BMI - MyRepublic

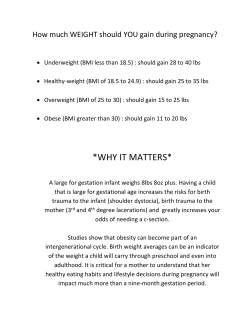

IMPORTANT NOTICE: The information in this PDF file is subject to Business Monitor International’s full copyright and entitlements as defined and protected by international law. The contents of the file are for the sole use of the addressee. All content in this file is owned and operated by Business Monitor International, and the copying or distribution of this file, internally or externally, is strictly prohibited without the prior written permission and consent of Business Monitor International Ltd. If you wish to distribute the file, please email the Subscriptions Department at [email protected], providing details of your subscription and the number of recipients you wish to forward or distribute this information to. DISCLAIMER All information contained in this publication has been researched and compiled from sources believed to be accurate and reliable at the time of publishing. However, in view of the natural scope for human and/or mechanical error, either at source or during production, Business Monitor International accepts no liability whatsoever for any loss or damage resulting from errors, inaccuracies or omissions affecting any part of the publication. All information is provided without warranty, and Business Monitor International makes no representation of warranty of any kind as to the accuracy or completeness of any information hereto contained. September 2014 Issue 100 Asia Pacific Telecommunications INSIGHT BMI’s monthly market intelligence, trend analysis and forecasts for the telecommunications industry across Asia Pacific ISSN: 1750-7685 Contents Asia Asia Pacific Risk/Reward Ratings– Q414 BMI View: BMI's Asia Pacific Telecoms Risk/Reward Ratings assess the potential and challenges of investing in telecoms markets across the region. As subscriber growth is no longer the key driving force behind market value growth in many cases, most operators are now looking at encouraging existing subscribers to increase their spending on services. This makes factors such as economic health an increasingly important determinant in ranking market opportunities. Future spending ability and our long-term economic views are therefore integral to our adjusted ratings. In the Q414 risk/reward outlook, we have categorised the Asian countries in our telecoms portfolio into different geographical zones to identify the risks and rewards associated with each region. Developed Economies Deliver Best Risks To Rewards Payoff Asia Pacific Risk/Reward Ratings Q414 Asia Asia Pacific Risk/Reward Ratings – Q414................................................................. 1 Tencent: The East's Breakaway Internet Giant......................................................... 3 Mobile Data: Rise of Mobile Gaming........................................................................ 4 Global Self Care Offers Greatest Wearables Potential.......................................................... 5 M2M: From Millions To Billions In 10 Years.............................................................. 6 China Cloud Ready To Fly................................................................................................ 8 Hong Kong Cloud Services Lift HKBN's Long Term Outlook........................................................ 8 India Spectrum Sharing: Strongest Benefit, Smallest Disadvantaged.................................. 9 Tower Companies: Increasing Tenancy Key To Profitability.......................................10 Indonesia Indonesian Towercos Top Asian Market Potential....................................................11 Data Centre Partnerships Offer Long-Term Investment Upside.................................12 Myanmar Competition Heats Up With Newcomers.................................................................13 80 Thailand 70 4G Delay Confirms Risk Outlook............................................................................13 60 Singapore 50 Data ARPU Growth Threatened By Newcomer........................................................14 40 30 20 10 Telecoms Score Laos Sri Lanka Nepal Cambodia Bangladesh Vietnam Myanmar India Thailand Pakistan Indonesia Philippines Taiwan Malaysia South Korea China Hong Kong Australia Japan Singapore 0 Average Source: BMI Operators Gear Up For 4G Ecosystem North Asian operators are experiencing declining subscription growth rates and ARPUs amid strong competition from over-the-top (OTT) services and saturated 3G markets. However, mass adoption of laptops, smartphones and tablets drives fresh demand for broadband services. Virtually all operators in North Asia have introduced commercial 4G, with those in South Korea already conducting LTE-Advanced trials. BMI expects the shift towards 4G and adoption of value-added services (VAS), such as cloud computing, machine-to-machine (M2M) and big data analytics, to make up the region's core growth theme. China moves up by three places in our Q414 ranking after scoring a huge improvement in the industry rewards component. The key impetus is the introduction of 19 new MVNOs into the Chinese market dominated Editorial Office: 85 Queen Victoria Street, London EC4V 4AB, UK Tel: +44 (0)20 7246 5162 Fax: +44 (0)20 7248 0467 www.businessmonitor.com www.telecomsinsight.com Asia AsiaTelecommunications by operators China Mobile, China Telecom and China Unicom. We believe this will drive the number of products and niche services as seen in other MVNO-driven markets such as Malaysia and Japan. The MVNOs' wide distribution networks will facilitate access to a vast addressable market and accelerate the 3G/4G migration trend. The key downside is a reduction in ARPU if operators engage in price-based competition. There are no revisions to the telecoms score for either Taiwan or Hong Kong this quarter as we have previously accounted for the entrance of new 4G MVNOs in Taiwan as well as Hong Kong Telekom (HKT)'s acquisition of mobile network operator CSL in January 2014. South Korea's country risk score improves slightly on President Park Geun-hye's proposal to deregulate and support the services sector, a plan that aims to provide the country with new pillars of economic growth and a more sustainable path of economic expansion. South East Asia: A Two-Speed Market There is a huge disparity in telecoms market development within South East Asia. More developed telecoms markets will see increasing contribution from data services, BMI forecasts. In contrast, countries such as Vietnam, Cambodia, Laos and Myanmar are still growing their basic voice and SMS subscriptions. The difference between the two groups is due to the difference in economic progression, level of household disposable income and the state of telecoms infrastructure development. Among the less developed telecoms markets in the region, Vietnam is the highest ranked. Vietnam moves up by two positions in Q414 to 14 th place following the divestiture of operator MobiFone from state-owned Vietnam Posts and Telecommunications Group (VNPT) in June 2014, a move BMI expects will promote constructive competition. Myanmar ranks lower than Vietnam in terms of risks/rewards payoff after the government liberalised the mobile sector in July 2013. Meanwhile, operator Smart Axiata launched Cambodia's first mobile 4G services in January 2014 but BMI does not believe there is much demand for 4G as 3G usage is still low. Laos remains lowest ranked in this sub region as its political and economic environment scores are weak. The more developed telecoms markets in South East Asia are Singapore, Malaysia, Indonesia, Thailand and the Philippines. Singapore is the highest ranked due to its stable regulatory environment that is conducive to innovations and developments. This reflected in Singapore's country risk score of 86.5, topping the Asia Pacific list. Indonesia's telecoms rating dropped after the nation's risk rating was downgraded from 58.5 to 57.5 over uncertainty surrounding the outcome of the July 2014 presidential elections. BMI's Country Risk team expects victory for candidate Joko Widodo, who has a negligible track record in implementing economic policy, weighing on the short-term economic risk outlook. We also highlight Thailand, which has witnessed political unrest since December 2013. BMI's Country Risk team believes the political turmoil will persist into H214, having a negative effect on FDI and preventing fiscally funded large-scale infrastructure projects from getting the go-ahead from the government. In June 2014, the Thai junta suspended the 4G spectrum auction that was originally scheduled to take place in H214. Asia-Pacific Telecoms Risk/Rewards Ratings–Q414 Rewards Country Japan Risks Industry Rewards Country Rewards Industry Risks Country Risks Telecoms Score Rank Previous Rank 67.5 73.3 80.0 70.4 71.2 1 1 Singapore 50.0 80.0 90.0 86.5 68.8 2 2 Australia 57.8 70.0 70.0 63.8 63.5 3 3 China 71.5 33.3 70.0 81.8 63.5 3 6 Hong Kong 47.5 73.3 90.0 64.2 62.7 5 4 South Korea 55.0 60.0 80.0 72.7 62.6 6 5 Taiwan 52.5 60.0 80.0 76.0 62.0 7 6 Malaysia 52.5 45.0 70.0 74.0 56.5 8 8 Indonesia 52.5 46.0 60.0 57.7 52.8 9 9 Philippines 50.0 43.3 60.0 64.4 52.0 10 11 Pakistan 51.8 42.0 60.0 48.4 50.1 11 12 India 47.5 32.1 65.0 65.4 49.0 12 13 Thailand 49.5 29.3 50.0 59.1 46.1 13 14 Vietnam 49.5 33.3 30.0 69.1 45.6 14 16 Myanmar 52.5 32.7 30.0 48.7 43.7 15 15 Bangladesh 50.0 33.3 60.0 21.9 43.2 16 10 