I. Marketplace Updates: Enrollment Update: 16.4

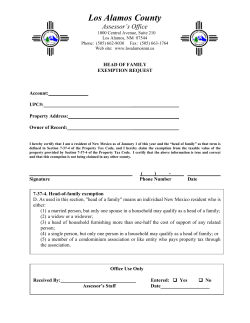

Tuesday, March 17, 2015 Today’s newsletter will cover several new and updated pieces of information. We include CMS’ new “Fast Facts” sheet to help assisters work with consumers to understand their Summaries of Benefits and Coverage (SBC) (see “Guidance” section). We also explain when dependents who lose employer -sponsored coverage may be eligible for a Special Enrollment Period (SEP) to purchase coverage through the Marketplace (see “Grab Bag FAQs” section), provided links to the SEP and Exemptions Screener tools(see “Reminders” section), and included several additional tips for assisters working with consumers who may be eligible for the Tax Penalty SEP (see TIPS on Filing Taxes section). I. Marketplace Updates: Enrollment Update: 16.4 million uninsured people have gained coverage since 2010! / Healthcare.gov Has New Pop-Ups to Help Reduce Data-Matching Issues / System Fix Affecting Immigrants Below 100% FPL II. Guidance: Understanding the Summary of Benefits and Coverage (SBC) Fast Facts for Assisters III. Grab Bag FAQs: Loss of Employer-Sponsored Coverage as a Dependent / Medicaid Breast Cancer Treatment as MEC IV. TIPS on Filing Taxes: Assisting Consumers with the Tax Penalty SEP / Q&A on Why the IRS may ask consumers to submit their Forms 1095-A / NEW Presentation Slides and Q&A from “Commonly Asked Questions about the Form 1095-A and Taxes” V. REMINDERS: SEP and Exemptions Tools / Helping Consumers with Data Matching Issues / 2016 Open Enrollment Period VI. Assister TIPS and Webinar Sneak Peek: Assister Tips on Exemptions Series / How to Appeal a Marketplace Decision VII. Webinar Resources: NEW Summary and Assister Q&A from “Exemptions” Webinar Presentation / NEW Summary and Slides from “Complex Case Scenario - Coverage Options for Young Adults Under Age 26” / NEW Presentation Slides from Webinar on “From Coverage to Care” VIII. Assister Webinar Schedule and Supplemental Webinars IX. Assister Resources and Contact Information for Assisters I. Marketplace Updates: Enrollment Update: 16.4 million uninsured people have gained coverage since 2010! / Healthcare.gov Has New Pop-Ups to Help Reduce Data-Matching Issues / System Fix Affecting Immigrants Below 100% FPL 1. Enrollment Update: 16.4 million uninsured people have gained health coverage since the ACA’s passage KEY MESSAGE: Since 2010, more than 16 million uninsured people have gained coverage from the ACA! Additional details are included in the report described below, which assisters can use to highlight the effectiveness of the healthcare law. Since several of the Affordable Care Act’s coverage provisions took effect, about 16.4 million uninsured people have gained health insurance coverage. This includes 14.1 million adults who gained health insurance coverage since the beginning of the first Marketplace Open Enrollment in October 2013 through March 4, 2015, as well as 2.3 million young adults (aged 19-25) who gained health insurance coverage between 2010 and the start of Open Enrollment in October 2013 due to the ACA provision allowing young adults to remain on a parent’s plan until age 26. From the beginning of the first Marketplace Open Enrollment in October 2013 through March 4, 2015, the uninsured rate dropped from 20.3 percent to 13.2 percent – a 35 percent (or 7.1 percentage point) reduction. Click here to view the full report, click here to view the report’s technical appendix, and visit this page for infographics highlighting the report’s results. Sample Tweets to highlight results from the report: #ACAisWorking -To date, 16.4M uninsured people have gained health care coverage - a historic reduction in the uninsured. The Affordable Care Act at work - To date, 16.4M uninsured people have gained health care coverage - a historic reduction in the uninsured. #ACA addresses disparities in access to quality, affordable health coverage – new #’s show historic reduction in the uninsured. The uninsured rate dropped by 9.2 percentage points among African Americans, with 2.3M adults gaining coverage. #ACAisWorking #AfAmHealth The uninsured rate dropped by 12.3 percentage points among Latinos - with 4.2M adults gaining coverage. #ACAisWorking #ACAisWorking for #AfAmHealth – since 2014, 2.3M African American adults have gained coverage. #ACAisWorking for the Latino community – since 2014, with 4.2M Latino adults have gained coverage. #ACA addresses disparities in access to health care. New numbers show uninsured rate dropped 9.2 percentage points for African Americans. #ACA addresses disparities in access to health coverage - the uninsured rate dropped 12.3 percentage points among Latinos. 2. Healthcare.gov Has New Pop-Ups to Help Reduce Data-Matching Issues KEY MESSAGE: Assisters should encourage applicants to fill out as many of the fields in the application as possible, such as their Social Security number or immigration documentation if they have it, to expedite the application process. New pop-ups on the application are aimed at reinforcing this message. The Healthcare.gov application now features two new pop-ups to encourage applicants to input a social security number (SSN), if available, and all immigration documentation, if needed. Although the SSN field and many of the fields in the immigration section of the application are labeled as optional, we highly recommend that applicants input all the information they have and fill out as many of the fields as possible. This increases the likelihood of a smooth and swift verification of information, and reduces the likelihood that consumers will have to provide documentation later. To encourage applicants to input an SSN, a pop-up on the Healthcare.gov application will alert applicants who do not initially provide an SSN that providing an SSN “makes the application process go smoother and faster.” The Healthcare.gov application has another pop-up to encourage applicants to provide full immigration documentation, if available, so they won’t have to provide the information later. As a reminder, non-applicants are not required to provide their SSNs, but are strongly encouraged to provide them if they have them. 3. System Fix Affecting Immigrants Below 100% FPL KEY MESSAGE: We have resolved