NAI SIOUX FALLS Year End Market Report 2007

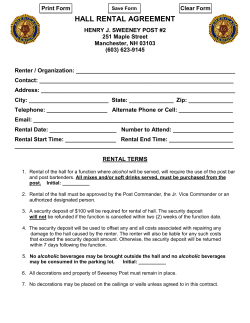

NAI SIOUX FALLS Year End Market Report 2007 ∞ INDUSTRIAL ∞ RETAIL ∞ OFFICE ∞ LAND ∞ INVESTMENT ∞ MULTI-FAMILY ∞ CORPORATE SERVICES ∞ PROPERTY MANAGEMENT INTRODUCTION We are pleased to present The NAI Sioux Falls Year End 2007 Market Report, an analysis of the Sioux Falls commercial real estate market. Our goal is to provide you with a detailed perspective on the area’s vibrant commercial real estate market. NAI Sioux Falls is one of Sioux Falls’ largest and most active commercial real estate firms. It is the Sioux Falls area representative for NAI Global, the industry’s largest managed network of global real estate service providers, comprised of over 3500 professionals in 300 markets in 45 countries. The process of building the comprehensive computerized property database necessary to produce this detailed report began in June of 1999 when Dennis Breske founded Sioux Falls Commercial, Inc. Through the efforts of our licensed agents, summer interns and our full time database administrator, we have detailed information on 753 industrial properties, 635 office buildings, 988 retail buildings and 953 multi-family properties. We are now gathering information on properties in the surrounding communities of Tea, Brandon, Harrisburg, Dell Rapids and Hartford. This report is being sent to approximately 3500 Sioux Falls area business leaders. You have been selected to receive this report because you are either a current owner of commercial property in the Sioux Falls market, or a professional serving individuals involved in the local commercial real estate market. NAI Sioux Falls’ agents are in the market daily, insuring the most current, comprehensive market knowledge for our clients. Give us the opportunity to earn your trust, and we will deliver results. Sincerely, Dennis Breske, CCIM, SIOR, MBA President and Co-owner Troy Fawcett, CCIM, SIOR Vice President and Co-owner Methodology The NAI Sioux Falls annual market update for the City of Sioux Falls is a comprehensive report designed to provide you with an accurate, objective representation of the local commercial real estate climate. We have drawn on our resources, expertise, and supporting data to compile this detailed snapshot of the local market. The statistics have been extracted from our internal database, with up-to-date information supplied by our brokerage and management staff. We have also utilized data available from the City of Sioux Falls. our agents Dennis Breske CCIM, SIOR, MBA President Troy Fawcett CCIM, SIOR Vice-President Tom Ode Broker Associate CCIM Candidate Land Specialist Kathleen Hovland Broker Associate CCIM Candidate Retail/Office Specialist Dan Tunge Broker Associate Industrial Specialist Mike Hauck, J.D. Vice President & Chief Operating Officer Office Properties/ Business opportunities Jeff Brooks Broker Associate CCIM Candidate Multi-Family Specialist Jim Wilber Broker Associate Ag Land Specialist 2007 Building Permit Statistics I. New Residential Buildings 1. Single-Family Dwellings 2. Townhouses (40) 3. Duplexes (65) 4. Apartments (25) New Dwelling Units Building Permit Value 889 (-9%) $127,111,551 (-6%) 234 (+95%) $15,368,067 (-2%) 108 (+217%) $14,921,069 (+292%) 426 (+19%) $30,422,275 (+31%) 5. Other (2) $679,000 (-84%) II. Residential Buildings 1. Additions (545) $5,000,719 (-25%) 2. Repair (859) $4,119,920 (+13%) 3. Remodel (1254) $10,259,138 (-26%) 4. Roofing and Siding (1234) $7,270,271 (+12%) 5. Foundation (44) 6. Change in Use (9) $2,179,400 (+356%) 1 7. Accessory Buildings (298) $384,700 (-19%) $825,914 (+15%) 8. Accessory Buildings-Garages (105) $1,836,841 (+15%) 9. Other (93) $ III. New Nonresidential Buildings 1. Light Manufacturing (13) $9,578,000 (26%) 2. Heavy Manufacturing 3. Transportation (1) $2,500 (-99%) 4. General Commercial (5) $2,781,000 (-72%) 5. Intensive Commercial (10) $9,240,800 (-60%) 6. Office, Institutional (31) 54 7. Entertainment, Recreation (8) $88,012,755 (+28%) $10,114,639 (231%) 8. Agricultural (1) IV. Nonresidential Buildings 1. Additions (58) $57,852,852 (+36%) 2. Repair (70) $1,220,960 (-62%) 3. Remodel (444) $69,808,722 (+89%) 4. Foundation (33) $9,493,500 (-25%) 5. Roofing and Siding (90) $2,624,913 (-10%) 6. Change in Use (25) 35 7. Accessory Buildings (13) $8,328,500 (+124%) $241,018 (+45%) 8. Accessory Buildings-Garages (3) $58,732 (-99%) 9. Other (72) $15,478,019 (+172%) V. Demolition and Razing of Buildings 1. Main Buildings (71) 2. Accessory Buildings (18) State Exempt Projects Total Number of Permits in all Categories Total Amount of All Categories