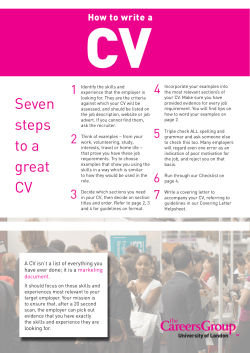

Document 168106