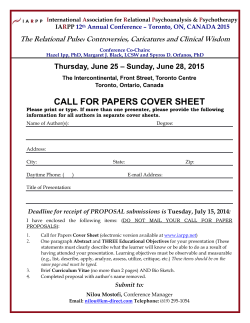

The Effects of Governance on Relational and