Selected Charts on the Long-Term Fiscal Challenges of the United

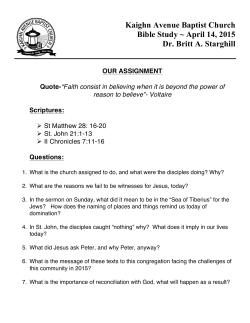

CHARTS MAY 19, 2015 WASHINGTON, D.C. America’s economic recovery is finally taking hold and current deficits are down from their highs during the recession. But at the same time, far too many American families are being left out of the recovery, and our nation still faces an unsustainable long-term fiscal outlook. It is in this context—with progress made, but work still to be done—that America has an important opportunity to secure its fiscal and economic future. On the economic side, while lower unemployment and improvements in growth are fueling renewed optimism, the recovery is uneven and longer-term trends of income stagnation are of great concern. There is widespread agreement that we need to ensure continued access to opportunity for Americans. When it comes to our fiscal challenges, many said that the fragile nature of the recovery meant that fiscal action needed to be delayed until the economy was stronger. Now, as the economic recovery strengthens, lawmakers have a new and important opportunity to address America’s unsustainable long-term fiscal outlook. The current economic environment allows more room to maneuver, and provides a window to plan for success—making smart, reasoned decisions that will benefit America over the long term. The charts in this book outline the nature of the long-term challenges we face and what we have to gain if we take action to stabilize our fiscal outlook. It’s clear that the United States is on an unsustainable fiscal path, driven by a structural long-term imbalance between spending and revenue. Without action, rising debt and interest payments will weigh down the economy and undermine investments in our future, including in key areas like education, research, and infrastructure. Moreover, unless we change course, critically important safety net programs could be threatened by sharp cuts that hurt the most vulnerable Americans. The charts also show that we can choose a better path. There’s no shortage of good solutions to stabilize our long-term fiscal outlook and ensure our future isn’t diminished by our past. The Peter G. Peterson Foundation regularly produces charts and analyses to explain the scope and seriousness of America’s fiscal challenges and to help policymakers, experts, and the public make progress toward solutions. To view and share these charts and other materials, please visit www.pgpf.org. © 2015 Peter G. Peterson Foundation #FiscalSummit 1 PGPF.org FiscalSummit.org U.S. debt held by the public is on an unsustainable path DEBT HELD BY THE PUBLIC (% OF GDP) Actual 200% Projected 183% in 2039 (Alternative Fiscal Scenario) 175% 150% 125% World War II 106% in 2039 (Current Law) 100% 75% 50% 25% 0% 1930 1940 1950 1960 1970 1980 1990 2000 2010 2020 2030 SOURCE: Congressional Budget Office, The 2014 Long-Term Budget Outlook, July 2014. Compiled by PGPF. NOTE: Data for the alternative fiscal scenario include economic feedback. © 2015 Peter G. Peterson Foundation #FiscalSummit 4 PGPF.org FiscalSummit.org The growing debt is caused by a structural mismatch between spending and revenues FEDERAL REVENUES AND SPENDING (% OF GDP) 30% Actual Projected Spending Average Spending (1980-2014) 25% 20% 15% Revenues Average Revenues (1980-2014) 10% 5% 0% 1980 1985 1990 1995 2000 2005 2010 2015 2020 2025 2030 2035 SOURCE: Congressional Budget Office, The 2014 Long-Term Budget Outlook, July 2014, and Updated Budget Projections: 2015 to 2025, March 2015. Compiled