INVEST WITH ANDORRA

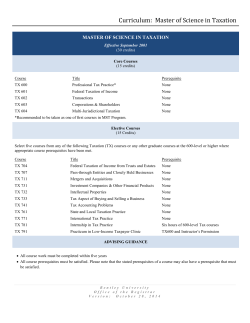

INVEST WITH ANDORRA ANDORRA AND ITS NEW ECONOMIC AND TAX MODEL: ECONOMIC LIBERALIZATION, COMPETITIVE TAX BURDEN AND INTERNATIONAL SCOPE 2015 In collaboration with: “Beyond your expectations” This is a document regularly updated accordingly to the changes of the Andorran normative legal base. The latest version of the document is available on the website of the CEA www.cea.ad All rights in this document are reserved by the CEA and Auge Grup. Any manipulation, modification, partial reproduction, reprography, computer processing without the written permission of the copyright holders are prohibited. 2 CONTENTS I. Andorra. Strategic location I. Initial view II. Quality of life II. Differential standardization I. Towards a new fiscal framework II. The new fiscal framework III. Agreements on avoidance of double taxation, DTA III. Foreign investment:100% liberalization IV. Imminent structural changes V. Immigration Reform: 3 new models of non-profit residency VI. Practical aspects of the new tax and economic model I. Two models of investment structures II. Comparison with other European tax jurisdictions 3 I. ANDORRA. STRATEGIC LOCATION I. Initial view Andorra, strategically located between Spain and France, has historically based its great economic prosperity on a competitive model based on tourism, trade, construction and its capacity as an offshore financial center. The emergence of strong competition in the tourism sector, the relativization of the price differential, the global crisis in the financial and construction sectors and the international pressure to eliminate the offshore areas, have led to a significant decline of the classical model and the urgent need to create a new econòmic model. Andorra has opted for standardization with Europe, but modulating certain distinctive features that not only make us 4 more competitive in the services we offer, particularly in trade and tourism, but also enable us to become one of the most attractive jurisdictions in Europe with respect to the development of investment projects and business initiatives worldwide. Our new economic model, based on the liberalization of foreign investment, provides a host of international strategic opportunities at both corporate and individual levels, which complemented by a competitive tax framework and exceptional living conditions which will certainly fulfill all expectations. Within this context of changes there are also great opportunities for those Andorran entre- preneurs that wish to expand their horizons. The new fiscal framework, which not only has permitted Andorra to cease being considered a tax haven but has also created great expectations resulting from the impending double taxation agreements (DTA), opens the path to other jurisdictions where we have set our future goals. In summary, the particular and attractive fiscal advantages of our jurisdiction, integrated in an international context, becomes an opportunity of growth, optimization and expansion for companies with a clear international vocation. I. ANDORRA. STRATEGIC LOCATION II. Quality of life The main feature of Andorra in comparison with most countries in Europe is its exceptional quality of life. This is reflected in aspects such as: High living standards: Privileged position in terms of income per capita: 47.314 U.S. USD in 2010, beating Spain (29.863 USD), France (42.503 USD), Germany (46.269 USD) or Italy (35.926 USD). It also exceeds the average of OECD countries (44.490 USD) and the European Union (35.551 USD). Andorra is surpassed by countries such as Luxembourg (110.697 USD), Switzerland (84.815 USD) or the U.S. (53.042 USD). Low pricing: Low taxation allows the cost of living to be lower than in most European countries, therefore our future citizens, investors and their families will enjoy lower prices for most products and services which makes them much more competitive than prices in their home countries. Proximity: One of the great virtues of Andorra is its limited territory. Proximity helps to solve most issues that excessive bureaucracy tends to complicate. Stability and security: Andorra is a socially stable country with high security. The crime rate is one of the lowest in the world. Natural environment: surroundings. Andorra has a protected environment and incomparable natural Communications: Andorra is in the process of rethinking and improving communication routes that will make it much more accessible by land and air. Education: Andorra has three educational systems which are of both high quality and free of charge, as well as a choice of private education and other specialised branches. Health: The public health services are of excellent quality and allows through International agreements to benefit from health care abroad. Technology: Andorra is an innovative country, pioneer in the field of technology. The digital switchover has occurred and UMTS coverage too. Andorra has fiber optic in 100% of the territory. Recreational and sports facilities: Andorra has ski resorts, sports facilities for high-level sport practice and skill improving centres, spas and areas for extreme, adventure and mountain sports. Cultural activities: National Auditorium, Congress Centre, events and festivals of all kinds. 