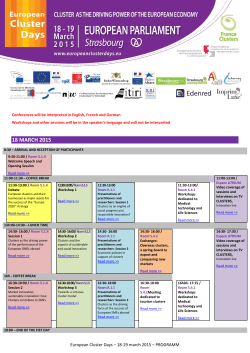

Foreward for supporting London business clusters