 1) through omitted variable bias in regression coefficients; 2) in regression residuals. Omitted variable bias depends on the correlation between informal economy and independent variables. The most important bias is expected for variables which measure official output because economic activity can be correlated in formal and informal sector due to common macroeconomic drivers. In order to exclude macroeconomic factor from regression we divide regression by regional gross domestic product (in formal sector). In the right-hand side of equation there are shares of different industries in total regional output. In the regression we cannot use all industries as their sum is equal to 1 for each region meaning 12 perfect multicollinearity in a cross-regional regression. Moreover there are industries with relatively low contribution to the cross-regional variance of electricity consumption per unit of gross regional product. Thus it is reasonable to split industries into two parts: 1) significant industries which should be estimated explicitly in a regression; 2) insignificant industries. Electricity consumption by insignificant industries is approximated by their output multiplied by the Russian average electricity intensity of those industries. We use Russian average instead of regional average simply because there is no data on the regional level. Divided by GRP of a particular region, this indicator could be used among independent variables in the right-hand side of the regression. Electricity consumption by industries is presented in the exhibit 2. Significant industries used in a regression are marked with a dark color. They are 1) production of metals; 2) mining industry; 3) chemical industries; 4) electricity generation, gas and water distribution; 5) production of nonmetal mineral commodities (cements, bricks, etc.); 6) production of transport goods (passenger cars, trucks, etc.); 7) paper production; 8) construction. Transportation industry is labeled as insignificant despite high electricity consumption. The reason is that transportation statistics is mixed with goods, people and telecommunications which have significantly different electricity intensity. As a result, electricity intensity of transportation is not stable in a cross-regional regression leading to insignificant coefficients. Trade was assigned to insignificant industries also due to high volatility of electricity intensity across different regions. 13 Exhibit 2. Electricity consumption by industries in Russia in 2011, GWt*h 160000 140000 120000 100000 80000 60000 40000 20000 0 Source: Rosstat, author’s calculations Subdividing industries into significant and insignificant we can use the following representation of electricity consumption in the region: 𝐸𝐸𝑖𝑖 𝑓𝑓 Where 𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖 𝐸𝐸𝑖𝑖 𝑓𝑓 𝑄𝑄𝑖𝑖 𝑄𝑄𝑖𝑖 = 𝑓𝑓 ∑𝑗𝑗∈𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖 𝛾𝛾𝑖𝑖,𝑗𝑗 𝑄𝑄𝑖𝑖,𝑗𝑗 𝑓𝑓 𝑄𝑄𝑖𝑖,𝑡𝑡 = 𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖 𝐸𝐸𝑖𝑖 𝑓𝑓 𝑄𝑄𝑖𝑖 + ∑𝑗𝑗∈𝑠𝑠𝑠𝑠𝑠𝑠𝑠𝑠 𝑓𝑓 𝛽𝛽𝑗𝑗 𝑄𝑄𝑖𝑖,𝑗𝑗 𝑓𝑓 𝑄𝑄𝑖𝑖 (8) represents electricity consumption by insignificant industries. Electricity intensities of significant industries are parameters 𝛽𝛽𝑗𝑗 (𝑗𝑗 ∈ 𝑠𝑠𝑠𝑠𝑠𝑠𝑠𝑠) which should be estimated in a regression. Besides industrial structure of economy regional electricity consumption is subject to the following factors which could differ across regions. • Capacity utilization. The higher capacity utilization, the lower electricity intensity due to the existence of fixed costs. In a regression we suppose that all regions have similar capacity utilization for a particular industry. It allows us not include this factor into the regression. • Electricity prices which could stimulate more efficient use of electricity. • Availability and prices of substitutes for electricity. If natural gas is very expensive or there is no sufficient natural gas infrastructure, then region will rely more on electricity. 14 • Weather conditions: cold winter or hot summer could increase electricity consumption for heating or air-conditioning. Taking into account additional factors, we use the following regression specification: 𝐸𝐸𝑖𝑖 𝑓𝑓 𝑄𝑄𝑖𝑖 = 𝛽𝛽1 𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖 𝐸𝐸𝑖𝑖 𝑓𝑓 𝑄𝑄𝑖𝑖 + ∑𝑗𝑗=𝑠𝑠𝑠𝑠𝑠𝑠𝑠𝑠 𝑓𝑓 𝛽𝛽𝑗𝑗 𝑄𝑄𝑖𝑖,𝑗𝑗 𝑓𝑓 𝑄𝑄𝑖𝑖 + 𝛽𝛽2 𝑡𝑡𝑡𝑡𝑡𝑡𝑡𝑡𝑡𝑡𝑡𝑡𝑖𝑖 + 𝛽𝛽3 𝑃𝑃𝑖𝑖𝑒𝑒 + 𝛽𝛽4 𝑃𝑃𝑖𝑖𝐺𝐺 + 𝛽𝛽0 + 𝜀𝜀𝑖𝑖 (9) Coefficient 𝛽𝛽1 is assumed to be 1 because we subtract insignificant industries from the total electricity consumption. However, calculating electricity consumption by insignificant industries 𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖𝑖 𝐸𝐸𝑖𝑖 we use Russian average electricity intensities. It does not guarantee that it will be accurate for a particular region. We need to estimate in regression whether coefficient 𝛽𝛽1 equals 1 in order to check appropriateness of our approach. Electricity consumption in informal sector is assumed to be equal to the intercept plus the residual: 𝑢𝑢 ∑𝑗𝑗 𝛾𝛾𝑖𝑖,𝑗𝑗 𝑄𝑄𝑖𝑖,𝑗𝑗 𝑓𝑓 𝑄𝑄𝑖𝑖 = 𝛽𝛽0 + 𝜀𝜀𝑖𝑖 (10) This regression equation (9) is estimated on the basis of cross-section data for Russian regions in 2011. 3.1 Estimates of informal activity in Russian regions in 2011 The principal source of data is “The common interagency statistical information system” (EMISS) presented on Rosstat website (http://www.fedstat.ru/indicators/start.do). I used the data on 67 Russian regions and 28 industries: 14 aggregated economic sectors (agriculture, mining, transport, educations, etc.) and 14 individual manufacturing sub-sectors (food, metallurgy, machinery, etc.). Official economic activity was measured by the gross regional product (GRP) and value added in aggregated sectors published by Rosstat. GRP and value added nominal volumes in 2011 were used. Rosstat does not provide GRP statistics by individual manufacturing industries. It was 15 estimated as a product of manufacturing GRP and a share of particular manufacturing industry in the volume of manufacturing production. Electricity consumption by production sectors is calculated as the total electricity consumption in the region less losses in electricity grids and consumption by households. Table 1. Descriptive statistics of the estimation sample (67 Russian regions in 2011) Variable Mean Std. Dev Min Max Electricity