a system issue in which not all applicants who were eligible based on an income under 100% of the Federal Poverty Level and ineligibility for Medicaid due to immigration status received APTC. Consumers affected by this issue can now change their applications to receive an updated APTC determination. The Marketplace includes a question to help consumers who have been denied Medicaid and the Children’s Health Insurance Program (CHIP) by the state because of their immigration status. Answering this question will help HealthCare.gov properly evaluate eligibility for individuals with income under 100% of the Federal Poverty Level (FPL) who are ineligible for Medicaid or CHIP based on immigration status, but who may be eligible for an advance payment of the premium tax credit (APTC) and cost-sharing reductions (CSRs). This question allows these consumers to be evaluated for APTC and CSRs and enroll in a plan, if they are otherwise eligible. The question will appear when: 1. an applicant attests to being denied eligibility for Medicaid or CHIP; and 2. the applicant also attests (earlier in the same application) to having eligible immigration status. We have resolved a system issue that was affecting this question. Because of the system issue, when a household applied for Marketplace coverage and more than one applicant selected “yes” to the question described above, only the first person on the list of applicants received APTC. This issue has been resolved so that all applicants who select “yes” to the question can receive APTC, if otherwise eligible. We will have guidance available soon for consumers affected by the issue. II. Guidance: Understanding the Summary of Benefits and Coverage (SBC) Fast Facts for Assisters A “summary of benefits and coverage” (SBC) includes a snapshot of a health plan’s costs, benefits, covered health care services, and other features that are important to consumers. SBCs are valuable tools to help consumers compare the different features of the plans that are available to them. This fact sheet explains how assisters can help consumers to locate SBCs and to understand the information they provide. Helping consumers to better understand their coverage options can be a great way to start a discussion about how plan features such as deductible amounts, copay requirements, and provider networks can affect the services they have access to, which can help them better determine what kind of plan might be best for them based on their health care needs and financial situations. Click here (or use the link above) to view this “Fast Facts” sheet, or click here to view the sheet along with additional guidance and regulation on assister programs. Click here to view an explanation of the SBC requirement on the CCIIO website, and click here to view a consumer-facing explanation of the SBC on HealthCare.gov. III. Grab Bag FAQs: Loss of Employer-Sponsored Coverage as a Dependent / Medicaid Breast Cancer Treatment as MEC 1. Loss of Employer-Sponsored Coverage as a Dependent Q: If an employee removes a spouse or dependent from his or her employer-sponsored coverage (ESC), would this trigger a special enrollment period (SEP) for the spouse or dependent? For example, if a parent drops his child from his ESC or if a husband terminates his own ESC making his spouse ineligible, would the child and/or spouse in these situations qualify for a SEP to apply for coverage through the Marketplace? A: Under Marketplace rules, an individual is not eligible for a SEP based on loss of minimum essential coverage (MEC) if the individual voluntarily terminated his or her coverage. When an employee terminates ESC (that meets the MEC standard) on behalf of a spouse or dependent, it is considered an involuntary termination of coverage by the spouse or dependent. This means that the spouse or dependent may be eligible for a SEP based on loss of MEC. In contrast, the employee would only be eligible for a SEP based on loss of MEC if he or she was terminated from ESC involuntarily through, for example: Lost job-based coverage involuntarily for any reason, including resigning, getting laid off, or getting fired; Lost coverage through a divorce; or COBRA coverage ended (because it expired or the employee did not cancel it him or herself before it expired) Consumers who are eligible for a SEP due to loss of MEC will have 60 days to enroll in coverage, which will be prospective based on the date that the consumer completes enrollment into a QHP. Note: Losing coverage that does not qualify as MEC does not qualify consumers for a SEP. An applicant can be assessed for a SEP based on loss of ESC by answering the following questions on the online application, or through the Marketplace Call Center: Did any of these people recently lose health coverage? Are any of these people losing health coverage in the next 60 days? 2. Medicaid Breast Cancer Treatment as MEC Q: Does Medicaid coverage for women who need treatment for breast and cervical cancer through the CDC’s National Breast and Cervical Cancer Early Detection Program count as minimum essential coverage (MEC)? If not, can a consumer enrolled in this coverage keep it and also enroll in a QHP with subsidies? A: Consumers who qualify for treatment for breast and cervical cancer through the CDC’s National Breast and Cervical Early Detection Program are eligible for full Medicaid benefits, which count as minimum essential coverage (MEC). Eligibility for Medicaid benefits through this program is not state-specific, and it continues as long as there is a need for breast cancer services. Therefore, women who gain coverage through this program are not eligible for financial assistance (tax credits and cost-sharing reductions) to purchase a QHP. Click here to learn more about the National Breast and Cervical Cancer Early Detection Program (NBCCEDP), and here to search for local screening providers. IV. TIPS on Filing Taxes: Assisting Consumers with the Tax Penalty SEP / Q&A on Why the IRS may ask consumers to submit their Forms 1095-A / NEW Presentation Slides and Q&A from “Commonly Asked Questions about the Form 1095-A and Taxes” 1. Reminder: Assisting Consumers with the Tax Penalty SEP HHS understands that the requirements to have health insurance and to include information about health insurance on tax forms are new, and because of this, a decision was made to provide individuals who are subject to the shared responsibility payment with one last chance to get covered for the remainder of 2015. As we have described in previous newsletters, CMS has announced that individuals and families without insurance who are subject to the shared responsibility payment when they file their 2014 taxes in states which use the Federally-facilitated Marketplaces will be eligible for a Special Enrollment Period (SEP) if they meet all of the following requirements: 1. They must owe the fee for not having health insurance in 2014. 