5 II. DIFFERENTIAL STANDARDISATION I. Towards a new fiscal framework The international pressure The unfolding of the international economic and financial crisis and the G20 meeting held in London on the 2nd of April 2009, clearly stated the international community’s will to move forward towards the transparency of the financial activity. The Declaration of the Principality of Andorra signed in Paris on the 10th of March 2009 by the Andorran Prime Minister, Albert Pintat, acknowledged a strong commitment to establish tax information exchange agreements upon request from the tax authorities, pursuant to the OECD tax information exchange models. Exchange of tax information upon prior request As a result of the enactment of this new Law many different agreements have been signed. As of today more than 21 Tax Information Exchange agreements have been subscribed: 1. France: signed on 22 September 2009 and published in the BOPA on June 9, 2010. Came into force on December 22, 2010. 2. Spain: signed on January 14, 2010 and published in the BOPA on May 13, 2010. Came into force on February 10, 2011. 3. Signed and in force: in addition to Spain and France, Portugal, San Marino, Monaco, Liechtenstein, Austria, Faeroe Islands, Norway, Denmark, Sweden, Finland, Netherlands, Germany, Poland, Iceland, Greenland. Australia and Argentina. 4. Signed but not yet in force: Belgium , Switzerland , Czech Republic and Italy. With these agreements Andorra is no longer considered a tax haven and out of the gray list of the OECD and the respective States. These agreements affect the different countries that have subscribed them and consists of an administrative procedure between financial authorities and their delegates (tax offices). 6 These agreements are applicable to tax matters that have arisen on or after the date of entry the agreements came into force. Their application is not retroactive and affects the tax accounting periods applicable from the date of entry into force. There are certain legal procedures of appeal for those who are required information or are investigated for tax matters. These agreements will in due course be replaced by the Agreements on Avoidance of Double Taxation Tax information automatic exchange Andorra is aware of the international trend towards transparency, and its response to it has been to move in the same direction, understanding the fact that the automatic exchange is an unavoidable future for all jurisdictions. Currently, a total of 51 countries have signed the multilateral agreement on the automatic exchange of tax information in relation to certain financial accounts held in Andorran banks by individuals and legal entities which are non-tax residents in Andorra. Most of the adhering countries will start applying this agreement in 2017, Andorra will do so in 2018. At the start of 2015, only four countries have not expressed their commitment to adhere to this agreement nonetheless, everything indicates that the international pressure will be a decisive factor in this respect. It is important to state that even though the tax information automatic exchange in Andorra won’t come into force till 2018, the agreement foresees a one year retroactive effect. What is unknown as of today are the financial accounts that will be reported and the general application of this automatic exchange. 7 The new fiscal frame • Objective: To facilitate political and economic relations between Andorra and its neighbouring countries through the standardisation of the taxation framework. • Need: Approval is necessary to reach agreements to avoid double taxation. • New: Income taxation of business and professional origin: resident individuals, nonresidents and legal entities. • Simplification and unification of the indirect taxation: Impost General Indirecte, IGI. • Concision and creation of 4 new types of taxes: On the one hand, 3 laws have been approved to regulate the direct taxation, adopted on 29 December 2010 and came into force on January 27, 2011. 1. Tax on Income of Nonresident: Effective from April 1, 2011. General rate of 10%. 2. Corporate income tax: Effective from January 1, 2012. General rate of 10%. 