SOURCE: Planning and Building Services Note: Percentages + or—relate to last year’s statistics $16,800,000 6428 (+0.1%) $523,125,775 (+18%) 2007 Building Permit Statistics Permits Issued: The total number of building permits issued in 2007 totaled 6,428, only 0.1 percent above permits issued in 2006, which was 6,419. The number of permits issued in 2007 is significantly lower than the record number of permits, which totaled 7,722 in 2002. Residential: In addition to the 889 single-family units issued in 2007, there were 108 duplex units, 234 town home units, and 516 apartment units for a total number of 1,747 permitted dwelling units. The total number of dwelling units permitted increased from 1,568 in 2006 to 1,747 in 2007, an increase of 11.4 percent. The cumulative number of dwelling units issued in 2007 is the third highest number of dwelling units issued in a single year. Commercial: Leading the increase in construction valuation was the number of commercial projects that were submitted in 2007. There were 127 projects that were issued above the $500,0000 valuation; of those, 67 separate projects were submitted at $1,000,000 or more of construction valuation. The ten largest projects submitted in 2007 are: Sanford Children’s Hospital, 1600 West 22nd Street—$35 million University Center, 4800 North Career Avenue—$16.8 million Midland National Life Insurance, 5400 South Solberg Avenue—$15 million Sioux Falls Surgical Addition, 910 East 20th Street—$11.55 million Sanford Remodel and Additions, 1305 West 18th Street—$9.78 million Avera McKennan 4th Floor Remodel/Emergency Addition, 800 East 21st Street—$9.74 million Foxmoor at Steeplechase Apartments, 5005 Equestrian Place—$7.35 million Journey Elementary School, 6801 South Grange Avenue—$7.24 million Sanford Cancer Center Addition, 1309 West 18th Street—$6.60 million Courtyard by Marriott, 4300 West Empire Place—$6.40 million Legend and Sub-Market Boundaries Property classification definitions Class A = Building condition is above average Class B = Building condition is average Class C = Building condition is below average Sioux Falls Central Business District (“CBD”) NE NW CBD Sioux Falls Metropolitan Area SW SE 2007 At A Glance Retail Overview Total Retail Market Size Total Vacant Sq. Ft. 2007 Vacancy Rate 2006 Vacancy Rate The Sioux Falls market had va10,982,735 488,381 4.45% 5.61% cancies decrease in three of the five quadrants we track. Our most significant retail quadrant in Southwest Sioux Falls saw vacancies decrease from 6.64% at end of year 2006 to 4.62% at end of year 2007. Very little new retail coupled with the usual steady flow of new tenants allowed some of the struggling 2006 projects to make good progress filling vacant spaces. The Northwest and Southeast Quadrants also saw vacancies decrease. Look for 2008 to be a year of significant growth for the eastern end of the East 10th Street corridor given the strong likelihood that this will be the year that Dawley Farm Village and Galleria at Rivers Bend start seeing significant construction. Uncertainty in the national economy and a lack of prime development sites in the Southwest Quadrant will likely lead to very moderate growth for our main retail corridor. Efforts for retail projects in Southwest Sioux Falls will be focused on leasing the 300,000 square feet of existing vacant retail space. Northwest Sioux Falls has excellent long term potential for retail growth but significant construction of retail spaces will not start in earnest until significantly more single family homes are completed and the new I-90 – Marion Road interchange is complete. Buying commercial land in this area during 2008 before prices escalate may be a good move for the savvy investor/developer. Office Overview Total Office Market Size Total Vacant Sq. Ft. 2007 Vacancy Rate 2006 Vacancy Rate 8,692,211 776,162 8.93% 9.09% The Sioux Falls office market continues to move in a positive direction, fueled by the strength of the consistently stable local economy. The market saw a drop in the vacancy rates in each quadrant we track with the exception of the Northeast Quadrant. The office market experienced 233,618 square feet of positive absorption which means the total occupied square feet at end of year 2007 exceeded occupied square feet end of year 2006 by 233,618 square feet. With the cost of new construction constantly increasing, developers continue to ask for higher rental rates. So far, the market seems willing to pay the higher rates which are reaching as high as $ 18.00 triple net, though most newly constructed space is available for $ 14.00/sq.ft., triple net or