POULTRY INVESTMENT PROPOSAL

POULTRY INVESTMENT PROPOSAL Gambia Investment & Export Promotion Agency Business & Export Development Department Contents COUNTRY BRIEF ............................................................................................................................................ 3 Background ............................................................................................................................................... 3 Economy.................................................................................................................................................... 3 Geography................................................................................................................................................. 3 People ....................................................................................................................................................... 3 Why The Gambia? ......................................................................................................................................... 4 THE POULTRY SECTOR FACTS AT A GLANCE ................................................................................................. 5 Eggs ........................................................................................................................................................... 5 Broiler Chicken .......................................................................................................................................... 5 SECTOR OVERVIEW ....................................................................................................................................... 5 Trends in Production and Imports ................................................................................................................ 6 The Poultry Value Chain ................................................................................................................................ 7 Hatcheries ................................................................................................................................................. 7 Suppliers of day-old chicks (DOC) ............................................................................................................. 7 Feed Production and Distribution............................................................................................................. 7 Marketing of Chicken ................................................................................................................................ 7 Marketing of Eggs ..................................................................................................................................... 8 Broiler production Cost and Return (USD$).................................................................................................. 8 Commercial Layer Production Cost and returns (USD$) ............................................................................... 9 Investment Opportunities in the Poultry Value Chain ................................................................................ 10 Profile of the Enabling Environment ........................................................................................................... 10 Tariff and Pricing Policies for the Industry .................................................................................................. 11 Available Investment Incentives ................................................................................................................. 11 2|Page COUNTRY BRIEF Background • • • • Gained independence in 1965 Government type – Republic Capital – Banjul Mixed legal system of English common law, Islamic law, and customary law Economy • • • • • • GDP in Purchasing Power Parity (PPP) is US$3.774 billion in 2011 (est.) GDP in real terms is US$1.1 billion (Official Exchange rate) GDP growth rate in 2011 is 5.5% GDP per capita in PPP terms is US$2,100 Economy comprises of Agriculture, Industry, and Service sectors Agriculture accounts for 30% of GDP: Industry 15%; & Service 55% Geography • • • • Situated in west Africa, bordering the North Atlantic Ocean and Senegal Total land area of 11,295 square kilometers 1,295 square kilometers of water bodies with 80 kilometers coastline Exclusive fishing zone of 200 nautical miles with continental shelf People • • • • • • Population size of 1.8 million (est.) 0-14 year age group accounts for 405 of the population 15-64 year age group accounts for 56.9% of the population 56 years and over accounts for 3.1% Annual population growth rate is about 2.344% Literacy, defined as those of age 15 and over who can read and write • 40.1% of the population is literate • 47.8% literacy rate for males • 32.8% literacy rate for females 3|Page Why The Gambia? The investment climate remains positive as evidenced by the stable political and macroeconomic environment. The business environment continues to be conducive for foreign direct investment and private public partnership initiatives. The country has open and liberal trade policies with a commitment to improving public service delivery. The country has a comparatively well educated and cheap labor force competitive to any country in the sub-region. As a member of the Economic Community of West African State (ECOWAS), the Gambia is an economic gateway providing access to an ECOWAS market of over 300 million consumers. Being a developing country, the Gambia also has its fair share of challenges. Principal among these are: • It being a small open economy with low domestic demand given its