the professional Mar2015.pub

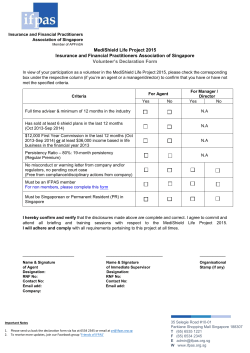

MAR 2015 THE PROFESSIONAL PUBLICATION OF PAUL WAN & CO Table of Contents 3 Singapore Economy 6 Singapore Budget 2015 8 Revision to Singapore Transfer Pricing Guidelines 13 Board and Audit Committees Responsibility over Risk Management 15 Protecting Businesses from Being Hacked 19 Clients and MI Members 22 Happenings at Paul Wan & Co 23 Singapore Qualification Programme Lee Kuan Yew - An Inspiration Paul Wan & Co’s Tribute to The Late Mr Lee Kuan Yew On 23rd March 2015, 12 noon, staff of Paul Wan & Co observed a minute of silence and paid tribute to the Founding Father of Singapore, the late Mr Lee Kuan Yew, who departed on 23rd March 2015, 3:18am. • 3 Economy Singapore Economy Mr. Paul Wan, Managing Partner On 17th February 2015, the Ministry of Trade and Industry announced that the GDP growth for Singapore in 2014 is 2.9% (2013: 4.4%). This figure is much lower than the 3.0% forecast and the range of most analysts of 3.4% to 3.5%. What went wrong? Manufacturing sector up 0.9% Construction down 3.3% Non oil exports down. The tightening on foreign workers is perhaps one key factor and many companies, both MNCs and local companies, have to adjust their need for foreign workers. Many companies, however, just have to cut orders and production as they could hardly find Singaporeans to take up the jobs. Gross Domestic Product 2013 2014 Overall GDP 4.4 2.9 Goods Producing Industries Manufacturing Construction 1.7 6.3 2.6 3.0 Services Producing Industries 6.1 3.2 The government is trying to push for productivity by encouraging companies to innovate and hand out Productivity and Incentive Credit, but few companies are taking the cue. By raising the foreign workers levy to the extent that it costs almost as much as what it would take to employ a Singaporean, profit margins of most companies are eroded and they have no choice but to continue to hire foreign workers because there are no local takers for the job. • 4 Economy Looking into 2015, we strongly believe that the economy will spiral downwards sharply for the following reasons: 1. The World Economy is in turmoil notwithstanding oil prices have come down to close to US$45 per barrel. The Euroland economy is sluggish and many central banks do not have money to prop up the economy. The US economy which has been on the recovery path for the last 15 months seems to be losing steam and could be flat over the next 2 quarters with potential of further decline if the world economy worsens. 2. The China economy is still heading south and we may see 2015 China GDP going down to 6.08% from 7.2% for 2014. China is one of Singapore's main trading partners. 3. Malaysia is another major trading partner of Singapore and their economy is in shatters. Exports are down dramatically and the fall in the oil price worsens the situation as oil is one of the major revenue for Malaysia. The Malaysian ringgit has weakened dramatically over the past 2 months as confidence in both the economy and government plummets. 4. The Financial services sector, one of the darlings of growth for Singapore, is expected to be flat as cost factor has prevented many foreign institutions from expanding their operations in Singapore, and countries in Asia are nipping into the pie - notably Shanghai. 5. The Tourism and Hospitality sector, in any slow down of both regional and domestic economy will be on the decline with less tourist arrivals - notably tourists from China. 6. Local consumption will definitely be dampened with consumers tightening their belts on an imminent slowdown of Singapore economy. 7. The Singapore dollar has weakened substantially to almost 10% over the last quarter against the US dollar and regional currencies. Whilst this may help exports but in a downturn of the world economy, the demand is weak, so a weak Singapore dollar will not bring in any advantage. In fact, many Singapore companies with foreign operations, encountered increased businesses costs especially if the foreign operations depend on their head office/parent company for funding. • Conclusion A very tough year ahead for Singapore and it comes at the wrong time - Singapore's 50th Anniversary and a possible snap election in the third quarter of 2015. It is possible that the government may come out with some sort of stimulus plan but it will be very difficult to estimate how much to inject into the black hole. Is Singapore in a recession? Yes, definitely in a technical recession. 