Minnesota`s Progress Against Regressivity

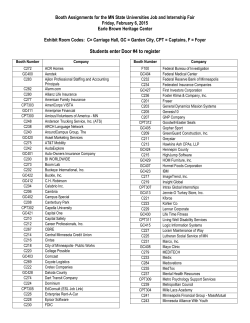

MINNESOTA’S PROGRESS AGAINST REGRESSIVITY MINNESOTA’S PROGRESS AGAINST REGRESSIVITY Published April 2015 by Growth & Justice Written by: Jeff Van Wychen, Policy Fellow Edited by: Dane Smith, President Jennifer Weddell, Director of Finance, Operations & Publications Designed by: Mark Tundel, Communications Manager Growth & Justice is a nonprofit research and advocacy organization that develops innovative public policy proposals based on independent research and civic engagement. We believe when Minnesota makes smart investments in practical solutions it leads to broader prosperity for all. 2 5 6 7 8 9 10 13 16 17 19 21 EXECUTIVE SUMMARY TAX REGRESSIVITY AND WHY IT’S A PROBLEM DATA USED IN THIS REPORT THE INCIDENCE OF FEDERAL TAXES MEASURING TAX REGRESSIVITY USING THE SUITS INDEX THE FEDERAL TAX OFFSET STATE AND LOCAL TAX REGRESSIVITY IN THE 50 STATES CHANGES IN 50-STATE TAX REGRESSIVITY OVER THE LAST TWO YEARS STATE & LOCAL EFFECTIVE TAX RATES IN MINNESOTA TAX REGRESSIVITY AND ECONOMIC PERFORMANCE CONCLUSION: PROGRESS ACHIEVED, WORK YET TO BE DONE APPENDIX: STATE & LOCAL SUITS INDICES FOR THE 50 STATES State and local taxes in the vast majority of states—including Minnesota—are regressive, meaning that low and middle income households pay a larger percentage of their income in state and local taxes than do high income households. Based on data from the recently released Minnesota Tax Incidence Study (MTIS) from the Minnesota Department of Revenue, in 2012 middle income Minnesotans were paying 25 percent more in state and local taxes per dollar of income than were the top one percent. The good news is that over the last two years Minnesota has made more progress than any other state in reducing tax regressivity. Credit for this goes primarily to the powerfully progressive tax acts passed during the 2013 and 2014 legislative sessions. There are at least three reasons why policymakers should be concerned about tax regressivity and seek to reduce it. » » REVENUE ADEQUACY. Some public resistance to taxation is inevitable and even helpful. However, it is imprudent to enflame this resistance through a regressive tax system. State and local governments will be hard pressed to generate sufficient revenue to adequately fund public services and infrastructure if they are relying disproportionately on tax dollars derived from low and moderate income families, whose budgets are already stretched due to decades of growing income inequality and declining real wages. » » ECONOMIC NECESSITY. These same trends—growing income inequality and declining wages— have eroded the purchasing power of lower and moderate income households, thereby undermining the consumer purchasing power which is the backbone of the state and national economies and contributing to severe recessions and anemic recoveries. Tax regressivity accelerates this pernicious pattern by further eroding the purchasing power of moderate income families. » » TAX FAIRNESS. State and local government expenditures help to provide safe neighborhoods, adequate transportation, and a legal system that protects property rights and enforces contracts. Insofar as citizens benefit from these expenditures in proportion to their income, they should pay taxes in proportion to their income. A regressive state and local tax system undermines this basic notion of fairness by disproportionately taxing those with the least ability to pay. To examine tax regressivity in Minnesota relative to other states, this report relies on data from Who Pays? A Distributional Analysis of the Tax Systems in All 50 States, published by the Institute on Taxation & Economic Policy. While the MTIS is an excellent source of information on state and local tax regressivity in Minnesota, it does not include information for other states (with the exception of a subsection of the MTIS that is based on data from the Who Pays report). The Who Pays report is unique in that it provides a breakdown of the major state and local taxes paid in all fifty states by income group. By comparing data from the 2013 and 2015 editions of the Who Pays report, it is possible to rank states based on the degree of state and local tax regressivity and determine the extent to which regressivity in each of the states has changed over the last two years. The degree of tax regressivity in each state is measured by the Suits index; a Suits index of -1.0 denotes a tax system that is completely regressive, while a Suits index of +1.0 denotes a tax system that is completely progressive (i.e., taxes are paid entirely by the highest income household). 2 Only three states—California, Delaware, and Oregon—have a positive Suits index, denoting a state and local tax system that is not regressive (i.e., progressive). The moderate degree of tax progressivity in these states is attributable to the fact that all three rely heavily on a progressive income tax, which is sufficient to offset more regressive sales and property taxes. Six states— GROWTH & JUSTICE Wyoming, Florida, Washington, South Dakota, Nevada, and Texas—have Suits indices below -0.2, which denotes extreme tax regressivity. The defining characteristic of these states is the absence of an individual income tax and heavy reliance on regressive sales, excise, and property taxes. Over the last two years, the state and local tax system in four out of five states became more regressive as measured by the Suits index. However, Minnesota has successfully bucked the trend toward greater tax regressivity. From 2013 to 2015, the Suits index in Minnesota increased more than in any other state in the nation.1 Translation: over the last two years, Minnesota led the nation in terms of reducing tax regressivity. CHANGE IN SUITS INDEX BY STATE FROM 2013 TO 2015 WITHOUT ADJUSTING FOR FEDERAL TAX OFFSET 0.03 0.02 0.01 0.00 -0.01 -0.02 -0.03 -0.04 -0.05 -0.06 -0.07 based on data from the 2013 and 2015 “Who Pays” reports While the Suits index for the state and local tax systems in all fifty states fell by 0.012, the Suits index in Minnesota increased by 0.018.2 While the values of these changes do not appear large, Suits index changes of this magnitude denote a significant change in tax regressivity. Over this two year period, Minnesota improved from the 16th least regressive state in the nation to the seventh least regressive. The cause of the significant reduction in tax regressivity in Minnesota was no doubt driven in large part by tax changes enacted during the 2013 and 2014 legislative sessions. The most significant of these changes were: • A higher income tax rate for the wealthiest households, which had the effect of increasing dependence on the progressive income tax and making the income tax more progressive. (The only state that had a regressivity reduction comparable to Minnesota—Delaware— also increased its income tax rate on the highest income households.) • Increased utilization of the homeowners and renters property tax refunds, which had the effect of reducing dependence on regressive property tax and making the property tax less regressive. 1 This conclusion is based on a comparison of data from the 2013 and 2015 Who Pays reports. The 2013 Who Pays is based on 2010 income levels and tax laws in effect as of January 2013. The 2015 Who Pays is based on 2012 income levels and tax laws in effect as of December 31, 2014. 