2. They did not know until after February 15, 2015 (which was the end of Open Enrollment) that the health care law required them and their household to have health insurance, or they didn’t understand how that requirement would affect them or their household. 3. They are not already enrolled in minimum essential coverage in 2015 (either through the Health Insurance Marketplace or outside the Marketplace). Remember, along with the other criteria mentioned above, consumers eligible for the Tax Penalty SEP had to have owed the fee for one or more months in 2014. While consumers do not need to have filed their taxes and paid the fee yet to qualify for the SEP, these consumers will need to owe the fee when they file their 2014 taxes. As of Sunday, March 15 a new two-part question on the HealthCare.gov application allows consumers to take advantage of the Tax Penalty SEP by asking them to attest that they first became aware of (or understood the meaning of) the requirement to have health care coverage until after the end of Open Enrollment. The SEP screener tool will also include questions about this SEP. The Tax Penalty SEP application questions are shown in the screen shot below: If a consumer selects “Yes” to both of these questions on the application, and is not currently enrolled in coverage, he or she will be able to qualify for a SEP, and then be able to select a plan. To summarize, we wanted to mention some important points you can share with consumers who may be eligible for the Tax Penalty SEP: Assisters should help educate consumers about the eligibility requirements for the Tax Penalty SEP, and help eligible consumers enroll in coverage. Consumers can apply online or via the Marketplace Call Center. The SEP is only open from March 15 – April 30, and consumers must complete enrollment and select a plan prior to 11:59pm E.T. on April 30, 2015. Under this SEP, consumers will receive regular prospective coverage effective dates. For example, if a consumer wants April 1, 2015 coverage, he or she must have applied and selected a plan by 11:59 pm EDT on March 15, 2015, the day that the SEP began. If a consumer enrolls between March 16 and April 30, his or her coverage will not begin until May 1, 2015. Consumers who select and confirm a plan through the tax SEP between March 15 and April 30 can change plans until 11:59 pm EDT on April 30, 2015. In order to be eligible for this SEP, consumers have to owe the fee for one or more months in 2014. Consumers are not required to have actually filed their taxes and made the payment yet. If eligible consumers do not enroll in coverage for 2015 during this SEP, and do not have other minimum essential coverage, they may be subject to the shared responsibility payment for 2015 when they file their 2015 income taxes. Additionally, consumers who do take advantage of this SEP, will be responsible for the shared responsibility payment for the months in 2015 when they were without minimum essential coverage or an exemption on their 2015 income taxes. Resources: Information on the Tax Penalty SEP is included on healthcare.gov, and a new blog post.Additional information on the Tax Penalty SEP is also included in the March 10, 2015 assister newsletter. Below are some frequently asked questions on the Tax Penalty SEP: Q. Would a consumer who received an exemption from the fee for 2014 be able to enroll in 2015 coverage through the Tax Penalty SEP? A: No. If a consumer received an exemption from the shared responsibility payment for 2014 coverage, the consumer would not be eligible for the Tax Penalty SEP. To eligible for this SEP the consumer must be able to attest that they first became aware or didn’t understand the requirement to maintain minimum essential coverage until after the end of Open Enrollment in connection with preparing their 2014 taxes. Q: If a consumer had an exemption in 2014 can they now choose to pay the fee could they now qualify for the Tax Penalty SEP. Can the exemption granted from the Marketplace or IRS be undone? A: No. Consumer who received an exemption cannot undo their exemption. In addition the requirements for the Tax Penalty SEP include that a consumer must be able to attest that they first became aware or didn’t understand the ACA requirement to maintain minimum essential coverage until after the end of open enrollment in connection with preparing their 2014 taxes. Consumers who received an exemption were aware that they were exempt from the fee. Q: Is the Tax Penalty SEP available outside of the Marketplace? A: No, the Tax Penalty SEP is only available inside the Marketplace. Consumers can always search for plans outside of the Marketplace if they choose to do so. Q: If one member of the household on the application owes the fee and meets the criteria for the Tax Penalty SEP, but not all people in the household owe penalty, does the entire tax household qualify for an SEP? A: Yes, all of the applicants in the household would qualify for the Tax Penalty SEP if one consumer within the household is eligible. 