consumption in production of goods and services per official GRP, KWt*h per ths rubles 13.4 8.76 1.15 46.1 Electricity consumption by insignificant industries per official GRP, KWt*h per ths rubles 6.171 2.525 0.87 13.47 252.8 42.56 151.72 380.000 Paper industry share in GRP 0.6% 1.0% 0.0% 6.3% Chemical industry share in GRP 1.4% 1.9% 0.0% 9.7% Non-metal minerals share in GRP 0.8% 0.7% 0.1% 4.0% Metals industry share in GRP 3.0% 5.4% 0.0% 26.5% Transport machinery share in GRP 1.6% 1.8% 0.0% 9.0% Mining industry share in GRP 5.1% 9.4% 0.0% 49.5% Electricity, gas, water supply share in GRP 2.9% 1.4% 0.4% 7.8% 5.2% 2.8% 1.3% 19.1% Electricity price Construction share in GRP Source: Rosstat, author’s calculations Results of cross-regional regression estimation for 2011 year are reported in the table 2 below. Table 2. Results of regression for electricity consumption in production sectors per Gross regional product, cross-section of Russian regions, 2011 year Regressor Electricity consumption by insignificant industries per GRP Electricity price Paper industry share in GRP Chemical industry share in GRP Non-metal minerals share in GRP Metals industry share in GRP Coef. Std. error tstatistics P>t 1.06 0.23 4.7 0.000 -0.029 0.012 -2.5 0.015 238.5 43.99 5.42 0.000 5.6 21.73 0.26 0.797 65.4 62.62 1.04 0.301 87.1 8.11 10.73 0.000 -15.1 22.01 -0.69 0.496 Mining industry share in GRP 24.7 5.05 4.89 0.000 Electricity, gas, water supply share in GRP 77.6 34.73 2.23 0.030 -22.4 16.22 -1.38 0.174 7.46 4.00 1.87 0.067 Transport machinery share in GRP Construction share in GRP Constant Number of observations (regions): 67. R-squared: 89%. Adj. R-squared: 87%. Source: Author’s calculations 16 Adjusted R2 of regression is 87%. It is very important indicator of regression for us because we are going to use a residual for calculation of informal economy share. If R2 were low like 20%40%, it would mean either a) there is a huge informal economy variation or b) there are other factors which were not captured in the regression, they exist in residual term. In this case, due to high impact of other factors we cannot use residual term for calculation of informal economy share. When R2 is high then influence of other factors on regression residual is as low as possible. It allows us to use residual for estimation of informal economy. According to regression results, electricity prices affect electricity consumption negatively (in line with our hypothesis). Temperature and natural gas prices are not presented in the final regression as they are insignificant. Industrial structure of the region has significant effect on electricity intensity of GRP. Industries which influence positively electricity intensity are paper, chemical industry, metals industry, mining industry, electricity production and water & natural gas supply. The higher their share in the regional output, the higher electricity consumption per unit of GRP. Transport machinery and construction sectors are insignificant factors for electricity consumption intensity in the region. Results of initial regression which includes all factors (some of them were dropped) are presented in appendix 2. Coefficient at electricity consumption of “insignificant” industries is close to 1 which means that we calculated it correctly. Thus, we can directly subtract it from dependent variable or leave it in independent variables. Electricity consumption in the informal sector is captured by 𝛽𝛽̂0 + 𝑒𝑒𝑖𝑖 where 𝛽𝛽̂0 is an estimate of the intercept in the regression and 𝑒𝑒𝑖𝑖 is regression residual for region i. 𝑢𝑢 ∑𝑗𝑗 𝛾𝛾𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑓𝑓 𝑄𝑄𝑖𝑖,𝑡𝑡 = 𝛽𝛽̂0 + 𝑒𝑒𝑖𝑖 (11) Total informal output is estimated under assumption that it has the same electricity intensity as a ratio of total electricity consumption to official GRP: 𝑢𝑢 𝑄𝑄𝑖𝑖,𝑡𝑡 = �0 +𝑒𝑒𝑖𝑖 �𝑄𝑄𝑓𝑓 �𝛽𝛽 𝑖𝑖,𝑡𝑡 𝐸𝐸𝑖𝑖,𝑡𝑡 𝑓𝑓 𝑄𝑄 𝑖𝑖,𝑡𝑡 (12) 17 Informal economy share in GRP is easy to calculate: 𝑢𝑢𝑖𝑖 = 𝑢𝑢 𝑄𝑄𝑖𝑖,𝑡𝑡 𝑓𝑓 𝑢𝑢 +𝑄𝑄 𝑄𝑄𝑖𝑖,𝑡𝑡 𝑖𝑖,𝑡𝑡 (13) Calculated informal economy share ranges from 3.8% to 85% with the average level of 40%. 85% seems unrealistically high. The histogram, table and the map with informal economy share by regions in 2011 are presented below. There are 10 regions with informal economy share above 60%: Ingushetia, Moscow, Dagestan, Kalmykia, Altay Republic, Krasnodar region, Kabardino Balkaria, Kaliningrad, Astrakhan, and Saint-Petersburg. Southern small regions are likely to have high informal economy share because they have a large share of small business and low government control over economic activity. Informal economy share in Moscow (79%) is likely to be overestimated. It could be caused by large electricity consumption for lightning, air conditioning and other requirements of a large city. The same bias is applicable for SaintPetersburg (estimated informal share at 60%). Thus, we need special study to estimate informal economy share in these two cities. The lowest informal economy share is in Komi, Marii El, Lipetsk region, Arkhangelsk region, Krasnoyarsk territory, Vologda region. 0 2 Number of regions 6 4 8 10 Exhibit 3. Distribution of Russian regions by estimated informal economy share in 2011 0 .2 .4 .6 Estimated informal economy share in GRP in 2011 .8 Source: Author’s calculations 18 Table 3. Russian regions ranking according to the share of informal economy in total GRP (formal and informal), from the highest to lowest # Region name Informal economy share, % # Region name Informal economy share, % 1 Republic of Ingushetia 85% 36 Smolensk Region 36% 2 Republic of Dagestan 81% 37 Murmansk Region 35% 3 City of Moscow 79% 38 Novosibirsk Region 34% 4 Republic of Kalmykia 77% 39 Penza Region 34% 5 Altay republic 76% 40 Republic of Bashkortostan 34% 6 Krasnodar Territory 68% 41 Ivanovo Region 33% 7 Republic of Kabardino Balkaria 64% 42 Tomsk Region 33% 8 Kaliningrad Region 62% 43 Tula Region 33% 9 Astrakhan Region 61% 44 Ryazan Region 32% 10 City of St Petersburg 60% 45 Kurgan Region 32% 11 Republic of Adygea 57% 46 Leningrad Region 31% 12 Pskov Region 55% 47 Volgograd Region 31% 13 Khabarovsk Territory 54% 48 Kemerovo Region 31% 14 Kaluga Region 53% 49 Novgorod Region 30% 15 Stavropol Territory 53% 50 Kirov Region 30% 16 Primorsky Territory 52% 51 