2 These Suits changes are based on data which excludes the impact of the federal tax offset. (See page 9 of the report for a description of the federal tax offset.) Including the effects of the federal tax offset, the fifty state Suits index fell by 0.009, while Minnesota’s Suits index increased by 0.022— once again the largest increase among all fifty states. MINNESOTA MAKES PROGRESS 3 The progressivity resulting from these changes was sufficient to overcome increased income concentration that was pushing Minnesota’s tax system toward greater regressivity. Not only did the 2013 and 2014 tax acts produce the most significant reduction in tax regressivity in the nation, but they also generated significant new resources to partially restore a decade of funding cuts to critical public investments while simultaneously reducing taxes paid by most Minnesota households, as demonstrated by two separate tax incidence analyses prepared by the Minnesota Department of Revenue in 2013 and 2014. Despite the concerns of naysayers, the reduction in tax regressivity resulting from the 2013 and 2014 tax acts does not appear to have damaged Minnesota’s economy, as the state continues to outperform the national average based on most key indicators. Furthermore, a correlation between these indicators and the degree of tax regressivity as measured by the Suits index for 44 states (excluding oil and gas producing states that are economic outliers) shows that lower levels of regressivity are associated with above average rates of personal income and GDP growth over the last five years. In short, the preliminary indication is that reduced regressivity is correlated with higher—not lower—levels of economic growth. While Minnesota has made notable progress in reducing tax regressivity over the last two years, the state and local tax system remains significantly regressive. Based on MTIS data for 2012—prior to passage of the 2013 and 2014 tax acts—the average middle income household (defined here as the middle twenty percent of all households by income) in Minnesota was paying 12.2 cents of each dollar of income in state and local taxes, while the top one percent were paying just 9.8 percent. In other words, state and local taxes per dollar of income were 25 percent higher for middle income families than for the top one percent. Based on MTIS projections for 2017— after passage of the 2013 and 2014 tax acts—state and local taxes per dollar of income will fall modestly for middle income households and increase significantly for the top one percent relative to 2012, leading to a significant reduction in the tax disparity between these two income groups. Nonetheless, despite a significant reduction in tax regressivity, middle income households will still be paying 13 percent more in state and local taxes per dollar of income than the top one percent. STATE & LOCAL TAX PER DOLLAR OF INCOME 2012 VS. 2017 Furthermore, threats to fair taxation loom on the horizon. Bills introduced during the 2015 legislative session would increase tax regressivity by dramatically reducing the progressive 2015 MTIS estate tax, providing social security income tax breaks that would primarily benefit high income households, and cutting the powerfully progressive renters property tax refund. Continued vigilance is needed to guard against creeping tax regressivity and to protect the gains made during the 2013 and 2014 legislative sessions. 4 The principal argument in favor of reducing tax regressivity is one of common sense. If a family with an income of $50,000 or less can pay 12 percent of their income in state and local taxes, families with incomes of $500,000 or more can be expected to do the same. This is not socialism or class warfare, but simple tax fairness. Protection of past progress and pursuit of additional reduction in tax regressivity should continue to be among the goals of state policymakers. GROWTH & JUSTICE 50 STATE TAX INCIDENCE ANALYSIS TAX REGRESSIVITY AND WHY IT’S A PROBLEM A regressive tax system is one in which low- and moderate-income households pay a higher percentage of their income in taxes than do high-income households. The level of taxes borne by a household is typically measured in terms of A REGRESSIVE TAX SYSTEM the “effective tax rate” (ETR). For example, a household with a $50,000 income that pays 0.20 $5,000 in state and local taxes would have a state and local ETR of 10 percent ($5,000 ÷ $50,000 = 10%). In a regressive tax system, 0.15 ETRs tend to decline as household income rises, so that the highest income households 0.10 have the lowest rates. There are several reasons why policymakers should seek to reduce the degree of tax 0.05 regressivity. The first and most obvious of these is simple tax fairness. Households 0.00 benefit from many public services in proportion to their income. For example, the owner of a business benefits from a well-educated workforce that public investments in education help to provide. In addition, businesses benefit from public expenditures on roads and bridges in order to move raw materials and finished products and a legal system that enforces contracts and protects property rights. In general, high income households benefit from the social stability that public expenditures make possible and thus it is only fair that they pay for these investments in proportion to their income. A second rationale for reducing tax regressivity is revenue adequacy. In recent decades, declining real per household income1 has eroded, pinching many low- and moderate-income families. State and local governments will have a difficult time generating sufficient revenue to adequately fund public services and infrastructure if they are relying disproportionately on tax dollars from lowand moderate-income families who have precious few dollars to spare. While a degree of public resistance to taxes is inevitable, one way to mitigate this resistance and generate sufficient revenue to support state and local investments in education, infrastructure, and other areas is through a fairer, less regressive system that taxes all households at a similar (or at least less disparate) effective rate. A final rationale for reducing tax regressivity is economic necessity. Low- and moderate-income families tend to spend a larger share of each dollar of income than do high income households; the purchasing power of these households—which comprise the overwhelming majority of consumers—is the backbone of the state and national economies. In recent decades, rising income inequality has eroded the purchasing power of these families, contributing to more severe recessions and more anemic recoveries. While a reduction in tax regressivity will not solve the problem of rising income inequality, it will enhance middle class purchasing power by keeping more dollars in the pockets of low- and moderate-income consumers, thereby promoting a stronger, more robust economy. 1 For more on this, see a 2013 Growth & Justice report, Widening Economic Inequality in Minnesota: Causes, Effects, and a Proposal for Estimating Its Impact in Policymaking found online at: http://growthandjustice.org/publication/EconomicInequality.pdf GROWTH & JUSTICE 5 MINNESOTA’S PROGRESS AGAINST REGRESSIVITY DATA USED IN THIS REPORT There are many reports that examine tax regressivity; most notable among these is the Minnesota Tax Incidence Study2 (MTIS), published biennially by the Minnesota Department of Revenue. This report is extensive in that it is based on a large cross-section of Minnesota households and includes information on nearly all state and local taxes. The most recent edition of the MTIS was published in March 2015 and is based on 2012 income and tax information with projections for 2017. However, the MTIS focuses on state and local taxes in Minnesota. We must rely on other sources to conduct a comparative analysis of the degree of state and local tax regressivity in Minnesota relative to other states. This report uses data from the fifth edition of Who Pays? A Distributional Analysis of the Tax Systems in All 50 States3 published in January 2015 by the Institute on Taxation and Economic Policy and based on 2012 income levels and incorporating state and local tax changes enacted through December 31, 2014. The Who Pays report is an ideal source for an interstate tax incidence analysis because it provides state and local ETRs by income group that are comparable across all fifty states. There are significant differences between the Who Pays report and the MTIS which should be noted: • Senior households are excluded from