2015 GDP forecast by the government: 2% to 4% Economist forecast: 2.6% to 2.8% Our forecast: 1.2% to 1.5% 5 Economy • 6 Tax Update Singapore Budget 2015 The 2015 Budget was unveiled in Parliament on 23rd February 2015 by Singapore Deputy Prime Minister and Finance Minister Tharman Shanmugaratnam. Unlike past years, this year’s budget neither provides one-off generous SG50 celebratory goodies nor a pre-election carrot for all businesses as well as Singaporeans. It focused mainly on building Singapore’s future by taking steps now, moving ahead relentlessly, and never thinking that status quo will get us to a better Singapore. The two clearly future-focused measures of this year’s budget are:1. 2. SkillsFuture – to help workers gain expertise through learning and training through creating new ideas and technologies and mastery; and Spur SMEs to innovate through grants, R&D investments, etc. and internationalize. Other key measures unveiled in this year’s budget are:Corporate & Businesses a) b) c) d) e) f) g) h) i) j) k) Extending and enhancing Mergers & Acquisitions (M & A) scheme; Refining tax incentive for Venture Capital funds and Venture Capital Fund Management Companies; Extending investment allowance – Energy Efficiency (IA-EE) schemes; Extending tax deductions for Collective Impairment Provisions made under Monetary Authority of Singapore (MAS) notices; Extending and refining tax incentive Scheme for Insurance Businesses; Improving Enhanced-Tier Fund Tax Incentive scheme; Extending tax concessions for Listed Real Estate Investment Trusts (REITs); Extending and enhancing the Maritime Sector Incentive (MSI); Restoration of CPF rates for older workers aged 50 and above; increasing CPF by raising monthly salary ceiling cap to $6,000/- and adjustment to Supplementary Retirement scheme to meet financial needs in key areas for retirement, home ownership and health care; Deferment of Foreign Worker Levy; Enhancing tax deduction for approved donations, etc. Goods & Services Tax (GST) a) b) Simplifying Pre-registration GST claim rules for newly GST -registered business; and Extending and enhancing GST remission for Listed REITs, Listed registered Business Trusts, Ship Leasing & Aircraft Leasing Sectors. • 7 Tax Update Individuals & Households a) b) c) d) e) f) g) Revision of personal progressive tax rates for top earners and a 50% one-off tax rebate capped at S$1,000/- to all Singapore tax resident individual taxpayers; Allowing specific expenses to set-off against passive rental income; Tax exemption for non-resident Mediators and Arbitrators; Extending and enhancing Angel Investors tax deduction (AITD) scheme; One-off GST voucher and service & conservancy charges rebates; Enhancing & expanding Foreign Domestic Worker (FDW) Levy concession; Help childcare and education costs by topping up of Child Development Account, Edu save account, waiver of exam fees for Singaporean students, etc. Others a) b) c) Refining Carbon emissions-Based Vehicle scheme (CEVS); Enhancing early turnover scheme for older commercial vehicles; and Revision to petrol duty rates and granting of one year road tax rebate. In view of the sufficient accumulated reserves from past years, the Minister is projecting an overall deficit of S$6.7 billion for 2015. For full details of our firm’s Singapore Budget Synopsis 2015, please refer to our website at: http://www.pwco.com.sg or you may contact our Tax Personnel for a hard copy at Tel.: +65 6220 3280 Ext. 200/201/202 or email us at [email protected] • 8 Transfer Pricing Guidelines Revision to Singapore Transfer Pricing Guidelines On 6 January 2015, IRAS released the 2nd edition of the Singapore transfer pricing guidelines relating to business entities incorporated or registered in Singapore or carrying on a business in Singapore that have transactions with related parties. This guideline will take immediate effect. As transfer pricing concerns the price charged on transactions between related parties, it is important to the integrity of the tax system that the price for the transaction approximates to the market price. To prevent price distortion, IRAS may carry out an audit of the related party transactions to verify that the prices are reflective of market prices. Such audit can lead to transfer pricing adjustments bringing about double taxation. Therefore, to reduce the risk of audits and double taxation, taxpayers transacting with their related parties should apply the internationally endorsed arm’s length principle – that the transfer price between them are at arm’s length price as if they were unrelated parties negotiating in a normal market. Where taxpayers are faced with double taxation, they may apply for a mutual agreement procedure with their tax authorities under the tax treaty provisions to eliminate double taxation. Application for an advance pricing arrangement may also be made to agree in advance with one or more tax authorities