EC487 sol-moch-summer-15

LONDON SCHOOL OF ECONOMICS

Department of Economics

Solution Lent Mock Exam 2010/2011

EC487: Advanced Microeconomics

1.

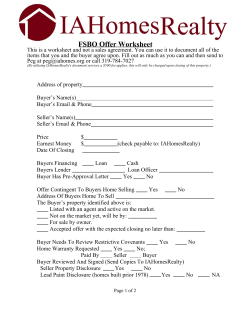

(a) (10 marks) The normal form associated with Γ is:

L

R

L

R

U

1, 3, 2 1, 3, 2

U

2, 1, 3 1, 0, 3

D

1, 3, 2 1, 3, 2

D

0, 2, 4 0, 2, 0

S

C

The two pure strategy Bayesian Nash equilibria are: (D, R, S) and

(U, L, C).

(b) (20 marks) The two pure strategy Bayesian equilibria of the game Γ

are: {(U, L, C), p = 1} and {(D, R, S), p = 0}. Only {(U, L, C), p = 1}

is a Perfect Bayesian equilibrium since {(D, R, S), p = 0} violates sequential rationality. Indeed, if player 1 expects player 2 to play R

player 1 has a profitable deviation by playing U instead of D. Notice that in the latter equilibrium player 2’s information set is off-theequilibrium-path, hence Bayes rule does not impose any restriction on

player 2’s belief p.

(c) (20 marks) The unique pure strategy Strong Perfect Bayesian equilibrium of Γ is {(U, L, C), p = 1}. This is because by backward induction

1

the proper subgame:

1

r

,@

U ,

@D

,

@

,

2

@

,

[p] ...............................

,

r

@r [1 − p]

,J

@

L , JR

L

@ R

,

J

@

,

J

@

,

r

r

Jr

@r

(2, 1, 3)

(1, 0, 3) (0, 2, 4)

has a unique PBE {(U, L), p = 1}.

2

(0, 2, 0)

2.

(a) (30 marks) The seller’s action space is As = {ws ≥ 0} while the buyer’s

action space is Ab = {wb ≥ 0}. The extensive form of the game is such

that both the buyer and the seller announce their reservation prices

(ws , wb ). Then if wb ≥ ws then trade occurs if instead wb < ws then

no trade occurs.

Given the local authority subsidy scheme the price paid by the buyer

is pb = ws while the price received by the seller is ps = wb .

The payoffs to both the seller and the buyer are then:

(

us (ws , wb ; vs , vb ) =

and

(

ub (ws , wb ; vs , vb ) =

wb if wb ≥ ws

vs

if wb < ws

vb − ws if wb ≥ ws

0

if wb < ws

The strategies for both the seller and the buyer are then the two functions ws (vs ) and wb (vb ). We restrict attention to strictly monotonic,

(linear) and differentiable strategies for the two players.

Substituting the inverse functions wb−1 (·) and ws−1 (·) in the parties’

payoffs we obtain:

(

us (ws , wb ; vs , vb ) =

(

ub (ws , wb ; vs , vb ) =

wb if vb ≥ wb−1 (ws )

vs

if vb < wb−1 (ws )

vb − ws if vs ≤ ws−1 (wb )

0

if vs < ws−1 (wb )

(1)

(2)

We can then write the seller’s and buyer’s problems as:

Z

wb−1 (ws )

max

ws

vs dvb +

vb =0

Z

1

wb (vb )dvb =

vb =wb−1 (ws )

=

vs wb−1 (ws )

Z

+

1

wb (vb )dvb

vb =wb−1 (ws )

(3)

3

and

Z

ws−1 (wb )

[vb − ws (vs )] dvs =

max

wb

vb ws−1 (wb )

Z

ws−1 (wb )

−

ws (vs )dvs (4)

vs =0

vs =0

Therefore the first order conditions of these problem are

(vs − ws )

dwb−1 (ws )

=0

dws

(5)

(vb − wb )

dws−1 (wb )

=0

dwb

(6)

The two differential equations (5) and (6) define the optimal strategies

for both the buyer and the seller.

The Bayesian Nash equilibrium of this bilateral trade model is then

characterized by the solutions to these differential equations:

vs = w s ,

vb = wb

(7)

wb (vb ) = vb

(8)

or

ws (vs ) = vs ,

(b) (20 marks) Notice that (8) implies that trade will occur whenever it is

efficient to trade: vb ≥ vs . In other words, the Government’s subsidy

eliminates any inefficiency in the trading process while inducing both

the buyer and the seller to report the truth.

4

© Copyright 2026