the Who Pays report, while the MTIS is based on a random sample of all Minnesota households, including seniors. • While both reports are based on 2012 income data, the MTIS is based on 2012 tax laws, while Who Pays uses a microsimulation model4 to project the impact of tax changes enacted through the end of 2014. This is critical, since major tax changes were enacted in Minnesota during the 2013 and 2014 legislative sessions. The MTIS’s 2017 tax incidence analysis does incorporate tax changes enacted in 2013 and 2014 based on projected 2017 income levels. • While the MTIS examines nearly every state and local tax in Minnesota, Who Pays is restricted to a smaller set of major taxes (specifically, property, sales and excise, and individual and corporate income taxes) which comprise the bulk of state and local tax revenue in each of the fifty states. • Assumptions regarding business tax incidence between the two reports are different, although the results for Minnesota are similar. • The MTIS presents data based on ten equally-sized deciles, ranging from the lowest income (or first) decile to the highest income (or tenth) decile, with the tenth decile further broken down into the top five percent and the top one percent. (The MTIS also reports data for groups comprised of ten equal shares of state income, referred to as “income deciles.”) The Who Pays report presents data based on five equally sized quintiles, ranging from the lowest income (or first) quintile to the highest income (or fifth) quintile, with the fifth quintile broken down into the “next 15%” (i.e., the bottom three-fourths of the top quintile), the “next 4%,” and the “top 1%.” 2 The most recent version of the MTIS can be found at: http://www.revenue.state.mn.us/research_stats/research_reports/2015/2015_tax_ incidence_study_links.pdf 3 This report can be found at: http://www.itep.org/pdf/whopaysreport.pdf 4 A description of the ITEP microsimulation model can be found at: http://ctj.org/ITEP/about/itep_tax_model_simple.php 6 GROWTH & JUSTICE 50 STATE TAX INCIDENCE ANALYSIS These differences help to explain some of the differences between the two reports in terms of findings for Minnesota. For example, Minnesota ETRs reported in the MTIS tend to be higher relative to those reported in Who Pays. This is no doubt largely attributable to the fact that the MTIS includes a variety of minor taxes that are not included in Who Pays. In addition, the ETR for Minnesota’s first (lowest income) decile from the MTIS is much higher than the ETR for the first quintile ETR reported in Who Pays. This is likely due to a combination of the following factors: • Some of the minor taxes excluded from Who Pays but included in the MTIS are highly regressive, falling most heavily on low-income households. • Low-income households are more heavily concentrated in the first decile than in the first quintile, since the first decile consists of the lowest ten percent of households by income, while the first quintile consists of the lowest 20 percent. The heavier concentration of low-income households in the first decile no doubt contributes to higher ETRs relative to the first quintile.5 • The first decile in the MTIS includes low-income seniors who are living off savings and thus report low annual income, thereby inflating their ETR. As noted above, Who Pays excludes senior households. • For various reasons described in the 2015 MTIS (including the understatement of income in the first decile and the inclusion in the first decile of households with negative income due to business or capital losses), “the effective tax rate for the first decile [reported in the MTIS] is overstated…”6 Despite these differences, Who Pays “uses a methodology that is relatively close to what is used in [the MTIS].”7 THE INCIDENCE OF FEDERAL TAXES In aggregate, federal taxes are progressive,8 meaning that federal taxes per dollar of income tend to be higher for high income households than for low income households. This is largely due to the federal income tax, which is sufficiently progressive to offset other regressive features of the federal tax code, such as payroll taxes and various deductions and subtractions to the federal income tax that disproportionately benefit high income households. Including federal taxes in this analysis would undoubtedly reduce the degree of observed tax regressivity. Nonetheless, federal taxes are excluded from this analysis for various technical and philosophical reasons. Among the technical reasons for not including the incidence of federal taxes in this analysis is that it would require redefining income within each income group in all fifty states. This is because federal payroll taxes for Social Security and Medicare are ultimately shifted onto workers; even the employer share of these taxes are presumed to be borne by workers in the form of reduced compensation. Thus, taking into account the impact of federal payroll taxes would require increasing income levels in each group by the employer share of the tax, since even the employer share of the tax is effectively paid out of employee income. An undertaking of this magnitude is beyond the scope of this research.9 5 6 7 8 9 For example, based exclusively on MTIS data for 2017, ETRs for the lowest income group fall by 37 percent if we define “lowest income” as the bottom quintile instead of the bottom decile. 2015 MTIS, p. 17. 2015 MTIS, p. 72. The overall progressivity of federal taxes is described in a 2008 policy briefing prepared by the Tax Policy Center, found at: http://www. taxpolicycenter.org/briefing-book/background/distribution/progressive-taxes.cfm In fact, no research conducted anywhere to date has undertaken such an adjustment to income for each income group in all fifty states. GROWTH & JUSTICE 7 MINNESOTA’S PROGRESS AGAINST REGRESSIVITY Even including federal taxes in an incidence study would not give a complete picture of the extent to which public services are paid for by low versus high income households because it would not take into account: • The extent to which state and local taxes in one state are shifted to taxpayers in other states. For example, state taxes on commodities such as oil and gas are effectively shifted out of state in the form of higher commodity prices. State and local taxes that are borne by non-residents would still be overlooked even if federal taxes were included. Who Pays, the MTIS, and this report examine only the incidence of state and local taxes upon taxpayers within the state imposing them—not the incidence on taxpayers residing outside the state. • Fees and charges used to pay for public services. Neither Who Pays nor the MTIS10 take into account fees and service charges used to pay for things such as park and trail usage, renewal of drivers licenses, etc. Insofar as fees and charges are regressive, omitting them from an incidence analysis understates the regressivity of the overall system used to pay for public goods and services. To date, no study has examined the degree of regressivity resulting from federal, state, and local taxes and fees in all fifty states. A strong case can be made for excluding federal taxes from a study of tax regressivity for use by state policymakers, insofar as state policymakers have no control over tax decisions made at the federal level. Regardless of the incidence of federal taxes, state and local governments will be hard pressed to generate adequate revenue to fund state and local services if they are relying disproportionately on taxes paid by low and moderate income families who have been squeezed by increasing income inequality and decreasing real wages. A progressive federal tax system does not justify—nor does it eliminate the problems caused by—a regressive state and local tax system. For the reasons cited above, the research presented in this report will focus exclusively on the regressivity of state and local taxes, excluding federal taxes. The only exception to this rule is the consideration of the deductibility of state and local taxes from federally taxable income; for more information on this, see “The Federal Tax Offset” on page 11. MEASURING TAX REGRESSIVITY USING THE SUITS INDEX The MTIS assesses the overall level of Minnesota state and local tax regressivity using a statistical measure known as the Suits index. While the Who Pays report does not report Suits indices, it is possible to calculate Suits indices for the state and local tax systems in all fifty states based on data from the 2015 Who Pays report. Using the Suits indices for each state calculated based on Who Pays data, it is possible to rank states in terms of the degree of state and local tax regressivity. The value of the Suits index ranges from +1.0 to -1.0, with values above zero denoting a progressive tax system (i.e., high income households tend to have higher ETRs than do low income households), while values below zero denote a regressive system. A Suits index with a value of zero denotes a proportional system in which ETRs across income levels are approximately equal (or, more precisely, ETRs display no aggregate variation based on income). 