population size. • Endowment with a narrow natural resource base. • An undiversified export base • Low domestic savings • Heavy reliance on agriculture for employment • Growth volatility given reliance on a few real sector activities and terms of trade vulnerabilities. In view of the Government’s effort to make Gambia the Gateway to West Africa, efforts are still being made to improve the business environment in efforts to reducing cost of doing business. The government is keen to make Gambia a leading agro-industrial nation and therefore is committed to providing incentives to increase agricultural productivity and investment. The Gambia is attractive to foreign direct investment for a number of reasons. These include….. • • • • • Stable political environment: Gambia is a stable democracy with transparent and accountable governance with a legal system premised on English law. Macro-economic policies: The Gambia has macroeconomic policies with the principal mandate of ensuring price stability and prudent government expenditure. Capital Accounts: The Gambia has a liberal business environment with provision for 100% foreign investment ownership and allowance for profit repatriation. Access to ECOWAS Market: Gambia is easily accessible to the markets of all the member states of the Economic Community of West Africa (ECOWAS) with a market of about 300 million people. Physical infrastructure: The Gambia has a well developed seaport, airport and road networks capable of meeting the transportation needs of businesses. Telecommunication facilities in The Gambia are excellent with more private service provides offering telephone, internet and other telecommunication services. 4|Page • • Labor force: Currently has an educated human resource base, both skilled and unskilled labour, with relatively cheap wage rates. Warm and friendly people: Gambia is internationally acclaimed for her hospitality to investors and tourists. THE POULTRY SECTOR FACTS AT A GLANCE Eggs • • • Consumption: 200,000 eggs daily Total annual imports: in 2010 was 3,439 metric tons Current domestic production: 18,000 eggs daily, domestic production only meets 9% of total egg consumption daily Broiler Chicken • • • • Total import: 18,000 tons annually Total domestic production: 300 ton annually Total domestic production: less than 1% of consumption Feed production plant: capacity of five thousand (5000) tons daily SECTOR OVERVIEW Globally the poultry market is dominated by the United States. The US accounts for just over 20% of the world production, of which 17% is exported. China, Brazil and Thailand are making inroads in the broiler production. Tariff and non-tariff barriers are erected both by developed and developing countries to protect their poultry industry from competition. These barriers make it difficult for poultry farmers and businesses in developing countries to compete because of the imports of cheap subsidized poultry products from the US and the EU. The global broiler production has increased by 37% between 2002 to 2011. Consumption of chicken and other chicken products also continues to grow. Currently nearly 42 kilograms of chicken is produced per person worldwide, but chicken consumption varies greatly by region and socioeconomic status. In the developing world, people eat about 30 kilograms of meat a year, but consumers in the industrial world eat more than 80 kilograms per person each year. With the above trends there are growth opportunities in both developed and developing country markets. With the limited growth opportunities in developed countries, poultry businesses are increasingly attracted to developing markets where growth is strong. The domestic poultry farmers have to raise production and efficiency levels to be able to compete against imports. A modern state of the art animal feed plant with a capacity of 5000 metric tons a day is recently been commissioned. This will reduce the high costs, limited availability and poor quality of locally produced feed. 5|Page Trends in Production and Imports The Food and Agricultural Organization estimates of chicken meat and egg production from 200 to 2008 are presented in the table below. The table also shows the amount of poultry products (whole chicken, cut and offals) imported from 2000 to 2009. It is clear that annual production does not satisfy the needs and requirements of the country. The differential figures below indicates gap in domestic production and this presents an opportunity for investment in the poultry industry. Production and Imports (in metric tones) Local Production Imports Local Production Imports Item 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Eggs 731 731 731 731 748 748 780 830 850 NA Eggs Difference Poultry Products Poultry products Difference 1,412 681 960 1,293 562 900 1,941 1,210 1,100 825 94 950 1,214 466 1,080 1,15 667 975 889 109 1,020 1,247 417 1,120 638 212 1,120 565 565 NA 3,614 3,642 4,467 2,067 1,865 2,983 3,213 1,865 2,745 4,237 2,654 2,742 3,367 1,117 785 2,008 2,193 745 1,625 4,237 Source: FAOSTAT, 2011; Gambia Bureau of Statistics, 2010. Poultry products are imported from different sources, but predominantly from Brazil with TAJCO and CONTICOM being the major local importers. Monthly importation of eggs for 2010 is presented in figure below and shows fluctuations in both values and quantities. The highest monthly importation of eggs was reported in October (270 MT) coinciding with the start of the winter tourist season and the least in August. Monthly Imports of Eggs in 2010 3000 2500 2000 1500 Values D'000 1000 Quantity MT 500 0 6|Page The Poultry Value Chain The poultry value chain in The