Management Proposal 2015 OSM

MANAGEMENT’S PROPOSAL

Annual General Meeting

April 24, 2015

TABLE OF CONTENTS

Management´s Proposal for the Annual General Meeting ............................................. 03

Attachment I – Section 10 of the Reference Form ......................................................... 06

Attachment II – Section 12.6 through 12.10 of the Reference Form .............................. 97

Attachment III – Section 13 of the Reference Form ..................................................... 112

2/141

MARFRIG GLOBAL FOODS S.A.

Taxpayer ID (CNPJ/MF) 03.853.896/0001-40

State registration (NIRE) 35.300.341.031

A Public Company

PROPOSAL THE MANAGEMENT OF MARFRIG GLOBAL FOODS S.A.

PUTS FORWARD TO SHAREHOLDERS CONVENING IN THE

ANNUAL GENERAL MEETING SET FOR APRIL 24, 2015.

Dear Shareholders,

We, the Management of Marfrig Global Foods S.A. submit for your consideration at the Annual

General Meeting called to convene at 10 a.m. on April 24, 2015, the following Proposal

(“Proposal”) concerning the topics in the meeting agenda.

1.

Receiving the management’s annual report; reviewing and judging the financial

statements as of and for the year ended December 31, 2014.

The Management’s Annual Report and the Financial Statements and related notes prepared under

Management’s responsibility as of and for the year ended December 31, 2014, in conjunction with

the related independent auditors’ report, the Audit Committee Opinion have been approved at a

meeting of the Board of Directors held on February 27, 2015. These documents were published in

the “Valor Econômico” newspaper, issue of February 28, 2015, and in the Official Gazette of the

State of São Paulo, issue of March 3, 2015. Additionally, the Fiscal Council of the Company has

issued opinion to the effect that the financial statements and related notes are suitable to being

submitted to a vote of the shareholders convening in the upcoming Annual General Meeting.

Appendix I to this Proposal presents the Management’s Discussion and Analysis of Financial

Condition and Results of Operations required to be presented in section 10 of the Reference

Form adopted pursuant to Brazilian Securities Commission (CVM) Ruling No. 480 dated

December 7, 2009 (“CVM Ruling 480”). The Financial Statements and related notes as of and

for the year ended December 31, 2014, are available for collection at our registered office

premises and are also accessible in our investor relations gateway at www.marfrig.com.br/ri

and in the websites of BM&FBOVESPA at www.bmfbovespa.com.br and the Brazilian

Securities Commission (Comissão de Valores Mobiliários), or CVM, at www.cvm.gov.br.

Given the net loss determined for the year ended December 31, 2014, we are not presenting a

proposal for allocation of results, as otherwise would be required per Annex 9-1-II of

CVM Ruling No. 481 dated December 17, 2009.

2.

Determining the number of active board of directors seats, in line with the main

provision of article 16 of the Bylaws.

Under article 16 of the Company’s Bylaws, our Board of Directors is composed of at least five (5)

and at most eleven (11) members that are elected (for unified two-year terms) or removed upon a

3/141

decision of the shareholders’ convening in a general meeting. Additionally, under subsection 4.3 of

the Novo Mercado Listing Rules, at least a five-seat board is required.

Accordingly, we are now proposing that you vote to have an eight-seat board of directors.

3.

Electing the members of the Board of Directors.

The current members of the Board of Directors of Marfrig Global Foods S.A were elected at the

annual shareholders’ meeting held on April 30, 2013, for a unified two-year term set to expire at the

date of the upcoming annual meeting. Accordingly, you are now being asked to vote to elect the

members of the Board of Directors for a two-year term ending at the time of the 2017 annual

meeting. For such purpose, we present for your consideration the following slate of nominee

candidate directors.

Nominee candidates up for reelection as independent directors: Mr. Antonio dos Santos

Maciel Neto, Mr. Carlos Geraldo Langoni, Mr. David G. McDonald and Mr. Marcelo Maia de

Azevedo Correa.

Nominee candidates up for reelection as non-independent directors: Mr. Marcos Antonio

Molina dos Santos, Ms. Marcia Aparecida Pascoal Marçal dos Santos, Mr. Alain Emilie Henry

Martinet and Mr. Rodrigo Marçal Filho.

Appendix II to this Proposal presents the identification and background information regarding

nominee candidate directors required to be presented in subsections 12.6 to 12.10 of the

Reference Form adopted under CVM Ruling 480.

Consistent with the provision of article 3 of CVM Ruling No. 367 dated May 29, 2002 (“CVM Ruling

367”), Management reports having obtained from each of the nominated candidate directors

assurances that he or she meets the no-liability standards which qualify them as eligible for office

and, therefore, each fulfils the requirements of article 147 of Brazilian Corporate Law and CVM

Ruling 367. In addition, as President, chief executive and member of the Board of Directors of the

OSI Group, LLC, Mr. David G. McDonald could potentially have a conflict of interest with us in the

future, as the Marfrig and OSI groups compete in certain international operations.

4.

Eleição dos membros do Conselho Fiscal.

The current members of the Fiscal Council of Marfrig Global Foods S.A. were elected at the

annual shareholders’ meeting held on April 17, 2014, for a unified one-year term set to expire at

the date of the upcoming annual meeting. Accordingly, you are being asked to vote to elect the

members of the Fiscal Council for another term, and for this purpose, we present for your

consideration the following slate of nominee candidate fiscal council members.

Nominee candidates for election as effective fiscal council members: Messrs. Eduardo

Augusto Rocha Pocetti, Roberto Lamb and Alexandre Mendonça.

Nominee candidates for election as alternate fiscal council members: Messrs. Peter Vaz da

Fonseca, Carlos Roberto de Albuquerque Sá and Marcelo Silva.

Appendix II to this Proposal presents the identification and background information regarding

4/141

nominee candidate fiscal council members required to be presented in subsections 12.6 to

12.10 of the Reference Form adopted under CVM Ruling 480. Moreover, the nominations of

Messrs. Roberto Lamb and Carlos Roberto de Albuquerque Sá are contingent on consent

being obtained from shareholder BNDES Participações S.A.

5.

Ratifying the amounts paid to directors and officers by way of aggregate annual

compensation in the year ended December 31, 2011.

Management is proposing that you vote to confirm payments the Company made by way of

aggregate compensation of directors and officers over the year ended December 31, 2011,

which totaled $16,546,601.00, thus having exceeded by R$ 546,601.00 the amount of

R$16,000,000.00 approved at the annual general meeting held on April 30, 2011.

6.

Setting the aggregate compensation of directors, officers and fiscal council members

for 2015.

The compensation proposal put forward to you is for the Company to pay the directors, officers

and fiscal council members an aggregate annual amount up to twenty seven million Brazilian reais

(R$27,000,000.00), which amount includes benefits and related payroll charges. The proposed

total compensation of R$ 27,000,000.00, breaks down into an amount of R$19,241,904.86

attributable to the executive officers collectively, plus R$6,939,105.93 attributable to the Board

members collectively, and R$ 818,989.21 attributable to the fiscal council members collectively.

This compensation proposal covers the period from January to December 2015.

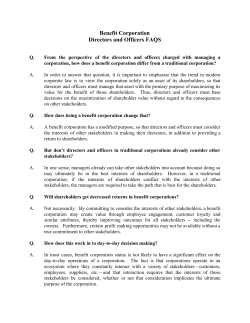

The table below sets forth detailed data regarding the compensation proposal.

Proposed Compensation

For 2015

# of

Persons

Fixed

Compensation

Short-term

Variable

Compensation

Share-based

Payment

Payroll

Charges

Benefits

Package

TOTAL

(In Brazilian reais – R$)

BOARD OF DIRECTORS

8.00

5,717,692.82

–

–

1,143,538.56

77,874.55

6,939,105.93

EXECUTIVE BOARD OF

OFFICERS

5.00

6,712,193.12

7,825,218.18

2,038,337.91

2,467,903.72

198,251.93

19,241,904.86

FISCAL COUNCIL

6.00

674,309.13

–

–

134,861.83

9,818.25

818,989.21

SUM TOTAL

19.00

13,104,195.07

7,825,218.18

2,038,337.91

3,746,304.11

285,944.73

27,000,000.00

Consistent with the reporting requirements of section 13 of the Reference Form adopted pursuant

to CVM Ruling 480, Appendix III to this Proposal presents detailed information regarding the

executive compensation proposal we are putting forward to you.