Saratov Region 28% 17 Republic of Northern Osetia Alania 51% 52 Kursk Region 28% 18 Tambov Region 51% 53 Republic of Karelia 28% 19 Rostov Region 50% 54 Republic of Udmurtia 26% 20 Tver Region 50% 55 Tumen Region 25% 21 Ulyanovsk Region 44% 56 Nizhny Novgorod Region 25% 22 Republic of Tatarstan 44% 57 Kostroma Region 24% 23 Republic of Mordovia 44% 58 Perm Territory 24% 24 Orel Region 44% 59 Sverdlovsk Region 23% 25 Voronezh Region 44% 60 Vologda Region 21% 26 Altay Territory 43% 61 Chelyabinsk Region 18% 27 Omsk Region 43% 62 Orenburg Region 14% 28 Samara Region 41% 63 Krasnoyarsk Territory 14% 29 Bryansk Region 41% 64 Arkhangelsk Region 13% 30 Vladimir Region 40% 65 Lipetsk Region 13% 31 Moscow Region 40% 66 Republic of Marii El 11% 32 Belgorod Region 39% 67 Republic of Komi 33 Republic of Buryatia 37% 34 Republic of Chuvashia 37% 35 Yaroslavl Region 37% 4% Source: Author’s calculations 19 Exhibit 4. Map of Russian regions by estimated informal economy share in 2011 20 3.2 Comparison with alternative indicators of informal economy We need to compare our results with alternative indicators of informal economy. We think that credible results should correlate with other sources of estimates. We have considered a number of benchmarks for informal economy; this paragraph summarizes the main conclusions. Our estimates of informal economy share have 35% correlation with estimates by Rosstat which measures the share of workers employed in the informal economy. It is important to stress that we have a positive and significant correlation although it is not very high. The average informal economy share in Russia is 19% according to Rosstat versus our 40%. We plot these two indicators on a chart below. For Dagestan and Ingushetia Rosstat estimates are close to our results. Exhibit 5. Comparison of two indicators of informal economy by Russian regions Source: Author’s calculations Sub-national Russian data of “Doing business rating” (2012) has a low correlation with our estimates of informal economy. Two charts below demonstrate plotting our estimates against “starting a business” and “dealing with construction permits” rankings. 21 Exhibit 6. Comparison with “Doing business” (2012) rankings by Russian regions Source: Author’s calculations There is a Corruption perception index for Russian regions for 2002 prepared by “Transparency international Russia”. Unfortunately we do not have more “fresh” estimates. However our estimates of informal economy share in 2011 show 35% correlation with Corruption perception index for 2002. It supports reliability of our estimates because it is theoretically proven that the higher corruption the higher informal economy share. Exhibit 7. Comparison with “Corruption perception index for 2002” by Russian regions Source: Author’s calculations We calculated specific indicators which characterize the degree of violations by taxpayers in a region. It is a ratio of cameral tax inspections which found violations to a total number of cameral tax inspections in Russian regions in 2011. Higher amount of revealed violations should correspond to higher informal economy share because the main motive for being informal is tax 22 evasion. We have found that the share of tax violations have 30% correlation with our estimate of informal economy share. We should note that we could underestimate informal economy share in Northern Osetia – Alania as it has extremely high reveled tax violations. Exhibit 8. Comparison with the share of cameral tax inspections which found violations in 2011 by Russian regions Source: Author’s calculations Usually residential housing prices are considered as an indicator of real incomes of population. Thus we used them for comparison with our informal economy estimates. We calculated a ratio of housing purchase price to the average monthly per capita income in a region. This indicator has 17% (low) correlation with informal economy share. Exhibit 9. Comparison with the housing purchase price in 2011 by Russian regions Source: Author’s calculations 23 We can conclude that our measure of informal activity has imperfect correlation with other individual indicators. No one of these indicators measures informal economy precisely. Moreover they are definitely impacted by other factors which do not relate to informal economy. However we could suppose that all considered indicators should have something common which relates to informal economy. In order to measure it we calculate the average of 3 indicators: informal economy share by Rosstat, corruption perception index and housing price to income ratio. Before averaging we standardized indicators deducting their cross-regional average and divided by cross-regional standard deviation. Exhibit 10. Comparison with the aggregate indicator (average of 3 standardized indicators: Rosstat informal economy share, corruption perception, housing prices to income ratio) in Russian regions Source: Author’s calculations This average of 3 indicators has 44% (pretty high) correlation with our estimate of informal economy. This is the highest value among considered indicators. It supports that our measure of informal economy is reliable in the sense that it reflects some common regional trends. It is important that 1) correlation is not negative – we do not have completely unreasonable results, 2) though positive, correlation is not very high meaning that our indicator is different from existing proxies. Difference could come either from our advantage of informal economy measurement or from our mistakes in measurement of informal economy. 24 3.3 Informal economy and economic conditions in Russian regions In theory informal economy has significant impact on economic development. We are interested to find any correlation between our estimate of informal economy share and economic performance of Russian regions. We consider the following regional economic indicators: an official unemployment rate, formal gross regional product (GRP) per resident, an investment share in GRP. From fiscal point of view, it is interesting to find any correlation between the informal economy and the regional public deficit or federal transfers to the regional budget. Official unemployment rate is supposed to be positively correlated with informal economy share because informal economy absorbs officially unemployed people. Correlation between these two indicators in 2011 is 38% which is pretty high. Exhibit 11. Comparison with the unemployment rate (by methodology of International Labor Organization) by Russian regions in 2011 GRP per capita has negative correlation (-17%) with informal economy share which corresponds to our expectations. The higher level of formal income in the region, the higher opportunities in formal sector which becomes relatively more attractive than informal sector. 