STUDY ON STATE SUPPORT TO UNDERTAKINGS IN UKRAINE

HARMONISATION OF PUBLIC PROCUREMENT SYSTEM IN UKRAINE WITH

EU STANDARDS

www.eupublicprocurement.org.ua

STUDY ON

STATE SUPPORT TO UNDERTAKINGS IN UKRAINE

Authors:

Dr Heinrich Hölzler

Dr Ella Libanova

Dr Tetiana Iefymenko

Dr Yaroslav Kotlyarevsky

Svitlana Taran

Denys Chernikov

Valentin Dereviankin

Dr Eugene Stuart

March 2015

The contents of this document are the sole responsibility of the Crown Agents and its Consortium

partners and any opinions expressed here are not to be understood as in any way reflecting an

official opinion of EUROPEAID, the European Union or any of its constituent or connected

organisations.

2

ABOUT THE AUTHORS

Dr. Heinrich Hölzler (Germany) holds a PhD in economics and has more than 40 years professional

experience in competition and State aid law, public procurement and economics. He also has an

extensive experience since 1996 as a Team leader of multi-disciplinary advisory teams.

Dr. Hölzler is the author of a number of books and articles on international competition and State

aid policy and law. He has coordinated the contributions of experts to this Study.

Dr. Ella Libanova (Ukraine) is a Doctor of Economic Sciences, Director of the Ptoukha Institute for

Demography and Social Studies of the National Academy of Sciences of Ukraine, an Academician of

the National Academy of Sciences of Ukraine and a Member of the International Union for the

Scientific Study of Population.

Dr. Libanova has contributed the material on State support for regional development and the

shipbuilding and civil aviation sectors in the Study.

Dr. Tetiana Iefymenko (Ukraine) is a Doctor of Economic Sciences, a Member of the National

Academy of Sciences of Ukraine, a certified auditor and the author of the numerous publications on

tax policy and public finance. In addition, Dr.Iefimenko is the President of the Academy of Financial

Management of the Ministry of Finance of Ukraine.

Dr. Iefymenko contributed the sections of the Study concerning State support by means of tax

benefits and support to the energy and coal sectors.

Dr. Yaroslav Kotlyarevsky (Ukraine) holds a PhD in Economics and is the Head of Postgraduate

Studies Institute of the Academy of Financial Management of the Ministry of Finance of Ukraine.

Dr. Kotlyarevsky prepared the section of the Study regarding State support for the rescue and

restructuring of enterprises.

Svitlana Taran (Ukraine) is an economist and analyst at the Institute for Strategic Research “New

Ukraine”. She is also an advisor to a number of international technical assistance projects in

Ukraine and the author of numerous publications on free trade, EU economic policy and State aid

law and policy.

Ms. Taran prepared the material in the present Study on State support in the steel sector.

Denys Chernikov (Ukraine) is an economist with 13 years experience in public administration;

specialising in public policy, public finance and European integration issues. Mr. Chernikov has

published several articles on State aid policy and law.

Mr. Chernikov is the author of the material in the Study concerning State support to culture and

sports activities.

3

Valentin Dereviankin (Ukraine) is a lawyer with extensive professional experience in competition

law, corporate financing and public procurement. He is currently Deputy Team Leader of the EU

funded Project: “Harmonisation of Public Procurement System in Ukraine with EU Standards”.

Previously, he was Deputy Team Leader of the EU funded project: “Harmonisation of Competition

and Public Procurement Systems in Ukraine with EU Standards” (2009-2012) and, in that capacity,

he was a member of the working group drafting the law of Ukraine “On State aid to Undertakings”

which was subsequently adopted in July 2014.

Mr Dereviankin assisted the coordination of the Study and prepared the section dealing with the

legal framework for public support to undertakings together with additional materials on support

to regional development.

Dr. Eugene Stuart (Irish) is Team Leader of the EU funded Project: Harmonisation of Public

Procurement System in Ukraine with EU Standards. He holds PHD in International Law with a

speciality in State aid and Subsidy regulation. He was Head of the Irish State Aid Department of the

Ministry of Economy and since 1996, he has been working as an international legal & policy advisor

in various capacities in over 20 different countries. In the State aids field, he has contributed to the

development of State aid regulatory systems in Albania, Serbia, Montenegro, Bosnia and

Herzegovina, Hungary, Estonia, Slovakia, Slovenia, Lithuania, Croatia, Bulgaria, Ukraine, Kazakhstan,

Moldova and the Russian Federation. He has also been a Team Leader/ Deputy Team Leader in

many EU funded projects – including large horizontal projects with an EU law approximation and

policy dialogue focus in Lithuania, Moldova, Serbia (and Montenegro) and Kazakhstan – and later

served as EU High Level Policy Advisor on Public Procurement to the Moldovan Government in

2011.

Dr Stuart was primarily responsible for the design of the Study and provided additional guidance,

material and advice in its final stages of preparation.

4

ABBREVIATIONS

AA

Association Agreement between EU and Ukraine

AEA

Association of European Airlines

AMCU

Anti-Monopoly Committee of Ukraine

bn.

Billion

CAS

Common Air Space

CIB Programme

Comprehensive Institution Building Programme

CIT

Corporate Income Tax

CMU

Cabinet of Ministers of Ukraine

CEFTA

Central European Free Trade Agreement

CFCEL

Codes under Functional Classification of Expenditures and Lending

CHP

Heat Power Station

DCFTA

Deep and Comprehensive Free Trade Area

EC

European Commission

ECAC

European Civil Aviation Conference

ENPI

European Neighbourhood & Partnership Instrument

EU

European Union

EUR

Euro

EUROCONTROL

European Organisation for the Safety of Navigation

FAA

US Federal Aviation Administration

GATS

General Agreement on Trade in Services

GDP

Gross Domestic Product

GGMS

General Government Management Sector

HS code

Commodity Nomenclature of Foreign Trade in Ukraine

IATA

International Air Transport Association

ICAO

International Civil Aviation Organisation

IMF

International Monetary Fund

IT

Internet Technology

JSCB

Joint Stock Commercial Bank

kop./kWh

Kopeck per Kilowatt Hour

KVED

The Classifier of Economic Activities in Ukraine

MEDT

Ministry of Economic Development and Trade

MINFIN

Ministry of Finance

MJ

Ministry of Justice

MoU

Memoranda of Understandings

MME

Mining and Metal Enterprises

5

n. a.

Not available

NACE

Statistical Classification of Economic Activities in the European Community

NERC

National Energy and Utilities Regulatory Commission

NGO

Non-Governmental Organisation

NJSC

National Joint Stock Company

PDT

Priority Development Territories

PCA

Partnership and Cooperation Agreement

PLC

Public limited Company

PSP

Hydro Nuclear Power Station

PJSC

Public Joint Stock Company

R&D

Research and Development

SAA

Stabilisation and Association Agreement

SAL

Law of Ukraine “On State Aid to Undertakings”