We remain at your disposal for any additional clarification you may require.

São Paulo, March 23, 2015.

MARFRIG GLOBAL FOODS S.A.

Marcos Antonio Molina dos Santos

Chairman of the Board

5/141

APPENDIX I

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

MARFRIG GLOBAL FOODS S.A.

PER SECTION 10 OF THE REFERENCE FORM

10.1 General financial and equity conditions

(a)

Comments of Executive Officers on the general financial and equity conditions

Marfrig Global Foods S.A. is a global corporation operating in the food service and retail segments that offers

innovative, safe and healthy food solutions to its clients. With a diversified and comprehensive product

portfolio, the Corporation is committed to excellence and quality and to ensuring the presence of its

products in the largest restaurant chains and supermarkets, as well as in the households of its consumers, in

over 110 countries.

The Corporation has created an integrated and geographically diversified business model that is formed by

strategically located production units, combined with a vast distribution network with access to key channels

and consumer markets, which gives the Corporation significant growth capacity as well as the ability to

hedge against certain industry risks.

As part of its constant efforts to add value to its business, the Corporation made a significant divestment in

2013, selling the Seara and Zenda business units for R$ 5.85 billion. The payment was made through the

assumption, by the acquirer, of the debts of the units sold and of Marfrig itself, which led to a significant

reduction in the Corporation’s leverage.

The strategy behind the divestment of assets was guided by the strategy of simplifying and optimizing the

Corporation's organizational structure and reducing the need for resources, while benefiting from the lower

leverage and greater focus on the core business through a more robust capital structure. The management

believes that continuous improvement in its internal processes will enable it to further improve efficiency

and cut costs, which, coupled with a result-driven management that is committed to profitable growth, will

drive profitability and cash generation.

The Corporation closed the fiscal year ended December 31, 2014 with consolidated gross debt of R$11,060.9

million, compared to R$8,939.8 million on December 31, 2013 and R$12,381.9 million on December 31,

2012.

This debt does not include the Private Instrument of Indenture of the 2nd Issue of Convertible Debentures of

Convertible Debentures of the Corporation, as amended (“Convertible Mandatory Deed”), since, unlike

other items in the Corporation’s liabilities, the Convertible Mandatory Deed cannot be settled through cash

and equivalents, but only through common shares issued by the Corporation.

6/141

Of the total debt at the end of 2014, only 15.0% matures in the short term and 85.0% in the long term. Of

the total debt, 8.4% is denominated in Brazilian real and 91.6% in other currencies, while 19.5% of the

Group’s revenues are generated in Brazilian real and 80.5% in other currencies. The weighted average cost

of our consolidated bank debt was 7.7. The leverage ratio (net debt/EBITDA) stood at 3.4x, while the current

liquidity ratio stood at 1.79x, considering cash and cash equivalents at December 31, 2014 of R$2,659

million.

In 2014, the net financial result was an expense of R$2,126.8 million, versus R$2,031.0 million in 2013. The

4.7% increase in the financial result in the year was driven mainly by (i) the Company participating in the

REFIS tax amnesty program in August, which led to an expense with interest and accumulated fine through

the close of the year of R$117.4 million; and (ii) the realization of deferred costs from the issue of bonds

repurchased in connection with a liability management plan executed throughout 2014.

In 2014, interest expenses amounted to R$ 1.17 billion, slightly below the R$ 1.27 billion recorded in 2013,

mainly due to liability management strategy adopted throughout the year.

On December 31, 2013, the breakdown of gross debt (loans and non-convertible debentures) by currency

was 4.5% in Brazilian real and 95.5% in other currencies, totaling R$9,092.5 million, while cash and cash

equivalents totaled R$1,812.6 million. The weighted average cost of the Corporation’s consolidated debt as

on December 31, 2013 was 8.0%. This debt does not include the Private Deed of the 2nd Issue of Convertible

Debentures of the Corporation, as amended (“Mandatory Deed Convertible into Shares”), since contrary to

other liabilities of the Corporation, the Mandatory Deed Convertible into Shares is not due for settlement

through cash or cash equivalents but merely converted into shares issued by the Corporation itself.

The 2013 financial result was a net expense of R$2,031.0 million, versus a net expense of R$2,081.4 million

in 2012. According to the Executive Officers, the result was mainly due to the exchange variation in the year,

which has no cash impact, which was a loss of R$589.9 million, compared to a loss of R$538.4 million in

2012, which is explained by the depreciation in the Brazilian real against the U.S. dollar, and nonrecurring

negative result from derivative operations, which, although transferred upon the sale of the Seara and Zenda

operations, still impacted the result of 2013.

On December 31, 2012, the breakdown of gross debt (loans and non-convertible debentures) by currency

was 25.1% in Brazilian real and 74.9% in other currencies, totaling R$12,381.9 million, while cash and cash

equivalents totaled R$3,178.2 million. At December 31, 2012, the weighted average cost of our consolidated

debt decreased to 7.6% compared to 8.0% in 2011, which is explained by the lower borrowing costs of

transactions carried out in the period. This debt does not include the Private Instrument of Indenture of the

2nd Issue of Convertible Debentures of Convertible Debentures of the Corporation, as amended

(“Convertible Mandatory Deed”), since, unlike other items in the Corporation’s liabilities, the Convertible

Mandatory Deed cannot be settled through cash and equivalents, but only through common shares issued

by the Corporation.

In 2012, the financial result was a net expense of R$2,081.4 million, versus R$2,300.7 million in 2011.

According to the Executive Officers ,the result was mainly due to the exchange variation in the year, which

has no cash impact, which was a loss of R$538.4 million, compared to a loss of R$780.5 million in 2011,

which is explained by the average depreciation in the Brazilian real against the U.S. dollar of 14.3%. In the

year, the financial result excluding exchange effects was an expense of R$1.54 billion, in line with 2011.

7/141

The Executive Officers inform that the Corporation does not contract leveraged operations involving

derivatives or similar instruments that do not have the objective of providing minimum protection against its

exposure to other currencies, and maintains a conservative policy of not contracting operations that could

jeopardize its financial position.

The Executive Officers inform that, on December 31, 2014, 2013 and 2012, the current liquidity ratio of the

Corporation was 1.79 times, 2.03 times and 1.33 times, respectively. The debt ratio (net debt to EBITDA) of

the Corporation on December 31, 2014, 2013 and 2012 was 4.98 times, 3.0 times and 4.3 times, respectively.

(b) Comments of the Executive Officers on capital structure and possibility of share redemptions

Below is the capital structure of the Corporation in the periods indicated. In the opinion of the Executive

Officers, the capital structure of the Corporation currently represents an adequate balance between equity

and debt:

On December 31, 2014, the capital structure of the Corporation consisted of 15.8% equity and 84.2% debt.

On December 31, 2013, the capital structure of the Corporation consisted of 17.5% equity and 82.5% debt.

On December 31, 2012, the capital structure of the Corporation consisted of 16.8% equity and 83.2% debt.

The Executive Officers also inform that the Corporation has not issued any redeemable shares.

(c) Comments of the Executive Officers on the payment capacity regarding financial commitments assumed

The Executive Officers believe that the Corporation’s capacity to pay its financial commitments is considered

comfortable, considering its level of cash and equivalents, debt profile, and expectation of future cash flow

generation.

Of the total debt at the end of 2014, only 15.0% matures in the short term, while 85.0% matures in the long

term. The cash position of R$2,658.8 million corresponds to a short-term liquidity ratio (Cash and

Equivalents / Short-Term Debt) of 1.6x.

Furthermore, the Officers inform that the Corporation is seeking to improve the profile of its long-term debt,

with a better balance of maturities.

Of the total debt at the end of 2013, only 12.6% matures in the short term and 87.4% in the long term. The

cash position of R$1,811.6 million corresponds to a short-term liquidity ratio (Cash and Equivalents / ShortTerm Debt) of 1.6x.

8/141

On December 31, 2012, the cash balance of the Corporation, amounting to R$3,178.2 million, represented a

short-term liquidity ratio of 0.86x. In the same period, of the total debt, only 29.9% matured in the short

term while 70.1% was due in the long term.

(d) Comments of the Executive Officers on sources of working capital and capital expenditure financing

The Executive Officers believe that in the last three fiscal years, the Corporation’s main sources of cash were:

(i) cash flow generated by our operating activities; (ii) short and long term bank debt; (iii) issuance of shares

(equity); and (iv) issuances of debt (bonds and debentures). These financing sources are used by the

Corporation mostly to cover costs, expenses and investments related to: (i) operating its business, (ii) capital

disbursements including investment in new plants, expansions and/or modernizations of existing plants and

(iii) the payment obligations related to its debt.