2. IRS Q&A: Why the IRS may ask consumers to submit their Forms 1095-A Q. I filed my return claiming the premium tax credit. Why did I get a letter from the IRS asking for more information and a copy of my 1095-A? A. You do not have to send your Form 1095-A to the IRS with your tax return when you file and claim the premium tax credit. However, using the information on your Form 1095-A you must complete and file Form 8962, Premium Tax Credit. The IRS verifies the information on your Form 8962 by comparing it to information received from the Marketplace and to other information you entered on your tax return. In some situations, before we can send your refund, the IRS may send you a letter asking you to clarify or verify information that you entered on your income tax return. The letter may ask for a copy of your Form 1095-A. Some common examples of issues or questions that may arise are: It appears that you are required to reconcile but did not include Form 8962. You submitted Form 8962 but it is incomplete. Based on the income that you reported, it appears that you are not eligible for the credit. The income or other entries on your Form 8962 are inconsistent with information on your tax return. The premium that you entered on your Form 8962 appears to be an annual amount, rather than monthly. There are questions about entries on your Form 8962 that may be clarified by a review of your 1095-A. We need to review your Form 1095-A to verify your Marketplace coverage. You should follow the instructions on the correspondence that you receive in order to help the IRS verify information that has been entered on the tax return and issue the appropriate refund. Click here to view this Q&A on the IRS website along with other commonly asked questions and resources. 3. NEW Presentation Slides and Q&A from “Commonly Asked Questions about the Form 1095-A and Taxes” The Friday, February 27, 2015 assister webinar included a presentation on commonly asked questions about the Form 1095-A, taxes, and exemptions. Last week, the March 10, 2015 assister newsletter featured answers to four questions asked during this presentation, along with a link to additional CMS resources related to taxes and assisting consumers, which you can view here. Below are two new resources: slides from this presentation, and additional responses to assister questions. Presentation slides from the February 27 webinar can be accessed here; you can also view them along with other resources on ACA –related tax information for assisters here. Webinar Q&A “Commonly Asked Questions about the Form 1095-A and Taxes” | Assister Webinar February 27, 2015 Note: This section includes responses to questions that assisters asked during this presentation. Additional responses to questions from this presentation were included in the assister newsletter last week, Tuesday, March 10, 2015. Q1: Will consumers be prompted to fill out Form 8962? If not, how will they know to seek that information out? A1: The results page of the tax tool resource will direct consumers to the appropriate next steps including the related tax forms that they will need to complete. Q2: Does automated tax software, such as TurboTax, pull the info automatically for the Second Lowest Cost Silver Plan (SLCSP) and lowest cost Bronze Plan? A2: For the 2014 tax filing season the Second Lowest Cost Silver Plan and lowest cost Bronze Plan tools do not have an interface with automated tax software. Q3: What zip code should a consumer who is homeless enter when using the tax tools? A3: An address is needed in order to complete an application through the Marketplace. If a consumer is homeless he or she can provide the address of a shelter, friend or relative. Also, the address needs to be in the state in which the application is being filed. To use the tax tool, the consumer should use the zip code they provided during the application period. Q4: If a consumer moved multiple times during a month, what zip code should they enter for that month when using the tax tools? A4: The consumer should use the zip code for the address where they lived on the first of the month. V. REMINDERS: SEP and Exemptions Tools / Helping Consumers with Data Matching Issues / 2016 Open Enrollment Period 1. Reminder to use SEP and Exemptions Tools CMS recently released two new tools to help consumers better understand special enrollment periods (SEPs) and exemptions. We encourage assisters to use these tools to help educate consumers and determine what they may be eligible for. SEP Screener Tool: Assisters can use this tool to help consumers determine whether they may be eligible for a SEP to enroll in 2015 health insurance coverage through the Marketplace or to enroll in Medicaid or the Children’s Health Insurance Program. Consumers will be able to use the SEP screener tool to determine if they qualify for the tax penalty special enrollment period, which provides a limited period to enroll from March 15 to April 30, 2015. Remember, this tool is not an application for an SEP; it is just a tool to help consumers understand what they may be eligible for. Click here (or use the link above) to view the tool. For additional information about SEPs, see the HealthCare.gov page, “Getting 2015 Coverage with a Special Enrollment Period.” To view slides from the March 6, 2015 webinar presentation on this topic, click here. A summary of this presentation was included in the Tuesday, March 10 assister newsletter. Exemptions Screener Tool: While a variety of exemptions from the requirement to have health insurance are available, many consumers still do not know which exemptions they may qualify for, or they may not understand that there is a fee for those who can afford health insurance but choose not to buy it. In fact, one recent study found that of people who are still uninsured, 41 percent report not knowing about the fee (see page 4 after clicking on the link). Assisters can use the Exemptions Screener Tool to help consumers figure out which exemptions from the shared responsibility payment may apply to them, if any, as well as step-by-step instructions on how to apply for each exemption through the Marketplace or on their tax return.Remember, this tool is not an application for an exemption; it is a tool to help consumers understand what they may be eligible for. Click here (or use the link above) to view the tool. For additional information about exemptions, see the HealthCare.gov page, “Exemptions from the fee for not having health coverage.” To view slides from the March 6, 2015 webinar presentation on this topic, click here. A summary of this presentation was included in the Tuesday, March 10 assister newsletter. 