less. Rental rates going forward will be largely dependent on absorption activity during 2008 as there is currently 776,162 square feet of vacant space available. With vacancy somewhat high at 8.93%, another year of positive absorption will put the market back to a more normal vacancy rate of 5%. We see the call center office market moving forward at a slower pace as national companies considering new locations are cautious about entering the highly competitive Sioux Falls call center labor market. Loyal to Sioux Falls, local call center operators will be responsible for the bulk of any growth in this market niche. The next big office market niche likely will be related to medical research facilities given the Sanford Health and Avera Health initiatives. Industrial Overview Total Industrial Market Size Total Vacant Sq. Ft. 2007 Vacancy Rate 2006 Vacancy Rate 13,582,130 458,396 3.37% 4.38% The Sioux Falls industrial real estate market maintained a below average vacancy rate and saw a nice amount of new construction during 2007. With a total market size of over 13,000,000 sq. ft., we are tracking about 450,000 sq. ft. of vacant space which yields a 3.36% vacancy rate. This low vacancy rate forced several industrial users to build new which led to another outstanding year for industrial land sales. The new Sioux Falls Development Foundation Park east of I-229, and the Jansmick Park located between I-29 and North Westport Avenue in the city’s northwest quadrant, were the main beneficiaries. New construction activity was led by the following projects: Krieser’s, Inc. (I-90 and Marion Road area); Cimarron Label and Baete Forseth HVAC, (North Westport Avenue area); Brower’s Moving and Architectural Roofing & Sheetmetal (Sioux Falls Development Foundation Park VIII – East 60th Street area east of I-229) The low vacancy rates and promising demand spurred a few speculative development projects. Flintwood Partners constructed a very high quality 64,512 sq. ft. tilt-up concrete building that is well suited for manufacturing or warehouse uses. Midwestern Mechanical built a new building for its own business and have 17,000 sq. ft. of speculative space for lease. The 17,500 sq. ft. Schmit Flex building has had some early success and has only 5,000 sq. ft. for lease. There are a number of projects out for bid moving into 2008. Industrial land prices should remain flat or experience very moderate upward price movement as there are still quite a few good sites with excellent access and infrastructure available. Rental rates for existing properties should be increasing due to low vacancy and the significantly higher asking rents associated with newly constructed properties. MultiFamily Overview PRESENTED BY Jeff Brooks Broker Associate Multi-Family Specialist Growing Demand Vacancy Rates Capitalization Rates The Sioux Falls market, comprised of Sioux Falls, Harrisburg, Hartford, Brandon and Tea, overall enjoyed a good year. The area’s steadily growing population has helped fuel the demand for apartments. According to the U.S. Census Bureau Report released July 1, 2006, Harrisburg had the highest growth rate from 2005 to 2006 for cities with a population of 1,000 or more. It grew at a rate of 31.4%, followed by Tea (10.9%), Brandon (6.4%) and Crooks (4.9%). Sioux Falls experienced the largest numeric growth with an increase of 2,902 persons, followed by Rapid City (697), Harrisburg (599), Brandon (463) and Brookings (442). Sioux Falls continues to be the most populous city in South Dakota with a population of 142,396. According to the July 2007 Vacancy Survey, conducted by the South Dakota Multi-Housing Association (SDMHA), the average vacancy rate for the Sioux Falls market for all unit types (Conventional/Tax Credit/HUD) was 6.53%, compared to 5.23% for the same time last year. Capitalization rates for 2007 multifamily product in the Sioux Falls market ranged from mid 7.00% to mid 9.00%. Building Permits In 2007, the City of Sioux Falls issued $30,422,275 million (+31%) in apartment building permits that will result in 426 units (+19%). Building permits for duplexes totaled $14,921,069 (+292%) that will result in 108 units (+217%). Townhouses totaled $15,368,067 (-2%) that will add 234 units (234%) to the Sioux Falls Market. Out-of-state investors are expected to play a considerable role again this year, drawn by cap rates that are higher than those available in major coastal markets. Investment Forecast Ambitious projects, such as the Sanford Health Project and a pro-business environment, are expected to add local jobs and generate additional demand for multi-family units