the appropriate transfer pricing for their related party transactions for a period of time. • 9 Transfer Pricing Guidelines Arm’s Length Principle IRAS recognises that applying arm’s length principle is not easily achieved especially where business structures and arrangements are complicated and unique, date and information are not readily available due to confidentiality and business secrets and also costly to perform comprehensive analyses. Hence, IRAS laid down the following guiding principles on applying the arm’s length principle: (a) As establishing and demonstrating compliance with the arm’s length principle require the exercise of judgment, a pragmatic approach would be adopted in ascertaining arm’s length pricing for related party transactions. (b) IRAS does not expect taxpayers to adhere rigidly to a defined set of rules in order to establish arm’s length pricing. Depending on the facts and circumstances, i.e. where there is a reasonable basis for doing so, taxpayers may determine and demonstrate arm’s length pricing using a different/ complement approach. (c) Taxpayers would have intimate knowledge of the commercial circumstances that their businesses operate in and the economic relationships between various related parties. Hence, they are in a better position to perform a robust and comprehensive transfer pricing analysis to determine the arm’s length price. (d) With the advantage of knowing their businesses and circumstances best, taxpayers should exert reasonable efforts to undertake a sound transfer pricing analysis. IRAS will consider the transfer prices determined as, prima facie, arm’s length when taxpayers have: • • (e) Applied the arm’s length principle in their analysis; and Exercised reasonable efforts to comply with the arm’s length principle, i.e. the transfer prices may reasonably be considered to approximate to arm’s length prices. IRAS welcomes taxpayers to discuss their concerns and difficulties in applying the arm’s length principle as consultation and cooperation between taxpayers and IRAS is a mutually beneficial and pragmatic way in complying with the arm’s length principle. • 10 Transfer Pricing Guidelines Three-step approach to apply the arm’s length principle IRAS recommends that taxpayers adopt the three-step approach in applying the arm’s length principle to their related party transactions as shown below:1. 2. 3. Conduct comparability analysis of transactions and make adjustments for material differences; Identify the most appropriate transfer pricing method that produces the most reliable results and tested party; and Apply the most appropriate transfer pricing method on the data of comparable independent related party transactions. Consider using interquartile range to enhance reliability of results. Contemporaneous transfer pricing documentation The revised transfer pricing guidelines also require proper contemporaneous transfer pricing documentation to be maintained for related party transactions. This documentation is to be prepared prior to or at the time of undertaking the related party transactions. Hence, IRAS is adamant to consider accepting any documentation prepared at any time after the completion and filing of the tax return for the financial year in which the transfer pricing transaction took place. IRAS does not require taxpayers to submit the documentation with their tax returns but it must be available and submitted within 30 days upon request. Where there is material impact on their operational business conditions, the documentation must be reviewed timely and updated at least once every three years, to ensure transfer prices are concluded at arm’s length. It is anticipated that the preparation of the transfer pricing documentation will result in substantial compliance and administrative costs for businesses. Hence, to ease compliance and administrative burden to taxpayers, IRAS has simplified the administrative rules by the inclusion of exemption for taxpayers from the preparation of the transfer pricing documentation if any of the following situations are met:(a) Where the taxpayer transacts with a related party in Singapore and such local transactions (excluding related party loans) are subject to the same Singapore tax rates for both parties; (b) Where a related domestic loan is provided between the taxpayer and a related party in Singapore and the lender is not in the business of borrowing and lending (e.g. banks or other financial institutions, finance and treasury centres); (c) Where the taxpayer applies the 5% cost mark-up for routine support services; (d) Where the related party transactions are covered by an agreement under an APA whereby annual compliance report is kept