10 Technically, the MTIS examines the incidence of tobacco and cigarette “fees,” but these “fees” actually resemble conventional taxes. 8 GROWTH & JUSTICE 50 STATE TAX INCIDENCE ANALYSIS For a tax system to have a Suits index of +1.0, all of the taxes would have to be paid by the single household with the highest income. For a system to have a Suits index of -1.0, all of the taxes would have to be paid by households with zero income. Tax systems with a Suits index of +1.0 or -1.0 never occur in the real world. In practice, a Suits index of -0.2 denotes an extremely regressive tax system. Even a Suits index of -0.02 denotes a degree of tax regressivity which, while relatively low, is not negligible.11 The state and local Suits index for Minnesota based on the MTIS is lower (denoting greater regressivity) than the Minnesota Suits index calculated using data from the Who Pays report. This is due to the fact that: • As noted above, the two reports draw from different data sources. Most notably, the MTIS includes data for senior households and incorporates minor regressive taxes that are omitted from the Who Pays report. These differences contribute to a lower Suits index for Minnesota based on MTIS data relative to Who Pays data. • Suits indices calculated using Who Pays data are based on seven income groups (i.e., the bottom four quintiles and a fifth quintile divided into three parts), while the Suits indices reported in the MTIS are based on ten income groups or upon the “full sample” in which data for each individual household in the sample is incorporated into the Suits calculation (i.e., no grouping of households). Suits indices calculated based on a larger number of groups (or ideally the full sample) are more accurate than Suits indices calculated based on a smaller number of groups.12 Because the Suits indices for Minnesota reported in the MTIS are based on a more comprehensive array of taxes and a larger number of income groups (or the full sample), they are more accurate than the Suits indices for Minnesota calculated using Who Pays data. However, the MTIS provides no insight into how Minnesota compares to other states in terms of the degree of state and local tax regressivity because it contains data for Minnesota only. (The only exception to this rule is in chapter 4, section E of the MTIS which contains fifty state tax incidence information from the Who Pays report.) The Who Pays report, on the other hand, contains data on the ETRs by income group that is consistent for all 50 states. This data can be used to calculate a state and local Suits index for each state and subsequently rank the states in terms of the degree of tax regressivity. THE FEDERAL TAX OFFSET Taxpayers can deduct what they pay in homestead property taxes, state income taxes, and motor vehicle registration taxes from their federally taxable income. As a result, those who claim these itemized deductions pay less federal income tax. Similarly, insofar as state and local business taxes reduce business income, the federal tax liability is lowered. This “federal tax offset” primarily benefits higher income households. Arguably, this federal tax offset should be taken into account when measuring the net regressivity of state and local tax systems. Who Pays reports ETRs by household both with and without the effects of the federal tax offset. (The MTIS primarily examines ETRs without taking into account the federal offset, although it does include federal offset effects in chapter 4, section B.) Because the impact of the federal offset can vary significantly from state to state, the following analysis will examine Suits indices both with and without taking into account the impact of the federal tax offset. 11 A 2014 Minnesota 2020 article, Tax Fairness: How Minnesota Compares to Other States, discusses the interpretation of Suits indices and the degree of tax regressivity associated with Suits indices of varying values. This article can be found at: http://www.mn2020.org/issues-that-matter/fiscalpolicy/tax-fairness-how-does-minnesota-compare-to-other-states 12 The regressivity of a regressive tax system (or the progressivity of a progressive tax system) is more likely to be understated when fewer groups are used in the Suits calculation. GROWTH & JUSTICE 9 MINNESOTA’S PROGRESS AGAINST REGRESSIVITY STATE AND LOCAL TAX REGRESSIVITY IN THE 50 STATES The Suits indices calculated using data from the 2015 Who Pays report demonstrates that the state and local tax systems in the vast majority of states are regressive. Minnesota is no exception to this rule, although the Gopher State numbers among the top ten least regressive states based on Suits indices calculated using 50-state data from the most recent Who Pays report, based on 2012 income levels and tax laws as of December 31, 2014. TABLE 1: STATE & LOCAL SUITS INDICES FOR THE 50 STATES Without Adjusting for Federal Offset Adjusting for Federal Offset Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming All U.S. Based on 2015 Who Pays data 10 GROWTH & JUSTICE Suits Index -0.139 -0.127 -0.120 -0.095 0.046 -0.084 -0.084 0.028 -0.253 -0.072 -0.080 -0.021 -0.124 -0.102 -0.054 -0.101 -0.059 -0.122 -0.005 -0.030 -0.086 -0.078 -0.015 -0.102 -0.055 -0.014 -0.055 -0.222 -0.128 -0.005 -0.098 -0.015 -0.051 -0.144 -0.076 -0.123 0.015 -0.107 -0.042 -0.042 -0.230 -0.192 -0.202 -0.074 -0.017 -0.048 -0.236 -0.025 -0.043 -0.260 -0.069 Rank 42 40 36 30 1 28 27 2 49 22 26 10 39 34 18 32 21 37 4 12 29 25 7 33 20 6 19 46 41 5 31 8 17 43 24 38 3 35 13 14 47 44 45 23 9 16 48 11 15 50 Suits Index -0.174 -0.152 -0.158 -0.130 0.004 -0.116 -0.136 -0.018 -0.290 -0.115 -0.111 -0.050 -0.160 -0.131 -0.089 -0.149 -0.093 -0.156 -0.037 -0.065 -0.126 -0.103 -0.048 -0.133 -0.093 -0.051 -0.091 -0.257 -0.163 -0.046 -0.125 -0.068 -0.093 -0.176 -0.110 -0.151 -0.024 -0.147 -0.080 -0.078 -0.250 -0.209 -0.221 -0.102 -0.046 -0.087 -0.257 -0.057 -0.077 -0.302 -0.110 Rank 42 37 39 30 1 27 33 2 49 26 25 8 40 31 17 35 20 38 4 11 29 23 7 32 21 9 18 48 41 5 28 12 19 43 24 36 3 34 15 14 46 44 45 22 6 16 47 10 13 50 50 STATE TAX INCIDENCE ANALYSIS The first two columns in Table 1 list the state and local Suits indices of all fifty states excluding the impact of the federal tax offset and the rank of each from least regressive (“1”) to most regressive (“50”). The graph below lists all fifty states in order of their Suits indices, with states listed from left to right from least to most regressive. The state and local Suits index for all 50 states combined is -0.069 (the green bar in the graph), which denotes a fairly significant level of tax regressivity; 21 states have Suits indices above the 50 states Suits index (denoting below average regressivity), while 29 states have indices below the 50 states index (denoting above average regressivity). SUITS INDICES BY STATE - WITHOUT ADJUSTING FOR FEDERAL TAX