in the Sioux Falls market. Largest 2007 Multi-Family Transactions: Below is a breakdown of the five largest multi-family transactions for 2007 in the Sioux Falls market: Property Sale Price Sale Date Units Price/Unit Platinum Valley Apartments Somerset Apartments Hamlet Apartments Charlotte's Place Apartments Willow Wood Apartments $19,537,800.00 $15,811,238.00 $9,669,722.00 $8,052,000.00 $6,550,000.00 May-07 August-07 August-07 May-07 September-07 264 360 210 248 168 $74,006 $43,920 $46,046 $32,467 $38,988 Somerset Apartments Hamlet Apartments If you are interested in either buying or selling a multi-family property, please call Jeff Brooks (605) 444-7122 or e-mail [email protected]. Please visit our website at www.siouxfallscommercial.com for further information and a list of our current multi-family property listings. Mike Hauck Broker Office/Investment Specialist OFFICE Kathleen Hovland Broker Associate Office Specialist MARKET REVIEW Central Business District (CBD) Northwest Quadrant (NW) CBD OFFICE VACANCY STATISTICS NW OFFICE VACANCY STATISTICS Northeast Quadrant (NE) NE OFFICE VACANCY STATISTICS CBD Total Sq. Ft.: 2,289,566 NW Total Sq. Ft.: 1,070,371 NE Total Sq. Ft.: 1,641,928 CBD Vacant Sq. Ft.: 144,676 NW Vacant Sq. Ft.: 77,722 NE Vacant Sq. Ft.: 90,139 CBD Overall Vacancy: EOY ‘06 6.61% EOY ‘07 6.32% NW Overall Vacancy: EOY ‘06 8.81% EOY ‘07 7.26% NE Overall Vacancy: EOY ‘06 2.28% EOY ‘07 5.49% CBD Class A Vacancy: 2.05% NW Class A Vacancy: 0% NE Class A Vacancy: 3.25% CBD Class A Rental Rates/Sq. Ft.: $14 to $18 NW Class A Rental Rates: CBD Class B Vacancy: 5.2% NW Class B Vacancy: 6.36% NE Class B Vacancy: 7.07% CBD Class B Rental Rates/Sq. Ft.: $12 to $15 NW Class B Rental Rates/Sq. Ft.: $7.50 to $10 NE Class B Rental Rates/Sq. Ft.: $7 to $11 CBD Class C Vacancy: * NW Class C Vacancy: * NE Class C Vacancy: CBD Class C Rental Rates/Sq. Ft.: $8 to $10 NW Class C Rental Rates/Sq. Ft.: $6.50 to $9 NE Class C Rental Rates/Sq. Ft.: $6.50 to $10 CBD NOTABLE OFFICE EVENTS * SECOG on North Western Ave. NE Class A Rental Rates/Sq. Ft.: $12 to $14 * NE NOTABLE OFFICE EVENTS Security National Bank Building renovation New Army Reserve Office Building Cherapa Place new home to CorTrust Bank, Howalt McDowell, Risk Administration Services and Sanford Health Plan Completion of POET expansion Northwestern vacates 27,000 sq. ft. in Qwest Tower Corporate Center Building New four story office building-Minnesota Centre at 9th and Minnesota NW NOTABLE OFFICE EVENTS The Credit Union Building at 500 North Western Avenue sold to SECOG-$315,000 Cherapa Place NW 2008 OFFICE PROJECTS TO WATCH Additional growth in the office market near e-Surance, Premier Bankcard and Midco CBD 2008 OFFICE PROJECTS TO WATCH Van Buskirk Companies new development at the Northwest intersection of Benson & Marion Road Houwman Building renovation Further development of Jansmick land between Westport and I-29 Uptown At The Falls—The Arches First Bank & Trust relocation to Minnesota Centre * Statistically not significant NE 2008 OFFICE PROJECTS TO WATCH Further development of Ashbury Condos on South Sycamore Avenue Corporate Center IV now under construction "Should your company ever need an experienced and qualified commercial real estate broker, I would encourage you to let Dennis and his staff at NAI Sioux Falls provide to you the same he has for us - Complete Satisfaction!" - David W. King/Bankfirst OFFICE MARKET REVIEW Southeast Quadrant (SE) SE OFFICE VACANCY STATISTICS Southwest Quadrant (SW) SW OFFICE VACANCY STATISTICS Noteworthy Listings OFFICE FOR SALE SE Total Sq. Ft.: 918,402 SW Total Sq. Ft. : 2,771,944 Former Midco Call Center: $3,175,000 SE Vacant Sq. Ft.: 78,572 SW Vacant Sq. Ft.: 385,737 Ashbury Plaza Buildings: $550,000—$1,064,075 SE Overall Vacancy: EOY ‘06 10.41% EOY ‘07 8.75% SW Total Vacancy: EOY ‘06 15.65% EOY ‘07 13.83% Independence Plaza Condo: $299,900 SE Class A Vacancy: 11.94% SW Class A Vacancy: 14.91% First Bank & Trust: $2,850,000 SE Class A Rental Rates/Sq. Ft.: $13.50 to $15 SW Class A Rental Rates/Sq. Ft.: $15 to $18 Howalt McDowell Building: $1,500,000 SE Class B Vacancy: 7.43% SW Class B Vacancy: 11.59% SE Class B Rental Rates/Sq. Ft.: $12.45 to $13 SW Class B Rental Rates/Sq. Ft.: $13 to $15 SE Class C Vacancy: 2.21% SW Class C Vacancy: * SE Class C Rental Rates/Sq. Ft.: $7.80 to $11 SW Class C Rental Rates/Sq. Ft.: $7.70 to $11.50 Ashbury Condos on Sycamore First Dakota Branch on Louise SE NOTABLE OFFICE EVENTS Qwest Tower Howalt McDowell moves from 225 South Minnesota to Cherapa Place leaving their building for sale-$1,500,000 Rural Metro Medical Building