The Executive Officers believe that these sources of financing are appropriate to the debt profile of the

Corporation, meeting the working capital and capex needs, while always preserving the long-term profile of

financial debt and, consequently, the payment capacity of the Corporation.

(e) Comments of the Executive Officers on sources of working capital and capital expenditure financing that

the Corporation plans to use to cover liquidity deficiencies

In the opinion of the Executive Officers, the current cash and cash equivalents of the Corporation reduce the

need for fresh short-term loans. Nevertheless, they inform that the Corporation plans to contract low cost

and long-term funding in order to improve its debt profile. In this regard, the Corporation has sought and

plans to use loans from development institutions such as the Brazilian Development Bank (BNDES) and the

Caixa Econômica Federal, as well as other financial institutions. These funds are basically used to finance

fixed capital and for the renewal of operations.

As mentioned in the previous item, the Executive Officers are of the opinion that the capital market is also

an important source of funding for future growth of the Corporation, either organically or through

acquisitions.

In the next item 10.1(f) of this Reference Form, we describe the main financing lines taken out by the

Corporation and the characteristics of each.

(f) Comments of the Executive Officers on debt levels and characteristics of such debts, indicating:

(i) Relevant loan and financing contracts;

The following table shows the consolidated debt as of December 31, 2014, 2013 and 2012, described by

type, with the respective weighted average rates and terms:

9/141

Credit Line

Charges

Weighted

average

interest

rate

Weighted

average

maturity

2014

2014

Balance on Balance on Balance on

December December December

31, 2014

31, 2013

31, 2012

(R$

thousand)

(R$

thousand)

645

2,320

(% p.a.)

(p.a.)

(year)

(R$

thousand)

FINAME

TJLP + Fixed Rate

6.08

2.29

294

BNDES Finem

TJLP + 1.80

-

-

-

FINEP

TJLP + 1%

4.40

4.63

38,283

50,509

79,453

NCE

Fixed Rate +%CDI

11.36

1.23

575,148

221,995

823,811

Working capital (R$)

Fixed Rate +%CDI

16.46

2.87

120,633

99,936

1,038,384

Rural Credit Notes (R$)

Fixed Rate

-

-

-

-

387,849

FCO – Midwest Constitution

Fund

Fixed Rate

-

-

-

-

12,693

Debentures

payable

interest on debentures

IPCA + CDI

-

-

190,582

26,272

740,521

Fixed Rate

-

-

-

-

25,020

924,940

399,357

3,113,798

Local Currency

BNDES Revitaliza

3,747

and

Total Local Currency

11.83

Foreign Currency

Financing of Industrial Facilities Libor + Fixed Rate +

(US$)

E.V

-

-

-

Prepayment (US$)

Libor + Fixed Rate +

E.V

5.39

1.63

84,213

224,977

2,485,905

Bonds(US$)

Fixed Rate + E.V.

4.84

7,749,702

5,624,277

3,226,378

BNDES Finem

Basket of Currencies

+ 1.30% CDI + Fixed

Rate + E.V.

-

-

-

0.48

825,768

NCE (US$) / ACC

%CDI + Fixed Rate +

8.29

6.16

5,230

220

893,170

1,797,240

10/141

Credit Line

Charges

Weighted

average

interest

rate

Weighted

average

maturity

2014

2014

Balance on Balance on Balance on

December December December

31, 2014

31, 2013

31, 2012

E.V. (US$)+Libor

Working Capital (US$)

Fixed Rate + Libor

-

-

-

-

215,279

Working Capital (Pesos)

Development Unit

-

-

-

2,266

2,121

Bank Loan (US$)

Fixed Rate + E.V.

3.88

3.84

871,760

921,504

540,181

Revolving Credit Line

Libor + 2.75%

2.10

3.26

556,781

806,528

941,069

PAE (US$)

Fixed Rate + E.V.

2.26

0.14

26,160

17,036

21,259

Financing agreements (US$)

Fixed Rate + E.V.

-

-

-

22,071

-

Negotiable Liabilities

Fixed Rate

6.50

0.84

21,601

28,578

33,239

Total Foreign Currency

7.35

10,135,985 8,540,407

9,268,121

Total Debt

7.65

11,060,925 8,939,764

12,381,919

Current Liabilities

1,660,819

1,123,242

3,702,975

Noncurrent Liabilities

9,400,106

7,816,522

8,678,944

11/141

Among the loans and financing shown above, the table below shows the individual contracts whose balance

due as on December 31, 2014, exceeded R$ 100.0 million.

Counterparty

Type of Contract

Principal

Date

Contract

of

Annual Cost

Balance

(R$

million)

(million)

Banco Bradesco

Export Credit Note

R$194.9

03/31/2011

105.3% CDI

Deutsche

Bank/ING

Export Prepayment

US$100.0

11/12/2013

Libor + 4.9%

Banco Itau BBA

Export Prepayment

US$170.0

09/20/2010

8.2%

458.0

Credit Suisse

Export Prepayment

US$60.0

03/28/2012

9.0%

159.5

Caixa Econômica

Bank Credit Note

R$100.0

30/12/2014

CDI + 0.35% 100.1

p.m.

Caixa Econômica

Export

Financing R$200.0

Agreement

11/27/2014

8.00%

201.5

Banco do Brasil

Export Credit Note

R$200.0

09/01/2014

116%CDI

202.8

Senior Notes

Senior Notes

US$400.0

09/20/2013

11.3%

125.3

Senior Notes

Senior Notes

US$750.0

05/09/2011

8.4%

1,924.7

Senior Notes

Senior Notes

US$600.0

01/24/2013

9.9%

421.3

Senior Notes

Senior Notes

US$500.0

05/04/2010

9.5%

2,034.1

Senior Notes

Senior Notes

US$191.1

11/16/2006

9.6%

486.9

Senior Notes

Senior Notes

US$850.0

06/24/2014

Senior Notes

Senior Notes

£200.0

05/19/2014

6.25%

814.1

Revolving Credit Line

US$400.0

03/29/2013

Libor

2.75%

+ 546.6

Bank loans

US$200.0

03/29/2013

Libor

2.75%

+ 530.0

Rabobank

Rabobank

6.875%

133.7

245.0

1,943.4

12/141

As Executive Officers of the Corporation, we have described below what we consider the most important

loans and financing modalities:

Non-Convertible Debentures (Debentures)

Senior Notes - BONDS

Long-term debts, in US$, through debt securities issued abroad (Bonds) exclusively for qualified institutional

investors (Rule 144A/Reg S) not listed on the CVM, under the Securities Act of 1933, as amended.

The Corporation has conducted seven funding operations of this nature since 2006, which were classified by

Moody’s under B1 risk rating in foreign currency and by Standard & Poor’s and Fitch under B+ rating,

described as follows:

The first bond operation was concluded in November 2006, upon the issue by Marfrig Overseas Ltd., a

wholly-owned subsidiary of the Corporation, of US$375 million in Senior Notes, with a 9.625% p.a. coupon,

semi-annual interest payment beginning in May 2007 and maturity of principal in 10 years (November 2016),

which were assigned foreign currency risk ratings of B1 by Moody’s and B+ by Standard & Poor’s and Fitch.

The proceeds from the issue were used for the acquisition by the Corporation of business units in Argentina

and Uruguay.

In March 2010, Senior Note holders approved the amendment of certain clauses included in the indenture

that governs this issue, including the change in and/or omission of restrictions applicable to the guarantees

provided by the Corporation and its subsidiaries. Said amendment did not comprise any change in the

financial conditions of this debt, which maintained the same maturity term and interest rate originally

established (this addendum, jointly with the indenture, the “First Issue”). The First Issue is guaranteed by

Marfrig Global Foods S.A. and Marfrig Holdings (Europe) BV.;

The second operation was conducted in April 2010, upon the issue by Marfrig Overseas Ltd. of US$500

million in Senior Notes, with a coupon of 9.50% p.a., semiannual interest payments beginning in November

2010 and maturity of principal in 10 years (November 2020), which were assigned foreign currency risk

ratings of B1 by Moody’s and B+ by Standard & Poor’s and Fitch. This operation also was guaranteed by

Marfrig Global Foods S.A. and Marfrig Holdings (Europe) B.V. and its proceeds were used to lengthen the

debt profile of the Corporation (“Second Issue”).