SCMA

Subsidies and Countervailing Measures Agreement

SEZ

Special Economic Zone

SFI

State Finance Inspection

SMEs

Small and Medium Sized Enterprises

SRDF

State Regional Development Fund

STA

State Taxation Administration of Ukraine

TCU

Tax Code of Ukraine

TFEU

Treaty on Functioning of the European Union

TP

Technology Parks

TRIMS

Trade Related Investment Measures Agreement

UAH

Ukrainian Hryvnia

UIA

Ukrainian International Airlines

UZ

State-owned Railway Company Ukrzaliznytsia

VAT

Value Added Tax

WTO

World Trade Organisation

6

TABLE OF CONTENTS

Page

EXECUTIVE SUMMARY

14

CHAPTER 1: INTRODUCTION

18

CHAPTER 2: DEVELOPMENT OF THE STATE AID SYSTEM IN UKRAINE

22

2.1. Legisaltive, Political and Economic Environment for monitoring and control of

State aid in Ukraine

22

2.1.1. International context

22

2.1.2. Legal Framework for the Public Support of Undertakings

24

CHAPTER 3: MAIN FORMS OF STATE SUPPORT TO UNDERTAKINGS IN UKRAINE

28

3.1. Subsidies

31

3.1.1. Compensation for Services of General Interest and Quasi-Fiscal Activities

35

3.2. Tax Benefits

38

3.2.1. Brief Overview of Tax System

38

3.2.2. Benefits related to Corporate Income Tax

41

3.2.3. Benefits related to Value Added Tax

47

3.2.4 Budgetary revenue foregone due to Tax Benefits

47

3.3 State Guarantees

50

3.4 Writing-off Debts and Penalties

53

CHAPTER 4: HORIZONTAL SUPPORT MEASURES

59

4.1. Regional Development

59

4.1.1. Legal framework for regional development

59

4.1.2. Support of investments

63

4.1.3. State Regional Development Fund

65

4.1.4. Special (Free) Economic Zones

67

4.1.5. Industrial Parks

69

4.1.6. Priority sectors for investment

70

4.2. Support to Rescue and Restructuring of Enterprises

71

4.3. Support to Small and Medium-Sized Enterprises (SMEs)

74

4.4. Support for Research and Development

76

4.4.1. Technoparks

76

7

4.5. Support to the Training of Employees

78

4.5.1. Legal Framework and Statistics

78

4.5.2. Employment of Young Persons

80

4.5.3. Employment of persons with disabilities

83

4.6. Support for Environmental Protection

85

CHAPTER 5: SECTORAL SUPPORT MEASURES

87

5.1. Support to the Energy Sector

87

5.1.1. Structure and Regulation of the Energy Sector

87

5.1.2. Support to the Coal industry

91

5.1.3. QFAs of "Naftogaz of Ukraine"

94

5.2. Support to the Steel Sector

98

5.2.1. Overview of the sector

98

5.2.2. Memoranda of Understandings (MoUs) between the Government and Industry

101

5.2.3. Tax benefits to domestic consumers of metal scrap

109

5.2.4. Direct budget support to the steel sector

110

5.3. State Support to Aircraft- and Ship-Building Enterprises

113

5.3.1. Overview of the legal basis for State support

113

5.3.2. State support policies for the ship and aircraft building industries

113

5.4. Support to Civil Aviation

119

5.4.1. Overview of the civil aviation sector

119

5.4.2. Legal framework and State Policy

120

5.5. Support to Culture and Sports Activities

127

5.5.1. Overview of Legal and Institutional Framework for Support of Cultural Activities

127

5.5.2. Support of cultural establishments and production of goods for cultural activities

131

5.5.3. Protection of cultural heritage

136

5.5.4. Support for film production

137

5.5.5. Support for audio-visual production, TV and radio broadcasting

139

5.5.6. Support for book publishing

140

5.5.7. Support for sports activities

143

5.6. State Support to the Financial Sector

144

CHAPTER 6: CONCLUSIONS

148

ANNEXES

151

Annex 1: Budget Revenues foregone based on tax measures

153

Table 1: Budget revenues foregone due to preferential taxation by types of taxes and duties

(mandatory payments) as of 1 January 2011, UAH thousands

153

8

Table 2: Budget revenue foregone due to preferential taxation by types of taxes and duties

(mandatory payments) as of 1 January 2012, UAH thousands

155

Table 3: Budget revenue foregone due to preferential taxation by types of taxes and duties

(mandatory payments) as of 1 January 2013, UAH thousands

157

Table 4: Budget revenue foregone due to preferential taxation by types of taxes and duties

(mandatory payments) as of 1 January 2014, UAH thousands

159

Table 5: Budget revenue foregone due to preferential taxation by types of taxes and duties

(mandatory payments) as of 1 July 2011, UAH thousands

161

Table 6: Budget revenue foregone from Tax Benefits for Employment of Disabled Persons

from 2008 to 2013, UAH million.

164

Annex 2: State Guarantees

174

Table 1: State Guarantees provided from 2011 to 2013

174

Annex 3: Support to the Coal sector

176

Table 1: Support to Coal Sector from the State Budget from 2002 to 2012, UAH million.

176

Annex 4: State Investment Projects

179

Table 1: State investment projects (programmes) involving loans from foreign

governments, foreign banks and international financial institutions in 2011

179

Table 2: State investment projects (programmes) involving loans from foreign

governments, foreign banks and international financial institutions in 2012

180

Table 3: State investment projects (programmes) involving loans from foreign

governments, foreign banks and international financial institutions in 2013

181

Annex 5: Tax benefits in the energy sector

182

Table 1: Number of industrial enterprises involved in economic activities classified as

energy, coal mining, oil and oil processing, numner of employees at these enteprises.

Table 2. Indicators of consolidated budget revenue foregone due to tax benefits for energy

sector from 2010 to 2013, UAH million.

Table 3: Budget Support for Coal Industry from 2007 to 2014 according to purposes, UAH

million.

Annex 6: Legal bases for support to aircraft construction and shipbuilding

182

Table 1: Legislation providing public support to the aircraft construction sector

187

Table 2: Legislation providing public support to the shipbuilding sector

190

Annex 7: Legal bases for support to the civil aviation sector

192

Legal framework for support of the civil aviation sector (air transportation services and

airports)

192

Annex 8: State support to Culture and Sports

195

Table 1: Consolidated budget support (including State and local budgets) for Sports, Culture

and Mass Media from 2008 to2009, UAH million.

195

Table 2: Consolidated budget support (State and local budgets) for Sports, Culture and

Mass Media from 2010 to 2011, UAH million.

196

Table 3: Consolidated budget support (State and local budgets) for Sports, Culture and

Mass Media from 2012 to 2013, UAH million.

197

9

184

186

187

LIST OF TABLES

Tables

Table 1: Provisions of EU-Ukraine Association Agreement concerning State aid

Table 2: Structure of budget support to economic activities in Ukraine , 2011-2013.

Table 3: Consolidated budget expenditures on economic activities

Table 4: Subsidies and money transfers to enterprises (institutions, organisations) in Ukraine in 2007-2013

Table 5. Structure of State subsidies by economic sectors in 2011-2013

Table 6: Taxes and duties before and after adoption of the Tax Code of Ukraine in 2010

Table 7: Budgetary revenue foregone due to preferential rates of corporate income tax (CIT)

Table 8: State budget revenue foregone due to tax benefits)

Table 9: State Budget revenue foregone due to tax benefits by economic activities in 2007-2012n

Table 10: State guarantees provided to undertakings in 2010 - 2013

Table 11: Resolutions by the Cabinet of Ministers on writing-off debts and provision of State guarantees in

2011-2013

Table 12: Support to Special Economic Zones, 2000 - 2009

Table 13: Support to enterprise restructuring and liquidation

Table 14: Local budget support to SMEs in the period 2008 to 2012

Table 15: Employment of disadvantaged persons and new jobs created in priority sectors (2013)

Table 16: Employment of persons entitled to additional guarantees (2013)

Table 17: Unemployed entitled to compensations for starting up a new business (January 2013 to

September 2014)