Nepal 35.0 33.3 60.0 49.7 40.5 17 17 Cambodia 37.5 41.7 40.0 44.9 40.0 18 18 Sri Lanka 37.5 30.0 60.0 27.1 37.5 19 19 20 20 Laos 27.5 39.0 40.0 55.7 36.4 Average 49.8 46.6 62.3 60.1 52.4 Scores are weighted as follows: ‘Rewards’: 70%, of which Industry Rewards 65% and Country Rewards 35%; ‘Risks’: 30%, of which Industry Risks 40% and Country Risks 60%. The ‘Rewards’ rating evaluates the size and growth potential of a telecoms market in any given state, and country’s broader economic/socio-demographic characteristics that impact the industry’s development; the ‘Risks’ rating evaluates industry specific dangers and those emanating from the state’s political/economic profile, based on BMI’s proprietary Country Risk Ratings that could affect the realisation of anticipated returns. Source: BMI 2 www.telecomsinsight.com Asia South Asia: Rural Coverage While Continuing 3G Push South Asian countries have substantial growth potential due to their underserved 2G and 3G markets, but face regulatory challenges which derail developments. With the exception of Sri Lanka, the other four South Asian countries mobile penetration is below 100%. This rate, however, disguises markets where there are high multi-SIM rates. Consumers often buy SIMs to take advantage of promotions, or own one from all operators in order to receive lower on-net calling. The key to unlocking mobile subscriptions growth is expanding into under-penetrated areas. India, Pakistan, Bangladesh and Nepal all have around 70% mobile penetration and operators must extend their networks to cover remaining suburban areas or come up with innovative approaches to make the services accessible to the remotest areas. Bangladesh and Pakistan introduced 3G services in the past 12 months. We have raised the industry risk score for Pakistan from 50 to 60 after the Pakistan Telecommunication Authority (PTA) issued 3G concessions in May 2014. In the previous quarter, we also upgraded Bangladesh's industry reward ratings after an improvement in ARPU following the 3G auction in September 2013. India's overall telecoms score improves from 47.9 to 49.0 this quarter after BMI's Country Risk team upgraded India's political outlook on the back of the Bharatiya Janata Party's landmark election win in May 2014. Underpinning this upgrade are the increased unity within the cabinet, positive changes in policy direction as well as a reduction in security threats and constraints from both internal and external groups. However, despite the impressive move up in our political risk ratings, any major policy reforms – such as the breaking up of state-owned companies and raising foreign investment caps – will likely only take place beyond Prime Minister Narendra Modi's first year in office. Tencent: The East's Breakaway Internet Giant BMI View: South and South East Asian markets offer great commercial potential for Chinese Internet giant, Tencent. A combination of low-cost smartphone adoption trends and the shift towards using mobile devices to access online content are helping Tencent to gain significant overseas presence with its mobile-based messaging application WeChat. That said, we see strict censorship controls and China's tense relationships with its maritime neighbours as key impediments to Tencent's regional expansion efforts. Tencent Moves Beyond China's Borders Tencent started its search for international opportunities since 2009. To this end, the company modified its popular applications QQ messenger and WeChat with multiple language supports in English, French, Spanish, German, Korean, Japanese and Classical Chinese to target international audiences. At the same time, the company has placed a greater emphasis on global marketing campaigns. In July 2013, for example, Tencent recruited global football phenomenon Lionel Messi to be the product ambassador for WeChat. Other branding efforts include establishing local branch offices in overseas markets such as Malaysia and India, as well as tie-ups with local firms and celebrities to bolster the firm's local presence. www.telecomsinsight.com AsiaTelecommunications Tencent's biggest overseas success to date has been establishing WeChat in India and key South East Asian markets, such as Malaysia and the Philippines. In July 2013, WeChat was the most downloaded mobile social app on application stores in the Philippines, Singapore and Thailand, according to thenextweb.com. Tencent's management reported that monthly average users (MAU) for WeChat grew by 103.6% y-o-y in Q114 to reach a subscription base of 395mn; of that figure, an estimated 15% comprised international users. Growing Smartphone Sales To Bring Mobile Internet Opportunities Domestic Smartphone Sales (000) e/f = BMI estimate/forecast. Source: BMI WeChat's foreign success can be attributed to two key trends. The first is the emergence of budget handset makers such as China's Xiaomi and India's Micromax, a trend that has led to rising adoption of low cost smartphones. At the same time, 3G networks are beginning to be rolled out in emerging markets such as Pakistan and Bangladesh, driving smartphone adoption even further. Between 2014 and 2018, BMI forecasts compound annual smartphone sales growth in the region of 5-15% in the key markets of India, Malaysia, Indonesia and the Philippines. We believe the strong smartphone uptake creates unparalleled demand for mobile internet services. The second most important trend is the shift from desktop computing to mobile devices. The latter is increasingly viewed as the preferred way of accessing online content and services. The combination of mass smartphone adoption and first-time usage of mobile-based messaging applications presents an enormous opportunity for WeChat to grow its subscriber base, particularly in South and South East Asia. BMI believes these sub-regions present Tencent with the greatest commercial opportunities as their nascent smartphone markets mean that consumers' mobile behaviour has yet to be defined. This is compared with mature markets in North Asia where big companies such as Google, Facebook and Naver already dominate the mobile internet scene. WeChat Grows, QQ International Slows The same optimistic outlook for WeChat, however, could not be said for QQ International, Tencent's international instant messaging platform. The transition to mobile devices remains challenging and for the PC-based instant messaging portal which was launched globally in January 2009 with multiple language support. QQ International only introduced mobile access in Q413 after Tencent decided that its future lies in the mobile sector. Although mobile QQ recorded 426mn MAU in its first quarter – MAU for QQ instant messaging in Q413 was 808mn – BMI believes WeChat will continue to remain the poster child for Tencent in the international market. So 3 Asia far, there is little anecdotal evidence to suggest QQ international is widely adopted across Asia outside of China. As both WeChat and QQ share so much in common in terms of features and functionalities, it seems odd for Tencent to push two very similar products to the same market. A more likely scenario, in our view, is that WeChat will continue to be developed for international audiences while QQ International is aimed more at foreign residents in China. When QQ International was first launched, Tencent had intended it to be a communication platform between Chinese and residential foreigners as popular international services such as Facebook and Twitter are not available in China. Given the amount of marketing resources Tencent spends on WeChat, it is clear the company intends for WeChat to be its international mascot. Strict Censorship Rule Could Be Tencent's AsiaTelecommunications services are beginning to be realised through the proliferation of smart mobile devices and the rollout of mobile broadband networks across Asia. BMI predicts 3G/4G penetration will increase rapidly across the region, with countries in the Greater China and North East Asia sub-regions forecast to take the lead in 3G/4G adoption: 59.3% and 61.1% in 2018, respectively. BMI believes this growth will be largely aided by the widespread adoption of low-cost smartphones such as those produced by budget handset makers Xiaomi (see 'Smart-Enough Low Cost Phones The New Hype?', January 14 2014). Demand for 3G services is expected to be more pronounced in more developed Asian telecoms states such as South Korea, Japan, China, Taiwan, Hong Kong, Malaysia and Singapore, owing to greater consumer spending power in these markets. 