The third operation was concluded in May 2011 and comprised the issue by Marfrig Holdings (Europe) B.V.

of US$750 million in Senior Notes, with a coupon of 8.375% p.a., semiannual interest payment beginning in

November 2011 and maturity of principal in 7 years (May 2018), which were assigned foreign currency risk

ratings of B1 by Moody’s and B+ by Standard & Poor’s and Fitch. The operation was guaranteed by Marfrig

Global Foods S.A. and Marfrig Overseas Limited and the proceeds were used to lengthen the debt profile of

the Corporation and to strengthen its working capital (“Third Issue”).

The fourth operation was concluded in January 2013 and comprised the issue by Marfrig Holdings (Europe)

B.V. of US$600 million in Senior Notes, with a coupon of 9.875% p.a., semiannual interest payments

beginning in July 2013 and maturity of the principal in 4.5 years (July 2017), which were assigned foreign

currency risk ratings of B2 by Moody’s and B+ by Standard & Poor’s and Fitch. This operation was

13/141

guaranteed by Marfrig Global Foods S.A. and Marfrig Overseas Ltd. and the proceeds were used to lengthen

the debt profile of the Corporation and to strengthen its working capital (“Fourth Issue”).

The fifth operation was concluded in January 2013 and comprised the issue by Marfrig Holdings (Europe)

B.V. of US$400 million in Senior Notes, with a coupon of 11.25% p.a., semiannual interest payments

beginning in March 2014 and maturity of the principal in 8 years (September 2021), which were assigned

foreign currency risk ratings of B2 by Moody’s and B+ by Standard & Poor’s and Fitch. This operation was

guaranteed by Marfrig Global Foods S.A. and Marfrig Overseas and the proceeds were used to lengthen the

debt profile of the Corporation and to strengthen its working capital (“Fifth Issue”). Also in connection with

the Fifth Issue, the Corporation carried out a consent solicitation and tender offer to acquire the Bonds of

the First Issue, which mature in 2016. Based on the conclusion of this offering, the Corporation repurchased

Bonds in the approximate amount of US$191 million, or approximately 50.97% of the outstanding bonds of

the First Issue. As a result of the tender offer, the First Issue was amended through a complementary

indenture that sets forth, among other things, the elimination of virtually all the restrictive covenants of the

Indenture.

In March 2014, the Corporation concluded the re-tap of its Senior Notes linked to the Second Issue in the

aggregate amount of US$275 million (“Additional Notes”). The Additional Notes were consolidated into a

single series with the Senior Notes of the Second Issue, with coupon of 9.50% p.a. (yield of 9.43% p.a. for the

issue). The additional notes were assigned foreign currency risk ratings of B2 by Moody’s and B by Standard

& Poor’s and Fitch. The issue of Additional Notes issue is guaranteed by Marfrig Global Foods. S.A. and its

subsidiary Marfrig Holdings (Europe) B.V. In connection with the Additional Notes, the Corporation carried

out a tender offer to acquire the Bonds of the 2017 Bonds of the Fourth Issue and the 2021 Bonds of the

Fifth Issue. Based on the conclusion of this offering, the Corporation repurchased Bonds in the approximate

amount of (i) US$72.8 million, or 12.14% of the outstanding Bonds of the Fourth Issue; and (ii) US$57.1

million or 14.28% of the outstanding Bonds of the Fifth Issue.

The sixth operation was concluded in May 2014 and comprised the issue by Moy Park (Bondco) Plc of the

first issue of Senior Notes in pound sterling, in the total amount of GBP 200 million, with a coupon of 6.25%

p.a., semiannual interest payments starting in November 2014 and maturity of the principal in 7 years (May

2021), which were assigned foreign currency risk ratings of B1 by Moody’s and B+ by Standard & Poor’s. This

operation was guaranteed by Moy Park Holdings Europe Ltd., Moy Park Ltd. and some of its affiliates, with

no guarantee provided by the Corporation to the Notes. The proceeds were allocated to the Corporation and

used to repay existing debt (“Sixth Issue”);

The seventh operation was carried out in June 2014 and comprised the issue by Marfrig Holdings (Europe)

B.V. of US$850 million in Senior Notes, with a coupon of 6.875% p.a., semiannual interest payments starting

in December 2014 and maturity of the principal in 5 years (June 2019), which were assigned foreign currency

risk ratings of B2 by Moody’s and B by Standard & Poor’s. This operation was guaranteed by Marfrig Global

Foods S.A. and Marfrig Overseas Ltd., with the proceeds used to reduce the cost and lengthen the profile of

debt (“Seventh Issue”). In connection with the Seventh Issue, the Corporation carried out a tender offer

together with a consent solicitation, for 2017 Bonds of the Fourth Issue and 2021 Bonds of the Fifth Issue.

Based on the conclusion of these offers, the Corporation repurchased a total principal amount of about (i)

US$291.5 million, or 85.03% of the outstanding Notes of the Fifth Issue; and (ii) US$371.8 million or 70.54%

of the outstanding Notes of the Fourth Issue. As a result of the early tender offer, the Fourth and Fifth Issues

14/141

were amended through a complementary indenture that set forth, among other things, the elimination of

virtually all the covenants in the Indenture.

Furthermore, due to the settlement of the transaction governed by the Agreement for the Purchase and Sale

of Ownership Interests and Other Covenants of September 30, 2013, which formalized, among other things,

the sale by the Corporation of certain rights and ownership interests in the companies of its group that

owned the business unit Seara Brasil to JBS S.A., the guarantees originally offered by União Frederiquense

Participações Ltda. and Seara Alimentos Ltda. in the First Issue, Second Issue, Third Issue and Fourth Issue

were released as per the release mechanism provided for in their respective indentures.

Maturity schedule of debt in Brazilian real

The following table shows the schedule of payment of loans and financing, debentures and interest on

debentures in Brazilian real, of the Corporation on December 31, 2014, 2013 and 2012:

In R$ thousand

12/31/2014

Consolidated

12/31/2013

12/31/2012

Local currency

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

1Q15

2Q15

3Q15

4Q15

Current liabilities

281,145

205,264

12,140

212,328

710,877

105,416

19,537

102,433

3,060

230,446

1,607,561

2014

2015

2016

2017

2018

2019

2020

2021

Non-current liabilities

77,980

74,407

54,745

5,932

998

1

214,063

44,375

40,628

38,462

38,462

5,977

1,006

1

168,911

627,537

582,949

180,318

42,504

42,372

29,798

761

1

1,506,240

Total

924,940

399,357

3,113,801

516,899

348,850

599,125

142,687

15/141

Maturity schedule of foreign currency debt

The following table shows the schedule of payment of loans and financing, debentures and interest on

debentures in foreign currency, of the Corporation on December 31, 2014, 2013 and 2012:

In R$ '000

12/31/2014

Foreign currency

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

1Q15

2Q15

3Q15

4Q15

Current liabilities

Consolidated

12/31/2013

12/31/2012

324,050

193,029

111,863

321,000

949,942

398,020

105,269

52,448

337,059

892,796

2014

2015

2016

2017

2018

2019

2020

2021

636,374

584,840

2,471,982

2,008,403

2,551,992

932,452

640,716

541,355

1,539,382

2,434,983

2,722

1,595,671

892,782

Non-current

9,186,043

7,647,611

7,172,707

10,135,985

8,540,407

9,268,121

Total

1,094,509

373,051

153,267

474,587

2,095,414

2,463,558

1,126,442

1,008,757

131,432

1,459,837

982,681

Mandatory deed convertible into Shares

According to the “Indenture for the Second Issue of Debentures Convertible into Shares of (Mandatory

Deed) Marfrig Global Foods S/A”, the Corporation issued two hundred and fifty thousand (250,000)

debentures, mainly convertible into shares, with unit par value of R$10, amounting to R$2,500,000. The

Mandatory Deed was issued on July 15, 2010 through private subscription, with maturity within 60 months,

annually restated at the interest rate at 100% of the accumulated variation of average interbank deposit

rates of a day, plus spread of one per cent (1%). Remuneration of the Mandatory Deed is recognized as

current liabilities and collateralized by a bank guarantee provided by Banco Itaú BBA S/A. The total amount

of the two hundred and fifty thousand (250,000) debentures was subscribed to, and the main debenture

holder is BNDES Participações S/A.