25 Exhibit 12. Comparison with GRP per capita by Russian regions in 2011 Transfers from federal to regional budgets (in terms of their share in total income of regional budget) have the strongest correlation with informal economy share at 54%. Indeed, the higher share of informal activities the lower ability of regional government to collect taxes. In order to maintain necessary social spending such regions needs external financing from the Federal government. Exhibit 13. Comparison with transfers to the regional budget (as % of GRP) by Russian regions in 2011 4 Dynamics of informal economy share In the previous section we estimated the absolute level of informal economy in a given year. Now we want to determine how it changed over time, i.e. what is dynamics of informal economy. 26 For this purpose we use different approach. It is based on calculation of statistical discrepancies between dynamics of electricity consumption and official economic activity. We need to explain why we need another method. One could suggest to estimate dynamics of informal economy running panel regression. We think that this could lead us to contradicting results. For example, regression method does not guarantee that estimated informal economy share decreases when electricity consumption significantly falls and official output grows. For such observations regression would try to decrease coefficient at official output rather than decrease residual (which plays the role of informal economy). 4.1 Methodology 4.1.1 Traditional electricity consumption method Let us start with basic relationship used by Kaufman and Kaliberda (1996). We consider the model of electricity consumption Ei,t in total economy of the region i. It is supposed to be proportionate to the total output Q i,t . Ei,t = γi,t Q i,t γi,t is electricity intensity. (14) Total output is a sum of official Qfi,t and unofficial Qui,t . It is easy to see that total output can be expressed through the official output and the share of unofficial sector in the economy ui,t: Qf Q i,t = 1−ui,t where ui,t = i,t Qu i,t Qi,t (15) Thus, total electricity consumption can be expressed on the basis of official output and informal economy share: Qf Ei,t = γi,t 1−ui,t Taking logarithms and differentiating: ̇ Eı,ȷ,t Ei,j,t γı,ȷ,t ̇ =γ i,j,t + ḟ Qı,ȷ,t f Qi,j,t i,t + u̇ i,j,t (16) (17) 27 Thus, growth rate of electricity consumption in the region is a sum of growth rate of electricity intensity, growth rate of official output and the change in the share of unofficial economy. Usually authors assume no changes in electricity intensity and use only difference between electricity consumption and formal output. Kaufman and Kaliberda (1996) simplified this equation to the following: 𝐸𝐸̇ 𝑢𝑢̇ 𝑡𝑡 = 𝐸𝐸𝑡𝑡 − 𝑡𝑡 𝑓𝑓 𝑄𝑄̇𝑡𝑡 𝑓𝑓 𝑄𝑄𝑡𝑡 (18) It is important to return electricity intensity into consideration. Actually, it can change in the economy by a number of reasons. We can take into account changes which are associated with unequal growth of industries with different electricity intensity. It could significantly improve quality of results. For example, if during economic crisis industries with high electricity intensity are hit the most, electricity consumption can fall higher than total gross regional product. In this case, simple approach could lead us to the wrong conclusion that informal economy share diminishes. 4.1.2 Proposed augmented electricity consumption method I am proposing to use augmented method which takes into account changes in industrial structure and trends in electricity intensity in the economy. It was developed by the author and generally motivated by usual critics of Kaufman-Kaliberda approach. Let us consider total electricity consumption in a region i as a sum of consumption by individual industries denoted by index j. As we derived in section 3, total electricity consumption in the region is a sum of variable part depending on current output and fixed part depending on a size of capacities: 𝐸𝐸𝑖𝑖,𝑡𝑡 = ∑𝑗𝑗 (𝛾𝛾𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 + 𝜇𝜇𝑖𝑖,𝑗𝑗,𝑡𝑡 𝐶𝐶𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 ) (19) Capacity in the industry can be represented as output divided by capacity utilization rate CU. Let us denote 𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 = 𝛾𝛾𝑖𝑖,𝑗𝑗,𝑡𝑡 + 𝜇𝜇𝑖𝑖,𝑗𝑗,𝑡𝑡 𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 (20) 28 Then we can simplify 𝐸𝐸𝑖𝑖,𝑡𝑡 = ∑𝑗𝑗 𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 (21) Let us express industry output using official output and the share of informal economy in that industry 𝑢𝑢𝑖𝑖,𝑗𝑗,𝑡𝑡 : 𝑓𝑓 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 = 1−𝑢𝑢 (22) 𝑖𝑖,𝑗𝑗,𝑡𝑡 Using this for total electricity consumption, we get: 𝑓𝑓 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 𝐸𝐸𝑖𝑖,𝑡𝑡 = ∑𝑗𝑗 𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 1−𝑢𝑢 (23) 𝑖𝑖,𝑗𝑗,𝑡𝑡 Let us take a derivative of this equation by time: 𝐸𝐸̇𝑖𝑖,𝑡𝑡 = ∑𝑗𝑗 𝑓𝑓 𝑓𝑓 𝑓𝑓 𝜌𝜌̇ 𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 +𝑄𝑄̇𝑖𝑖,𝑗𝑗,𝑡𝑡 𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 +𝑢𝑢̇ 𝑖𝑖,𝑗𝑗,𝑡𝑡 𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 1−𝑢𝑢𝑖𝑖,𝑗𝑗,𝑡𝑡 (24) This equation means that increase in total electricity consumption is due to increase in electricity intensity (which depends on capacity utilization as well), increase in official output and increase in informal output. Let us suppose that informal economy share 𝑢𝑢𝑖𝑖,𝑡𝑡 is equal across all industries; hence its dynamics 𝑢𝑢̇ 𝑖𝑖,𝑡𝑡 is equal too. Multiplying eq. 28 by 1 − 𝑢𝑢𝑖𝑖,𝑡𝑡 and splitting up the sum in the right- hand part: 𝑓𝑓 𝑓𝑓 𝑓𝑓 𝐸𝐸̇𝑖𝑖,𝑡𝑡 �1 − 𝑢𝑢𝑖𝑖,𝑡𝑡 � = ∑𝑗𝑗 𝜌𝜌̇ 𝑖𝑖 ,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 + ∑𝑗𝑗 𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄̇𝑖𝑖,𝑗𝑗,𝑡𝑡 + 𝑢𝑢̇ 𝑖𝑖,𝑡𝑡 ∑𝑗𝑗 𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 (25) From this equation we can express dynamics of informal economy share: 𝑢𝑢̇ 𝑖𝑖,𝑡𝑡 = (1−𝑢𝑢𝑖𝑖,𝑗𝑗,𝑡𝑡 )𝐸𝐸̇𝑖𝑖,𝑡𝑡 𝑓𝑓 ∑𝑗𝑗 𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 − 𝑓𝑓 ∑𝑗𝑗 𝜌𝜌̇ 𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑓𝑓 ∑𝑗𝑗 𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 − 𝑓𝑓 ∑𝑗𝑗 𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄̇𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑓𝑓 ∑𝑗𝑗 𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 (26) 𝑓𝑓 𝑓𝑓 Taking into account that ∑𝑗𝑗 𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 = 𝐸𝐸𝑖𝑖,𝑡𝑡 = (1 − 𝑢𝑢𝑖𝑖,𝑗𝑗,𝑡𝑡 )(𝐸𝐸𝑖𝑖,𝑡𝑡 ) we come to the following: 𝑢𝑢̇ 𝑖𝑖,𝑡𝑡 = 𝐸𝐸̇𝑖𝑖,𝑡𝑡 𝐸𝐸𝑖𝑖,𝑡𝑡 − 𝑓𝑓 ∑𝑗𝑗 𝜌𝜌̇ 𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑓𝑓 ∑𝑗𝑗 𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 − 𝑓𝑓 ∑𝑗𝑗 𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄̇𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑓𝑓 ∑𝑗𝑗 𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑄𝑄𝑖𝑖,𝑗𝑗,𝑡𝑡 (27) Thus, a change of informal economy share equals to the growth rate of total electricity consumption less the weighted growth of electricity intensity less the weighted growth of 29 production in formal sector. If there were no cross-industry differences in electricity intensities 𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 this equation would equal to Kaufman-Kaliberda equation. Modeling changes in electricity intensity Changes in official output can be measured directly using official statistics. However changes in electricity intensity are unobservable and should be considered in more detail. Let us take derivative by time of equation for electricity intensity (20): 𝜌𝜌̇ 𝑖𝑖 ,𝑗𝑗,𝑡𝑡 = 𝛾𝛾̇𝑖𝑖 ,𝑗𝑗,𝑡𝑡 + 𝜇𝜇̇ 𝑖𝑖,𝑗𝑗,𝑡𝑡 1 𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 − 1 ̇ 𝑖𝑖,𝑗𝑗,𝑡𝑡 𝐶𝐶𝐶𝐶 𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 𝜇𝜇𝑖𝑖,𝑗𝑗,𝑡𝑡 (28) Let us suppose that efficiency gains (or technological progress) are the same for variable and fixed part of electricity consumption that is: 𝛾𝛾̇𝑖𝑖 ,𝑗𝑗,𝑡𝑡 = 𝜇𝜇̇ 𝑖𝑖,𝑗𝑗,𝑡𝑡 , then 𝜌𝜌̇ 𝑖𝑖,𝑗𝑗,𝑡𝑡 = 𝛾𝛾̇𝑖𝑖,𝑗𝑗,𝑡𝑡 1+𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 − ̇ 𝑖𝑖,𝑗𝑗,𝑡𝑡 𝜇𝜇𝑖𝑖,𝑗𝑗,𝑡𝑡 𝐶𝐶𝐶𝐶 (29) 𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 Thus the electricity intensity in industry j is a) depends on efficiency improvements measured by decreasing 𝛾𝛾̇𝑖𝑖,𝑗𝑗,𝑡𝑡 and b) depends on the changes in capacity utilization (negatively). Growth of capacity utilization has negative decreases electricity intensity due to existence of fixed electricity costs. The relative importance of fixed electricity costs is measured by the ratio 𝜇𝜇𝑖𝑖,𝑗𝑗,𝑡𝑡 𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 . We can assume that 𝛾𝛾̇ 𝑖𝑖,𝑗𝑗,𝑡𝑡 is decreasing by 1% per year. This rate corresponds to technological progress in electricity use which is estimated at 1% per year by Bashmakov and Myshak (2012). Dynamics of electricity intensity is directly connected with dynamics of informal economy share. If we mistake by 1 percentage point in technological progress assumption, we automatically mistake by 1 percentage point in informal economy share. Dynamics of capacity utilization ̇ CU i,j,t CUi,j,t was estimated on the basis of Rosstat data on particular aggregated economic sectors in Russia. We suppose that dynamics for all regions is equal to the Russian average within the same sector. The average annual growth rate of total value added in Russian economy in 2004-2011 was 4.4%; annual average growth rate of capacities over the same periods was 2.9%. Thus capacity utilization increased by 1.5% each year on average. 30 We should determine 𝛾𝛾 𝜇𝜇𝑖𝑖,𝑗𝑗,𝑡𝑡 𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 . We can express it from equation (20) 𝜇𝜇𝑖𝑖,𝑗𝑗,𝑡𝑡 𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 = (1 − 𝜂𝜂)𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 (30) Where 𝜂𝜂𝑖𝑖,𝑗𝑗,𝑡𝑡 = 𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 represents the share of variable cost in total electricity intensity. We should 𝑖𝑖,𝑗𝑗,𝑡𝑡 somehow estimate 𝜂𝜂𝑖𝑖,𝑗𝑗,𝑡𝑡 as there is no statistical data on it. It should be different across industries. We can suppose that the higher electricity intensity of a particular industry, the higher share of variable electricity consumption. The idea is that high-electricity intensive industries use electricity as one of the main inputs for production. Thus electricity consumption is mainly variable depending on the amount of output. Let us suppose that variable part ranges from some reasonable maximal level 0.8 (our expert opinion) for electricity intensive industries to minimal level of 0.2 for service sectors. It can be formalized in the following equations: 𝜂𝜂𝑖𝑖,𝑗𝑗,𝑡𝑡 𝐾𝐾𝐾𝐾𝐾𝐾ℎ 0.2, 𝑖𝑖𝑖𝑖 𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 < 7 ⎧ 𝑡𝑡ℎ𝑠𝑠 𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟 0.08 + 0.011𝜌𝜌 , 𝑖𝑖𝑖𝑖 7 < 𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 < 60 = 𝑖𝑖,𝑗𝑗,𝑡𝑡 ⎨ 𝐾𝐾𝐾𝐾𝐾𝐾ℎ 0.8, 𝑖𝑖𝑖𝑖 𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 > 60 ⎩ 𝑡𝑡ℎ𝑠𝑠 𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟𝑟 (31) Because numbers 0.2 and 0.8 are taken from our expert opinion, we are interested in how results are sensitive to them. Let us also suppose that the average capacity utilization is around 70%. Now we can rewrite and approximate eq. (28): 𝜌𝜌̇ 𝑖𝑖,𝑗𝑗,𝑡𝑡 𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 𝜌𝜌̇ 𝑖𝑖,𝑗𝑗,𝑡𝑡 𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 ≈( =( ̇ 𝑖𝑖,𝑗𝑗,𝑡𝑡 𝐶𝐶𝐶𝐶 𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 ̇ 𝑖𝑖,𝑗𝑗,𝑡𝑡 𝐶𝐶𝐶𝐶 𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 𝛾𝛾̇ + 𝛾𝛾𝑖𝑖,𝑗𝑗,𝑡𝑡 𝑖𝑖,𝑗𝑗,𝑡𝑡 1+𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 )𝜂𝜂𝑖𝑖,𝑗𝑗,𝑡𝑡 − ̇ 𝑖𝑖,𝑗𝑗,𝑡𝑡 𝐶𝐶𝐶𝐶 𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 + 1%)(0.08 + 0.011𝜌𝜌𝑖𝑖,𝑗𝑗,𝑡𝑡 ) − ̇ 𝑖𝑖,𝑗𝑗,𝑡𝑡 𝐶𝐶𝐶𝐶 𝐶𝐶𝐶𝐶𝑖𝑖,𝑗𝑗,𝑡𝑡 (32) 31 4.2 Empirical results on dynamics of informal economy share in Russian regions over 2004-2011 The data used for informal economy dynamics estimation is similar to data for regression analysis described in 3.2. Electricity consumption by production sectors is calculated as the total electricity