3G Growth In Asia Creates Huge Opportunities For Mobile VAS 3G Penetration (%) International Undoing The biggest downside risk to Tencent's overseas venture is its strict censorship rules. It is hardly surprising that communication via WeChat is closely scrutinised by the Beijing administration, keen to keep Chinese citizens from discussing politically sensitive topics or gathering together to take on a cause. Tests conducted by blogger website TechInAsia had shown that certain inputs such as the Chinese characters for the word ‘Southern Weekend’ – a magazine at the centre of a separate censorship controversy – were blocked when sent between users in China, Thailand, and Singapore at the height of the controversy in January 2013. When international users complained about these restrictions, Tencent reportedly referred to the problem as a 'technical glitch'. In our view, such paternalistic surveillance can be a very unwelcome development for many international users of WeChat who are used to greater freedom of speech. To some extent, Tencent's expansion into the South East Asian markets will be hampered by the tense maritime relationships the Chinese government has with its neighbours. In the spring of 2014, the emphasis shifted from the East China Sea, where China claims the Japanese-administered Senkaku Islands (known as Diaoyu in Chinese) to the South China Sea, where China established an oil rig in waters claimed by Vietnam (see 'Q3 2014-2015: International Crises Mask Broad Domestic Stability', June 30 2014). The standoff between China and Vietnam, in particular, led to a series of antiChina protests following by unrests and riots across Vietnam in May 2014. These political risk developments will certainly pose a major hurdle to Tencent's efforts to internationalise its services. Mobile Data: Rise of Mobile Gaming BMI View: Increased smartphone adoption and the shift from desktop computing to mobile devices are creating new demand for mobile games, particularly in the more advanced Asian telecoms markets. As gaming platforms, publishers and developers cash in on the mobile games opportunities, we expect competition to intensify. High quality and more sophisticated games releases will also result in greater monetisation opportunities for the mobile gaming sector. Increased Smartphone Adoption Provides A Key Enabler The potential commercial opportunities for mobile value-added 4 f = BMI forecast. Source: BMI Recent third-party data suggest that these mature Asian markets have become significant consumers of games via smartphones, tablets and other portable connected devices. BMI expects this trend to continue unabated, with the only constraints being pricing and the costs borne by operators in upgrading their networks. According to analytics specialist App Annie Index, as of May 2014, six of the top 10 global publishers on Apple iOS and Google Play by revenue were from China and Japan, and seven of the top 10 games on Google Play by revenue were released by South Korean and Japanese games publishers. iResearch Consulting Group predicts that Chinese mobile gaming revenues will grow by a compound annual rate of 27.9% between 2013 and 2017, reaching CNY36.7bn (USD5.9bn). This latent demand for gaming creates huge commercial opportunities for games developers, publishers and distribution platforms. Mobile Games Competition Intensifies Web games developers have increasingly switched their focus towards mobile games in recent quarters. In China, for example, online games developer Shanda Games reported average daily active users (DAU) of 462,700 in Q114 for its mobile games segment, representing an increase of 59.4% y-o-y. Evidence of strong subscription growth had prompted the company to release several mobile games hits such as 'Million Arthur' and 'Guardian Cross', of which the former was successfully launched in multiple markets across South Korea, Taiwan, China, Singapore and Malaysia. Games developers are not the only ones benefiting from these mobile games opportunities, BMI notes. Platforms and publishers such as Tencent and Qihoo 360 have positioned themselves to capture the mobile gaming potential and have ramped up their www.telecomsinsight.com Global AsiaTelecommunications monetisation models. Tencent is leveraging its WeChat and mobile QQ messaging applications to distribute its mobile gaming genres. Qihoo, on the other hand, reported that its internet value-added service revenues achieved a solid 172% y-o-y growth to reach USD124.8mn in Q114 on the back of growing demand for PC games and a strong ramp-up in mobile games. Although the company did not specify mobile games revenue contribution, BMI believes the company has made positive progress in monetising mobile games via its app store distribution channel. In its May 2014 SEC filing, Qihoo's management noted that mobile monetisation and search had achieved faster-than-expected ramp up and are now an integral focus of its future strategy. The Philippines, Vietnam, India and Indonesia Are High-Potential Mobile Gaming Markets Domestic Smartphone Sales (000) e/f = BMI estimate/forecast. Source: BMI In Japan and South Korea, prominent mobile messaging applications such as LINE and KakaoTalk are similarly on the lookout for mobile gaming monetisation opportunities. KakaoTalk differentiates its services from rival messaging applications by combining free texting with games and mobile commerce. Looking at its monetising model, BMI believes it is likely the company is treating the messaging platform as a subscription growth driver while treating the gaming platform as revenue generator. This model has so far proved successful, with the company reportedly earning gross revenue of USD311mn in H113, according to thenextweb.com. Three-Year Outlook For Asian Mobile Games BMI believes Asia's mobile gaming markets are, at present, in a state of high subscription growth but suffer from under-developed monetising potential. In our view, two key trends will emerge over the next three years. First, most of the mobile gaming subscription growth will continue to be derived from mature telecoms markets with widespread 3G/4G adoption. It is not surprising that the largest mobile gaming commercial opportunities also exist in large smartphone user countries such as China, South Korea, Japan, Singapore, Malaysia and Taiwan, where high-speed mobile broadband connections are ubiquitous. BMI attributes this to the high user traction of mobile games in these countries. We also note the high mobile gaming growth potential in countries such as the Philippines, Vietnam, India and Indonesia where low-cost 'smart-enough' handsets are driving domestic smartphone sales. Second, we expect mobile games industry players to gradually shift their focus from gaining subscription shares to extracting the full monetisable value from their customers. At present, games developers derive their revenues from either paid-mobile games www.telecomsinsight.com downloads or virtual item sales, after offsetting commissions paid to third-party platforms for distributing mobile games. The monetisation of these mobile games has not yet caught up with subscription growth, for instance, with Shanda Games reporting that its mobile games revenue declined 38.4% y-o-y in Q114 despite a 59.4% growth in DAU over the same period. The decrease was largely due to a decline in revenue from several key mobile games which are entering the mature stages of their lifecycles, including 'Million Arthur' and fewer new releases, according to the company. Considering the company derives only less than 10% of its net revenues from mobile games in Q114, BMI believes more can still be done to extract the sector's vast potential, either through better monetising model or more sophisticated games releases. How Mobile Operators Fit In Few of Asia's mobile network operators report revenues from sales of mobile games and ancillary products and services. This is not surprising, given the complexity of revenue-sharing agreements with other players in the mobile gaming ecosystem, as well as the fact that a growing number of games are now purchased off-net or off-portal and operators merely generate income from data transfer traffic. However, games developers and publishers need to work more closely with operators as these companies provide direct access to hundreds of millions of potential consumers that their own or third-party app stores cannot target effectively. In May 2014, China Mobile, China Unicom and China Telecom announced plans to collaborate with each other and with fames publishers to help publish as many as 100 games a year. They target annual sales of CNY1mn (USD160,000) per game. Assuming a revenue-sharing model similar to that of Apple's App Store and iTunes platforms (30% to the mobile operators, 70% to the developers/publishers), this represents a potentially lucrative new revenue stream for mobile operators facing falling voice revenues and spiralling handset subsidisation costs. Already reporting modest success in monetising mobile gaming services, Asia's mobile network operators are preparing to move to the next level. Global Self Care Offers Greatest Wearables Potential BMI View: Growing awareness of chronic diseases and fitness is leading more consumers to try new means of managing their health. Self Care is the area of the Telecare market that offers greatest potential profits for telecoms operators and device manufacturers though the development of sophisticated wearable devices. Mobile devices and mobile operating systems offer consumers the ability to manage their own health in a number of highly customisable ways. Smartphone market leaders Apple, Samsung and Google launched their healthcare apps and devices in May and June 2014. As smartphone growth in developed markets slows considerably, vendors are seeking new ways to encourage loyalty and increase spending. Of the available wearable devices in the market, health wearables offer practical applications and BMI believes these devices will lead the growth in wearables over the next 12 months. The new launches relate predominantly to the fitness market with brands such as Google Fit, S Health and Apple Health. These 5 Global AsiaTelecommunications allow users to track their own health and