Table 18: New jobs created during the period from January to September 2014 by employers compensated

in the amount of the consolidated social security tax

Table 19: Consolidated indicators of budget revenue foregone due to tax benefits (CIT) in the coal sector

during 2010–2013

Table 20: QFAs and their results in the case of “Naftogaz of Ukraine” in 2011 - 2013

Table 21: Price of Domestically Produced Natural Gas for "Naftogaz of Ukraine"

Table 22: Top 15 commodities of Ukraine’s metallurgical exports in 2013

Table 23: Overview of regulated retail tariff for supply of electricity to enterprises in mining, metal, coking

and chemical sectors compared to other industrial consumers (period from November 2008 to June 2010)

Table 24. Compensation of losses from supplying electricity to mining and metal and chemical enterprises

at a preferential regulated tariff

Table 25: Import - export of metal scrap by Ukraine in 2013 (HS code 7204)

Table 26: Budget support within the State programme for development and reform of the ore mining and

metallurgical sectors until 2011 (planned and actual)

Table 27: Budget spending on the programmes for restructuring of industrial enterprises including steel

10

and mining enterprises

Тable 28: Amounts of budget revenue foregone due to tax benefits provided for aircraft and shipbuilding

industries 2010 to 2013

Table 29: Ratio of tax benefits for aircraft and shipbuilding industries presented as the budget revenues

foregone and the total amount of budget losses during 2010 – 2013

Table 30: Exemption from Import duty, UAH million for the Aircraft Industry 2010 to 2013

Table 31: Compensations from the State budget to the local budgets

Тable 32: Economic indicators for aircraft and shipbuilding industries 2012 – 2013

Table 33. Budget financing of the State Aviation Service of Ukraine in 2011-2013

Table 34. Key Indicators for passenger air transportation in Ukraine 2010 to 2013

Table 35: Financial performance of the passenger air transport sector 2010 to 2013

Table 36: Capital Investment in Passenger Air Transport Sector

Table 37: Forecast of financing needs for the design, construction, reconstruction and repair works at

Ukrainian airports

Table 38: Consolidated indicators on tax benefits ("Zero" VAT rate) provided for civil aviation in 2011 to

2013

Table 39: Overview of legal provision on State support for culture and sports

Table 40: Selected Budget Programmes in the Spheres of Culture and Sports

Table 41: CIT Tax benefits to film production, 2011 to 2013

Table 42: VAT Tax benefits to film production, 2011 to 2013

Table 43: Land Tax benefits to film production, 2011 to 2013

Table 44: Film undertakings exempted from Land tax until 2016

Table 45: CIT Tax benefits to book publishing, 2011 to 2013

Table 46: VAT Tax benefits to book publishing, 2011 to 2013 (Tax Code Title XX, Chapter 2, Article 5)

Table 47: VAT Tax benefits to book publishing, 2011 to 2013 (Tax Code Title XX, Chapter 2, Article 5)

Table 48: Anti-crisis measures in the financial sector

Table 49: Key financial indicators of banks recapitalised by the State (as of the 3d quarter of 2014)

11

PREFACE

The Law of Ukraine on State Aid to Undertakings of July 2014 provides the foundation for a

new system of regulatory control on State support measures to business undertakings that

give specific benefits to some firms and may, therefore, have an undue impact on

competition.

Various additional regulatory steps, institutional preparedness and certain policy reviews

will be needed by 2017/2018 to ensure that this system works smoothly when it comes

into full operation and that continuing State support measures to business undertakings

can comfortably comply with the Law.

When the State Aid System is fully in force, it has the potential to deliver important

benefits to Ukraine. These include:

1) The promotion of higher standards in public finance management, including the

avoidance of duplicating or wasteful public expenditure.

2) A contribution to the anti-corruption efforts of Ukraine by ending secret subsidies

or subsidies to specific firms that have no justification.

3) Increasing the level of competition in the economy by removing any cases where an

artificial competitive advantage is unnecessarily given to some firms.

4) Ensuring that support measures to the business sector (in whatever form) are well

justified and likely to succeed in achieving tangible economic results.

5) Contributing to the functioning market economy in Ukraine by rationalising future

industrial modernisation, foreign direct investment

and other economic

development policies in line with best international practice.

6) Meeting the international commitments undertaken by Ukraine in regard to State

support to business and industrial sectors (specifically under the EU-Ukraine

Association Agreement, several WTO agreements and the Energy Community

Treaty).

Similar systems were established since the 1990s in all Candidate countries for EU

membership and are to be found in many non-EU countries which are currently forging

closer economic and trade relations with the EU. In all such cases, one of the important

initial challenges was to identify the range of active (or potentially active) State support

measures that could be regarded as possible State aids in order to establish the national

State Aid Inventory - which is a core element of State Aid regulatory systems.

As Ukraine works through the transitional period set out in the Law on State Aid to

Undertakings there needs to be a growing consciousness of which State support measures

12

might constitute “State aid” on the part of all relevant public authorities. Accordingly, the

EU funded Project is pleased to present an initial outline in this Study of at least some of

the types of measures which will need to be examined in more detail, included in the

Ukrainian Inventory (if they do amount to “State aids”) and reviewed further as regards

their continuing usefulness and compliance with EU and international standards.

Finally, our thanks to the expert team which developed the Study. Theirs was a unique

endeavour as so little was known or consolidated regarding State supports to business

undertakings in Ukraine. The Study will undoubtedly prove very helpful in raising the

necessary awareness of what needs to be considered in the coming years.

Dr Eugene Stuart

PROJECT TEAM LEADER

March 2015

13

EXECUTIVE SUMMARY

The EU funded Project “Harmonisation of Public Procurement System in Ukraine with EU standards”

commenced work in Kiev on 11 November 2013. The general objective of the Project is “to

contribute to the development of a solid and consistent public finance management through the

establishment of a comprehensive and transparent regulatory framework for public procurement,

an efficient public procurement institutional infrastructure, the accountability and integrity of

public authorities in regard to public procurement and the development of the Ukrainian State aid

system”.

In the context of the Project’s work supporting the development of the Ukrainian State aid system,

this Study was prepared in order to provide the Government of Ukraine, interested public

institutions and non-governmental organisations with a general overview of the legal framework,

the scope and forms of State support to undertakings in Ukraine. It is a based on publicly available

data on State budget expenditures, budgetary revenue foregone and public liabilities registered

during a period of three to five years that can be categorised as support to economic activities in

Ukraine.

While public funds are normally spent in accordance with particular political and economic

priorities, defined by the State and are used, in various ways, to subsidise a wide range of economic

activities and sectors, there is no scrutiny in Ukraine as regards the consequences of such support

measures for competition, trade, or value for public money. Equally, there is little, if any, oversight

as regards the public needs, rationality, general public interest and proportionality of State support,

in any form, direct or indirect, to business in Ukraine. This represents an important information gap

in the context of the development of the Ukrainian State aid system. Accordingly, the overall

purpose of this Study is to improve the availability of information on State support measures in

Ukraine and the main objective of the Study is:

to provide the central Government, involved public authorities and institutions, as well as

the public at large with an initial insight regarding the objectives, scope, key beneficiaries

and generally estimated amounts of State support to undertakings in Ukraine in recent

years.

The Study concentrates on the notion of State support rather than State aid, as it is defined in the

Law of Ukraine “On State aid to Undertakings”. State support is a more general term, covering any

type of public assistance to undertakings, whereas the notion of State aid is a specific sub-set of the

overall concept of State support that can be identified as such only after a proper assessment

according to the Law and formal decisions by the AMCU. With this important distinction, the Study

does not seek to prejudge any eventual position of the AMCU as to whether specific measures are

or are not technically qualified as State aid. At the same time, the Study provides a compendium of

available legal, economic, statistical and policy data concerning certain support measures that

might, in principle, be characterised as State aid.