2. Helping Consumers with Data Matching Issues Data matching issues occur when information that consumers provide in their Marketplace applications to help determine eligibility for coverage and financial assistance does not match information from data sources the Marketplace uses to verify this information. In these cases, the Marketplace must confirm the information that a consumer submitted, or requires the consumer to submit more information. As you all know, it is critical that consumers submit this information as soon as possible. If they do not, consumers with immigration or citizenship data matching issues may lose eligibility for coverage through the Marketplace, and consumers with income data matching issues may experience a modification of their premium tax credits and cost-sharing reductions. We encourage assisters to keep helping consumers review their notices from the Marketplace to identify what documents the Marketplace needs, and help determine whether or not they have submitted the required information. Remember, consumers with citizenship/immigration data matching issues who are terminated from coverage can submit documentation to the Marketplace to resolve their data matching issues and regain coverage through a Special Enrollment Period. You can find more information on data matching in the January 27, 2015 assister newsletter and here on HealthCare.gov, and we will continue to share more updates and resources in the coming weeks. 3. 2016 Open Enrollment Period The 2016 Open Enrollment Period for the Marketplace will start on November 1, 2015 and run through January 31, 2016. As you prepare for the next Open Enrollment Period, and work with consumers we wanted you to have those dates in mind. These dates are listed in the Payment Notice fact sheet, and the press release announcing the Payment Notice, both of which were also featured in the Tuesday, February 24 newsletter. VI. Assister TIPS and Webinar Sneak Peek: Assister Tips on Exemptions Series / How to Appeal a Marketplace Decision 1. Webinar Sneak Peek: Assister Tips on Exemptions Series In the coming weeks, we will be highlighting a few specific exemptions to help assisters become more familiar with them. To learn more about these exemptions in the meantime, please visit the links below: Short coverage gap: You were uninsured for no more than 2 consecutive months of the year Gap in coverage at the beginning of 2014: You were uninsured any number of months before May 2014, but enrolled in a plan starting no later than May 1, 2014 Resident of a state that did not expand Medicaid: You lived in a state that didn’t expand its Medicaid program but you would have qualified if it had Members of Indian tribes: You’re a member of a federally recognized Indian tribe or eligible for services through an Indian Health Services provider For more information about exemptions, please check out the exemptions screener tool and this page on HealthCare.gov. 2. Assister TIP: How to Appeal a Marketplace Decision Once consumers apply for coverage in the Marketplace, they will get an eligibility notice that explains what they qualify for. If consumers do not agree with a decision made by the Health Insurance Marketplace, they may be eligible to file an appeal. Given that consumers have 90 days from the date they receive their eligibility notice to start an appeal, we wanted to remind assisters about the process for consumers to appeal a Marketplace decision. When can a consumer file a Marketplace appeal? Consumers have 90 days from the date they receive their eligibility notice to start an appeal. What kinds of Marketplace decisions can consumers appeal? Whether they’re eligible to buy a Marketplace plan Whether they can enroll in a Marketplace plan outside the regular Open Enrollment Period Whether they’re eligible for lower costs based on their income The amount of savings they’re eligible for Whether they’re eligible for Medicaid or the Children’s Health Insurance Program (CHIP) Whether they are eligible for an exemption from the individual responsibility requirement How can consumers file a Marketplace eligibility appeal? Consumers have two ways to file a Marketplace* eligibility appeal: Write a letter explaining the reason for your appeal. Include your name, address, and the application ID number from your eligibility determination notice. Send the letter to: Health Insurance Marketplace 465 Industrial Blvd. London, KY 40750-0061 Mail in an appeal request form, using the proper form for your state. Consumers are encouraged to include a copy of their eligibility determination notices with their Marketplace appeal forms. *Note: Depending on your state and your eligibility results, you may be able to appeal through the Marketplace. Or you may have to file an appeal with your state Medicaid or CHIP agency. Your letter will explain options and next steps. Then what happens? Once you submit your eligibility appeal, the Marketplace Appeals Center will review your request. You’ll get a letter in the mail letting you know that they received your appeal. The Marketplace Appeals Center will contact you to discuss your appeal and will work with you to resolve your appeal informally. If you have questions about your eligibility appeal, call the Marketplace Appeals Center at 1-855-231-1751. TTY users should call 1-855-739-2231. If you’re not satisfied with the outcome of the informal resolution of your eligibility appeal, you have the right to a hearing. A hearing is a more formal way for you to present your case and get a decision on your appeal. If you want a hearing, a federal hearing officer will conduct it, usually by phone. You’ll get a letter in the mail 15 days before your hearing with the date, time, and instructions on how to call into the hearing. If you don’t show up for your hearing, your appeal could be dismissed. If your appeal is dismissed, it’s the same as if you had never filed an appeal, and your last Marketplace eligibility determination will remain in effect. After your eligibility appeal is determined, you’ll get a letter in the mail explaining the decision. If an appeal is urgent, consumers can request an expedited appeal. Consumers can file a request for an expedited (faster) appeal if the time needed for the standard appeal process would jeopardize the consumer’s life or ability to attain, maintain, or regain maximum function. A consumer’s request to expedite your appeal should