at 310 South Cleveland sold as investment property$471,500 SW NOTABLE OFFICE EVENTS River Boulevard Office Building at 515 South Cliff sold—$575,000 Assam Companies purchases the Former Boy Scouts Building at 3200 West 49th River Boulevard Office Building First Dakota National Bank new branch on South Louise Avenue Former HJN Team Real Estate Building at 2601 South Western Avenue sells to Rick Gourley Hutchinson Technology: 34,750 sq. ft. SW 2008 OFFICE PROJECTS TO WATCH Former Midco Call Center: 23,500 sq. ft. Interstate Crossings Business Park new home to Midland National Life Minnesota School of Business to develop 30,000 sq. ft. building at 57th Street and I-29 “Given the opportunity for additional expansion, I would look forward to working with Kathleen again, and I would recommend her professional and courteous services to any business person. I can describe my overall experience with Kathleen Hovland and NAI Sioux Falls Commercial with one word: Great! - Mike Mitchell/ Wireless Network Management, Inc. * Statistically not significant OFFICE FOR LEASE Qwest Tower: 27,350 sq. ft. MWM N. Lewis office/warehouse: 17,764 sq. ft. Ashbury Plaza: Various up to 6,865 sq. ft. Plains Commerce Bank: 8,496 sq. ft. JDS Industries: 12,284 sq. ft. Group II Architects Building: 4,500 sq. ft. Kirkwood Plaza: 5,160 sq. ft. PRESENTED BY Dennis Breske RETAIL MARKET REVIEW Broker / Owner CCIM/SIOR Central Business District (CBD) Northwest Quadrant (NW) Northeast Quadrant (NE) CBD RETAIL VACANCY STATISTICS NW RETAIL VACANCY STATISTICS NE RETAIL VACANCY STATISTICS CBD Total Sq. Ft.: 593,521 NW Total Sq. Ft.: 1,175,761 NE Total Sq. Ft.: 1,482,381 CBD Vacant Sq. Ft.: 21,078 NW Vacant Sq. Ft.: 29,054 NE Vacant Sq. Ft.: 75,175 CBD Overall Vacancy: EOY ‘06 2.57% EOY ‘07 3.55% NW Overall Vacancy: EOY ‘06 3.74% NE Overall Vacancy: EOY ‘06 2.13% EOY ‘07 2.47% EOY ‘07 5.07% CBD Class A Vacancy: 0 % NW Class A Vacancy: 7.39% NE Class A Vacancy: 6.3% CBD Class A Rental Rates/Sq. Ft.: $15 to $18 NW Class A Rental Rates/Sq. Ft.: $14 to $15 NE Class A Rental Rates/Sq. Ft.: $13 to $16 CBD Class B Vacancy: 3.56% NW Class B Vacancy: 1.81% NE Class B Vacancy: 4.41% CBD Class B Rental Rates/Sq. Ft.: $12 to $15.50 NW Class B Rental Rates/Sq. Ft.: $8.95 to $13 NE Class B Rental Rates/Sq. Ft.: $5.50 to $13 CBD Class C Vacancy: 5.84% NW Class C Vacancy: 1.14% NE Class C Vacancy: 5.58% CBD Class C Rental Rates: * NW Class C Rental Rates/Sq. Ft.: $7.50 to $8 NE Class C Rental Rates: * CBD NOTABLE RETAIL EVENTS NW NOTABLE RETAIL EVENTS Acme Drink Club demolished to create new city-owned parking lot needed for Library expansion Walmart decides not to open new store near I-29 & 60th Street North Paramount Wine Studio opens next to Minerva’s Uptown Sioux Falls-The Arches Hillcrest Plaza—Talecris Blood Bank opens on North Minnesota Avenue Maple Mall opens near I-29 & Maple Street— First National Bank branch and Subway are first tenants Dollar General leases space from Ace Hardware at 12th & Kiwanis Nutty’s North takes over former Homer’s Bar NW 2008 RETAIL PROJECTS TO WATCH Proposed Walmart site may develop with other projects CBD 2008 RETAIL PROJECTS TO WATCH East Benson Plaza Maple Mall NE NOTABLE RETAIL EVENTS Dewitt Designs nears opening at new location on East 8th Street New Dollar General opens on East Rice St. East Benson Plaza lands Chinese Restaurant and Jimmy John’s as first tenants Armstrong Plaza—East side Splash City Arrowhead Ridge Mall—home to four new tenants Banquet opens on East 8th Street Uptown Sioux Falls Developments Monk’s Bar opens on East 8th Street Events Center—Will it be built? Where will it be? Former Stockman’s Bar now home to Latitude 44 “I work with brokers all across the nation. I have found Dennis Breske's professional efforts, creativity and personal ethics to be of the highest caliber. We have worked together on leases, sales, listings and site selection for some of the largest firms in the state and he has completed every transaction with clarity, timeliness and resounding success for our clients. I recommend Dennis Breske to anyone who wants to hire a commercial real estate broker no matter how large or challenging the assignment.” - Jim Owen/USA Income Properties * Statistically not significant NE 2008 RETAIL PROJECTS TO WATCH Continued redevelopment of East Bank Schoeneman Lumber site ripe for redevelopment RETAIL MARKET REVIEW continued Southeast Quadrant (SE) SE RETAIL VACANCY STATISTICS Southwest Quadrant (SW) SW RETAIL VACANCY STATISTICS Southwest Quadrant continued SW 2008 RETAIL PROJECTS TO WATCH SE Total Sq. Ft.: = 1,482,453 SW Total Sq. Ft.: = 6,248,619 