3. Personal Income Tax (IRPF): the fiscal framework has been complemented with a tax treatment for individuals under a very competitive tax rate and which under no circumstances surpasses a 10%. Law 5/2014, of 24th of April, in force from the 1st of January 2015. On the other hand, the law that regulates the indirect taxation: 4. The General Indirect Tax similar to Value Added Tax (IGI). The general rate is 4,5% as the Law 11/2012 indicates, approved on 21 June 2012, came into force on 1 January 2013. Corporation Tax The taxpayers under this type of tax are all those companies operating in Andorra and people having their residency or registered office in the Principality of Andorra be it by having been incorporated in Andorra or as a result of a change of the jurisdiction. This new tax leads to a highly attractive tax model, which has created a treatment that combines the best virtues of jurisdictions like the Netherlands, Luxembourg, Switzerland, Ireland and Cyprus. Depending upon the nature of the company there are: 8 • Traditional Andorran companies The tax rate is 10% on the income obtained by the company for a tax accounting year with important reductions making the tax amounts to be paid lower. • International operating companies of intangible assets The result is an ideal international position improving the traditional model of the Netherlands. The taxpayers can benefit from an 80% reduction in the following cases: 1. Authorization for the use, sale or license of patent rights, industrial forms and designs, trademarks, domain names and other distinctive signs of enterprise and the industrial property rights. 2. License for use of drafts, formulas or procedures, industrial, commercial or scientific rights as well as the use of industrial, commercial or scientific equipment. 3. Assignment of copyrights, artistic and scientific rights as well as audiovisual productions, computer programs and systems. Moreover, the exemption operates whether there is a business premise or office of minimum 20m2 and a part-time employee at least. • Companies that take part in international commerce Taxpayers can benefit from an 80% reduction on the taxation base if the trading of goods is made at an international level or when a realtor or an intermediary executes the sale and purchase of properties abroad, also if the activity of a commission agent is done from Andorra, and if the commercialised product does not enter nor leave Andorra. Business premise or offices of a minimum of 20m2 and at least one part-time employee are requirements needed for the exemption to operate. 9 • Management and Investment Companies Taxpayers benefit from an 80% reduction on the tax base. These types of entities are those tax residents in Andorra whose business consists of receiving loans from related companies or third parties, which added to its own share capital are used for entering into loans with related entities not possessing tax residents’ status. In order to carry out this business, a company must have a minimum share capital of 250,000 €, should also have its own staff in the Principality of Andorra, at least one employee, even as a part-time worker and an office space specifically dedicated to carry out this type of activity. • Holding Companies Holding companies are companies with shares in other companies located in foreign countries. These companies are tax-exempt on received dividends and capital gains in the following cases: 1. A non-resident company whose shareholder is an Andorran company should be subject to paying taxes in its own country, i.e. paying taxes similar to the Andorran income tax. 2. The percentage of participation, be it direct or indirect, in the share capital, equity and assets of the enterprise, the patrimony or voting rights should be at least 5%; this participation must be held without interruption for at least one year preceding the day on which the profit is to be distributed, or if the profit is not distributed, the participation must be maintained for the necessary time to complete this period. Income tax for non-residents Non-resident individuals and legal entities in the Principality of Andorra that obtain incomes in Andorra are obliged to pay this tax. The standard rate is 10% with some exceptions. This tax is not applied to dividends from non-real estate assets earned by non-residents in Andorra (there is a tax cost for citizens of the European Union).This is an important issue for assessing incomes from bank accounts. Income obtained in the Andorran territory is considered to be the income from activities within this territory, from property in Andorra or exercisable rights arising or usable in the Principality. 10 The new law of general indirect tax IGI The tax called IGI (similar in nature to the European VAT) combines and encompasses most of the indirect taxation types of tax. The law was adopted on the 18th of July 2012 and came into force on 1 January, 2013. With the entry of the IGI, indirect taxation is comprised of the following: 1. The IGI that taxes the transfer of new real estate and the rendering of services. 