As defined in said Indenture and except for the cases of voluntary conversion, the conversion price will be

lower than the following items: (i) R$21.50, plus the percentage of interest paid to debenture holders over

the par value of the issues, less earnings distributed to each share, both restated at CDI as from the actual

payment, in the case of interest on debentures, or the date of debentures less earnings, in the case of

16/141

earnings, until the conversion date; and (ii) the higher between the market price and R$24.50, the latter

without adjustment for earnings in cash or monetary restatement.

The Corporation, based on the essence of the operation (equity) and on the characteristics thereof, initially

recorded the Mandatory Deed (principal) as Capital Reserve, under Shareholders' Equity. However, the

Securities and Exchange Commission of Brazil (CVM), through Official Letter CVM/SEP/GEA-5/no. 329/2012

dated October 10, 2012, stated its opinion of this instrument and ordered: (i) the accounting reclassification

of the Mandatory Deed; and (ii) the re-filing of the 2011 financial statements with comparisons to the 2010

financial instatements.

The Corporation abided by the order of the CVM, proceeding with the full reclassification of the Mandatory

Deed to the specific accounting line non-current liabilities. The previous method of accounting was based on

accounting and legal opinions issued specifically regarding this matter.

Said reclassification does not affect any terms and conditions of the Mandatory Deed and there is no effect

on the current financial indebtedness of the Corporation, on the servicing of its debt or on its financial

covenants, since, unlike others items under the liabilities of the Corporation, the Mandatory Deed may not

be liquidated into cash or cash equivalents, but only into common shares issued by the Corporation.

The Corporation spent R$12,328 to issue the Mandatory Deed, which was initially recorded as a valuation

allowance to the Capital Reserve account. The surety was renewed annually bringing the expenses with the

issue of the Mandatory Deed to R$41,180 on June 30, 2014. These expenses were also reclassified under

non-current liabilities, as a deduction from the account “Mandatory Deed Convertible into Shares”. As

determined by the Corporation, the value started to be amortized on a monthly basis.

Because of the paying in of such debentures made by BNDES Participações S/A, MMS Participações S/A and

BNDES Participações S/A have entered into a Shareholders' Agreement with the purpose of regulating the

relationship between the parties as shareholders of Marfrig Global Foods S.A.

On February 5, 2013 the Corporation conducted a capital increase, within the authorized limit due to the

conversion of thirty-five thousand (35,000) debentures from the 2nd Issue of Convertible Debentures of the

Corporation that were held by BNDES Participações S.A. – BNDESPAR into forty-three million, seven hundred

and fifty thousand (43,750) common shares issued by the Corporation, in accordance with Item III.16.11 of

the “Private Deed of the 2nd Issue of Debentures Convertible Into Shares of Marfrig Global Foods S.A.” that

was entered into by the Corporation and Planner Trustee DTVM Ltda. on July 22, 2010, and as per the

Material Fact published on October 24, 2012.

The Shares resulting from the conversion have the same characteristics and conditions and enjoy all of the

same rights and advantages ascribed by law and by the bylaws that are attributed to the existing common

shares issued by the Corporation.

As a result of the abovementioned conversion of debentures, there was a material increase in the ownership

interest held by the shareholder BNDESPAR, which now holds common shares representing 19.63% of the

Share Capital of the Corporation.

On January 6, 2014, the Board of Directors of the Corporation approved the submission to the Meeting of

Shareholders of the proposal for Fifth (5th) Issue of Unsecured Convertible Debentures in a Single Series in

the aggregate amount of R$2,150,000 (5th Issue of Convertible Debentures of the Corporation).

17/141

On January 22, 2014, the shareholders of the Corporation, assembled in an Extraordinary Shareholders'

Meeting, approved said Firth Issue of Convertible Debentures of the Corporation in the aggregate amount of

R$2,150,000, in a single series, upon the issue of 215,000 thousand debentures at the unit face value of

R$10, restated by an interest rate corresponding to 100% of the cumulative variation in the average

overnight rate for one day, plus a spread of one percent (1%). The interest will be paid annually on the

following dates: January 25, 2015, January 25, 2016; with the last payment date coinciding with the maturity

date, on January 25, 2017. The Fifth Issue had the objective, within the limits of its indenture, of fully

redeeming the debentures of the Second Issue of Convertible Debentures of the Corporation.

Likewise, the debentures of the Fifth Issue of Convertible Debentures of the Corporation are mandatorily

convertible into shares of the Corporation on the Maturity Date, with the conversion price corresponding to

the lowest of the following amounts: (i) R$21.50, restated annually by an interest rate corresponding to the

overnight rate plus one percent (CDI+1%), less any and all payments received by shareholders (dividends or

interest on equity); or (ii) the highest between the market price, as defined in the indenture as the weighted

average market price of MRFG3 stock quoted in the spot market of the BM&FBovespa in the sixty (60)

trading sessions immediately prior to the conversion date, and R$21.50 (without adjustment for cash

dividends or monetary restatement).

On March 17, 2014, the Corporation released a Notice to the Market informing the market of the conclusion

of its Fifth Issue of Convertible Debentures of the Corporation, with the subscription of 214,955 Debentures,

with unit face value of R$10, as per the information received from Itaú Unibanco S.A., the agent bank, and

that 45 unsubscribed debentures were canceled by the Corporation.

Lastly, on March 28, 2014, the Corporation published a Notice to the Market informing that, as decided in

the Meeting of Debenture Holders of the Second Issue of Convertible Debentures of the Corporation, held

on January 22, 2014, of a total of 215,000 debentures of the Second Issue: a) 214,900 were used by the

respective debenture holders to pay up the debentures of the Fifth Issue of Convertible Debentures of the

Corporation; and b) 100 outstanding debentures were fully redeemed, on the date hereof, which resulted in

the cancelation of all 215,000 debentures of the Second Issue of Convertible Debentures of the Corporation

and the consequent conclusion of said Second Issue of Debentures.

(ii)

Other long-term relationships with financial institutions

The Executive Officers confirm that the Corporation does not have any long-term relationship with financial

institutions other than those resulting from financing, loans and guarantees described above.

18/141

(iii)

Degree of debt subordination

“The Officers declare that the debts of the Corporation do not have a degree of subordination among them

and therefore have equal payment rights. Note, however, that the FINAME credit facilities contracted by the

Corporation from the Brazilian Development Bank (BNDES) feature security interests on the assets acquired

using the credit, and certain export prepayment credit facilities feature assignment of receivables. Marfrig

further clarifies that, during the last three fiscal years, no degree of subordination has existed among the

unsecured debts of the Corporation. Debts with security interest enjoy the preferences and prerogatives

provided for by law.”

(iv) Any restrictions imposed on the Corporation, especially those relating to limits on debt and the

contracting of new debt, the distribution of dividends, the disposal of assets, the issuance of new securities

and the transfer of control.

According to the Executive Officers, the main restrictions imposed on the Corporation regarding the debt

limits and the contracting of new debts, disposal of assets, issue of fresh securities and the sale of

shareholding control, are:

Debt limits

Senior Notes

Considering that the Senior Notes issued in 2006, 2010 (“Second Issue”), 2011 (“Third Issue”), January 2013,

September 2013, May 2014 (“Sixth Issue”) and June 2014 (“Seventh Issue”) represent 71.29% of the

Corporation’s consolidated debt as of December 31, 2014 (and represented 63.10% of the Company’s debt

on December 31, 2013), the obligation of maintaining a ratio of adjusted net debt to EBITDA in the last 12

months serves as a guide for the other outstanding loans and financing of the Corporation at the end of the

period.

Regarding the ratio of adjusted net debt to EBITDA, note that the (i) The Second Issue, Third Issue and

Seventh Issue establish a maximum ratio of 4.75x (excluding the impact of exchange variation); and (ii) the

Sixth Issue establishes a maximum ratio of 3.5x, applicable only to the Moy Park conglomerate and not

related to the ratio of adjusted net debt to EBITDA applicable to the Corporation’s consolidated results.

“Adjusted net debt”, for this purpose, signifies the consolidated debt of the Corporation, calculated in the

last four quarters before calculating (-) the sum of cash and equivalents and tradable securities considered

current assets in the balance sheet of the Corporation, calculated in the last quarter before the calculation

(except for any interest held by the Corporation in any person).

“EBITDA”, for this purpose, means, for any period, the sum of the consolidated profit (loss) of the controlling

shareholders of the Corporation (+) net financial costs (+) income tax and social contribution (+) depreciation

and amortization expenses (+) minority interest.