to demonstrate compliance with the terms of the agreement and the critical assumptions remain valid; or (e) Where the value of the related party transactions does not exceed the thresholds as below: • 11 Transfer Pricing Guidelines Category of related party transactions Purchase of goods from all related parties Sale of goods to all related parties Loans owed to all related parties Loans owed by all related parties All other categories of related party transactions, including: · service income · service payment · royalty expense · rental income Threshold (SGD) per financial year 15 million 15 million 15 million 15 million 1 million per category of transactions · rental expense For the purpose of determining if the threshold is met, aggregation should be done for each category of related party transactions. For example, all service income received from related parties is to be aggregated. Any taxpayer whose related party transactions has little risk of tax leakages and are below the required threshold should still be compliant with arm’s length pricing. The revised guidelines also require substantially more group and entity level detailed documentation such as worldwide organisational and management structure chart, location, ownership linkages among all related parties, nature of global business products and services, key competitors, recent developments and restructuring and overall transfer pricing policies. Transfer Pricing Adjustments The revised guidelines also provide a new section with respect to transfer pricing adjustments which provides clarity to taxpayers on managing their transfer pricing results. However, to be acceptable by IRAS, proper contemporaneous documentation must be available to substantiate the adjustments. Some of the adjustments are:1. Year-end adjustments – these are due to difficulties in assessing market variables and making market assumptions accurately during their transfer pricing study before or during their year-end closing 2. Compensating adjustments – these are made in accordance with the terms in the APA agreements to arrive at the agreed arm’s length prices. Self-initiated retrospective adjustments – these are due to review of past transfer prices relating to changes in circumstances such as group global transfer pricing policy not accounted for previously, arm’s length charge overlooked previously, etc. 3. • 12 Transfer Pricing Guidelines Consequence for Non-Preparation of Proper Contemporaneous Documentation In the event that taxpayers failed to provide or substantiate with proper documentation as to how the transfer prices have been concluded, the following steps could apply:i) Penalties will be imposed for failure to keep proper records and to provide proper documentation upon request; ii) An upward adjustment will be made if found to be understating their profits through improper transfer pricing; iii) IRAS will not support companies in Mutual Agreement Procedure (MAP) discussions in the event companies suffer double tax arising from any transfer pricing audit by IRAS or foreign tax authorities; iv) Application for an APA will not be considered; and v) Self-initiated transfer pricing adjustments will not be acceptable. The above factors are just a general guideline. For full details and illustrations, please refer to IRAS website at: http://www.iras.gov.sg Our comments As the revised transfer pricing guidelines involves all entities with related party transactions, please review your company or group of companies to ensure that proper transfer pricing documentation has been maintained, reviewed, updated regularly and available upon request by IRAS. Otherwise, please take necessary steps to comply with the arm’s length principle on all transactions with related parties. • 13 Risk Management Board and Audit Committees Responsibility over Risk Management Greater Responsibility over Risk Management In recent years, there is growing emphasis on how listed companies manage their risks in the current economic market. With the global economic climate still uncertain and unstable, there is greater need for companies to focus on risk governance, and that companies should have a sound system of risk management and internal controls to identify, assess, manage and mitigate risks. It is also increasingly more important that companies take an integrated, enterprise-wide approach to manage their risk exposure. With the amendments to the SGX listing rules and the revised 2012 Code (Guidelines 11 and 12.4(b)), we acknowledge that the Board's responsibility over risk management has become more explicit now. For example:• The responsibility of risk governance has been added as part of the board’s responsibilities and