MNI FX Technical Analysis Report

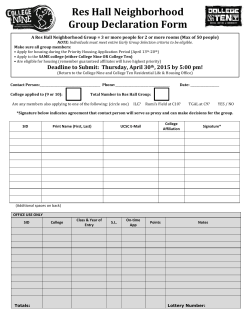

MNI FX Technical Analysis Mail 07 July 2015 Contents EURO-DOLLAR: Above 21-DMA To Shift Focus Higher 2 CABLE: Channel Base Continues To Support 3 DOLLAR-YEN: Bears Favour 100-DMA Test 4 EURO-YEN: Above 55-DMA To Ease Bearish Pressure 5 EURO-STERLING: Bears Focused On Channel Base 6 The information contained herein has been obtained from, or is based upon, sources believed by us to be reliable but we make no representation or warranty as to its accuracy or completeness. This is not an offer or solicitation of an offer to buy/sell. Copyright © 2015 Market News International, Inc. All rights reserved. Unauthorized distribution or reproduction is prohibited. MNI FX Technical Analysis Report | Page 2 EURO-DOLLAR: Above 21-DMA To Shift Focus Higher *RES 4: $1.1171 High July 1 *RES 3: $1.1143 55-DMA *RES 2: $1.1121 High July 2 *RES 1: $1.1061 Hourly resistance July 7 *PRICE: $1.1028 @ 0430GMT *SUP 1: $1.0967 Hourly support July 6 *SUP 2: $1.0952 Low June 2 *SUP 3: $1.0867 Low May 28 *SUP 4: $1.0819 Monthly Low May 27 *COMMENTARY: The pair remains heavy with layers of resistance noted $1.1061-1.1283. Bulls continue to look for a close above the 21-DMA ($1.1197) to shift focus back to the key $1.1283-1.1467 region where May and June highs are located. While the 21-DMA caps bears remain focused on the $1.0952 support with a close below needed to confirm focus on the $1.0819 May low. The Bollinger base and O/S studies are key concerns for bears. The information contained herein has been obtained from, or is based upon, sources believed by us to be reliable but we make no representation or warranty as to its accuracy or completeness. This is not an offer or solicitation of an offer to buy/sell. Copyright © 2015 Market News International, Inc. All rights reserved. Unauthorized distribution or reproduction is prohibited. MNI FX Technical Analysis Report | Page 3 CABLE: Channel Base Continues To Support *RES 4: $1.5788 High June 29 *RES 3: $1.5730 High July 1 *RES 2: $1.5673 Hourly resistance July 1 *RES 1: $1.5643 High July 3 *PRICE: $1.5588 @ 0430GMT *SUP 1: $1.5542 Rising daily channel base *SUP 2: $1.5493 55-DMA *SUP 3: $1.5445 200-DMA *SUP 4: $1.5417 Low June 11 *COMMENTARY: The rising daily channel base confirmed significance Monday and providing the base for a bounce. Layers of support remain $1.5369-1.5542 with bears needing a close below this region to confirm breaks of the channel base and 55 & 20-DMAs. This then shifts immediate focus to retests of the $1.5090 May monthly low. Bulls continue to look for a close above $1.5673 to gain some breathing room and to shift focus back to the $1.5788-1.5947 region. The information contained herein has been obtained from, or is based upon, sources believed by us to be reliable but we make no representation or warranty as to its accuracy or completeness. This is not an offer or solicitation of an offer to buy/sell. Copyright © 2015 Market News International, Inc. All rights reserved. Unauthorized distribution or reproduction is prohibited. MNI FX Technical Analysis Report | Page 4 DOLLAR-YEN: Bears Favour 100-DMA Test *RES 4: ¥123.37 Falling daily trend line *RES 3: ¥123.22 21-DMA *RES 2: ¥123.18 Hourly resistance July 2 *RES 1: ¥122.93 High July 6 *PRICE: ¥122.66 @ 0430GMT *SUP 1: ¥121.75 Low July 6 *SUP 2: ¥121.44 Low May 25 *SUP 3: ¥121.03 100-DMA *SUP 4: ¥120.58 Low May 20 *COMMENTARY: Having failed to make headway above the 21-DMA last week the pair gapped lower to start the new week before bouncing from marginally below the 55-DMA and Bollinger band base. Layers of resistance remain ¥122.93-123.99 with bulls now needing a close above the falling daily trend line to confirm an easing of bearish pressure and to shift focus to ¥123.99-125.90. While ¥122.73 caps bears focus on a break lower and tests of the 100-DMA with the Bollinger base their key concern. The information contained herein has been obtained from, or is based upon, sources believed by us to be reliable but we make no representation or warranty as to its accuracy or completeness. This is not an offer or solicitation of an offer to buy/sell. Copyright © 2015 Market News International, Inc. All rights reserved. Unauthorized distribution or reproduction is prohibited. MNI FX Technical Analysis Report | Page 5 EURO-YEN: Above 55-DMA To Ease Bearish Pressure *RES 4: ¥137.20 200-DMA *RES 3: ¥136.91 High July 2 *RES 2: ¥136.48 Hourly resistance July 3 *RES 1: ¥136.03 55-DMA *PRICE: ¥135.30 @ 0430GMT *SUP 1: ¥135.00 Hourly support July 6 *SUP 2: ¥133.79 Low July 6 *SUP 3: ¥133.69 21-WMA *SUP 4: ¥133.58 100-DMA *COMMENTARY: The 55-DMA is now noted as initial resistance with bulls needing a close above to ease bearish pressure and to shift immediate focus to layers of resistance ¥137.20-139.20 where 21 & 200-DMAs are located. While the 55-DMA caps a bearish bias remains with focus on layers of support ¥132.92-133.79 where the 21-WMA and 100-DMA are located. In saying that, the Bollinger base remains the key concern for bears as it continues to limit downside follow through. The information contained herein has been obtained from, or is based upon, sources believed by us to be reliable but we make no representation or warranty as to its accuracy or completeness. This is not an offer or solicitation of an offer to buy/sell. Copyright © 2015 Market News International, Inc. All rights reserved. Unauthorized distribution or reproduction is prohibited. MNI FX Technical Analysis Report | Page 6 EURO-STERLING: Bears Focused On Channel Base *RES 4: £0.7222 100-DMA *RES 3: £0.7216 High June 17 *RES 2: £0.7167 High June 29 *RES 1: £0.7128 High July 1 *PRICE: £0.7075 @ 0430GMT *SUP 1: £0.7054 Low July 3 *SUP 2: £0.7021 Alternating hourly support/resistance *SUP 3: £0.6983 2015 Low June 29 *SUP 4: £0.6899 Falling daily channel base *COMMENTARY: The aggressive bounce from fresh 2015 and 7+ year lows early last week provided bulls with some relief although the failure to carry on with the move remains a concern. The £0.7167-0.7222 resistance region is now key with bulls needing a close above to confirm a break of key DMAs and a shift in focus back to £0.7319-92. While £0.7167 caps bears target the daily channel base with below £0.7954 needed to add weight to their case. The information contained herein has been obtained from, or is based upon, sources believed by us to be reliable but we make no representation or warranty as to its accuracy or completeness. This is not an offer or solicitation of an offer to buy/sell. Copyright © 2015 Market News International, Inc. All rights reserved. Unauthorized distribution or reproduction is prohibited.

© Copyright 2026