The Company has other loan agreements that are ruled by covenant of 4.75x (excluding the impact of

exchange variation), in its most restrictive form, in relation to consolidated indebtedness level, as maximum

quotient of Net Debt/annualized (last 12 months) EBITDA ratio, and restrictions to the distribution of

dividends.

19/141

Due to the contractual provisions (carve-out) that allow the exclusion of foreign exchange variation effects

from the calculation of leverage ratio (net debt/EBITDA LTM), the Corporation clarifies that based on this

methodology, the current leverage ratio (net debt/EBITDA LTM) stood at 3.42x at December 31, 2014.

20/141

Disposal of assets

There are restrictions to the disposal of assets and/or of a substantial part of assets that may lead to default

with the obligations under certain instruments: 5th Issues of Convertible Debentures and 4th Issue of NonConvertible Debentures issued by the Corporation and certain Advances on Exchange Contracts (ACC).

In the case of FINAME of BNDES, there is a prohibition to placing encumbrance on the Corporation’s

permanent assets, after contracting the operation, without prior express authorization from BNDES,

pursuant to clause XII, article 34 of the Provisions Applicable to Agreements with BNDES.

The Second Issue, Third Issue and Seventh Issue of Senior Notes and the Credit Agreement with Deutsche

Bank include a clause prohibiting the divestment of assets, except: (1) at fair market value; (2) 75% of the

price is paid in cash/liquid investments or assets/properties related to the Corporation’s businesses; and (3)

if within 360 days of receipt, such funds are used to repay debts or acquire assets in businesses related to

the Corporation’s activities.

Issue of securities

The agreements executed through the BNDES FINAME credit lines and the 2nd and 5th Issues of NonConvertible Debentures issued by the Corporation include a restriction on the issue of debentures and

beneficiaries by the borrower, after contracting the operation, without prior express authorization from

BNDES, pursuant to clause IX, article 34 of the Provisions Applicable to Agreements with BNDES.

Sale of control

The agreements executed through the BNDES FINAME credit lines and the 2nd and 5th Issues of Convertible

Debentures and the 4th Issue of Non-Convertible Debentures issued by the Corporation include a restriction

on the alteration of direct or indirect control, of the borrower, after contracting the operation, without prior

express authorization from BNDES, pursuant to clause III, article 39 of the Provisions Applicable to

Agreements with BNDES.

There are restrictions also on the sale of control of the beneficiary of the credits in the financing from NCEs,

Finame, NPRs, CCBs and certain ACCs.

(g) Comments of the Executive Officers on financing line use limits already contracted

The Executive Officers inform that all the financing agreements were fully released after the respective

approval and formalization with the creditors.

(h) Comments of Executive Officers on Material changes in each item of the financial statements

21/141

The following sections present a summary of our financial and operational information for the periods

indicated. The following information should be read and analyzed in conjunction with the Corporation’s

consolidated financial statements and the consolidated interim quarterly financial information of the

Corporation and accompanying notes, which are available on the Corporation’s website

(www.marfrig.com.br/ri) and on the website of the Securities and Exchange Commission of Brazil - CVM

(www.cvm.gov.br).

22/141

BALANCE SHEETS

12/31/2

014

AV

12/31/2

013

AV

12/31/2

012

AV

2014 x 2013 x

2013 2012

(in R$ thousand, except %)