ensures sound system of risk management. • Determine the company’s levels of risk tolerance and risks policies. • Oversee Management in designing, implementing and monitoring of the risk management and internal control systems. • Require the Board to provide opinion on the adequacy of internal controls, addressing financial, operational, and compliance risks of their companies. Enterprise Risk Management Framework Requirement According to the Guidebook for Audit Committees in Singapore, Second Edition, Audit Committee (“AC”) members should ensure that there is an ERM framework in place that enables risks and internal controls to be identified, assessed, managed, monitored and reported. AC could engage the Internal Auditors to critically evaluate the framework designed by the Management. An annual review of the adequacy and effectiveness of the company’s risk management and internal control system should also be carried out by the Internal Auditor and the board should comment on the adequacy and effectiveness in the Company’s Annual Report. • 14 Risk Management Improvement in Risk Management for Singapore Listed Companies According to 2014 The Governance and Transparency Index (“GTI”), Singapore listed companies have realised higher corporate governance standards across the years. The GTI 2014 continued to capture improvements in corporate governance practices as seen in ascending GTI scores since 2011. The revision of the code and recent changes in Singapore Exchange listing rules have place greater responsibility on the board and senior management in risk governance. These changes require the board to comment on the adequacy of the internal controls and risk management framework. In 2014, there has been a sharp increase in the number of companies with the boards commenting on the adequacy of their companies’ internal controls and risk management policies, maintained at a high level of 82% or 528 companies. How can Paul Wan and Co help? We can facilitate the Board and AC in conducting assessment of the company's current risk management process and internal controls system. Following the assessment, we can support the Board and the AC in formalizing and assessing the Enterprise Risk Management, and other necessary reviews in supporting the Board and the AC in forming the basis to assess the internal controls system. For more information, please contact Lawrence Lim (+65 62203280 or [email protected]). • 15 Protecting Businesses Protecting Businesses from being Hacked What is happening in the world? In the recent times, the word “hacked” has been making appearances in the news. Just days ago, the US Centcom Twitter account was hacked by pro-IS group. This led to Twitter and Youtube accounts of the US Military Command suspended for a few hours. But this was not before the US Military Command was humiliated when the hackers posted on Centcom’s Twitter feed reading: “American soldiers, we are coming, watch your back.” Some internal military documents also appeared in the Twitter feed. Embarrassingly, the hack took place as US President Barack Obama was given a speech on cyber security. In his speech, President Obama said that the internet creates enormous vulnerabilities for the nation and its economy. US spokesperson attempted to play down this incident by claiming that this is “cyber vandalism” and not a serious data breach. In the wake of the recent spate of hacking incidents, the White House are pushing for cyber security legislation. Not too long before this was the hacking of Sony Pictures last November. A group of hackers calling themselves the Guardians of Peace pulled off an enormous hack by breaking into Sony Pictures Entertainment computer networks. The hackers claimed to have stolen everything in the network and steadily leaked the stolen data periodically. The almost hundred terabytes of data included emails from senior executives, secrets on upcoming films and projects. The FBI has put the blame on North Korea while the latter has denied the allegations. However, this hack was widely thought to be North Korea’s reprisal for the Sony produced movie “The Interview”, in which North Korea Dictator Kim Jong Un is assassinated by the CIA. It is interesting to note that before the hack, PriceWaterhouseCoopers conducted a security audit and found major gaps in the company’s cyber security infrastructure. Coincidentally, weeks after the Sony Pictures hack, internet researchers reported that the North Korean networks are under duress and there were evidence of Denial of Services directed at North Korea’s servers, essentially bringing internet connections to a halt. • 16 Protecting Businesses Singapore is not immune to hacking activity Our local