consumption in the region less losses in electricity grids, less consumption by households. Statistics for losses and household consumption is available for 2004-2010. Other years were estimated on the basis of assumption of the constant share of losses in the total electricity consumption. Electricity intensity of production sectors in 2011 was estimated as a ratio of electricity consumption in a sector to the value added in that sector if Rosstat provided statistics on electricity consumption by sector in the particular region. If these data did not exist, electricity intensity in the industry/sector was set up at the average level for the whole Russia. Total electricity consumption for manufacturing was available for all regions. Using this information, electricity intensities of individual manufacturing industries were corrected by equalizing the sum of estimated electricity consumption by individual industries to the total electricity consumption in manufacturing taken from Rosstat. All this work was done for 2011 year only. Electricity intensity in other years was calculated using assumption of the average electricity intensity change by -1% per annum. It is assumed to be equal for all industries/sectors. First of all, we calculated dynamics of informal economy share using data for the whole Russia. Result is that informal economy share was decreasing during 2004-2011. This trend can be explained 1) by the growth of official sector during economic expansion in Russia; 2) migration of entrepreneurs from informal to official sectors in order to utilize opportunities in official sector; 3) positive changes in Russian tax regimes (introduction of the flat income tax rate which is among lowest in the world). 2009 was the only year when informal economy share increased by 1 percentage point. This could be due to economic crisis which forced people to look for alternative 32 income sources apart from formal sector. Tax minimization through informal activity was also a tool for business survival. Exhibit 14. Dynamics of informal economy share in Russian Federation estimated by augmented electricity consumption method, y-o-y, percentage points Source: Author’s calculations Let us take a look on the regional picture. Excluding few outliers we can see relatively plausible dynamics of informal economy share. Cumulative dynamics of informal economy share in 20042011 lies in the range -30 - +30 percentage points across different regions. Only 16 from 65 regions witnessed an increase in informal economy share over this period. Exhibit 15. Distribution of Russian regions by an increase/decrease in informal economy share in 2011 vs. 2003 (equals to cumulative change over 2004-2011) 18 16 16 12 12 10 9 9 8 7 5 1 1 0 (20%; 30%) 1 (50%; 60%) (10%; 20%) (0%; 10%) (-10%; 0%) (-20%; -10%) (-40%; -30%) -50% 0 0 (-50%; -40%) 2 (40%; 50%) 4 4 (30%; 40%) 6 (20%; 30%) Number of regions 14 Cumulative increase of informal economy share in 2011 vs 2004 Source: Author’s calculations 33 42 out of 65 regions demonstrated decrease in informal economy share over 2004-2011. Thus, majority of Russian regions achieved some progress in decreasing informal economy share. It was done thanks to 2 reasons: 1) increasing absolute volume of formal sector which made informal activities relatively less important, 2) decreasing absolute volume of informal economy (which was a minor factor as we will show further). The highest decrease of informal economy is evident for Kaluga region, Penza, Tula, Ivanovo, Kabardino Balkaria, Omsk region, Tambov region, Irkutsk, Mordovia, Altay territory, Tatarstan, Bashkortostan, Moscow region. The highest increase of informal economy share is registered for city of Moscow, Murmansk, Stavropol territory, Tumen, Udmurtia, Tomsk. It is interesting to compare results of two methodologies: 1) informal economy share in 2011 calculated on the basis of regression model and 2) cumulative increase of informal economy share in 2004-2011 on the basis of augmented electricity consumption model (see exhibit below). Surprisingly we do not see any correlation. It means that the level of informal economy share does not determine any particular trend in its dynamics. Exhibit 16. Comparison of results of two approaches to measurement of informal economy share by Russian regions Source: Author’s calculations 34 We can combine results of two methodologies to calculate informal economy share in Russian regions in other years except 2011: let us take base level in 2011 from regression model approach and then calculate 2004-2010 years on the basis of informal economy share dynamics. Results are presented in Appendix 1. Finally we can calculate informal economy in Russia as a sum of regional informal economies. Our sample covers 66% of total Russian gross regional product. We excluded from analysis city of Moscow and Saint-Petersburg which have rather ambiguous results on informal economy share. Informal economy share has decreased from 55% in 2004 to 40% in 2011 with slight growth in 2009 during economic slump. Exhibit 17. Informal economy share in Russia, % (on the basis of regional sample covering 66% of Russian GDP) Source: Author’s calculations We calculated volume of informal value added in 2011 rubles. It was relatively stable. Only in 2011 it decreased significantly. It means that observed decrease in informal economy share was driven by increasing official output. Existing informal activities were not significantly affected. Nevertheless the good thing is that informal economy did not attract new participants. 35 Exhibit 18. Volume of informal value added in Russia, in trn 2011rubles Source: Author’s calculations 5 Conclusion This study develops two approaches for estimation of informal economy share. The first method is based on cross-regional regression model for electricity consumption in production sectors of economy. The level of informal economy share is estimated as a difference between total actual electricity consumption and electricity consumption implied by regression, i.e. by the level of official economic activity. In the second approach, dynamics of electricity consumption was studied. Traditional approach by Kaufman and Kaliberda was augmented by taking into account changes in industrial structure and intensity of electricity use which affect electricity consumption in the economy of the region. Main conclusions from this analysis are the following: • Cross-section variation of electricity consumption per output in Russian regions is explained by the model with electricity consumption per unit of GRP as dependent variable and a number of independent variables: electricity prices, shares of particular industries in GRP (metals, mining, chemicals, electricity generation, non-metal mineral products, transport machinery, paper, and construction). Adjusted R2 for a sample of 67 regions in 2011 is 87%. 