Current Assets

Cash and cash equivalents

Financial investments

41.91

3.59%

%

16.16

%

1,567,11

1,040,28 5.84

7.76%

2

2

%

2,258,28

50.60

8.83%

6

%

53.93

%

941,277

1,075,60 6.03

4.66%

2

%

1,391,75

5.44% 12.06

2

%

22.72

%

677,483

3.36% 875,860

401,563

118.11

%

1,091,68

5.41% 771,254

5

Trade accounts receivable – domestic

Trade accounts receivable – foreign

Inventories of goods and merchandise

1.74% 350,106

Biological assets

1.57% 5.96%

943,832

32.37

%

3.69% 0.60% 62.91

%

1,240,45

61.39

4.85%

7

%

10.48

%

91,475

103.82

10.41

0.36%

%

%

0.29% 224,739

1.26

%

77,372

0.30% 74.31

%

190.47

%

57,204

0.28% 59,370

0.33

%

51,196

0.20% -3.65%

15.97

%

66,711

0.33% 75,580

0.42

155,079

0.61% -9.44% -

0.83% 81,949

0.46

%

58,261

Prepaid expenses

Notes receivable

Other receivables

1.96

%

1,361,63

1,110,43 6.23

6.75%

5

6

%

167,030

Advances to suppliers

4.91

%

919,908

2,027,91 10.05 1,828,55 10.26 2,703,73 10.57 11.12

9

%

2

%

2

%

%

352,200

Recoverable taxes

4.33

%

23/141

12/31/2

014

AV

12/31/2

013

AV

12/31/2

012

AV

2014 x 2013 x

2013 2012

51.26

%

%

8,368,51 41.46 7,493,73 42.03 10,234,6 40.00 20.92

7

%

0

%

52

%

%

Total current assets

26.78

%

Non-current Assets

Financial investments

Court deposits

Notes receivable

Deferred

income

contribution taxes

and

Recoverable taxes

970

0.00% 1,030

0.01

%

886

0.00% -5.83%

16.25

%

64,972

0.32% 71,519

0.40

%

44,366

0.17% -9.15%

61.20

%

345,664

1.71% 55,657

0.31

%

53,704

0.21%

1,708,43

1,447,96 8.12

social

8.46%

7

5

%

1,232,64

4.82% 8.73% 19.67

0

%

42,773

0.21% 33,207

0.19

%

77,807

0.30%

0.18% 54,774

0.31

%

11,107

0.04% 32.58

%

Investments

29.80

%

57.32

%

393.15

%

4,961,62 24.58 4,754,75 26.67 7,757,25 30.31

4.35% 38.71

3

%

2

%

9

%

%

142,140

Intangible assets

21.81

%

5.55

%

36,934

Biological assets

1,851,74

21.68

7.24%

7

%

1,509,16

7.48% 990,162

9

Other receivables

Property, plant and equipment

521.06

3.64%

%

0.70% 113,483

0.64

%

253,361

0.99%

25.25

%

55.21

%

3,004,70 14.71 2,811,28 15.77 4,071,92 15.91

6.88% 9

%

5

%

5

%

30.96

24/141

12/31/2

014

AV

12/31/2

013

AV

12/31/2

012

AV

2014 x 2013 x

2013 2012

%

Total non-current assets

Total assets

11,817,3 58.54 10,333,8 57.97 15,354,8 60.00 10.69

91

%

34

%

02

%

%

32.70

%

20,185,9 100.0 17,827,5

25,589,4

14.99

100%

100%

08

%

64

54

%

30.33

%

2,028,30 10.05 1,596,09 8.95

3

%

1

%

38.14

%

Current Liabilities

Trade accounts payable

506,969

1.98% 2.00% 33.34

%

187,503

71.78

0.73%

%

38.85

%

1,470,23

1,096,97 6.15

7.28%

7

0

%

3,359,13 13.13 34.28

0

%

%

67.34

%

352,852

1.38% 43.34

%

22.78

%

38,805

0.15%

144,445

625.42

81.81

0.56%

%

%

199,400

0.78% 0.00% 100.00

%

341,979

1.69% 337,931

1.90

%

0.99% 114,651

0.64

%

Payroll and related charges

200,312

Taxes

Loans and financing

129,895

0.64% 272,486

1.53

%

69,229

0.34% 49,663

0.28

%

0.94% 26,272

0.15

%

0.00% -

0.00

%

Notes payable

Lease payable

190,582

Interest on debentures

Debentures payable

2,580,22 10.08 27.09

7

%

%

39.40

%

27.983

%

25/141

12/31/2

014

AV

12/31/2

013

AV

12/31/2

012

2014 x 2013 x

2013 2012

90,553

418.46

34.64

0.35%

%

%

227,436

17.93

0.89%

%

40.50

%

4,662,46 23.10 3,688,56 20.69 7,687,32 30.04 33.49

5

%

6

%

0

%

%

52.02

%

9,400,10 46.57 7,816,52 43.85 8,282,26 32.37 20.26

6

%

2

%

8

%

%

-5.62%

72,645

0.36% 59,186

0.33

0.79% 135,316

0.76

%

Advances from customers

159,283

Other payables

Total current liabilities

AV

Non-current Liabilities

Loans and financing

706,545

3.50% 181,989

252,737

3.15% 646,857

3.63

%

1,474,66

5.76% 6.35% 56.14

0

%

0.20% 26,462

0.15

%

0.35% 103,096

0.58

%

0.00% -

0.00

%

Taxes

Deferred

income

contribution taxes

and

social 635,758

40,448

Provisions for contingencies

70,745

Lease payable

Debentures payable

Mandatory convertible deed

237,889

52.85

0.93%

%

88.88

%

107,523

0.42% 31.38

%

-4.12%

396,676

1.55% 0.00% 100.00

%

2,121,47 10.51 2,113,11 11.85 2,470,92

9.66% 0.40% 14.48

0

%

3

%

0

%

353,570

Notes payable

288.37

27.99

0.99%

%

%

1.02

%

1.75% 4,414

0.02

%

208,492

7910.8

97.88

0.81%

1%

%

26/141

12/31/2

014

123,076

AV

12/31/2

013

0.61% 127,523

Other

Total non-current liabilities

Total Liabilities

AV

0.72

%

12/31/2

012

165,877

AV

2014 x 2013 x

2013 2012

0.65% 0.49% 23.12

%

13,451,7 66.64 11,019,9 61.81 13,597,0 53.14 22.59

18

%

76

%

42

%

%

18.95

%

18,114,1 89.74 14,708,5 82.50 21,284,3 83.18 25.32

83

%

42

%

62

%

%

30.90

%

Shareholders' Equity

Share capital

5,276,67 26.14 5,276,67 29.60 4,926,67 19.25

0.00% 7.10%

8

%

8

%

8

%

(-) Share issue expenses

-108,210

-108,210 0.61

0.54%

%

Capital reserve

Acquisition of shares in subsidiaries

Issue of common shares

Profit reserve

Legal reserve

Retained earnings

0.00% 0.00%

0.42%

184,642

0.91% 184,800

1.04

%

184,800

0.72% -0.09% 0.00%

-158

0.00% -

0.00

%

-

0.00% 0.00% 0.00%

184,800

0.92% 184,800

1.04

%

184,800

0.72% 0.00% 0.00%

36,449

0.18% 35,773

0.20

%

33,604

0.13% 1.89% 6.45%

44,476

0.22% 44,476

0.25

%

44,476

0.17% 0,00% 0%

7,348

0.04% 7,348

0.04

%

7,348

0.03% 0,00% 0%

-3,685

-4,361

0.02%

0.02

%

-6,530

15.50

0.03%

%

-11,690

-11,690

0.06%

0.07

%

-11,690

0.05% 0.00% 0.00%

Treasury shares

Canceled treasury shares

-108,210

33.22

%

27/141

12/31/2

014

AV

12/31/2

013

AV

12/31/2

012

AV

2014 x 2013 x

2013 2012

514,371

Other comprehensive income

-438,071

-100,411 0.56

2.17%

%

347.83

119.52

2.01%

%

%

-168,805

Asset valuation adjustment

1,713,19

-969,306 5.44

8.49%

8

%

76.68

0.66% %

683,176

2.67%

Cumulative translation adjustment

1,275,12

6.32% 868,895

7

45.34

%

27.18

%

Accumulated losses

32.38

2,998,02 14.85 2,259,30 12.67 1,395,00

5.45% %

3

%

4

%

5

61.96

%

31.83

0.58%

%

39.74

%

2,071,72 10.26 3,119,02 17.50 4,305,09 16.82

33.72

5

%

2

%

2

%

%

27.55

%

20,185,9 100.0 17,827,5 100.0 25,589,4 100.0 14.99

shareholders'

08

0%

64

0%

54

0%

%

30.33

%

118,260

Non-controlling interest

Total shareholders' equity

Total liabilities

equity

and

4.87

%

474.22

%

0.59% 89,696

0.50

%

148,854

28/141

Comparative analysis of the Balance Sheets as of December 31, 2014 and 2013

Current Assets

Current assets were R$8,368.5 million at December 31, 2014 compared to R$7,493.7 million at December

31, 2013, for an increase of 11.7%. As a percentage of total assets, current assets represented 41.5% and

42.0% at December 31, 2014 and 2013, respectively.

Cash and cash equivalents. The Corporation’s cash and cash equivalents totaled R$2,658.8 million at

December 31, 2014, an increase of 46.8% from R$1,811.5 million at December 31, 2013. Cash and

equivalents as a percentage of total assets came to 13.2%, at December 31, 2014, compared to 10.1% at

December 31, 2013. The officers of the Corporation believe this increase in cash and equivalents is due to

increases in cash and marketable securities, of 41.9% and 50.6%, respectively, from the prior year.

Trade Accounts Receivable. The Corporation’s trade accounts receivable totaled R$1,618.8 million at

December 31, 2014, a decrease of 17.0% from R$1,951.4 million at December 31, 2013. As a percentage of

total assets, trade accounts receivable represented 8.0% at December 31, 2014, compared to 10.9% at

December 31, 2013. The officers of the Corporation believe the 17.0% decrease in Trade Accounts

Receivable was mainly due to the 57.2% increase in Advances on Exchange Deliverables (ACEs).

Inventory and Biological Assets. Inventory and biological assets of the Corporation amounted to R$2,380.1

million at December 31, 2014 compared to R$2,178.6 million at December 31, 2013, for an increase of 9.2%.

As a percentage of total assets, inventory and biological assets represented 11.8% and 12.2% at December

31, 2013, respectively.

Non-Current Assets

The Corporation’s non-current assets amounted to R$11,817.4 million at December 31, 2014, an increase of

14.4% from R$10,333.8 million at December 31, 2013. As a percentage of total assets, non-current assets

represented 58.5% at December 31, 2014, compared to 58.0% at December 31, 2013.

Property, plant and equipment and Biological Assets. Property, plant and equipment and biological assets

were R$5,103.8 million at December 31, 2014 compared to R$4,868.2 million at December 31, 2013, for an

increase of 4.8%. As a percentage of total assets, property, plant and equipment and biological assets

represented 25.3% and 27.3% at December 31, 2014 and December 31, 2013, respectively.

Intangible assets. Intangible assets totaled R$3,004.7 million at December 31, 2014 compared to R$2,811.3

million at December 31, 2013, for an increase of 6.9%. As a percentage of total assets, intangible assets

represented 14.9% and 15.8% at December 31, 2014 and December 31, 2013, respectively.

Current Liabilities

Current liabilities increased 26.4%, from R$4,662.5 million at December 31, 2013 to R$3,688.5 million at

December 31, 2014. As a percentage of total liabilities, current liabilities represented 23.1% at December 31,

2014, compared to 20.6% at December 31, 2013.

Trade accounts payable. At December 31, 2014, trade accounts payable amounted to R$2,028.3 million, an

increase of 27.1% from R$1,596.0 million at December 31, 2013. As a percentage of total liabilities, trade

accounts payable represented 10.0% at December 31, 2014, compared to 8.9% at December 31, 2013.

29/141

Loans and Financing. At December 31, 2014, loans totaled R$1,470.2 million, increasing 34.0% from

R$1,096.9 million at December 31, 2013. As a percentage of total liabilities, cost from loans and financing

represented 7.3% at December 31, 2014, compared to 6.1% at December 31, 2013. The Officers believe this

increase was mainly due to foreign-denominated debt (non-cash exchange variation in the Bonds line).

Interest on Debentures. At December 31, 2014, non-convertible debentures payable and interest on

debentures amounted to R$190.6 million, an increase of 625.4% from R$26.2 million at December 31, 2013.

As a percentage of total liabilities, interest on debentures represented 0.9% at December 31, 2014,

compared to 0.1% at December 31, 2013.

Noncurrent Liabilities

Noncurrent liabilities increased 22.1% to R$13,451.7 million at December 31, 2014, from R$11,019.9 million

at December 31, 2013. As a percentage of total liabilities, noncurrent liabilities represented 66.6% at

December 31, 2014, compared to 61.8% at December 31, 2013.

Loans and Financing. At December 31, 2014, loans totaled R$9,400.1 million, increasing 20.3% from

R$7,816.5 million at December 31, 2013. As a percentage of total liabilities, loans and financing including

debentures represented 46.6% at December 31, 2014, compared to 43.8% at December 31, 2013. The

Officers of the Corporation believe this increase was mainly due to foreign-denominated debt (non-cash

exchange variation in the Bonds line).