scene is not spared from hacker attacks either. In late 2013, a global hacker group named Anonymous threatened to hack Singapore’s IT infrastructure to protest against the Singapore Government’s new licensing rules imposed on websites here. Before this, a member from the group known by the online moniker “The Messiah” has already attacked some government sites, namely People’s Action Party’s Community Foundation page and Ang Mo Kio Town Council page, and modifying their website contents. In response, a IT Security Incident Response team was set up to coordinate responses to a cyber-intrusion and all government agencies were alerted. Following these, more government websites were hacked and defaced, ranging from Seletar Airport page, Straits Times page to websites of several schools. The website of Singapore Prime Minister Lee Hsien Loong and the Istana were not spared either. The spate of cyberattacks was dubbed malicious and plans are made to further secure the websites and rectify any security vulnerabilities. Prime Minister Lee also pledged to hunt down the perpetrators. It is obvious that cyber attacks are not bounded by geographical distances. As information technology becomes more pervasive in our daily lives, we are also increasingly exposing ourselves to cyber attacks. Cyber attacks could happen to anyone at all levels – countries, governments, corporate entities and individuals, like you and me. How can I protect my business against hackers? Change your passwords frequently Your password should always be unique and take time to choose a strong password. A strong password incudes a mixture of numbers and letters, big case and small case, and random symbols. User names and passwords are easy gateways for hackers to enter your iphone, email accounts and corporate systems. So keep them away by changing your passwords periodically on a monthly basis. If your corporate system requires two factor authentication, that is even more secure. Keep out spyware on your workstations Avoid Trojans through downloading of software and music. Also keep your anti virus software updated so that it can detect and remove any impending danger. Another way to keep hackers from sneaking in through Trojans is to have a firewall setup in the corporate environment. It would act as the first line of defence. Office staff should also limit the use of their workstations to work only. Incessant surfing of online shops and downloading of free media, increases the risk of getting infected by Trojans. • 17 Protecting Businesses Limit network access Office staff should only be allowed enough network access to perform their work obligations. It is a hassle to monitor and track their access but definitely worth the pain. It lowers the chances of a firm wide data breach; hence it is always good practice to make sure only the necessary users have access to certain data. Do not store more data than you need There is often no reason to keep customers’ identification details and other sensitive information just so that you have them on file. Make it a policy to purge customers’ data once the data is no longer relevant or required. The risk of a data breach outweighs the convenience of your customers. “If you have nothing to steal, you can’t be robbed.” Train your staff Many security breaches occurred because internal staff unknowingly and unintentionally leaked out sensitive information either to hackers posing as clients or by clicking on malicious email links. Training your staff on how to identify and avoid such breaches can save your business from being the next victim. Avoid releasing too much company details on social media A hacker can obtain information about the company through social engineering. The hacker does his research on the company using various techniques to hack a company based on human error. They attempt to identify business relations the company has through social media or by simply calling the reception. They would then use the information obtained previously to make another call, in the hope of getting more information now that the receptionist believed the hacker is a genuine client. After a string of inquiries, the hacker could have obtained enough information to hack the corporate system. The hacker may also know who to approach if he requires assistance from inside. This could be a disgruntled staff or a dull staff. By manipulating the weakest link to make a bad decision, the hacker could obtain what he wants easily. • 18 Protecting Businesses Have a security guy in your business Most businesses are willing to pay for security guards to look after warehouses and offices. However, it is surprising that most of them do not think that they need a