Gambia has tremendous value and has been relatively under-developed. The market is flooded with cheap broiler/eggs mainly from Brazil, Holland and Middle East which makes it difficult for local producers to compete. However, there exist opportunities in the domestic market which is yet to be exploited. Hatcheries • • • • No Breeders and Hatcheries are currently established in country RHUE Farm has a 19,200 capacity hatchery, but import fertile eggs from USA, and RHUE Farm has a capacity to produce 17,228 broiler day-old chicks MOGGIE Farm plan to install a 20,000 capacity hatchery, and will import fertile eggs from Holland Suppliers of day-old chicks (DOC) • • • • • • • Day-old chicks (DOC) are mainly imported from Senegal and Holland According to Animal Health and production services 30,000 broiler and 60,000 layers DOC were imported in 2004 Department of Veterinary Services (DVS) indicated that 64,800 broiler and 37,872 layers DOCs were imported in 2007 According to the Gambia Bureau of statistics (GBOS), 222,000 DOCs were imported in 2010 Currently, the main local importers are SAADIS, ROMAR and AHPS Cost of importing 10,000 DOCs per flight from Europe is €8,000 Importers pay US$1.20 and US$1.55 per broiler and layer DOCs respectively Feed Production and Distribution There are 2 major feed mills and a third feed mill under construction in The Gambia. These comprise BSC Farms and SAADIS and the New Feed Plant. There also exist maize, oyster shells and smoke fish suppliers that provide ingredients to the feed manufacturers and producers. • • • • • • • BSC Farms sell poultry feed packed in 50kg bags at US$27.85/bag SAADIS sell poultry feed packed in 50kg bags at US$30.17/bag for broiler and US$26.72 for layer Charge a transportation fee of US$0.35 per bag Kharafi Farm sell maize at US$0.32 per kg Local Market (SANDIKA and LUMOS) sell from US$0.22 per kg at harvest in October/November to US$0.45 per in August/September Oyster shells sold at US$0.10per kg Smoked fish packed in 30kg box sold at prices range from US$13.79 to US$20.70 per box Marketing of Chicken • The marketing of broilers is conducted at the production site and involves the selling of live birds and dressed frozen broilers to individuals or to middlemen 7|Page • • • • • Daily labor cost for slaughtering, processing and packaging on farm is at US$1.72 per person or US$0.10 per bird Farm gate prices of live birds range between US$3.45 to US$5.17 per bird Farm gate prices for dressed chicken range between US$3.45 to US$5.17 per bird Dressed broilers are sold between US$4.31 to US$5.17 through the supermarket network Poultry manure bagged in 50kg bags sold at US$3.45 Marketing of Eggs The producers market their eggs through the following channels: • • Middlemen or Collectors collect eggs from the producers and sell them to retailers operating small retail shops, kiosks and restaurants in urban centers and to domestic consumers. • Purchase price of a 30-egg crate or tray depending on size and availability range between US$3.45 to US$4.31 • Normally sold at a markup of 10% when they resell to customers Retailers operating small shops and kiosks in urban centers sell single eggs or crates to domestic consumers whilst the super and minimarkets retail eggs by the crate/tray. • Small retail shop sell a single egg at US$0.17 • Super an Minimarkets sell a 30-egg crate for US$4.82 to US$5.00 • ROMAR Farm with its distribution network of Marouns Supermarket, EM Holdings, ELTON, GALP and JAPAL retail at US$3.96 per crate Broiler production Cost and Return (USD$) The production cost of the commercial broiler production system is estimated 500 birds. This is presented in the table below. It shows a total cost of US$2,220.50 with revenue of US$2,353.45 with a US$132.93 for the first cycle of 8 weeks. The margin in the second cycle is higher at US$388.96. The housing costs are not included in the model. Production and Revenue Computation of a commercial Broiler Enterprise with 500 birds Cycle Item Broiler Chicks Feeb Broiler starts (0-3 wks) 50kg bags Feed broiler(4-8 wks) 50kg bags Plastic Drinkers Feeding Troughs Drugs/biosecurity(lump sum) Brooding Materials(lump sum) Labour-month Slaughtering/processing/packaging Unit cost 1.20 27.58 1st Cycle Quantity Total Cost 500 603.45 15 413.79 2nd cycle Unit Quantity Total Cost Cost 1.20 500 603.45 27.58 15 413.79 27.58 6.03 4.13 25 16 33 27.58 25 689.65 51.73 2 0.10 490 68.96 17.24 103.45 50.68 51.73 0.10 2 490 689.65 96.55 142.24 68.96 34.48 103.45 50.68 8|Page Marketing Cost Total Cost Revenue Sale of Broilers Sale of Offals Sale of organic manure Total Revenue Gross Margin 17.24 2,220.50 4.13 490 2,112.06 103.45 137.93 2.353.45 132.93 17.24 1,964.48 4.13 490 2,112.06 103.45 137.93 2,353.45 388.96 Source: value chain analysis of the poultry industry in The Gambia With such a project, the profit margin is about 200%. An annual increase sales volume 10-15% will be expected in the first five years whilst Day-Old-Chick (DOC) breeding program will be ongoing to enable the farm to maintain and increase its production of DOC into broilers and layers. Commercial Layer Production Cost and returns (USD$) The production cost of the commercial layer production system is estimated using 500 layers. This is presented in the table below. It shows a total cost of D372, 275.00 with a gross margin of D210, 100.00 for a production cycle of 80 weeks. Housing not included in the model. Production and Revenue Computation of a Commercial layer Enterprise with 500 birds 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 Item Layer Chicks Feed Starter (0-8 wks) 50kg Bags Mortality rate (1.2%) Number