(21st March 2015 to 16th May 2015) at

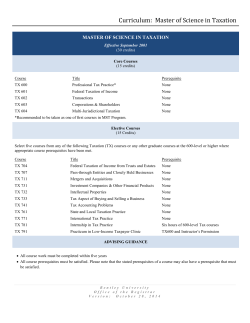

I International Fiscal Association India Branch - Southern Regional Chapter Weekend Course on the Basics of International Taxation (21st March 2015 to 16th May 2015) at “Hotel Benzz Park” Thirumalaipillai Road, T.Nagar, Chennai - 600 017 About the Course on Basics of International Taxation Tax laws in India or elsewhere were, and will always be complex. Integration of economies, increase in the number of cross border transactions (in-bound and out-bound), mergers, acquisitions, tax treaties, transfer pricing coupled with the government’s single point agenda to increase its share of taxes in every transaction (unmindful of the fact that the transaction in only remotely connected to its state) etc. have added to these complexities. The interplay between tax treaties and domestic tax laws is a highly technical and complex study which requires in depth knowledge of the nuances and the niceties of both the systems. Appreciating these increasing complexities in the area of International Taxation, the Southern Regional Chapter of IFA has yet again launched the Course on Basics of International Taxation so that the participants acquire basic knowledge in the area of International Taxation. The Course deals at theoretical level the provisions in the Double Tax Avoidance Treaties (DTAAs) which India has entered and also a variety of issues in cross border taxation. As the structure of the Course also recognises the value of practical exposure it is conducted by a panel of eminent speakers who are well known and well experienced in international tax. The schedule of the Course is enclosed herewith. The topics chosen are contemporary. The Course would be held on a Seminar type format with a blend of presentations and case studies. It is ensured that the speakers also add weight to the discussions with their insights and personal experiences, thereby enhancing the knowledge of the participants. It is the endeavour of the organizers that by attending this Course, the participants are in a position to apply the principles of international tax in their professional corporate, consulting and administrative environments. Schedule of the Course Day & Session Date Subject 1-A 21.03.2015 Orientation on International Taxation & Overview of DTAA 1-B 21.03.2015 Persons, Residency & Taxes covered 2-A 28.03.2015 Permanent Establishment - What & examples 2-B 28.03.2015 Attribution of Profits to PE - examples 3-A 11.04.2015 Income from Business 3-B 11.04.2015 Income from Immovable property, shipping & Air 4-A 18.04.2015 Interest, Dividend & capital gains 4-B 18.04.2015 FTS & Royalty 5-A 25.04.2015 Salary & Other income of musician & sportsman 5-A 25.04.2015 Foreign Tax Credit - computation methodologies 6-A 02.05.2015 Exchange of Information MAP, Collection of Taxes, Non-discrimination, LOB, GAAR, Anti Avoidance 6-B 02.05.2015 Country specific DTAA provisions 7 - A& B 09.05.2015 Associate Enterprises, Transfer Pricing, - Methodology & issues 8-A 16.05.2015 Section 195 - Concept & issues 8-B 16.05.2015 An overview of Important judgements on International Taxation The panel of Speakers who would take the above classes Mr. Sampath Raghunathan Advocate, Madras High Court Mr. PVSS Prasad Prasad & Prasad Chartered Accountants Hyderabad Mr. N. Madhan Ernst and Young LLP Mr. T.G. Suresh Suresh and Balaji Chartered Accountants Chennai Mr. S.P. Singh Deloitte Haskins and Sells Mr. Kunj Vaidya PwC Mr. Kamesh Susarla B S R and Company Mr. S.Siddhartha Ernst & Young LLP Mr. Sridhar Swaminathan B S R & CO LLP Mr. Vikram Vijayaraghavan Advocate, Madras High Court Mr. Chidambaram SP Deloitte Haskins and Sells Mr. N.V.Balaji Advocate, Madras High Court Mr. Sivam Subramanian BMR & Associates LLP Mr. M.V. Swaroop Advocate, Madras High Court Mr. Kamal Bafna Mr. Roopesh Rao Cognizant Technology Solutions B S R & CO LLP Mr. Sudhakar G BMR & Associates LLP Mr. P. Bharath Ernst & Young LLP Mr. R. Swathanth Ernst and Young LLP Course Fee : The Course fee is fixed at Rs.16,831 including service tax at 12.36% (which includes the cost of course material, lunch and refreshments). How to Register : Please collect the Registration Form (also downloadable from the website- www.ifasrc.org) and submit the filled form (along with a cheque for Rs.16,831 including service tax at 12.36% payable in favor of the International Fiscal Association, IB-SRC) to 2-L, Prince Arcade, 22-A, Cathedral Road, Chennai - 600 086 (Phone : 28114283). Kindly note that the registration is limited to 40 persons on a first come first served basis. REGISTRATION FORM Weekend Course on the Basics of International Taxation Conducted by the International Fiscal Association I India Branch - Southern Regional Chapter (21st March 2015 to 16th May 2015) To The Secretary International Fiscal Association (India Branch, Southern Region Chapter) 2-L, Prince Arcade, 22-A, Cathedral Road (Next to Stella Mary’s College) Chennai - 600 086 Subject : Weekend Course on the Basics of International Taxation I / We would be thankful if you can kindly enroll the following persons from our organization to the above Course : Name & Designation 1. 2. 3. Name & Address of the Organization ** Tel : ** Mobile : ** Email : Signature : Registration Fee : Rs.16,831 including service tax at 12.36%, per participant (Cheque / DD should be drawn in favor of “IFA-IB-SRC” payable at Chennai). The completed registration form is to be forwarded to along with the participation fee to the International Fiscal Association - IB - SRC at the above mentioned address. Nomination will only be confirmed on receipt of participation fees. The fee paid is non-refundable. However, substitution before the first class may be allowed. Website : www.ifasrc.org Email : [email protected] / [email protected] ** Kindly fill up the details fully and legibly for better communication

© Copyright 2026