36 • Level of informal economy share can be estimated as a residual of this regression. The average level of informal economy share in 2011 is 40%, there is significant cross-regional variation (from 4% to 85%). • The highest share of informal economy in 2011 is registered for Ingushetia, Moscow, Dagestan, Kalmykia, Altay Republic, Krasnodar region. The lowest informal economy share in 2011 was in Komi, Marii El, Lipetsk region, Arkhangelsk region, Krasnoyarsk territory, Vologda region. • Our estimates of informal economy share have 35% correlation with estimates by Rosstat which measures the share of workers employed in the informal economy. • Sub-national Russian data of “Doing business rating” (2012) has a low correlation with our estimates of informal economy. • Our estimates of informal economy share in 2011 show 35% correlation with Corruption perception index for 2002. We have found that the share of tax violations have 30% correlation with our estimate of informal economy share. • Informal economy is positively correlated with unemployment (correlation in 2011 is 38% pretty high), negatively correlated with GRP per capita (-17%). • Transfers from federal to regional budgets (in terms of their share in total income of regional budget) have the strongest correlation with informal economy share at 54%. The higher share of informal activities the lower ability of the regional government to collect taxes. In order to maintain necessary social spending such regions needs external financing from the Federal government. • Majority of Russian regions experienced decline of informal economy share over 2004-2011. Only 16 from 65 regions witnessed an increase in informal economy share over this period. • Informal economy share in the whole regional sample (which covers 66% of Russian GDP) has decreased from 55% in 2004 to 40% in 2011 with slight growth in 2009 during economic slump. 37 • Declining share of informal economy can be explained by the growth of formal activities rather than contraction of informal activities in absolute terms. This study suggests that government should implement “facilitative” policies instead of “prohibitive” which means deregulation and support of formal activities. Estimates of informal sector in regional dimension can be used in a number of ways: • For the fiscal policy. Estimates of unofficial economy in Russian regions could be used to assess a potential increase of the tax base by moving business from unofficial sector. • Incentives for regional institutional development. Comparison of regions by the unofficial sector size gives incentives for the regional authorities to improve institutions • Federal investments allocation policy. Federal investments should be spent in regions where unofficial economy is relatively low. Otherwise fiscal multiplier will be low due to corruption and weak spillovers. 38 6 Bibliography Alexeev, M. and Habodaszova, L. (2012) Fiscal decentralization, corruption, and the shadow economy, Public finance and management, Volume 12, Number 1, pp. 74-99 Alexeev, M. and Pyle, W. (2003) A Note on Measuring the Unofficial Economy in the Former Soviet Republics, The Economics of Transition 3, 153-175 Breusch, T. (2005) Estimating the Underground Economy using MIMIC Models (Working Paper, The Australian National University) Ernste, D. and F. Schneider (1998) Increasing Shadow Economies all over the World – Fiction or Reality (Institute for the Study of Labor Discussion Paper No. 26) Eilat, Y. and C. Zinnes, (2002) The Evolution of the Shadow Economy in Transition Countries: Consequences for Economic Growth and Donor Assistance, CAER II Discussion Paper No. 83, September Feige, E. and I. Urban, (2003) Estimating the Size and Growth on Unrecorded Economic Activity in Transition Countries: A Re-evaluation of Electric Consumption Method Estimates and their Implications, William Davidson Institute Working paper No. 636 Friedman, E., Johnson, S., Kaufmann, D. and P. Zoido-Lobaton (2000) Dodging the grabbing hand: The determinants of unofficial activity in 69 countries, Journal of Public Economics, 76/6, 459-493 Johnson, S., Kaufmann, D. and P. Zoido-Lobatón (1998) Regulatory discretion and the unofficial economy, The American Economic Review 88/ 2, 387-92 Johnson, S., Kaufmann, D. and A. Shleifer (1997) The unofficial economy in transition, in Brookings Papers on Economic Activity 88, 159-240 Kaufmann, D. and Kaliberda, A. (1996) Integrating the unofficial economy into the dynamics of post socialist economies: A framework of analyses and evidence, in: B. Kaminski, ed., Economic Transition in Russia and the New States of Eurasia (London: M.E. Sharpe) 81-120. 39 Komarova, T. (2003) Shadow Economy in Russian Regions (Magister Thesis. Moscow, New Economic School) Lacko M. (1996) Hidden economy in East-European countries in international comparison (Laxenburg: International Institute for Applied Systems Analysis, working paper) Lacko M. (2000) Hidden Economy – An Unknown Quantity: Comparative Analysis of Hidden Economics in Transition Countries 1989-95, Economics of Transition 8/1, 117-149 Martynov, A., Artyukhov, V., Vinogradov, V. (1997) Rossiya kak systema (Practical Science, Http://www.sci.aha.ru/RUS/wab__.htm) Nikolayenko, S., Lissovolik, Y., and R. MacFarquar (1997) Special Report: The Shadow Economy in Russia’s Regions, Russian Economic Trends, No. 4 Popov V. (2001) Reform Strategies and Economic Performance of Russia's Regions, World Development 5, 865-886 Plekhanov A., Isakova A. (2011) Region-specific constraints to doing business: evidence from Russia. EBRD working paper No. 125. Schneider, F. (2000) The Increase of the Size of the Shadow Economy of 18 OECD Countries: Some Preliminary Explanations (Paper presented at the Annual Public Choice Meeting, March 1012, Charleston, S.C.) Schneider, F. and D. Enste (2000) Shadow Economies: Size, Causes, and Consequences, The Journal of Economic Literature 38/1, 77-114 Schneider F. (2006) Shadow Economies and Corruption All Over the World: What Do We Really Know (Institute for the Study of Labor Discussion Paper No. 2315) Schneider F., Buehn A., Montenegro C. (2010) Shadow economies all over the world. New estimates for 162 countries from 1999 to 2007. World Bank. Policy research working paper No. 5356. Sharapenko, Denis (2009) Estimation of the shadow economy in Russia. Master thesis. Central European University. Department of Economics. 