fitness levels. These data are stored for consumer use only, with few instances of the data being used to monitor overall health by healthcare professionals. BMI believes this is the greatest hurdle to making self care apps and wearables a fundamental part of the healthcare system in developed markets. With limited connection between the devices’ data and electronic health records these apps and devices are more consumer driven, rather than requirements from healthcare providers. As an out-ofpocket expense, we believe growth will be driven by developed market consumers in North America and Western Europe, as well as wealthier consumers in the larger cities of emerging economies. As BMI’s Telecare Matrix shows, top markets include UK, Japan, France, USA and Italy where consumers are accustomed to buying high-end mobile devices and spending heavily on a monthly basis. Even so, we expect it to remain a niche product while unconnected from healthcare providers. platform offering longer term loyalty among users. However, BMI believes wearables will remain a niche product over the next 1-3 years as devices have yet to prove their necessity to consumers. M2M: From Millions To Billions In 10 Years BMI View: We have long-held a positive view on the potential of machine-to-machine (M2M) technology to transform the telecoms industry. We expect to see strong growth in this area over the next 10 years, with the technology forming a key part of our 2024 outlook (see ‘The Telecoms Industry In 10 Years’, 12 June 2014). Smartphones Tap Into Growing Market Global Healthcare Expenditure (USDbn) 14,000 12,000 Developed Markets Already High Smartphone Penetration 10,000 Smartphones Shipments By Region (%) 8,000 100 90 6,000 80 70 4,000 60 2,000 50 40 North America Western Europe Middle East Latin America Eastern Europe Africa 2018f 2017f 2016f 2015f 2014f 2013f 2012 2011 2010 2009 2008 2007 0 Caribbean Asia Global f = BMI forecast. Source: BMI, Vendors, Mobile Operators For healthcare wearables and apps to become a common feature in health management, BMI believes there will need to be acceptance among healthcare providers and clinicians. This will be driven by regulatory approval for apps and devices. In the meantime, these services form a key part of the marketing strategy for smartphone and mobile operating system companies to cement consumers in their product ecosystems. The greater usage by consumers on a particular platform or device, the more difficult it becomes to change to a new 2023f 2022f 2021f 2020f 2019f 2018f 2017f 2016f 2015f 2013 2012 2011 10 2010 20 2014f 0 30 f = BMI forecast. Source: BMI, WHO For telecoms companies, M2M represents the next step in the transition from voice to data, with huge revenue growth opportunities presenting themselves as more SIM cards are connected to networks. Mobile phones are generally limited to one per person in any market. However, with M2M, the ratio could be anywhere between five to 10 connected devices per person. We believe this will enable the number of connected M2M datacards to outnumber the amount of cellular subscriptions within 10 years. We are growing increasingly optimistic towards M2M technology as governments are also taking notice of the sector’s potential and playing an active role in the technology’s development. For example, Brazil’s government has lowered taxes on M2M SIM cards, while in the UK, smart meter contracts have been auctioned Top Markets For Self Care Development Opportunities Tech Base Market Opportunity United Kingdom Excellent High Japan Excellent High France Excellent High United States Excellent High Italy Excellent High Germany Excellent High South Korea Excellent Medium Australia Excellent Medium Spain Excellent Medium Canada Excellent Medium Source: BMI’s Telecare Matrix 6 www.telecomsinsight.com Global AsiaTelecommunications off. Alliances between operators and M2M vendors are becoming increasingly common and a critical part of the M2M ecosystem, as telecoms operators’ investment in upgrading to 4G networks provides the backbone infrastructure for M2M connectivity. Auction of ‘white space’ spectrum from the digital switchover should also provide a boon for the M2M market, allowing companies further bandwidth and greater coverage of rural regions. Meanwhile, the switch to 700MHz frequencies is expected to be completed by the end of 2015 and should also provide a global standard of technology which will allow M2M to flourish. ing cost of SIM cards will help to bolster margins and is a further indicator that M2M is becoming a reality with multiple industries beginning to explore the potential benefits. Further To Rise After Hype Plateau BMI M2M Index 250 200 M2M Moving Beyond The Hype 150 Selected Operator M2M Connections (mn) 35 2012 2013 100 30 25 15 10 5 0 Telefónica China Mobile Vodafone* AT&T * Vodafone FY ends in March. Source: Bloomberg, BMI The costs associated with M2M technology have also come down significantly. M2M is a low margin business, as the small amounts of data transmitted means that it requires thousands of connected SIM cards to translate into strong revenue growth. However, the declin- Jun -14 Jan -14 Aug -13 Mar-13 Oct-12 May-12 20 Dec-11 Jul-11 50 Source: BMI, Bloomberg We expect developed markets and China to show the strongest M2M growth over the next two to three years. However, there is still enormous long-term potential in emerging markets over the next five to 10 years. China is currently the largest market for M2M in the world in terms of total connections and we expect it to stay in front, as its huge population creates a larger market. There has also been significant progress in the US, Japan and the Nordic countries, where we expect to see M2M connections account for a greater proportion of mobile subscriptions. To help us assess the accuracy of our bullish view towards the M2M industry (by way of determining whether investors share our positive outlook) we have created a market cap weighted custom What Is Machine-To-Machine (M2M) Technology? Technologies that allow businesses to wirelessly connect everyday devices, heavy equipment, vehicles and utilities to each other and to central hubs using mobile operator networks. SIM cards are used to remotely capture events and record data that can then be disseminated by users and algorithms to create efficiencies and cut costs for businesses. The data from these ‘smarter’ products translates into actionable business intelligence. For example, an insurance company can remotely monitor the driving habits of its customers to offer tailored rates that reduce risk for the company. Source: BMI BMI M2M Index Company Security Weighting (%) Value CalAmp CAMP US Equity 5.2 10.221 Comarch CMR PW Equity 1.7 3.285 DGII US Equity 1.8 3.504 Elecsys Corporation ESYS US Equity 0.3 0.676 Fleetmatics Group FLTX US Equity 9.2 18.139 Digi International Gemalto GTOMY US Equity 68.7 135.914 Numerex Corporation NMRX US Equity 1.8 3.512 ORBCOMM Inc ORBC US Equity 2.7 5.355 Sierra Wireless Inc SWIR US Equity 5.0 9.816 Telit Communications TTCNF US Equity 3.1 6.218 USA Technologies Inc USAT US Equity 0.6 1.106 100.0 197.75 M2M Index Total Source: BMI, Bloomberg www.telecomsinsight.com 7 China AsiaTelecommunications index, denominated in US Dollars. The companies included are those which we believe are heavily exposed to the M2M growth trend, and can therefore expect to benefit as vendors of M2M SIMs, as well as M2M software and service providers. The index saw strong growth between 2011 and 2013. However, it has dropped by 9.8% since the start of 2014. While we believe much of this earlier growth was based on hype surrounding the M2M industry with little concrete results, we are now seeing strong growth in connections reported by mobile operators as well as revenue and profit growth from M2M vendors. With further positive developments expected, such as the release of digital dividend spectrum, lower costs of M2M equipment and favourable government policies, we believe that M2M has further to rise, with the number of connections expected to increase into the billions and overtake mobile phone subscriptions within the next 10 years. Hong Kong China Cloud Ready To Fly Government support for the cloud computing market in China will see growth take off over our five-year forecast period. A policy identifying cloud computing as a nationally strategic industry will accelerate development and place China among the industry’s biggest players. The focus on selling cloud services internationally will only have a limited impact on our forecasts but we believe developments will filter through into local market growth. Government Supports Growth China Cloud Computing Forecasts e/f = BMI estimate/forecast. Source: BMI China’s Ministry of Industry and Information Technology (MIIT) estimates China’s cloud computing market was worth CNY4.76bn in 2013, up 36% from 2012. The strong growth reflects BMI’s view that cloud computing is gaining traction in both developed and emerging markets. BMI’s forecasts show the domestic market was worth CNY4.3bn in 2013 and we expect growth to average 58% over our forecast period seeing Chinese consumers and businesses spending CNY41bn on cloud computing by 2018. Businesses, particularly small and medium enterprises, will drive demand for cloud computing in China. While consumer cloud services are available and will continue to expand, BMI believes