The Study begins with an overview of the fundamental rules for public support of economic

activities in Ukraine in national legislation; focussed on Constitutional provisions, the Ukrainian

Commercial Code, competition legislation and the recently adopted Law on State Aid to

Undertakings. It also addresses the political and economic environment related to development of

a national State aid system and explains the international context (Association Agreement, Energy

14

Community Treaty and WTO requirements) necessitating the aproximation of the Ukrainian system

with the relevant EU State aid legislation and international subsidy regulations.

In Chapter 2, the Study sets out information on the main forms and general structure of public

support to undertakings in Ukraine based on the overall findings of this research and some official

statistics on subsidies and other forms of public support currently available to undertakings in

Ukraine.

The Study reveals that all Ukrainian Governments have provided undertakings with public support

in various forms – direct budget subsidies and loans, tax exemptions and deferrals, writing off debts

and penalties in regard to the social insurance system, compensating interest rates for commercial

borrowings, issuing State guarantees to secure financial liabilities of State owned enterprises,

compensating the cost of services provided to the population below their actual costs and

providing additional funds to State owned companies through increased shareholdings.

In general, State support to undertakings in Ukraine has been predominantly sectoral in character;

during the latest 3 years the largest share of support measures (mainly through direct budget

financing, State guarantees and tax benefits) has been granted to agricultural producers, although

comparable amounts have been also directed to support coal mining and energy enterprises.

According to the estimations here, sectoral measures, for example in 2012, accounted for

approximately 43.6% (or 46.1 billion UAH) of the total financial resources dedicated to public

support for economic activities in Ukraine.

While the Study analyses horizontal and sectoral support measures in a few selected industrial

sectors, it does not deal with supports to agricultural producers as that sector requires special

policies for development and support and will not be covered by the Ukrainian State aid regulatory

system. At the same time, it is to be noted that Ukrainian agricultural producers received about one

third of all fiscal benefits, about 11-12% of government subsidies and about 32% of State

guarantees in 2012.

Chapter 3 of the Study provides an analysis of the most common forms of “horizontal” support

measures; in particular tax benefits, the preferential regulatory regime for special priority zones

and technological parks, existing public support measures within regional development

programmes and support to rescue and restructure State-owned enterprises facing financial

difficulties. Inturn, Chapter 4 examines State support measures in several selected sectors - energy

and coal, steel, shipbuilding, civil aviation, culture and sports.

The Government of Ukraine has been supporting economic activities in order to maintain the

viability and competitiveness of domestic producers, especially those working in “strategic” sectors

of the national economy. A particular objective of this Study was to analyse policies and

instruments used by the Ukrainian governments to support industries that typically confront

growing inefficiencies, low productivity, environmental and overcapacity problems, mass

redundancies and decreasing competitiveness in international markets. These are often referred to

internationally as “sensitive sectors” and there is an increasing presumption that State supports in

such sectors are inefficient as free trade, competition and globalisation have become increasingly

prevalent in these sectors. In this regard, the Study focuses primarily on the energy, coal, steel,

aircraft construction and shipbuilding, civil aviation sectors in Ukraine. Certain attention is also

given to film production, book publishing, music, theatres and sports, which have been traditionally

considered in Ukraine, as in other post-Soviet countries, to be public sector activities. Today

relevant institutions and organisations in these sectors are gradually adjusting to normal market

conditions but they still require substantial budget support.

15

Public financial support to economic activities in Ukraine has been largely motivated by the

necessity for the Government to address growing social problems that could have emerged as a

result of immediate bankruptcies of large State-owned enterprises that continued to lose markets

under unfavourable economic conditions and growing competition in international markets. The

governments of Ukraine took steps to prevent redundancies and maintain the profitability of

industrial enterprises; especially those located in coal mining, depressed and densely populated

areas. At the same time, the scope of horizontal measures that could have encouraged

investments, SMEs development, research and innovation, new jobs, energy saving, environmental

protection and regional cohesion, has been rather limited. In particular, the Regional Development

Fund, established in 2012 as the main instrument for financing regional and local programmes, has

been chronically under-financed by 70-80% due to lingering budgetary deficits.

In recent years, the Ukrainian governments have adopted a number of legislative acts and

strategies promoting better a fiscal and regulatory environment for investment: these primarily

focussed on VAT and corporate income tax exemptions for certain priority industries and territories

with a special legal regime and for economic operators participating in industrial and techno-parks.

Nonetheless, these measures have not produced any significant effect on the macro-economic

indicators of Ukraine.

The largest share of public support (including subsidies, tax benefits, write offs, State guarantees

and compensations) has been granted to State owned enterprises in the energy sector (including

coal), and to shipbuilding, aircraft building, steel production and IT development. These supports

were generally directed towards supporting the profitability and operational needs of large Stateowned enterprises, large exporters and producers of energy from renewable resources. Exceptional

measures were also applied to support business operations related to one national investment

project – the organisation of the Euro-2012 football finals in 2012 (where State guarantees issued

to secure commitments of such undertakings alone amounted to some 650 million UAH).

The Government has also directed budget resources to compensate losses of undertakings selling

essential services and products at regulated prices or below their actual cost. In that regard, the

Study examines quasi-fiscal operations and subsidies directed to the National Joint Stock Company

”Naftogaz of Ukraine”, the largest operator in the Ukrainian energy sector.

The energy sector (including coal, oil and gas, electricity) received on the average some 30% of the

total amount of budget support for undertakings in Ukraine from 2011 to 2013. Energy enterprises,

including the coal and peat mining segment, were the main beneficiaries of tax benefits. Thus, total

budget revenue foregone from tax benefits to undertakings accounted for approximately 3.5% of

GDP annually (between 32 billion and 46 billion UAH). Within that category of State support, VAT

exemptions represented the main share of budget revenue foregone: on average 32.68 billion UAH

per year.

Another widely used form of State support in Ukraine is State guarantees granted by the

Government to State owned enterprises, mainly in the energy sector, which increased public

liabilities by approximately 40 billion UAH in the period 2011 to 2013. 90% of these State

guarantees were granted to energy sector enterprises and primarily secured the financial position

of only one company - NJSC “Naftogaz of Ukraine”. The coal mining industry also received on

average 20% of all direct subsidies and compensations supporting economic activities in Ukraine.

The Study also demonstrates that a large share of State support has been provided through direct

subsidies to State-owned enterprises and institutions involved in the provision of certain public

16

functions (such as hospitals, cultural establishments, research institutions, educational institutions

and sports organisations) which partially participating in economic activities, including the provision

of services of general economic interest. In the period 2011 to 2013, direct budget subsidies to

undertakings amounted on the average to 30 billion UAH annually.

At the same time budget financing for cultural activities, such as film making and distribution, book

publishing, theatres, music and arts production and performances and sports, amounted to a

modest 11 -13 billion UAH per year (three times less than the single amount of State support to the

“Euro-2012” football project in 2012).

While the nature and use of State supports in Ukraine has been largely similar to schemes of

support to be found in other countries, many of the amounts are quite small in overall terms with

the exception of highly targeted supports to certain industries and generally expensive VAT

exemptions. Nonetheless, the Study points to several significant policy and operational issues

concerning State support to undertakings in Ukraine, including:

A lack of strategic approach, transparency and predictability of the decision-making process

for State support measures;

A lack of eligibility criteria for the scope, categories of recipients of State support and

accountability, both on behalf of the public grantors and beneficiaries of public resources,

for the effective use of available public resources;

A lack of information concerning existing State support measures, actual amounts in all

forms being provided for particular enterprises and business activities;

The absence of a streamlined institutional infrastructure for the assessment, approval and

monitoring of State support measures in all sectors and regions of Ukraine.