SE Vacant Sq. Ft.: = 74,425 SW Vacant Sq. Ft.: = 288,649 SE Overall Vacancy Rate: EOY ‘06 9.53% EOY ‘07 5.02% SW Overall Vacancy: EOY ‘06 6.64% EOY ‘07 4.62% SE Class A Vacancy: 6.3% SW Class A Vacancy: 9.79% SE Class A Rental Rates/Sq. Ft.: $13 to $15 SW Class A Rental Rates/Sq. Ft.: $10 to $27.50 SE Class B Vacancy: 4.58% SW Class B Vacancy: 2.74% SE Class B Rental Rates/Sq. Ft.: $9 to $13 SW Class B Rental Rates/Sq. Ft.: $8 to $23.50 Ashbury Office/Retail Condos on North Sycamore SE Class C Vacancy: 3.40% SW Class C Vacancy: 5.51% Former Tractor Supply on North Cliff SE Class C Rental Rates/Sq. Ft. : $5 to $6 SW Class C Rental Rates/Sq. Ft.: $7.69 to $7.69 Arrowhead Ridge Mall Times Square SE NOTABLE RETAIL EVENTS Lorraine Town Center near Lowe’s Noteworthy Listings RETAIL FOR LEASE Kum N Go on North Sycamore New Hy-Vee opens at 39th & Minnesota Former Dan Nelson Auto Showroom and car lot available on West 12th Street Hy-Vee at 33rd & Minnesota sold to Avera Historic Loop Center near 12th and Grange Former Lithia Dodge sold to Tires, Tires, Tires CarVantage Building and car lot near West 12th Street and I-29 Tryon Gym leases former Kreiser’s at 21st and Minnesota Former Fujifilm sold to Maxwell Hotel Supply SW NOTABLE RETAIL EVENTS Beakon Centre lands Spezia, Home Décor, Tokyo Restaurant, Sherwin Williams and French Door Bridal Center Big O Tires closes on East 10th Street Plaza 41 leases to Pizza Ranch and Holz Haus Furniture New Goodwill Store built on East 41st Street Hutterite Prairie Market closes Big O Tires on East 10th Street Jans proposed 19,750 sq. ft. retail center on West 41st Street Dacotah Mall near 57th and Cliff Avenue Various sizes at Beakon Centre Beakon Centre Former Total Card space under contract— buyer undisclosed Former Fujifilm Building Krispy Kreme site redeveloped As Times Square—new home to Cellular Only, Eyemart Express, Jimmy’s Pizza Walgreen’s and new Kum N Go open at 41st Street and Sertoma SE 2008 RETAIL PROJECTS TO WATCH Dawley Farm Village—Several big box users may be close to announcing plans REALTrac™ Online is NAI Global’s Web-based transaction management software used by NAI affiliates to coordinate projects and facilitate the transaction cycle. At NAI Sioux Falls, we also use REALTrac™ to inform our clients of our efforts to sell or lease their property. Call us to discuss this award winning client reporting tool. PRESENTED BY Troy Fawcett INDUSTRIAL Broker /co-owner Industrial Specialist MARKET REVIEW Northwest Quadrant (NW) Northwest Quadrant Trends Vacancy Absorption Asking Rents Northwest Quadrant continued NE NOTABLE INDUSTRIAL EVENTS Kreiser’s property on 5208 N. Annika ABC Supply leased 40,000 sq. ft. from Guardian TSF property at 3900 W. 34th Street North Northeast Quadrant (NE) NW Total Sq. Ft.: 5,094,518 NW Vacant Sq. Ft.: 175,178 Northeast Quadrant Trends NW Overall Vacancy: EOY ‘06 6.88% EOY ‘07 3.44% Vacancy NW Class A Vacancy: continued NW INDUSTRIAL NEW CONSTRUCTION Dakota Digital at 4510 W. 61st Street North NW INDUSTRIAL VACANCY STATISTICS Northeast Quadrant Absorption Nordica Warehouse sold for $5.9 million (212,000 sq. ft.) The former Cimarron/Schwan’s property sold for $1.5 million Midwestern Mechanical Asking Rents * NW Class A Rental Rates/Sq. Ft.: $5.50 to $6.50 NW Class B Vacancy: 3.1% NW Class B Rental Rates/Sq. Ft.: $3.50 to $4.50 Brouwer Building NE INDUSTRIAL VACANCY STATISTICS NE Total Sq. Ft.: 7,409,435 NE INDUSTRIAL NEW CONSTRUCTION NE Vacant Sq. Ft.: 217,322 Peska Construction property at 810 & 820 East Amidon NE Overall Vacancy: EOY ‘06 2.18% EOY ‘07 2.93% NE Class A Vacancy: 8.61% NW NOTABLE INDUSTRIAL EVENTS Kreiser’s leased 4,000 sq. ft. at 523 North Kiwanis Pro Cleanup leased the Former Fleetpride Building (10,000 sq. ft.) Lodgenet leased 15,000 sq. ft. in the US Oil/ Pam Oil Building Former Phoenix Crystals Building sold for $375,000 (5,896 sq. ft.) US Oil leased 144,000 sq. ft. on Petro Avenue * Statistically not significant NE Class A Rental Rates/Sq. Ft.: $5.50 to $6.50 Flintwood Partners 64,000 sq. ft. spec building Midwestern Mechanical at 4101 N. Lewis NE Class B Vacancy: 3.25% NE Class B Rental Rates/Sq. Ft.: $3.50 to $4.50 Former Schwan’s Flintwood Partners INDUSTRIAL MARKET REVIEW continued Southeast Quadrant (SE) Southwest Quadrant (SW) Southwest Quadrant continued Southeast Quadrant Trends Southwest Quadrant Trends Vacancy Vacancy Absorption Asking Rents Absorption Peska Build-To-Suit Asking Rents SE INDUSTRIAL VACANCY STATISTICS SE Total Sq. Ft.: 522,684 SE Vacant Sq. Ft.: 10,500 SE Overall Vacancy Rate: EOY ‘06 9.27% EOY ‘07 2.01% SE Class A Vacancy: * SW INDUSTRIAL