these services will be lower cost and have only a small impact on the market’s growth. The MIIT’s goal of increasing cloud revenues by at least 50% annually ‘over the next few years’ focuses on generating revenues for cloud services from international sources and building China’s 8 presence in the global cloud computing market. Nevertheless, increased development by Chinese companies on their cloud services offerings will support the domestic market’s growth. Chinese cloud companies face competition from large established cloud computing companies such as Salesforce.com, EDS and Amazon Web Services, which have already targeted China’s cloud potential. With security a key hurdle in the expansion of cloud computing services, BMI believes Chinese SMEs will favour Chinese cloud providers for their IT services expansion, particularly as a result of the NSA spying scandal. Our forecasts show there is considerable potential for cloud services in China and government support for developments is a major boost to our expectations of the market. We believe there is upside risk to our forecasts as cloud computing becomes a fixed part of companies’ IT spending. Cloud Services Lift HKBN's Long Term Outlook BMI View: Hong Kong's reputation as a leading regional business hub will increasingly depend on the availability of advanced communications services and solutions. Although already well served by data centres, the enterprise market lacks choice in scalable cloud services. HKBN's partnership with eight leading technology companies sees its long-term outlook improve. Hong Kong Broadband Network (HKBN) is working with Broadsoft, Cisco Systems, Deltapath, Hitachi Data Systems, Macroview Telecom, Oracle Asia Pacific, Polycom and Towngas Telecom to develop and market a complete suite of cloud computing solutions to its corporate clients, ranging from small and medium-sized enterprises (SMEs) to multinationals and other carriers. The move is the latest development in HKBN's strategy to transform itself into a full ICT services provider and reduce its dependence on the crowded retail telecoms services market. BMI forecasts spending on cloud computing services in Hong Kong to rise steadily over the 2013-2018 period, from USD103mn to USD414mn. Cloud spending per capita will therefore increase from 14.3% to 55.5% of total IT spending over this timeframe, ultimately accounting for 16.0% of total spending on IT services, software and hardware in the country. HKBN has yet to detail its long-term strategy with respect to the cloud services market in Hong Kong, including a likely timeframe for the roll out of key services and solutions. However, BMI notes that the operator–one of the largest alternative telecoms infrastructure operators in the country–is already well placed to take advantage of the nascent cloud opportunity. Its 100Mbps nationwide fibre-optic network has the capacity, resiliency and security needed to cater to the heavy data traffic requirements of pan-Asian clients operating out of Hong Kong and it has a well-established reputation amongst local businesses for its traditional telecoms services. The company believes there is huge potential in Hong Kong's non-residential market for telecoms and ICT services. It values that market at around HKD15bn; its current telecoms-focused activities account for just 2.5% of that market. The company believes that its new cloud-optimised business model enables it to offer advanced services to SMEs at considerable savings to its traditional equipmentbased offering yet delivering double the revenue per customer. With service revenue and service EBITDA up by 10% and 19%, www.telecomsinsight.com India AsiaTelecommunications respectively, y-o-y in the half-year ended March 2014, it is clear that the company's transformation is beginning to reap rewards. Adding scalable cloud solutions from leading vendors will help ensure that financial growth continues, playing into BMI's bullish view of the company's long-term future. India Spectrum Sharing: Strongest Benefit, Smallest Disadvantaged BMI View: Proposed new spectrum sharing rules in India make reaching out to under-served areas more attractive to operators. This provides considerable upside potential for future revenue and customer growth. However, we believe the new rules would help only a few, already-dominant players, while increased spectrum usage charges would increase the financial burdens on smaller operators. Business Hub Depends On Cloud Hong Kong Cloud Computing Forecast – is not an 800MHz licensee. Similarly, small regional players such as Tata TeleServices, Telenor, MTS and Aircel will see few opportunities owing to the fact that, in most cases, potential partners use different bands. Further hurdles include the proposal that only two operators can collaborate in spectrum sharing deals and, even then, half of the spectrum being shared by each party will count towards their total spectrum holdings. As spectrum ownership is capped at 25% of total spectrum allocated to each 'circle' and at 50% of any single band within a 'circle', the potential number of deals that can be reached is somewhat diminished. Furthermore, as spectrum sharing effectively results in increased spectrum usage, so operators engaging in spectrum sharing will see an increase in their spectrum usage payments to the government. TRAI has recommended a 0.5% increase in those charges, applicable to individual sharing agreements. For those operators already owning significant parcels of spectrum, this will represent a significant but bearable additional operational cost. It would nevertheless need to be factored into capex plans and may dissuade them from using the spectrum-sharing rules to reach out to disadvantaged areas, counter to the TRAI's ambitions. Spectrum Sharing Offers Market Expansion Upside Mobile Market Forecasts, 2012-2018 e/f = BMI estimate/forecast. Source: BMI The Telecom Regulation Authority of India (TRAI) has recommended that mobile network operators be allowed to share spectrum in the interests of raising spectral efficiency and encouraging them to invest more in rural areas. However, the proposals apply only when operators hold frequencies in the same band and in the same service 'circle'. The aim of preventing operators from dominating in markets where they are not licensed spectrum owners is laudable, but BMI believes the new rules benefit only the largest players with pan-Indian footprints and do little to help smaller players. Vodafone India, Bharti Airtel, IDEA Cellular and Bharat Sanchar Nigam Ltd (BSNL) would have the most to gain from the new rules as they mostly operate in the same circles and hold 2G and 3G spectrum in the same bands. We believe they would quickly draw up strategic partnerships aimed at reducing congestion in their largest and most profitable 2G circles and look to exploit enhanced network roll-out opportunities for 3G. Of particular interest will be the opportunities afforded for low-cost 4G roll-out: few operators hold pan-India 4G concessions and the high cost of building 'closed' 4G networks means that returns on investment will be hard to realise without easier resource-sharing rules. Despite its size, Reliance Communications will not be able to take full advantage of the new rules because it has few peers in the 800MHz market and its preferred partner – Reliance Jio Infocomm www.telecomsinsight.com e/f = BMI estimate/forecast. Source: BMI, operators, COAI, TRAI Further downside from the new rules impacts the telecoms towers sector. Increased spectral efficiency would lower demand for capacity on towers, leading to a decreased tenancy and, therefore, recurring revenues on which third party tower companies depend (see 'Indian Tower Companies: Increasing Tenancy Key To Profitability', July 22 2014). We there await with considerable interest the government's decision on whether to implement the TRAI's guidelines. Assuming that the new rules are implemented as planned, we see considerable potential for additional subscription and service revenue growth arising from shared spectrum agreements in the medium term. In particular, there will be a boost to 3G/4G uptake as lower rollout costs will allow operators to lower prices and thus attract new customers to their networks. We currently forecast total mobile subscriptions to rise from 890.7mn in 2013 to 1.104bn by the end of 2018, with the number of 3G/4G subscriptions rising from 44.1mn to 134.8mn over the same period. 9 India AsiaTelecommunications Tower Companies: Increasing Tenancy Key To Profitability BMI View: Indian telecoms tower companies will benefit from accelerated network rollouts by service providers. Strong mobile subscription growth – which continues to be driven by 2G services and expansion into underserved areas – coupled with capex constraints results in potent demand for passive infrastructure. Meanwhile, growing mobile data utilisation requires more efficient tenancy management, raising the need for specialist third-party asset management. Outlook And Risk With BMI forecasting rapid mobile subscription growth in India, we believe there is a growing need for infrastructure sharing in this cost-conscious market, making dedicated tower companies an attractive investment prospect. Since Indian telecoms operators' advanced 3G services currently rely on the relatively inefficient 1800MHz, 2100MHz and 2300MHz frequencies, more base stations will be needed to provide the same coverage than is the case with 900MHz spectrum. This will increase tenancy rates in the Indian tower market, which averaged 2.0 in 2013. 