Accordingly, the Study provides a starting point for policy reflection on State support measures in

Ukraine under various national policy headings. It also provides a starting point for the compilation

of a comprehensive State aid inventory required under the Law on State Aid to Undertakings of 1

July 2014 and which is also necessary to fulfil Ukraine’s commitments under the EU-Ukraine

Association Agreement (Section 2 of Chapter 10) that require the establishment of a fully

functioning State aid system in Ukraine in the coming years.

17

CHAPTER 1: INTRODUCTION

The Project

The EU funded Project “Harmonisation of Public Procurement System in Ukraine with EU

Standards” implemented by a consortium led by CROWN AGENTS Ltd commenced work in Kiev on

11 November 2013 and will operate until November 2016. The general objective of the Project is

“to contribute to the development of a solid and consistent public finance management through the

establishment of a comprehensive and transparent regulatory framework for public procurement,

an efficient public procurement institutional infrastructure, the accountability and integrity of public

authorities in regard to public procurement and the development of the Ukrainian State aid

system”.

The Project is working to contribute to the development of a consistent public finance management

system through the development of a comprehensive and transparent legal framework, an efficient

institutional infrastructure for public procurement, the accountability and integrity of public

authorities in this sector, as well as through the development of the national State aid system in

Ukraine.

The main beneficiaries of the Project are the Ministry of Economic Development and Trade (MEDT)

and the Anti-Monopoly Committee of Ukraine (AMCU). At the same time, the Project is also

working with a wider range of stakeholders, including the Cabinet of Ministers, the Parliament

(Verkhovna Rada), the Ministry of Finance, the Ministry of Justice, the Accounting Chamber, the

State Financial Inspection of Ukraine and other public organisations with an interest in the reform

of the public procurement system and the development of the State aid system.

The Project is currently providing priority assistance in regard to State aid legislation in Ukraine,

preparations for the entry into force of the Law on State Aid to Undertakings of July 2014, the

strengthening of the AMCU as the main institution responsible in the State aid system of Ukraine

and training and awareness-raising across the government system.

State Aid and and the development of the Ukrainian State Aid System

“State aid” is essentially about the impact on competition and trade of subsidies, tax breaks and

other forms of government concessions, which benefit some firms and, therefore, can impact

negatively on other firms. In the modern era of free trade, these types of State economic

intervention are now regarded as problematic when they have a significant impact on trade and

competition. With the opening up of trade and the international position of a country (including EU

integration, WTO and Energy Community Treaty membership) a key consequence is that

international rules concerning State support to economic activity (and the interests of new trading

partners in the impact of State aids and subsidies on trade and competition) need to be taken fully

into account.

The legal necessity to control State aid in Ukraine arises from a number of Ukraine’s international

obligations, in particular, from the EU-Ukraine Association Agreement, which require Ukraine,

within a specified transitional period, to accomplish a range of important steps towards the full

operation of a State aid control system which would be fully compatible with EU standards.

The present Study has been prepared by the Project in the context of advisory support to the

Ukrainian Government regarding the development of the State aid system and the implementation

18

of Chapter 10 of the EU-Ukraine Association Agreement. The Study examines statistics on State

support granted to undertakings in Ukraine over the last 5 to 10 years and provides an initial

overview of measures that might be assessed as State aid in terms of relevant EU legislation.

Objectives and approach of the Study

The fragmented information about State support measures in Ukraine creates a certain constraint

for the establishment of a functioning State aid monitoring and control system at the national level.

The AMCU has been authorised under the new Law of Ukraine “On State aid to Undertakings”

adopted on 1 July 2014 to monitor and control State aid measures in Ukraine. Starting from 2017, it

will have to assess notified support measures to identify incompatible State aid measures and to

enforce the alignment of existing State aid measures with the new Law. In a wider sense, the AMCU

will have to ensure the alignment of the national system of State aid control with EU State aid rules

within a certain set period.

For that purpose, as a primary step, a State aid inventory needs to be established and maintained

and annual reports on State aid measures and trends must be prepared. The Law of Ukraine “On

State aid to Undertakings” provides that all existing State aid measures are to be notified to the

AMCU within one year of the entry into force of the Law (i.e. by August 2018). However, the

present availability of data makes it rather difficult for the AMCU to anticipate the range, number

and importance of such measures within the economy. Moreover, there is a risk that State aid

providers (in effect a wide range of public institutions) will not be in a position to properly identify

public interventions in the market for which they are responsible.

In the absence of a functioning system of State aid monitoring and control in Ukraine, it can be

assumed that public funds are used, in various ways, to subsidise a wide range of economic

activities and sectors. While public funds are normally spent in accordance with particular political

and economic priorities, defined by the State, there is no scrutiny in Ukraine as regards the

consequences of such support measures for competition, trade, or value for public money. Equally,

there is little, if any, oversight as regards the public needs, rationality, general public interest and

proportionality of State support, in any form, direct or indirect, to business in Ukraine.

Therefore, the main objective of this Study is to provide the central Government, involved public

authorities and institutions, as well as the public at large with an initial insight regarding the

objectives, scope, key beneficiaries and generally estimated amounts of State support to

undertakings in Ukraine in recent years. It appears that there have been no previous similar studies

carried out in Ukraine. Accordingly, the overall purpose of this Study is to improve the availability

of information on State support measures in Ukraine.

The Study concentrates on the notion of State support rather than State aid, as it is defined in the

Law of Ukraine “On State aid to Undertakings”. State support is a more general term, covering any

type of public assistance to undertakings, whereas the notion of State aid is a specific sub-set of the

overall concept of State support that can be identified as such only after a proper assessment

according to the Law and formal decisions by the AMCU. The distinction between State support and

State aid, therefore, is important and does not seek to prejudge any eventual position of the AMCU

as to whether specific measures are or are not technically qualified as State aid. The Study provides

a compendium of available legal, economic, statistical and policy data concerning certain support

measures that might, in principle, be characterised as State aid.

“State aid” specifically refers to the impact of subsidies, tax benefits and other forms of

government advantages granted to undertakings on competition and trade, which, therefore, can

impact negatively other firms, that do not receive similar benefits. Economic interventions by the

19

Government must be regarded as problematic when they have a significant impact on trade and

competition.

With opening up of the country’s position in international trade within the context of EU

integration, the WTO and the Energy Community Treaty membership, international standards for

ensuring the interests of the trading partners must also be applied in Ukraine and interventions by

the Government affecting trade and competition need, therefore, to be fully taken into account.

The Law of Ukraine “On State Aid to Undertakings” defines the notion of State aid as follows:1

“State aid to undertakings (hereinafter “State aid”) means any form of support to undertakings

through State resources or local resources which distorts or threatens to distort economic

competition by creating advantages for the production of certain kinds of goods or for carrying

out certain types of economic activities;”

State support measures pursuing objectives of the general economic development and sustainable

growth (such as regional development programmes, environmental protection measures, job

creation, professional training, R&D activities, etc.) are referred to as “horizontal” measures. State

support promoting the development of certain priority sectors or certain economic activities,

including measures aimed at the conservation and promotion of the national heritage, culture and

sports, are referred to as “sectoral”. However, the distinction between horizontal and sectoral

measures is not always absolute because there may be certain overlaps. For example,

environmental measures can be viewed as horizontal, while the Government might specifically

encourage such measures only in one or two sectors of the economy, or even only in certain

individual enterprises. Rescue and restructuring measures typically favour certain individual

strategic enterprises but they can be also viewed as horizontal policies.