2. Property Transfer Tax (ITP) which taxes the second and subsequent transfers of real estate. Nonetheless, in first transfers of real estate and those transfers managed by authorized real estate agents, the IGI tax rate of 4,5% will be applied. In all other real estate operations a 4% ITP tax is applied. It is important to underline that the IGI tax rates under both the general and the reduced rates, are at levels below those neighbouring countries and adapt to the needs of the Andorran economy. According to the new law, all operations are subject to a general tax rate of 4.5% except for those products and services considered of first necessity to which a reduced tax rate of 1% applies, or even a super reduced tax rate of 0%. An increased rate of 9.5% will be applied to banking and financial services. Personal Income Tax The personal income tax is the figure that as of 1 January 2015 completes the new fiscal framework of the Principality of Andorra. Its structure is identical to that one of Spain and other neighbouring countries, but with the peculiarity of a 10% fixed rate. It includes important exemptions such as those applicable to employment income up to € 24,000 and movable assets up to € 3,000 or a total exemption on dividends from Andorran companies. Exemptions and deductions that substantially reduce the effective tax rate along with the absence of tax on net wealth or property, inheritance and gifts, have made Andorra become one of the most competitive and lax jurisdictions on individuals’ taxation in Europe. 11 II. DIFFERENTIAL STANDARDISATION II. Agreements on avoidance of double taxation, DTA The existence of agreements to avoid double taxation (DTA) is essential to promote foreign investment in Andorra or Andorran investment abroad, as they provide legal certainty to investors and reduce the tax burden of those investments. All agreements to exchange tax information foresee their replacement by agreements of avoidance of double taxation and the commitment to start negotiations after their entry into force. The agreements to avoid double taxation are the key to international competitiveness of the companies that eventually settle in Andorra. The agreement to avoid double taxation between Andorra and France has already been signed (April 2013), the agreement to avoid double taxation between Andorra and Spain has already been signed too (January 2015) and finally, the DTA between Andorra and Luxembourg was entered into on the 2 of June 2014. And now, the government has already started negotiations and / or contacts with Portugal, Belgium, Switzerland and Austria, with whom it is expected to sign separate agreements at the beginning of 2015. Furthermore, the campaign throughout 2013 on this matter is expected to be very important towards the signing of other agreements to avoid double taxation with other countries which have already signed agreements to exchange tax information and those that are strategic for the international relations of Andorra. 12 III. FOREIGN INVESTMENT: 100% LIBERALIZATION In terms of Foreign Investment, a new Law 10/2012 was approved on the 21st of June 2012 which came into force on the 19th of July 2012.The Law permits 100% liberalization of investment in all sectors and simplifies the process of incorporating companies to accelerate the market in the short term and open the doors to talent and foreign investment, revivint and strengthening the economy of Andorra by way of diversification, competitiveness, promoting innovation initiatives and a wise use of tax differential. This new competitive model as a strategic tax platform, has been created to attract foregin investment start-ups, create jobs and wealth, focusing on sectors and recruitment to those businesses that generate higher added value and growth. This is intended to: • Provide a good service to established investments and potential investors, providing suport to potential investors at all stages: preinvestment, investment and post-investment. • Promote an adequate investment climate that encourages investment, identifying the needs of potential investors and investors already established and suggesting measures to meet those needs, strengthening relations with associations and institutions related to foreign investment. • Disseminate and promote a competitive country image associated to Andorra, including a modern and innovative view, increasingly internationalized and provided with adequate human and technological resources to the process of globalization of markets and the economy. • Establish lines of collaboration with all institutions in the State (and also at a local level) which are focused on the promotion and attraction of investments to establish a network of leverage to achieve the above objectives. It should be noted that for new external investments an investment project shall be submitted and will be analyzed by the Andorran government who will assess its suitability. If it fulfills all the necessary requirements, the investment will be authorized. However, this