Convertible mandatory deed. At December 31, 2014, the amount under convertible mandatory deed totaled

R$2,121.5 million, increasing 0.4% from R$2,113.1 million at December 31, 2013. As a percentage of total

liabilities, cost from the convertible mandatory deed represented 10.5% at December 31, 2014, compared to

11.8% at December 31, 2013.

Shareholders' Equity

The Corporation’s shareholders’ equity decreased by 33.6%, to R$3,119.0 million on December 31, 2014

from R$2,071.7 million at December 31, 2013.

30/141

STATEMENT OF INCOME 2014 VS. 2013

12/31/2014 VA

12/31/2013 VA

12/31/2014

vs.

12/31/2013

(in R$ thousand, except %)

Net Operating Revenue

21,073,322 100% 18,752,376 100% 12%

Cost of goods sold

(18,408,152) -87% (16,442,702) -88% 12%

Gross Income

2,665,170

Operating income (expenses)

(3,707,481) -18% (3,473,914) -19% 7%

Selling expenses

(935,351)

-4%

(805,303)

-4%

16%

General and administrative expenses

(529,148)

-3%

(563,524)

-3%

-6%

Equity in earnings (losses) of subsidiaries

(17,795)

0%

(9,109)

0%

95%

Other operating income (expenses)

(98,423)

0%

(64,984)

0%

51%

Financial income (expenses)

(2,126,764) -10% (2,030,994) -11% 5%

13% 2,309,674

12% 15%

Financial income

294,701

1%

364,955

2%

-19%

Exchange gain

781,107

4%

778,261

4%

0%

Financial expenses

(1,970,693) -9%

(1,806,023) -10% 9%

Exchange loss

(1,231,879) -6%

(1,368,187) -7%

-10%

Operating Income

(1,042,311) -5%

(1,164,240) -6%

-10%

Loss before tax effects

(1,042,311) -5%

(1,164,240) -6%

-10%

Provision for income and social contribution taxes

322,018

2%

361,330

2%

-11%

Income tax

222,054

1%

267,470

1%

-17%

Social contribution tax

99,964

0%

93,860

1%

7%

Net income (loss) in the period from continuing

operations

(720,293)

-3%

(802,910)

-4%

-10%

Net income (loss) in the period from discontinued

operations

0

0%

(94,178)

-1%

-100%

Net income (loss) in the period before interest

-3%

(897,088)

-5%

-20%

(720,293)

31/141

12/31/2014 VA

12/31/2013 VA

12/31/2014

vs.

12/31/2013

Attributable to:

Marfrig Alimentos – controlling interest – continuing

operations

(739,472)

-4%

(815,768)

-4%

-9%

Marfrig Alimentos –

discontinued operations

0

0%

(97,825)

-1%

-100%

Marfrig Alimentos - controlling interest – Total

(739,472)

-4%

(913,593)

-5%

-19%

Non–controlling Interest – continuing operations

19,179

0%

12,858

0%

49%

Non–controlling Interest – discontinued operations

0

0%

3,647

0%

-100%

Non–controlling shareholders - Total

19,179

0%

16,505

0%

16%

Basic earnings (losses) per share – common continuing operations

(1.4212)

0%

(1.5679)

0%

-9%

Basic earnings (losses) per share – common discontinued operations

0.0000

0%

(0.1880)

0%

-100%

Basic earnings (losses) per share – common - Total

0%

(1.7559)

0%

-19%

controlling

interest

–

(1.4212)

32/141

Comparative analysis of the Balance Sheets as of December 31, 2013 and 2012

Current Assets

Current assets were R$7,493.7 million at December 31, 2013 compared to R$10,234.6 million at December

31, 2012, for a decrease of 26.8%. As a percentage of total assets, current assets represented 42.0% and

40.0% at December 31, 2013 and 2012, respectively. The officers of the Corporation believe this decrease in

current assets is due to the sale of ownership interests to JBS S.A., as per note 12.4 to the financial

statements for the fiscal year ended December 31, 2013.

Cash and cash equivalents. The Corporation’s cash and cash equivalents totaled R$1,811.5 million at

December 31, 2013, a decrease of 43.0% from R$3,178.2 million at December 31, 2012. Cash and

equivalents as a percentage of total assets came to 10.1%, at December 31, 2013, compared to 12.4% at

December 31, 2012. The officers of the Corporation believe this decrease in cash and equivalents is due to

the sale of ownership interests to JBS S.A., as per 12.4 to the financial statements for the fiscal year ended

December 31, 2013.

Trade Accounts Receivable. The Corporation’s trade accounts receivable totaled R$1,951.4 million at

December 31, 2013, an increase of 8.8% from R$1,793.3 million at December 31, 2012. As a percentage of

total assets, trade accounts receivable represented 10.9% at December 31, 2013, compared to 7.0% at

December 31, 2012. The officers of the Corporation believe the 8.8% increase in Trade Accounts Receivable

was due to the sale of ownership interests to JBS S.A., as per 12.4 to the financial statements for the fiscal

year ended December 31, 2013.

Inventory and Biological Assets. Inventory and biological assets of the Corporation amounted to R$2,178.6

million at December 31, 2013 compared to R$3,647.6 million at December 31, 2012, for a decrease of 40.2%.

As a percentage of total assets, inventory and biological assets represented 12.2% and 14.3% at December

31, 2013 and December 31, 2012, respectively. The officers of the Corporation believe this 40.2% decrease in

inventories and Biological Assets is due to the sale of ownership interests to JBS S.A., as per 12.4 to the

financial statements for the fiscal year ended December 31, 2013.

Non-Current Assets

The Corporation’s non-current assets amounted to R$10,333.8 million at December 31, 2013, a decrease of

32.7% from R$15,354.8 million at December 31, 2012. As a percentage of total assets, non-current assets

represented 57.9% at December 31, 2013, compared to 60.0% at December 31, 2012. The Officers inform

that the most relevant lines were Notes Receivable, Deferred Taxes and Recoverable Taxes, which decreased

as a result of the sale of ownership interests to JBS S.A., as per 12.4 to the financial statements for the fiscal

year ended December 31, 2013.

Property, plant and equipment and Biological Assets. Property, plant and equipment and biological assets

were R$4,868.2 million at December 31, 2013 compared to R$8,010.6 million at December 31, 2012, for a

decrease of 39.2%. As a percentage of total assets, property, plant and equipment represented 27.3% and

31.3% at December 31, 2013 and December 31, 2012, respectively. The officers of the Corporation believe

the decrease of 39.2% in property, plant and equipment was due to the sale of ownership interests to JBS

S.A., as per 12.4 to the financial statements for the fiscal year ended December 31, 2013.

33/141

Intangible assets. Intangible assets totaled R$2,811.2 million at December 31, 2013 compared to R$4,071.9

million at December 31, 2012, for a decrease of 31.0%. As a percentage of total assets, intangible assets

represented 15.7% and 16.0% at December 31, 2013 and December 31, 2012, respectively. The officers of

the Corporation believe the decrease of 30.9% was due to the sale of ownership interests to JBS S.A., as per

12.4 to the financial statements for the fiscal year ended December 31, 2013.

Current Liabilities

Current liabilities decreased 52.0%, from R$7,687.3 million at December 31, 2012 to R$3,688.5 million at

December 31, 2013. As a percentage of total liabilities, current liabilities represented 20.6% at December 31,

2013, compared to 30.0% at December 31, 2012. Regarding current liabilities, the officers of the Corporation

believe the 52.0% decrease was due to the sale of ownership interests to JBS S.A., as per 12.4 to the financial

statements for the fiscal year ended December 31, 2013.

Trade accounts payable. At December 31, 2013, trade accounts payable amounted to R$1,596.0 million, a

decrease of 38.1% from R$2,580.2 million at December 31, 2012. As a percentage of total liabilities, trade

accounts payable represented 8.9% at December 31, 2013, compared to 10.0% at December 31, 2012. The

Officers believe this decrease was due to the sale of ownership interests to JBS S.A., as per 12.4 to the

financial statements for the fiscal year ended December 31, 2013.

Loans and Financing. At December 31, 2013, loans totaled R$1,096.9 million, decreasing 67.3% from

R$3,359.1 million at December 31, 2012. As a percentage of total liabilities, cost from loans and financing

represented 6.1% at December 31, 2013, compared to 13.1% at December 31, 2012. The Officers believe this