This Study presents statistical data and other information on State support measures within the

following categories:

Horizontal support measures, i.e. support to undertakings through the establishment of special taxation

regimes, the implementation of regional and industrial development programmes, the rescue and

restructuring of enterprises, social development programmes, etc.;

Sectoral support measures, i.e. examples of support to undertakings in the sectors of energy and coal,

steel, ship and aircraft building, civil aviation, cultural development and financial markets;

Objectives, instruments and forms of State support to undertakings in Ukraine, based on the outcome

of interviews and meetings with representatives of public authorities, as well as representatives of

undertakings in the selected sectors.

The sectors selected for this Study have been identified as the most likely to become of importance

for monitoring in the future implementation of the national State Aid System in Ukraine.

The latest publically available statistical information refers to 2012-2013. At the same time, the

political, economic and social environment in Ukraine has dramatically changed in 2014.

Accordingly, the relevance of the data presented here may be questioned in the light of the new,

different and changing political, economic and financial situation in Ukraine. To address such

concerns, the following considerations are relevant and justify the approach taken in this Study:

1. In order to analyse the scope and adequacy of public support to undertakings in different

economic sectors and to better understand relevance and effect of such measures for the

economy, it is necessary to have historic data on State interventions in order to make

comparisons possible. In each sector there is a certain tradition and methodology of State

intervention and support, based on changing political priorities or actual needs for the

sector’s development.

1

Law of Ukraine “On State Aid to Undertakings”, No. 1555-VII of 1 July 2014, Article 1(1).

20

2. The amount of public support to undertakings decreases the potential revenues of public

budgets at the national and/or local level and, consequently, it constrains the financing of

other essential public needs and functions. Thus, a comparison over time can help to

better understand the extent to which State support measures have been actually

justified in terms of the efficient performance of the national economy.

3. State support to undertakings should always be justified by a real necessity to address

certain general interests of the country, regardless of other interests and effects that a

support measure may also produce. The maintenance and development of effective

competition as a core principle of the market economy is also an important public

interest. Therefore, there is an inherent conflict between the purpose of a particular

public support measure and the wider goal of promoting free and fair competition as a

general economic interest. However, the effect of State support on competition becomes

visible only over time through certain changes in market structures or economic

efficiencies. Historic data provide the possibility to compare the effects of State

interventions on competition over several years.

4. The comparison of historic data on horizontal and sectoral support measures provides a

basis for future government decisions concerning budgetary and industrial policies and

the approval of economic development programmes. It is important to maintain State

support to business activities where it is necessary for economic and social development;

but such measures need to be transparent, well targeted and should have the least

possible effects on existing and potential competition.

Structure of the Report on the Study

This Report is structured as follows:

Chapter 1

Provides an overview of the fundamental rules for public support of economic

activities in Ukraine in national legislation and of the political environment for the

functioning of a national State aid system and the international context requiring

gradual approximation of the Ukrainian system with the relevant EU State aid

legislation;

Chapter 2

Provides information on the main forms and general structure of public support

to undertakings in Ukraine based on the overall findings this research and some

official statistics on subsidies and other forms of public support currently available

to undertakings in Ukraine.

Chapter 3

Provides an analysis of the most common forms of “horizontal” support

measures; in particular tax benefits, the preferential regulatory regime for special

priority zones and techno-parks, existing public support measures within regional

development programmes and support to rescue and restructure State-owned

enterprises facing financial difficulties.

Chapter 4

Examines State support measures in several selected sectors - energy and coal,

steel, shipbuilding, civil aviation, culture and sports.

Chapter 5

Presents the conclusions of the Study.

21

CHAPTER 2: DEVELOPMENT OF THE STATE AID SYSTEM IN UKRAINE

2.1. Legislative, political and economic environment in Ukraine

In 2013 Ukraine had a population of almost 46 million people and a nominal GDP of 177,431 billion

USD (in December 2013 this amounted to € 130 billion). Ukraine ranks 53rd in the world for

merchandise exports and 40th in the world for merchandise imports. In regard to commercial

services, Ukraine ranks 42nd for exports and 27th for imports2. The Ukrainian economy traditionally

has a strong agribusiness base, comparatively well-developed industrial sectors (food, steel, coal,

engineering and shipbuilding) and a fast growing services sector. 2013 data indicate that there were

1.7 million business entities in Ukraine. Most of these were sole entrepreneurs, but nearly 400,000

were firms/legal entities (i.e. SMEs and larger enterprises).

The 2014 IMF Country Report on Ukraine3 highlights various economic and financial objectives that

Ukraine needs to achieve in order to overcome economic development difficulties and financial

risks. In 2014 the IMF downgraded Ukraine’s GDP growth to 6.5 per cent4 and the current account

deficit for 2014 was projected at the level of 2.5 per cent of GDP5.

Ukraine has inherited from the Soviet Union an economy heavily dependent on public funds and

the political decisions of the central Government. In the course of the history of Ukrainian political

and economic reforms, industrial and regional policy objectives may have varied significantly but all

Ukrainian Governments have continuously supported State-owned enterprises and producers in

certain “priority sectors” (e.g. coal mining, steel, chemicals, aircraft manufacture, ship-building and

book publishing) in order to ensure their survival and viability in conditions of economic instability

and growing international competition.

2.1.1 International context for development of State aid system in Ukraine

The initial legal framework for monitoring and control of State aid in Ukraine was established in the

context of the Partnership and Cooperation Agreement (PCA), effective since 19986. In February

2005, the EU and Ukraine agreed on an Action Plan to facilitate the implementation of PCA and

transfer towards deeper economic integration and political association between Ukraine and the

EU7.

2

Data are taken from the official Ukraine Report to the WTO of September 2014, WTO News/Trade

Topics/Resources/Documents/English.

3

International Monetary Fund: Country Report on Ukraine, No. 14/263 of September 2014.

4

IMF Report, ibid, page 7.

5

ibid. page 8.

6

Ukraine was the first country of the former Soviet Union to conclude a PCA with the European Union in June

1994. After ratification by Ukraine, the EU and its Member States, the PCA came into force in March 1998.

7

In the specific context of competition policy, the Action Plan set several important priorities. In regard to the

overall functioning of the market economy in Ukraine, the priority is defined in terms of continuing progress

in the establishment of a fully functioning market economy, including price-formation, control of State aid,

and a legal environment that ensures fair competition between economic operators. As regards competition

policy, particular importance is given to prioritising the development of a functioning State aid system in

22

In March 2007, negotiations on an EU - Ukraine Association Agreement, including provisions on a

Deep and Comprehensive Free Trade Area (DCFTA), were launched. The DCFTA provisions

envisaged that, among a wide scope of comprehensive regulatory and institutional reforms,

Ukraine would introduce a national State aid regime compatible with EU State aid rules. The EU, for

its part, would provide Ukraine with necessary technical assistance and budget support to prepare

and implement the DCFTA provisions and ensure the functioning of the national State aid system.

Following the deep political crisis in Ukraine from November 2013 to March 2014, the political

provisions of the EU-Ukraine Association Agreement were signed on 21 March 2014 and the

remaining trade provisions, including Articles 262-267 setting out detailed commitments for the

establishment of a State aid system, were signed on 27 June 2014.

In September 2014, due to political complications and growing military conflict affecting Ukraine, it

was decided to delay the enactment of the trade and economic chapters of Association Agreement

until 1 January 2016 (while the remaining parts of the Agreement entered into force on 1

November 2014). The relevant Association Agreement requirements are summarised in Table 1

below.

