The Automated Terminal Equipment Market

INSERT PARTNER LOGO Paul Avery, Editorial Director WorldCargo News CONNECT. COLLABORATE. INNOVATE. The Automated Terminal Equipment Market INSERT PARTNER LOGO Overview Automated equipment market • History ‐ at first a false start, with implications. • CTA and beyond ‐ huge growth in the number of automated terminals • Cranes by the numbers • Automation has changed the equipment market • Preparing for the future ‐ automation and the market today INSERT PARTNER LOGO A slow start The 1990s • Four terminals ‐ Pasir Panjang, ECT, Thamesport, Kawasaki • Cost and productivity issues • No real competitive market for automated equipment • Difficult investment environment for manufacturers 3 INSERT PARTNER LOGO A decade of testing RMGs, OHBCs? Racking systems and concepts Remote control STS Separate cabs Automated AGV AGV prototypes Key terminals changed their mind • PSA Singapore • Kwangyang • Thamesport Little interest in semi-automation Very little process automation All or nothing approach INSERT PARTNER LOGO Second wave of pioneers More terminals • • • • • HHLA - CTA Patrick Stevedores APMT Virginia CTB Hamburg TCB Nagoya 5 INSERT PARTNER LOGO Take off HIT T6/&, Evergreen Kaoshiung, Pusan Newport, TTIA Algeciras Two more terminals in Busan Australia - 5 terminals ASCs One with autostrads The USA - Global, TraPac, LBCT BEST (Spain) London Gateway Indonesia - Automated RTGs Lazero Cardenas MIT Panama and Tuxpan PSA Singapore Xiamen Ocean Gate Port Botany - Autostraddles 6 INSERT PARTNER LOGO Quayside automation APMT MVII & RWG Lift AGVs Remote controlled STS cranes T3 Jebel Ali, Damman 7 INSERT PARTNER LOGO RMG/RTG terminals Existing terminals applying automation Further automated RTG terminals 8 INSERT PARTNER LOGO Future demand - scaling up Tuas Megaport - up to 65M TEU PSA Software with competitive interchangeable equipment AGVs, over a thousand? 9 INSERT PARTNER LOGO A changing port equipment market Huge increase in rail mounted cranes In 2003 just 37 RMGs produced, compared to 421 RTGs. In 2006 RTG production peaked when 15 suppliers produced over 950 RTGs Crane production was a bottleneck 10 INSERT PARTNER LOGO In 2014 and beyond RTGs still dominate - around 550 deliveries in 2014. ASCs - 430 machines delivered in 2014 - 2015 to 19 different terminals Over 100 on order for 2016 and beyond Mature straddle carrier market - shift to low height machines 11 INSERT PARTNER LOGO Crane suppliers Consolidation and scale ASCs - Crane plus drives Automation has created a new bottleneck 12 INSERT PARTNER LOGO AGV market Initially only Gottwald (TPS) 10 years between first and generation machines Now six terminals: ECT 350, RWG 59, MVII 62, CTA 84, LBCT 72, Euromax 96 Toyota 33 machines VDL 87 machines ZPMC 18 + ? Gaussin AIV One terminal so far with a mixed fleet 13 INSERT PARTNER LOGO A changed market Semi-automation with manned equipment Cameras Load control and positioning Safety, and practicality Collision avoidance Integrated process automation 14 INSERT PARTNER LOGO A path to automation A 25 year investment should be “automation ready” Infrastructure RTGs - remote control retrofit? STS cranes - retrofits. INSERT PARTNER LOGO CONNECT. COLLABORATE. INNOVATE. Thank you!

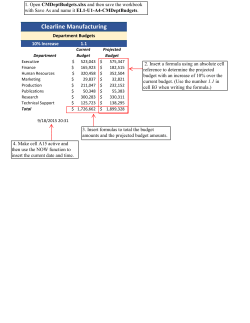

© Copyright 2026