by PGPF. NOTE: Projections are from CBO’s extended baseline scenario. © 2015 Peter G. Peterson Foundation #FiscalSummit 5 PGPF.org FiscalSummit.org Healthcare is the major driver of the projected growth in federal spending over the long term FEDERAL SPENDING (% OF GDP) 10% Actual Projected Major Health Programs 9% 8% 7% Social Security 6% 5% 4% 3% Defense Discretionary 2% Nondefense Discretionary 1% Other Mandatory 0% 1980 1990 2000 2010 2020 2030 2040 2050 SOURCE: Congressional Budget Office, Historical Budget Data, April 2014, and The 2014 Long-Term Budget Outlook, July 2014; and PGPF projections based on CBO data. Calculated by PGPF. NOTE: Projections are based on CBO’s extended baseline scenario. Major health programs include Medicare, Medicaid, Children’s Health Insurance Program (CHIP), and the health exchanges. © 2015 Peter G. Peterson Foundation #FiscalSummit 6 PGPF.org FiscalSummit.org The elderly population is growing rapidly and living longer U.S. POPULATION AGE 65+ (MILLIONS) 100 Baby Boomers Turn 65 90 80 85+ 70 60 75-84 50 40 30 65-74 20 10 0 1990 2000 2010 2020 2030 2040 2050 2060 SOURCE: U.S. Census Bureau, National Intercensal Estimates, and 2014 National Population Projections, December 2014. Compiled by PGPF. © 2015 Peter G. Peterson Foundation #FiscalSummit 7 PGPF.org FiscalSummit.org Social Security moved from annual surpluses to annual deficits in 2010 SOCIAL SECURITY SURPLUSES/DEFICITS (% OF GDP) 1.0% Actual 0.5% Projected Trust Fund Depleted Total Deficit $2.8 Trillion 0.0% -0.5% -1.0% -1.5% -2.0% 1975 1985 1995 2005 2015 2025 2035 2045 2055 2065 2075 2085 SOURCE: Social Security Administration, The 2014 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds, July 2014. Compiled by PGPF. NOTE: Surplus/deficit numbers exclude interest income. The total deficit of $2.8 trillion is the present value of the cash deficits between 2014 and 2033. © 2015 Peter G. Peterson Foundation #FiscalSummit 8 PGPF.org FiscalSummit.org As the population ages, fewer workers will be paying taxes to support each Social Security beneficiary WORKERS PER BENEFICIARY 5 4 3.7 3.4 3 2.9 2 2.2 1 0 1970 1990 2010 2030 SOURCE: Social Security Administration, The 2014 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds, July 2014. Compiled by PGPF. © 2015 Peter G. Peterson Foundation #FiscalSummit 9 PGPF.org FiscalSummit.org The United States spends more than twice as much per capita on healthcare as the average developed country does HEALTHCARE COSTS PER CAPITA (DOLLARS) $10,000 $8,745 $8,000 $6,000 $6,080 $4,000 $2,000 $3,209 $3,289 $3,649 $4,288 $3,997 $4,106 $4,602 $4,811 $3,484 OECD Average United States Switzerland Germany Canada France Sweden Australia Japan U.K. Italy $0 SOURCE: Organization for Economic Cooperation and Development, OECD Health Statistics 2014, June 2014. Compiled by PGPF. NOTE: Per capita health expenditures are for 2012, except Australia for which 2011 data are the latest available. Chart uses purchasing power parities to convert data into U.S. dollars. © 2015 Peter G. Peterson Foundation #FiscalSummit 10 PGPF.org FiscalSummit.org Life expectancy at birth in the United States is lower than in other developed countries, despite higher healthcare costs LIFE EXPECTANCY (YEARS) 86 Japan 84 Italy 82 France Canada U.K. 80 Germany 78 United States 76 74 72 $0 $2,000 $4,000 $6,000 $8,000 $10,000 HEALTHCARE SPENDING PER CAPITA SOURCE: Organization for Economic Cooperation and Development, OECD Health Statistics 2014, June 2014. Compiled by PGPF. NOTE: The trend line comes from a logarithmic