OFFSET 0.05 BASED ON 2012 INCOME DATA AND TAX LAWS AS OF DEC. 31, 2014 0.00 -0.05 -0.10 -0.15 -0.20 -0.25 -0.30 Only three states (California, Delaware, and Oregon) have a positive Suits index, denoting a state and local tax system that is not regressive (i.e., progressive). The moderate degree of tax progressivity in these states is attributable to the fact that all three rely heavily on a progressive income tax, which is sufficient to offset more regressive sales and property taxes.13 On the other end of the spectrum from the three progressive states are six extremely regressive states, each with a state and local Suits index below -0.20. These six states—Wyoming, Florida, Washington, South Dakota, Nevada, and Texas—each lack an individual income tax. These states rely almost exclusively on regressive sales, excise, and property taxes (although one of these states, Nevada, relies heavily on a corporate income tax), with the result being a highly regressive overall state and local tax system. Minnesota—with a Suits index of -0.015 (the orange bar in the above graph)—ekes ahead of New York as the seventh least regressive state and local tax system in the nation.14 Among neighboring states, Minnesota has by far the least regressive state and local tax system. Minnesota’s rank as the seventh least regressive state in the nation is primarily due to (1) its relatively heavy reliance on progressive income taxes and (2) the fact that income taxes in Minnesota are more progressive than in most other states. 13 Based on Who Pays data, Oregon and Delaware rank 1st and 2nd respectively among the 50 states in the extent to which they rely on the individual income tax. While California ranks a relatively modest 14th in terms of individual income tax dependence, the individual income tax in that state is more than twice as progressive as state and local individual income taxes in other states. 14 New York also has a Suits index of -0.015 ignoring the impact of the federal offset, but falls behind Minnesota before rounding. Minnesota’s Suits index is slightly greater than New York’s but both states round off to -0.015. GROWTH & JUSTICE 11 MINNESOTA’S PROGRESS AGAINST REGRESSIVITY Including the impact of the federal tax offset—which primarily benefits high income households— has the effect of reducing the Suits index and increasing the degree of observed state and local tax regressivity in all 50 states. The last two columns in Table 1 list the state and local Suits indices for all fifty states including the impact of the federal tax offset. The graph below lists all fifty states in order of their Suits indices after adjusting for the offset, with states listed from left (least regressive) to right (most regressive). The aggregate Suits index of all 50 states is also shown. SUITS INDICES BY STATE - ADJUSTING FOR FEDERAL TAX OFFSET 0.05 BASED ON 2012 INCOME DATA AND TAX LAWS AS OF DEC. 31, 2014 0.00 -0.05 -0.10 -0.15 -0.20 -0.25 -0.30 -0.35 The average Suits index for all fifty states after adjusting for the effects of the federal tax offset (the green bar) is -0.110, compared to just -0.069 prior to adjusting for the offset; 24 states have Suits indices above this fifty state average (denoting below average regressivity) while 26 states have indices below the fifty state average (denoting above average regressivity). While the observed degree of regressivity increases after adjusting for the federal tax offset, the position of states relative to each other in terms of the degree of state and local tax regressivity generally does not change much; the regressivity ranking of most states changes by only one position or stays the same after adjusting for the effects of the offset. The three least regressive states prior to adjusting for the offset (California, Delaware, and Oregon) remain the three least regressive states after the offset, although only California remains truly progressive, with a Suits index above zero (+0.004). On the other end of the regressivity spectrum, the six most regressive states prior to adjusting for the federal offset remain the six most regressive states after adjusting for the offset. Minnesota’s Suits index after adjusting for the federal offset is -0.048 (the orange bar), compared to just -0.015 prior to adjusting for the offset. However, Minnesota’s regressivity rank among states after adjusting for the offset is the same as before adjusting for the offset (seventh). Minnesota’s emergence among the top ten least regressive states in the nation is a relatively recent development that is largely attributable to changes in tax law enacted over the last two years. 12 GROWTH & JUSTICE 50 STATE TAX INCIDENCE ANALYSIS CHANGES IN 50-STATE TAX REGRESSIVITY OVER THE LAST TWO YEARS While the state and local tax systems in the vast majority of states became more regressive over the last two years, Minnesota’s tax system became significantly less regressive. These conclusions are based on a comparison of Suits indices calculated from data in the 2013 edition of Who Pays, which is based on 2010 income levels and tax laws as of January 2013, and the 2015 edition, which as noted above, is based on 2012 income levels and tax laws as of December 31,2014. (An appendix to this report features a table showing the state and local Suits index and regressivity ranking based on data from the 2013 Who Pays report. The table in the preceding section shows similar information based on the 2015 Who Pays report.) The graph below shows the change in Suits indices from 2013 to 2015 (i.e., based on data from the 2013 and 2015 Who Pays reports) for all fifty states, with states listed from left to right from the largest Suits index increase (i.e., the greatest reduction in tax regressivity) to the largest Suits index reduction (i.e., the greatest increase in tax regressivity). The data in this graph is based on the Suits index change prior to taking into account the federal tax offset. CHANGE IN SUITS INDEX BY STATE FROM 2013 TO 2015 - WITHOUT ADJUSTING FOR FEDERAL TAX OFFSET 0.03 0.02 0.01 0.00 -0.01 -0.02 -0.03 -0.04 -0.05 -0.06 -0.07 BASED ON DATA FROM THE 2013 AND 2015 WHO PAYS REPORTS Over the last two years, tax regressivity increased in the vast majority of states. Only ten states had an increase in their state and local Suits index from 2013 to 2015, denoting a reduction in tax regressivity. The largest reduction in tax regressivity occurred in Minnesota; Minnesota’s Suits index increased by 0.018 from 2013 to 2015 (the orange bar). Tax regressivity increased in the remaining forty states, as did the aggregate for all fifty states combined (the green bar). The graph on the following page shows the change in Suits indices among the fifty states over the same two year period, this time including the impact of the federal tax offset. GROWTH & JUSTICE 13 MINNESOTA’S PROGRESS AGAINST REGRESSIVITY CHANGE IN SUITS INDEX BY STATE FROM 2013 TO 2015 - ADJUSTING FOR FEDERAL TAX OFFSET BASED ON DATA FROM THE 2013 AND 2015 WHO PAYS REPORTS 0.03 0.02 0.01 0.00 -0.01 -0.02 -0.03 -0.04 -0.05 -0.06 -0.07 The trend observed after taking into account the effects of the federal tax offset is roughly similar to the trends observed without the offset. Only fifteen states—again led by Minnesota (the orange bar)— showed a reduction in tax regressivity over the last two years. The remaining 35 states, as well as the aggregate change for all fifty states combined (the green bar), showed an increase in tax regressivity. The overall increase in tax regressivity among the fifty states is almost certainly due in large part to growth in income concentration at the top of the income spectrum. The graph to the right shows the growth by income group based on data from the 2013 and 2015 Who Pays reports (corresponding to 2010 and 2012 income levels) for all fifty states combined. CHANGE IN AVERAGE INCOME FROM 2013 TO 2015 CORRESPONDING TO 2010 AND 2012 INCOME LEVELS On a national basis, growth in average income among the top one percent grew three times faster than among the bottom 95 percent. A similar pattern was observed in each of the fifty states, with the top one percent showing the largest increase in income in every state except one. Furthermore, Gini coefficients15 for each of the fifty states increased over the last two years (denoting an increase in income concentration at the top) based on data from the 2013 and 2015 Who Pays reports. Who Pays reports The degree of tax regressivity tends to increase as the degree of income concentration increases. This is due in large part to the fact that as the share of income accruing to the highest income households increases, the share of income subject to the lowest state and local ETRs also increases, since the highest income households have the lowest ETRs. The growth in nationwide state and local tax regressivity is consistent with the trend of growing income concentration. 