Russell Investments Hedged Global Shares Fund

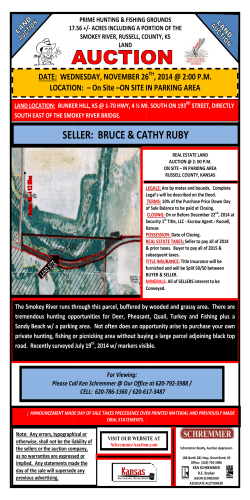

Russell Investments Hedged Global Shares Fund Report and Update 31 March 2015 Fund Commentary Investment Performance and Positions The Russell Investments Hedged Global Shares Fund returned 0.34% for the month of March and 6.69% for the quarter, outperforming its benchmark by 0.31% and 1.17%, respectively. The following information provides the investment performance and exposures within the underlying investment portfolio. Please note that this information is indicative only and is provided for general information purposes only. The market favoured growth strategies relative to value strategies for the first quarter of 2015. The Fund benefited from an aggregate tilt away from high dividend yielding stocks. Other notable contributors included an overweight to Europe and an underweight to the energy sector. Stock selection was successful within the materials, consumer discretionary and health care sectors. Underlying Manager Allocations (31/03/15) Manager Current Weight Target Weight MFS 19.0% 22.5% Manager Commentary Numeric 19.2% 20.0% Wellington’s aggressive earnings growth strategy comfortably outperformed the benchmark. Stock selection within the information technology and consumer discretionary sectors drove the outperformance. An overweight to, and positive stock selection in, the health care sector further enhanced relative returns. Harris 17.2% 15.0% Wellington 15.4% 15.0% Sanders Capital 19.3% 15.0% Russell Positioning Strategies 5.0% 7.5% Russell Emerging Markets (CPM) 4.9% 5.0% Harris underperformed the benchmark for the quarter. Stock selection in lower valuation securities acted as a headwind in the prevailing market environment. A significant underweight to the health care sector and stock selection in the consumer discretionary sector, detracted. Sector Allocations (31/03/15) Sector Fund Index Market Commentary Financials 21.9% 21.7% Global equity markets returned 0.03% for the month and 5.52% for the quarter, as measured by the Russell Global Large Cap Net Index hedged to the NZ dollar. Information Technology 17.8% 13.9% Consumer Discretionary 16.1% 12.6% Health Care 13.2% 11.9% Industrials 10.8% 11.2% Consumer Staples 8.6% 9.3% Energy 3.7% 7.3% Materials 4.0% 5.4% Telecommunication Services 1.8% 3.6% Utilities 2.1% 3.1% Global markets finished the quarter in positive territory, taking encouragement from loose monetary policy in Europe and Japan. A more dovish stance by the US Federal Reserve also buoyed sentiment. After months of deliberation, the European Central Bank launched a larger-than-expected package of asset buying, prompting a rally in eurozone markets and a slump in the euro. Over the quarter, macroeconomic data for the region surprised on the upside. Japanese equities continued their recent strong run over the quarter on the back of high levels of central bank liquidity, with ultra-low returns on bonds pushing investors towards equities. The market was also buoyed by strong buying from the country’s massive Government Pension Investment Fund. US growth remained comfortably ahead of most developed markets, with labour market data coming in strong. Other economic reports fell short of expectations which prompted investors to push back their expected date for an interest-rate rise. Meanwhile, a stabilising oil price also provided support, especially to energy stocks and oil-exporting countries. Emerging markets gained in aggregate over the period. Following the recent slump, Russian equities were the star performers in the first quarter. China continued its strong run, as soft economic data raised the prospect of further monetary stimulus. India gained as cheaper oil improved the country’s balance of payments, allowing the central bank to cut interest rates. Regional Allocations (31/03/15) Region Fund Index North America 53.1% 56.1% EMEA ex UK 22.7% 16.0% Emerging markets 9.5% 10.0% UK 6.8% 6.9% Japan 5.3% 6.9% Asia Pacific ex Japan 2.6% 4.1% Russell Investments Hedged Global Shares Fund Growth of $100,000 to 31 March 2015** ** The performance is gross of tax and fees. From July 2012 the performance is for the Russell Investments Hedged Global Shares Fund. For the period July 2011 to July 2012 the performance is for the Russell Global Opportunities Fund - $NZ Hedged (Class B). This is the Fund that the Russell Investments Hedged Global Shares Fund invests in, and is available to NZ investors (including retail investors). Prior to July 2011 the performance is for the Russell Global Opportunities Fund - $NZ Hedged (Class A), which is a fund held by wholesale investors. Prior to April 2010 the Russell Global Opportunities Fund - $NZ Hedged (Class A) was called the “Russell Global Equity Strategies Fund $NZ Hedged”, and included an enhanced passive exposure. In April 2010 the Fund was re-named the "Russell Global Opportunities Fund - $NZ Hedged", and adopted a more concentrated investment approach. The benchmark is the MSCI World Net – $NZ Hedged until 31 December 2010 and the Russell Global Large Cap $NZ Hedged Net Index thereafter. Gross Returns to 31 March 2015 Month Quarter 6 Months 1 Year 2 Years p.a. Fund 0.34% 6.69% 12.64% 19.46% 19.73% Index* 0.03% 5.52% 9.56% 16.68% 18.01% * The benchmark is the MSCI World Net Index - $NZ Hedged until 31 December 2010 and the Russell Global Large Cap Net Index - $NZ Hedged thereafter. Past performance is not necessarily indicative of future performance. Contact Details For further information please contact Anthony Edmonds: Phone: 04-499-9654 or 0800-499-466 Email: [email protected] or [email protected] Disclaimer This Report and Update is provided by Implemented Investment Solutions Limited (IIS) in good faith and is designed as a summary to accompany the Investment Statement for the Russell Investment Funds. The information contained in this Report and Update is not an offer of units in the Fund or a proposal or an invitation to make an offer to sell, or a recommendation to subscribe for or purchase, any units in the Fund. Any person wishing to apply for units in the Fund must complete the application form attached to the current Investment Statement. The information and any opinions in this Report and Update are based on sources IIS believes are reliable and accurate. IIS, its directors, officers and employees make no representations or warranties of any kind as to the accuracy or completeness of the information contained in this fact sheet and disclaim liability for any loss, damage, cost or expense that may arise from any reliance on the information or any opinions, conclusions or recommendations contained in it, whether that loss or damage is caused by any fault or negligence on the part of IIS, or otherwise, except for any statutory liability which cannot be excluded. All opinions reflect IIS' judgment on the date of this Report and Update and are subject to change without notice. This disclaimer extends to any entity that may distribute this publication and in which IIS or its related companies have an interest. The information in this Report and Update is not intended to be financial advice for the purposes of the Financial Advisers Act 2008. In particular, in preparing this document, IIS did not take into account the investment objectives, financial situation and particular needs of any particular person. Professional investment advice from an appropriately qualified adviser should be taken before making any investment. Past performance is not necessarily indicative of future performance, unit prices may go down as well as up and an investor in the fund may not recover the full amount of capital that they invest. This disclaimer must accompany any information regarding IIS or its products. No part of this document may be reproduced without the permission of IIS. IIS is the manager of the Fund and will receive management fees as set out in the Investment Statement.

© Copyright 2026