regression. © 2015 Peter G. Peterson Foundation #FiscalSummit 11 PGPF.org FiscalSummit.org Medical spending increases rapidly with age ANNUAL HEALTHCARE SPENDING PER CAPITA (DOLLARS) $40,000 $35,000 $34,783 $30,000 $25,000 $20,000 $15,000 $15,857 $10,000 $8,370 $5,000 $0 $3,628 $4,422 0-18 19-44 45-64 65-84 85+ SOURCE: Centers for Medicare and Medicaid Services, National Health Expenditures by Age and Gender, May 2014. Data are for 2010. Compiled by PGPF. © 2015 Peter G. Peterson Foundation #FiscalSummit 12 PGPF.org FiscalSummit.org Total U.S. health expenditures (both public and private) are projected to rise to nearly one-quarter of the economy by 2039 NATIONAL HEALTH SPENDING (% OF GDP) 25% Actual Projected 22% 20% 18% 15% 15% 11% 10% 7% 5% 5% 0% 1960 1975 1990 2005 2020 2039 SOURCE: Centers for Medicare and Medicaid Services, National Health Expenditures, December 2014; and the Congressional Budget Office, The 2014 Long-Term Budget Outlook, July 2014. Compiled by PGPF. NOTE: CMS data are for 1960–2020. The 2039 figure is based on the latest projection from CBO. National spending on healthcare is health consumption expenditures as defined in the national health expenditure accounts and excludes spending on medical research, structures, and equipment. © 2015 Peter G. Peterson Foundation #FiscalSummit 13 PGPF.org FiscalSummit.org Corporate and individual tax expenditures are large in comparison to annual taxes collected, as well as to the government’s major programs BUDGETARY COST (BILLIONS OF DOLLARS) $1,800 $1.7 Trillion $1,500 $1,200 $1.4 Trillion $900 $845 Billion $600 $596 Billion $505 Billion $300 $0 All Tax Expenditures Individual & Corporate Tax Revenues Medicare Social Security Defense SOURCE: Office of Management and Budget, Budget of the United States Government, Fiscal Year 2016, February 2015. Data are for 2014. Compiled by PGPF. NOTE: Medicare spending is net of premiums and payments from the states. Those receipts were $95 billion in 2014. Defense represents discretionary defense spending. Income tax revenues includes both individual and corporate income tax receipts. Tax expenditures are deductions, credits, exclusions, and preferential rates. The estimates include effects on income, payroll, and excise tax revenues, as well as effects on outlays. © 2015 Peter G. Peterson Foundation #FiscalSummit 14 PGPF.org FiscalSummit.org The U.S. tax system is progressive, with higher-income taxpayers facing higher tax rates AVERAGE TAX RATE (% OF CASH INCOME) 40% 30% Estate Tax Corporate Income Tax Payroll Tax Individual Income Tax 33.4% 35.7% 23.8% 20% 16.6% 18.8% 20.3% 13.7% 10% 8.0% 3.1% 0% Lowest Quintile Second Quintile Middle Quintile Fourth Quintile 80-90th 90-95th 95-99th Percentile Percentile Percentile Top 1 Percent Top 0.1 Percent SOURCE: Tax Policy Center, Baseline Average Effective Federal Tax Rates by Cash Income Percentile; 2014, July 2013. Compiled by PGPF. NOTE: Data are for 2014. Individual income tax rates for the lowest and second lowest quintiles are negative and are netted against the payroll tax rate. A quintile is one fifth of the population. In 2013 dollars, the income breaks are 20%: $24,191; 40%: $47,261; 60%: $79,521; 80%: $134,266; 90%: $180,482; 95%: $261,471; 99%: $615,048; 99.9%: $3,170,865. © 2015 Peter G. Peterson Foundation #FiscalSummit 15 PGPF.org FiscalSummit.org Compared with other major countries, the United States has had a low national saving rate NET NATIONAL SAVING RATE (% OF GDP) 8% 6% G-7 Average (Excluding U.S.) 4% 2% 0% United States -2% -4% 2000 2002 