requirement does not exist for projects launched by residents in Andorra, whatever their category (active or non-profit) and country of origin is. 13 IV. IMMINENT STRUCTURAL CHANGES All these social and legislative changes involve a number of structural changes that have already begun to develop: Heliport The Government is working on the project of construction, management and operation of the national heliport in order for it to be operative in the near future, and operating it with various regular lines connecting Andorra, Barcelona, Toulouse, Lleida (Alguaire) or La Seu d’Urgell. Commercial Boulevard Andorra wishes to offer its tourists, visitors and citizens commercial offer of excellent quality and well positioned on a level with the major capitals of the world. In this regard, Andorra wishes to attract the leading international retail brands. Thanks to the new fiscal framework and its economic openness, once those leading brands are established in Andorra, it will become a hub of top level shopping in Europe. Tourism infrastructure (hotels and restaurants) The new economic model and future demands of tourists, visitors and new citizens, calls for transformation and improvement of tourism infrastructure and the process analysis and boost has already begun. These initiatives also involve changes to the technical training of people linked to these improvements. Elite Healthcare One of the new goals of the Andorran Government is driving Andorra towards the top of medical excellence emulating the Swiss model of implementing the most Advanced medical technology with no waiting lists and having at its disposal a network of technology. Training and educational elite Promotion of new training centres and high level international scope centres. Promotion of research, development and technology in all areas. 14 Development of the leisure and gambling in particular Alongside initiatives to promote the development of multiple leisure options, special emphasis has been put on gambling so it brings added value. The first step was the Decree of 7 March 2012 which sets up the Agency of the Interministerial Commission of Gambling and which in turn has led to the creation of the Office of Gambling. Its aim is to analyze the strengths and weaknesses of this new activity and move on to a new law that includes gambling options like casinos, lotteries, online gambling and betting offline. The project of the gambling Law will be submitted to parliament during this year 2013. Other initiatives Additionally, the development of international exhibitions and conferences will be promoted, as well as various initiatives and events related to sports, culture, music, art, science, etc. 15 V. IMMIGRATION REFORM: 3 NEW MODELS OF NON-PROFIT RESIDENCY In terms of active residency in Andorra, membership in the Andorran Social Security (CASS) is mandatory for all employees, and similar workers performing an activity on their own account. Employees are subject to a tax rate of a 5.5% up to 10.5%, the employers will be subject to a 14.5%. Self-employed employees will have to pay between a 20% to 25%. All foreigners working in the Principality must have a work permit. Once an employee is hired by a national company, this company should apply to the Ministry of Home Affairs for a permit. The granting of permits by the Ministry is subject to an immigration quota. Foreign investors and professionals who channel their investments through Andorran companies have the right to request a Residence and Work Permit under the Self-Employment regime. This permit can be obtained by complying with two specific conditions, these being becoming a shareholder of the Andorran entity (participation of >10%) as well as being appointed to the Board of Directors of the company. This kind of permit requires the permanent and effective residence in Andorra of the holder and the corresponding contribution before the Andorran public health system (CASS). As a result, the new resident will have access to the Andorran public health system as well as to a subsequent family reunification if required. In respect of the residency without the right to work status, with the legislative changes operated during the year 2012, there are three types of residency immigration permits without work: residency without lucrative activity, residency permits for professionals with an international outlook and residency permits for reasons of scientific, cultural and sporting interests (all directed to the promotion of this type of residency among the High Net Worth Individuals). The característics and minimum requirements for obtaining these permits aret he following: 1. Non-profit resident: the person who does not have the Andorran citizenship and establishes their main residence in the Principality for at least 90 days per year, without exercising any professional activity. The holder of a Non-profit Residence Permit is required to invest at least 16 four hundred thousand euros (400.000 euros) in one of the many types of Andorran assets. It is compulsory to deposit a non-remunerated fifty thousand euros (50.000 euros) bond before the Andorran National Finance Institute (INAF) for the main holder and a ten thousand euros (10.000 euros) bond for each dependent person who will also obtain a Non-profit Resident profile. The deposit made before INAF is deducted from the 400.000 euro investment. 