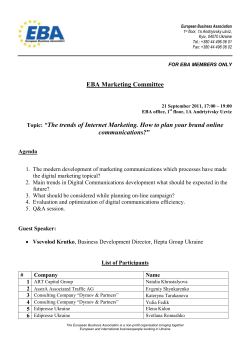

Table 1: Provisions of the EU-Ukraine Association Agreement concerning State aid.

Generally

Specifically

State aid regulation is addressed in Articles 262 to 267 of the Association Agreement. The

intention is to further elaborate, prioritise and timetable the steps to be taken to achieve a

functioning State aid system in Ukraine fully compatible with EU standards.

Element

Source

Timetable

Entry into force of Trade provisions (including

State aid Articles)

Title IV

31 December

2015

First Annual Report on State aid in Ukraine

Article 263 (1) and (5)

31 December

2020

a. Transparency of financial relations between

public authorities and public undertakings

Article 263 (3), (4)

and (5)

31 December

2020

Adoption of the national State aid legislation and

establishment of an operationally independent

authority to apply the State aid rules

Article 267(1)

31 December

2020

Full consistency of new State aid with EU General

Principles

Article 267(1)

31 December

2021

Establishment of a comprehensive inventory of

“existing” State aid schemes

Article 267(2)

31 December

2020

Alignment of “existing” State aid schemes with

the State aid rules

Article 267(2)

31 December

2022

Use of maximum State aid limits under the

category of regional State aid

Article 267(3)(a)

(at least until) 31

December 2020

Completion of a “State aid mapping” exercise

Article 267(3)(b)

31 December

b. Organisational and financial structure of

undertakings enjoying special or exclusive rights

(or entrusted with the provision of services of

general economic interest) that receive public

compensation, produce separate accounts

Ukraine in line with PCA commitments, including the development of legislation compatible with EU rules and

the establishment of monitoring and transparency mechanisms.

23

with the European Commission

2019

It is also important to note that since 1 February 2011, Ukraine has been a Contracting Party to the

Energy Community Treaty. In contrast to the provisions of Chapter 10 of the Association

Agreement, which establishes general requirements for the development of a State aid system and

allows Ukraine a 7 year transitional period for the legislative and institutional adjustment before

full implementation of the State aid control in compliance with EU standards, Articles 18 and 19 of

the Energy Community Treaty require its signatories to ensure State aid control in the energy

sector8 and apply some EU energy sector regulations without any transitional periods.

In addition, as a WTO member since 16 May 2008, Ukraine must implement the Subsidies and

Countervailing Measures Agreement (SCMA), the Trade Related Investment Measures Agreement

(TRIMS) and the General Agreement on Trade in Services (GATS) – each of which regulate certain

aspects of subsidies to business operators. As a WTO Member, Ukraine has notified its subsidies

according to the relevant international standard. For instance, the SCMA notification submitted on

2 July 2013 to the WTO covered the following aspects:

Ukraine WTO Subsidies under the SCMA

(period 2011 and 2012)9

HORIZONTAL PROGRAMMES

Special Economic Zones and Priority Territories

Technology Parks

SECTORAL PROGRAMMES

Shipbuilding

Aircraft construction

Machinery for agriculture

Space industry

Coal Mining

Book-Publishing

2.1.2. Legal Framework for State Support of Undertakings

The right to conduct entrepreneurial activities and the Governmental guarantees to protect

competition in Ukraine are provided by Article 42 of the Constitution of Ukraine10. In addition,

Article 92 of the Constitution provides that the fundamental rules for ownership (part 1, Para.7),

entrepreneurial activities, competition rules and anti-monopoly regulation (part 1, Para.8), the

functioning of the budgetary system, the principles for the establishment and functioning of the

financial, monetary, credit and investment markets, the taxation system, taxes and duties (part 2,

8

It can be noted here that the energy sector as covered by the Energy Community Treaty does not include

the coal industry.

9

WTO Committee on Subsidies and Countervailing Measures, New and Full Notification pursuant to Article

XVI:1 of the GATT 1994 and Article 25 of the Agreement on Subsidies and Countervailing Measures,

G/SCM/N/253/UKR, 11 July 2013.

10

Law of Ukraine No. 254к/96-ВР of 28 June 1996.

24

Para. 1), the rules on free trade and the establishment of special economic zones (part 2, Para. 8)

shall be regulated exclusively by the laws of Ukraine.

The Commercial Code of Ukraine11 provides for a number of justifications allowing the State to

support undertakings. In particular, Article 16(1) of the Commercial Code provides that the State

may subsidise undertakings to achieve the following purposes:

to support the production of essential foods, medicines and means for the rehabilitation of the

disabled;

to ensure the procurement of certain imported goods and socially important transportation

services;

to finance undertakings in critical social, economic, or environmental situations in order to

ensure the necessary level of investments into their viability and technical development,

provided that such capital investments produce a significant economic effect;

in other cases provided by the law.

It can be noted here that the list of purposes established by Article 16 of the Commercial Code for

the public support of undertakings is not exhaustive and the final provision actually opens up the

potential for the Government to provide direct or indirect assistance to economic operators for

other reasons, provided that there is a law securing the relevant legal base.

Article 48 of Commercial Code also provides that the State may assist economic operators under

conditions and in the manner explicitly prescribed by the law, in order to create a beneficial

organisational and economic environment for the development of entrepreneurship, in particular

through:

the provision of land plots and the transfer of State property necessary for business

activities;

facilitation of technical assistance and the delivery of supplies, as well as information

services for business activities and for the training of personnel;

the establishment of new production and social infrastructure objects in underdeveloped

territories and the further sale or transfer of such objects to economic operators through

procedures established by the law;

the creation of incentives for technological modernisation, innovation and the

development of new products or services by economic operators;

provision of other types of a support.

Moreover, Article 18 (3) of the Commercial Code restricts the right of public authorities and bodies

of local self-governance to adopt regulatory acts or take measures that might eliminate

competition or unduly promote the business of certain competitors, or impose market restrictions

not explicitly envisaged in the legislation. At the same time, the laws of Ukraine may establish

exceptions to this rule if it is necessary to ensure national security, defence or other general public

interests.

As regards interference by the State in the market mechanism, Article 31 of the Commercial Code

defines a notion of “discrimination of undertakings by public authorities”. In particular, among

possible forms of discriminatory treatment of undertakings, Article 31 refers to the following:

11

Commercial Code of Ukraine, No. 436-IV of 16 January 2003.

25

”providing entrepreneurs with tax and other benefits that create an advantage compared to

positions of other undertakings, and resulting in monopolisation of the relevant product

market.”

Section 2 of the same Article 31 contains a prohibition of discrimination against undertakings by

public authorities. However, there is an exception for cases where discriminatory decisions or

actions by public authorities are applied in order to ensure national security, defence or some other

general interest.

In the same context, Article 15 of the Law of Ukraine “On the protection of economic competition”

expands the the scope of the prohibition on discriminatory (i.e. anti-competitive) actions by public

authorities. In particular, inter alia, the following behaviour by public authorities, local selfgovernance bodies or administrative and control bodies, is deemed to be anti-competitive:

“the provision of benefits or any advantages for certain undertakings or groups of

undertakings that place them in a privileged position compared to their competitors, and

which results or may result in the prevention, elimination, restriction or distortion of

competition."

