PFNYC 2015 State Budget Priorities

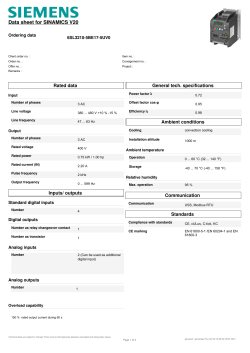

PARTNERSHIP for New York City PARTNERSHIP FOR NEW YORK CITY STATE BUDGET PRIORITIES On April 1, 2015, the New York State 2015–16 budget was passed. The Partnership championed a number of priorities that were included in the budget, opposed some items that were excluded, and will continue to work through the legislative session to advance items on our agenda that were not part of the final package. TAXES The New York City business tax code has been amended to largely conform to state code, which will provide a simpler filing and audit process for all corporations and consolidate the “bank tax” under the general corporate tax regime. The Partnership opposed a number of tax proposals that, if enacted, would have been detrimental to the business community or were poor public policy, which were omitted from the budget: »» Marketplace Provider Tax, which would have made e-commerce platforms responsible for collection of sales taxes. »» A $1.7 billion homeowner tax rebate program creating a new middle class entitlement. »» New health insurance tax, that would have been passed to consumers, to help pay for the State’s health exchanges. »» A new tax on intercompany transactions. EDUCATION The budget provides $9.2 billion in aid to NYC schools, a 5.8% increase from the current spending. Reforms enacted include: »» Authorization for the State Education Department to intervene by requiring a receiver for failing schools. »» Expedited process for removal of teachers rated ineffective for consecutive years, and of those accused of physical or sexual abuse. »» Redesigned, two-pronged teacher evaluation system based on student performance and teacher observations. »» Full scholarships to SUNY and CUNY education programs for top college graduates who commit to teach in the state for five years. »» Extension of the trial period before a teacher can win tenure from three to four years , as well as a requirement that probationary teachers are rated at least “effective” for three out of four years in order to be tenured. »» More rigorous teacher preparation programs. »» Performance-based bonus pay for top teachers. POST-BUDGET PRIORITIES Items proposed by the governor and supported by the Partnership that were not included in the budget: »» Renewal of Mayoral Control of New York City schools. »» Expansion of the authorization to carry out capital projects using design-build contracting to all state and city agencies, public authorities and CUNY and SUNY. Expansion will encourage more efficient and cost-effective infrastructure development. »» Increase in the state minimum wage. »» Increase in the cap on charter schools. »» Education Investment Tax Credit to support parochial and private school tuition.

© Copyright 2026