Marco PERONA Commercial Director EMEA RES Group

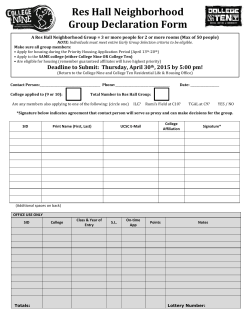

Renewable Energy Systems Group IWPC 2015, April 2nd Renewable Energy in MENA & Turkey Region The RES Group • One of the world’s leading independent renewable energy companies • 1,200 staff in 21 offices and 14 countries across the world • Established in 1982, by Sir Robert McAlpine group, a British family-owned firm with over 140 years of experience in construction and engineering INSERT IMAGE INSERT IMAGE INSERT IMAGE 2 RES Group today Over 140 renewable projects have been developed and/or built worldwide, including: – 5 solar parks with 15 consented or in construction – over 4,800 turbines Over 8,800 MW installed capacity worldwide, equivalent to: – powering 5 million homes – saving over 9 million tonnes of CO2 every year Projects consented or under construction: >1,000MW 1.3GW of wind and solar projects under management for RES and third parties Project Life Cycle Development project management Operation & Maintenance Financing and Ownership Technical data collection and analysis Engineering and construction 4 Business segments Wind On & Offshore Asset management Transmission Solar PV Storage /DSM 5 Saudi Arabia Wind potential RES’ high level estimate of wind capacity in Saudi Arabia RES has performed a high level estimate on the potential for wind energy: • Our wind speed forecast uses 3 Tier mesoscale data, but adjusted by RES using real measurement station data • We take into account steep slopes & high altitudes, where wind turbines cannot be installed • This estimate shows only an order of magnitude of the wind potential – it does not take into account many constraints, such as habitation, permitting, bird migration. -Wind power is now economically viable at much lower wind speeds – down to 6 m/s -This opens up huge areas of land which are suitable, not just well known high wind areas in the north west, near Aqaba 8 MW Gulf of Suez BOO wind tender Gabal el Zeit Wind Farm Timeline and process 2009 70 companies prequalfied 2010 -13 10 shortlisted bidders - Joint Development 2014 Bidding docs 2015 Bidding 7 bidders remaining: RES, Enel, GdF, Kepco, ElSewedy/Terna, Powertek/Siemens, Toyota 2015-16 Selection – Financing – Start of construction Timeline and process • unusual development process • 10 bidders shared costs of: • Wind Measurement • Wind Evaluation • Geotechnical Survey • Topographic Survey • EIA and ornithological survey • 1 site • 1 dataset • 1 winner • Competitive hedge on financing engineering and construction Project features • Land allocated by NREA • 280km grid line being built by EETC • 20-year PPA • Ministry of Finance Guarantee • Winner = lowest PPA price & compliance with the detailed RFP (including EPC TS, PPA and other project documents mark-ups, financial model output, commitment letters from lenders) • bid bond of $5 million must be provided, upfront to be replaced by a $40 million development bond by the winning bidder Background Background to the Market Energy Storage is not about price arbitrage (“buy low, sell high”) Energy storage is too expensive on a “$€£ per MWh” basis at the moment Value is in the (approximately) 20 different grid functions that storage can perform In RES, Energy Storage is about 5 years old Analysis on over 100 energy storage companies and technologies to date RES’ Energy Storage CV Background to the Market Location Function MW MWh Status Ohio, USA Frequency Regulation 4.0 2.6 2014 Operational Ontario, Canada Frequency Regulation 4.0 2.6 2014 Operational Washington, USA Distribution Deferral 2.0 2.2 Under Construction Illinois, USA Frequency Regulation 19.8 7.9 Under Construction Illinois, USA Frequency Regulation 19.8 7.9 Under Construction USA Frequency Regulation 6.0 2.0 Board approved USA Frequency Regulation 19.8 7.9 Board approved Q&A

© Copyright 2026