2. Residence permit for professionals with an International Outlook: the person who does not have the Andorran citizenship and establishes their main residence in Andorra for at least 90 days per year, in order to develop a professional activity with an International Outlook. The center of the professional activity must be located in Andorra, the holder has the right to recruit up to a maximum of one person and at least 85% of the income must come from the clients located abroad. 3. Residents for reasons of scientific, cultural and sporting interests: the person who does not have the Andorran citizenship and establishes their main residence in Andorra for at least 90 days per year, thus establishing the center of their professional activity in Andorra, in the following fields: science, culture and sports. At least 85% of the income must come from the clients located abroad. The main holder of a Residence permit for professionals with an International Outlook, as well as the residents for reasons of scientific, cultural and sporting interests, must deposit a non-remunerated fifty thousand euros (50.000 euros) bond before the Andorran National Finance Institute (INAF) for the main holder and a ten thousand euros (10.000 euros) bond for each dependent person who will also obtain the same residence status. Moreover, in both cases, they must submit a business plan to be evaluated and approved by the Government. 17 VI. PRACTICAL ASPECTS OF THE NEW TAX AND ECONOMIC MODEL I. Two models of investment structures a. Model of individual investment in Andorra International company Unilateral investment Andorra Trading company Company-owner of intellectual property Intragroup finance company Production company or service provider Taxation 2% Taxation 2% Taxation 2% Taxation 10% In vo i ce Inv oic e Holding company Company of country B Company of country A goods *Necessity of Avoidance of Double Taxation Agreement 18 Producer Services provider No DTA Necessity of DTA* International company Unilateral investment Andorra Holding company Dividends and capital gains exemption Country A Country B Country C These countries have their respective tax rates Necessity of DTA* 19 VI. PRACTICAL ASPECTS OF THE NEW TAX AND ECONOMIC MODEL I. Two models of investment structures b. Joint Venture model : International company – Andorran company International company Andorran company Investment A Investment B Andorran Holding with equity participation. Headquarters of the group Subsidiary A in Spain Andorran alternative Trading Company 20 Projects in North Africa Company owner of intellectual property Intragroup finance company Projects in Middle East Production company or service provider Dividends and capital gains exemption. Need of DTA Subsidiary B in France Other European projects Projects in the USA VI. PRACTICAL ASPECTS OF THE NEW TAX AND ECONOMIC MODEL II. Comparison with other European tax jurisdictions Andorra Spain Portugal France Corporation Income Tax 10% 30% 25% 33,33% Capital Gains Tax 0-15% 30% 25% 33,33% Royalties 5% 24,75% 15% 33,33% Interests 0% 21% 25% - Dividends 0% 21% 25% 25% Variuous Fees - 21% - 24,75% 15,% - 21,5% 33,33% 4,5% 21% 23% 21,20% Taxation of Companies Withholding Tax-Non Treaty (for non-residents) Indirect Tax (VAT) Value Added Tax (Equivalent) Indirect Taxation (IGI) 21 Andorra Lietchestein Monaco Corporation Income Tax 10% 12,5% 33,3% 17% Capital Gains Tax 0-15% - 33,3% 17% Royalties 5% - - 15% Interests 0% - - 13% Dividends 0% - - - Variuous Fees - - - 15% 4,5% 8% 19,6% 0% - IGI 17% - Import Tax San Marino Taxation of Companies Withholding Tax-Non Treaty (for non-residents) Indirect Tax (VAT) Value Added Tax (Equivalent) Indirect Taxation (IGI) 22 Andorra Ireland Netherlands Luxemburg Switzerland Malta Cyprus Taxation of Companies Corporation Income Tax 10% 12,5% 20% 22,05% 8,5% 35% 10% Capital Gains Tax 0-15% 30% 20% 22,05% 8,5% 35% 10% Royalties 5% 20% - - - 0% - Interests Excento 20% - - 35% 0% - Dividends Excento 20% 15% 15% 35% 0% - Variuous Fees - - - - - 35% 10% 4,5% 23% 19% 15% 8% 18% 18% Withholding Tax-Non Treaty (for non-residents) Indirect Tax (VAT) Value Added Tax (Equivalent) Indirect Taxation (IGI) 23 C/Prat de la Creu, 59-65, Escala B 2n AD500 Andorra la Vella +376 800 020 [email protected] www.cea.ad C/ Pere d’Urg, núm. 10 5ena planta AD500 Andorra la Vella +376 803 636 [email protected] investwithandorra.com www.augegrup.com

© Copyright 2026