15 A description of the Gini coefficient can be found at: http://simple.wikipedia.org/wiki/Gini_coefficient 14 GROWTH & JUSTICE 50 STATE TAX INCIDENCE ANALYSIS However, tax regressivity in Minnesota declined significantly over the last two years, despite the fact that the level of income concentration at the top increased in Minnesota at a rate commensurate with the rest of the nation. The decline in tax regressivity in Minnesota is no doubt due largely to tax legislation passed during the 2013 and 2014 legislative sessions, specifically: • The enactment of a higher income tax rate for the wealthiest two percent of Minnesota households. More precisely, the 2013 tax act increased the income tax rate from 7.85 percent to 9.85 percent on the portion of taxable income above $250,000 for married joint filers, $200,000 for heads of households, and $150,000 for single filers. This change made Minnesota’s tax system less regressive by making Minnesota more dependent on revenue generated from the progressive income tax and by simultaneously making Minnesota’s state income tax more progressive. • Expansion of property tax relief programs, most notably the homeowners and renters property tax refunds. The largest single property tax relief measure was the expansion of the homeowners refund (renamed the homestead credit refund),16 which increased refunds for eligible households with incomes from $19,530 to $105,500. The property tax relief provisions in the 2013 and 2014 tax acts reduced tax regressivity in Minnesota by reducing dependence on regressive property taxes and by simultaneously making the property tax itself less regressive through increased utilization of progressive refund programs. The fact that progressive changes in tax policy in Minnesota were more than sufficient to offset the regressive impact of increased income concentration is not surprising. Previous research17 has demonstrated that changes in tax policy (more precisely, tax policy changes that modify the extent to which a state depends on regressive versus progressive taxes) are a far more powerful determinant of changes in tax regressivity than are changes in the degree of income concentration. It is worth noting that the only state that came close to Minnesota in terms of reducing tax regressivity from 2013 to 2015—Delaware—also implemented tax policy changes that increased the income tax rate for the highest income households. The powerfully progressive aspects of the 2013 and 2014 tax acts were not only sufficient to offset the regressive impact of increased income concentration, but also the effects of regressive tax changes—most notably, a large increase in regressive cigarette taxes18 and a large reduction in the progressive estate tax.19 The 2015 Who Pays report includes some components of personal income that were excluded from the 2013 Who Pays report, which may contribute to the change in personal income levels and effective tax rates published in the last two reports. Nonetheless, the growth in income concentration indicated by a comparison of data from the last two Who Pays reports is consistent with trends observed from other sources.20 Furthermore, the significant reduction in tax regressivity in Minnesota is consistent with trends reported in the 2015 MTIS.21 Thus, while the measure of income has changed from the 2013 to 2015 Who Pays reports, the trends in income growth and tax regressivity in Minnesota are confirmed by data from other sources. 16 The new homestead credit refund was described in a 2013 Minnesota 2020 article, which can found at: http://www.mn2020.org/issues-thatmatter/fiscal-policy/targeted-powerful-property-tax-relief 17 Specifically, a 2014 Minnesota 2020 report, which can be found at: http://www.mn2020.org/assets/uploads/article/MN_moves_ahead_web.pdf 18 Described more fully in a 2013 Minnesota 2020 article, which can be found at: http://www.mn2020.org/issues-that-matter/fiscal-policy/despiteregressivity-tobacco-tax-increase-was-good-policy 19 Described more fully in a 2014 Minnesota 2020 article, which can be found at: http://www.mn2020.org/issues-that-matter/fiscal-policy/newestate-tax-break-comes-with-high-cost-in-revenue-fairness 20 For example, based on data from the last two Minnesota Tax Incidence Studies, from 2010 to 2012 the average income among the top 1% grew 2.7 times faster than among the bottom 95 percent—a trend roughly similar to what is observed in Minnesota based on Who Pays data. 21 The 2015 MTIS shows a significant reduction in tax regressivity from 2012 (prior to the 2013 and 2014 tax acts) to projected 2017 (after the 2013 and 2014 tax acts). GROWTH & JUSTICE 15 MINNESOTA’S PROGRESS AGAINST REGRESSIVITY From 2013 to 2015, state and local tax regressivity in Minnesota declined more than in any other state in the nation. Furthermore, Minnesota’s jump in the fifty state regressivity ranking—from the 16th least regressive state22 based on 2013 Who Pays data to 7th least regressive based on 2015 data—represents the largest leap in the nation. These improvements can be largely attributed to powerfully progressive tax changes enacted during the 2013 and 2014 sessions. STATE & LOCAL EFFECTIVE TAX RATES IN MINNESOTA As noted above, the 2015 MTIS provides the most accurate and detailed information currently available regarding Minnesota state and local effective tax rates (ETRs) by income group. The graph to the right shows Minnesota state and local ETRs by decile based on data from the 2015 MTIS, with the top decile further broken down into the “next 5%” (i.e., the bottom half of the top decile), the “next 4%,” and the “top 1%.” In order to reflect the impact of the 2013 and 2014 tax changes, the graph presents the projected ETRs based on projected 2017 data. (The 2012 ETRs presented in the 2015 MTIS do not include the impact of the 2013 and 2014 tax acts.) In this graph, the ETR of the first decile (26.4%) is omitted due to first tier data anomalies noted previously (and described in more detail on page 17 of the 2015 MTIS). PROJECTED 2017 EFFECTIVE TAX RATES 2015 MTIS The table below shows the income ranges associated with each of these income groups. Deciles Income Groups 1st 2nd 3rd 4th 5th 6th 7th 8th 9th 10th 10th Next 5% Decile Next 4% Detail Top 1% Income Range Average Income Under $12,585 $12,585 to $20,449 $20,450 to $29,136 $29,137 to $39,054 $39,055 to $51,098 $51,099 to $66,362 $66.363 to $86,340 $86,341 to $113,860 $113,861 to $165,870 Over $165,870 $165,871 to $241,940 $241,941 to $595,346 Over $595,346 $7,491 $16,531 $24,637 $34,065 $44,886 $58,600 $75,791 $99,207 $136,276 $394,093 $197,409 $345,152 $1,571,524 22 From a 2014 Minnesota 2020 report, Minnesota had the 16th least regressive state and local tax system in the nation based on data from the 2013 Who Pays report. 