Article 25 of the Commercial Code and Article 15 of the Law on Protection of Economic Competition

explicitly prohibit the adoption of regulatory or administrative acts by public authorities, or any

other such actions that put certain undertakings, irrespective of their ownership, in a privileged

position or otherwise violate the competition law of Ukraine. However, Article 26 of the

Commercial Code provides for a possibility to restrict competition in the cases when public

authorities or local self-governance bodies pursue the following objectives:

the provision of aid of a social character to certain undertakings provided that such aid

is granted without discrimination of other undertakings;

the provision of aid through public resources in order to compensate losses caused by

natural disasters or other emergencies, or in specific product or services markets, the

list of which should be established by the legislation;

the provision of aid, in particular through the creation of favourable economic

conditions for separate territories, in order to compensate social and economic

damages caused by severe environmental situations;

the implementation of regulatory measures related to the operation of important

national projects.

In addition, the Commercial Code of Ukraine establishes a special legal regime for State-owned

enterprises (Article 22) and municipal enterprises (Article 24), particularly, in the context of the

competition rules and bankruptcy procedures.

Accordingly, Ukraine has established a regulatory limit to the scope for public support to

undertakings within the context of competition policy (i.e. prohibition of monopolisation or

elimination of competition and anti-competitive, discriminatory measures by public authorities).

The current legislation of Ukraine also provides for a number of legitimate exceptions from specific

prohibitions on discriminatory actions by the State, provided that such exemptions are established

by the laws of Ukraine. In turn, the existing legal provisions for public support to undertakings are

rather fragmented and do not fully comply with the principles and standards under the EU State aid

rules.

26

Following several unsuccessful attempts dating back to 2002, the Law “On State Aid to

Undertakings”12 was adopted in Ukraine on 1 July 2014 and published on 2 August 2014. Essentially

it is a framework law, allowing for a three-year transitional period until it becomes fully operative.

In the meantime, it is necessary to adopt an extensive range of secondary legislation, together with

significant institutional efforts, in order to ensure a fully functioning national State aid system.

On 4 March 2013, the Cabinet of Ministers adopted an Action Plan to implement the institutional

reform for the establishment of monitoring and control of State aid to undertakings, covering the

period 2013 to 202013. This act was primarily developed in order to meet a pre-condition for

proposed EU funded Comprehensive Institution Building (CIB) Programme for the development of

the State Aid system (with an indicative budget of up to €10 million). The main activities set out in

the Governmental Action Plan include the following:

drafting the relevant legislation on State aid;

collection of data on State aid;

institutional development;

establishment of a State aid register; and

training the staff of the AMCU and other stakeholders in the future operations of

the State aid system14.

The development of a national State aid system compliant with EU standards also needs to take

account of the interpretative jurisprudence of the European Courts and the EU State Aid

Modernisation Programme, launched by the European Commission on 8 May 2012, which seeks,

inter alia, to:

12

identify new common principles for assessing the compatibility of aid with the internal

market, across various legislative acts (guidelines and frameworks);

revise, streamline and possibly consolidate State aid rules to make them consistent

with those common principles;

revise the General Block Exemption Regulation, the Enabling Regulation and the De

Minimis Regulation in the EU system; and

modernise the Procedural Regulation and create a new common State aid evaluation

method.

Law of Ukraine “On State Aid to Undertakings”, No. 1555-VII of 1 July 2014.

13

Government Decision No. 102-p of 4 March 2013 concerning the main provisions for institutional reform in

the field of State aid.

14

The Action Plan is more of a general road map for the State aid system than an Institutional Development

Plan (IDP) per se. Its biggest weakness is the absence of any indication as to how staffing and other resources

are to be mobilised and organised to create the basic institutional structures and network necessary to carry

out any of the specific actions in the Action Plan and many others that will be needed for the establishment

of the State aid System. This Action Plan was not accepted as effectively fulfilling the terms of the precondition for EU CIB funding and is currently being revised.

27

CHAPTER 3: MAIN FORMS OF STATE SUPPORT

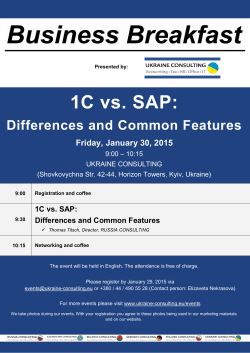

The overall structure of State support to enterprises in Ukraine is presented below in Table 2 and in

Figure 1. This structure was developed on the basis of publicly available statistics about budget

expenditures, classified as support to economic activities, and their assessment by the experts

involved in the Study. This structure does not include public liabilities stemming from quasi-fiscal

operations; as there is very little statistical information available concerning these operations and

they have been included into the Study only to demonstrate the risk of inadequate compensation

to undertakings involved in quasi-fiscal activities the Study also analyses one example of these

activities by the National Joint Stock Company «Naftogaz of Ukraine».

The structure of public support to undertakings in Ukraine includes both forecast and actually

disbursed amounts of budget expenditures for support of economic activities. The amounts spent

and revenues foregone, as presented in Table 2 and in Figure 1, have been calculated exclusively for

the purpose of demonstrating the most popular forms and approximate volumes of public support

to economic activities in Ukraine. Further adjustments to the proposed structure may be needed

when relevant data are made available in accordance with the international accounting standards

for public finances, including fiscal accounting standards.

State support to undertakings in Ukraine have been provided mainly in the form of tax benefits,

direct subsidies and compensations from relevant budgets, as well as through State guarantees

securing borrowings by State-owned enterprises. In 2014 there were some 150 legislative

provisions providing tax exemptions and tax breaks, budget subsidies for operational needs of

State-owned enterprises and institutions including compensations for the provision of services of

general interest, as well as for providing State guarantees to undertakings in the energy and coal,

ship and aircraft building, agriculture and some other sectors. An overview of sectoral supports is

set out in Table 3.

Table 2: Structure of budget support to economic activities in Ukraine - 2011-2013

UAH. billion

%

2011

2012

2013

2011

2012

2013

Total volume of budget expenditures/ revenues

foregone due to support of enterprises

(institutions, organisations)

91.39

163.38

92.14

100

100

100

Budget subsidies and money transfers to

enterprises (organisations, institutions)

24.60

43.20

29.40

26.92

26.44

31.91

Tax benefits as budget revenue foregone

(excluding 11020255, 11020284, 11020025)

46.66

37.02

32.57

51.05

22.66

35.35

State guarantees to undertakings

12.84

75.35

21.90

14.05

46.12

23.77

Write offs of social insurance contributions

2.90

3.10

3.50

3.17

1.90

3.80

Write offs of tax liabilities (revenue foregone)

2.70

3.10

2.90

2.95

1.90

3.15

Budget support measures to restructuring of

enterprises

1.66

1.11

1.33

1.82

0.68

1.45

Budget expenditures for investment projects

financed through loans (credit) from foreign States,

banks and international financial institutions

0.03

0.50

0.54

0.03

0.31

0.58

28

Fig.1 Structure of main forms of State support to economic activities in 2011-2013

Disclaimer:

The diagrams of state support structure in Ukraine are based on the official statistics and on the experts’

assessment. The scope of quasi-fiscal operations are not included into the official statistics, although such

29

operations, presented as an example of "Naftogaz Ukraine", have been considered by the experts. In order to

present several forms of state support as a consolidated structure, both planned and actual (registered)

expenditures have been taken into account, although these will require futher clarifications due to the

introduction of International Financial Reporting Standards, including for fiscal purposes.

Table 3: Consolidated budget expenditures by sector to support economic activities, UAH million

Major expenditures

General economic, commercial

activities

Agriculture, forestry, hunting and

fisheries

% of total

Fuel and energy complex

% of total

Fuel/Energy complex components: