HOME BUYERS GUIDE

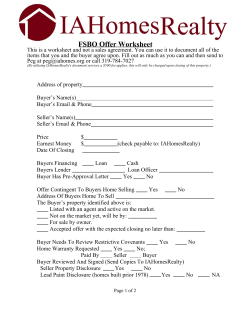

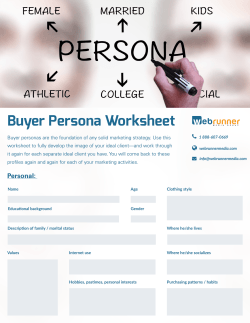

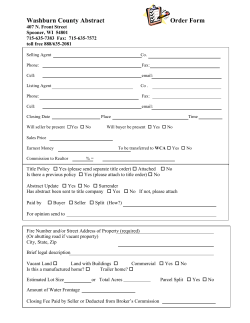

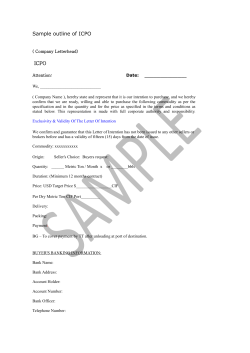

HOME BUYERS GUIDE I-Agent Realty Inc. Inside ou ill ind a comprehensi e guide that goes o er the home bu ing process. We talk about e er thing from the mortgage, searching for properties, contracts, negotiations, inspections, closing, and much more. Our goal is to help ou feel comfortable and to pro ide ou ith all the necessar information ahead of time, so that the purchase of our home is smooth and stress free. HOME BUYER’S GUIDE TABLE OF CONTENTS TALK TO A LENDER CHOOSING YOUR AGENT The I-Agent 50% Commission Rebate THE SEARCH THE OFFER THE INSPECTION THE FINANCE CONTINGENCY AND APPRAISAL THE FINAL WALK-THROUGH TITLE COMPANY AND CLOSING I-AGENT REALTY INC Local Lending Institutions 2 5 7 9 11 14 18 20 21 25 26 HOME BUYER’S GUIDE TALK TO A LENDER The importance of getting pre-approved cannot be overstated. More often than not in today’s market, a seller will not even entertain an ofer without a letter of pre-approval. You should talk to a lender as much as a year before you plan on buying a home. This is important because oftentimes there can be issues with credit that the applicant is unaware of, and these issues need to be addressed in order to qualify. A good lender will assist in putting you on a path to being credit worthy by directing you to what items need to be resolved. Getting pre-approved is also important when establishing a budget for your home search so that you are looking at properties that you can comfortably aford. Your credit score is the just one of the items looked at by a lender. Lenders will also look at payment history, employment history, and debt-to-income ratio. How many lines of credit do you currently have open? Are they revolving or installment lines? There are a lot of questions to ask and answer. When deciding on a lender to use, there are some other factors to consider besides your own credit. What type of experience does the lender have? How many lending avenues do they have available to get you approved? Will they be assessable during the loan process? It is also recommended that you work with a local lender so that if there are any issues, you will have direct access to your lender to resolve anything that comes to light. HOME BUYER’S GUIDE 8 THINGS YOU SHOULDN’T DO UNTIL YOU’VE CLOSED ON YOUR HOME It is important to know that your application and credit will be reviewed again just before the act of sale. There are 8 things that you want to avoid doing until after the purchase is complete. 1. 2. 3. 4. 5. 6. 7. 8. Do not open or apply for any new credit cards. Do not close out any credit cards. Do not change jobs during the process of buying a home. Do not inance new furniture or appliances until the day after your closing! Do not buy a new car. Do not move money between accounts unnecessarily. Do not skip a payment or be late on a payment. Do not spend your savings. Following these guidelines will help make sure your home purchase goes smoothly. HOME BUYER’S GUIDE TYPES OF LOANS Conventional Loans 5% minimum do n pa ment and Pri ate Mortgage Insurance can be remo ed if applicable; do n pa ments can be gifted. Seller can assist ith closing costs and the ma imum amount allo ed aries b lender. FHA 3.5% do n pa ment, Pri ate Mortgage Insurance is for the life of the loan. Do n pa ment can be gifted. Seller can assist ith closing costs and the ma imum amount allo ed aries b lender. VA Loan Ofered to Veterans at 0 Do n. Can be used multiple times, seller can assist ith closing costs. Notes Lender’s Contact Information NAME : CELL : EMAIL : HOME BUYER’S GUIDE I-AGENT REALTORS GIVE 50% OF THEIR COMMISSION BACK TO YOU! ON AVERAGE THAT’S $6,000 BACK TO THE BUYER! CHOOSING YOUR AGENT Understanding the diference between Client & Customer How do you deine a client? Client - A client is in a binding contractual relationship with a Realtor or broker. This is documented by a Buyer Representation Agreement when an agent represents a buyer in purchasing a property listed by another agent. The Listing Agreement for Sellers documents the relationship when an agent lists a property for sale. How do you deine a customer? Customer - A customer is serviced by an agent, but without contractual agreement. Customers must be treated honestly and fairly by agents and given truthful responses to their questions. What’s the key diference between the two? An agent may only give their advice and opinion to a client. To receive the full beneit of the services of a Realtor, it is highly recommended that you enter into an agreement to be a client. When a listing agent works with the seller and a buyer for the same property, the seller is often a client and the buyer is a customer. HOME BUYER’S GUIDE Buyer’s Agent Agreements and Why I-Agent Realty is Diferent Most home buyers balk at signing an exclusive buyer’s agent agreement and we don’t blame them. Why lock yourself into working with an agent for 30, 60, or even 90 days right after you’ve met them? That’s where I-Agent is diferent. We allow you to cancel the buyer’s agent agreement at any time. If you’re not happy with our service, we aren’t going to force you to work with us or do anything to hold you back from inding your dream home! You’re probably asking yourself what’s the point in even signing one, then? There are plenty of beneits that come with signing a buyer’s agency agreement. The biggest reason to sign one with I-Agent Realty Inc. is because that is where we state the terms for our rebate and guarantee your commission rebate. It gives you a legal document protecting your rebate after you close on your home and the agreement also covers the following items: Broker/Agents Duties and Responsibilities to the Buyer Rules/Guidelines for Dual and Designated Representation Information on Fair Housing Laws Contact information for everyone involved in the transaction and preferred methods of communication Notes Agent Contact Information NAME : CELL : EMAIL : HOME BUYER’S GUIDE The I-Agent 50% Commission Rebate Not only do I-Agent.com Realtors provide unparalleled customer service but we also rebate 50% of our commission back to you! Over the past 20-30 years home prices have doubled and tripled in some areas but the traditional 3% buyer’s agent commission has stayed the same. If an agent in the 70’s represented a buyer in purchasing a $150,000 home, he or she would have made $4,500. If that house was in the D.C. Metropolitan area, there is a good chance that home is worth well over $450,000. Today that same agent would make $13,500 or more. We thought this was unfair to the buyer, so we decided to rebate 50% of our real estate commission back to you! Realtor rebates are 100% legal in Virginia and if you would like for us to send you the article released by the Department of Justice, please email your request to [email protected] and we’ll send you a link to the article. You can use this money to help you with closing costs, a down payment, or we can even give you a certiied check after closing so that you can do as you please with the money. HOME BUYER’S GUIDE If you’re buying a $400,000 property, your rebate would be $6,000 ! What would you do with an extra $6,000 and a new home? We’re sure you can think of a thing or two to do with that money. You’re probably asking yourself what’s the catch? There really is none. You get the same, if not better full service that traditional agents give plus our rebate! We do have minimum rebate requirements, and here below are examples of both. 1% Minimum - If you’re buying a property where the seller is only ofering 2.5% commission and not 3% to the buyers’ agent, you would receive 1.5% and I-Agent would receive 1% of the total 2.5%. $4,000 Minimum- We have a $4,000 minimum commission earned requirement. If you’re purchasing a property for $250,000 and the seller is ofering 3% commission to the buyers’ agent, that means the total commission would be $7,500. Out of the $7,500, you would receive $3,500 and your I-Agent Realtor would make $4,000. Notes HOME BUYER’S GUIDE THE SEARCH Now you must decide what criteria to use as you begin your search. You want to pick out and prioritize your personal must-haves for your dream home. Deciding early on which of these factors are most important and which are least important will make it much easier to recognize the right house when you see it. It is also important to communicate these factors to your agent, as every client’s list of priorities is diferent and your agent can do a much better job helping you ind your dream home if he or she knows what’s important to you. Here’s a sample list of items that were important to some of our past clients: Location/ School District Number of Bedrooms and Bathrooms Lot / Land Size Requirements Size of Home / Square Footage Kitchen Finishes and Layout Flooring - Hardwood, Carpet, Ceramic, Etc… Finished Basement Fireplace Proximity to Major Highways, Metro, or Public Transportation HOME BUYER’S GUIDE Search Tools on the Internet No matter how much you tell us about your dream home, the only person that truly knows your dream home is you! There are some excellent search tools on the internet to help you ind homes you want to visit. Below is a list of sites that have excellent home searches. If you ind a property or a group of properties you want to see, email the address and/or the MLS number along with your availability to your agent. www.iagentrichmond.com ”of course!) www.zillow.com Notes www.Realtor.com HOME BUYER’S GUIDE THE OFFER Once you find the house that is for you, it is time to make an offer. This is where we reach for that pre-approval letter. Sellers want to know that you are able to buy before they will entertain your offer. When writing the offer, it is important to remember that you are trying to spend as little as possible while the seller is trying to make as much profit as possible. A good agent will look at the recent sales and comparable properties in the area and provide a Comparative Market Analysis ”CMA) and suggest the best offer strategy to get you the home for the best price possible. If you would like to see a sample of a CMA that I-Agent Realtors complete for their clients, email us at [email protected] with the request and we’ll send one over to you. It’s important to understand the price per square foot, difference in lot sizes, finishes, etc. for the most recent sales near your prospective home before making an offer. The Earnest Money Deposit ”EMD) This is where you can expect to see your first expense; just like when you are renting a property, you have to put down a deposit to show you are serious about the purchase. The time period from accepting an offer to getting to the act of sale can be as little as 2 weeks or as long as 90 days, depending on the circumstances. In order to get the seller to take the property off of the market for that long, they will expect what is called an earnest money deposit. This deposit can be as little as 1% of the sales price or up to 10% based on the size of the purchase. This money is held in escrow by your Realtors’ broker and it will be returned to you at closing or it can also be used towards your down payment. The EMD shows good faith by you to the seller that you’re serious about purchasing their home. It is important for you and your agent to understand every contingency in your contract so that your EMD is never at risk of being lost if you decide to walk away from the deal. We’ll discuss contingencies a little further down. HOME BUYER’S GUIDE Closing Cost and Contingencies When you’re writing the offer, you can ask the seller to help you pay some of your closing cost. Closing costs will typically add up to 2-3% of the sales price, depending on the county. These costs include property taxes, transfer taxes, lender fees, title insurance, title company fees, and other expenses the county might charge you for buying a property. It’s best to look at the offer in terms of net price. If you offer $400,000 with 0 closing costs or $410,000 with $10,000 in closing cost paid by the seller, your net sales price is still $400,000. Having the seller pay for your closing cost can help you to reduce the amount of funds you will need to bring to closing. Within the contract, you’ll also have to figure out timelines for completing a few contingencies. We’ll get into the details of each contingency a little further down, but below is a list of standard contingencies you’ll have to complete and the typical time frame to complete each: Home Inspection / Lead Based Paint / Radon Contingency - 7-10 days after ratification Finance Contingency - 10-15 days after ratification Appraisal Contingency - 21 days after ratification HOA / Condo Doc Review (if the property you’re interested in is located within a neighborhood that has a homeowners association or if the property is a condo) - 3 days after receiving the documents Well / Septic Inspection (if the property you’re interested in does not have public utilities) - 7-10 days after ratification Termite Inspection - Before closing HOME BUYER’S GUIDE Once you’ve decided the offer price, closing cost, and other terms of the contract, your Realtor will put together the offer for you. Once your offer is ready and signed by you, your Realtor will need your pre-approval letter and a copy of your EMD check to submit to the listing agent. Typically, you can expect to hear a response within 24 hours of submitting your offer, but sometimes it can take a little longer. Your Realtor will get in touch with you right away after he or she has received the counter offer and/or response from the sellers. There is no set number of counteroffers but you can typically expect two to four rounds of back-and-forth negotiation. You’ll not only be negotiating the price but also the closing cost, inspection timelines, and any other item the seller needs your cooperation with. Once everything is agreed upon and signatures are in place, you now have a ratified contract and the real work begins. The listing agent should put the home under contract in the MLS within 24 hours; the home will then officially be off the market and yours to settle on! Notes HOME BUYER’S GUIDE THE HOME INSPECTION Now that you have agreed to purchase a home, there are several things to do before the sale is complete. One of the first steps is the home inspection. Home Inspections are not mandatory but… HOME INSPECTIONS ARE ALWAYS RECOMMENDED. A good home inspection can usually be completed for $250-600. It all just depends on the size of the home you’re purchasing. You can rest assured that this is money well spent. A good inspection will uncover any defects that you cannot see with the naked eye. Things like the condition of the roof, electrical system, plumbing, HVAC, and many other home facets will be included in a thorough inspection. Oftentimes, a house that looks great on the surface can have skeletons in the closet that show up during inspection. You don’t want to buy a house that has hidden problems that could potentially cost you thousands down the road. Home inspections can take anywhere from 2-4 hours, depending on the size of the home and the inspector. We highly recommend that you attend the home inspection and go over the inspection with the home inspector in detail. The home inspector can and will point out things for you to look at and give you maintenance tips. Once the inspection report is obtained, you will discuss your options with your agent. If there are any defects that you think are deal breakers and you do not wish to go forward with the sale, now is the opportunity to walk away, get your deposit back, and start your search again. If you feel as if you still want to move forward after the inspection, but only on the condition that the seller addresses a few items, your Realtor will work with you to create the best strategy. There are certain items that are considered walk-through items . By law, the seller has to fix these items. These items are: Plumbing issues Electrical issues Smoke and heat detectors Appliances must be in normal working order Heating and cooling systems must be in normal working order HOME BUYER’S GUIDE A list of some items that the seller doesn’t have to fix but you can still request is below; please note that this is not a comprehensive list and each house could reveal much more or even less complex issues that are considered negotiable, non-walk-through items: Clean and service the HVAC unit Replace a cracked tile Replace torn screens on windows Clean the chimney Replace shingles on the roof Have carpet restretched HOME BUYER’S GUIDE Once you’ve created a list of the walk-through and non-walk-through items you want fixed, there are three options: 1. 2. 3. Ask the seller to fix the issues before you close on the property Ask for an allowance to be given to have the issues fixed by you after the closing Move forward regardless of the inspection report Sometimes the seller will agree to these requests, sometimes they will refuse, often there is compromise on both sides, because at this point everyone wants to make sure this sale takes place. You don’t want to submit every item from your home inspection report, and it is best to pick and choose your battles. Remember, the job of a home inspector is to be nitpicky and find all the little issues. He might find 50 items to include on the list, but it’s important to remember that someone has been living in the house this entire time with those issues. We’re not saying to let things slide, we’re just saying that if there are 50 items on this list, figure out which items are most important to you and would cost you the most amount of money down the road. Your Realtor will then create an addendum with all of your repair requests to submit to the listing agent. It’s always a good idea to add two or three throw away items on the list. This way, when the seller starts negotiating which ones he or she will address, you can work with them and knock a few items off the list in good faith. Negotiations can take two to three rounds and your Realtor will work with you and the listing agent to get everyone to a mutually acceptable middle ground. It is important to note that often people think if they are buying new construction they do not need to have an inspection. This is not correct, as with any industry there are good builders and there are bad builders. You want to have an inspection to make sure everything was done correctly. There is nothing worse than a brand new house that has problems. HOME BUYER’S GUIDE Notes HOME BUYER’S GUIDE THE FINANCE CONTINGENCY AND THE APPRAISAL Finance Contingency The purpose of the finance contingency is to give you enough time to send the ratified contract to your lender and have him or her go through the entire loan approval process for you. Your lender might ask you for updated pay stubs, bank statements, and other important information that could factor into getting a full loan approval. He or she will then submit all the new documentation to underwriting and they will review the loan application, contract, documents, etc. and come back with either a loan approval or a request for more documents. This process can take anywhere from 14-21 days, and this will result in a loan approval that is contingent on a satisfactory appraisal. You might be wondering why you have to include a finance contingency if you’ve already been pre-approved by a lender. It’s important to include a finance contingency because the lender could change their requirements, your credit could have been affected without you knowing, and loan programs could also change. The 14-21 days you write in for your finance contingency gives you time to go through the loan approval process while protecting your earnest money deposit. Once your loan is approved and the lender gives you a green light, your Realtor will then prepare the forms to remove the finance contingency. HOME BUYER’S GUIDE Appraisal Contingency The purpose of the appraisal is to ensure that the house is worth what the lender is loaning. A lender will not loan more money than the property is worth. Typically, an appraisal will cost you $300-$500. This charge depends on the size of the home. You can pay for the appraisal up front, or your lender can charge you at settlement and include this as part of your closing costs. The appraiser will look at the property in question and attempt to find similar properties that recently sold to gain an accurate market value of the property. Lenders work with a third party company to place the appraisal order. In the past, the lender or a buyer could choose the appraiser themselves, and, as you might guess, that could lead to questions about who the appraiser is really working for. If the appraiser is working for the lender, he might do whatever it takes to keep the lender happy and meet the contract price. If the appraiser is working for you, then they might scrutinize it a little more and try to get you a price point that might require the seller to lower his or her price. These days, the appraiser receives an appraisal request from a third party and he or she does not know if it is for a purchase, refinance, or informational request, and they also don’t know who requested the appraisal. This new system helps to get an unbiased, accurate appraisal report. If the appraisal report comes back at the sales price or higher, you are good to go and your Realtor will prepare the documents to remove the appraisal contingency. If the appraisal comes back lower than the agreed upon sales price, you have a few options: 1. 2. 3. 4. The agent can challenge the appraisal, offer new data for consideration, and request a reappraisal The seller can lower the sales price to meet the appraisal value The buyer can produce the difference out of pocket The buyer and seller can negotiate and agree to a solution accept able to both parties This is why it is important to work with a Realtor that really understands current market valuations, how to properly conduct their own, and share it with you before preparing the offer. A good Realtor will be able to help you avoid this appraisal issue all together by researching and completing a proper CMA before you write and submit your offer. Notes HOME BUYER’S GUIDE THE FINAL WALK -THROUGH You’re almost at the finish line! Before you close on your home, you need to conduct one final walk-through. You and your Realtor will walk through the property to make sure all home inspection items have been fixed ”you should have receipts for these as well), the house is clean and in good shape, and nothing was destroyed or taken by the seller that wasn’t specifically stated in the contract. If there are any issues, your agent will work with the listing agent to have them resolved before closing. We recommend you try and complete the walk-through 48 hours before the closing date so that if there are issues, there is ample time to resolve them. If there aren’t any issues at the walk-through, it’s time to move to the final step! HOME BUYER’S GUIDE TITLE COMPANY AND CLOSING Before your contract was even submitted for negotiations to the seller, you had to put down a title company to represent you in the purchase of your home. By law, the buyer has the right to select the title company he or she wants to handle the purchase. Within 24-48 hours of having a ratified contract, your Realtor will send the contract and your contact information to the title company you chose. So what exactly does a title company do? Conduct a thorough title search to make sure the title is free and clear of any liens Make sure ownership belongs to the actual seller listed on the contract Prepare HUDs and other documents needed to sign for closing (loan documents, county transfer docs, etc…) Provide the buyer with title insurance options Facilitate the entire closing process between the buyer, seller, lender, agents, and the county This is where some of your closing costs are incurred. When choosing a title company, it is important to ask for an estimate of closing costs. It is also important to note that these costs can be negotiated to some extent. What exactly is a HUD-1 statement? The HUD-1 Settlement Statement is a standard form used in the United States that itemizes services and fees charged to the borrower by the lender, title company, or broker when applying for a loan for the purpose of purchasing or refinancing real estate. Hold on to the HUD and provide it to your accountant or whoever helps you with your taxes. A lot of the fees you’re charged are tax deductible. What is title insurance and do I really need it? Title insurance is a one-time fee that can help provide the home buyer and/or the mortgage lender necessary protection against losses resulting from unknown defects in the title to the property you’re purchasing. These defects could have occurred prior to the closing of a real estate transaction. Unknown defects in a title include, but are not limited to, any outstanding liens on the property ”e.g., unpaid real estate taxes by a prior owner) or encumbrances ”anything that might hinder the owner’s right of ownership: e.g., errors or omissions in deeds, undisclosed errors, fraud, forgery, mistakes in examining records), and improper transfer due to an heir. These can all result in additional costs in the future or even invalidate a home buyer’s right of ownership in the property, and might also invalidate the lender’s security interest in the policy. HOME BUYER’S GUIDE Title insurance policies will cover the insured party for any covered losses or legal fees that might arise out of such problems. When the title company completes their work, the lender will be notified. Once the lender is notified that everything is clear regarding the title and HUDs, they will once again look at the file. Then, if all requirements have been met and the HUD looks accurate, they will issue the final approval known as the Clear to Close at that time. The Clear to Close is basically the green light to sign the papers. Once received, the title company will schedule a time for everyone to come in and sign the necessary paperwork. The title company will also let you know how much you will need to either wire or bring in the form of a certified check to the closing. You will need to make sure these funds are wired or brought to the closing. You will also need to bring a valid driver’s license or passport. On the day of the closing, you will go in at the time you scheduled with the title company and sign all the necessary documents to complete the purchase of the home. Sellers and buyers sometimes conduct the closing at the same time; this gives you one last opportunity to ask the seller questions about the property and exchange contact information, if you wish. Now that all signatures are in place, the loan will fund the sale and you are officially a homeowner. You should make sure you have all house keys, mail keys, garage door openers, security key fobs, etc… HOME BUYER’S GUIDE Congratulations You’re Oicially a Home Owner! HOME BUYER’S GUIDE Notes HOME BUYER’S GUIDE I-Agent Realty Inc. Realtor & Residential Real Estate Specialist located in Richmond, VA. Our mission is to provide unparalleled client services to home buyers and sellers while providing the largest Realtor commission rebate in Central Virginia. Even though we give a commission rebate and a discount on our listing services, that doesn’t mean the professionalism and contribution from us will be discounted as well. We strive to provide services above and beyond any current full service real estate brokerages. We accomplish this by placing the client’s needs above our own at all times. We use traditional methods of client services while embracing technology and we strive to adapt and stay ahead of all the local market real estate trends. Our primary focus is to make sure the client feels optimistic and confident in every step of the home buying or selling process. By doing this we ensure the process is exciting, enjoyable, stress free, and fulfilling for our clients. We want to create a positive lasting impression to ensure I-Agent Realty will be your real estate representatives for life. HOME BUYER’S GUIDE Local Lending Institutions Capital Center, L. L. C. Dominion Capital Mortgage Dixon Hughes Goodman Building 4510 Cox Road, Suite 402 Glen Allen, VA 23060 Tel: 804-968-5000 Email: [email protected] Fax: 804-217-7825 Website: www.capcenter.com 3900 Westerre Parkway, Suite 100 Richmond, VA 23233 Tel: 888-667-0404 Email: [email protected] Fax: 866-931-3101 Website: www.dcmloan.com HOME BUYER’S GUIDE Notes Thank you for allowing us to go over our home buyers guide with you. If you have any questions about the home buying process, want to schedule a showing, or write an ofer please don’t hesitate to call us at 804.625.1676 or email us at [email protected]. It would be a privilege for us to be able to help and guide you with the purchase of your home! I-Agent Realty Inc. 3600 Chain Bridge Road, Suite 100 Fairfax, VA 22030 and 4001 Springield Road, Suite 200 Glen Allen, VA 23060 Toll Free : 804.625.1676 Email: [email protected]

© Copyright 2026