40 Suslov, N. and S. Ageeva (2009) Influence of Energy Prices on the Size of Shadow Economy: A Cross Country Analysis (Publication of EERC, www.eerc.ru) Tanzi, V. (1983) The Underground Economy in the United States: Annual Estimates, 19301980, IMF-Staff Papers, 30/2, 283-305. Teobaldelli D. (2010) Federalism and the shadow economy. Public Choice. CENEF (2007) Оценка параметров ценовой эластичности спроса на электроэнергию по отдельным группам потребителей и по субъектам Российской Федерации. Том 1. ООО «Центр по эффективному использованию энергии» (ООО «ЦЭНЭФ»). – Москва, 2007. Башмаков И.А., Мышак А.Д. (2012) Российская система учета повышения энергоэффективности и экономии энергии. – Центр по эффективному использованию энергии. – www.cenef.ru. Mishura, A.V. (2008) Elasticities of long-run electricity demand for productive sectors of the Russian economy 41 7 Appendix Appendix 1. Informal economy share in Russian regions (combined results of regression model for 2011 and augmented electricity consumption dynamics approach) № Region name 1 Republic of Ingushetia 85% 2 Republic of Dagestan 81% 3 City of Moscow 4 Republic of Kalmykia 5 Altay republic 75% 67% 61% 67% 68% 71% 81% 76% 6 Krasnodar Territory 75% 67% 76% 77% 72% 74% 70% 68% 7 Republic of Kabardino Balkaria 87% 78% 83% 68% 67% 60% 60% 64% 8 Kaliningrad Region 9 Astrakhan Region 10 City of St Petersburg 11 Republic of Adygea 12 Pskov Region 13 Khabarovsk Territory 14 Kaluga Region 15 2004 2005 2006 2007 2008 2009 2010 2011 Results are considered as an outlier, another approach is needed 77% 62% 61% Results are considered as an outlier, another approach is needed 57% 72% 64% 68% 63% 64% 71% 64% 55% 63% 65% 66% 60% 65% 48% 40% 54% 101% 96% 94% 85% 67% 73% 66% 53% Stavropol Territory 21% 46% 66% 66% 55% 54% 50% 53% 16 Primorsky Territory 69% 75% 61% 67% 68% 64% 57% 52% 17 Republic of Northern Osetia Alania 62% 60% 53% 58% 48% 53% 57% 51% 18 Tambov Region 74% 70% 69% 67% 64% 48% 57% 51% 19 Rostov Region 57% 54% 52% 49% 60% 54% 53% 50% 20 Tver Region 21 Ulyanovsk Region 71% 59% 54% 47% 42% 59% 48% 44% 22 Republic of Tatarstan 74% 70% 68% 55% 54% 47% 46% 44% 23 Republic of Mordovia 79% 71% 69% 57% 42% 38% 36% 44% 24 Orel Region 57% 45% 37% 44% 38% 50% 53% 44% 25 Voronezh Region 59% 50% 43% 39% 46% 51% 47% 44% 26 Altay Territory 70% 65% 61% 56% 59% 50% 52% 43% 27 Omsk Region 74% 60% 60% 52% 56% 53% 47% 43% 28 Samara Region 37% 37% 31% 33% 23% 48% 40% 41% 29 Bryansk Region 70% 69% 55% 47% 42% 52% 51% 41% 30 Vladimir Region 56% 51% 49% 39% 32% 56% 47% 40% 31 Moscow Region 71% 68% 77% 69% 58% 68% 59% 40% 32 Belgorod Region 66% 61% 71% 67% 53% 50% 41% 39% 33 Republic of Buryatia 33% 43% 24% 27% 39% 29% 42% 37% 34 Republic of Chuvashia 56% 46% 43% 37% 33% 52% 43% 37% 35 Yaroslavl Region 31% 14% 20% 26% 31% 41% 44% 37% 36 Smolensk Region 47% 52% 52% 43% 48% 46% 41% 36% 37 Murmansk Region 17% 35% 38% 38% 42% 38% 35% 38 Novosibirsk Region 38% 31% 32% 27% 28% 39% 30% 34% 39 Penza Region 82% 80% 69% 59% 53% 45% 39% 34% 40 Republic of Bashkortostan 60% 58% 55% 50% 47% 40% 35% 34% 41 Ivanovo Region 70% 59% 46% 32% 35% 53% 48% 33% 42 Tomsk Region 16% 26% 32% 43% 50% 49% 38% 33% 50% 42 № Region name 2004 2005 2006 2007 2008 2009 2010 2011 43 Tula Region 61% 52% 49% 45% 46% 36% 35% 33% 44 Ryazan Region 47% 48% 50% 39% 38% 39% 38% 32% 45 Kurgan Region 43% 37% 31% 30% 28% 32% 26% 32% 46 Leningrad Region 28% 47% 60% 41% 51% 33% 38% 31% 47 Volgograd Region 30% 30% 32% 32% 38% 36% 35% 31% 48 Kemerovo Region 39% 37% 35% 33% 35% 35% 34% 31% 49 Novgorod Region 28% 27% 31% 19% 19% 16% 24% 30% 50 Kirov Region 43% 42% 42% 41% 41% 38% 34% 30% 51 Saratov Region 46% 44% 40% 46% 36% 27% 26% 28% 52 Kursk Region 13% 16% 36% 29% 28% 31% 29% 28% 53 Republic of Karelia 54 Republic of Udmurtia 18% 20% 22% 22% 23% 28% 28% 26% 55 Tumen Region 19% 18% 22% 20% 24% 28% 26% 25% 56 Nizhny Novgorod Region 22% 19% 20% 20% 18% 21% 19% 25% 57 Kostroma Region 36% 41% 40% 34% 31% 35% 29% 24% 58 Perm Territory 59 Sverdlovsk Region 19% 17% 15% 13% 24% 29% 34% 23% 60 Vologda Region 31% 30% 24% 25% 31% 26% 25% 21% 61 Chelyabinsk Region 16% 13% 11% 8% 12% 18% 17% 18% 62 Orenburg Region 15% 19% 10% 11% 14% 63 Krasnoyarsk Territory 21% 19% 18% 15% 14% 64 Arkhangelsk Region 65 Lipetsk Region 10% 9% 14% 7% 9% 7% 10% 13% 66 Republic of Marii El 11% 16% 16% 21% 20% 3% 12% 11% 67 Republic of Komi 16% 14% 13% 13% 7% 5% 5% 4% NA 28% NA 23% 21% 21% 24% NA 13% Source: Author’s calculations 43 Appendix 2. Regression results with all possible independent variables Regressor Electricity consumption by insignificant industries per GRP Average temperature in heating season Natural gas price Electricity price Share of houses with gas available Metals industry share in GRP Mining industry share in GRP Transport share in GRP Chemical industry share in GRP Trade share in GRP Electricity, gas, water supply share in GRP Non-metal minerals share in GRP Transport machinery share in GRP Paper industry share in GRP Construction share in GRP Constant Coef. Std. error t-statistics P>t 1.283 0.25 5.2 0.000 0.252 0.051 -0.023 -0.052 89.3 27.8 -33.6 21.7 12.2 75.1 112.3 -9.8 212.7 -22.9 7.60 0.14 0.03 0.012 0.024 8.14 5.60 24.35 21.93 10.82 34.78 63.78 21.98 45.79 17.80 4.59 1.85 1.74 -1.95 -2.21 10.96 4.97 -1.38 0.99 1.13 2.16 1.76 -0.45 4.64 -1.29 1.66 0.070 0.087 0.057 0.032 0.000 0.000 0.174 0.327 0.264 0.036 0.084 0.657 0.000 0.204 0.104 Number of obs 67 R-squared 89% Adj R-squared 87% 44

© Copyright 2026