of birds (1-3) Feed Grower (9-18 wks) 50kg Bags Mortality rate (0.8%) Number of birds (3-6) Feed layer mash (19-80 wks) 50kg bags Plastic drinkers (5 liters) Feeding Troughs (1m lengths) Drugs/Biosecurity (lump sum) Debeaking Brooding materials (lump sum) Nest Boxes (lump sum) Labour 18 months Egg trays Marketing Cost (lump sum) Total Cost Mortality during laying period (3%) Number of birds (6- 19) Revenue Eggs Spent Layers Unit Price 1.55 27.58 Quantity 24.14 6.89 6.89 500 23 6 494 34 4 490 356 16 30 51.73 0.05 18 4275 27.58 15 475 0.14 4.13 128,250 475 Total Cost 775.86 634.48 937.93 8,593.10 110.34 206.89 241.38 86.20 34.48 68.96 827.58 147.41 172.41 12,837.06 25,674.13 17,689.65 2,047.41 9|Page 24 25 26 Organic Manure Total Revenue Gross Margin (25-18) 344.83 20,081.89 7,244.82 Source: value chain analysis of the poultry industry in The Gambia 2010 Investment Opportunities in the Poultry Value Chain Based on the challenges faced by the actors in the poultry sector, the following investment opportunities exist in The Gambia. • • • Specialized poultry slaughter and packaging facility : A state of the art Slaughter/Packing facility will compliment the poultry sector immensely. Currently the only packaging that a commercial poultry producer could consider is located in Senegal. Hatchery for the supply of day-old-chicks (DOC) : Breeders and hatcheries play a crucial role in the commercial poultry industry because of supply of Day-Old Chicks (DOCs) to commercial farmers. However, all DOCs are currently imported from Senegal and Holland. With occasional shortages in supply. An investment in hatchery will improve the productivity and efficiency level of poultry producers and reduce their costs. Veterinary suppliers and services : Inadequate veterinary services make it difficult for poultry farmers to invest in broiler/layer breeding as this requires veterinary services. The lack of appropriate medicines and expertise is a threat to the success of farmers. Investment in complimentary veterinary services would help in boosting the poultry industry. Profile of the Enabling Environment In 2006 the Department of State for Agriculture with support from FAO prepared the draft Agriculture and Natural Resources Policy. The draft document provides a broad-based policy framework for the Agriculture and Natural Resources sector to cater for the following: • • • In the short term - a strengthened agricultural sector supported by at least 10% of the national budget, producing sustainable increased level of self-sufficiency in food production by at least 25% as well as increase income and food security of small holders; In the medium term – a sector linked to markets with measurable levels of productivity and competitiveness, leading the growth of the economy, reducing poverty, particularly rural poverty; and In the long term – a vibrant diversified modernized agricultural sector with high levels of competitiveness, and a major source of sustainable food security, agricultural trade and investment 10 | P a g e Tariff and Pricing Policies for the Industry The tariff charged by the National Water and Electricity Company (NAWEC) for water and electricity for agricultural purposes are less that the charges for domestic and commercial purposes. • • Water charges US$0.27 per cubic meter Electricity charges US$0.28 per kilowatt hour Available Investment Incentives Investment incentives are offered by the Gambia Government and administered by the Gambia Investment and Export Promotion Agency (GIEPA). Minimum investment of two hundred and fifty thousand US Dollars (USD250, 000) in priority sectors (Agriculture is a priority sector) qualify for a Special Investment Certificate (SIC) or EPZ License for businesses looking at exporting. Holders of these qualify for the following: • Tax Holiday for 5 years on Corporate or Turnover Tax (32%) • Import Sales Tax Waiver on importation of manufacturing plant, construction materials, and spares for a period of 5 years from date of signing an investment agreement. • Import Sales Tax Waiver on importation of raw and intermediate inputs for a period of 5 years from the date of commencement of operations. • Exemption from Depreciation Allowance calculations for tax purposes. • Exemption from Withholding Tax on Dividend Payments. Further to the above incentives, businesses designated as Economic Processing Zones (EPZ) qualify for the below incentives depending on the percentage of manufactured products exported. Those exporting a minimum of 80% of their output qualify for the following waivers: • Import or Excise Duty & Sales Tax • Corporate or Turnover Tax • Municipal Tax • Import Duty on Capital Equipment • Withholding Tax on Dividends • Depreciation Allowance. Those exporting 30% of their products but below 80% within designated EPZ qualify for the following: • Ten percentage points concession on Corporate Tax for Five Years 11 | P a g e • Financial planning and advisory services • Participation in training courses, symposia, seminars and workshops on export promotion. • Export market research • Advertisement & publicity campaigns in foreign markets • Product design & consultancy services Investments located within an EPZ, irrespective of percentage of manufactured products exported, enjoy these incentives and benefits over an eight year period. Licenses entitling investors to these benefits are, however, renewable on a yearly basis under circumstances of evidence of compliance with the agreed guidelines of employment creation, export thresholds, and general EPZ protocol and statutes. 12 | P a g e

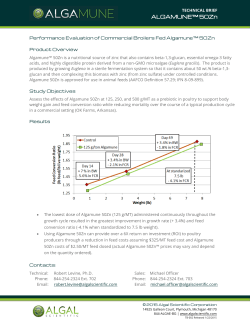

© Copyright 2026