2004 2006 2008 2010 2012 SOURCE: Organization for Economic Cooperation and Development, National Accounts at a Glance, November 2014. Compiled by PGPF. NOTE: The G-7 is a group of seven advanced economies: Canada, France, Germany, Italy, Japan, the U.K., and the United States. © 2015 Peter G. Peterson Foundation #FiscalSummit 16 PGPF.org FiscalSummit.org Interest costs are projected to grow to unsustainable levels if current policies aren’t changed % OF GDP Actual 60% Projected Revenues Noninterest Spending 50% Net Interest Spending 40% Total Spending 30% 20% 10% 0% 1965 1975 1985 1995 2005 2015 2025 2035 2045 2055 2065 2075 SOURCE: Congressional Budget Office, The 2014 Long-Term Budget Outlook, July 2014; and Office of Management and Budget, Budget of the United States Government, Fiscal Year 2016, Historical Tables, February 2015. Calculated by PGPF. NOTE: Projections are based on CBO’s alternative fiscal scenario. © 2015 Peter G. Peterson Foundation #FiscalSummit 18 PGPF.org FiscalSummit.org By 2066, interest costs on the federal debt will exceed federal revenues. If the economic effects of debt on interest rates are included, that date will occur in 2048. INTEREST COSTS (% OF GDP) 40% 35% Interest Costs with Economic Effects 30% Interest Costs without Economic Effects 25% 20% Revenues 15% 10% 5% 0% 2010 2020 2030 2040 2050 2060 2070 2080 SOURCE: Congressional Budget Office, The Budget and Economic Outlook: 2014 to 2024, February 2014, and The 2014 Long-Term Budget Outlook, July 2014. Calculated by PGPF. NOTE: Projections are based on CBO’s alternative fiscal scenario and CBO’s assumptions about the effects of high debt levels on interest rates. The effective interest rate on federal debt rises gradually until it is one-and-one-third percentage points higher in 2039 than in CBO’s economic benchmark projections. © 2015 Peter G. Peterson Foundation #FiscalSummit 19 PGPF.org FiscalSummit.org Interest costs will be the third largest category of the budget in 2023 FEDERAL SPENDING IN 2023 (BILLIONS OF DOLLARS) $1,500 $1,394 $1,000 $852 $704 $697 $677 $659 $500 $519 $0 Social Security Medicare Interest Other Mandatory Defense Nondefense Discretionary Discretionary Medicaid SOURCE: Congressional Budget Office, Updated Budget Projections: 2015 to 2025, March 2015. Compiled by PGPF. NOTE: Medicare is net of offsetting receipts. © 2015 Peter G. Peterson Foundation #FiscalSummit 20 PGPF.org FiscalSummit.org Mandatory spending and interest costs will climb significantly, while discretionary spending will fall to well below historical averages % OF FEDERAL SPENDING 100% 61% 68% 90% 80% % of GDP 77% Mandatory Spending and Net Interest Costs 16% Actual Projected 14% 12% 70% 10% 60% 8% 50% 40% 30% 6% 39% 32% 20% 4% 23% 10% 2015 Discretionary Spending Discretionary Spending 2% 0% 1995 0% 2005 20-Year Average (1995-2014) 2025 2001 2007 2013 2019 2025 SOURCE: Congressional Budget Office, Updated Budget Projections: 2015 to 2025, March 2015. Compiled by PGPF. © 2015 Peter G. Peterson Foundation #FiscalSummit 22 PGPF.org FiscalSummit.org By 2050, interest costs on the debt are projected to be four times what the federal government has historically spent on education, R&D, and infrastructure combined FEDERAL SPENDING (% OF GDP) 12% 10.7% 10% 8% Alternative Fiscal Scenario 7.0% 6% 4% 2.6% 2% 0% R&D Infrastructure Education Current Law 1.3% 2014 2039 Average Spending (1965-2014) 2050 Interest Costs SOURCE: Congressional Budget Office, The 2014 Long-Term Budget Outlook, July 2014; and Office of Management and Budget, Budget