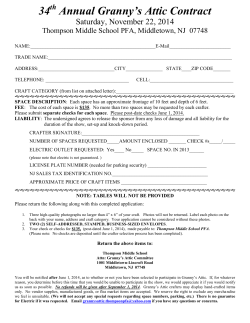

PFA HOLDING ANNUAL REPORT 2014