Updated Regulatory Framework for Corporate

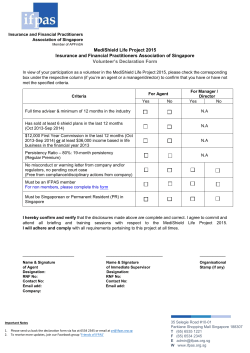

Western Management – 12 Offices – Since 1979 – Over 120 Professionals Updated Regulatory Framework for Corporate Service Providers in Singapore Koehler Group International Accountants and Management Consultants Hong Kong, Singapore & China Beijing | Chengdu | Dalian | Guangzhou | Hangzhou | Hong Kong | Shanghai | Shenzhen | Singapore | Tianjin New York | Munich Koehler Group Level 40, Unit 91, Ocean Financial Centre, 10 Collyer Quay, Singapore 049315 Tel: +65 6808 6245 Fax: +65 6808 6299 Email: [email protected] Website: www.koehlerservices.com The Accounting and Corporate Regulatory Authority (ACRA) released a new amendment for the th regulation of corporate service providers in Singapore scheduled to be effective from 15 May 2015 onwards. What does that mean for corporate service providers? Companies or individuals, which currently use ACRA’s electronic transaction system for their clients and wish to continue to do so, will have to be registered as Filing Agents (FA) and th Qualified Individuals (QI) by 8 May 2015, thereby confirming their conformation to the new amendment. The terms and conditions include a range of fines and penalties targeting Filing Agents incompliant to the law. These fines can reach up to SG$ 25,000 per breach. Holding companies and group secretaries are exempt from these regulations, as it only targets corporate service providers. What are the requirements for becoming a FA or QI? To be able to register as a Qualified Individual you need to be any of the following: an advocate and solicitor; a public accountant registered under the Accountants Act; a corporate secretarial agent; a member of the Institute of Singapore Chartered Accountants, the Association of International Accountants (Singapore Branch), the Institute of Company Accountants, Singapore, or the Singapore Association of the Institute of Chartered Secretaries and Administrators The registration fees are SG$ 250 and SG$100 per year for a Filing Agent and Qualified Individual respectively. What changes? The regulation already includes recommendations of the Financial Action Task Force (FATF), who are planning to visit Singapore in late 2015, to keep a comprehensive record of transactions and business relationships in order to prevent money laundering and hinder terrorism financing. FATF also promotes enhanced customer due diligence, constant monitoring during the course of business relationships and internal risk management procedures for that purpose. The new amendment brings the level of control on corporate service providers close to that of fund management companies and trust service providers. Written By Kristina Koehler-Coluccia Director at Koehler Group Email: [email protected] Page 2 of 2

© Copyright 2026