Ashman, S., Mohamed, S. and Newman, S. (2013) Financialisation

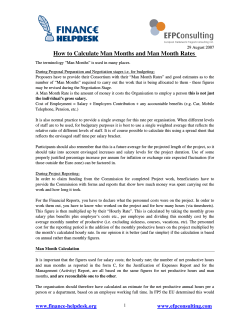

Ashman, S., Mohamed, S. and Newman, S. (2013) Financialisation of the South African economy: Impact on the economic growth path and employment. Discussion Paper. United Nations Department of Economic and Social Affairs. We recommend you cite the published version. The publisher’s URL is: http://eprints.uwe.ac.uk/25392/ Refereed: No ?From United Nations Department of Economic and Social Affairs, by Ashc man, S., Mohamed, S. and Newman, S., 2013 United Nations. Reprinted with the permission of the United Nations.? Disclaimer UWE has obtained warranties from all depositors as to their title in the material deposited and as to their right to deposit such material. UWE makes no representation or warranties of commercial utility, title, or fitness for a particular purpose or any other warranty, express or implied in respect of any material deposited. UWE makes no representation that the use of the materials will not infringe any patent, copyright, trademark or other property or proprietary rights. UWE accepts no liability for any infringement of intellectual property rights in any material deposited but will remove such material from public view pending investigation in the event of an allegation of any such infringement. PLEASE SCROLL DOWN FOR TEXT. Financialisation and (un)employment in South Africa Financialised corporate strategies and restructuring (unbundling & internationalisation) of former conglomerates Firm performance directly related to share prices linked to profitability and delinked from productive expansion, innovation and productivity Neoliberal Macroeconomic Framework Trade liberalisation Liberalised international capital flows Long-term capital outflows Unbundling, downsizing and focus on ‘core competence’ Outsourcing of noncore functions ↓Long-term ‘productive’ investment Deindustrialisation + reproduces apartheid pattern of ‘productive’ investment focussed on MEC core ↓Direct employment by NFCs Structural* Unemployment + High interest rates Short-term (speculative) capital outflows via financial sector ↑Macroeconomic instability (↑frequency and amplitude of economic cycles ↑Investment in short-term financial assets ↑procyclical nature of ‘real’ investment expansion of services sectors during upswings (e.g. retail) ↑Employment in services ↑Labour broking ↑precarious contractual arrangements ↓social protection & provision ↓investment on skills development ↑procyclical pattern on employment

© Copyright 2026