specifically explain how a standard appeal would jeopardize the consumer’s life or your ability to attain, maintain, or regain maximum function. Consumers’ requests to expedite their appeals will be processed as quickly as possible. A final decision must be made as quickly as the situation requires. The Marketplace can help. Consumers can visit Healthcare.gov here to get more information on how to get help filing an appeal. If consumers want to get help in a language other than English, they have the right to get help and information about appeals and other Marketplace issues in their language at no cost. To talk to an interpreter, consumers can call 1-800-318-2596. SHOP Marketplace decisions can also be appealed. Consumers can visit Healthcare.gov here to get more information on how to appeal a SHOP Marketplace decision. Additional Resources: HealthCare.gov – “How to appeal a Marketplace decision” Fact sheet and instructions - Appeals: Eligibility & Health PlanDecisions in the Health Insurance Marketplace Infographic – “Steps for a Marketplace Appeal” VII. Webinar Resources: NEW Summary and Assister Q&A from “Exemptions” Webinar Presentation / NEW Summary and Slides from “Complex Case Scenario - Coverage Options for Young Adults Under Age 26” / NEW Presentation Slides from Webinar on “From Coverage to Care” 1. NEW Summary and Assister Q&A from “Exemptions” Webinar Presentation The March 13, 2015 assister webinar featured an updated presentation on exemptions from the individual shared responsibility payment, as well tips for assisters to help consumers apply for exemptions. We are including responses to several frequently asked questions on this topic in the “Webinar Resources” section of this newsletter, and will share additional answers to questions that assisters asked during the webinar in a future newsletter. We will also post the presentation slides in a future assister newsletter. In addition, we want to remind assisters that they can play a critical role to help consumers understand the exemptions for which they may qualify, where to apply for the exemption (either through the Marketplace or through their tax return), and which forms they may need to submit. An assister should not recommend that a consumer apply for a particular exemption or persuade a consumer to do so. An assister can help a consumer populate information into an exemption application, but an assister cannot apply for an exemption on behalf of a consumer. Unless they are a licensed tax preparer, assisters should NOT help consumers file for IRS exemptions through their taxes, or complete tax forms. More information on exemptions can be found here. For more information about exemptions, please check out the assister resources we have posted on the technical assistance resources page related to exemptions here. We also recommend that you explore theexemptions screener tool on HealthCare.gov. NEW Webinar Q&A from “Exemptions” Webinar Presentation Note: This section includes responses to questions that assisters asked during this presentation as well as responses to questions from the January 16, 2015 assister webinar presentation on exemptions that came up again during this presentation. Q1: Suppose a consumer files a tax return and realizes that she is going to have to pay a penalty; can she still apply for a hardship exemption before April 15? A1: Consumers can apply for hardship exemptions either on their taxes or through the Marketplace. If a consumer is filling out her tax return and realizes that she needs to apply for a hardship exemption, she can either claim it on her tax return (if applicable), or apply for the exemption through the Marketplace. (For information about where to apply for each exemption, see this page on IRS.gov.) If the Marketplace has not processed her exemption application before she files her tax return, she should complete Part I of Form 8965 and enter “pending” in Column C for each person listed. Q2: I understand that the short coverage gap exemption applies for consumers who went without coverage for less than 3 consecutive months. Does that mean 2 months? Or can it be 2 and a half months? A2: Anyone with a gap in health coverage of no more than 2 months in 2014 can claim this exemption. Consumers are considered covered any month they had minimum essential coverage for even 1 day. For example, if a consumer didn’t have coverage from March 2 to June 15, her coverage gap was 2 months: April and May. She qualifies for the exemption. Q3: How does the exemption work for consumers who had two or more gaps in coverage during the year? A3: If a consumer had 2 or more gaps in coverage during the year, the consumer can claim this exemption only for the months of the first coverage gap. This is true even if both gaps are less than 3 months. For example, if a consumer didn’t have coverage for any day in May or any day in November or December, she can claim this exemption only for May. Q4: Can a consumer apply for an exemption retroactively? A4: Consumers can still apply for exemptions for the 2014 coverage year. However, only certain exemptions are still available through the Marketplace. Consumers who did not already receive an Exemption Certificate Number, or ECN, from the Marketplace must claim an exemption on their tax return for 2014 exemptions for lack of affordable coverage, membership in a Health Care Sharing Ministry, or Incarceration. Exemptions for Indian status may be claimed on a tax return or obtained through the Marketplace year round. Hardship exemptions and exemptions for members of recognized religious sects may only be obtained through the Marketplace. Q5: What exemption would a consumer file if they live in a state that expanded Medicaid, but the consumer did not receive Medicaid until months after they applied? For example, a consumer applied in March but did not receive Medicaid until July of 2014 for the 2014 tax year. What exemption is applicable, if any? A5: Medicaid coverage may start retroactively for up to 3 months prior to the month of application, if the individual would have been eligible during the retroactive period had he or she applied then. This means that a consumer who applied for Medicaid coverage in March but did not receive her eligibility determination