2015-2016 MAYOR`S BUDGET MESSAGE

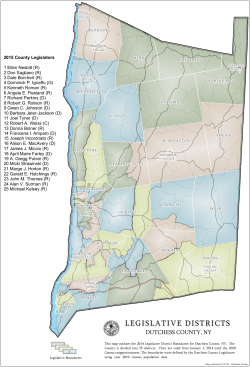

2015-2016 MAYOR'S BUDGET MESSAGE Before starting to discuss our proposed budget for our next fiscal year, let me briefly note some of the things your trustees and I recently have been working on. Our multi-year roadway program to rebuild or repave every Village road has reached over 80%. We, with help from Ellen Birnbaum our County Legislator, were successful in getting the County to repave Steamboat Road last spring and, on an emergency basis, Middle Neck Road just this week. We have been working, and will continue to work, on our Old Village, New Main Street project. Our Steamboat Road and Middle Neck Road zoning changes have been completed. We planted a substantial number of trees this year and will plant 65 more this spring. The AvalonBay 191 unit luxury rental community, which will include 19 workforce housing units, has been approved and is proceeding. The oil tanks and old building on the site have been removed and remediation of the soil has begun. AvalonBay will pay us $885,000 which, by law, has been earmarked for community benefits such as improvements to our Middle Neck Road parking lots, signage and sidewalks. It will be received, almost half when they receive their building permit, which should be very soon, and the balance when they receive their certificate of occupancy. Our Middle Neck Road pedestrian safety and traffic calming initiatives should be approved by Nassau County soon and will be constructed with grant and community benefit funds. Also, plans to build a new DPW facility and Village Hall on our old sewer plant property and an adjacent parcel are underway. The sale of our current DPW site on Middle Neck Road should more than fund the cost of the new DPW facility and the excess plus the sale of our Village Hall, which is planned to be to the Great Neck Public School District, should defray much of the cost of a new Village Hall. If we were not to do that, we would have to spend hundreds of thousands of dollars to upgrade those facilities and they still would not be as functional or as long lasting as new facilities. Also, as you know, we are “out of the sewer business,” and we have 2 wrapped up or accounted for the expenses relating to the cessation of that function. So, for the first time, our budget no longer separately accounts for sewer revenues or expenses. We have reserved and will utilize accumulated sewer related funds to pay for continuing sewer expenses (primarily remaining bond payments relating to the sewer plant and future successful tax reduction proceedings), so they will have no impact on future operations of the Village. Preparing a budget is not an exact science or an easy task. Most of the revenues necessary to operate Village government, as required by law, must be derived from real estate taxes. This puts a great burden upon your Board of Trustees in determining the services that our residents need and desire, and in planning for the known, anticipated and extraordinary expenditures that may occur over the twelve months beginning over a month from now. Our budget can be compared to an individual who receives one paycheck a year on January 1. That paycheck, though it may seem significant, must provide for all expenditures throughout the next twelve months, until the following December 31. This budget is a result of much thought and hard work on the part of all concerned. The process started in January with our Budget Officer's, that's Joe Gill, our Clerk-Treasurer, review of the year to date expenditures and revenues and his estimation of what they will be for the balance of the year. He then furnished his review to our department heads. The department heads then gave the Budget Officer their requests and recommendations. The Budget Officer then reviewed them and prepared a worksheet for the budget, which he then presented to the Mayor. The Mayor and the Budget Officer then conferred and discussed those requests and conferred with our department heads. After further discussions and revisions, the Budget Officer presented budget worksheets to the Mayor and Board of Trustees. Then a number of public meetings of the Mayor, the Board and the Budget Officer were held. When a consensus was reached by the Mayor and the Board, the worksheets were returned to the Budget Officer for the task of assembling all of the data and providing the budget package you see before you tonight. The budget for the next fiscal year, June 1, 2015 through May 31, 2016, was not an easy document to prepare. The past several years have been difficult for local governments and we are not an exception. In addition, to 3 the ever increasing costs of providing government services, we have been subjected to no, or very minor, increases in state aid revenues and to continuing or significant increases in pension, health insurance and other unfunded state mandated costs. Continuing successful tax reduction claims also are a burden on us. Also, our near complete program to repave or rebuild every Village road has forced us to bond substantial sums, and bonds must be repaid with interest. I will provide details on those costs in a few moments. State aid once was a reimbursement for state mandated programs. The unfortunate situation is that the state has not diminished the mandates and continually adds new ones. With the existing mandates remaining in place, new mandates and state aid lagging, they have become a significant financial burden upon our taxpayers. State aid, once called revenue sharing, now is only 3% of our revenue. Another important fact is that almost 20% of our Village’s real property is not taxed. We have four public schools; a number of parks, some very large; more than 15 synagogues and churches; and two fire houses; as well as other property tax exemptions. In addition to details of our projected revenues and expenditures, the budget package includes: schedules providing financial information about our special reserves, currently proposed three-year capital projects plan, our debt service costs, outstanding debt and tax exemptions. Estimated expenditures, also called appropriations, total $10,270,000. From that, we subtract estimated non-real estate tax revenues of $2,985,000. Other than the reserved sewer related surplus being used to pay continuing sewer related expenses, as I noted earlier, we do not plan to use any portion of our surplus, as we have done in many previous years. After applying the accumulated sewer related funds, the balance, which must be raised by real property taxes, is $7,022,000. It is important to note that, before the so-called tax cap, we were using portions of our surplus to keep taxes as low as possible. Some may say our timing was wrong. Had we not done that, we would have a higher tax cap number and could now use surplus to offset taxes. One result of