security guy to guard their Information Systems. It is unthinkable because often the data holds more value than the inventory they have in their warehouses. Business owners often assume their data is well protected or that no one would bother to steal them. Having a security expert or consultant means he would be able to identify security lapses and advise the management accordingly on a regular basis. Companies would then be proactive in thinking about IS security in a long term basis. This is contrary to the traditional view of hiring a security consultant only after a major data breach has been exposed. What do we do at Paul Wan & Co IT landscapes today are large and diverse, moving towards more complex systems. Several companies are faced with the challenge of controlling IT costs and delivering on quality, security and risks. Paul Wan & Co offers technology consulting services tailored for your business challenges. For more information please contact Shaun Soh (+65 6220 3280 or [email protected]). • 19 Clients and MI Members Clients and MI Members 2015 Hayes Knight Annual Conference Hayes Knight, the Australia/New Zealand member firm of Morison International organized their annual conference in Adelaide from 12 March 2015 to 15 March 2015. Mr. Wan, our Managing Partner, is also the Chairman for Morison International Asia Pacific was invited to attend the Conference. Mr. Paul Wan (extreme right) with Directors from Hayes Knight Group Australia (left). Mr. Paul Wan (middle) with Mr. Greg Hayes (left), Chairman of Hayes Knight Group and Lisa Armstrong (right), Knowledge Shop Australia. • 20 Clients and MI Members Mr. Paul Wan met up with Mr. Kenji Yamamoto, the Chairman of the Libera Group, one of Japan's largest and oldest shipping group in Tokyo in late February. Mr. Kenji Yamamoto is the 7th generation owner of the Group which spans close to 300 years in business. Mr. Paul Wan and Mr. Kenji Yamamoto Paul Wan & Co is proud to serve the Libera Group for the last 22 years. Mr. Paul Wan and Mr. Henry Shin, Senior Partner of Echon & Co were in Phuket recently for a meeting. Echon & Co is the 8th largest South Korea CPA firm and is the member firm of Morison International. Paul Wan & Co and Echon are working in collaboration to bring a client of Paul Wan & Co in Thailand to list on KOSDAQ in South Korea. Mr. Paul Wan and Mr. Henry Shin • 21 Clients and MI Members Mr. Paul Wan and Mr. Henry Shin met up with client of Paul Wan & Co, Mr. Rathrhai Promarsa, Managing Partner of the Prince Hotel Group Thailand for discussion. Mr. Henry Shi, Mr. Paul Wan, Mr. Rathrhai Promarsa Mr. Paul Wan, Mr. Rathrhai Promarsa • 22 Happenings at Paul Wan & Co Happenings at Paul Wan & Co Paul Wan & Co celebrated Chinese New Year at Raffles Town Club on 13th February 2015. Paul Wan & Co Bangkok Retreat 25th - 28th September 2014 • 23 Singapore Qualification Programme Singapore Qualification Programme Launched in June 2013, the Singapore Qualification Programme (Singapore QP) is one of the key initiatives to transform Singapore into a leading global accountancy hub. It offers a career pathway to graduates with either accountancy or nonaccountancy degrees, it also adds diversity and depth to the talent pool of the accountancy profession. The successful completion of the Singapore QP will lead to the conferment of the Chartered Accountant of Singapore designation that is globally recognised and internationally portable. Employers globally will recognise the candidates as a professional with broad knowledge and deep expertise, opening the doors for them to be presented with the opportunities to work in major business and financial centres such as New York, London and Hong Kong. Paul Wan & Co is an Accredited Training Organisation (ATO) that has been certified by the Singapore Accountancy Commission (SAC) to possess the appropriate standards of staff training, accountancy resources and development for Singapore QP candidates to fulfil their Practical Experience. We are pleased to introduce our first Singapore QP candidate, Mr. Shaun Soh who holds a degree in Computer Engineering from National University of Singapore. As his ATO, we are honoured to provide him with the learning environment and mentorship in his journey to become a Chartered Accountant of Singapore. For more information, please contact: Mr. Paul Wan, 10 Anson Road #35-07/08, International Plaza, Singapore 079903 Tel: (65)6220 3280 Fax: (65) 6224 5473 Email: [email protected] Website: www.pwco.com.sg The Professional is for the use of clients, professional contacts and staff of Paul Wan & Co. Coverage of topics are not necessarily comprehensive and does not purport to give professional advice.

© Copyright 2026