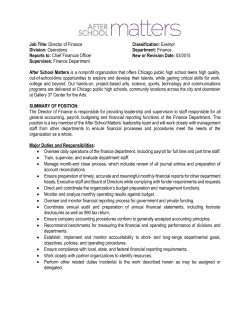

Model Law and Commentary for Financial Consumer Protection