3G-driven Data Opportunities To Increase Tower Tenancies India e/f = BMI estimate/forecast. Source: BMI There are several downside risks to India's towers market. First, the Indian telecom industry is heading towards consolidation following the removal of a foreign direct investment (FDI) cap in July 2013. Merging parties could look to offload redundant tower sites (see 'Bharti Airtel Purchases Loop Mobile', February 24 2014). Another drawback is the downward pressure on rental rates. Bharti Infratel reported in March 2014 that its monthly average revenue per tenant was INR34,000 (USD570). In comparison, Indonesian tower companies charge an average USD1,300 per month. The difference is due to Indian tower companies' unique practice of offering a 10% discount to both existing and new tenants when a new tenant is added to the tower. Third, there is a risk that the government's Department of Telecommunications (DoT) will bring tower companies under the purview of unified licensing. If approved, tower owners would be required to pay a licence fee of about 8% of their adjusted gross revenue to the state. Presently, tower companies just pay a one-off registration fee of INR5,000. The proposal was raised by the DoT 10 in October 2013; there is no news on whether the government will proceed with this idea but, given its view of the telecoms market as a cash-cow, we believe the risk is high. Bharti Infratel: Close Relationships With Leading Operators BMI believes Bharti Infratel's large scale and pan-India presence make the firm a key beneficiary of the anticipated tenancy growth in the local towers market. Bharti Infratel owns 100% of its core towers business as well as 42% of Indus Towers, a joint venture with Vodafone India and Aditya Birla Telecom on a 42%, 42% and 16% ownership split, respectively. The company's consolidated portfolio of over 83,000 towers in March 2014, which includes 36,000 of its own towers and the balance from its interest in Indus Towers, makes it one of the largest tower infrastructure providers in the country with a presence in all 22 telecoms 'circles'. Another factor in favour of Bharti Infratel is its right of first refusal for rollouts from incumbents Bharti Airtel, Vodafone and IDEA ; these three players jointly accounted for 55% of the mobile subscriptions market in 2013. BMI believes this has a positive implication for the revenue scalability for Bharti Infratel as the leading telecoms players are expected to further increase their market shares by acquiring smaller players. Reliance Infratel: Benefiting From Reliance Jio's Entry Reliance Infratel is a subsidiary of Reliance Communications with a portfolio of nearly 50,000 towers across all 22 telecoms circles, as of March 2013. In March 2014, Reliance Communications was reported to be seeking potential buyer for its 95% stake in Reliance Infratel at the valuation range of INR150bn to INR200bn to help deleverage the parent's balance sheet. Reliance Infratel is a beneficiary of the entrance of new tenant Reliance Jio, which holds a nationwide 4G permit. Reliance Jio had expressed its ambition to commence 4G offerings in H215 using 2300MHz spectrum and the 1800MHz frequencies it obtained at an auction in February 2014. The launch of 4G services using these high-frequency bands is expected to drive an increase in tenancy as more network sites will be needed to deploy 4G. In order to meet its 4G launch date target, Reliance Jio has established leasing agreements with Reliance Infratel, Bharti Infratel, Viom Networks and ATC India Tower. Reliance Infratel had entered into three partnership agreements with Reliance Jio as of March 2014; an inter-city fibre-optic sharing agreement in April 2013, a nationwide telecom towers infrastructure sharing agreement in August 2013 and a Master Services Agreement in March 2014 to share Reliance Communications' extensive intracity fibre-optic network. These infrastructure sharing pacts are the first few business tie-ups between the once-feuding brothers Anil Ambani and Mukesh Ambani, who own Reliance Communications and Reliance Jio Infocomm respectively. Although Reliance Infratel may not be the exclusive towers provider to Reliance Jio, BMI notes these infrastructure sharing pacts are signs of healthy progress from the animosity that has existed between the Ambani brothers for years. Viom Networks: Highest Tenancy In India Viom Networks' strength lies in its pan-Indian presence and high tenancy ratio. The company reported it had the nation's highest tenancy ratio of 2.3 in December 2013, compared with Bharti Infratel's 2.0 www.telecomsinsight.com Indonesia and Reliance Infratel's 1.84. The company had over 42,000 towers across all 22 telecoms circles in India supporting close to 92,000 tenants as of July 2014. Like Bharti Infratel, Viom's wide portfolio of telecom towers gives the company significant exposure to voice and data growth as telecoms operators ramp up capacity and coverage. Viom Networks is a joint venture between Tata Teleservices Ltd and SREI Infrastructure. Viom Networks' shareholders are presently considering options regarding the sale or refinancing of that company. In early January 2014, Viom said that several private equity investors were discussing plans to buy into the company. An overseas listing has also been considered. With a high tenancy ratio and expansive coverage, Viom Networks is an attractive proposition for private equity funds. The key risk to Viom is its tenant mix. Presently, less than 10% of Viom's revenue comes from incumbents such as IDEA and Vodafone; revenues from new operators such as Telenor, Aircel and MTS India make up close to 33% of the firm's revenue mix, although these three mobile operators jointly accounted for less than 13% of the mobile subscriptions market. As India's telecoms market heads towards consolidation and incumbent operators gain further market share, Viom's tenancy risk profile will increase significantly. AsiaTelecommunications fer significant investment upside. The median enterprise value to EBITDA ratio (trailing twelve months) was 17.1x, which is lower than the 21.7x among US tower companies, despite the higher growth potential. TBG: Strong Client Relationship With Large Telecoms Operators BMI sees huge investment potential in Tower Bersama Group (TBG) due to its strong client base and strong financial position. TBG is the second largest independent tower company in Indonesia in terms of tower sites and tenancy; the company had 8,866 tower sites and a tenancy ratio of 1.73 in 2013. Presently, the majority of the firm's tower portfolio is in high-demand areas such as Java, Bali and urban areas in other parts of Indonesia where population density is high. Strong Growth Expected For 3G Sector Indonesia 3G/4G Subscriber Growth Forecasts Indonesia Indonesian Towercos Top Asian Market Potential BMI View: The combination of a solid growth outlook amid robust demand, high EBITDA margins and a favourable regulatory environment bode well for Indonesian tower players. The trend of rising smartphone and tablet adoption in Indonesia, driven by wireless data usage, has increased demand for base stations and tower rollouts. BMI forecasts Indonesian 3G/4G subscriptions growth of 18.8% CAGR between 2014 and 2018, reaching 75.4mn by the end of the five-year period. As operators apportion more capex towards coverage rollout, BMI expects demand for tower sites and base stations to grow. A major plus for the Indonesian tower industry is that most 3G customers are served by the relatively inefficient 1800-2100MHz frequencies, which require more towers to provide the same signal coverage than is necessary with lower frequencies. Indonesian tower companies also benefit from a favourable regulatory regime, which prevents foreign companies from owning tower firms and encourages the telecoms operators to share towers rather than building single-tenancy tower sites. These factors explain why independent tower companies in Indonesia enjoyed one of the highest EBITDA margins in the tower business globally in 2013, close to 80%. The key downside risks to Indonesia's tower industry include difficulties in securing new building permits for tower sites and payments defaults by smaller telecoms players. The Tower Decree issued in March 2008 requires tower owners to seek approvals from local government bodies before they can construct new towers. BMI believes this ruling increases the competition among tower companies to acquire new locations for future expansion. Meanwhile, a prolonged price war in Indonesia's overcrowded mobile market has placed huge debt burdens on smaller operators, posing a threat of default in tower rental payments (see 'Bakrie Telecom Defaulted On Debt Payment', November 11 2013). From a valuation perspective, Indonesia's tower companies of- www.telecomsinsight.com f = BMI forecast. Source: BMI A key differentiator for TBG is its strong client relationship with top three telecoms operators PT Telkom, Indosat and XL Axiata. In 2013, these companies contributed close to 75% of TBG's revenues. BMI notes this greatly improves the firm's revenue scalability as the incumbents are expected to become bigger customers to independent