VACANCY STATISTICS SW Total Sq. Ft.: 555,493 SE Class B Rental Rates/Sq. Ft.: $3.50 to $4.50 SE NOTABLE INDUSTRIAL EVENTS South Dakota Achieve leased 9,800 sq. ft. on South Cliff Avenue Tea Industrial Park SW Vacant Sq. Ft.: 55,396 SW Overall Vacancy: EOY ‘06 9.16% EOY ‘07 9.97% SE Class A Rental Rates/Sq. Ft.: $5.50 to $6.50 SE Class B Vacancy: .96% SW PROJECTS TO WATCH SW Class A Vacancy: * SW Class A Rental Rates/Sq. Ft.: $5.50 to $6.50 SW Class B Vacancy: 10.06% SW Class B Rental Rates/Sq. Ft.: $2.50 to $4 SW NOTABLE INDUSTRIAL EVENTS South Dakota Achieve on Cliff Eberts Construction purchased the former Burkhart Building: $380,500 (12,000 sq. ft.) Peska new construction Walmart leased the former Rich Brothers Building (15,000 sq. ft.) Sioux Steel leased 67,000 sq. ft. of the former WARE Manufacturing Building Doug Kenzy purchased a 12,000 sq. ft. building from Phil Pudenz: $675,000 Noteworthy Listings INDUSTRIAL FOR SALE Flintwood Partners Warehouse at 2001 East 60th Street North TJN Building (Former Midcontinent Building) at 5620 West 9th Street Tipler Companies Warehouse at 1321 North Cleveland Avenue Former Stoakes Building at 1100 South Stoakes Avenue INDUSTRIAL FOR LEASE Flintwood Partners Warehouse at 2001 East 60th Street North Sycamore Commerce Center at 400 South Sycamore Avenue JDS Industries at 2704 West 3rd Street Midwestern Mechanical Building at 4101 North Lewis Avenue “Troy has a unique ability to recognize opportunities and make things happen. His outstanding market knowledge and positive attitude have delivered for me personally. I would recommend his commercial real estate services to anyone.” - David R. Billion / Billion Automotive * Statistically not significant Commercial Land Overview East Side Project 2007 was a strong year for land sales in the Sioux Falls market. It also saw the completion of the Eastside Sanitary Sewer project, which is the largest expansion in Sioux Falls history of its service area. The area served will ultimately total around 23,000 acres and will include commercial, multi family and residential development. The city of Sioux Falls approved 33 annexation requests for a total of 1,875 acres. This record total represents a 22% increase over 2006. Unimproved Land Transactions 156 acres of future development land near the intersection of Marion Road and Benson Road for $36,500 per acre 132 acres of potential future development land in Delapre Township PRESENTED BY Tom Ode Broker Associate Land Specialist in Lincoln County for $20,750 per acre 40 acres purchased by the Sioux Falls School district on the west side of Sioux Falls for $50,000 per acre CBD Land Transactions 1.09 acres located at the NE intersection of Minnesota Ave. and 14th St. sold for $22.02 per square foot. 1.03 acres located at 305 N. Dakota Ave. sold for $30.00 per square foot. Industrial Land Transactions 32 acres located near the intersection of Career Ave. and Tickman Street sold for $1.59 per square foot. 37.34 acres sold by the Sioux Falls Development Foundation for $2,190,000 13 acres at the intersection of Gulby Ave. and E. 60th St. N for $1.80 per square foot Retail Land Transactions 6.23 acres at 4000 S. Grange Ave. sold for $8.51 per square foot 1.70 acres at 4701 E. 41st St sold for $7.00 per square foot 38,168 square feet at 2400 S. Louise Ave. sold for $30.41 per square foot Overall, purchase prices for land in all categories of zoning use remained strong in 2007 and it appears that will hold true in 2008. About Tom Ode: Tom has been involved in all aspects of commercial real estate including the sale and leasing of office, retail and industrial buildings but specializes in industrial, land and land development. His work in land sales and development has resulted in sales exceeding $5,00,000 in 2007 alone. Tom has the ability to analyze commercial real estate opportunities quickly from both a buyer’s and a seller’s perspective. He can successfully help either party efficiently reach their goals. Tom joined the company in 2000 with a broad base of experience not only as a result of working with a competing real estate firm, but also from his agricultural background. He owned and operated a family dairy and crop farm near Sioux Falls prior to his work in commercial real estate. Agricultural Land Overview PRESENTED BY Jim Wilber Broker Associate Ag Land Specialist Commodity Prices Soar Comparable Sales Pasture Land While the United States economy may be bracing for an upcoming recession, the South Dakota agriculture industry can only be described in one word Booming!! Farm commodity grain prices reached an unprecedented level last