of the United States Government, Fiscal Year 2016, Historical Tables, February 2015. Compiled by PGPF. NOTE: Infrastructure excludes defense. Data for the alternative fiscal scenario does not include economic feedback. © 2015 Peter G. Peterson Foundation #FiscalSummit 23 PGPF.org FiscalSummit.org Discretionary spending funds a wide range of government programs DISCRETIONARY BUDGET Defense Transportation Education Income Security Veterans Benefits and Services Health (Discretionary Only) Administration of Justice International Affairs Natural Resources and Environment General Science, Space and Technology Community and Regional Development General Government Energy Medicare Administrative Costs Social Security Administrative Costs Agriculture Defense SOURCE: Office of Management and Budget, Budget of the United States Government, Fiscal Year 2016, February 2015. Data are for 2014. Compiled by PGPF. NOTE: Data excludes function 900, 990, and functions with negative outlays. Health (discretionary only) includes National Institutes of Health, Center for Disease Control and Prevention, veterans’ healthcare, and administrative costs for Medicaid. © 2015 Peter G. Peterson Foundation #FiscalSummit 24 PGPF.org FiscalSummit.org The United States spends more on defense than the next seven countries combined DEFENSE SPENDING (BILLIONS OF DOLLARS) $700 $600 $500 $610 Billion $601 Billion China $400 Russia United States $300 Saudi Arabia $200 $100 $0 France United Kingdom India Germany SOURCE: Stockholm International Peace Research Institute, SIPRI Military Expenditure Database, April 2015. Data are for 2014. Compiled by PGPF. NOTE: Figures are in U.S. dollars, converted from local currencies using market exchange rates. © 2015 Peter G. Peterson Foundation #FiscalSummit 25 PGPF.org FiscalSummit.org The United States lags in the percentage of university students earning science and engineering degrees SCIENCE AND ENGINEERING DEGREES (% OF UNDERGRADUATE DEGREES) 50% 44% 40% 30% 31% 23% 20% 16% 10% 0% United States European Union Asia China SOURCE: National Science Foundation, Science and Engineering Indicators 2014, February 2014. Compiled by PGPF. NOTE: This chart includes natural sciences (physical, biological, agricultural, computer science, and mathematics) and engineering but excludes social sciences. © 2015 Peter G. Peterson Foundation #FiscalSummit 28 PGPF.org FiscalSummit.org The United States ranks only 16th in quality of overall infrastructure according to the World Economic Forum Best QUALITY OF OVERALL INFRASTRUCTURE Switzerland UAE Hong Kong Singapore Finland Austria Japan Netherlands Iceland Germany France Spain Portugal Belgium Denmark Luxembourg U.S. Canada Sweden Worst Malaysia SOURCE: World Economic Forum, The Global Competitiveness Report 2014-2015, 2014. Compiled by PGPF. NOTE: The World Economic Forum score on overall infrastructure includes transport, telephony, and energy. Only the top 20 ranked countries are shown. © 2015 Peter G. Peterson Foundation #FiscalSummit 29 PGPF.org FiscalSummit.org The median real income for families in the United States has been relatively stagnant for two decades MEDIAN FAMILY INCOME (2013 DOLLARS) $80,000 $70,000 Average Income (1994-2013) $60,000 $50,000 $40,000 $30,000 $20,000 $10,000 $0 1950 1960 1970 1980 1990 2000 2010 SOURCE: U.S. Census Bureau, Historical Income Tables, September 2014. Compiled by PGPF. © 2015 Peter G. Peterson Foundation #FiscalSummit 30 PGPF.org FiscalSummit.org The United States ranks only 13th in income mobility from one generation to