tower companies when consolidation in the mobile market takes effect: XL recently acquired Axis Telekom, Bakrie Telekom is facing significant financial difficulties and minor players such as 3 Indonesia (Hutch) and Ceria could be targeted for their passive and active infrastructure, including spectrum (see 'Axiata Acquisition Paves Way For Future Consolidation', December 3 2013). Another benefit TBG has is its strong cash flow visibility. The company's management is committed to undertake new tower constructions only after securing long-term lease commitments from telecom operators. In our view, this eliminates a lot of speculative developmental risk. Most of the company's contracts are also on a minimum of 10-year lease terms with clauses that protect the company against inflationary risk–25% of the rental is pegged to the country's inflation rate. According to BMI's Oil and Gas team, diesel prices are expected to remain at historically elevated levels above USD100 per barrel over the next three years. Protelindo: Largest Tower Portfolio And Compelling Valuation Serana Menara Nusantara (Protelindo) is the market leader based on three important operational metrics: number of tower sites, size 11 Indonesia AsiaTelecommunications of tenant base and tenancy ratio. At the end of 2013, the company owned 18,322 tenants on 9,746 tower sites, giving a tenancy ratio of 1.88. The company's biggest strength is its expansive geographical coverage. Approximately 95% of Protelindo's towers are located in Indonesia's four most populated regions: Java, Sumatra, Kalimantan and Sulawesi. Over the next three years, BMI expects Protelindo to remain the largest tower operator given its track record of tower acquisitions; Protelindo purchased Hutch's 3,600 towers between 2008 and 2010. Indonesia’s Tower Companies Offer Cheaper Valuation Than US Peers TTM EV/EBITDA 25 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 20 15 10 5 EV / EBITDA TTM SBA Communications Crown Castle American Tower Corp Bharti Infratel (Consl) Solusi Tunas Pratama Tower Bersama Protelindo 0 EBITDA Margin (RHS) Source: Bloomberg That said, Protelindo's perceived weaker relationship with the top vendors will limit its revenue scalability, in our view. Unlike TBG, only 36% of Protelindo's leasing income came from Telkomsel, XL Axiata and Indosat in 2013. Although the revenue mix has improved from less than 30% in 2011, the rate of change is still too slow owing to the use of long contractual lock-in periods. BMI believes it is vital for Indonesia's tower companies to increase their revenue exposure to top three telecoms operators as they are expected to gain greater mobile market share over time by acquiring smaller operators. BMI believes a major weakness of STP is its customer mix. Over the past two years, STP has been heavily reliant on tier-2 telecoms operators such as Bakrie Telekom and Hutch for its revenue. Given the weak growth metrics reported by Bakrie in 2013, it is important STP further diversify its customer profile towards larger mobile operators. A major positive is that STP's management has actively worked to rebalance its lopsided revenue dependence, as contributions from XL Axiata, PT Telekom and Indosat increased from 22.6% in 2012 to 34.6% in 2013. Data Centre Partnerships Offer Long-Term Investment Upside BMI View: Indonesia offers the greatest potential for returns on data centre investment in Asia. A new strategic partnership with Dimension Data provides additional upside to our bullish forecasts for spending on cloud computing services as the relationship will give Telkomsigma greater traction among Japanese multinationals operating out of Indonesia. Telkomsigma and Dimension Data are to collaborate on the development and provision of end-to-end data centre services to local and global enterprises. Specifically, they will pool their resources and capabilities to enable them to reach out to the Japanese business community in Indonesia, a market that Telkomsigma has yet to penetrate. Dimension Data is owned by Japan's NTT and can leverage its parent's global high-capacity fibre backbone and points of presence as well as its proprietary remote networking technology and solutions. Telkom Spotted Market Potential Early Indonesia Cloud Computing Spending Forecasts STP: Strong Presence In Greater Jakarta Solusi Tunas Pratama (STP) began commercial operations in 2008 and is the third largest independent tower company in Indonesia. By the end of 2013, the firm had 2,798 towers and average tenancy of 1.68. STP is a niche tower operator that focuses on acquiring and building towers in the Greater Jakarta area and Java where the population density is highest. By concentrating its operations in a geographical area, STP is able to reduce its operating costs while extending its footprints in areas with the highest traffic growth potential. e/f = BMI estimate/forecast. Source: BMI BMI forecasts Indonesia's data centre and related services market STP’s Towers Locations (2013) Area Greater Jakarta No. of Towers (2013) 1,352 Java 984 Sumatera 227 Kalimantan–Sulawesi 100 Bali–Nusa Tenggara 118 Papua Total 17 2,798 Source: STP 12 www.telecomsinsight.com Myanmar to be among the fastest-growing in Asia over the next five years, driven by growing demand for cloud computing, system integration and advanced connected services such as online financial solutions. This view is informed by our observations that an acceleration in new business start-ups has been accompanied by a surge in investments in local business hubs by multinational players. Furthermore, rapid improvements in wireline broadband infrastructure capacity and Telkomsigma's ambitious data centre capacity investments lead us to forecast Indonesian cloud computing spending to grow from just USD62mn in 2013 to USD270mn by 2018. By then, cloud will account for 14% of total IT spending in the country, among the highest in the region. As Telkomsigma is the leading provider of such services in Indonesia, partnerships with global players such as Dimension Data can only deliver further upside to this outlook. Telkomsigma is part of the PT Telkom group, Indonesia's incumbent telecoms operator. By the end of 2015, the group expects to be operating the fourth-largest data centre business in the world with 100,000 square metres of capacity. New tier-2 and tier-3 facilities will have been built out by the end of 2014 and, with the completion of Indonesia's first tier-4 facility also scheduled for this year, Telkom will have 70,000 square metres of capacity at its disposal. Telkomsigma's services and solutions have, so far, been tailored to meet the needs of local businesses. However, by adding the service portfolios of strategic global partners–deals have recently been struck with China's Huawei Technologies and Australia's Telstra – we believe it can significantly broaden both its appeal and its reach and ultimately accelerate returns on investment for Telkom. Myanmar Competition Heats Up With Newcomers AsiaTelecommunications 75% mobile coverage by 2016 although we see downside risk in the government's aggressive deployment requirements, as few emerging markets have achieved this feat in such a short span of time (see 'Unique Opportunity, Major Challenges Await Licence Winners', June 28 2013). We expect the initial growth phase to be driven by cost effective coverage and affordable mobile service pricing. The key downside risk to the partnership is cultural compatibility. Examples of rocky relationships between foreign investors and local partners are not unusual. Telenor, for example, is increasingly at odds with its Indian partner Unitech over issues such as rights issuance (see ' Unitech, Telenor In New Argument', July 27 2012). The Norway-based company has, more recently, incurred the wrath of Thailand's new military junta, further souring its relations with a state increasingly wary of international investment in key strategic industries. Given the vast differences in Japanese culture and the newly liberalised Myanmar market, the likelihood of an eventual dispute is significant, in our view. Thailand 4G Delay Confirms Risk Outlook BMI View: The postponement of the 4G auction confirms our shortterm telecoms risk outlook. We believe regulatory headwinds are unlikely to dissipate anytime soon under the military Junta and this will upset operators' business development and investment plans, particularly AIS. The risk of a potential increase in base pricing for spectrum is also significantly raised, in our view, as the delay pushes the operators closer to concession expiration dates. Bulk Of Subscription Growth Expected In 2014 and 2015 Mobile Subscribers (000) BMI View: Telecoms competition will intensify as a result of Japanese investment in incumbent MPT. We expect Myanmar's two new mobile operators to respond aggressively to this unexpected new threat. However, KDDI's deep technical exp ertise and operational know-how can only help mobile penetrat ion increase to 87.7% by 2018. It is BMI's view that newly-licensed Telenor and Ooredoo will embark on aggressive coverage expansion and low-cost retail strategies to secure healthy market shares before a reinvigorated Myanmar Post and Telecommunication (MPT) enters the fray (see 'Myanmar's Ambition Starts With Network Sharing', July 12 2013). Leveraging the technical expertise and financial resources of KDDI and Sumitomo