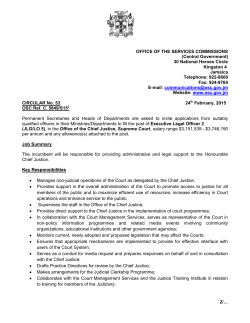

JUDICIARY OF GUAM - Unified Courts of Guam