until July may still have been retroactively covered beginning in March or up to three months earlier. If coverage was not retroactive, but the consumer applied during Open Enrollment in 2014, he or she may claim the coverage gap at the beginning of 2014 exemption on their tax return (using code “G”). A consumer may claim this exemption type as long as he or she applied for coverage during the initial open enrollment period, even if the consumer’s coverage started after May 1, 2014 because of technical delays which affected the timing of their enrollment. Q6: If a consumer lives in a state that expanded Medicaid mid-year such as Michigan and New Hampshire, can consumers in these states still file for an exemption based on ineligibility for Medicaid in a nonexpansion state? Would the exemption apply for the full year, or only for the months prior to when the state expanded Medicaid? A6: Consumers who live in a state that expanded Medicaid mid-year in 2014 can still receive an exemption for the full year. Consumers in these states may claim the exemption for the full year on their tax return if their household income was below 138% of the Federal Poverty Level (FPL). Note that this exemption through the IRS does not require proof of Medicaid denial. The guidance can be found here. Q7: If a consumer’s gap in coverage was 3 months or more, can the consumer claim the exemption for two of those months? A7: No, if a consumer’s gap in coverage was 3 months or more, the consumer can’t claim this exemption for any of those months. For example, if a consumer did not have coverage for any day in April, May, or June, she cannot claim this exemption for any of those months. Q8: Does everyone in the household have to fill out every field on the exemption applications? For example, there may be times that undocumented parents are applying for exemptions on behalf of their citizen children. Would the undocumented parents be required to disclose their immigration status in order to apply for an exemption for their child? (Note: This question was also featured in the February 27, 2015 assister newsletter.) A8: When applying for an exemption, a consumer should list each person who will be on the same tax return on the application, even if not every person needs an exemption. Consumers must complete all questions on the application, but only some of the questions will apply to a consumer who is not seeking an exemption for herself, and the other questions will apply to the person seeking the exemption. For example, a parent who does not want an exemption but is applying on behalf of her child should complete Step 1 and the applicable questions in Step 2:1 of the application for herself. She should then complete the second part of Step 2 for her child. A consumer should complete one application per tax household for each exemption type. If multiple tax households live together, the consumer still needs to submit one application per tax filer/household. Please note that applicants will not be required to disclose their immigration status on the application for an exemption. Q9: If someone falls into the Medicaid coverage gap in a non-expansion state, does he or she need to apply to the Marketplace first and then apply for an exemption? (Note: This question was also featured in the February 10, 2015 assister newsletter.) A9: Consumers who applied during the 2014 Open Enrollment through the Marketplace, have incomes below 100% of the FPL, and live in a state that did not expand Medicaid do not need to send in a separate exemption application. To claim the exemption, they should have received a letter from the Marketplace with their Exemption Certificate Number (ECN) to list on the IRS Form 8965 as part of their tax return. Otherwise, consumers who meet the criteria for this exemption can list code “G” on their Form 8965. Consumers only need to apply to the Marketplace if they experienced an increase in income after they were previously denied coverage for Medicaid, and therefore are unable to claim this exemption on their tax return because their household income is higher than 138% of the Federal Poverty Level. Q10: For consumers who are applying for an affordability exemption, how does a consumer calculate or find out what the lowest cost bronze plan is in order to claim the exemption? (Note: This question was also featured in the January 27, 2015 assister newsletter.) A10: Consumers can access the lowest cost bronze plan finder tool on the taxes section of HealthCare.gov.Consumers may need the premium for the lowest cost Bronze plan that was available to them for 2014 when they fill out Form 8965 to claim the exemption for coverage being unaffordable. Remember consumers won’t need to use this tool if they already have an Exemption Certificate Number (ECN) for this exemption. Consumers will just enter their ECN on Part 1 of Form 8965. To claim the affordability exemption, consumers will also need to know how much financial assistance they were eligible for by looking up the premium for the second lowest cost Silver plan (SLCSP) available to them for 2014. This information is also available here on the taxes section of HealthCare.gov. Q11: What if a consumer could afford a bronze plan, but the silver plans were above 8% of their income; do they qualify for an affordability exemption? (Note: This question was also featured in the January 27, 2015 assister newsletter.) A11: No, the affordability exemption is based on a consumer’s ability to pay for the lowest cost bronze plan (or employer sponsored coverage, if offered). To qualify for an affordability exemption, the lowest cost bronze plan available to the consumer (or employer sponsored coverage, if offered) in 2014 would have to cost more than 8% of their household income. Q12: The webinar presentation on exemptions mentions Appendix A, “Health Coverage from Jobs,” which asks for the premium amount the employee would pay for the coverage for themselves (“self-only”) as well as for the premium the employee would pay for family coverage (if available)? Where is Appendix A found? A12: Appendix A is an appendix to the affordability exemption application. For consumers who live in states with Federally-facilitated Marketplaces, the application, including