the next Most Mobile INTERGENERATIONAL INCOME MOBILITY Canada Sweden Spain Italy Chile Finland Denmark Germany Australia New Zealand Japan U.S. Least Mobile U.K. Switzerland France Norway SOURCE: Miles Corak, Inequality from Generation to Generation: the United States in Comparison, 2012. Compiled by PGPF. NOTE: Mobility is measured as intergenerational earnings elasticity, an indicator of how closely children’s earnings are related to those of their parents. In low-mobility countries, children’s earnings in adulthood depend heavily on their parents’ earnings. © 2015 Peter G. Peterson Foundation #FiscalSummit 31 PGPF.org FiscalSummit.org Although the incomes of the wealthy are volatile, they have grown much faster than the incomes of other groups AVERAGE ANNUAL AFTER-TAX INCOME (2011 DOLLARS) $1,500,000 Top 1%: Increase of $688,200 (+200%) $1,200,000 Top 20%: Increase of $87,700 (+87%) $900,000 Middle 20%: Increase of $15,400 (+35%) $600,000 $300,000 $0 1979 Lowest 20%: Increase of $7,800 (+48%) 1983 1987 1991 1995 1999 2003 2007 2011 SOURCE: Congressional Budget Office, The Distribution of Household Income and Federal Taxes, 2011, November 2014. Compiled by PGPF. © 2015 Peter G. Peterson Foundation #FiscalSummit 32 PGPF.org FiscalSummit.org Poverty levels among children have remained high, while poverty levels among the elderly have declined % IN POVERTY 30% 25% Under 18 Years 20% 15% 10% 65 Years and Older 5% 0% 1966 1971 1976 1981 1986 1991 1996 2001 2006 2011 SOURCE: U.S. Census Bureau, Historical Poverty Tables, September 2014. Data are for 2013. Compiled by PGPF. © 2015 Peter G. Peterson Foundation #FiscalSummit 33 PGPF.org FiscalSummit.org The growing federal debt is projected to reduce average income per person by $5,000 in 2039 AVERAGE INCOME LOSS PER CAPITA (2014 DOLLARS) $0 -$1,000 -$2,000 -$2,000 -$3,000 -$3,000 -$4,000 -$5,000 -$5,000 -$6,000 2029 2034 2039 SOURCE: Congressional Budget Office, The 2014 Long-Term Budget Outlook, July 2014. Compiled by PGPF. NOTE: Income is measured as real gross national product (GNP) per person. The reduction to income is the difference between the level of income if debt rises as it does under the alternative fiscal scenario and the level of income if debt remains near its current share of GNP. © 2015 Peter G. Peterson Foundation #FiscalSummit 34 PGPF.org FiscalSummit.org Solutions do exist: PGPF Solutions Initiative III plans from five think tanks show stable or declining federal debt through 2040 DEBT HELD BY THE PUBLIC (% OF GDP) 200% 175% Current Policy 150% 125% Bipartisan Policy Center 100% 75% American Enterprise Institute 50% Economic Policy Institute 25% Center for American Progress 0% 2015 2020 2025 2030 2035 2040 American Action Forum SOURCE: Peter G. Peterson Foundation, Solutions Initiative III, May 2015. See pgpf.org/solutions-initiative-iii for more details. NOTE: Current policy is defined as the alternative fiscal scenario without economic feedback from CBO’s 2014 Long-Term Budget Outlook. © 2015 Peter G. Peterson Foundation #FiscalSummit 36 PGPF.org FiscalSummit.org Delaying action raises the cost of stabilizing the debt in the long run SIZE OF BUDGET CHANGES NEEDED TO STABILIZE THE DEBT (% OF GDP) 7% 6% 5.8% 5% 4% 3% 4.3% 3.4% 2% 1% 0% 2015 If Fiscal Reforms Begin in… 2020 2025 SOURCE: Congressional Budget Office, The 2014 Long-Term Budget Outlook, July 2014. Calculated by PGPF. NOTE: Calculations are based on CBO’s alternative fiscal scenario. © 2015 Peter G. Peterson Foundation #FiscalSummit 37 PGPF.org FiscalSummit.org

© Copyright 2026