our revaluation four years ago is that we have two classes of taxable property -- Homestead, which is one and two family homes, and 4 Non-Homestead, which is all other property. So, our taxes are allocated to each class based on their portion of our total assessment. Note that I have been talking about the total amount of taxes -- not the amount each property pays. That is based upon its assessed value and the relationship it bears to the assessed value of the other properties in the same class in the Village. The total assessed value of Homestead properties next year will increase 6.8%, so the approximate value of the average home for Village real estate tax purposes will increase from $727,000 to $773,000. The tax on a house with that value this year was $2,256. Our tax increase of $179 next year for that house will result in an increase of just under $15 a month or just under 50 cents a day. For the average Non-Homestead property, taxes will increase by $71 for the year or about $6 per month or 20 cents a day. As I mentioned earlier, we have used portions of our surplus to keep taxes low in many past years. Of course, we continually strive to keep taxes as low as possible without reducing services. And remember, your mayor and trustees pay real estate taxes just like every other Village resident. Over the past seven years we have seen significant increases in certain costs. Without sewer costs: Pension costs have increased 124% from $208,000 to $487,000. Health insurance has increased 74% from $576,000 to $1,000,000. Workers’ compensation insurance has increased 67% from $120,000 to $220,000. Bond payments have increased 57% from $765,000 to $1,200,000. However, salaries have only increased 21% from $2,291,000 to $2,781,000, a 3% per year average. Also, we continue to have to budget a significant sum, $180,000 for successful tax assessment challenges. We reassessed the entire village four years ago because our property assessments did not reflect fair values. However, commercial tax reduction proceedings take years before they are settled, so there are substantial sums the Village must pay over the next few years. That will diminish over time. Since our revaluation, successful new property reduction proceedings have been significantly less. We now have reached the point that taxes must go up to cover those costs and to permit us to have a surplus to keep our bonding interest costs low and to pay for unforeseen circumstances such as the microburst of June 2010 and later hurricanes. In preparing next year's budget we were very cost conscious but did not want to reduce Village services. Our decision not to reduce services is in stark 5 contrast to the substantial reductions in services we are seeing at the state and county levels, which, by the way, do not enjoy our AAA, stable Standard & Poor bond rating. Also note that, included in our budget is $1,520,000, over 15% of our expenditures, that our Village pays just for volunteer fire and ambulance service. Our 37 employees are dedicated individuals and our Village's greatest asset. They are responsible for the excellent Village services we all enjoy. Without taking into account certain longevity increases, our employees will be given a 2.5% salary increase next year. The Board labored long and hard in arriving at that number, and we believe it is a fair increase in today's economic times. Throughout the year, the budget is always under review and your mayor, trustees, Clerk/Treasurer and all department heads are constantly seeking ways to cut or reduce costs. I call to your attention the fact that the Village does not have the power to create new revenue sources or impose different taxes to reduce the real estate tax burden on property owners. We get no share of state income taxes, no funds from the town and almost no funds from the county for Village operations and, as I mentioned earlier, very little from the state. Because the law mandates that we balance our budget, the only place we can look in order to accomplish that is real property taxes, which, next year, will account for almost 70% of our revenue. And, as I mentioned earlier, almost 20% of the property in our Village is exempt from taxes. Throughout the budget preparation process, a serious concern is that we maintain the superior level of service to which our residents are accustomed and demand. We also endeavor to further improve the services that are offered to Village residents and businesses, and at the same time invest in a future that will be a heritage for our children and future residents and businesses of our great Village -- one we hope they will be proud of and enjoy. With your support and cooperation, these goals will be met each year. Now, let me try to put our taxes into perspective. First, they are less than 13% of your total taxes. 6 Our average house next year will pay $203 a month in taxes. Most people pay almost that for just cable, Internet and home telephone service. And they pay more than $234 per month in taxes just for county police protection. But that $2,435 per year paid to the Village will provide: Fire protection Ambulance service Road paving Road repairs, including County roadway center islands, curbs and sidewalks Street plowing, sanding and salting Street sweeping Garbage pickup and disposal Recycling Street lighting Building inspections and safety Tree trimming of Village trees Village tree and stump removal and new tree planting Traffic signage, crosswalks and striping Parking and code enforcement Court with two judges Storm sewers Fire hydrants Zoning and other local laws Board of Appeals Planning Board Architectural Review Committee A passive eco-park That's quite a bit for about the cost of cable, Internet and home phone service. Before closing, I would like to refer you to a very recent Siena College Research Institute statewide poll. The public rates New York’s local 7 governments significantly higher than their State government on a variety of criteria. In selecting whether local government or state government does a better job at three fundamental governmental tasks – protecting and managing tax dollars, understanding and responding to your needs, and getting important things done – New York voters, by a substantial margin, chose their local government. However, registered voters have a clear misconception of the portion of their total property tax bill which goes to their school district as opposed to municipal services. Respondents estimated that 42% of their property tax bill is for school purposes and 58% is for all other services. In fact, however, for New York’s average taxpayer, school district taxes account for approximately 60% of the property tax “pie,” with the remaining 40% allocated to all municipal governments. Thank you for your time, and I hope my summary and explanation was helpful. April 7, 2015

© Copyright 2026