year and are expected to rise even higher this coming season. Corn prices have doubled to the $4.00 per bushel level during the past fall harvest and soybeans (mired in a $5.00/bu. quagmire) have recently crept toward $13.00/bu. Another long-time staple of our state, spring and winter wheat, rose from the customary $3.00 to $4.00/bu. range to an astonishing $10.00/bu. mark. A number of factors – ethanol demand, past drought, crop shortages – have all contributed to the sudden rise in farm commodity prices. These price surges, combined with near record 2007 har- Here is a capsule summary of land price increases in a few areas across South Dakota: Grasslands and pastures across the state are not immune to the upswing in prices, thanks to a mostly steady cattle market. Today, good pasture is in Hand County land was locked in a $300 per acre mode for a couple of decades. Suddenly, farm land east of Miller surpassed the $1000/acre barrier two years ago. Recently, 700 acres of good farm ground brought $1850/acre and a southeast Hand County half section was auctioned off for $1925/acre. Aurora and west Davison County farm ground could be purchased routinely in the $1400 per acre range. Now, area farmers are wondering when the first $3000/acre sale will occur. During the past few months, tracts of land near Mt. Vernon sold for $2600 and $2850/acre. In Brown County, near Groton, an excellent piece of farm ground was sold for $4100/acre recently, outdistancing the customary $2000/acre base price. Last fall, east central farmers witnessed auctions of $2500 (Miner Co.) and $2650 (Kingsbury Co.) on land where $1400/acre was once considered the norm. vest yields in most areas, have resulted in very healthy incomes for the South Dakota farmer. Land Prices Follow The unexpected side effect of the grain price surge has been the marked escalation of land prices across the state. South Dakota crop land and pasture prices have generally shown a steady increase during the past few years. But in the second half of 2007, auctions and private sales resulted in a dramatic increase in per acre values. “Buying land at $3000/acre and harvesting $3.00/bu. corn makes a lot more sense than $2.00/bu. corn on $1800/acre land,” said one veteran landowner. Landowners in Turner, Yankton and Clay Counties saw land finally exceed $4000/acre last year with most of the land purchased in the $3200-$3500/ acre range. In the “Garden Spots” of Moody, Lincoln and Minnehaha Counties, land sales of $4000 to $4500/acre have become commonplace. Smaller tracts (60-80 acres) of choice ground saw record prices of $5920/acre near Baltic and $6200/acre east of Lyons. With agricultural land selling as high as $8700/acre in northwest Iowa, pressure from out-of-state buyers in eastern South Dakota is understandable. strong demand and will bring near $1000/acre in most East River counties. Grassland near the Iowa/ Minnesota border commands over $1500/acre. “Go West Young Man” seems to be the motto for local buyers as a number of big grass ranches (and some farm ground) have been purchased by East River investors. Most West River sales, pasture or tilled, have approached the $400/acre mark with a few $500/acre sales recorded. About Jim Wilber: Upon joining NAI Sioux Falls, Jim Wilber has specialized in agriculture land sales and purchases, spanning the state of South Dakota. Jim has closed transactions on over 16,000 acres of agriculture land since 2005 for a total of nearly $8,000,000. Utilizing the experience from his agriculture business days in his hometown of Miller, SD, Jim has contacts with farmers and landowners in both East River and West River counties. Contact Jim Wilber for assistance in purchasing, selling or leasing agriculture properties. Build on the power of our network. Wherever you are. Wherever you want to be. We’re already there. About NAI Global NAI Sioux Falls is part of a network of 375 offices in 55 countries. NAI Global has deep roots in commercial real estate. We bring people and resources together in over 375 offices and 55 countries around the world to deliver results for our clients. As the world’s only managed network of commercial real estate firms, the independently-owned NAI affiliates conduct over $40 billion in real estate transactions annually by working together to help their clients strategically optimize their assets. Our clients come to us for our deep local knowledge. They build their businesses on the power of our global managed network. Local Touch 101 North Main Avenue Suite 213 Sioux Falls SD 57104 605.357.7100 www.siouxfallscommercial.com Global Reach

© Copyright 2026