16 GROWTH & JUSTICE 50 STATE TAX INCIDENCE ANALYSIS Based on projected 2017 data, the lowest ETR for any decile is 10.7 percent, found within the tenth (highest income) decile. While the third decile ETR is 10.9 percent, the ETRs of all other deciles excluding the tenth are above 11 percent and most are near 12 percent or above. A more detailed analysis of the tenth decile shows that the lowest ETRs are concentrated in the top half of the decile (i.e., the top five percent, represented as the “next 4%” and “top 1%” in the graph), which has an ETR of 10.5 percent. In short, the households with the highest incomes in Minnesota still enjoy the lowest effective tax rates. The regressivity of Minnesota’s tax system is further underscored by a comparison of state and local taxes borne by moderate income versus high income households. The average ETR of the top one percent is 10.5 percent, while the average ETR of middle-income households (defined here as the 5th and 6th deciles combined) is 11.9 percent. In other words, households with incomes between $39,000 and $66,000 are paying 13 percent more in state and local taxes per dollar of income than are households in the top one percent with an average income of nearly $1.6 million. Minnesota’s state and local tax system remains significantly regressive. The regressivity of Minnesota’s state and local tax system is also demonstrated in the state’s projected 2017 Suits index of -0.035. As noted above, state and local Suits indices for Minnesota from the MTIS are more accurate than Suits indices calculated based on Who Pays data because the MTIS includes a wider array of taxes and a broader sampling of Minnesota’s population (although Who Pays remains the only source of data for making comparisons between Minnesota and other states). The projected 2017 Suits index of -0.035—while greater than the Suits indices from previous years—still denotes continuing and significant tax regressivity. Based on a comparison of Minnesota’s 2012 and projected 2017 state and local ETRs, it is clear that Minnesota has made progress in reducing tax regressivity. As noted in previous sections of this report, Minnesota has also made progress relative to other states in reducing tax regressivity. Most of the credit for this goes to the robustly progressive tax acts of 2013 and 2014. Nonetheless, moderate income households continue to pay significantly higher state and local taxes per dollar of income than do high income households. The degree of tax regressivity in Minnesota— while diminished relative to the levels of the recent past and relative to other states—remains significant. In the battle against tax regressivity, Minnesota policymakers cannot afford to rest on their laurels. TAX REGRESSIVITY AND ECONOMIC PERFORMANCE The first section of this report argued that reduced tax regressivity contributes to improved economic performance by putting more dollars in the pockets of low and moderate income households. As these households tend to spend a larger portion of their income on goods and services than do high income households, an increase in their purchasing power through reduced tax regressivity provides more dollar-for-dollar stimulus than a similar reduction for high income households resulting from increased tax regressivity. The first section also argued that reduced tax regressivity can result in higher state and local revenues and greater public investment because state and local governments are relying less heavily on taxes generated from low and moderate income households that are struggling to make ends meet; the higher level of public investment can in turn result in improved education, transportation, and overall quality of life—assets that will make a state more attractive to businesses and more likely to create well paying jobs. GROWTH & JUSTICE 17 MINNESOTA’S PROGRESS AGAINST REGRESSIVITY However, conservatives dispute these conclusions, arguing that a reduction in tax regressivity at the state and local level will contribute to “tax flight” among high income households, as they relocate to states where they are not taxed as heavily (i.e., states with higher tax regressivity). Insofar as these high income households are “job creators,” a move toward a less regressive tax system can lead to a loss of businesses and jobs within a state. Progressives in return dispute the extent to which tax flight occurs at all, as well as the extent to which high income households are necessarily “job creators.” Minnesota’s progress in reducing tax regressivity certainly does not seem to have hurt overall economic performance, as the state’s unemployment rate is a full two percent below the national average and personal income growth remains healthy. However, given that the 2013 tax act was enacted less than two years ago and the 2014 act was enacted less than one year ago, not enough time has passed to fully gauge the success of this legislation. Furthermore, one state does not a pattern make. However, it is possible to examine the impact of tax regressivity on economic performance by comparing the degree of regressivity in each state to the level of economic performance. Specifically, the following analysis correlates the Suits index of each state—with and without the federal tax offset—to six widely used measures of economic performance: • Annual personal income per capita (2013; source: U.S. Bureau of Economic Analysis) • Growth in personal income per capita over the last five years (2008-2013; source: U.S. BEA) • Gross domestic product per capita (2013; source: U.S. BEA) • Growth in GDP per capita over the last five years (2008-2013; source: U.S. BEA) • Unemployment rate (December 2014; U.S. Bureau of Labor Statistics) • Growth in non-farm employment over the last five years (December 2009-2014, U.S. BLS) In each case, the most recently available data at the time this research was conducted was used. When correlating the Suits indices with the level of economic performance as measured by the six factors listed above, there were no statistically significant relationships.23 Based on this analysis, there is no strong evidence that the degree of tax regressivity in a state has any impact on economic performance. However, these results could be influenced by the economic boom experienced within oil and gas producing states during the period under examination. For example, the economic growth in North Dakota over the last five years was driven by oil and gas production in that state and would have occurred regardless of the degree of tax regressivity in North Dakota. Insofar as oil and gas producing states are economic outliers, they could arguably be excluded from this analysis. If we exclude the top tier of oil and gas producing states (states in which oil and gas extraction and related support activities exceed ten percent of state GDP)— defined here as Alaska, Louisiana, North Dakota, Oklahoma, Texas, and Wyoming—a somewhat different picture emerges. While there is no statistically significant relationship between the degree of tax regressivity and (1) job growth over the last five years and (2) the current unemployment rate, there is a statistically significant relationship between the degree of tax regressivity and some of the GDP and personal income measures: 23 A relationship is considered to be “statistically significant” if—based on commonly used statistical measures—we can be 95 percent confident that the observed relationship is not the result of random chance. 