Corporation, MPT will be well-placed to develop attractive wireline and mobile services for its existing customer base. KDDI is the second largest mobile operator in Japan by subscription share, as of Q114, and it brings deep operational expertise and the know-how to defend market share in an open market setting. It also offers access to an extensive international submarine cable network, which could considerably lower bandwidth costs for MPT. Reuters reports that the three companies plan to invest approximately USD2.0bn over the next 10 years in the joint business. BMI forecasts mobile subscribers to increase from 9.2mn in 2013 to 48.2mn in 2018. The bulk of the growth is expected to come in 2014 and 2015, when these international operators start to launch their mobile services. Myanmar's government is keen to achieve www.telecomsinsight.com e/f = BMI estimate/forecast. Source: BMI The Risk To Outlook The telecoms sector will continue to be a target of the Junta's reforms and further uncertainty is expected after the Junta ordered the suspension of the 1800MHz and 900MHz spectrum auctions, scheduled for August and November 2014, respectively. The latest move is in line with our expectations of a heightened risk of delay to the 4G auction (see 'Short-Term Risk Outlook Will Worsen', May 28 2014). Of further concern is a Bangkok Post report claiming that the Junta wants to revamp the 2010 Frequency Allocation Act to help state-owned TOT regain its rights to revenues from its mobile concession partners. In addition, the office of the auditor general 13 Singapore AsiaTelecommunications has also ordered regulator NBTC to transfer the auction fees from digital TV licences to state coffers and has also raised the prospect of dissolving the NBTC altogether. ment obstacles. Nevertheless, increased competition would boost breadth and quality of services and the upstart newcomer could be a useful catalyst for change. Operators At Risk Privately-owned MyRepublic has proposed acquiring 20MHz of sub-1GHz spectrum plus a further 100MHz of 2.3GHz or 2.6GHz spectrum in order to establish a new mobile broadband service in Singapore. The wireline broadband operator believes the lack of price competition in the mobile market means that consumers are unwilling to utilise advanced services due to the high price of data bundles. It advocates the licensing of a fourth mobile operator focused on unlimited data plans as a means of reinvigorating the data services market. Singapore Data ARPU Growth Threatened By Newcomer BMI View: In addition to its lack of scale, MyRepublic's ambitions to become Singapore's fourth converged services provider will be frustrated by substantial strategic, regulatory and business environ- Data ARPU Growth Under Threat Monthly Data Plan ARPU By Operator (SGD) 35 30 25 20 15 SingTel StarHub Q114 Q313 Q413 Q213 Q113 Q412 Q312 Q212 Q411 Q112 Q311 Q111 10 Q211 Mobile operators, particularly AIS, are most at risk if the 4G auctions were to be delayed beyond November 2015 – the expiration date of AIS' 900MHz spectrum concession. Under this scenario, AIS would be left with only 15MHz of 2100MHz to serve its 42mn subscriptions. Considering the growth in data usage, we see considerable risk to AIS' ability to maintain network quality. We believe DTAC and True are less at risk as each of them owns 850MHz spectrum which is highly suitable for cost-effectively reaching rural and low-income areas with advanced services, and their concessions are not due to expire for at least another three years. However, DTAC has problems of its own. In June 2014, Norway's Telenor – which owns 42.6% of DTAC – issued a lengthy apology after angering the Thai Junta with a public announcement that it had been ordered to briefly block Facebook access the previous month. The apology followed NBTC's threat to ban DTAC from participating in the 4G licence auction process over the incident; it is unclear whether that apology will carry sufficient weight with the Junta. As operators are pushed closer to their respective concession expiry dates, BMI expects the risk of an escalation in base spectrum pricing for the 1800MHz spectrum to be raised considerably. The 1800MHz band is most suitable for 4G use because it is compatible with the broadest range of smart devices worldwide. However, only two licences will be offered in the 1800MHz auction, while at least three operators are participating. Even though DTAC already owns 1800MHz spectrum under concession, it is likely to bid as there are regulatory cost savings to be made by migrating customers to a new block of licensed spectrum–frequencies it can use unconditionally without interference from cash-strapped TOT or CAT Telecom. We believe the delay only serves to heighten operators' anxiety of being left out of the crucial 1800MHz market and will push the final bid prices higher. M1 Source: BMI Mobile Operator Database The company correctly anticipates strong opposition from incumbents SingTel Mobile, M1 and StarHub; they are likely to claim that, owing to market saturation and the small size of the addressable market, a fourth player would harm their ability to invest in networks and services. It also acknowledges that Singapore's regulatory apparatus does not yet provide the tools it would need to succeed in its aims of acquiring a 10-15% share of the mobile market. We consider that MyRepublic overestimates its ability to convince the Infocomm Development Authority (IDA) that it should reserve spectrum for a new player rather than auction it to the highest bidders. Even if its case were accepted, it would still require regulatory support – in the form of a mandatory national roaming agreement with existing operators – that would be difficult to broker. After three years, French newcomer Free Mobile has yet to secure a comprehensive network access deal with its peers as the regulator Spectrum Ownership In Thai Telecoms Operator Frequency Spectrum Allocation Contract Type Expiry AIS 900MHz 17.5MHz BTO (TOT) Nov 2015 AIS 1800MHz 12.5MHz BTO (CAT) Sep 2013 + 1 yr extension AIS 2100MHz 15MHz Auction Licence 2027 DTAC 850MHz 10MHz BTO (CAT) 2018 DTAC 1800MHz 50MHz BTO (CAT) 2018 DTAC 2100MHz 15MHz Auction Licence 2027 TRUE Corp 850MHz 15MHz Wholesale (CAT) 2025 TRUE Corp 1800MHz 12.5MHz BTO (CAT) Sep 2013 + 1 yr extension TRUE Corp 2100MHz 15MHz Auction Licence 2027 Note: BTO–Build-Transfer-Operate concession, secured from TOT plc or CAT Telecom, as appropriate. Source: Operators 14 www.telecomsinsight.com Singapore AsiaTelecommunications has proved unwilling to intercede in negotiations. We also believe Singapore's existing operators will have noted with dismay the impact Free has already had on the profitability of France's three incumbents and their ability to invest in advanced services. MyRepublic proposes building an initial network of 200-300 macro base stations in order to launch services; however, it will need much deeper coverage in order to achieve traction it needs to recover its projected SGD250-300mn (USD160-240mn) investment. Network access and roaming would be vital in reaching the majority of consumers; persuading the regulator to mandate this would be difficult at best. BMI's Mobile Operator Database shows that SingTel and StarHub would have much to lose if price competition intensified in the non-voice services market. SingTel's data ARPU reached SGD32 (USD25.6) in Q114 and has risen rapidly in recent quarters owing to its ability to promote data within multi-product bundles straddling its broadband, TV, voice telephony and mobile businesses. StarHub's data ARPU is also growing, albeit at a slower pace and is–for the moment–the lowest in the market at SGD19.3. For M1, however, the trend is downwards in nature, recording ARPU of SGD19.5 in Q114. SingTel's high data ARPUs and slow-growing total user base versus M1's ARPU decline and robust subscription growth suggest that data plans are expensive and that consumers would benefit from more competitive pricing. While there is scope for a fourth operator– and we believe MyRepublic's low-cost, low-margin strategy marks it out as a credible candidate – we share the incumbents' views that a newcomer would merely cannibalise the existing market rather than add organically to it. Analyst: Andrew Kitson Sub-Editor: Sofia Abasolo Subscriptions Manager: Yen Ly Production: Fauzia Borah Isahaque Copy Deadline: 23 July 2014 www.telecomsinsight.com © 2014 Business Monitor International. All rights reserved. All information, analysis, forecasts and data provided by Business Monitor International Ltd is for the exclusive use of subscribing persons or organisations (including those using the service on a trial basis). All such content is copyrighted in the name of Business Monitor International, and as such no part of this content may be reproduced, repackaged, copied or redistributed without the express consent of Business Monitor International Ltd. All content, including forecasts, analysis and opinion, has been based on information and sources believed to be accurate and reliable at the time of publishing. Business Monitor International Ltd makes no representation of warranty of any kind as to the accuracy or completeness of any information provided, and accepts no liability whatsoever for any loss or damage resulting from opinion, errors, inaccuracies or omissions affecting any part of the content. 15

© Copyright 2026