THE MONTGOMERY FUND

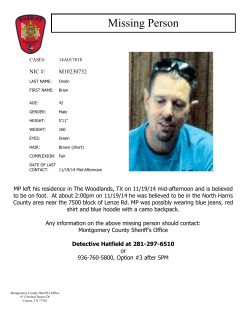

THE MONTGOMERY FUND ARSN 159 364 155 | APIR FHT0030AU April 2015 INVESTMENT REPORT ADDITIONAL INVESTMENTS AND NEW INVESTORS The Montgomery Fund $167,066 02 8046 5000 ASX 300 Accumulation Index $148,586 www.montinvest.com/tmf [email protected] To make an additional investment in the Fund, complete the Additional Investment Form on page A13 of the Application Form, which can be downloaded with the Product Disclosure Statement from www.montinvest.com/tmf. INDUSTRY Information Technology 10% Telecommunications Services 7% Industrials 13% Health Care 22% QUALITY AND PERFORMANCE Consumer Discretionary 7% B3 22% Financials 41% A1 19% Top 50 25% B1 3% A3 14% MARKET CAPITALISATION A2 42% Top 100 ex. Top 50 34% Outside Top 300 3% Top 300 ex. Top 100 38% Page 1 of 2 FUND COMMENTARY APPLICATION AND REDEMPTION PRICES* (at 30 April 2015) (cum distribution) After a buoyant start to the year, the two months to end April 2015 saw a more subdued equity market, with the S&P/ASX300 Accumulation Index losing 1.7 per cent for the period. In part this result reflected a continuing deterioration in the iron ore price, and the “chase for yield” appearing to take a welcome rest. The large miners and big four banks represent a large part of the benchmark index, and a lacklustre showing from these companies translates into a lacklustre showing for the market overall. The Montgomery Fund’s limited interest in these sectors helped it to deliver a somewhat better result – a positive return of 0.66 per cent for the two months, for outperformance of 2.36 per cent. While performance suffered due to the announcement in March of some disappointing clinical trial results for Sirtex Limited, The Fund’s other investments generally performed well, including a material contribution from iiNet Limited, which became the target of takeover interest. With equity prices remaining generally on the expensive side of fair value, we remain cautious in our approach. We continue to look for opportunities, but it may be some time before we see them in quantity. Fund application price $ 1.5142 Fund mid price $ 1.5105** Fund redemption price $ 1.5067 *The Fund is forward-priced; you will receive the price struck subsequent to the receipt of your application/redemption request. **The **The **The **The Montgomery Montgomery Montgomery Montgomery Fund Fund Fund Fund went went went went ex ex ex ex 7.2834 0.9540 3.0949 1.4073 THE MONTGOMERY FUND S&P/ASX 300 ACCUM. INDEX OUT/UNDER PERFORMANCE cents cents cents cents per per per per unit unit unit unit distribution distribution distribution distribution on on on on 30 31 30 31 June 2013 December 2013 June 2014 December 2014 PORTFOLIO STRUCTURE COMPONENT % $ Equities weighting 72.2% $ 233.0m Cash weighting 27.8% $ 89.5m TOP COMPLETED HOLDINGS* (TCH) Q&P SCORE RETURN ON EQUITY (%) Challenger Ltd A3 13.2 n/a 11.4 Henderson Group A2 18.0 -8.4 17.1 CSL Ltd A2 43.0 40.5 23.6 SEEK Ltd A2 19.6 3.6 28.0 COMPANY NAME PORTFOLIO PERFORMANCE (to 30 April 2015) Historical unit prices available at www.fundhost.com.au/investor/tmf NET DEBT/ PRICE/ EQUITY (%) EARNINGS (X) 2 months 0.66% -1.70% 2.36% Westpac Banking Corp Ltd A1 15.8 n/a 13.0 6 months 9.94% 7.12% 2.82% Aust & NZ Banking Group Ltd A2 15.9 n/a 12.9 15.83% 10.16% 5.67% Ansell Ltd B3 15.7 36.3 16.1 Burson Group Ltd B3 20.0 64.4 25.9 Flexigroup Ltd B3 15.8 n/a 11.2 Ramsay Health Care Ltd B3 22.4 68.9 27.9 TCH AVERAGE 19.9 34.2 18.7 ASX 300 AVERAGE 15.2 61.4 18.0 12 months 2 years (p.a.) 13.86% 10.15% 3.71% Since inception# 67.07% 48.59% 18.48% Compound annual return (since inception)# # 17 August 2012 20.52% 15.49% 5.03% *Top Completed Holdings are businesses we own but are not actively buying or selling at the time of writing. Investment Manager Montgomery Investment Management Pty Ltd | ABN 73 139 161 701 | AFSL 354 564 | Suite 7.02, 45 Jones Street Ultimo NSW 2007 | 02 8046 5000 | www.montinvest.com Responsible Entity Fundhost Limited | ABN 69 092 517 087 | AFSL 233 045 | PO Box N561 Grosvenor Place NSW 1219 | 02 8223 5400 | www.fundhost.com.au | [email protected] | [email protected] # Portfolio Performance is calculated after fees and costs, including the Investment management fee and Performance fee, but excludes the buy/sell spread. All returns are on a pre-tax basis. This report was prepared by Montgomery Investment Management Pty Ltd, AFSL No: 354564 ("Montgomery") the investment manager of The Montgomery Fund ("TMF"), ARSN 159 364 155. The Responsible Entity of The Fund is Fundhost Limited (ABN 69 092 517 087) (AFSL No: 233 045) ("Fundhost"). This document has been prepared for the purpose of providing general information, without taking into account your particular objectives, financial circumstances or needs. You should obtain and consider a copy of the Product Disclosure Document ("PDS") relating to the Fund before making a decision to invest. Available here: http://fundhost.com.au/investor/tmf. While the information in this document has been prepared with all reasonable care, neither Fundhost nor Montgomery makes any representation or warranty as to the accuracy or completeness of any statement in this document including any forecasts. Neither Fundhost nor Montgomery guarantees the performance of the Fund or the repayment of any investor’s capital. To the extent permitted by law, neither Fundhost nor Montgomery, including their employees, consultants, advisers, officers or authorised representatives, are liable for any loss or damage arising as a result of reliance placed on the contents of this report. Past performance is not indicative of future performance. Page 2 of 2

© Copyright 2026