18 GROWTH & JUSTICE 50 STATE TAX INCIDENCE ANALYSIS • States with relatively less tax regressivity had stronger GDP growth based on the correlation between the Suits index (with and without taking into account the federal tax offset) and the five year growth in per capita GDP. • States with relatively less tax regressivity had stronger personal income growth based on the correlation between the Suits index (including the impact of the federal tax offset) and the five year growth in per capita personal income.24 Among the 44 states included in this analysis, the degree of tax regressivity as measured by the Suits index was sufficient to explain over 12 percent of the variation among states in per capita GDP growth over the last five years (12.2 percent based on the Suits index excluding the impact of the federal offset and 14.6 percent including the impact of the offset). Meanwhile, the degree of tax regressivity as measured by the Suits index including the impact of the federal offset was sufficient to explain 9.2 percent of the variation in per capita personal income growth. In each of these instances, superior and statistically significant economic growth was associated with reduced tax regressivity. While reduced tax regressivity was not associated with higher (or lower) rates of unemployment or job growth over the last five years, it was associated with stronger GDP and personal income growth. Although correlation does not necessarily prove causation, the trends observed suggest at a minimum that reduction in tax regressivity does not hurt a state’s economic performance and could help to promote more robust income and GDP growth. While more extensive research is needed to confirm the relationship between the degree of state tax regressivity and economic performance, the results of this analysis indicate that the impact of reduced tax regressivity is primarily positive. CONCLUSION: PROGRESS ACHIEVED, WORK YET TO BE DONE Reduction in tax regressivity is not the only goal that policymakers should be concerned about, but—given the need to increase the purchasing power of lower and middle income families and generate sufficient revenue to provide adequate public services—it should be one of them. Reduction in the degree of tax regressivity was a primary objective of the framers of the 2013 and 2014 tax acts. By all indications, they succeeded. Based on information from the 2015 MTIS, the state and local Suits index for Minnesota fell from -0.052 based on 2012 data (before the 2013 and 2014 tax changes) to -0.035 based on projected 2017 data (after the 2013 and 2014 changes), denoting a significant reduction in tax regressivity. This trend is confirmed by the Suits indices cited above, which fell from -0.033 based on data from the 2013 Who Pays report (before the 2013 and 2014 changes) to -0.015 based on data from the 2015 Who Pays report (after the 2013 and 2014 changes). Not only did Minnesota tax regressivity decline in an absolute sense, but it also declined relative to other states. In fact, Minnesota led the nation in reducing tax regressivity over the last two years, as the Gopher State improved from the 16th least regressive state in the nation to the seventh. The principal mechanisms within the 2013 and 2014 tax acts which led to reduced state and local tax regressivity was the enactment of a higher income tax rate for the wealthiest households, which had the effect of increasing dependence on the progressive income tax and making the income tax more progressive, and increased utilization of the homeowners and renters property tax refunds, 24 The correlation between the degree of tax regressivity and the Suits index excluding the impact of the federal tax offset fell barely short of statistical significance based on 95 percent confidence criteria. GROWTH & JUSTICE 19 MINNESOTA’S PROGRESS AGAINST REGRESSIVITY which had the effect of reducing dependence on regressive property taxes and making the property tax less regressive. The progressivity resulting from these changes was sufficient to overcome increased income concentration and other factors that were pushing Minnesota’s tax system toward greater regressivity. Not only did the 2013 and 2014 tax acts produce the most significant reduction in tax regressivity in the nation, but they also generated significant new resources to partially restore a decade of funding cuts to critical public investments while simultaneously reducing taxes paid by most Minnesota households. Based upon tax incidence analyses of the 2013 and 2014 tax acts prepared by the Minnesota Department of Revenue,25 the collective changes resulting from this legislation produced tax reductions within six of Minnesota’s ten deciles; if we exclude the impact of the cigarette tax increase which affects fewer than one in six Minnesota adults, all income groups saw tax reductions as a result of the 2013 and 2014 tax acts with the exception of the top five percent. Despite the concerns of naysayers, the reduction in tax regressivity resulting from the 2013 and 2014 tax acts does not appear to have damaged Minnesota’s economy, as the state continues to outperform the national average based on most key indicators. Furthermore, research cited above shows that lower levels of tax regressivity are correlated with above average rates of personal income and GDP growth over the last five years. In short, the preliminary indication is that reduced regressivity is associated with higher—not lower—levels of economic growth. However, despite the progress made over the last two years, Minnesota’s overall state and local tax system remains regressive. The recently released 2015 MTIS shows that middle-income households are paying 13 percent more per dollar of income in state and local taxes than are the top one percent. Furthermore, bills introduced during the 2015 legislative session would erode the progress made toward reducing tax regressivity by dramatically reducing the progressive estate tax, providing social security income tax breaks that would primarily benefit high income households, and cutting the powerfully progressive renters property tax refund. Continued vigilance is needed to guard against creeping tax regressivity and to protect the gains made during the 2013 and 2014 legislative sessions. The principal argument in favor of reducing tax regressivity is based on common sense. If a family with an income of $50,000 or less can pay 12 percent of their income in state and local taxes, families with incomes of $500,000 or more can be expected to do the same. This is not socialism or class warfare, but simple tax fairness. Protection of past progress and pursuit of additional reduction in tax regressivity should continue to be among the goals of state policymakers. 25 These incidence analyses were summarized in a 2014 Minnesota 2020 article, which can be found at: http://www.mn2020.org/issues-that-matter/ fiscal-policy/tax-rates-fall-for-most-minnesotans-thanks-to-progressive-tax-acts 20 GROWTH & JUSTICE 50 STATE TAX INCIDENCE ANALYSIS APPENDIX: STATE & LOCAL SUITS INDICES FOR THE 50 STATES Without Adjusting for Federal Offset Suits Index Rank Alabama -0.132 43 Alaska -0.129 42 Arizona -0.112 38 Arkansas -0.081 30 California 0.050 1 Colorado -0.077 28 Connecticut -0.082 31 Delaware 0.011 3 Florida -0.215 50 Georgia -0.069 26 Hawaii -0.065 25 Idaho -0.009 7 Illinois -0.118 40 Indiana -0.094 35 Iowa -0.054 20 Kansas -0.076 27 Kentucky -0.062 23 Louisiana -0.115 39 Maine -0.011 8 Maryland -0.030 13 Massachusetts -0.079 29 Michigan -0.057 22 Minnesota -0.033 16 Mississippi -0.092 33 Missouri -0.052 19 Montana -0.007 5 Nebraska -0.056 21 Nevada -0.164 44 New Hampshire -0.123 41 New Jersey -0.008 6 New Mexico -0.088 32 New York -0.022 10 North Carolina -0.024 12 North Dakota -0.102 37 Ohio -0.050 18 Oklahoma -0.099 36 Oregon 0.023 2 Pennsylvania -0.092 34 Rhode Island -0.033 15 South Carolina -0.016 9 South Dakota -0.204 48 Tennessee -0.194 46 Texas -0.175 45 Utah -0.063 24 Vermont -0.003 4 Virginia -0.043 17 Washington -0.214 49 West Virginia -0.022 11 Wisconsin -0.032 14 Wyoming -0.203 47 All U.S. -0.057 Based on 2013 Who Pays data Adjusting for Federal Offset Suits Index Rank -0.169 43 -0.158 41 -0.153 40 -0.118 28 0.002 1 -0.115 26 -0.127 34 -0.040 5 -0.253 50 -0.118 27 -0.097 23 -0.038 3 -0.148 38 -0.123 33 -0.090 20 -0.122 31 -0.098 25 -0.149 39 -0.049 6 -0.070 13 -0.119 30 -0.083 16 -0.070 14 -0.123 32 -0.091 21 -0.050 7 -0.094 22 -0.193 44 -0.164 42 -0.053 8 -0.118 29 -0.084 17 -0.064 11 -0.135 37 -0.086 19 -0.130 35 -0.019 2 -0.133 36 -0.075 15 -0.054 9 -0.229 47 -0.221 46 -0.201 45 -0.097 24 -0.038 4 -0.085 18 -0.238 48 -0.057 10 -0.067 12 -0.250 49 -0.102 GROWTH & JUSTICE 21 970 Raymond Avenue, Suite 105 Saint Paul, MN 55114 growthandjustice.org

© Copyright 2026