appendices, is available here. 2. NEW Summary of “Complex Case Scenario: Coverage Options for Young Adults Under Age 26” The Friday, March 13 webinar included a presentation on some common complex scenarios for families that include young adults who are under 26 years old. Young adults under age 26 may have multiple options for coverage available to them including coverage through their employer, coverage as a dependent through a parent’s employersponsored coverage, or coverage through the Marketplace. Young adults may join or remain on a parent’s employer-sponsored coverage until they turn 26 if the plan offers dependent coverage. This is true even if the young adult is married, a student, not living with his or her parents, not financially dependent on his or her parents or claimed as a dependent (for tax purposes), or eligible to enroll in his or her own employer’s plan. Please note that the Federally-facilitated Marketplace (FFM), however, cannot support individuals from different tax households enrolling in a plan together, so young adults who file their own tax returns and are not claimed as tax dependents by their parents currently must submit separate applications in the Marketplace; in other words, they cannot be in an enrollment group together. Unless they qualify for an exemption, young adults are responsible for enrolling in minimum essential coverage. Young adults who are not enrolled in minimum essential coverage (or the family members who claim them as tax dependents) may have to pay a fee for remaining uninsured. Presentation slides from the March 13 webinar can be accessed here; you can also view them along with other resources on assisting consumers after enrollment here. 3. NEW Presentation Slides from Webinar on “From Coverage to Care” The Friday, February 27, 2015 assister webinar included a presentation by Dr. Cara James, Director of the CMS Office of Minority Health, on the initiative From Coverage to Care. From Coverage to Care is an effort to help educate consumers about their new coverage and to connect them with primary care and preventive services that are right for them so they can live long, healthy lives. The presentation outlined resources available through the initiative, including the Roadmap to Better Care and a Healthier You. Resources are available in multiple languages; please click here to view and order materials online. Presentation slides from the February 27 webinar can be accessed here; you can also view them along with other resources on assisting consumers after enrollment here. VIII. Assister Webinar Schedule and Supplemental Webinars 1. Assister Spring Webinar Schedule Friday, March 20 at 2:00 pm EST Friday, March 27 at 2:00 pm EST THURSDAY, April 2, 2015 at 2:00 pm EST* Friday, April 10, 2015 at 2:00 pm EST Friday, April 24, 2015 at 2:00 pm EST* *Please note that there will NOT be an assister webinar on Friday, April 3 or on Friday, April 17, 2015. 2. Supplemental Webinars A. Affordable Care Act 101 Webinars for Small Employers, Including Nonprofit Organizations – Small Business Administration and Small Business Majority Thursday, March 19, 2015 | 2:00 PM EST: Click to Register Thursday, March 26, 2015 | 2:00 PM EST: Click to Register In Spanish: Tuesday, March 24, 2015 | 4:00 PM EST: Click to Register B. Questions and Answers on Federal Taxes and Health Coverage Wednesday, March 25, 2015 | 2:00 PM EST: Click to Register C. RECORDING AVAILABLE: Webinar on Using Dental Services and Benefits to Motivate Families to Enroll in Medicaid and CHIP If you missed the February 27, 2015 webinar “Using Dental Services and Benefits to Motivate Families to Enroll in Medicaid and CHIP,” you can view it here. This 90-minute webinar focused on the instrumental role Medicaid and CHIP play in providing access to oral health benefits for enrolled children. Participants shared outreach tips and experiences enrolling families in Medicaid and CHIP at dental service events. All past National Campaign webinars can be viewed here. Ways to Stay Connected With the National Campaign: Share our materials; Contact us to get more involved with the National Campaign [email protected] or 1-855-313-KIDS (5437); Follow the Campaign on Twitter; Sign up here to receive the Connecting Kids to Coverage National Campaign Notes eNewsletter. IX. Assister Resources and Contact Information for Assisters 1. Standing Assister Resources Below are some resources that assisters use on a regular basis. Technical Assistance Resources CMS Marketplace Applications & Forms CMS Outreach and Education Resources Marketplace.CMS.gov Page CMSzONE Community Online Resource Library Pilot for Marketplace Assisters https://zone.cms.gov/ HHS.gov Healthcare Web Page Center for Consumer Information & Insurance Oversight Page Find Local Help CAC Email Inbox Address ([email protected]) HealthCare.gov Website Medicaid.gov Website Department of Labor Affordable Care Act Page IRS Affordable Care Act Tax Provisions Page Department of Veterans Affairs Affordable Care Act Page OPM's Multi-State Plan Program and the Marketplace Page 2. Marketplace Call Center and SHOP Call Center Hours Health Insurance Marketplace Call Center: For customer service support, to start or finish an application, compare plans, enroll or ask a question. 1-800-318-2596 (TTY: 1-855-889-4325). Available 24/7. Closed Memorial Day, July 4th, Labor Day, Thanksgiving, and Christmas. SHOP Call Center: For customer service support, including assisting employers and employees apply for and enroll in SHOP. 1-800-706-7893 (TTY: 711). Available M-F 9:00 am-7:00 pm EST. 3. Stay in Touch To sign up for the CMS Weekly Assister Newsletter, please send a request to the Assister Listserv inbox ([email protected]) and write “Add to listserv” in the subject line. For requests to be removed from the listserv, please write "Remove” in the subject line. If you are a Navigator grantee and have specific questions or issues you’d like to see us highlight in our weekly webinar or here in this newsletter, please get in touch with your Navigator Project Officer or send a request to [email protected]. If you are a CAC designated organization, please send an email [email protected]. We welcome suggestions and comments, so please feel free to contact us.

© Copyright 2026